Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 27 2023 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number 001-35991

AENZA S.A.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Republic of Peru

(Jurisdiction of incorporation or organization)

Av. Petit Thouars 4957

Miraflores

Lima 34, Peru

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

October 26, 2023

Pursuant to the provisions of Article 30 of the

Securities Market Law, Sole Ordered Text approved by Supreme Decree No. 020-2023-EF, and the Regulation of Relevant and Reserved Information,

approved by Resolution SMV No. 005-2014-SM/01, we hereby communicate as a Relevant Information Communication, that, as informed by means

of a Relevant Information Communication dated October 24, 2023, through the meeting of the General Shareholders’ Meeting of AENZA S. A.A.A.

(the “Company”), held on the same date on first call, it was resolved to approve the capital increase of the Company

(the “Capital Increase”) and to delegate powers to the Board of Directors of the Company to define the terms and conditions

of such capital increase and the exercise of the preemptive subscription right.

In this regard, the Board of Directors met today

to deliberate on the matter and the following resolutions were adopted:

| 1. | Terms and conditions of the capital increase by new monetary contributions and the exercise of pre-emptive

subscription rights approved at the General Shareholders’ Meeting held on October 24, 2023. |

The following was unanimously approved:

| 1 |

|

Form and purpose of the Capital Increase |

|

Monetary contributions of US$ 22,500,000 to use the funds obtained to partially repay the Company’s financial obligations and, in general, to strengthen the equity of the Company and/or its subsidiaries. |

| |

|

|

|

|

| 2 |

|

Amount of the Capital Increase |

|

Up to the amount of S/ 174,984,912, equivalent to contributions of USD 22,500,000 at the Exchange Rate, at the Placement Price and considering the Capital Loss (equivalent to S/ 87,999,912.24). |

| |

|

|

|

|

| 3 |

|

Exchange rate |

|

S/. 3.866 for each US$1.00 |

| |

|

|

|

|

| 4 |

|

Number of shares entitled to participate in the subscription of shares |

|

In accordance with the provisions of the Securities Market Law, we specify that the 1,196,979,979 common shares that comprise the capital of the Company may participate in the subscription of new shares in Peru. |

| |

|

|

|

|

| 5 |

|

Type and number of shares to be issued |

|

The shares to be issued will be common shares

with voting rights and other rights established by law and the Company’s bylaws, with a par value of S/. 1.00 (one and 00/100 Soles) each.

The number of shares to be issued will be determined

by the Board of Directors at the end of the Capital Increase process, based on the final amount of the Capital Increase. Notwithstanding

the foregoing, the maximum number of shares to be issued will be 174,984,912. |

| 6 |

|

Placement Price |

|

The price per common share will be S/. 0.4971,

which will be converted into Dollars for purposes of the payment of the contributions using the Exchange Rate.

The Unit Placement Price is equal to the volume

weighted average price (VWAP) as of 60 calendar days prior to October 24, 2023, as reported on the Lima Stock Exchange, minus 15%.

The placement price calculation considers the

quotations registered between August 25 and October 23, 2023. |

| |

|

|

|

|

| 7 |

|

Capital Loss |

|

The Capital Loss will be the difference between the par value and the Placement Price of the common shares to be issued as part of the Capital Increase. The Placement Loss will be S/. 0.5029 per share. |

| |

|

|

|

|

| 8 |

|

Subscription Percentage |

|

The subscription percentage will be 14.619%. For purposes of the calculation, it will be considered that for each issued and outstanding common share of the Company, a subscription right equivalent to 0.14619 shares to be subscribed will be computed. |

| |

|

|

|

|

| 9 |

|

Subscription Rounds |

|

The preemptive subscription right may be exercised

in two (2) rounds:

First Round: 26 calendar days (17 business

days and 9 non-business days) and would commence on November 17, 2023, at the opening of trading hours of the Lima Stock Exchange and

would end on December 12, 2023, at the close of trading hours of the Lima Stock Exchange.

Second Round: 3 business days and will

begin on December 13, 2023, at the opening of trading hours of the Lima Stock Exchange and will end on December 15, 2023, at the close

of trading hours of the Lima Stock Exchange. |

| |

|

|

|

|

| 10 |

|

Information on subscription rounds |

|

Holders of CAVALI registered common shares:

Information regarding the percentage of subscription corresponding to each of the holders of common shares in the First Round, according

to their ownership, will be available as of the first day of the First Round, at the offices of their broker or CAVALI participant, as

applicable, and at the Company’s offices at Av. Abel Bergasse Du Petit Thouars No. 4957, Miraflores, Lima, Peru.

