8-K0001993004false0000073088false☐☐☐☐00000730882023-10-262023-10-260000073088nwe:NorthwesternEnergyGroupIncMember2023-10-262023-10-260000073088nwe:NorthwesternCorporationMember2023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2023

NorthWestern Energy Group, Inc.

NorthWestern Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 000-56598 | 93-2020320 |

| Delaware | 1-10499 | 46-0172280 |

(State or other jurisdiction of

incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| 3010 W. 69th Street | Sioux Falls | South Dakota | | 57108 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 605-978-2900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Registrant | Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| NorthWestern Energy Group, Inc. | Common stock | NWE | Nasdaq Stock Market LLC |

| NorthWestern Corporation | None | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition

On October 26, 2023, NorthWestern Energy Group, Inc. d/b/a NorthWestern Energy (Nasdaq: NWE) (the “Company”) issued a press release (the “Press Release”) discussing financial results for the quarter ended September 30, 2023, initiating earnings guidance for 2024 in the range of $3.42 to $3.62 per diluted share, and announcing 2023 non-GAAP earnings to range between $3.00 to $3.10 per diluted share. The Press Release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Current Report on Form 8-K provided under Item 2.02 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information provided under Item 2.02 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

As previously announced and as stated in the Press Release, the Company will host an investor conference call and webcast on October 27, 2023, at 3:00 p.m. Eastern time to review its financial results. During the conference call, Brian B. Bird, president and chief executive officer, and Crystal D. Lail, vice president and chief financial officer of the Company, will make a slide presentation (the "Investor Call Presentation") concerning the Company's financial results.

A live webcast of the investor conference call can be accessed from the Company’s website at www.northwesternenergy.com/earnings-registration. To listen and view the slideshow presentation, please go to the site at least 15 minutes in advance of the call to register. An archived webcast will be available shortly after the call and will be available for one year.

A copy of the Investor Call Presentation is being furnished pursuant to Regulation FD as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference. The information in the presentation shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section. Furthermore, the presentation shall not be deemed to be incorporated by reference into the Company's filings under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, except as set forth with respect thereto in any such filing.

Item 9.01 Financial Statements and Exhibits. | | | | | | | | |

| Exhibit No. | | Description of Document |

| | Press Release, dated October 26, 2023 |

| | Investor Call Presentation, dated October 27, 2023 |

104

| | Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document |

| | |

| * filed herewith |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | NorthWestern Energy Group, Inc. | |

| | NorthWestern Corporation | |

| | | |

| By: | /s/ Timothy P. Olson | |

| | Timothy P. Olson | |

| | Corporate Secretary | |

Date: October 27, 2023

| | | | | |

| NorthWestern Energy Group, Inc. d/b/a NorthWestern Energy 3010 W. 69th Street Sioux Falls, SD 57108 www.northwesternenergy.com |

FOR IMMEDIATE RELEASE

NorthWestern Reports Third Quarter 2023 Financial Results

Company reports GAAP diluted earnings per share of $0.48 for the quarter;

affirms $510 million capital plan for 2023; initiates earnings guidance for 2023 and 2024 and increases

long-term earnings per share growth to 4% to 6% from a 2022 adjusted base year; and

announces a $0.64 per share quarterly dividend payable December 29, 2023

BUTTE, MT / SIOUX FALLS, SD - October 26, 2023 - NorthWestern Energy Group, Inc. d/b/a NorthWestern Energy (Nasdaq: NWE) reported financial results for the three months ended September 30, 2023. Net income for the period was $29.3 million, or $0.48 per diluted share, as compared with net income of $27.4 million, or $0.47 per diluted share, for the same period in 2022.

“Our entire team is focused on serving customers with reliable, affordable power, and managing our costs, while we make investments in critical infrastructure and support the growth in our jurisdictions,” said Brian Bird, President and CEO. “This week’s approval of our settlement in Montana provides a solid foundation as we continue execution of our plan. With that, we are announcing an increase to our long-term EPS growth to 4% to 6% and initiating 2023 and 2024 EPS guidance.”

THIRD QUARTER 2023 COMPARED TO THIRD QUARTER 2022

Higher revenues were driven by higher Montana interim rates and Montana property tax tracker collections, partly offset by cooler summer weather and lower transmission revenues. Non-recoverable Montana supply costs were lower driven by quarter over quarter tailwinds due to challenging market conditions in 2022 and the increase to base supply costs included in interim rates. Depreciation, interest, and income tax expenses also increased in 2023. Diluted earnings per share increased as a result of higher net income being partially offset with equity issuances during 2022 and 2023 that increased average shares outstanding in 2023.

Non-GAAP Adjusted diluted earnings per share for the quarter ended September 30, 2023 was $0.49 as compared to $0.44 for the same period in 2022. See “Adjusted Non-GAAP Earnings” and “Non-GAAP Financial Measures” sections below for more information on these measures.

COMPANY UPDATES

Increasing Long-Term EPS Growth Guidance to 4% to 6% from a 2022 base year

We are increasing long-term (5 year) diluted earnings per share growth guidance to 4% to 6% from a 2022 base year of $3.18 diluted earnings per share on a non-GAAP basis (from 3% to 6% previously disclosed). We expect rate base growth of 4% to 6% (from 4% to 5% previously disclosed). Our current capital investment program is sized to provide for no equity issuances. Future generation capacity additions or other strategic opportunities may require equity financing.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 2

Earnings Guidance

We are initiating 2024 diluted earnings guidance of $3.42 - $3.62 per diluted share. We expect our 2023 non-GAAP earnings to range between $3.00 - $3.10 per diluted share. This guidance is based upon, but not limited to, the following major assumptions:

• Final approval of all material aspects of the Montana general rate review settlement agreement

• Constructive outcomes in our current South Dakota rate review and regulatory proceedings

• Normal weather in our service territories;

• An effective income tax rate of approximately 4%-5% for 2023 and 12%-14% for 2024; and

• Diluted average shares outstanding of approximately 60.4 million in 2023 and 61.3 million in 2024.

Montana Rate Review

This week, the Montana Public Service Commission (MPSC) approved the settlement agreement filed in April 2023, providing for an increase in base electric rates of $67.4 million and base natural gas rates of $14.1 million. We expect final rates, adjusting from interim to settled rates, to be effective November 1, 2023. Our 2023 earnings through September 30, 2023, reflect revenues from interim rates. Based on the draft order, we do not expect a refund for interim rate revenues collected since their effective date nor a true-up for interim to final rates for the period from October 1, 2022, to October 31, 2023. See further details below.

Holding Company Reorganization

Effective October 2, 2023, NorthWestern Corporation executed on the initial steps of legally reorganizing into a holding company structure with NorthWestern Energy Group, Inc. (NorthWestern Energy Group) becoming the parent company. See further details below.

Dividend Declared

NorthWestern Energy Group's Board of Directors declared a quarterly common stock dividend of $0.64 per share payable December 29, 2023 to common shareholders of record as of December 15, 2023.

