0001433270

false

0001433270

2023-10-25

2023-10-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 25, 2023

ANTERO RESOURCES CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36120 |

|

80-0162034 |

(State or Other

Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

1615 Wynkoop Street

Denver, Colorado 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s

Telephone Number, Including Area Code: (303)

357-7310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name of each exchange

on which

registered |

| Common

Stock, par value $0.01 Per Share |

|

AR |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| |

Item 2.02 |

Results of Operations and Financial Condition |

On October 25,

2023, Antero Resources Corporation issued a press release, a copy of which is attached hereto as Exhibit 99.1 and incorporated by

reference herein, announcing its financial and operational results for the quarter ended September 30, 2023.

The information

in this Current Report, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of

1933, as amended, or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

| |

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANTERO RESOURCES CORPORATION |

| |

|

| |

By: |

/s/ Michael N. Kennedy |

| |

|

Michael N. Kennedy |

| |

|

Chief Financial Officer and Senior Vice President – Finance |

Dated: October 25, 2023

Exhibit 99.1

Antero Resources Announces Third Quarter 2023

Financial and Operating Results and Increased Production Guidance

Denver, Colorado, October 25, 2023—Antero

Resources Corporation (NYSE: AR) (“Antero Resources,” “Antero,” or the “Company”) today announced

its third quarter 2023 financial and operating results. The relevant consolidated financial statements are included in Antero Resources’

Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

Third Quarter

2023 Highlights:

| · | Net production averaged 3.5 Bcfe/d, an increase of 9% from the year ago period |

| o | Liquids production averaged 202 MBbl/d, an increase of 18% from the year ago period |

| o | Natural gas production averaged 2.3 Bcf/d, up 4% from the year ago period |

| · | Realized a pre-hedge natural gas equivalent price of $3.32 per Mcfe, a $0.77 per Mcfe premium to NYMEX

pricing |

| o | Realized a C3+ NGL price of $36.81 per barrel |

| o | Realized a pre-hedge natural gas price of $2.48 per Mcf, a $0.07 per Mcf discount to NYMEX pricing |

| · | Net income was $18 million, Adjusted Net Income was $25 million (Non-GAAP) |

| · | Adjusted EBITDAX was $271 million (Non-GAAP); net cash provided by operating activities was $183 million |

2023 Guidance

Updates:

| · | Increasing full year 2023 production guidance to a range of 3.39 to 3.41 Bcfe/d |

| · | Decreasing cash production costs to a range of $2.35 to $2.40 per Mcfe |

| · | Decreasing net marketing expense to a range of $0.05 to $0.07 per Mcfe |

| · | Decreasing realized natural gas price premium to flat to NYMEX Henry Hub |

Paul Rady, Chairman, CEO and President of Antero

Resources commented, “Our third quarter results continue to benefit from the operating momentum that we have built throughout this

year. During the first nine months of 2023 both our drilling and completion teams set numerous Company records. This operational excellence

combined with stellar well performance has led to quarterly production volumes above expectations. As a result, we are raising our full

year production guidance for the second consecutive quarter, while maintaining the same initial capital budget. We now expect production

volumes to increase by approximately 225 MMcfe/d, or 7%, from the 2022 exit rate to the 2023 exit rate.”

Mr. Rady continued, “On the macro front,

we see natural gas storage levels normalizing on the back of record Natural Gas Power Burn (natural gas fired electrical generation),

strong LNG exports and U.S. natural gas exported through pipelines to Mexico. At the same time, we anticipate that U.S. production growth

will be limited in the coming months following the dramatic decrease in drilling rigs. We believe this strong fundamental backdrop will

support and strengthen the forward natural gas curve. Further, as we move closer to the startup of additional LNG export capacity over

the next 12 months, we are seeing increasing premiums at our delivery points within the LNG corridor relative to NYMEX. We are uniquely

positioned to benefit from increasing NYMEX prices with approximately 75% of our natural gas being sold at Antero’s premium delivery

points in the LNG corridor.”

Michael Kennedy, CFO of Antero Resources said,

“Based entirely on the capital efficiency gains achieved this year, we continue to expect 2024 capital requirements to be materially

below our 2023 capital guidance. This capital program will target maintaining our increased 2023 production guidance. This reduced maintenance

capital combined with a higher natural gas and NGL price strip, is projected to generate substantial Free Cash Flow in 2024 that we will

use to pay down debt further and continue to return capital to our shareholders.”

For a discussion of the non-GAAP financial

measures including Adjusted Net Income, Adjusted EBITDAX, Free Cash Flow and Net Debt please see “Non-GAAP Financial Measures.”

2023 Guidance Update

Antero is increasing its full year 2023 production

guidance to 3.39 to 3.41 Bcfe/d, an increase at the midpoint of approximately 25 MMcfe/d. The higher than expected volumes are driven

by strong well performance and capital efficiency gains.

Antero is decreasing the high end of its cash

production expense guidance by $0.05 per Mcfe to a range of $2.35 to $2.40 per Mcfe reflecting lower fuel costs and lower production and

ad valorem taxes. Antero is also decreasing its natural gas realized price guidance to flat to NYMEX Henry Hub. This decrease is due to

increased exposure to the Columbia Gas Appalachia Hub during the third quarter driven by maintenance at the Cove Point LNG Terminal as

well as longer maintenance on a Gulf Coast directed pipeline during the quarter. Antero is reducing its net marketing expense guidance

by $0.02 per Mcfe to a range of $0.05 to $0.07 per Mcfe due to higher than expected production lowering unutilized firm transportation

expense.

| | |

Year 2023 –Initial | | |

Full Year 2023 – July | | |

Full Year 2023 – Current | |

| Full Year 2023 Guidance | |

Low | | |

High | | |

Low | | |

High | | |

Low | | |

High | |

| Net Production (Bcfe/d) | |

| 3.25 | | |

| 3.3 | | |

| 3.35 | | |

| 3.4 | | |

| 3.39 | | |

| 3.41 | |

| Net Natural Gas Production (Bcf/d) | |

| 2.1 | | |

| 2.15 | | |

| 2.2 | | |

| 2.225 | | |

| 2.22 | | |

| 2.24 | |

| Net Liquids Production (Bbl/d) | |

| 184,000 | | |

| 195,000 | | |

| 188,000 | | |

| 199,000 | | |

| 194,000 | | |

| 195,500 | |

| Net Daily C3+ NGL Production | |

| 105,000 | | |

| 110,000 | | |

| 110,000 | | |

| 115,000 | | |

| 114,500 | | |

| 115,000 | |

| Net Daily Ethane Production (Bbl/d) | |

| 70,000 | | |

| 75,000 | | |

| 67,500 | | |

| 72,500 | | |

| 69,000 | | |

| 69,500 | |

| Net Daily Oil Production (Bbl/d) | |

| 9,000 | | |

| 10,000 | | |

| 10,500 | | |

| 11,500 | | |

| 10,500 | | |

| 11,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash Production Expense ($/Mcfe) | |

$ | 2.40 | | |

$ | 2.50 | | |

$ | 2.35 | | |

$ | 2.45 | | |

$ | 2.35 | | |

$ | 2.40 | |

| Natural Gas Realized Price Expected Premium to NYMEX ($/Mcf) | |

$ | 0.10 | | |

$ | 0.20 | | |

$ | 0.00 | | |

$ | 0.10 | | |

$ | 0.00 | | |

$ | 0.00 | |

| Net Marketing Expense ($/Mcfe) | |

$ | 0.07 | | |

$ | 0.09 | | |

$ | 0.07 | | |

$ | 0.09 | | |

$ | 0.05 | | |

$ | 0.07 | |

Note: Any 2023 guidance items not discussed in this release are

unchanged from previously stated guidance.

