false

0000931584

0000931584

2023-10-25

2023-10-25

0000931584

usap:CommonStockParValue0001PerShareCustomMember

2023-10-25

2023-10-25

0000931584

usap:PreferredStockPurchaseRightsCustomMember

2023-10-25

2023-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2023

Universal Stainless & Alloy Products, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-39467

|

25-1724540

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

600 Mayer Street, Bridgeville, Pennsylvania

|

15017

|

|

(Address of principal executive offices)

|

(Zip code)

|

Registrant’s telephone number, including area code: (412) 257-7600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, par value $0.001 per share

|

|

USAP |

|

The NASDAQ Stock Market, LLC

|

|

Preferred Stock Purchase Rights

|

|

N/A |

|

The NASDAQ Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 25, 2023, Universal Stainless & Alloy Products, Inc. (the “Company”) issued a press release regarding its results for the quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including the attached press release regarding the Company’s results for the quarter ended September 30, 2023, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

UNIVERSAL STAINLESS & ALLOY PRODUCTS, INC.

|

| |

|

|

| |

By:

|

/s/ Steven V. DiTommaso

|

| |

|

Steven V. DiTommaso

|

| |

|

Vice President and Chief Financial Officer

|

Dated: October 25, 2023

Exhibit 99.1

| |

|

|

|

|

|

|

|

CONTACTS:

|

|

Dennis M. Oates

|

|

Steven V. DiTommaso

|

|

June Filingeri

|

| |

|

Chairman,

|

|

Vice President and

|

|

President

|

| |

|

President and CEO

|

|

Chief Financial Officer

|

|

Comm-Partners LLC

|

| |

|

(412) 257-7609

|

|

(412) 257-7661

|

|

(203) 972-0186

|

UNIVERSAL STAINLESS REPORTS STRONG Third QUARTER 2023 RESULTS

| |

•

|

Q3 2023 Sales reach $71.3 million, up 3% from Q2 2023, up 54% year-over-year |

| |

•

|

Premium Alloy sales of $16.5 million, up 28% from Q2 2023, more than double year-over-year |

| |

•

|

Gross margin improves to 15.2% of sales, highest since Q2 2018 |

| |

•

|

Operating income of $4.4 million, up 43% from Q2 2023 |

| |

•

|

Net income doubles from Q2 2023 to $1.9 million, or $0.20 per diluted share |

| |

•

|

Q3 2023 EBITDA is $9.2 million; Adjusted EBITDA is $9.5 million, up 20% from Q2 2023 |

| |

•

|

Cash flow from operations is $6.7 million for the quarter; $17.8 million year-to-date |

BRIDGEVILLE, PA, October 25, 2023 – Universal Stainless & Alloy Products, Inc. (Nasdaq: USAP) today reported net sales of $71.3 million for the third quarter of 2023, an increase of 3% from $69.0 million in the second quarter of 2023, and up 54% from net sales of $46.2 million in the third quarter of 2022. For the first nine months of 2023, net sales increased 41% to $206.2 million from $145.9 million in the same period of 2022.

Sales of premium alloys totaled $16.5 million, or 23.1% of sales, in the third quarter of 2023, versus 18.6% of 2023 second quarter sales and 17.3% of third quarter 2022 sales. Year-to-date 2023 premium alloy sales increased 83% to $47.0 million, or 22.8% of sales, from $25.7 million, or 17.6% of sales, in the same period of 2022. The Company’s backlog of premium alloys means that this positive momentum should continue in the fourth quarter.

The Company’s premium alloy sales are mainly driven by aerospace demand, and aerospace has driven growth in the Company’s specialty alloys as well. Third quarter 2023 aerospace sales increased 5% sequentially to a record $53.9 million, or 75.6% of sales, compared with $51.3 million, or 74.3% of sales in the second quarter of 2023, and increased 70.3% from $31.7 million, or 68.5% of sales in the third quarter of 2022. Year-to-date 2023 aerospace sales reached $154.1 million.

