Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 31 2023 - 1:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-40333

LARGO INC.

(Translation of registrant's name into English)

55 University Avenue

Suite 1105

Toronto, Ontario M5J 2H7

Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 31, 2023

LARGO INC.

By: /s/ Ernest Cleave

Name: Ernest Cleave

Title: Chief Financial Officer

| PRESS RELEASE |

OCTOBER 17, 2023 |

Largo Reports Third Quarter 2023 Production and Sales Results and Begins Hot Commissioning of its 6.1 MWh Vanadium Redox Flow Battery; Production and Cost Guidance Remains Unchanged

Q3 2023 and Other Highlights

-

V2O5 production of 2,163 tonnes (4.8 million lbs1) vs. 2,906 tonnes produced in Q3 2022, including 644 tonnes in July, 775 tonnes in August and 744 tonnes in September

-

Global V2O5 recovery rate3 of 76.9% in Q3 2023 vs. 80.7% in Q3 2022

-

V2O5 equivalent sales of 2,385 tonnes vs. 2,796 tonnes sold in Q3 2022

-

The average benchmark price per lb of V2O5 in Europe was $8.03, a 2.5% decrease from the average of $8.23 seen in Q3 2022

-

Ramp up of its new ilmenite concentration plant continues with ilmenite concentrate production of 350 tonnes in August and 700 tonnes in September

-

Largo Clean Energy ("LCE") completed site acceptance testing of its Enel Green Power España ("EGPE") 6.1 MWh vanadium redox flow battery ("VRFB") deployment and submitted results to EGPE, with the expectation of completing the hot commissioning phase of the battery; Provisional acceptance is expected in Q4 2023

-

2023 production, sales, cost and capital expenditures guidance remain unchanged

TORONTO - Largo Inc. ("Largo" or the "Company") (TSX: LGO) (NASDAQ: LGO) today announces quarterly production of 2,163 tonnes (4.8 million lbs1) and sales of 2,385 tonnes of vanadium pentoxide ("V2O5") equivalent, respectively, in Q3 2023.

Daniel Tellechea, Interim CEO and Director of Largo, stated: "Despite production setbacks in the third quarter caused by the previously reported accident in our chemical plant and delays in the ramp of our new magnetic separator in the crushing plant, Largo remains steadfast in its commitment to rectifying operations in the fourth quarter and has maintained its production, cost and capex guidance for 2023. Our top priority is safety and returning production to a more normalized level through the strengthening of operational efficiencies at the mine and crushing plant." He continued: "On the Largo Clean Energy front, we are pleased that hot commissioning and provisional acceptance of the EGPE 6.1 MWh VRFB deployment are in the final stages of completion, marking an exciting step towards the conclusion of LCE's inaugural vanadium battery project. Furthermore, the review of strategic alternatives to unlock and fully maximize the value of LCE remains ongoing and has garnered interest from various parties thus far. While near-term vanadium demand and prices are challenging on the back of weak demand from the steel sector, we are optimistic about future demand projections, particularly driven by an explosive growth of future VRFB deployments in the coming years."

Maracás Menchen Mine Operational and Sales Results

| |

|

Q3 2023 |

|

|

Q2 2023 |

|

|

Q1 2023 |

|

|

Q3 2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Ore Mined (tonnes) |

|

447,165 |

|

|

489,892 |

|

|

341,967 |

|

|

351,450 |

|

| Ore Grade Mined - Effective Grade (%)2 |

|

0.74 |

|

|

0.86 |

|

|

0.81 |

|

|

1.02 |

|

| Total Mined - Dry Basis (tonnes) |

|

4,178,185 |

|

|

3,671,842 |

|

|

3,523,656 |

|

|

2,248,360 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Concentrate Produced (tonnes) |

|

87,447 |

|

|

99,083 |

|

|

78,695 |

|

|

99,513 |

|

| Grade of Concentrate (%) |

|

2.94 |

|

|

3.34 |

|

|

2.99 |

|

|

3.26 |

|

| Global Recovery (%)3 |

|

76.9 |

|

|

81.0 |

|

|

83.0 |

|

|

80.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| V2O5 produced (Flake + Powder) (tonnes) |

|

2,163 |

|

|

2,639 |

|

|

2,111 |

|

|

2,906 |

|

| High purity V2O5 equivalent produced (%) |

|

37.6 |

|

|

37.3 |

|

|

49.3 |

|

|

34.5 |

|

| V2O5 produced (equivalent pounds) 1 |

|

4,768,593 |

|

|

5,817,992 |

|

|

4,653,953 |

|

|

6,406,626 |

|

| Total V2O5 equivalent sold (tonnes) |

|

2,385 |

|

|

2,557 |

|

|

2,849 |

|

|

2,796 |

|

| Produced V2O5 equivalent sold (tonnes) |

|

2,129 |

|

|

2,268 |

|

|

2,604 |

|

|

2,445 |

|

| Purchased V2O5 equivalent sold (tonnes) |

|

256 |

|

|

289 |

|

|

245 |

|

|

351 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2023 and Other Additional Highlights

-

Despite higher mining throughput in Q3 2023 (447,165 tonnes) compared with Q3 2022 (351,450 tonnes), V2O5 production from the Maracás Menchen Mine was impacted in July and August as a result of the accident at the chemical plant in July, while production in September was affected by the lack of availability of the crushing circuit in September. Mitigative measures to increase production levels in future quarters, including increasing crusher availability and recommissioning evaporation sections of the chemical plant are underway. High purity V2O5 equivalent production represented 38% of the total quarterly production in Q3 2023.