The contact person at the Company will be Paola

Pastor Aragón, e-mail paola.pastor@aenza.com.pe

Holders of common shares represented by physical

certificates: Information regarding the percentage of subscription corresponding to each of the holders of common shares in the First

Round, according to their holdings, will be available as from the first day of the First Round, only at the Company’s offices, at the

address indicated above and with the contact persons indicated above.

The information regarding the percentage of subscription

that will correspond in the Second Round to each of the holders of common shares that participated in the First Round, will be available

at the offices of its brokerage firm or CAVALI participant, as applicable, as well as at the Company’s offices, at the address and with

the contact persons indicated above. |

| 11 |

|

Benefits of common shares to be subscribed |

|

Benefits of common shares to be subscribed will have the same rights as common shares currently outstanding. |

| |

|

|

|

|

| 12 |

|

Bank account for payment of contributions and currency of payment |

|

The cash contributions to be made as part of the

Capital Increase must be deposited in the bank account (the “Contribution Account”) owned by the Company at Banco de

Crédito del Perú:

Account Number: 193-2318541-1-15

Interbank Code (ICC): 00219300231854111516

Swift Code: BCPLPEPL

Beneficiary: AENZA S.A.A.

Banco de Crédito del Perú Address:

Calle Centenario No. 156 – Urb. Santa Patricia – La Molina, Lima, 12, Perú

AENZA Address: Av. Petit Thouars 4957. Miraflores,

Lima 18, Perú

The Placement Price must (i) be deposited in full

in the Contribution Account, or (ii) be made available in full in the account of the brokerage firm of the subscribing shareholder or

of a third-party intermediary, in each case, to the satisfaction of the Company, at the time of subscription of the shares.

The Placement Price shall be paid in Dollars of

the United States of America.

The payment or transfer to the Contribution Account

or to the account of the brokerage firm or third-party intermediary, in each case, to the satisfaction of the Company, must be evidenced

by a deposit voucher issued by the corresponding bank or by any other means issued by the receiving bank, evidencing, to the satisfaction

of the Company, the entry of the funds to the corresponding account (the “Deposit Voucher”). |

| |

|

|

|

|

| 13 |

|

Incorporation of the preemptive subscription right in the Pre-emptive Subscription Certificates |

|

The preemptive subscription rights corresponding

to each shareholder are embodied in preemptive subscription certificates (the “Preemptive Subscription Certificates”).

Each Pre-emptive Subscription Certificate will

entitle the holder to subscribe one (1) new share of the Company in First Round.

The Preferred Subscription Certificates will be

represented by book entries in CAVALI in the case of shares represented by book entries, and by physical certificates in the case of shares

represented by physical certificates. |

| |

|

|

|

|

| 14 |

|

Registration Date and Cut-off

Date |

|

Record Date: November 15, 2023.

Cut-Off Date: To be determined in accordance with applicable regulations.

The Preferred Subscription Certificates will be issued in favor of the shareholders who, on the Record Date, appear registered as such in CAVALI, or in the Company’s share registry, as applicable, in proportion to their share ownership.

|

| 15 |

|

Date of Delivery of Preferred Subscription Certificates |

|

The date will be November 16, 2023. As of such

date, the Pre-emptive Subscription Certificates will be available to the Company’s shareholders.

The Preferred Subscription Certificates represented

by book entries in CAVALI will be delivered by book entry in CAVALI in the name of the corresponding shareholders. The Preferred Subscription

Certificates represented by physical certificates will be available to the beneficiaries at the Company’s offices located at Av. Abel

Bergasse Du Petit Thouars No. 4957, Miraflores, Lima, Peru, through the contact person Paola Pastor Aragón, with e-mail paola.pastor@aenza.com.pe.

In order to proceed with the delivery of Preferred

Subscription Certificates represented by physical certificates, the interested parties must appear at the address indicated above, presenting

a copy of their identification document in the case of natural persons and, in the case of legal entities, carrying: (i) letter of instruction

signed by the legal representative of the legal entity with legalized signatures requesting the delivery of the Preferred Subscription

Certificates to a specific representative; (ii) legalized copy of the power of attorney empowering to request the issuance of the Preferred

Subscription Certificates, (iii) validity of the power of attorney of the legal representative not older than 30 days; and, (iv) copy

of the legal representative’s identity document.

