0001810140

false

--12-31

0001810140

2023-10-19

2023-10-19

0001810140

POL:CommonStock0.0001ParValuePerShareMember

2023-10-19

2023-10-19

0001810140

POL:WarrantsToPurchaseCommonStockMember

2023-10-19

2023-10-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 19, 2023

POLISHED.COM INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-39418 |

|

83-3713938 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1870 Bath Avenue, Brooklyn, NY 11214

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (800) 299-9470

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.0001 par value per share |

|

POL |

|

NYSE American LLC |

| Warrants to Purchase Common Stock |

|

POL WS |

|

NYSE American LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.03. |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

As disclosed below, at the

Special Meeting of Stockholders (the “Special Meeting”) of Polished.com Inc. (the “Company”) held virtually on

October 19, 2023, the Company’s stockholders approved a proposal (the “Reverse Split Proposal”) authorizing an

amendment (the “Certificate of Amendment”) to the Company’s Amended and Restated Certificate of Incorporation to effect

a reverse stock split of the Company’s outstanding shares of common stock at an exchange ratio between 1 for 25 and 1 for 75, as

determined by the Company’s Board of Directors (the “Board”).

On October 19, 2023,

the Company filed with the Secretary of State of the State of Delaware the Certificate of Amendment to effect a reverse stock split (the

“Reverse Split”) of the Company’s common stock at an exchange ratio of 1 for 50, which was approved by the Board. The

Reverse Split was effective at 12:01 a.m. Eastern Time on October 20, 2023 (the “Effective Time”). At the Effective Time,

every 50 shares of the Company’s issued and outstanding common stock were automatically converted into one share of common stock,

without any change in the par value per share. In addition, proportionate adjustments were made to the per share exercise price and

the number of shares issuable upon the exercise of all outstanding stock options, warrants and convertible securities, and to the number

of shares issued and issuable under the Company’s stock incentive plans. Any stockholder who would otherwise be entitled to a fractional

share of common stock created as a result of the Reverse Split will be entitled to receive a cash payment in lieu thereof equal to the

fractional share to which the stockholder would otherwise be entitled multiplied by the closing sales price of a share of common stock

on October 19, 2023, as adjusted for the Reverse Split.

Following the Reverse Split,

the shares of common stock will continue to trade on NYSE American LLC under the symbol “POL”. The new CUSIP number for the

common stock following the Reverse Split will be 28252C 208.

The summary of the Certificate

of Amendment contained herein does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate

of Amendment, a copy of which is attached as Exhibit 3.1 of this Current Report on Form 8-K and incorporated herein by reference.

| Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

The Company held the Special

Meeting on October 19, 2023 at 11:00 a.m. Eastern Time in virtual format. Of the Company’s 105,469,878 shares of common stock

issued and outstanding and eligible to vote as of September 19, 2023, the record date for the Special Meeting, 59,477,848 shares, or approximately

56.4% of the eligible shares of common stock, were present virtually or represented by proxy. A quorum was present for all matters. Each

of the matters set forth below is described in detail in the Company’s definitive proxy statement filed with the Securities and

Exchange Commission on September 28, 2023. The following actions were taken at the Special Meeting:

Proposal 1

The

Company’s stockholders approved an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect

a reverse stock split of the Company’s common stock at an exchange ratio between 1 for 25 and 1 for 75, as determined by the Company’s

Board of Directors.

| Votes For |

|

Votes Against |

|

Votes Abstained |

| 40,585,966 |

|

18,825,686 |

|

66,196 |

Proposal 2

The Company’s stockholders

approved the adjournment of the Special Meeting in the event the Company did not receive the requisite stockholder vote to approve the

Reverse Split Proposal or establish a quorum. This proposal had no effect because the Company received the requisite stockholder vote.

| Votes For |

|

Votes Against |

|

Votes Abstained |

| 39,795,871 |

|

19,274,652 |

|

407,325 |

| Item 7.01. |

Regulation FD Disclosure. |

On October 19, 2023,

the Company issued a press release announcing the Reverse Split, a copy of which is furnished as Exhibit 99.1 to this Current Report on

Form 8-K.