The Company’s gross margin continued to improve in the 2023 third quarter and totaled $10.9 million, or 15.2% of sales, the highest since the second quarter of 2018. The gross margin in the most recent quarter mainly benefited from a richer product mix and higher selling prices, despite the headwind of negative surcharge misalignment as commodity prices fell during the period and reduced sales and margin.

Operating income increased 43% to $4.4 million in the third quarter of 2023 compared with $3.1 million, in the second quarter of 2023. In the third quarter of 2022, the Company incurred an operating loss of $2.3 million.

The Company’s net income more than doubled to $1.9 million, or $0.20 per diluted share, in the third quarter of 2023, compared with $0.9 million, or $0.10 per diluted share, in the second quarter of 2023. In the third quarter of 2022, the Company incurred a net loss of $1.3 million, or $0.14 per diluted share. For the first nine months of 2023, net income was $2.2 million, or $0.25 per diluted share.

The Company’s EBITDA for the third quarter of 2023 increased to $9.2 million from $7.6 million in the 2023 second quarter. Third quarter 2023 adjusted EBITDA increased 20% to $9.5 million from $7.9 million in the second quarter of 2023.

Dennis Oates, Chairman, President and CEO, commented: “We continued to meet our growth plan for the third quarter with sales of $71.3 million -- the second highest ever, gross margin expansion to 15.2%, a doubling of our net income sequentially to $1.9 million, or $0.20 per diluted share, and a 20% increase in adjusted EBITDA, which was one and a half times greater than in the third quarter a year ago. Our profitability benefitted from a richer product mix and higher prices, even as we experienced negative surcharge misalignment due to falling commodity prices.

“We also grew premium alloy sales compared to the second quarter, and our aerospace sales achieved a record $54 million. Demand for our products remains robust, and we have a substantial book of business extending through 2024, with 37% of our backlog consisting of premium alloys.

“We are now in the commissioning phase of our capital project to add two Vacuum-Arc Remelt (VAR) furnaces at our North Jackson facility. Once complete, this project will increase our capacity in premium and specialty alloys by 20%. It also will enable us to further expand our portfolio of more technologically advanced, higher margin products, with added applications in the aerospace market, including defense.

“We are on-track to achieve further sequential growth in the fourth quarter along with record sales and strengthened profitability for full year 2023. As we look to 2024, we are highly optimistic that our positive growth trajectory will continue. Our confidence is based on the commitment, hard work and talents of all our employees.”

Financial Position

Managed working capital, defined as accounts receivable, plus inventory, minus accounts payable, minus other current liabilities, was $151.6 million at September 30, 2023 compared with $148.4 million at June 30, 2023 and $147.4 million at September 30, 2022. Inventory at the end of the third quarter of 2023 was $150.8 million, which is down from $151.6 million at the end of the 2023 second quarter and $158.8 million at the end of the third quarter of 2022.

Backlog (before surcharges) at September 30, 2023 remained at a robust level of $345 million compared with $355 million at June 30, 2023 and $246 million at September 30, 2022. The average selling price per pound in the backlog increased by more than 5% compared with June 30, 2023.

The Company reduced total debt by $3.8 million to $89.5 million compared to $93.3 million at June 30, 2023. Total debt at September 30, 2022 was $86.6 million. Third quarter 2023 interest expense of $2.1 million was in line with $2.0 million in the 2023 second quarter, but up 75% from the third quarter of 2022, due mainly to higher interest rates on the Company’s variable debt.

Capital expenditures for the third quarter of 2023 totaled $2.7 million versus $2.4 million in the 2023 second quarter and $5.5 million in the third quarter of 2022.

Conference Call and Webcast

The Company has scheduled a conference call for today, October 25th, at 10:00 a.m. (Eastern) to discuss third quarter 2023 results. If you wish to listen to the live conference call via telephone, please Click Here to register for the call and obtain your dial-in number and personal PIN number. A simultaneous webcast will be available on the Company’s website at www.univstainless.com, and thereafter archived on the website through the end of the fourth quarter of 2023.