The Preferred Subscription Certificates will be

available to shareholders until December 12, 2023 (inclusive). |

| |

|

|

|

|

| 16 |

|

Methodology for allocation of securities to be subscribed as a result of the application of the subscription percentage |

|

If the application of the Subscription Percentage

or the prorate in any of the Rounds or in the determination of the remainder results in a number of shares to be subscribed that is not

a whole number, it will be rounded down to the next lower whole number.

In the event that the rounding technique set forth

in the preceding paragraph results in the number of Preferred Subscription Certificates to be allocated to the shareholders being less

than the number of new shares of common stock to be offered for subscription, the remaining Preferred Subscription Certificates shall

be allocated as follows:

(i) Preferred Subscription Certificates will be

issued to the shareholders who, before rounding, were closest to one (1).

(ii) In the event of a tie in criterion (i) above,

the shareholders with the largest number of common shares will have priority in order to minimize the effect on the shareholdings.

The payment obligation of the shares to be subscribed

will correspond to the amount stated in the respective Pre-emptive Subscription Certificates, which will be equivalent to the total amount

of the Placement Price, considering the aforementioned rounding. |

| 17 |

|

Deadline and mechanisms for the negotiation of the Preferred Subscription Certificates |

|

The Preferred Subscription Certificates represented

by book entries in CAVALI may be freely negotiated in the Lima Stock Exchange, or outside of it, in compliance with the rules that regulate

the transfer of securities, from November 17, 2023 and until December 7, 2023. The expiration date of the Preferred Subscription Certificates

will be December 12, 2023, inclusive.

In any case, the intervention of a brokerage firm

will be mandatory, being applicable the provisions of Conasev Resolution No. 27-1995-EF/94.10.

Holders of Preferred Subscription Certificates

represented by physical securities who wish to trade them may do so on or off the stock trading system. In the first case (transfers within

the stock exchange of the Lima Stock Exchange), they must previously dematerialize them. The dematerialization process is entirely the

responsibility of the holder of the Preferred Subscription Certificates. Likewise, holders who trade their Preferred Subscription Certificates

on the stock exchange trading floor must take care of the timely settlement of the transactions in order to be able to exercise their

subscription rights. |

| 18 |

|

Subscription deadline and procedure |

|

First Round: In the First Round, once the decision to participate in the Capital Increase has been made, the holders of Preferred Subscription Certificates must proceed as follows: |

| |

|

|

|

|

|

| |

|

|

|

(a) |

Contact the Company or its brokerage firm directly, in any such case, indicating the number of common shares they wish to subscribe. |

| |

|

|

|

|

|

| |

|

|

|

(b) |

Complete the share subscription process by satisfactorily completing and signing the form to be delivered by the Company or its brokerage firm, as applicable (the “Form”). The Form must be delivered to the Company or its brokerage firm within the term of the First Round. |

| |

|

|

|

|

|

| |

|

|

|

(c) |

Pay the amount of its capital contribution into the Contribution Account or transfer such amount in full to the account of its brokerage firm or a third-party intermediary to the satisfaction of the Company. |

| |

|

|

|

|

|

| |

|

|

|

(d) |

The payment made shall be recorded in the Deposit Voucher and shall be deemed to have been made on the day on which the funds are credited to the corresponding account. The Deposit Voucher must be delivered to the Company immediately. The subscription process in the First Round shall be considered satisfactorily completed once the Company has verified that the subscriber has complied with: (i) subscribing, delivering the Form directly to the Company or to its brokerage firm and delivering all the information requested by the Company as detailed in the Form, if applicable; and, (ii) making the payment or transfer and delivering the Deposit Voucher directly to the Company. |

| |

|

|

|

Second Round: If at the end of the First Round common shares remain unsubscribed, those who have participated in the First Round may subscribe, in the Second Round, all the remaining common shares pro rata to their ownership, considering the shares subscribed in the First Round, in accordance with the provisions of the last paragraph of Article 209 of the General Corporations Law. For purposes of calculating the number of common shares to be subscribed by persons who, without being shareholders, acquired Pre-emptive Subscription Certificates and participated in the First Round, the common shares subscribed in exercise of the pre-emptive subscription right acquired must be considered, as well as those that would correspond to the ownership of the shareholder who transferred the right to them. In the Second Round, after being informed of the number of common shares they are entitled to subscribe and once the decision to participate in the Second Round has been made, the shareholders must proceed as follows: |