The information in this Current

Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange

Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the

Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, except as shall be expressly set forth by a specific reference

in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

POLISHED.COM INC. |

| |

|

|

| |

By: |

/s/ Robert D. Barry |

| |

|

Robert D. Barry |

| |

|

Interim Chief Financial Officer and Secretary |

Date: October 20, 2023

3

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

POLISHED.COM INC.

(Pursuant to Section 242 of the

General Corporation Law of the State of Delaware)

Polished.com Inc. (the “Corporation”),

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”),

does hereby certify:

FIRST: The name of the

Corporation is Polished.com Inc. The Corporation’s original Certificate of Incorporation was filed with the Secretary of State of

the State of Delaware (the “Secretary of State”) on January 10, 2019 under the name 1847 Goedeker Inc. An Amended and

Restated Certificate of Incorporation was filed with the Secretary of State on July 30, 2020. A Certificate of Amendment to the Amended

and Restated Certificate of Incorporation was filed with the Secretary of State on December 22, 2021, and a Certificate of Correction

of the Certificate of Amendment to the Amended and Restated Certificate of Incorporation was filed with the Secretary of State on July

7, 2022. A second Certificate of Amendment to the Amended and Restated Certificate of Incorporation was filed with the Secretary of State

on July 20, 2022 (the Company’s Amended and Restated Certificate of Incorporation, as amended, is referred to herein as the “Current

Certificate”).

SECOND: Pursuant to Section

242(b) of the DGCL, the Board of Directors of the Corporation has duly adopted, and the outstanding stock entitled to vote thereon has

approved, the amendments to the Current Certificate set forth in this Certificate of Amendment.

THIRD: Article IV of the

Current Certificate is hereby amended and restated as follows:

The total number

of shares of capital stock which the Corporation shall have authority to issue is two hundred million (200,000,000) shares of common stock,

$0.0001 par value per share (the “Common Stock”), and twenty million (20,000,000) shares of preferred stock,

$0.0001 par value per share (the “Preferred Stock”). All Common Stock of the Corporation shall be of the same

class and shall have the same rights and preferences. Shares of Preferred Stock may be issued from time to time in one or more classes

or series, each of which class or series shall have such distinctive designation or title as shall be fixed by the Board of Directors

of the Corporation or, to the extent permitted by the DGCL, any committee thereof established by resolution of the Board of Directors

pursuant to the Bylaws of the Corporation prior to the issuance of any shares thereof. Each such class or series of Preferred Stock shall

have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special

rights and such qualifications, limitations or restrictions thereof, as shall be stated in such resolution or resolutions providing for

the issue of such class or series of Preferred Stock as may be adopted from time to time by the Board of Directors prior to the issuance

of any shares thereof pursuant to the authority hereby expressly vested in it, all in accordance with the laws of the State of Delaware.

Upon the effectiveness

of the certificate of amendment first inserting this paragraph (the “Effective Time”), each 50 shares of Common

Stock outstanding immediately prior to the Effective Time shall be automatically combined into (1) outstanding share of Common Stock of

the Corporation, without any further action by the Corporation or the holder thereof (the “Reverse Stock Split”).

No fractional shares shall be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to receive

fractional shares shall be entitled to cash in lieu of the fractional share. Each certificate that immediately prior to the Effective

Time represented shares of Common Stock (“Old Certificates”) shall thereafter represent that number of shares

of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to any elimination

of fractional share interests.

FOURTH: On October 18, 2023,

the Board of Directors of the Corporation determined that each 50 shares of the Corporation’s common stock, par value $0.0001 per

share, outstanding immediately prior to the Effective Time shall automatically be combined into one (1) validly issued, fully paid and

non-assessable share of the Corporation’s common stock, par value $0.0001 per share. The Corporation publicly announced this ratio

on October 19, 2023.

FIFTH: This Certificate of

Amendment shall become effective at 12:01 a.m. (local time in Wilmington, Delaware) on October 20, 2023.