About Universal Stainless & Alloy Products, Inc.

Universal Stainless & Alloy Products, Inc., established in 1994 and headquartered in Bridgeville, PA, manufactures and markets semi-finished and finished specialty steels, including stainless steel, nickel alloys, tool steel and certain other alloyed steels. The Company’s products are used in a variety of industries, including aerospace, power generation, oil and gas, and heavy equipment manufacturing. More information is available at www.univstainless.com.

Forward-Looking Information Safe Harbor

Except for historical information contained herein, the statements in this release are forward-looking statements that are made pursuant to the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to differ materially from forecasted results. Those risks include, among others, the Company’s ability to maintain its relationships with its significant customers and market segments; the Company’s response to competitive factors in its industry that may adversely affect the market for finished products manufactured by the Company or its customers; the Company’s ability to compete successfully with domestic and foreign producers of specialty steel products and products fashioned from alternative materials; changes in overall demand for the Company’s products and the prices at which the Company is able to sell its products in the aerospace industry, from which a substantial amount of its sales is derived; the Company’s ability to develop, commercialize, market and sell new applications and new products; the receipt, pricing and timing of future customer orders; the impact of changes in the Company’s product mix on the Company’s profitability; the Company’s ability to maintain the availability of raw materials and operating supplies with acceptable pricing; the availability and pricing of electricity, natural gas and other sources of energy that the Company needs for the manufacturing of its products; risks related to property, plant and equipment, including the Company’s reliance on the continuing operation of critical manufacturing equipment; the Company’s success in timely concluding collective bargaining agreements and avoiding strikes or work stoppages; the Company’s ability to attract and retain key personnel; the Company’s ongoing requirement for continued compliance with laws and regulations, including applicable safety and environmental regulations; the ultimate outcome of the Company’s current and future litigation matters; the Company’s ability to meet its debt service requirements and to comply with applicable financial covenants; risks associated with conducting business with suppliers and customers in foreign countries; public health issues, including COVID-19 and its impact on the Company and our customers and suppliers; risks related to acquisitions that the Company may make; the Company’s ability to protect its information technology infrastructure against service interruptions, data corruption, cyber-based attacks or network security breaches; the impact on the Company’s effective tax rates from changes in tax rules, regulations and interpretations in the United States and other countries where it does business; and the impact of various economic, credit and market risk uncertainties. Many of these factors are not within the Company’s control and involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from any future performance suggested herein. Any unfavorable change in the foregoing or other factors could have a material adverse effect on the Company’s business, financial condition and results of operations. Further, the Company operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond the Company’s control. Certain of these risks and other risks are described in the Company’s filings with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, copies of which are available from the SEC or may be obtained upon request from the Company.

Non-GAAP Financial Measures

This press release includes discussions of financial measures that have not been determined in accordance with U.S. Generally Accepted Accounting Principles (GAAP). These measures include earnings (loss) before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA. We include these measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings (loss), is a relevant indicator of trends relating to cash generating activity of our operations. adjusted EBITDA excludes the effect of share-based compensation expense and noted special items such as impairments and costs or income related to special events such as periods of low activity or insurance claims. We believe that excluding these costs provides a consistent comparison of the cash generating activity of our operations. We believe that EBITDA and adjusted EBITDA are useful to investors as they facilitate a comparison of our operating performance to other companies who also use EBITDA and adjusted EBITDA as supplemental operating measures. These non-GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measures. These non-GAAP measures may not be entirely comparable to similarly titled measures used by other companies due to potential differences among calculation methodologies. A reconciliation of these non-GAAP financial measures to their most directly comparable financial measure prepared in accordance with GAAP is included in the tables that follow.

[TABLES FOLLOW]

UNIVERSAL STAINLESS & ALLOY PRODUCTS, INC.