Free Cash Flow

During the third quarter of 2023, Free Cash Flow

before Changes in Working Capital was ($23) million.

| | |

Three Months Ended

September 30, | |

| | |

2022 | | |

2023 | |

| Net cash provided by operating activities | |

$ | 1,087,672 | | |

| 183,381 | |

| Less: Net cash used in investing activities | |

| (243,529 | ) | |

| (276,097 | ) |

| Less: Proceeds from sale of assets, net | |

| (952 | ) | |

| (136 | ) |

| Less: Distributions to non-controlling interests in Martica | |

| (46,217 | ) | |

| (21,161 | ) |

| Free Cash Flow | |

$ | 796,974 | | |

| (114,013 | ) |

| Changes in Working Capital (1) | |

| (241,136 | ) | |

| 90,755 | |

| Free Cash Flow before Changes in Working Capital | |

$ | 555,838 | | |

| (23,258 | ) |

| (1) | Working capital adjustments in the third quarter of 2022 include an increase of $214 million in changes

in current assets and liabilities and an increase of $27 million in accounts payable and accrued liabilities for additions to property

and equipment. Working capital adjustments in the third quarter of 2023 include a $77 million net decrease in current assets and liabilities

and a $14 million decrease in accounts payable and accrued liabilities for additions to property and equipment. |

Third Quarter 2023 Financial Results

Net daily natural gas equivalent production in

the third quarter averaged 3.5 Bcfe/d, including 202 MBbl/d of liquids, an increase of 9% from the third quarter of 2022. As a result

of Antero’s focus on its liquids-rich Marcellus acreage, liquids volumes increased 18%, while natural gas volumes increased 4%,

each compared to the year ago period.

Antero’s average realized natural gas price

before hedging was $2.48 per Mcf, a $0.07 per Mcf discount to the average first-of-month (“FOM”) NYMEX Henry Hub price. The

wider discount to NYMEX was due to higher volumes being sold into the Columbia Gas Appalachia Hub as a result of maintenance at the Cove

Point LNG Terminal and the Tennessee 500 Leg Pipeline. During the quarter, Antero sold approximately 15% of its volume into the Columbia

Gas Appalachia Hub, 5% above levels during the first six months of the year.

The following table details average net production

and average realized prices for the three months ended September 30, 2023:

| | |

Three Months Ended September 30, 2023 | |

| | |

Natural

Gas

(MMcf/d) | | |

Oil

(Bbl/d) | | |

C3+ NGLs

(Bbl/d) | | |

Ethane

(Bbl/d) | | |

Natural

Gas

Equivalent

(MMcfe/d) | |

| Average Net Production | |

| 2,261 | | |

| 9,978 | | |

| 119,315 | | |

| 72,783 | | |

| 3,474 | |

| | |

| | |

| | |

| | |

| | |

Combined | |

| | |

| | |

| | |

| | |

| | |

Natural

Gas | |

| | |

Natural Gas | | |

Oil | | |

C3+ NGLs | | |

Ethane | | |

Equivalent | |

| Average Realized Prices | |

($/Mcf) | | |

($/Bbl) | | |

($/Bbl) | | |

($/Bbl) | | |

($/Mcfe) | |

| Average realized prices before settled derivatives | |

$ | 2.48 | | |

$ | 68.22 | | |

$ | 36.81 | | |

$ | 11.73 | | |

$ | 3.32 | |

| NYMEX average price (1) | |

$ | 2.55 | | |

$ | 82.26 | | |

| | | |

| | | |

$ | 2.55 | |

| Premium / (Discount) to NYMEX | |

$ | (0.07 | ) | |

$ | (14.04 | ) | |

| | | |

| | | |

$ | 0.77 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Settled commodity derivatives (2) | |

$ | (0.02 | ) | |

$ | (0.31 | ) | |

$ | (0.05 | ) | |

$ | — | | |

$ | (0.02 | ) |

| Average realized prices after settled derivatives | |

$ | 2.46 | | |

$ | 67.91 | | |

$ | 36.76 | | |

$ | 11.73 | | |

$ | 3.30 | |

| Premium / (Discount) to NYMEX | |

$ | (0.09 | ) | |

$ | (14.35 | ) | |

| | | |

| | | |

$ | 0.75 | |

| (1) | The average index prices for natural gas and oil represent the New York Mercantile Exchange average first-of-month price and the Energy

Information Administration (EIA) calendar month average West Texas Intermediate future price, respectively. |

| (2) | These commodity derivative instruments include contracts attributable to Martica Holdings LLC (“Martica”), Antero’s

consolidated variable interest entity. All gains or losses from Martica’s derivative instruments are fully attributable to the noncontrolling

interests in Martica, which includes portions of the natural gas and all oil and C3+ NGL derivative instruments during the three months

ended September 30, 2023. |

Antero’s average realized C3+ NGL

price was $36.81 per barrel. Antero shipped 52% of its total C3+ NGL net production on Mariner East 2 (“ME2”) for export

and realized a $0.06 per gallon premium to Mont Belvieu pricing on these volumes at Marcus Hook, PA. Antero sold the remaining 48%

of C3+ NGL net production at an $0.07 per gallon discount to Mont Belvieu pricing at Hopedale, OH. The resulting blended price on

119 MBbl/d of net C3+ NGL production was a $0.01 per gallon premium to Mont Belvieu pricing.

| | |

Three Months Ended September 30, 2023 | |

| | |

Pricing Point | |

Net C3+ NGL

Production

(Bbl/d) | | |

% by

Destination | | |

Premium (Discount)

To Mont Belvieu

($/Gal) | |

| Propane / Butane on ME2 - Exported | |

Marcus Hook, PA | |

| 61,961 | | |

| 52 | % | |

$ | 0.06 | |

| Remaining C3+ NGL Volume – Sold Domestically | |

Hopedale, OH | |

| 57,354 | | |

| 48 | % | |

$ | (0.07 | ) |

| Total C3+ NGLs/Blended Premium | |

| |

| 119,315 | | |

| 100 | % | |

$ | 0.01 | |

All-in cash expense, which includes lease operating,

gathering, compression, processing, and transportation, production and ad valorem taxes was $2.31 per Mcfe in the third quarter, a 19%

decrease compared to $2.84 per Mcfe average during the third quarter of 2022. The decrease was due to lower production tax and transportation

expense due to lower fuel costs as a result of lower commodity prices. Net marketing expense was $0.05 per Mcfe in the third quarter,

a decrease from $0.09 per Mcfe during the third quarter of 2022. The decrease in net marketing expense was due to higher than expected

production lowering unutilized firm transportation expense.