| |

|

|

|

|

|

| |

|

|

|

(a) |

Contact the Company or its brokerage firm directly, in either case, indicating the number of common shares they wish to subscribe. |

| |

|

|

|

|

|

| |

|

|

|

(b) |

Complete the share subscription process by satisfactorily completing and signing the Form. The Form must be delivered to the Company or its brokerage firm within the effective period of the Second Round. |

| |

|

|

|

|

|

| |

|

|

|

(c) |

Make the payment corresponding to its capital contribution in the Contribution Account or make such amount available in full in the account of its brokerage firm or of a third-party intermediary to the satisfaction of the Company. The payment made shall be evidenced in the Deposit Voucher and shall be deemed to have been made on the day on which the funds are credited to the corresponding account. The Deposit Voucher shall be delivered to the Company immediately. |

| |

|

|

|

|

|

| |

|

|

|

(d) |

The subscription process in the Second Round will be considered satisfactorily completed once the Company has verified that the subscriber has complied with (i) subscribing, delivering the Form directly to the Company or its brokerage firm and delivering all the information requested by the Company as detailed in the Form, if applicable; and, (ii) making the payment or transfer and delivering the Deposit Voucher directly to the Company. |

| |

|

|

|

|

|

| |

|

|

|

Upon completion of the Second Round, all payments and transfers made by the subscribers of shares will be definitively applied to the payment of the Placement Price of the shares subscribed. For such purposes, the brokerage firms and third party intermediaries (to the satisfaction of the Company) that have received the corresponding funds from the subscribers for the subscription of shares, shall make such funds available to the Company, at the latest within two (2) business days of the Relevant Information Communication published by the Company informing of the results of the Second Round subscription procedure, by transfer to, or deposit in, the Contribution Account and shall send to the Company evidence of such transfers or deposits. |

| |

|

|

|

|

|

| |

|

|

|

The holder of Preferred Subscription Certificates represented by physical certificates who subscribes for shares without a brokerage firm must deliver such Certificate to the Company for cancellation. |

| 19 |

|

Subscription Certificate |

|

Once the processes detailed in section 18 above have been completed, the Company or each brokerage firm, on behalf of the Company, will deliver the respective Subscription Certificates, upon identification of the subscriber with its identification document, in the case of a natural person or, in the case of legal entities, by carrying: (i) letter of instruction signed by the legal representative of the legal entity with legalized signatures requesting the delivery of the Subscription Certificate to a specific representative; (ii) legalized copy of the power of attorney authorizing the request for the issuance of the Subscription Certificate, (iii) validity of the power of attorney of the legal representative not older than 30 days; and, (iv) copy of the legal representative’s identification document; in addition to the receipt of the documents indicated in paragraph 18 above, either directly through the Company or through the offices of the corresponding brokerage firm. |

| |

|

|

|

|

| 20 |

|

Private Placement |

|

In the event of any unsubscribed shares remaining after the processes detailed in paragraph 18 above, the Board of Directors may decide to offer such shares to third parties through a private placement and the issuance of provisional certificates derived from such private placement. |

| 21 |

|

Issuance of shares and provisional share certificates |

|

The Company will issue and deliver the shares

to all subscribers of the new common shares within two (2) business days after the Capital Increase is registered in the Public Registry

of Legal Entities of the Lima Registry Office.

The Company will issue provisional physical share

certificates to all subscribers of new common shares who request them, upon identification of the subscriber with his/her identity document,

in the case of a natural person or, in the case of legal entities, by carrying: (i) letter of instruction signed by the legal representative

of the legal entity with legalized signatures requesting the delivery of the provisional share certificate to a specific representative;

(ii) legalized copy of the power of attorney empowering to request the issuance of the provisional share certificate, (iii) validity of

the power of attorney of the legal representative not older than 30 days; and, (iv) copy of the identity document of the legal representative;

to the extent that the requirements for the subscription of common shares established in section 18 have been previously accredited.

Provisional physical share certificates derived

from the exercise of the pre-emptive subscription may be requested from the Company until December 18 and the delivery date will be December

20, 2023. The subscriber must have previously accredited the requirements for the subscription of shares established in paragraph 18 above,

either directly or through its brokerage firm.