Additional information regarding this release can be found in the earnings presentation found at

https://www.northwesternenergy.com/about-us/investors/financials/earnings

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 3

CONSOLIDATED STATEMENT OF INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in millions) | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| Reconciliation of gross margin to utility margin: | | 2023 | | 2022 | | 2023 | | 2022 |

| | |

Operating Revenues (1) | | $ | 321.1 | | | $ | 335.1 | | | $ | 1,066.1 | | | $ | 1,052.5 | |

| Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) | | 88.9 | | | 108.9 | | | 322.0 | | | 339.0 | |

| Less: Operating and maintenance | | 53.2 | | | 54.7 | | | 163.9 | | | 160.8 | |

| Less: Property and other taxes | | 43.3 | | | 46.5 | | | 132.6 | | | 140.2 | |

| Less: Depreciation and depletion | | 52.2 | | | 48.6 | | | 157.8 | | | 145.7 | |

| Gross Margin | | $ | 83.5 | | | $ | 76.4 | | | $ | 289.8 | | | $ | 266.8 | |

| | | | | | | | |

| Operating and maintenance | | 53.2 | | | 54.7 | | | 163.9 | | | 160.8 | |

| Property and other taxes | | 43.3 | | | 46.5 | | | 132.6 | | | 140.2 | |

| Depreciation and depletion | | 52.2 | | | 48.6 | | | 157.8 | | | 145.7 | |

Utility Margin(2) | | $ | 232.2 | | | $ | 226.2 | | | $ | 744.1 | | | $ | 713.5 | |

(1) Decrease in revenues for the third quarter is primarily related to lower pass-through supply costs and non-cash regulatory amortizations.

(2) Utility Margin is a Non-GAAP financial measure. See “Non-GAAP Financial Measures” section below. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in millions, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 |

Revenues (1) | | $ | 321.1 | | | $ | 335.1 | | | $ | 1,066.1 | | | $ | 1,052.5 | |

Fuel, purchased supply and direct transmission expense(2) | | 88.9 | | | 108.9 | | | $ | 322.0 | | | $ | 339.0 | |

Utility Margin (3) | | 232.2 | | | 226.2 | | | $ | 744.1 | | | $ | 713.5 | |

| | | | | | | | |

| Operating and maintenance | | 53.2 | | | 54.7 | | | $ | 163.9 | | | $ | 160.8 | |

| Administrative and general | | 29.4 | | | 28.1 | | | $ | 94.1 | | | $ | 87.0 | |

| Property and other taxes | | 41.8 | | | 46.5 | | | $ | 131.0 | | | $ | 140.2 | |

| Depreciation and depletion | | 52.2 | | | 48.6 | | | $ | 157.8 | | | $ | 145.7 | |

Total Operating Expenses (4) | | 176.6 | | | 177.9 | | | $ | 546.8 | | | $ | 533.7 | |

| Operating income | | 55.6 | | | 48.3 | | | $ | 197.3 | | | $ | 179.8 | |

| Interest expense, net | | (28.7) | | | (25.3) | | | $ | (85.1) | | | $ | (73.1) | |

| Other income, net | | 4.1 | | | 4.2 | | | $ | 12.9 | | | $ | 11.8 | |

| Income before income taxes | | 31.0 | | | 27.1 | | | $ | 125.1 | | | $ | 118.6 | |

| Income tax (expense) benefit | | (1.7) | | | 0.2 | | | $ | (14.1) | | | $ | (2.3) | |

| Net Income | | 29.3 | | | 27.4 | | | $ | 111.0 | | | $ | 116.3 | |

| Basic Shares Outstanding | | 60.4 | | | 56.3 | | | 60.0 | | | 54.9 | |

| Earnings per Share - Basic | | $ | 0.48 | | | $ | 0.48 | | | $ | 1.85 | | | $ | 2.12 | |

| Diluted Shares Outstanding | | 60.5 | | | 56.6 | | | 60.0 | | | 55.5 | |

| Earnings per Share - Diluted | | $ | 0.48 | | | $ | 0.47 | | | $ | 1.85 | | | $ | 2.09 | |

| | | | | | | | |

| Dividends Declared per Common Share | | $ | 0.64 | | | $ | 0.63 | | | $ | 1.92 | | | $ | 1.89 | |

(1) Decrease in revenues for the third quarter is primarily related to lower pass-through supply costs and non-cash regulatory amortizations.

(2) Exclusive of depreciation and depletion expense.

(3) Utility Margin is a Non-GAAP financial measure.

See "Reconciliation of gross margin to utility margin" above and “Non-GAAP Financial Measures” below.

(4) Excluding fuel, purchased supply and direct transmission expense. |

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 4

RECONCILIATION OF PRIMARY CHANGES DURING THE QUARTER

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, 2023 vs. 2022 |

| | Pre-tax

Income | | Income Tax (Expense) Benefit (3) | | Net

Income | | Diluted

Earnings

Per Share |

| | (in millions, except EPS) | | |

| Third Quarter, 2022 | | $ | 27.1 | | | $ | 0.3 | | | $ | 27.4 | | | $ | 0.47 | |

Variance in revenue and fuel, purchased supply, and direct transmission expense(1) items impacting net income: | | | | | | | | |

Montana interim rates | | 7.8 | | | (2.0) | | | 5.8 | | | 0.10 | |

| Lower non-recoverable Montana electric supply costs due to higher electric supply revenues and lower electric supply costs | | 4.0 | | | (1.0) | | | 3.0 | | | 0.06 | |

| Montana property tax tracker collections | | 1.3 | | | (0.3) | | | 1.0 | | | 0.02 | |

| Higher natural gas retail volumes | | 0.6 | | | (0.2) | | | 0.4 | | | 0.01 | |

Higher natural gas transportation | | 0.3 | | | (0.1) | | | 0.2 | | | — | |

| Lower electric retail volumes | | (4.3) | | | 1.1 | | | (3.2) | | | (0.06) | |

| Lower electric transmission revenue | | (0.5) | | | 0.1 | | | (0.4) | | | (0.01) | |

| Other | | (0.7) | | | 0.2 | | | (0.5) | | | (0.01) | |

| | | | | | | | |

Variance in expense items(2) impacting net income: | | | | | | | | |

| Higher depreciation expense | | (3.6) | | | 0.9 | | | (2.7) | | | (0.05) | |

| Higher interest expense | | (3.4) | | | 0.9 | | | (2.5) | | | (0.04) | |

Higher operating, maintenance, and administrative expenses | | (1.3) | | | 0.3 | | | (1.0) | | | (0.02) | |

| Income tax return to accrual adjustment | | — | | | (1.3) | | | (1.3) | | | (0.02) | |

| Lower other state and local tax expense | | 1.6 | | | (0.4) | | | 1.2 | | | 0.02 | |

| Other | | 2.1 | | | (0.2) | | | 1.9 | | | 0.04 | |

| Dilution from higher share count | | | | | | | | $ | (0.03) | |

| Third Quarter, 2023 | | $ | 31.0 | | | $ | (1.7) | | | $ | 29.3 | | | $ | 0.48 | |

| Change | | | | | | $ | 1.9 | | | $ | 0.01 | |

(1) Exclusive of depreciation and depletion shown separately below

(2) Excluding fuel, purchased supply, and direct transmission expense

(3) Income Tax (Expense) Benefit calculation on reconciling items assumes blended federal plus state effective tax rate of 25.3%.

SIGNIFICANT TRENDS AND REGULATION

Montana Rate Review Filing – On August 8, 2022, we filed a Montana electric and natural gas rate review with the MPSC under Docket 2022.07.78 requesting an annual increase to electric and natural gas utility rates. On October 25, 2023, the MPSC held a work session and approved the settlement agreement filed April, 3, 2023. The Commission approved settlement rates effective November 1, 2023.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 5

| | | | | | | | |

| Returns, Capital Structure & Revenue Increase Resulting From Settlement Agreement ($ in millions) |

| Electric | Natural Gas |

| Return on Equity (ROE) | 9.65% | 9.55% |

| Equity Capital Structure | 48.02% | 48.02% |

| | |

| Base Rates | $67.4 | $14.1 |

Power Cost & Credit Mechanism (PCCAM) (1) | $69.7 | n/a |

| Property Tax (tracker base adjustment) | $14.5 | $4.2 |

| Total Revenue Increase Through Settlement Agreement | $151.6 | $18.3 |

(1) These items are flow-through costs. PCCAM reflects our fuel and purchased power costs.