Third Quarter 2023 Operating Results

Antero placed 20 horizontal Marcellus wells to sales during the third

quarter with an average lateral length of 14,400 feet. Of the wells placed to sales, 14 of these wells have been on line for at least

60 days. The average 60-day rate per well was 24 MMcfe/d with approximately 1,150 Bbl/d of liquids per well assuming 25% ethane recovery.

The remaining six wells were completed in mid-September and had an average lateral length of approximately 18,400 feet.

Marcellus highlights include:

| · | A seven well pad with an average lateral length of 15,448 feet that had an average 60-day rate per well

of 32 MMcfe/d, including approximately 1,600 Bbl/d of liquids per well assuming 25% ethane recovery |

| · | A completion crew averaged a company record 13.7 completion stages per day, or 96 total stages in a single

week in August |

In the Utica, Antero has two pads consisting of seven total wells scheduled

to be turned in line during the fourth quarter. These wells are located in the highly rich 1300 BTU window of the Utica, with the natural

gas volumes being sold into the premium Chicago market this winter. Antero also set numerous company drilling and completion records for

the Utica during the third quarter.

Utica records include:

| · | Average stages per day of an entire pad of 10.9 stages per day |

| · | A single-day of 15 stages per day achieved in September |

| · | Utica single well drillout of 4,850 lateral feet per day |

Third Quarter 2023 Capital Investment

Antero’s accrued drilling and completion

capital expenditures for the three months ended September 30, 2023, were $231 million. Through the first nine months of 2023, the

Company has completed approximately 80% of its 2023 expected completion stages.

In addition to capital invested in drilling and

completion activities, the Company invested $27 million in land during the third quarter. During the quarter, Antero added approximately

4,000 net acres, representing over 14 incremental drilling locations. Through the first nine months of 2023, Antero has added approximately

26,000 net acres representing 93 incremental drilling locations at an average cost of approximately $1 million per location. Antero’s

organic leasing efforts focus on acreage in close proximity to its current development plan. These incremental locations more than offset

Antero’s maintenance capital plan that requires an average of 60 to 65 wells per year. In addition, these efforts allow Antero to

increase the average lateral length in its development program, which is expected to average 14,500 feet for wells drilled in 2023, or

7% longer than the 2022 average of 13,600 feet. The Company believes this organic leasing program is the most cost effective approach

to lengthening its core inventory position.

Commodity Derivative Positions

Antero did not enter into any new natural gas,

NGL or oil hedges during the third quarter of 2023.

Please see Antero’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, for more information on all commodity derivative positions. For detail on

current commodity positions, please see the Hedge Profile presentations at www.anteroresources.com.

Conference Call

A conference call is scheduled on Thursday, October 26,

2023 at 9:00 am MT to discuss the financial and operational results. A brief Q&A session for security analysts will immediately follow

the discussion of the results. To participate in the call, dial in at 877-407-9079 (U.S.), or 201-493-6746 (International) and reference

“Antero Resources.” A telephone replay of the call will be available until Thursday, November 2, 2023 at 9:00 am MT at

877-660-6853 (U.S.) or 201-612-7415 (International) using the conference ID: 13741536. To access the live webcast and view the related

earnings conference call presentation, visit Antero's website at www.anteroresources.com. The webcast will be archived for replay until

Thursday, November 2, 2023 at 9:00 am MT.

Presentation

An updated presentation will be posted to the

Company's website before the conference call. The presentation can be found at www.anteroresources.com

on the homepage. Information on the Company's website does not constitute a portion of, and is not incorporated by reference into this

press release.

Non-GAAP Financial Measures

Adjusted Net Income

Adjusted Net Income as set forth in this release

represents net income, adjusted for certain items. Antero believes that Adjusted Net Income is useful to investors in evaluating operational

trends of the Company and its performance relative to other oil and gas producing companies. Adjusted Net Income is not a measure of financial

performance under GAAP and should not be considered in isolation or as a substitute for net income as an indicator of financial performance.

The GAAP measure most directly comparable to Adjusted Net Income is net income. The following table reconciles net income to Adjusted

Net Income (in thousands):

| | |

Three Months Ended September 30, | |

| | |

2022 | | |

2023 | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 559,759 | | |

| 17,808 | |

| Net income and comprehensive income attributable to noncontrolling interests | |

| 34,748 | | |

| 14,834 | |

| Unrealized commodity derivative gains | |

| (109,424 | ) | |

| (9,172 | ) |

| Amortization of deferred revenue, VPP | |

| (9,478 | ) | |

| (7,701 | ) |

| Loss (gain) on sale of assets | |

| 214 | | |

| (136 | ) |

| Impairment of property and equipment | |

| 33,924 | | |

| 13,476 | |

| Equity-based compensation | |

| 10,402 | | |

| 18,458 | |

| Loss on early extinguishment of debt | |

| 30,307 | | |

| — | |

| Loss on convertible note inducement | |

| 169 | | |

| — | |

| Equity in earnings of unconsolidated affiliate | |

| (14,972 | ) | |

| (22,207 | ) |

| Contract termination and loss contingency | |

| 17,995 | | |

| 13,659 | |

| Tax effect of reconciling items (1) | |

| 9,486 | | |

| (1,371 | ) |

| | |

| 563,130 | | |

| 37,648 | |

| Martica adjustments (2) | |

| (31,984 | ) | |

| (12,161 | ) |

| Adjusted Net Income | |

$ | 531,146 | | |

| 25,487 | |

| | |

| | | |

| | |

| Diluted Weighted Average Shares Outstanding (3) | |

| 325,997 | | |

| 311,534 | |

| (1) | Deferred taxes were approximately 23% and 21% for 2022 and 2023, respectively. |

| (2) | Adjustments reflect noncontrolling interest in Martica not otherwise adjusted in amounts above. |

| (3) | Diluted weighted average shares outstanding does not include securities

that would have had an anti-dilutive effect on the computation of diluted earnings per share. Anti-dilutive weighted average shares outstanding

for the three months ended September 30, 2022 and 2023 were 0.3 million and 1.6 million, respectively. |

Net Debt

Net Debt is calculated as total long-term debt

less cash and cash equivalents. Management uses Net Debt to evaluate the Company’s financial position, including its ability to

service its debt obligations.