FINANCIAL HIGHLIGHTS

(Dollars in Thousands, Except Per Share Information)

(Unaudited)

CONSOLIDATED STATEMENTS OF OPERATIONS

| |

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

71,283 |

|

|

$ |

46,196 |

|

|

$ |

206,163 |

|

|

$ |

145,914 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold

|

|

|

60,424 |

|

|

|

43,218 |

|

|

|

177,732 |

|

|

|

134,144 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin

|

|

|

10,859 |

|

|

|

2,978 |

|

|

|

28,431 |

|

|

|

11,770 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

6,449 |

|

|

|

5,279 |

|

|

|

19,479 |

|

|

|

15,605 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss)

|

|

|

4,410 |

|

|

|

(2,301 |

) |

|

|

8,952 |

|

|

|

(3,835 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

2,073 |

|

|

|

1,165 |

|

|

|

6,020 |

|

|

|

2,632 |

|

|

Deferred financing amortization

|

|

|

65 |

|

|

|

56 |

|

|

|

195 |

|

|

|

168 |

|

|

Other expense (income), net

|

|

|

42 |

|

|

|

(599 |

) |

|

|

5 |

|

|

|

(625 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

2,230 |

|

|

|

(2,923 |

) |

|

|

2,732 |

|

|

|

(6,010 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income taxes

|

|

|

300 |

|

|

|

(1,626 |

) |

|

|

419 |

|

|

|

(1,661 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

1,930 |

|

|

$ |

(1,297 |

) |

|

$ |

2,313 |

|

|

$ |

(4,349 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share - Basic

|

|

$ |

0.21 |

|

|

$ |

(0.14 |

) |

|

$ |

0.26 |

|

|

$ |

(0.49 |

) |

|

Net income (loss) per common share - Diluted

|

|

$ |

0.20 |

|

|

$ |

(0.14 |

) |

|

$ |

0.25 |

|

|

$ |

(0.49 |

) |

MARKET SEGMENT INFORMATION

|

(Dollars in thousands; unaudited)

|

|

Three months ended |

|

|

|

|

|

Nine months ended |

|

|

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

|

Net Sales

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service centers

|

|

$ |

56,768 |

|

|

$ |

33,382 |

|

|

$ |

159,928 |

|

|

$ |

103,575 |

|

|

Original equipment manufacturers

|

|

|

5,142 |

|

|

|

3,986 |

|

|

|

13,218 |

|

|

|

12,872 |

|

|

Rerollers

|

|

|

2,373 |

|

|

|

3,386 |

|

|

|

12,700 |

|

|

|

14,783 |

|

|

Forgers

|

|

|

5,285 |

|

|

|

4,540 |

|

|

|

16,740 |

|

|

|

12,829 |

|

|

Conversion services and other

|

|

|

1,715 |

|

|

|

902 |

|

|

|

3,577 |

|

|

|

1,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net sales

|

|

$ |

71,283 |

|

|

$ |

46,196 |

|

|

$ |

206,163 |

|

|

$ |

145,914 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons shipped

|

|

|

8,246 |

|

|

|

5,926 |

|

|

|

23,934 |

|

|

|

20,071 |

|

MELT TYPE INFORMATION

|

(Dollars in thousands; unaudited)

|

|

Three months ended |

|

|

|

|

|

Nine months ended |

|

|

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

|

Net Sales

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Specialty alloys

|

|

$ |

53,092 |

|

|

$ |

37,308 |

|

|

$ |

155,588 |

|

|

$ |

118,352 |

|

|

Premium alloys *

|

|

|

16,476 |

|

|

|

7,986 |

|

|

|

46,998 |

|

|

|

25,707 |

|

|

Conversion services and other sales

|

|

|

1,715 |

|

|

|

902 |

|

|

|

3,577 |

|

|

|

1,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net sales

|

|

$ |

71,283 |

|

|

$ |

46,196 |

|

|

$ |

206,163 |

|

|

$ |

145,914 |

|

END MARKET INFORMATION **

|

(Dollars in thousands; unaudited)