The settlement agreement provides for an update to the PCCAM by adjusting the base costs from $138.7 million to $208.4 million and providing for more timely quarterly recovery of deferred balances instead of annual recovery. It also provides for the deferral of incremental operating costs related to our Enhanced Wildfire Mitigation Plan.

South Dakota Electric Rate Review Filing – On June 15, 2023, we filed a South Dakota electric rate review filing (2022 test year) under Docket EL23-016 for an annual increase to electric rates totaling approximately $30.9 million. Our request was based on a ROE of 10.7%, a capital structure including 50.5% equity, and rate base of $787.3 million.

Holding Company Reorganization – On October 2, 2023, NorthWestern Corporation and NorthWestern Energy Group reorganized into a holding company structure. In this reorganization, shareholders of Northwestern Corporation (the predecessor publicly held parent company) became shareholders of Northwestern Energy Group, maintaining the same number of shares and ownership percentage as held in Northwestern Corporation immediately prior to the reorganization. Northwestern Corporation became a wholly-owned subsidiary of Northwestern Energy Group. The transaction was effected pursuant to a merger pursuant to Section 251(g) of the General Corporation Law of the State of Delaware, which provides for the formation of a holding company without a vote of the shareholders of the constituent corporation. Immediately after consummation of the reorganization, NorthWestern Energy Group had, on a consolidated basis, the same assets, businesses and operations as NorthWestern Corporation had immediately prior to the consummation of the reorganization. As a result of the reorganization, NorthWestern Energy Group became the successor issuer to NorthWestern Corporation pursuant to Rule 12g-3(a) of the Securities Exchange Act of 1934, and as a result, NorthWestern Energy Group's common stock was deemed registered under Section 12(b) of the Securities Exchange Act of 1934. In the early part of 2024, we intend to complete the second and final phase of the holding company reorganization which will result in the South Dakota and Nebraska regulated utilities business becoming a separate direct subsidiary of NorthWestern Energy Group. This is planned to be accomplished through Northwestern Corporation contributing the assets and liabilities of its South Dakota and Nebraska regulated utilities to its direct subsidiary, Northwestern Energy Public Service Corporation (NPS), and then distributing its equity interest in NPS and certain other subsidiaries to Northwestern Energy Group, resulting in Northwestern Corporation owning and operating only the Montana regulated utility and NPS owning and operating the Nebraska and South Dakota utilities, each as a direct subsidiary of Northwestern Energy Group.

Electric Resource Planning - Montana

Yellowstone County 175 MW plant - As previously reported, in October 2021, the Montana Environmental Information Center and the Sierra Club filed a lawsuit in Montana State District Court, against the Montana Department of Environmental Quality (MDEQ) and us, alleging that the environmental analysis conducted prior to issuance of the Yellowstone County Generating Station's air quality permit was inadequate. On April 4, 2023, the Montana District Court issued an order finding the MDEQ's environmental analysis was deficient in not addressing exterior lighting and greenhouse gases and remanded it back to MDEQ to address the deficiencies and vacated the air quality permit pending that remand. As a result of the vacatur of the permit, we paused construction. On June 8, 2023, the Montana District Court granted our motion to stay the order vacating the air quality permit pending the

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 6

outcome of our notice of appeal with the Montana Supreme Court. We recommenced construction in June 2023 and expect the plant to be operational by the end of the third quarter 2024.

On May 10, 2023, Montana House Bill 971 was signed into law, preventing the MDEQ from, except under certain exceptions, evaluating greenhouse gas emissions and corresponding impacts to the climate in environmental reviews of large projects such as coal mines and power plants. On June 1, 2023, the MDEQ issued its supplemental environmental assessment that contained the updated exterior lighting analysis, and the MDEQ indicated that no other analysis was necessary. The comment period concerning the MDEQ’s supplemental air quality permit ended on July 3, 2023. On August 4, 2023, the Montana First Judicial District Court in Held v. State of Montana issued its order finding House Bill 971 unconstitutional. The Held case has delayed MDEQ's issuance of an updated air quality permit. The lawsuit challenging the Yellowstone County Generating Station air quality permit, as well as additional related legal challenges and construction challenges, could delay the project timing and increase costs. Total costs of approximately $217.5 million have been incurred, with expected total costs of approximately $275.0 million.

Future Integrated Resource Planning - Resource adequacy in the Western third of the U.S. has been declining with the retirement of thermal power plants. Our owned and long-term contracted resources are inadequate to supply the necessary capacity we require to meet our peak-demand loads, which exposes us to large quantities of market purchases at typically high and volatile energy prices. To comply with regulatory resource planning requirements, we submitted an integrated resource plan to the MPSC on April 28, 2023.

We remain concerned regarding an overall lack of capacity in the West and our owned and long-term contracted capacity deficit to meet peak-demand loads. The construction of the Yellowstone County Generating Station and acquisition of Avista's Colstrip Units 3 and 4 interests are expected to reduce our exposure to market purchases.

Proposed EPA Rules

In May 2023, the Environmental Protection Agency (EPA) proposed new greenhouse gas (GHG) emissions standards for coal and natural gas-fired plants. In particular, the proposed rules would (i) strengthen the current New Source Performance Standards for newly built fossil fuel-fired stationary combustion turbines (generally natural gas-fired); (ii) establish emission guidelines for states to follow in limiting carbon pollution from existing fossil fuel-fired steam generating electric generating units (including coal, oil and natural gas-fired units); and (iii) establish emission guidelines for large, frequently used existing fossil fuel-fired stationary combustion turbines (generally natural gas-fired). In addition, in April 2023, EPA proposed to amend the Mercury and Air Toxics Standards (MATS). Among other things, MATS currently sets stringent emission limits for acid gases, mercury, and other hazardous air pollutants from new and existing electric generating units. We are in compliance with existing MATS requirements. The proposed amendment of the MATS would strengthen the MATS requirements, and if adopted as written, both the GHG and MATS proposed rules could have a material negative impact on our coal-fired plants, including requiring potentially expensive upgrades or the early retirement of Colstrip Unit's 3 and 4 due to the rules making the facility uneconomic.

Previous efforts by the EPA were met with extensive litigation and we anticipate a similar response if the proposed rules are adopted. As MATS and GHG regulations are implemented, it could result in additional material compliance costs. We will continue working with federal and state regulatory authorities, other utilities, and stakeholders to seek relief from any MATS or GHG regulations that, in our view, disproportionately impact customers in our region.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 7

EXPLANATION OF CONSOLIDATED RESULTS

Three Months Ended September 30, 2023 Compared with the Three Months Ended September 30, 2022

Consolidated gross margin for the three months ended September 30, 2023 was $83.5 million as compared with $76.4 million in 2022, an increase of $7.1 million, or 9.3 percent. This increase was primarily due to higher Montana interim rates associated with our Montana rate review, lower non-recoverable Montana electric supply costs, higher Montana property tax tracker collections, and lower operating and maintenance costs, partly offset by lower electric retail volumes, lower transmission revenues, and higher depreciation and depletion expense.

| | | | | | | | | | | | | | |

| | Three Months Ended

June 30, |

| (in millions) | | 2023 | | 2022 |

| |

| Reconciliation of gross margin to utility margin: | | | | |

Operating Revenues (1) | | $ | 321.1 | | | $ | 335.1 | |

| Less: Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion shown separately below) | | 88.9 | | | 108.9 | |

| Less: Operating and maintenance | | 53.2 | | | 54.7 | |

| Less: Property and other taxes | | 43.3 | | | 46.5 | |

| Less: Depreciation and depletion | | 52.2 | | | 48.6 | |

| Gross Margin | | 83.5 | | | 76.4 | |

| | | | |

| Operating and maintenance | | 53.2 | | | 54.7 | |

| Property and other taxes | | 43.3 | | | 46.5 | |

| Depreciation and depletion | | 52.2 | | | 48.6 | |

Utility Margin (2) | | $ | 232.2 | | | $ | 226.2 | |

(1) Decrease in revenues for the third quarter is primarily related to lower pass-through supply costs and non-cash regulatory amortizations.