The following table reconciles consolidated total

long-term debt to Net Debt as used in this release (in thousands):

| | |

December 31, | | |

September 30, | |

| | |

2022 | | |

2023 | |

| Credit Facility | |

$ | 34,800 | | |

| 474,100 | |

| 8.375% senior notes due 2026 | |

| 96,870 | | |

| 96,870 | |

| 7.625% senior notes due 2029 | |

| 407,115 | | |

| 407,115 | |

| 5.375% senior notes due 2030 | |

| 600,000 | | |

| 600,000 | |

| 4.250% convertible senior notes due 2026 | |

| 56,932 | | |

| 39,418 | |

| Unamortized debt issuance costs | |

| (12,241 | ) | |

| (10,608 | ) |

| Total long-term debt | |

$ | 1,183,476 | | |

| 1,606,895 | |

| Less: Cash and cash equivalents | |

| — | | |

| — | |

| Net Debt | |

$ | 1,183,476 | | |

| 1,606,895 | |

Free Cash Flow

Free Cash Flow is a measure of financial performance

not calculated under GAAP and should not be considered in isolation or as a substitute for cash flow from operating, investing, or financing

activities, as an indicator of cash flow or as a measure of liquidity. The Company defines Free Cash Flow as net cash provided by operating

activities, less net cash used in investing activities, which includes drilling and completion capital and leasehold capital, plus payments

for early contract termination or derivative monetization, less proceeds from asset sales or derivative monetization and less distributions

to non-controlling interests in Martica.

The Company has not provided projected net cash

provided by operating activities or a reconciliation of Free Cash Flow to projected net cash provided by operating activities, the most

comparable financial measure calculated in accordance with GAAP. The Company is unable to project net cash provided by operating activities

for any future period because this metric includes the impact of changes in operating assets and liabilities related to the timing of

cash receipts and disbursements that may not relate to the period in which the operating activities occurred. The Company is unable to

project these timing differences with any reasonable degree of accuracy without unreasonable efforts.

Free Cash Flow is a useful indicator of the Company’s

ability to internally fund its activities, service or incur additional debt and estimate our ability to return capital to shareholders.

There are significant limitations to using Free Cash Flow as a measure of performance, including the inability to analyze the effect of

certain recurring and non-recurring items that materially affect the Company’s net income, the lack of comparability of results

of operations of different companies and the different methods of calculating Free Cash Flow reported by different companies. Free Cash

Flow does not represent funds available for discretionary use because those funds may be required for debt service, land acquisitions

and lease renewals, other capital expenditures, working capital, income taxes, exploration expenses, and other commitments and obligations.

Adjusted EBITDAX

Adjusted EBITDAX is a non-GAAP financial measure

that we define as net income (loss), adjusted for certain items detailed below.

Adjusted EBITDAX as used and defined by us, may

not be comparable to similarly titled measures employed by other companies and is not a measure of performance calculated in accordance

with GAAP. Adjusted EBITDAX should not be considered in isolation or as a substitute for operating income or loss, net income or loss,

cash flows provided by operating, investing, and financing activities, or other income or cash flow statement data prepared in accordance

with GAAP. Adjusted EBITDAX provides no information regarding our capital structure, borrowings, interest costs, capital expenditures,

working capital movement, or tax position. Adjusted EBITDAX does not represent funds available for discretionary use because those funds

may be required for debt service, capital expenditures, working capital, income taxes, exploration expenses, and other commitments and

obligations. However, our management team believes Adjusted EBITDAX is useful to an investor in evaluating our financial performance because

this measure:

| · | is widely used by investors in the oil and natural gas industry to measure operating performance without

regard to items excluded from the calculation of such term, which may vary substantially from company to company depending upon accounting

methods and the book value of assets, capital structure and the method by which assets were acquired, among other factors; |

| · | helps investors to more meaningfully evaluate and compare the results of our operations from period to

period by removing the effect of our capital and legal structure from our operating structure; |

| · | is used by our management team for various purposes, including as a measure of our operating performance,

in presentations to our Board of Directors, and as a basis for strategic planning and forecasting: and |

| · | is used by our Board of Directors as a performance measure in determining executive compensation. |

There are significant limitations to using Adjusted

EBITDAX as a measure of performance, including the inability to analyze the effects of certain recurring and non-recurring items that

materially affect our net income or loss, the lack of comparability of results of operations of different companies, and the different

methods of calculating Adjusted EBITDAX reported by different companies.

The GAAP measures most directly comparable to

Adjusted EBITDAX are net income (loss) and net cash provided by operating activities. The following table represents a reconciliation

of Antero’s net income (loss), including noncontrolling interest, to Adjusted EBITDAX and a reconciliation of Antero’s Adjusted

EBITDAX to net cash provided by operating activities per our consolidated statements of cash flows, in each case, for the three months

ended September 30, 2022 and 2023. Adjusted EBITDAX also excludes the noncontrolling interests in Martica, and these adjustments

are disclosed in the table below as Martica related adjustments.

| | |

Three Months Ended September 30, | |

| | |

2022 | | |

2023 | |

| Reconciliation of net income to Adjusted EBITDAX: | |

| | | |

| | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 559,759 | | |

| 17,808 | |

| Net income and comprehensive income attributable to noncontrolling interests | |

| 34,748 | | |

| 14,834 | |

| Unrealized commodity derivative gains | |

| (109,424 | ) | |

| (9,172 | ) |

| Amortization of deferred revenue, VPP | |

| (9,478 | ) | |

| (7,701 | ) |

| Loss (gain) on sale of assets | |

| 214 | | |

| (136 | ) |

| Interest expense, net | |

| 28,326 | | |

| 31,634 | |

| Loss on early extinguishment of debt | |

| 30,307 | | |

| — | |

| Loss on convertible note inducement | |

| 169 | | |

| — | |

| Income tax expense | |

| 135,823 | | |

| 13,663 | |

| Depletion, depreciation, amortization and accretion | |

| 170,237 | | |

| 177,148 | |

| Impairment of property and equipment | |

| 33,924 | | |

| 13,476 | |

| Exploration expense | |

| 1,263 | | |

| 591 | |

| Equity-based compensation expense | |

| 10,402 | | |

| 18,458 | |

| Equity in earnings of unconsolidated affiliate | |

| (14,972 | ) | |

| (22,207 | ) |

| Dividends from unconsolidated affiliate | |

| 31,285 | | |

| 31,285 | |

| Contract termination, loss contingency, transaction expense and other | |

| 18,080 | | |

| 13,649 | |

| | |

| 920,663 | | |

| 293,330 | |

| Martica related adjustments (1) | |

| (42,563 | ) | |

| (22,127 | ) |

| Adjusted EBITDAX | |

$ | 878,100 | | |

| 271,203 | |

| | |

| | | |

| | |

| Reconciliation of our Adjusted EBITDAX to net cash provided by operating activities: | |