|

|

Three months ended |

|

|

|

|

|

Nine months ended |

|

|

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

|

Net Sales

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aerospace

|

|

$ |

53,978 |

|

|

$ |

31,664 |

|

|

$ |

154,198 |

|

|

$ |

97,439 |

|

|

Power generation

|

|

|

715 |

|

|

|

1,553 |

|

|

|

3,131 |

|

|

|

5,074 |

|

|

Oil & gas

|

|

|

2,592 |

|

|

|

3,706 |

|

|

|

10,398 |

|

|

|

12,725 |

|

|

Heavy equipment

|

|

|

8,940 |

|

|

|

6,225 |

|

|

|

24,799 |

|

|

|

21,504 |

|

|

General industrial, conversion services and other

|

|

|

5,058 |

|

|

|

3,048 |

|

|

|

13,637 |

|

|

|

9,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net sales

|

|

$ |

71,283 |

|

|

$ |

46,196 |

|

|

$ |

206,163 |

|

|

$ |

145,914 |

|

|

*

|

Premium alloys represent all vacuum induction melted (VIM) products.

|

|

**

|

The majority of our products are sold to service centers rather than the ultimate end market customers. The end market information in this press release is our estimate based upon our knowledge of our customers and the grade of material sold to them, which they will in-turn sell to the ultimate end market customer.

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

(Dollars in thousands; unaudited)

|

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash

|

|

$ |

177 |

|

|

$ |

2,019 |

|

|

Accounts receivable, net

|

|

|

36,984 |

|

|

|

30,960 |

|

|

Inventory

|

|

|

150,751 |

|

|

|

154,193 |

|

|

Other current assets

|

|

|

8,621 |

|

|

|

10,392 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

196,533 |

|

|

|

197,564 |

|

|

Property, plant and equipment, net

|

|

|

158,881 |

|

|

|

163,490 |

|

|

Deferred income taxes

|

|

|

- |

|

|

|

143 |

|

|

Other long-term assets

|

|

|

1,602 |

|

|

|

2,137 |

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

357,016 |

|

|

$ |

363,334 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

35,095 |

|

|

$ |

38,179 |

|

|

Accrued employment costs

|

|

|

5,119 |

|

|

|

2,790 |

|

|

Current portion of long-term debt

|

|

|

3,697 |

|

|

|

3,419 |

|

|

Other current liabilities

|

|

|

1,006 |

|

|

|

1,112 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

44,917 |

|

|

|

45,500 |

|

|

Long-term debt, net

|

|

|

85,832 |

|

|

|

95,015 |

|

|

Deferred income taxes

|

|

|

219 |

|

|

|

- |

|

|

Other long-term liabilities, net

|

|

|

3,053 |

|

|

|

3,066 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

|

134,021 |

|

|

|

143,581 |

|

|

Stockholders’ equity

|

|

|

222,995 |

|

|

|

219,753 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$ |

357,016 |

|

|

$ |

363,334 |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

|

(Dollars in thousands; unaudited)

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

2,313 |

|

|

$ |

(4,349 |

) |

|

Adjustments for non-cash items:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

14,331 |

|

|

|

14,351 |

|

|

Amortization of deferred debt financing costs

|

|

|

194 |

|

|

|

169 |

|

|

Deferred income tax

|

|

|

370 |

|

|

|

(1,675 |

) |

|

Share-based compensation expense

|

|

|

1,008 |

|

|

|

1,001 |

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

(6,024 |

) |

|

|

(1,938 |

) |

|

Inventory

|

|

|

2,159 |

|

|

|

(19,342 |

) |

|

Accounts payable

|

|

|

(743 |

) |

|

|

7,255 |

|

|

Accrued employment costs

|

|

|

2,329 |

|

|

|

(335 |

) |

|

Other assets and liabilities, net

|

|

|

1,909 |

|

|

|

(1,449 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

|

|

17,846 |

|

|

|

(6,312 |

) |

| |

|

|

|

|

|

|

|

|

|

Investing activity:

|

|

|

|

|

|

|

|

|

|

Payments for property, plant and equipment

|

|

|

(9,656 |

) |

|

|

(10,974 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash used in investing activity