(2) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. |

Consolidated utility margin for the three months ended September 30, 2023 was $232.2 million as compared with $226.2 million for the same period in 2022, an increase of $6.0 million, or 2.7 percent.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 8

Primary components of the change in utility margin include the following (in millions):

| | | | | |

| Utility Margin

2023 vs. 2022 |

| Utility Margin Items Impacting Net Income | |

| Montana interim rates | $ | 7.8 | |

| Lower non-recoverable Montana electric supply costs due to higher electric supply revenues and lower electric supply costs | 4.0 | |

| Montana property tax tracker collections | 1.3 | |

| Higher natural gas retail volumes | 0.6 | |

| Higher Montana natural gas transportation | 0.3 | |

| Lower electric retail volumes | (4.3) | |

| Lower transmission revenue due to market conditions and lower rates | (0.5) | |

| Other | (0.7) | |

| Change in Utility Margin Items Impacting Net Income | $ | 8.5 | |

| Utility Margin Items Offset Within Net Income | |

| Lower property taxes recovered in revenue, offset in property and other taxes | (3.1) | |

| Lower natural gas production taxes recovered in revenue, offset in property and other taxes | (0.1) | |

| Higher revenue from lower production tax credits, offset in income tax expense | 0.4 | |

| Higher operating expenses recovered in revenue, offset in operating and maintenance expense | 0.3 | |

| Change in Utility Margin Items Offset Within Net Income | (2.5) | |

Increase in Consolidated Utility Margin(1) | $ | 6.0 | |

| (1) Non-GAAP financial measure. See “Non-GAAP Financial Measures” below. | |

Lower electric retail volumes were driven by unfavorable weather in Montana and South Dakota impacting residential demand and lower commercial demand, partly offset by customer growth. Higher natural gas retail volumes were driven by favorable weather and customer growth. Interim rates in our Montana rate review were effective October 1, 2022 and will be replaced with approved settlement rates effective November 1, 2023..

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| | 2023 | | 2022 | | Change | | % Change |

| ($ in millions) | |

| Operating Expenses (excluding fuel, purchased supply and direct transmission expense) | | | | | | | |

| Operating and maintenance | $ | 53.2 | | | $ | 54.7 | | | $ | (1.5) | | | (2.7) | % |

| Administrative and general | 29.4 | | | 28.1 | | | 1.3 | | | 4.6 | |

| Property and other taxes | 41.8 | | | 46.5 | | | (4.7) | | | (10.1) | |

| Depreciation and depletion | 52.2 | | | 48.6 | | | 3.6 | | | 7.4 | |

| Total Operating Expenses (excluding fuel, purchased supply and direct transmission expense) | $ | 176.6 | | | $ | 177.9 | | | $ | (1.3) | | | (0.7) | % |

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 9

Consolidated operating expenses, excluding fuel, purchased supply and direct transmission expense, were $176.6 million for the three months ended September 30, 2023, as compared with $177.9 million for the three months ended September 30, 2022. Primary components of the change include the following (in millions):

| | | | | |

| Operating Expenses |

| 2023 vs. 2022 |

| Operating Expenses (excluding fuel, purchased supply and direct transmission expense) Impacting Net Income | |

| Higher depreciation expense due to plant additions | $ | 3.6 | |

| Higher technology implementation and maintenance expense | 0.6 | |

| Higher insurance expense | 0.5 | |

| Increase in uncollectible accounts | 0.3 | |

| Lower other state and local tax expense | (1.6) | |

| Lower expenses at our electric generation facilities | (0.3) | |

| Other | 0.2 | |

| Change in Items Impacting Net Income | 3.3 | |

| |

| Operating Expenses Offset Within Net Income | |

| Lower property taxes recovered in trackers, offset in revenue | (3.1) | |

Lower pension and other postretirement benefits, offset in other income(1) | (1.7) | |

| Lower natural gas production taxes recovered in trackers, offset in revenue | (0.1) | |

| Higher operating and maintenance expenses recovered in trackers, offset in revenue | 0.3 | |

| Change in Items Offset Within Net Income | (4.6) | |

| Decrease in Operating Expenses (excluding fuel, purchased supply and direct transmission expense) | $ | (1.3) | |

| (1) In order to present the total change in labor and benefits, we have included the change in the non-service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses |

We estimate property taxes throughout each year, and update those estimates based on valuation reports received from the Montana Department of Revenue. Under Montana law, we are allowed to track the increases and decreases in the actual level of state and local taxes and fees and adjust our rates to recover the increase or decrease between rate cases less the amount allocated to FERC-jurisdictional customers and net of the associated income tax benefit.

Consolidated operating income for the three months ended September 30, 2023 was $55.6 million as compared with $48.3 million in the same period of 2022. This increase was primarily driven by higher Montana interim rates associated with our rate review, lower non-recoverable Montana electric supply costs, higher Montana property tax tracker collections, higher natural gas retail volumes, and lower other state and local tax expenses, partly offset by lower electric retail volumes, lower transmission revenues, higher depreciation and depletion expense, and higher operating, maintenance and administrative expenses.

Consolidated interest expense was $28.7 million for the three months ended September 30, 2023 as compared with $25.3 million for the same period of 2022. This increase was due to higher borrowings and interest rates, partly offset by higher capitalization of Allowance for Funds Used During Construction (AFUDC).

Consolidated other income was $4.1 million for the three months ended September 30, 2023 as compared with $4.2 million for the same period of 2022. This decrease was primarily due to an increase in the non-service component of pension expense, partly offset by higher capitalization of AFUDC.

Consolidated income tax expense was $1.7 million for the three months ended September 30, 2023 as compared to an income tax benefit of $0.2 million for the same period of 2022. Our effective tax rate for the three months ended September 30, 2023 was 5.5% as compared with (0.9)% for the same period in 2022.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 10

The following table summarizes the differences between our effective tax rate and the federal statutory rate ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2023 | | 2022 |

| Income Before Income Taxes | $ | 31.0 | | | | | $ | 27.1 | | | |

| | | | | | | |

| Income tax calculated at federal statutory rate | 6.5 | | | 21.0 | % | | 5.7 | | | 21.0 | % |

| | | | | | | |

| Permanent or flow-through adjustments: | | | | | | | |

| State income tax, net of federal provisions | 0.1 | | | 0.4 | | | 0.1 | | | 0.5 | |

| Flow-through repairs deductions | (4.2) | | | (13.5) | | | (3.4) | | | (12.4) | |

| Production tax credits | (1.3) | | | (4.1) | | | (1.7) | | | (6.2) | |

| Amortization of excess deferred income tax | (0.3) | | | (1.0) | | | (0.2) | | | (0.9) | |

| Income tax return to accrual adjustment | 0.4 | | | 1.3 | | | (0.9) | | | (3.4) | |

| Plant and depreciation flow-through items | 0.4 | | | 1.2 | | | 0.3 | | | 1.0 | |

| Other, net | 0.1 | | | 0.2 | | | (0.1) | | | (0.5) | |

| (4.8) | | | (15.5) | | | (5.9) | | | (21.9) | |

| | | | | | | |

| Income tax expense (benefit) | $ | 1.7 | | | 5.5 | % | | $ | (0.2) | | | (0.9) | % |

We compute income tax expense for each quarter based on the estimated annual effective tax rate for the year, adjusted for certain discrete items. Our effective tax rate typically differs from the federal statutory tax rate primarily due to the regulatory impact of flowing through federal and state tax benefits of repairs deductions, state tax benefit of accelerated tax depreciation deductions (including bonus depreciation when applicable) and production tax credits.