| | | |

| | |

| Adjusted EBITDAX | |

$ | 878,100 | | |

| 271,203 | |

| Martica related adjustments (1) | |

| 42,563 | | |

| 22,127 | |

| Interest expense, net | |

| (28,326 | ) | |

| (31,634 | ) |

| Amortization of debt issuance costs, debt discount and debt premium | |

| 943 | | |

| 869 | |

| Exploration expense | |

| (1,263 | ) | |

| (591 | ) |

| Changes in current assets and liabilities | |

| 213,999 | | |

| (76,808 | ) |

| Contract termination, loss contingency, transaction expense and other | |

| (18,080 | ) | |

| (1,748 | ) |

| Other items | |

| (264 | ) | |

| (37 | ) |

| Net cash provided by operating activities | |

$ | 1,087,672 | | |

| 183,381 | |

| (1) | Adjustments reflect noncontrolling interests in Martica not otherwise adjusted in amounts above. |

| | |

Twelve | |

| | |

Months Ended | |

| | |

September 30, | |

| | |

2023 | |

| Reconciliation of net income to Adjusted EBITDAX: | |

| | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 878,451 | |

| Net income and comprehensive income attributable to noncontrolling interests | |

| 141,588 | |

| Unrealized commodity derivative gains | |

| (974,908 | ) |

| Payments for derivative monetizations | |

| 202,339 | |

| Amortization of deferred revenue, VPP | |

| (32,330 | ) |

| Gain on sale of assets | |

| (2,047 | ) |

| Interest expense, net | |

| 110,382 | |

| Loss on early extinguishment of debt | |

| 652 | |

| Loss on convertible note inducement | |

| 86 | |

| Income tax expense | |

| 186,403 | |

| Depletion, depreciation, amortization, and accretion | |

| 688,177 | |

| Impairment of property and equipment | |

| 114,728 | |

| Exploration | |

| 2,716 | |

| Equity-based compensation expense | |

| 57,209 | |

| Equity in earnings of unconsolidated affiliate | |

| (76,450 | ) |

| Dividends from unconsolidated affiliate | |

| 125,138 | |

| Contract termination, loss contingency, transaction expense and other | |

| 55,542 | |

| | |

| 1,477,676 | |

| Martica related adjustments (1) | |

| (114,896 | ) |

| Adjusted EBITDAX | |

$ | 1,362,780 | |

| (1) | Adjustments reflect noncontrolling interests in Martica not otherwise adjusted in amounts above. |

Drilling and Completion Capital Expenditures

For a reconciliation between cash paid for drilling

and completion capital expenditures and drilling and completion accrued capital expenditures during the period, please see the capital

expenditures section below (in thousands):

| | |

Three Months Ended

September 30, | |

| | |

2022 | | |

2023 | |

| Drilling and completion costs (cash basis) | |

$ | 195,587 | | |

| 242,261 | |

| Change in accrued capital costs | |

| 31,539 | | |

| (11,191 | ) |

| Adjusted drilling and completion costs (accrual basis) | |

$ | 227,126 | | |

| 231,070 | |

Notwithstanding their use for comparative purposes,

the Company’s non-GAAP financial measures may not be comparable to similarly titled measures employed by other companies.

Antero Resources is an independent natural

gas and natural gas liquids company engaged in the acquisition, development and production of unconventional properties located in the

Appalachian Basin in West Virginia and Ohio. In conjunction with its affiliate, Antero Midstream (NYSE: AM), Antero is one of the most

integrated natural gas producers in the U.S. The Company’s website is located at www.anteroresources.com.

This release includes "forward-looking

statements." Such forward-looking statements are subject to a number of risks and uncertainties, many of which are not under Antero

Resources’ control. All statements, except for statements of historical fact, made in this release regarding activities, events

or developments Antero Resources expects, believes or anticipates will or may occur in the future, such as those regarding our strategy,

future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management,

return of capital, expected results, future commodity prices, future production targets, realizing potential future fee rebates or reductions,

including those related to certain levels of production, future earnings, leverage targets and debt repayment, future capital spending

plans, improved and/or increasing capital efficiency, estimated realized natural gas, NGL and oil prices, expected drilling and development

plans, projected well costs and cost savings initiatives, future financial position, the participation level of our drilling partner and

the financial and production results to be achieved as a result of that drilling partnership, the other key assumptions underlying our

projections, and future marketing opportunities, are forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All forward-looking statements speak only as of the date of this

release. Although Antero Resources believes that the plans, intentions and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes

and results could materially differ from what is expressed, implied or forecast in such statements. Except as required by law, Antero

Resources expressly disclaims any obligation to and does not intend to publicly update or revise any forward-looking statements.

Antero Resources cautions you that these forward-looking

statements are subject to all of the risks and uncertainties, incident to the exploration for and development, production, gathering and

sale of natural gas, NGLs and oil, most of which are difficult to predict and many of which are beyond the Antero Resources’ control.

These risks include, but are not limited to, commodity price volatility, inflation, supply chain or other disruption, lack of availability

and cost of drilling, completion and production equipment and services and cost of drilling, completion and production equipment and services,

environmental risks, drilling and completion and other operating risks, marketing and transportation risks, regulatory changes or changes

in law, the uncertainty inherent in estimating natural gas, NGLs and oil reserves and in projecting future rates of production, cash flows

and access to capital, the timing of development expenditures, conflicts of interest among our stockholders, impacts of geopolitical and

world health events, cybersecurity risks, our ability to achieve our greenhouse gas reduction targets and the costs associated therewith,

the state of markets for, and availability of, verified quality carbon offsets and the other risks described under the heading "Item

1A. Risk Factors" in Antero Resources’ Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly

Report on Form 10-Q for the quarter ended September 30, 2023.

For more information, contact Daniel Katzenberg,

Director - Finance and Investor Relations of Antero Resources at (303) 357-7219 or dkatzenberg@anteroresources.com.

ANTERO RESOURCES CORPORATION

Condensed Consolidated Balance Sheets

(In thousands, except per share amounts)

| | |

| | |

(Unaudited) | |

| | |

December 31, | | |

September 30, | |

| | |

2022 | | |

2023 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Accounts receivable | |