|

|

|

(9,656 |

) |

|

|

(10,974 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities:

|

|

|

|

|

|

|

|

|

|

Borrowings under revolving credit facility

|

|

|

151,929 |

|

|

|

102,098 |

|

|

Payments on revolving credit facility

|

|

|

(159,383 |

) |

|

|

(83,260 |

) |

|

Issuance of common stock under share-based plans

|

|

|

82 |

|

|

|

62 |

|

|

Payments on term loan facility and finance leases

|

|

|

(2,660 |

) |

|

|

(1,666 |

) |

| |

|

|

|

|

|

|

|

|

|

Net cash (used in) provided by financing activities

|

|

|

(10,032 |

) |

|

|

17,234 |

|

| |

|

|

|

|

|

|

|

|

|

Net decrease in cash

|

|

|

(1,842 |

) |

|

|

(52 |

) |

|

Cash at beginning of period

|

|

|

2,019 |

|

|

|

118 |

|

|

Cash at end of period

|

|

$ |

177 |

|

|

$ |

66 |

|

RECONCILIATION OF NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA

|

(Dollars in thousands; unaudited)

|

|

Three months ended

|

|

|

Nine months ended

|

|

| |

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$ |

1,930 |

|

|

$ |

(1,297 |

) |

|

$ |

2,313 |

|

|

$ |

(4,349 |

) |

|

Interest expense

|

|

|

2,073 |

|

|

|

1,165 |

|

|

|

6,020 |

|

|

|

2,632 |

|

|

Income taxes

|

|

|

300 |

|

|

|

(1,626 |

) |

|

|

419 |

|

|

|

(1,661 |

) |

|

Depreciation and amortization

|

|

|

4,688 |

|

|

|

4,826 |

|

|

|

14,331 |

|

|

|

14,351 |

|

|

EBITDA

|

|

|

8,991 |

|

|

|

3,068 |

|

|

|

23,083 |

|

|

|

10,973 |

|

|

Share-based compensation expense

|

|

|

336 |

|

|

|

306 |

|

|

|

1,008 |

|

|

|

695 |

|

|

Fixed cost absorption direct charge

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,300 |

|

|

Spill costs in addition to absorption charge, net

|

|

|

- |

|

|

|

1,490 |

|

|

|

- |

|

|

|

2,270 |

|

|

AMJP benefit

|

|

|

- |

|

|

|

(632 |

) |

|

|

- |

|

|

|

(2,818 |

) |

|

Adjusted EBITDA

|

|

$ |

9,327 |

|

|

$ |

4,232 |

|

|

$ |

24,091 |

|

|

$ |

12,420 |

|

v3.23.3

Document And Entity Information

|

Oct. 25, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Universal Stainless & Alloy Products, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 25, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39467

|

| Entity, Tax Identification Number |

25-1724540

|

| Entity, Address, Address Line One |

600 Mayer Street

|

| Entity, Address, City or Town |

Bridgeville

|

| Entity, Address, State or Province |

PA

|

| Entity, Address, Postal Zip Code |

15017

|

| City Area Code |

412

|

| Local Phone Number |

257-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000931584

|

| CommonStockParValue0001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

USAP

|

| Security Exchange Name |

NASDAQ

|

| PreferredStockPurchaseRights Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Security Exchange Name |

NASDAQ

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usap_CommonStockParValue0001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usap_PreferredStockPurchaseRightsCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

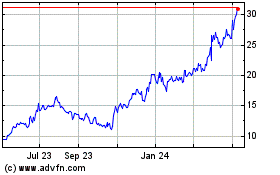

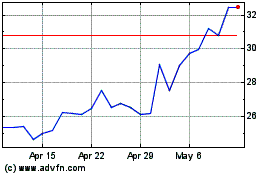

Unversal Stainless and A... (NASDAQ:USAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unversal Stainless and A... (NASDAQ:USAP)

Historical Stock Chart

From Apr 2023 to Apr 2024