Consolidated net income for the three months ended September 30, 2023 was $29.3 million as compared with $27.4 million for the same period in 2022. This increase was primarily due to higher Montana interim rates associated with our rate review, lower non-recoverable Montana electric supply costs, higher Montana property tax tracker collections, higher natural gas retail volumes, and lower other state and local tax expenses, partly offset by lower electric retail volumes, lower transmission revenues, higher depreciation and depletion expense, higher operating, maintenance, and administrative expenses, higher interest expense, and higher income tax expense.

LIQUIDITY AND OTHER CONSIDERATIONS

Liquidity and Capital Resources

As of September 30, 2023, our total net liquidity was approximately $378.1 million, including $5.1 million of cash and $373.0 million of revolving credit facility availability with no letters of credit outstanding. This compares to total net liquidity one year ago at September 30, 2022 of $74.1 million.

In the early part of 2024, we intend to establish separate unsecured revolving credit facilities for NorthWestern Energy Group and NorthWestern Energy Public Service Corporation.

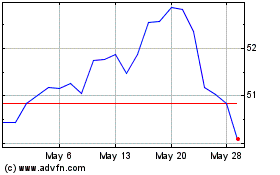

Pursuant to the NorthWestern Corporation Equity Distribution Agreement we have offered and sold shares of our common stock through an At-the-Market (ATM) offering program. During the three months ended September 30, 2023, we issued 1,244,056 shares of common stock under the ATM program at an average price of $51.14 per share, for net proceeds of $62.8 million which is net of sales commissions and other fees paid of approximately $0.8 million. During the nine months ended September 30, 2023, we issued 1,432,738 shares of common stock under the ATM program at an average price of $52.02 per share, for net proceeds of $73.6 million which is net of sales

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 11

commissions and other fees paid of approximately $0.9 million. As of September 30, 2023, we have completed the ATM offering program under the Equity Distribution Agreement.

Earnings Per Share

Basic earnings per share are computed by dividing earnings applicable to common stock by the weighted average number of common shares outstanding for the period. Diluted earnings per share reflect the potential dilution of common stock equivalent shares that could occur if unvested shares were to vest. Common stock equivalent shares are calculated using the treasury stock method, as applicable. The dilutive effect is computed by dividing earnings applicable to common stock by the weighted average number of common shares outstanding plus the effect of the outstanding unvested restricted stock and performance share awards and forward equity sale. Average shares used in computing the basic and diluted earnings per share are as follows:

| | | | | | | | | | | |

| Three Months Ended |

| September 30, 2023 | | September 30, 2022 |

| Basic computation | 60,442,164 | | | 56,310,526 | |

| Dilutive effect of: | | | |

Performance share awards(1) | 35,533 | | | 14,306 | |

Forward equity sale(2) | — | | | 312,572 | |

| Diluted computation | 60,477,697 | | | 56,637,404 | |

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2023 | | September 30, 2022 |

| Basic computation | 60,010,609 | | | 54,901,161 | |

| Dilutive effect of: | | | |

Performance share awards(1) | 31,311 | | | 20,150 | |

Forward equity sale(2) | — | | | 619,361 | |

| Diluted computation | 60,041,920 | | | 55,540,672 | |

| | | |

(1) Performance share awards are included in diluted weighted average number of shares outstanding based upon what would be issued if the end of the most recent reporting period was the end of the term of the award.

(2) Forward equity shares are included in diluted weighted average number of shares outstanding based upon what would be issued if the end of the most recent reporting period was the end of the term of the forward sale agreement.

As of September 30, 2023, there were 32,649 shares from performance and restricted share awards which were antidilutive and excluded from the earnings per share calculations, compared to 51,829 shares as of September 30, 2022.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 12

Adjusted Non-GAAP Earnings

We reported GAAP earnings of $0.48 per diluted share for the three months-ended September 30, 2023 and $0.47 per diluted share for the same period in 2022. Adjusted Non-GAAP earnings per diluted share for the same periods are $0.49 and $0.44, respectively. A reconciliation of items not factored into our Adjusted Non-GAAP diluted earnings are summarized below. The amount below represents a non-GAAP measure that may provide users of this data with additional meaningful information regarding the impact of certain items on our expected earnings. More information on this measure can be found in the "Non-GAAP Financial Measures" section below.

| | | | | | | | | | | |

| (in millions, except EPS) | |

| | | |

| Three Months Ended September 30, 2023 |

| Pre-tax

Income | Net(1)

Income | Diluted

EPS |

| 2023 Reported GAAP | $31.0 | $29.3 | $0.48 |

| | | |

| Non-GAAP Adjustments: |

Remove impact of unfavorable weather as compared to normal | 0.9 | | 0.7 | | 0.01 | |

| | | |

| 2023 Adj. Non-GAAP | $31.9 | $30.0 | $0.49 |

| | | |

| | | |

| Three Months Ended September 30, 2022 |

| Pre-tax

Income | Net(1)

Income | Diluted

EPS |

| 2022 Reported GAAP | $27.1 | $27.4 | $ | 0.47 | |

| | | |

| Non-GAAP Adjustments: |

Remove impact of favorable weather as compared to normal | (2.1) | | (1.6) | | (0.03) | |

| | | |

| 2022 Adj. Non-GAAP | $25.0 | $25.8 | $0.44 |

| | | |

| (1) Income tax rate on reconciling items assumes blended federal plus state effective tax rate of 25.3%. |

Company Hosting Earnings Webcast

NorthWestern will also host an investor earnings webcast on Friday, October 27, 2023, at 3:00 p.m. Eastern time to review its financial results for the quarter ending September 30, 2023. To register for the webcast, please visit www.northwesternenergy.com/earnings-registration. Please go to the site at least 15 minutes in advance of the webinar to register. An archived webcast will be available shortly after the event and remain active for one year.

NorthWestern Energy - DELIVERING A BRIGHT FUTURE

NorthWestern Corporation, doing business as NorthWestern Energy, provides essential energy infrastructure and valuable services that enrich lives and empower communities while serving as long-term partners to our customers and communities. We work to deliver safe, reliable, and innovative energy solutions that create value for customers, communities, employees, and investors. We do this by providing low-cost and reliable service performed by highly-adaptable and skilled employees. We provide electricity and / or natural gas to approximately 764,200 customers in Montana, South Dakota, Nebraska, and Yellowstone National Park. We have provided service in South Dakota and Nebraska since 1923 and in Montana since 2002.

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 13

Non-GAAP Financial Measures

This press release includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in the press release above.

Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow for recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report.

Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non- GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, without limitation, the information under "Adjusted Non-GAAP Earnings." Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and believe such statements are based on reasonable assumptions, including without limitation, management's examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that we will achieve our projections. Factors that may cause such differences include, but are not limited to:

•adverse determinations by regulators, as well as potential adverse federal, state, or local legislation or regulation, including costs of compliance with existing and future environmental requirements, could have a material effect on our liquidity, results of operations and financial condition;

•the impact of extraordinary external events and natural disasters, such as a wide-spread or global pandemic, geopolitical events, earthquake, flood, drought, lightning, weather, wind, and fire, could have a material effect on our liquidity, results of operations and financial condition;

NorthWestern Reports Third Quarter 2023 Financial Results

October 26, 2023

Page 14

•acts of terrorism, cybersecurity attacks, data security breaches, or other malicious acts that cause damage to our generation, transmission, or distribution facilities, information technology systems, or result in the release of confidential customer, employee, or Company information;

•supply chain constraints, recent high levels of inflation for product, services and labor costs, and their impact on capital expenditures, operating activities, and/or our ability to safely and reliably serve our customers;

•changes in availability of trade credit, creditworthiness of counterparties, usage, commodity prices, fuel supply costs or availability due to higher demand, shortages, weather conditions, transportation problems or other developments, may reduce revenues or may increase operating costs, each of which could adversely affect our liquidity and results of operations;

•unscheduled generation outages or forced reductions in output, maintenance or repairs, which may reduce revenues and increase operating costs or may require additional capital expenditures or other increased operating costs; and

•adverse changes in general economic and competitive conditions in the U.S. financial markets and in our service territories.