$ | 35,488 | | |

| 36,928 | |

| Accrued revenue | |

| 707,685 | | |

| 373,391 | |

| Derivative instruments | |

| 1,900 | | |

| 2,563 | |

| Prepaid expenses and other current assets | |

| 42,452 | | |

| 9,537 | |

| Total current assets | |

| 787,525 | | |

| 422,419 | |

| Property and equipment: | |

| | | |

| | |

| Oil and gas properties, at cost (successful efforts method): | |

| | | |

| | |

| Unproved properties | |

| 997,715 | | |

| 1,020,394 | |

| Proved properties | |

| 13,234,777 | | |

| 13,773,718 | |

| Gathering systems and facilities | |

| 5,802 | | |

| 5,802 | |

| Other property and equipment | |

| 83,909 | | |

| 95,317 | |

| | |

| 14,322,203 | | |

| 14,895,231 | |

| Less accumulated depletion, depreciation and amortization | |

| (4,683,399 | ) | |

| (4,957,449 | ) |

| Property and equipment, net | |

| 9,638,804 | | |

| 9,937,782 | |

| Operating leases right-of-use assets | |

| 3,444,331 | | |

| 3,128,584 | |

| Derivative instruments | |

| 9,844 | | |

| 6,627 | |

| Investment in unconsolidated affiliate | |

| 220,429 | | |

| 220,110 | |

| Other assets | |

| 17,106 | | |

| 21,035 | |

| Total assets | |

$ | 14,118,039 | | |

| 13,736,557 | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 77,543 | | |

| 81,904 | |

| Accounts payable, related parties | |

| 80,708 | | |

| 89,350 | |

| Accrued liabilities | |

| 461,788 | | |

| 335,093 | |

| Revenue distributions payable | |

| 468,210 | | |

| 338,244 | |

| Derivative instruments | |

| 97,765 | | |

| 31,134 | |

| Short-term lease liabilities | |

| 556,636 | | |

| 551,037 | |

| Deferred revenue, VPP | |

| 30,552 | | |

| 27,990 | |

| Other current liabilities | |

| 1,707 | | |

| 6,302 | |

| Total current liabilities | |

| 1,774,909 | | |

| 1,461,054 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term debt | |

| 1,183,476 | | |

| 1,606,895 | |

| Deferred income tax liability, net | |

| 759,861 | | |

| 805,775 | |

| Derivative instruments | |

| 345,280 | | |

| 52,584 | |

| Long-term lease liabilities | |

| 2,889,854 | | |

| 2,581,323 | |

| Deferred revenue, VPP | |

| 87,813 | | |

| 67,524 | |

| Other liabilities | |

| 59,692 | | |

| 63,214 | |

| Total liabilities | |

| 7,100,885 | | |

| 6,638,369 | |

| Commitments and contingencies | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value; authorized - 50,000 shares; none issued | |

| — | | |

| — | |

| Common stock, $0.01 par value; authorized - 1,000,000 shares; 297,393 shares issued and 297,359 outstanding as of December 31, 2022, and 300,386 shares issued and outstanding as of September 30, 2023 | |

| 2,974 | | |

| 3,004 | |

| Additional paid-in capital | |

| 5,838,848 | | |

| 5,822,013 | |

| Retained earnings | |

| 913,896 | | |

| 1,037,064 | |

| Treasury stock, at cost; 34 shares and zero shares as of December 31, 2022 and September 30, 2023, respectively | |

| (1,160 | ) | |

| — | |

| Total stockholders' equity | |

| 6,754,558 | | |

| 6,862,081 | |

| Noncontrolling interests | |

| 262,596 | | |

| 236,107 | |

| Total equity | |

| 7,017,154 | | |

| 7,098,188 | |

| Total liabilities and equity | |

$ | 14,118,039 | | |

| 13,736,557 | |

ANTERO RESOURCES CORPORATION

Condensed Consolidated Statements of Operations

and Comprehensive Income (Unaudited)

(In thousands, except per share amounts)

| | |

Three Months Ended September 30, | |

| | |

2022 | | |

2023 | |

| Revenue and other: | |

| | | |

| | |

| Natural gas sales | |

$ | 1,736,039 | | |

| 516,214 | |

| Natural gas liquids sales | |

| 620,816 | | |

| 482,570 | |

| Oil sales | |

| 67,025 | | |

| 62,629 | |

| Commodity derivative fair value gains (losses) | |

| (530,523 | ) | |

| 3,448 | |

| Marketing | |

| 159,985 | | |

| 53,068 | |

| Amortization of deferred revenue, VPP | |

| 9,478 | | |

| 7,701 | |

| Other revenue and income | |

| 1,804 | | |

| 546 | |

| Total revenue | |

| 2,064,624 | | |

| 1,126,176 | |

| Operating expenses: | |

| | | |

| | |

| Lease operating | |

| 27,453 | | |

| 33,484 | |

| Gathering, compression, processing and transportation | |

| 716,388 | | |

| 671,886 | |

| Production and ad valorem taxes | |

| 92,998 | | |

| 32,258 | |

| Marketing | |

| 185,377 | | |

| 69,542 | |

| Exploration and mine expenses | |

| 2,975 | | |

| 591 | |

| General and administrative (including equity-based compensation expense of $10,402 and $18,458 in 2022 and 2023, respectively) | |

| 42,903 | | |

| 58,425 | |

| Depletion, depreciation and amortization | |

| 169,607 | | |

| 176,259 | |

| Impairment of property and equipment | |

| 33,924 | | |

| 13,476 | |

| Accretion of asset retirement obligations | |

| 630 | | |

| 889 | |

| Contract termination and loss contingency | |

| 17,995 | | |

| 13,659 | |

| Loss (gain) on sale of assets | |

| 214 | | |

| (136 | ) |

| Other operating expense | |

| — | | |

| 111 | |

| Total operating expenses | |

| 1,290,464 | | |

| 1,070,444 | |

| Operating income | |

| 774,160 | | |

| 55,732 | |

| Other income (expense): | |

| | | |

| | |

| Interest expense, net | |

| (28,326 | ) | |

| (31,634 | ) |

| Equity in earnings of unconsolidated affiliate | |

| 14,972 | | |

| 22,207 | |

| Loss on early extinguishment of debt | |

| (30,307 | ) | |

| — | |

| Loss on convertible note inducement | |

| (169 | ) | |

| — | |

| Total other expense | |

| (43,830 | ) | |

| (9,427 | ) |

| Income before income taxes | |

| 730,330 | | |

| 46,305 | |

| Income tax expense | |

| (135,823 | ) | |

| (13,663 | ) |

| Net income and comprehensive income including noncontrolling interests | |

| 594,507 | | |

| 32,642 | |

| Less: net income and comprehensive income attributable to noncontrolling interests | |

| 34,748 | | |

| 14,834 | |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 559,759 | | |

| 17,808 | |

| | |

| | | |

| | |

| Income per share—basic | |

$ | 1.83 | | |

| 0.06 | |

| Income per share—diluted | |

$ | 1.72 | | |

| 0.06 | |

| | |

| | | |

| | |

| Weighted average number of shares outstanding: | |

| | | |

| | |

| Basic | |

| 305,343 | | |

| 300,141 | |

| Diluted | |

| 325,997 | | |

| 311,534 | |

ANTERO RESOURCES CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

| | |

Nine Months Ended September 30, | |

| | |

2022 | | |

2023 | |

| Cash flows provided by (used in) operating activities: | |

| | | |

| | |

| Net income including noncontrolling interests | |

$ | 1,231,844 | | |

| 225,911 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depletion, depreciation, amortization and accretion | |