IN WITNESS WHEREOF, Polished.com

Inc. has caused this Certificate of Amendment to be signed this 19th day of October, 2023.

| |

POLISHED.COM INC. |

| |

|

| |

By: |

/s/ Robert D. Barry |

| |

Name: |

Robert D. Barry |

| |

Title: |

Interim Chief Financial Officer and Secretary |

Exhibit 99.1

Polished.com Announces Reverse Stock Split

BROOKLYN, N.Y.--(BUSINESS WIRE)-- Polished.com

Inc. (the “Company” or “Polished”) (NYSE American: POL) today announced that the Board of Directors and stockholders

of the Company approved a 1-for-50 reverse stock split (the “Reverse Stock Split”) of its outstanding shares of common stock

(the “Common Stock”) that will become effective at 12:01 a.m. ET on October 20, 2023. The Company’s Common Stock will

continue to trade on the NYSE American under the existing symbol “POL.”

The Reverse Stock Split was approved by the Company’s

stockholders at the Special Meeting of Stockholders (the “Special Meeting”) on October 19, 2023. As a result of the Reverse

Stock Split, every 50 shares of Common Stock issued and outstanding will be automatically combined into one share of Common Stock. The

Reverse Stock Split will proportionately reduce the number of outstanding shares of Common Stock from approximately 105.5 million shares

to approximately 2.1 million shares and the ownership percentage of each stockholder will remain unchanged other than as a result of fractional

shares. The Company will pay cash for fractional shares.

The Reverse Stock Split is part of the Company’s

plan to regain compliance with the $0.20 per share minimum closing price required to maintain continued listing on the NYSE American.

About Polished.com Inc.

Polished is raising the bar, delivering a world-class,

white-glove shopping experience for home appliances. From the best product selections from top brands to exceptional customer service,

we are simplifying the purchasing process and empowering consumers as we provide a polished experience, from inspiration to installation.

A product expert helps customers get inspired and imagine the space they want, then shares fresh ideas, unbiased recommendations and excellent

deals to suit the project’s budget and style. The goal is peace of mind when it comes to new appliances. Polished perks include

its “Love-It-Or-Return-It” 30-day policy, extended warranties, the ability to arrange for delivery and installation at your

convenience and other special offers. Learn more at www.Polished.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained

in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by

the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,”

“expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,”

“predict,” “project,” “target,” “aim,” “should,” “will”, “would,”

or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are subject to inherent uncertainties, risks and assumptions that

are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove

to be accurate. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties

and other factors, which are, in some cases, beyond the Company’s control and which could materially affect results. Factors that

may cause actual results to differ materially from current expectations include, among other things, those described more fully in the

section titled “Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and the

Company’s other reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this press release

are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Additional Information and Where to Find It

Polished is holding the Special Meeting to approve

the reverse stock split. In connection with seeking shareholder approval, Polished has filed with the SEC a proxy statement and other

documents describing the proposed transaction. Stockholders are urged to read the proxy statement because it contains important information

about the transaction. A definitive proxy statement will be sent to the stockholders of Polished seeking their approval of the reverse

stock split. Stockholders may obtain a free copy of the proxy statement and other documents filed by Polished with the SEC at the SEC’s

Web site at www.sec.gov, or by directing a request to Polished.com Inc., 1870 Bath Avenue, Brooklyn, NY 11214, Attention: Secretary.

Participants in Solicitation

Polished and its directors and executive officers

may be deemed to be participants in the solicitation of proxies from the stockholders of Polished in connection with the Reverse Stock

Split. Information about the directors and executive officers of Polished is set forth in Polished’s Form 10-K for the fiscal year

ended December 31, 2022 filed with the SEC on July 31, 2023, as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on August

1, 2023 and Amendment No. 2 on Form 10-K/A filed with the SEC on August 8, 2023, and the proxy statement filed with the SEC on December

19, 2022. Additional information regarding the interests of these participants and other persons who may be deemed participants in the

Reverse Stock Split may be obtained by reading the proxy statement filed on September 28, 2023 regarding the Reverse Stock Split.

Contacts

Investor Relations

ir@polished.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POL_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POL_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

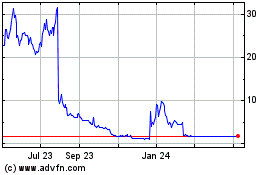

Polished (AMEX:POL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polished (AMEX:POL)

Historical Stock Chart

From Apr 2023 to Apr 2024