Our 2022 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, reports on Form 8-K and other Securities and Exchange Commission filings discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Relations Contact: Media Contact:

Travis Meyer (605) 978-2967 Jo Dee Black (866) 622-8081

travis.meyer@northwestern.com jodee.black@northwestern.com

2023 Third Quarter Earnings Webcast October 27, 2023 Western Montana 8-K October 27, 2023

2 Mission Working together to deliver safe, reliable and affordable energy solutions. Vision Enriching lives through a safe and sustainable energy future. Values Safety Excellence Respect Value Integrity Community Environment NorthWestern Energy

Presenting Today 3 Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date of this document unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward- looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s 10-K and 10-Q along with other public filings with the SEC. Crystal Lail CFO Brian Bird President & CEO

Highlights 4 • Initiating diluted earnings per share guidance1 2023: $3.00 - $3.10 2024: $3.42 - $3.62 • Increasing long-term (5 year) rate base and earnings per share growth rates targets to 4% - 6%2 • Unanimous approval of a constructive multi-party settlement in the Montana rate review • Electric & natural gas base rates increase of $67.4 million & $14.1 million, respectively • Rates effective November 1, 2023 • Effectuated first phase of holding company reorganization • Issued $63 million of the remaining $75 million, closing out our Equity Distribution Agreement • Dividend Declared: $0.64 per share payable December 29, 2023 to shareholders of record as of December 15, 2023 1.) See additional details and assumptions on page 16 2.) Based on 2022 estimated rate base of $4.54 billion and 2022 adjusted non-GAAP earnings of $3.18 per diluted share

Third Quarter 2023 Financial Results 5 *See slide 11 and “Non-GAAP Financial Measures” slide in the appendix for additional detail on this measure. Third Quarter Net Income vs Prior Period •GAAP: $1.9 Million or +7.1% •Non-GAAP*: $4.2 Million +16.3% Third Quarter EPS vs Prior Period •GAAP: $0.01 or +2.1% •Non-GAAP*: $0.05 or 11.4%

*See slide 47 and “Non-GAAP Financial Measures” slide in the appendix for additional detail on this measure. Year-to-Date 2023 Financial Results 6 Year-to-Date Net Income vs Prior Period •GAAP: $5.3 Million (or 4.6%) •Non-GAAP*: $1.9 Million (or 1.6%) Year-to-Date EPS vs Prior Period •GAAP: $0.24 (or 11.5%) •Non-GAAP*: $0.18 (or 8.7%)

Third Quarter Financial Results 7 (1) (1) Decrease in revenues is primarily related to pass-through supply costs and non-cash regulatory amortizations. (2) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (2)

Third Quarter EPS Bridge 8 Improvement in Utility Margin offset by higher expenses and share count dilution After-tax Earnings Per Share See slide 11 and “Non-GAAP Financial Measures” slide in the appendix for additional detail on this measure.

Third Quarter Utility Margin Bridge 9 $8.5 Million or 3.8% increase in Utility Margin due to items that impact Net Income NOTE: Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Pre-tax Millions

Third Quarter OA&G Bridge 10 $1.3 Million or 1.6% increase in OA&G Expense due to items that impact Net Income. NOTE: Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. Pre-tax Millions

Third Quarter Non-GAAP Earnings 11 The adjusted non-GAAP measures presented in the table are being shown to reflect significant items that are non- recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure.

Cash Flow 12 Cash from Operating Activities increased by $117.7 million driven primarily by a $101.6 million increase in collection of energy supply costs from customers and Montana interim rates. Funds from Operations decreased by $4.5 million over prior period. Net Under-Collected Supply Costs (in millions) Beginning (Jan. 1) Ending (Sept. 30) Inflow 2022 $99.1 $101.9 $(2.8) 2023 $115.4 $16.6 $98.8 2023 Improvement (less outflow) $101.6 Financing Activities in 2023 Equity Issuances in 2023 • Issued remaining $73.6 million of common stock under our At-the-Market program in Q2 & Q3. Debt financing in 2023 • Issued $239 million, 5.57% coupon, 10 year Montana FMBs priced in Q1 • Issued $31 million, 5.57% coupon, 10 year South Dakota FMB’s priced in Q1 • Issued $30 million, 5.42% coupon, 10 year, South Dakota FMBs in Q2 • Refinanced $144.7 million, 3.88% coupon, 5 year Pollution Control Revenue Refunding Bonds in Q2 Financing plans (targeting a FFO to Debt ratio > 14%) are expected maintain our current credit ratings and are subject to change.

Unanimous approval from the Montana Public Service Commission of a constructive multi-party settlement • We expect final settlement rates to be effective November 1, 2023 • We do not expect a true-up in rates from interim to final rates for the period from October 1, 2022 to October 31, 2023 Montana General Rate Review 13

South Dakota General Rate Review • First rate review since 2015. Seeking recovery of nearly 30 percent of rate base that is not included in South Dakota electric rates today. • Requested base rate increase driven by more than $267 million invested in South Dakota critical electric infrastructure, while keeping operating costs below the rate of inflation, since our last electric rate review. 14 Request to update our rates to reflect the current cost to provide safe and reliable service

Strong Outlook & 2024 Earnings Guidance 15 This guidance range is based upon, but not limited to, the following major assumptions: • Final approval of all material aspects of the Montana general rate review settlement agreement • Constructive outcomes in our current South Dakota rate review and regulatory proceedings • Normal weather in our service territories • An effective income tax rate of approximately 4%-5% for 2023 and 12%-14% for 2024; and • Diluted average shares outstanding of approximately 60.4 million in 2023 and 61.3 million in 2024. Initiating non-GAAP EPS guidance 2023: $3.00 - $3.10 2024: $3.42 - $3.62 Increasing long-term (5 Year) expected growth rates • EPS growth of 4% to 6% (from 3% to 6%) from 2022 base year of $3.18 Non-GAAP • Rate base growth of 4% - 6% (from 4% to 5%) from 2022 base year $4.54 billion. • Continued focus on earned returns driven by financial and operational execution No equity expected to fund the current 5-year capital plan • $510 million capital plan for 2023 on target • $2.4 billion infrastructure investment plan for ‘23–’27 sized to be self-funded • Any equity needs would be driven by opportunities incremental to the plan Targeting FFO > 14% by end of 2024 and beyond Annual dividend growth expected to be below earnings growth until we return to a payout ratio within our targeted 60% to 70%

Capital Investment 16 $2.4 billion of forecasted low-risk capital investment opportunity… • Capital investment addresses generation and transmission capacity constraints, grid modernization and renewable energy integration. This does not include any incremental opportunities related to additional supply investment. • This sustainable level of capex is expected to drive an annualized rate base growth of approximately 4%-6%. • We expect to finance this capital with a combination of cash flows from operations and first mortgage bonds. • Updated 2024 – 2028 capital investment plan to be provided at EEI Financial Conference (November 2023) Over $2.1 Billion investment* over last 5 years * Historical Capital Investment includes property, plant and equipment additions, acquisitions and capital expenditures included in accounts payable. 5 Year History of Capital Investment 5 Year Forecast of Capital Investment ($millions, unless stated otherwise) Yellowstone County Generating Station

Holding Company Reorganization 17

Conclusion 18 Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Strong Earnings & Cash Flows

19 Appendix

Regulated Utility Five-Year Capital Forecast 20 Appendix $2.4 billion of highly-executable and low-risk capital investment Electric Supply Resource Plans - Our energy resource plans identify portfolio resource requirements including potential investments. Included within our projections is approximately $120.0 million (in 2023 and 2024) of capital to complete construction of the 175 MW Yellowstone County Generating Station to be on line in 2024. Distribution and Transmission Modernization and Maintenance - The primary goals of our infrastructure investments are to reverse the trend in aging infrastructure, maintain reliability, proactively manage safety, build capacity into the system, and prepare our network for the adoption of new technologies. We are taking a proactive and pragmatic approach to replacing these assets while also evaluating the implementation of additional technologies to prepare the overall system for smart grid applications. Beginning in 2021, and continuing through 2025, we are installing automated metering infrastructure in Montana at a total cost of approximately $112.0 million, of which, $66.1 million remains and is reflected in the five year capital forecast.