| 515,268 | | |

| 518,218 | |

| Impairments | |

| 79,749 | | |

| 44,746 | |

| Commodity derivative fair value losses (gains) | |

| 1,807,565 | | |

| (137,924 | ) |

| Losses on settled commodity derivatives | |

| (1,484,660 | ) | |

| (16,511 | ) |

| Payments for derivative monetizations | |

| — | | |

| (202,339 | ) |

| Deferred income tax expense | |

| 307,326 | | |

| 45,914 | |

| Equity-based compensation expense | |

| 23,222 | | |

| 44,988 | |

| Equity in earnings of unconsolidated affiliate | |

| (54,863 | ) | |

| (58,986 | ) |

| Dividends of earnings from unconsolidated affiliate | |

| 93,854 | | |

| 93,854 | |

| Amortization of deferred revenue | |

| (28,125 | ) | |

| (22,852 | ) |

| Amortization of debt issuance costs, debt discount and debt premium | |

| 3,458 | | |

| 2,601 | |

| Settlement of asset retirement obligations | |

| (946 | ) | |

| (633 | ) |

| Contract termination and loss contingency | |

| — | | |

| 11,901 | |

| Loss (gain) on sale of assets | |

| 2,071 | | |

| (447 | ) |

| Loss on early extinguishment of debt | |

| 45,375 | | |

| — | |

| Loss on convertible note inducement | |

| 169 | | |

| 86 | |

| Changes in current assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 55,229 | | |

| (1,440 | ) |

| Accrued revenue | |

| (332,900 | ) | |

| 334,294 | |

| Other current assets | |

| (13,664 | ) | |

| 32,584 | |

| Accounts payable including related parties | |

| 59,222 | | |

| 12,236 | |

| Accrued liabilities | |

| 36,632 | | |

| (118,316 | ) |

| Revenue distributions payable | |

| 237,453 | | |

| (129,966 | ) |

| Other current liabilities | |

| (7,222 | ) | |

| 4,627 | |

| Net cash provided by operating activities | |

| 2,576,057 | | |

| 682,546 | |

| Cash flows provided by (used in) investing activities: | |

| | | |

| | |

| Additions to unproved properties | |

| (120,139 | ) | |

| (139,121 | ) |

| Drilling and completion costs | |

| (589,093 | ) | |

| (759,852 | ) |

| Additions to other property and equipment | |

| (12,188 | ) | |

| (13,073 | ) |

| Proceeds from asset sales | |

| 1,147 | | |

| 447 | |

| Change in other assets | |

| 1,910 | | |

| (2,538 | ) |

| Net cash used in investing activities | |

| (718,363 | ) | |

| (914,137 | ) |

| Cash flows provided by (used in) financing activities: | |

| | | |

| | |

| Repurchases of common stock | |

| (675,412 | ) | |

| (75,356 | ) |

| Repayment of senior notes | |

| (1,011,313 | ) | |

| — | |

| Borrowings on bank credit facilities, net | |

| 9,000 | | |

| 439,300 | |

| Payment of debt issuance costs | |

| (814 | ) | |

| — | |

| Convertible note inducement | |

| (169 | ) | |

| (86 | ) |

| Distributions to noncontrolling interests in Martica Holdings LLC | |

| (113,515 | ) | |

| (104,245 | ) |

| Employee tax withholding for settlement of equity compensation awards | |

| (65,029 | ) | |

| (27,443 | ) |

| Other | |

| (442 | ) | |

| (579 | ) |

| Net cash provided by (used in) financing activities | |

| (1,857,694 | ) | |

| 231,591 | |

| Net increase in cash and cash equivalents | |

| — | | |

| — | |

| Cash and cash equivalents, beginning of period | |

| — | | |

| — | |

| Cash and cash equivalents, end of period | |

$ | — | | |

| — | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 148,668 | | |

| 100,067 | |

| Increase (decrease) in accounts payable and accrued liabilities for additions to property and equipment | |

$ | 23,633 | | |

| (22,300 | ) |

The following table sets forth selected financial data for the three

months ended September 30, 2022 and 2023:

| | |

Three Months Ended | | |

Amount of | | |

| |

| | |

September 30, | | |

Increase | | |

Percent | |

| | |

2022 | | |

2023 | | |

(Decrease) | | |

Change | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Natural gas sales | |

$ | 1,736,039 | | |

| 516,214 | | |

| (1,219,825 | ) | |

| (70 | )% |

| Natural gas liquids sales | |

| 620,816 | | |

| 482,570 | | |

| (138,246 | ) | |

| (22 | )% |

| Oil sales | |

| 67,025 | | |

| 62,629 | | |

| (4,396 | ) | |

| (7 | )% |

| Commodity derivative fair value gains (losses) | |

| (530,523 | ) | |

| 3,448 | | |

| 533,971 | | |

| * | |

| Marketing | |

| 159,985 | | |

| 53,068 | | |

| (106,917 | ) | |

| (67 | )% |

| Amortization of deferred revenue, VPP | |

| 9,478 | | |

| 7,701 | | |

| (1,777 | ) | |

| (19 | )% |

| Other revenue and income | |

| 1,804 | | |

| 546 | | |

| (1,258 | ) | |

| (70 | )% |

| Total revenue | |

| 2,064,624 | | |

| 1,126,176 | | |

| (938,448 | ) | |

| (45 | )% |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Lease operating | |

| 27,453 | | |

| 33,484 | | |

| 6,031 | | |

| 22 | % |

| Gathering and compression | |

| 239,868 | | |

| 216,435 | | |

| (23,433 | ) | |

| (10 | )% |

| Processing | |

| 241,347 | | |

| 264,391 | | |

| 23,044 | | |

| 10 | % |

| Transportation | |

| 235,173 | | |

| 191,060 | | |

| (44,113 | ) | |

| (19 | )% |

| Production and ad valorem taxes | |

| 92,998 | | |

| 32,258 | | |

| (60,740 | ) | |

| (65 | )% |

| Marketing | |

| 185,377 | | |

| 69,542 | | |

| (115,835 | ) | |

| (62 | )% |

| Exploration and mine expenses | |

| 2,975 | | |

| 591 | | |

| (2,384 | ) | |

| (80 | )% |

| General and administrative (excluding equity-based compensation) | |

| 32,501 | | |

| 39,967 | | |

| 7,466 | | |

| 23 | % |

| Equity-based compensation | |

| 10,402 | | |

| 18,458 | | |

| 8,056 | | |

| 77 | % |

| Depletion, depreciation and amortization | |

| 169,607 | | |

| 176,259 | | |

| 6,652 | | |

| 4 | % |

| Impairment of property and equipment | |

| 33,924 | | |

| 13,476 | | |

| (20,448 | ) | |

| (60 | )% |

| Accretion of asset retirement obligations | |

| 630 | | |

| 889 | | |

| 259 | | |

| 41 | % |

| Contract termination and loss contingency | |

| 17,995 | | |

| 13,659 | | |

| (4,336 | ) | |

| (24 | )% |

| Loss (gain) on sale of assets | |

| 214 | | |

| (136 | ) | |

| (350 | ) | |

| * | |

| Other operating expense | |

| — | | |

| 111 | | |

| 111 | | |

| * | |

| Total operating expenses | |

| 1,290,464 | | |

| 1,070,444 | | |

| (220,020 | ) | |

| (17 | )% |

| Operating income | |

| 774,160 | | |

| 55,732 | | |

| (718,428 | ) | |

| (93 | )% |

| Other earnings (expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (28,326 | ) | |