The provisional certificates of physical shares

shall contain the legends and identification data set forth in articles 87° and 100° of the General Corporations Law, and any

others that may be applicable according to the regulations applicable to the Company. The date of exchange of the provisional physical

share certificates for definitive physical certificates shall be informed to the market, as a Relevant Information Communication, within

fifteen (15) business days after the registration of the capital increase in the Register of Legal Entities, but at least five (5) days

prior to the date set as the date of delivery. |

| |

|

|

|

|

| 22 |

|

Relevant information for the subscriber |

|

It is hereby stated for the record that the Pre-emptive

Subscription Certificates, as well as the common shares to be issued upon exercise of the subscription rights embodied in such securities

and those to be issued as a result of the private offering (in the event the Capital Increase is not fully subscribed after the Second

Round), have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or under the securities laws of any

state or jurisdiction outside Peru.

In this regard, the securities issued will be

made available to investors only in Peru pursuant to applicable Peruvian law and may not be offered, sold, resold, transferred, delivered,

or distributed, directly or indirectly, in or into the United States of America under the securities laws of that country or in other

jurisdictions where this is prohibited. In addition, the common shares to be issued may not be offered, sold, or subscribed for except

in a transaction that is exempt from, or not subject to, the registration requirements of the U.S. Securities Act of 1933.

This communication is not an offer to sell or

a solicitation of an offer to buy securities in the United States of America or to persons in the United States of America. |

| 2. | Delegation and granting of powers of attorney to execute agreements. |

Unanimously, the Directors of the Company agreed

to grant powers to Mr. Dennis Fernando Fernandez Armas, identified with DNI No. 15971076 and Zoila Maria Horna Zegarra, identified with

DNI No. 10220900 (collectively, the ” Authorized Agents”), so that any two (2) of them, acting jointly, may introduce any changes

they deem necessary to the rounding methodology, to the procedure for the allocation of Preferred Subscription Certificates in the First

Round and to the procedure for the allocation of common shares in the Second Round approved by this Board of Directors, as well as to

any of the characteristics of the procedure for the subscription of common shares agreed upon at the Board of Directors’ meeting. Likewise,

any two (2) of the Authorized Agents, acting jointly, are authorized to issue on behalf of the Company such certificates, certifications,

attestations and affidavits as may be required, as well as to perform any other act that may be necessary or, at the discretion of the

Authorized Agents, convenient for the effectiveness, validity, execution and formalization of the resolutions adopted at the meeting of

the Board of Directors, without any reservation or limitation whatsoever. The physical certificates to be issued may contain legends related

to the relevant aspects of the legislation of the United States of America to which the Company is subject.

| 3. | Proof of restrictions applicable to U.S. investors under the U.S. Securities Act of 1933, as amended

from time to time. |

The Directors of the Company unanimously agreed

to place on record that the preferred subscription certificates derived from the Capital Increase, as well as the shares to be issued

upon exercise of the subscription rights embodied in such certificates and those to be issued as a result of a potential private placement

of the remaining shares that are not subscribed after the end of the preferred subscription rounds, have not been and will not be registered

under the U.S. Securities Act of 1933, or under the securities laws of any state or jurisdiction outside of Peru.

In this regard, the securities issued will be

made available to investors only in Peru pursuant to the provisions of applicable Peruvian legislation (General Corporations Law, Law

No. 26887, the Securities Market Law, Sole Ordered Text approved by Supreme Decree No. 020-2023-EF and the Securities Law, Law No. 27287),

as such rules may be amended from time to time, and may not be offered, sold, resold, transferred, delivered or distributed, directly

or indirectly, in or into the United States of America under the securities laws of such country or in other jurisdictions where such

is prohibited. In addition, the shares to be issued may not be offered, sold, or subscribed for except in a transaction that is exempt

from, or not subject to, the registration requirements of the U.S. Securities Act of 1933.

This communication is not an offer to sell or

a solicitation of an offer to buy securities in the United States of America or to persons in the United States of America.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AENZA S.A.A.

| By: |

/s/ CRISTIAN RESTREPO HERNANDEZ |

|

| Name: |

Cristian Restrepo Hernandez |

|

| Title: |

VP of Corporate Finance |

|

| Date: |

October 26, 2023 |

|

Lima, 26 de octubre de 2023

9

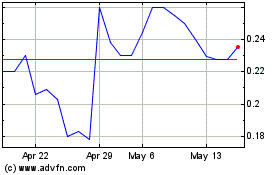

Gold Flora (PK) (USOTC:GRAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gold Flora (PK) (USOTC:GRAM)

Historical Stock Chart

From Apr 2023 to Apr 2024