Rate Base & Authorized Return Summary 21 Appendix (1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (4) On August 8, 2022, we filed a Montana electric and natural gas rate review filing (2021 test year) requesting an increase to our authorized rate base, return on equity, and equity level in our capital structure. We expect a final order regarding this rate review in 2023. Coal Generation Rate Base as a percentage of Total Rate Base Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver for earnings. The data to the left illustrates that NorthWestern only derives approximately 9 -14% of earnings from its jointly owned coal generation rate base.

22 Appendix South Dakota Rate Review

South Dakota Rate Review 23 Infrastructure investment drives nearly 99%* of the requested base rate adjustment * $19.0 million Cost of Capital plus $17.2 million Infrastructure Investment as a percent of $36.6 million Total Change in Cost of Service. Appendix

South Dakota Rate Review 24 Electric $19.14 Per month Increase for an average residential electric customer that uses 750 kWh if our requested rate increase is approved. Appendix

South Dakota Rate Review 25 Appendix Since our last rate adjustment, NorthWestern’s typical residential electric customer bills have maintained a pace well below inflation. This request, if granted in full, would still result in customer bills in line with inflation.

26 Appendix Colstrip Transfer

NorthWestern Energy executed an agreement with Avista Corporation (Exit Agreement) for the transfer of Avista’s ownership interests in Colstrip Units 3 and 4. • Effective date of transfer: December 31, 2025 • Generating capacity: 222 MW (bringing our total ownership to 444 MW) • Transfer price: $0.00 Colstrip Transaction Overview 27 • NorthWestern will be responsible for operational and capital costs beginning January 1, 2026. • The agreement does not require approval by the Montana Public Service Commission (MPSC). We expect to work with the MPSC in a future docket for cost recovery in 2026. • NorthWestern will have the right to exercise Avista’s vote with respect to capital expenditures1 between now and 2025 with Avista responsible for its pro rata share2. • Avista will retain its existing environmental and decommissioning obligations through life of plant. • Under the Colstrip Ownership & Operating Agreement, each of the owners will have a 90-day period in which to evaluate the transaction between NorthWestern and Avista to determine whether to exercise their respective right of first refusal. • We filed our Montana Integrated Resource Plan on April 28, 2023. This transaction is expected to satisfy our capacity needs in Montana for at least the next 5 years. 1. Avista retains the vote related to remediation activities. 2. Avista bears its current project share (15%) costs through 2025, other than “Enhancement Work Costs” for which it bears a time-based pro-rata share. Enhancement Work Costs are costs that are not performed on a least-costs basis or are intended to extend the life of the facility beyond 2025. See the Exit Agreement for additional detail. Appendix

Facility Ownership Overview 28 NorthWestern is actively working with the other owners to resolve outstanding issues, including the associated pending legal proceedings. Additionally, the owners intend to pursue a mutually beneficial reallocation (swap) of megawatts between the two units that would ideally provide NorthWestern with a controlling (> 370 megawatts) share of Unit 4. Appendix

Why Colstrip? 29 Reliable Existing resource, ready to serve our Montana customers. Avoids lengthy planning, permitting and construction of a new facility that would stretch in-service beyond 2026. Reduces reliance on imported power and volatile markets, providing increased energy independence. In-state and on-system asset mitigating the transmission constraints we experience importing capacity. Adds critical long-duration, 24/7 on-demand generation necessary for balancing our existing portfolio. Affordable 222 MW of capacity with no upfront capital costs and stable operating costs going forward. o Equivalent new build would cost in excess of $500 million. o Incremental operating costs are known and reasonable. Resulting variable generation costs represent a 90%+ discount to market prices incurred during December’s polar vortex. In addition to no upfront capital, low and stably priced mine-mouth coal supply costs. Sustainable We remain committed to our net zero goal by 2050. This additional capacity, with a remaining life of up to 20 years, helps bridge the interim gap and will likely lead to less carbon post 2040. Yellowstone County Generating Station is potentially our last natural gas resource addition in Montana. Partners are committed to evaluate non-carbon long-duration alternative resources for the site. Keeps the existing plant open and retains its highly skilled jobs vital to the Colstrip community. Protects existing ownership interests with an ultimate goal of majority ownership of Unit 4. NorthWestern Energy executed an agreement with Avista Corporation for the transfer of Avista’s ownership interests in Colstrip Units 3 & 4. • Effective date of transfer: 12/31/2025 • Generating capacity: 222 MW • Transfer price: $0.00 Appendix

Reduces Risk We are in a supply capacity crisis due to lack of resource adequacy, with approx. 40% of our customers’ peak needs on the market. This transaction will reduce our need to import expensive capacity during critical times. Establishes clarity regarding operations past 2025 Washington state legislation deadline. Reduces PCCAM risk sharing for customers and shareholders. Bill Headroom Stable pricing reduces impact of market volatility and high energy prices on customers. Aligned with ‘All of the Above’ energy transition in Montana Supports our generating portfolio that is nearly 60% carbon-free today. Provides future opportunity at the site while supporting economic development in Montana. Agreement considers the appropriate balance of reliability, affordability and sustainability. 30 Why Colstrip?Appendix

December 2022 Polar Vortex 31 The chart illustrates the actual resource specific contribution of energy, the capacity deficit we faced, and the market price of power during the late December 2022 multi-day cold weather event in Montana. As a result of our capacity deficit, we were reliant upon the high and volatile power market a majority of the time to meet customer demand. Appendix

Our Net-Zero Vision 32 Over the past 100 years, NorthWestern Energy has maintained our commitment to provide customers with reliable and affordable electric and natural gas service while also being good stewards of the environment. We have responded to climate change, its implications and risks, by increasing our environmental sustainability efforts and our access to clean energy resources. But more must be done. We are committed to achieving net zero emissions by 2050. • Committed to achieving net-zero by 2050 for Scope 1 and 2 emissions • Must balance Affordability, Reliability and Sustainability in this transition • No new carbon emitting generation additions after 2035 • Pipeline modernization, enhanced leak detection and development of alternative fuels for natural gas business • Electrify fleet and add charging infrastructure • Carbon offsets likely needed to ultimately achieve net-zero • Please visit www.NorthWesternEnergy.com/NetZero to learn more about our Net Zero Vision. Appendix