| (31,634 | ) | |

| (3,308 | ) | |

| 12 | % |

| Equity in earnings of unconsolidated affiliate | |

| 14,972 | | |

| 22,207 | | |

| 7,235 | | |

| 48 | % |

| Loss on early extinguishment of debt | |

| (30,307 | ) | |

| — | | |

| 30,307 | | |

| * | |

| Loss on convertible note inducement | |

| (169 | ) | |

| — | | |

| 169 | | |

| * | |

| Total other expense | |

| (43,830 | ) | |

| (9,427 | ) | |

| 34,403 | | |

| (78 | )% |

| Income before income taxes | |

| 730,330 | | |

| 46,305 | | |

| (684,025 | ) | |

| (94 | )% |

| Income tax expense | |

| (135,823 | ) | |

| (13,663 | ) | |

| 122,160 | | |

| (90 | )% |

| Net income and comprehensive income including noncontrolling interests | |

| 594,507 | | |

| 32,642 | | |

| (561,865 | ) | |

| (95 | )% |

| Less: net income and comprehensive income attributable to noncontrolling interests | |

| 34,748 | | |

| 14,834 | | |

| (19,914 | ) | |

| (57 | )% |

| Net income and comprehensive income attributable to Antero Resources Corporation | |

$ | 559,759 | | |

| 17,808 | | |

| (541,951 | ) | |

| (97 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDAX | |

$ | 878,100 | | |

| 271,203 | | |

| (606,897 | ) | |

| (69 | )% |

* Not meaningful

The following table sets forth selected financial data for the three

months ended September 30, 2022 and 2023:

| | |

Three Months Ended | | |

Amount of | | |

| |

| | |

September 30, | | |

Increase | | |

Percent | |

| | |

2022 | | |

2023 | | |

(Decrease) | | |

Change | |

| Production data (1) (2): | |

| | | |

| | | |

| | | |

| | |

| Natural gas (Bcf) | |

| 200 | | |

| 208 | | |

| 8 | | |

| 4 | % |

| C2 Ethane (MBbl) | |

| 5,010 | | |

| 6,696 | | |

| 1,686 | | |

| 34 | % |

| C3+ NGLs (MBbl) | |

| 9,950 | | |

| 10,977 | | |

| 1,027 | | |

| 10 | % |

| Oil (MBbl) | |

| 804 | | |

| 918 | | |

| 114 | | |

| 14 | % |

| Combined (Bcfe) | |

| 294 | | |

| 320 | | |

| 26 | | |

| 9 | % |

| Daily combined production (MMcfe/d) | |

| 3,200 | | |

| 3,474 | | |

| 274 | | |

| 9 | % |

| Average prices before effects of derivative settlements (3): | |

| | | |

| | | |

| | | |

| | |

| Natural gas (per Mcf) | |

$ | 8.69 | | |

| 2.48 | | |

| (6.21 | ) | |

| (71 | )% |

| C2 Ethane (per Bbl) (4) | |

$ | 23.40 | | |

| 11.73 | | |

| (11.67 | ) | |

| (50 | )% |

| C3+ NGLs (per Bbl) | |

$ | 50.61 | | |

| 36.81 | | |

| (13.80 | ) | |

| (27 | )% |

| Oil (per Bbl) | |

$ | 83.41 | | |

| 68.22 | | |

| (15.19 | ) | |

| (18 | )% |

| Weighted Average Combined (per Mcfe) | |

$ | 8.23 | | |

| 3.32 | | |

| (4.91 | ) | |

| (60 | )% |

| Average realized prices after effects of derivative settlements (3): | |

| | | |

| | | |

| | | |

| | |

| Natural gas (per Mcf) | |

$ | 5.51 | | |

| 2.46 | | |

| (3.05 | ) | |

| (55 | )% |

| C2 Ethane (per Bbl) (4) | |

$ | 23.40 | | |

| 11.73 | | |

| (11.67 | ) | |

| (50 | )% |

| C3+ NGLs (per Bbl) | |

$ | 50.27 | | |

| 36.76 | | |

| (13.51 | ) | |

| (27 | )% |

| Oil (per Bbl) | |

$ | 82.76 | | |

| 67.91 | | |

| (14.85 | ) | |

| (18 | )% |

| Weighted Average Combined (per Mcfe) | |

$ | 6.06 | | |

| 3.30 | | |

| (2.76 | ) | |

| (46 | )% |

| Average costs (per Mcfe): | |

| | | |

| | | |

| | | |

| | |

| Lease operating | |

$ | 0.09 | | |

| 0.10 | | |

| 0.01 | | |

| 11 | % |

| Gathering and compression | |

$ | 0.81 | | |

| 0.68 | | |

| (0.13 | ) | |

| (16 | )% |

| Processing | |

$ | 0.82 | | |

| 0.83 | | |

| 0.01 | | |

| 1 | % |

| Transportation | |

$ | 0.80 | | |

| 0.60 | | |

| (0.20 | ) | |

| (25 | )% |

| Production and ad valorem taxes | |

$ | 0.32 | | |

| 0.10 | | |

| (0.22 | ) | |

| (69 | )% |

| Marketing expense, net | |

$ | 0.09 | | |

| 0.05 | | |

| (0.04 | ) | |

| (44 | )% |

| General and administrative (excluding equity-based compensation) | |

$ | 0.11 | | |

| 0.13 | | |

| 0.02 | | |

| 18 | % |

| Depletion, depreciation, amortization and accretion | |

$ | 0.58 | | |

| 0.55 | | |

| (0.03 | ) | |

| (5 | )% |

| (1) | Production data excludes volumes related to the VPP. |

| (2) | Oil and NGLs production was converted at 6 Mcf per Bbl to calculate total Bcfe production and per Mcfe amounts. This ratio

is an estimate of the equivalent energy content of the products and may not reflect their relative economic value. |

| (3) | Average prices reflect the before and after effects of our settled commodity derivatives. Our calculation of such after effects includes

gains on settlements of commodity derivatives, which do not qualify for hedge accounting because we do not designate or document them

as hedges for accounting purposes. |

| (4) | The average realized price for the three months ended September 30, 2023 includes $6 million of proceeds related to a take-or-pay

contract. Excluding the effect of these proceeds, the average realized price for ethane before and after the effects of derivatives would

have been $10.88 per Bbl. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

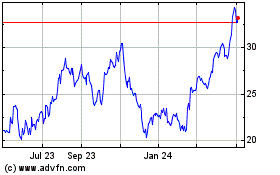

Antero Resources (NYSE:AR)

Historical Stock Chart

From Mar 2024 to Apr 2024

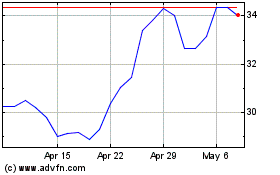

Antero Resources (NYSE:AR)

Historical Stock Chart

From Apr 2023 to Apr 2024