-

The global recovery3 achieved in Q3 2023 was 76.9%, representing a 5% decrease from the 80.7% achieved in Q3 2022 and 5% lower than the 81.0% achieved in Q2 2023. The global recovery3 in July was 78.8%, with 77.7% achieved in August and 73.6% achieved in September. Lower recovery levels achieved during the quarter relate production impacts mentioned previously. The Company produced 87,447 tonnes of concentrate with an effective grade2 of 2.94%.

-

V2O5 equivalent sales of 2,385 tonnes (inclusive of 256 tonnes of purchase material) were in line with expectations for Q3 2023 but represented a 17% decrease in tonnes sold over Q3 2022. The Company's sales remain geographically diversified, with North America and Europe each representing approximately one third of total sales, and South America and Asia representing the remaining third. Spot demand was soft in Q3 2023, primarily due to adverse conditions in the Chinese and European steel industries. However, strong demand for high purity vanadium products continued.

-

Effective Monday, October 9, 2023, Mr. Celio Pereira assumed the role of Chief Operating Officer (COO) of Largo Vanádio de Maracás S/A ("LVMSA"). This decision follows the departure of Álvaro Resende, to whom the Company thanks for his many years of service. Celio's appointment is a testament to his excellent track record and the trust and confidence placed in him by the Board and management of Largo. Celio brings to LVMSA over 8 years of operational and technical expertise, honed during his tenure at the Maracás Menchen Mine. He will be instrumental in implementing a culture of safety and operational efficiency at the mine. Following this operational restructuring, the Company expects an enhancement in operational efficiencies at the crushing and milling circuits, as well as the increasing throughput to the ilmenite plant.

About Largo

Largo is a globally recognized vanadium company known for its high-quality VPURETM and VPURE+TM products, sourced from its Maracás Menchen Mine in Brazil. The Company is currently focused on implementing an ilmenite concentrate plant and is undertaking a strategic evaluation of its U.S.-based clean energy business, including its advanced VCHARGE vanadium battery technology to maximize the value of the organization. Largo's strategic business plan centers on maintaining its position as a leading vanadium supplier with a growth strategy to support a low-carbon future.

Largo's common shares trade on the Nasdaq Stock Market and on the Toronto Stock Exchange under the symbol "LGO". For more information on the Company, please visit www.largoinc.com.

###

For further information, please contact:

Investor Relations

Alex Guthrie

Senior Manager, External Relations

+1.416.861.9778

aguthrie@largoinc.com

Cautionary Statement Regarding Forward-looking Information:

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities legislation. Forward‐looking information in this press release includes, but is not limited to, statements with respect to the hot commissioning and provisional acceptance of the LCE's EGPE 6.1 MWh VRFB deployment; the strategic review of LCE; future demand projections, including the growth of future VRFB deployments; and the success of mitigating measures to increase production levels. Forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this news release, other than statements of current and historical fact, is forward looking information. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Largo or LCE to be materially different from those expressed or implied by such forward-looking statements, including but not limited to those risks described in the annual information form of Largo and in its public documents filed on www.sedar.com and available on www.sec.gov from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although management of Largo has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Largo does not undertake to update any forward-looking statements, except in accordance with applicable securities laws. Readers should also review the risks and uncertainties sections of Largo's annual and interim MD&A which also apply.

Trademarks are owned by Largo Inc.

___________________________________

1 Conversion of tonnes to pounds, 1 tonne = 2,204.62 pounds or lbs.

2 Effective grade represents the percentage of magnetic material mined multiplied by the percentage of V2O5 in the magnetic concentrate.

3 Global recovery is the product of crushing recovery, milling recovery, kiln recovery, leaching recovery and chemical plant recovery.

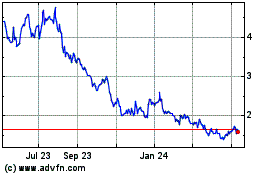

Largo (NASDAQ:LGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

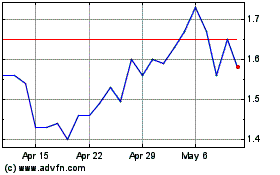

Largo (NASDAQ:LGO)

Historical Stock Chart

From Apr 2023 to Apr 2024