33 Appendix Third Quarter and Year-to-Date Financial Information

Increase in utility margin due to the following factors: $ 7.8 Montana interim rates 4.0 Lower non-recoverable Montana electric supply costs 1.3 Montana property tax tracker collections 0.6 Higher natural gas retail volumes 0.3 Higher Montana natural gas transportations (4.3) Lower electric retail volumes (0.5) Lower transmission revenue (market conditions & lower transmission rates) (0.7) Other $ 8.5 Change in Utility Margin Impacting Net Income 34 Utility Margin (3rd Quarter) (dollars in millions) Three Months Ended September 30, 2023 2022 Variance Electric $ 202.0 $ 196.7 $ 5.3 2.7% Natural Gas 30.2 29.5 0.7 2.4% Total Utility Margin $ 232.2 $ 226.2 $ 6.0 2.7% $ (3.1) Lower property taxes recovered in revenue, offset in property & other tax expense (0.1) Lower natural gas production taxes recovered in revenue, offset in property & other taxes 0.4 Higher revenue from lower production tax credits, offset in income tax expense 0.3 Higher operating expenses recovered in revenue, offset in O&M expense $ (2.5) Change in Utility Margin Offset Within Net Income $ 6.0 Increase in Utility Margin (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (1) Appendix

Decrease in operating expenses due to the following factors: $ 3.6 Higher depreciation due to plant additions 0.6 Higher technology implementation and maintenance expense 0.5 Higher insurance expense 0.3 Increase in uncollectible accounts (1.6) Lower other state and local tax expense (0.3) Lower expenses at our electric generation facilities 0.2 Other miscellaneous $ 3.3 Change in Operating Expense Items Impacting Net Income Operating Expenses 35 (3rd Quarter) (dollars in millions) Three Months Ended September 30, 2023 2022 Variance Operating & maintenance $ 53.2 $ 54.7 $ (1.5) (2.7)% Administrative & general 29.4 28.1 1.3 4.6% Property and other taxes 41.8 46.5 (4.7) (10.1)% Depreciation and depletion 52.2 48.6 3.6 7.4% Operating Expenses $ 176.6 $ 177.9 $ (1.3) (0.7)% $ (3.1) Lower property taxes recovered in trackers, offset in revenue (1.7) Lower pension and other postretirement benefits, offset in other income (1) (0.1) Lower natural gas production taxes recovered in trackers, offset in revenue 0.3 Higher operating and maintenance expenses recovered in trackers, offset in revenue $ (4.6) Change in Operating Expense Items Offset Within Net Income $ (1.3) Decrease in Operating Expenses $(0.2) Appendix (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses.

Operating to Net Income 36 (dollars in millions) Three Months Ended September 30, 2023 2022 Variance Operating Income $ 55.6 $ 48.2 $ 7.4 15.4% Interest expense (28.7) (25.3) (3.4) (13.4)% Other income, net 4.1 4.2 (0.1) (2.4)% Income Before Taxes 31.0 27.1 3.9 14.4% Income tax (expense) / benefit (1.7) 0.3 (2.0) (666.7)% Net Income $ 29.3 $ 27.4 $ 1.9 7.1% (3rd Quarter) $3.4 million increase in interest expenses was primarily due to higher borrowings and interest rates, partly offset by higher capitalization of AFUDC. $0.1 million decrease in other income, net was primarily due to an increase in the non- service component of pension expense, partly offset by higher capitalization of AFUDC. $2.0 million increase in income tax expense was primarily due to higher pre-tax income and an accrual adjustment to our income tax return, partly offset by higher flow- through repairs deductions. Appendix

Tax Reconciliation 37 Appendix (3rd Quarter)

38 Segment ResultsAppendix (1) (1) (3rd Quarter) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

Weather / Hydro Conditions 39 Snow water equivalents generally in line with the 30-year medians. (Missouri, Madison & Clark Fork Rivers and West Rosebud Creek basins) We estimated a $0.9 million pre-tax detriment as compared to normal and a $3.0 million detriment as compared to Q3 2022. Appendix (3rd Quarter) Real-Time Streamflows versus 30-Year Normal

40 Electric SegmentAppendix (1) (3rd Quarter) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

41 Natural Gas SegmentAppendix (1) (3rd Quarter) (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

Increase in utility margin due to the following factors: $ 23.4 Montana interim rates 8.3 Lower non-recoverable Montana electric supply costs 4.8 Montana property tax tracker collections 2.0 Higher electric retail volumes 1.8 Higher Montana natural gas transportation (1.0) Lower natural gas retail volumes (1.0) Lower transmission revenue (market conditions & lower transmission rates) (1.1) Other $ 37.2 Change in Utility Margin Impacting Net Income 42 Utility Margin (YTD thru 3rd Quarter) (dollars in millions) Nine Months Ended September 30, 2023 2022 Variance Electric $ 606.1 $ 576.5 $ 29.6 5.1% Natural Gas 138.0 137.0 1.0 0.7% Total Utility Margin $ 744.1 $ 713.5 $ 30.6 4.3% $ (7.7) Lower property taxes recovered in revenue, offset in property & other tax expense (1.4) Lower operating expenses recovered in revenue, offset in O&M expense (0.6) Lower natural gas production taxes recovered in revenue, offset in property & other taxes 3.1 Higher revenue from lower production tax credits, offset in income tax expense $ (6.6) Change in Utility Margin Offset Within Net Income $ 30.6 Increase in Utility Margin (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (1) Appendix

Increase in operating expenses due to the following factors: $ 12.1 Higher depreciation due to plant additions 7.5 Higher labor and benefits (1) 2.9 Higher expenses at our electric generation facilities 1.5 Higher insurance expense 1.4 Increase in uncollectible accounts 0.6 Higher cost of materials 0.2 Higher technology implementation and maintenance expenses (0.9) Lower other state and local tax expense 0.9 Other miscellaneous $ 26.2 Change in Operating Expense Items Impacting Net Income Operating Expenses 43 (YTD thru 3rd Quarter) (dollars in millions) Nine Months Ended September 30, 2023 2022 Variance Operating & maintenance $ 163.9 $ 160.8 $ 3.1 1.9% Administrative & general 94.1 87.0 7.1 8.2% Property and other taxes 131.0 140.2 (9.2) (6.6)% Depreciation and depletion 157.8 145.7 12.1 8.3% Operating Expenses $ 546.8 $ 533.7 $ 13.1 2.5% $ (7.7) Lower property taxes recovered in trackers, offset in revenue (3.2) Lower pension and other postretirement benefits, offset in other income (1.4) Lower operating and maintenance expenses recovered in trackers, offset in revenue (0.6) Lower natural gas production taxes recovered in trackers, offset in revenue (0.2) Lower non-employee directors deferred compensation, offset in other income $ (13.1) Change in Operating Expense Items Offset Within Net Income $ 13.1 Increase in Operating Expenses $10.2 Appendix (1) In order to present the total change in labor and benefits, we have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income. This change is offset within this table as it does not affect our operating expenses.

Operating to Net Income 44 (dollars in millions) Nine Months Ended September 30, 2023 2022 Variance Operating Income $ 197.3 $ 179.9 $ 17.4 9.7% Interest expense (85.1) (73.1) (12.0) (16.4)% Other income, net 12.9 11.8 1.1 9.3% Income Before Taxes 125.1 118.6 6.5 5.5% Income tax expense (14.1) (2.3) (11.8) (513.0)% Net Income $ 111.0 $ 116.3 $ (5.3) (4.6)% (YTD thru 3rd Quarter) $12.0 million increase in interest expenses was primarily due to higher borrowings and interest rates, partly offset by higher capitalization of AFUDC. $1.1 million increase in other income, net was primarily due to the prior year CREP penalty and higher capitalization of AFUDC, partly offset by an increase in the non-service component of pension expense $11.8 million increase in income tax expense was primarily due to higher pre-tax income, a reduction to previously claimed alternative minimum tax credit, lower plant and depreciation flow-through items and an accrual adjustment to an income tax return. Appendix

Tax Reconciliation 45 Appendix (YTD thru 3rd Quarter)