0000708781FALSE00007087812023-10-192023-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): October 19, 2023

______________________

CASS INFORMATION SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

______________________

| | | | | | | | |

| Missouri | 000-20827 | 43-1265338 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

12444 Powerscourt Drive, Suite 550 St. Louis, Missouri | 63131 |

| (Address of principal executive offices) | (Zip Code) |

(314) 506-5500

(Registrant’s telephone number, including area code)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act. |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act. |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol | | Name of each exchange

on which registered |

| Common Stock, par value $0.50 per share | | CASS | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 19, 2023, Cass Information Systems, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter of fiscal 2023. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Also on October 19, 2023, the Company made available on the Investors section of the Company’s website at www.cassinfo.com, an investor presentation that includes information about the Company’s business and developments and certain financial information relating to the third quarter of fiscal 2023. The information contained in the investor presentation is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission filings and other public announcements that the Company may make, by press release or otherwise, from time to time. A copy of this investor presentation is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The Company has used, and intends to continue using, the Investors portion of its website to disclose material non-public information and to comply with its disclosure obligations under Regulation FD. Accordingly, investors are encouraged to monitor the Company’s website in addition to following press releases, SEC filings, and public conference calls and webcasts.

The information reported under this Item 2.02 of Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On October 17, 2023, the Company’s Board of Directors declared a fourth quarter dividend of $0.30 per share payable on December 15, 2023 to shareholders of record on December 5, 2023. Additionally, the Board of Directors voted to authorize the repurchase of up to 500,000 shares. Repurchases will be made in the open market or through negotiated transactions from time to time, depending on market conditions. A copy of the press release announcing these matters is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| |

| 99.1 | | |

| |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 19, 2023

| | | | | | | | |

| CASS INFORMATION SYSTEMS, INC. |

| | |

| By: | /s/ Martin H. Resch |

| Name: | Martin H. Resch |

| Title: | President and Chief Executive Officer |

| | |

| By: | /s/ Michael J. Normile |

| Name: | Michael J. Normile |

| Title: | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Contact: Cass Investor Relations

ir@cassinfo.com

October 19, 2023

Cass Information Systems Reports Third Quarter 2023 Results

Third Quarter Results

(All comparisons refer to the third quarter of 2022, except as noted)

•Net income of $7.4 million, or $0.54 per diluted common share.

•Increase in total revenues of $2.0 million, or 4.3%.

•Return on average equity of 13.80%.

•Increase in net interest margin to 3.24% from 2.90%.

•Maintained exceptional credit quality, with no non-performing loans or charge-offs.

•Continued to make progress on technology initiatives to increase operational efficiency.

•Signed several new large facility clients.

•Repurchased 73,272 shares of Company stock.

•Increased quarterly dividend to $0.30 per share.

•Authorized the repurchase of up to 500,000 shares of common stock.

ST. LOUIS – Cass Information Systems, Inc. (Nasdaq: CASS), (the Company or Cass) reported third quarter 2023 earnings of $0.54 per diluted share, as compared to $0.64 in the third quarter of 2022 and $0.52 in the second quarter of 2023. Net income for the period was $7.4 million, a decrease of 16.0% from $8.8 million in the same period in 2022 and an increase of $256,000, or 3.6%, as compared to the second quarter of 2023.

The Company’s financial results have been impacted by a decrease in payment float generated from its transportation clients as a result of a decline in freight rates and a decrease in deposit balances generated from its Cass Commercial Bank clients. The lower level of funding provided by these sources has impacted the Company’s ability to earn interest income on short-term investments. The Company also continues to invest in updating and upgrading its technology platforms in its payment business. The Company anticipates an improvement in profitability levels as compared to the third quarter of 2023 in future quarters as efficiencies are gained around ingesting and processing invoices, new facility clients are onboarded and net interest income improves as a result of net interest margin expansion via repricing of maturing fixed rate loans and investment securities to current market interest rates.

Martin Resch, the Company’s President and Chief Executive Officer, noted, “We continue to update and upgrade the various technology platforms supporting our payments businesses. These technology enhancements, while temporarily increasing expense levels beyond what is necessary to run our business, are creating capacity to meet ongoing business demand, presenting significant revenue opportunities. We have recently signed several new large clients which are expected to increase our facility transaction and dollar volumes by 30-40% over third quarter of 2023 levels and marginally impact freight transaction and dollar volumes. The facilities clients are expected to be fully onboarded by the end of the first quarter of 2024.”

Third Quarter 2023 Highlights

Transportation Dollar Volumes – Transportation dollar volumes were $9.3 billion during the third quarter of 2023, a decrease of 19.8% as compared to the third quarter of 2022 and a decrease of 4.6% as compared to the second quarter of 2023. The decrease in dollar volumes was due to a decrease in the average dollars per transaction to $1,038 during the third quarter of 2023 as compared to $1,231 in the third quarter of 2022 and $1,056 in the second quarter of 2023 as a result of lower fuel costs and overall freight rates. Transportation dollar volumes are key to the Company’s revenue as higher

volumes generally lead to an increase in payment float, which generates interest income, as well as an increase in payments in advance of funding, which generates financial fees.

Facility Expense Dollar Volumes – Facility dollar volumes totaled $5.1 billion during the third quarter of 2023, a decrease of 7.1% as compared to the third quarter of 2022 and an increase of 11.3% as compared to the second quarter of 2023. The change in dollar volumes period to period are largely reflective of seasonality and energy prices.

Processing Fees – Processing fees increased $975,000, or 5.1%, over the same period in the prior year. The increase in processing fee income was largely driven by an increase in ancillary fees and an increase in facility transaction volumes of 3.1%. The Company has experienced recent success in winning facility clients with high transaction volumes which is expected to contribute to more meaningful growth in processing fees beginning in the first quarter of 2024 as these new clients are onboarded. Transportation invoice volumes decreased 4.9% over the same period. The decline in transportation volumes is due to the on-going freight recession.

Financial Fees – Financial fees, earned on a transactional level basis for invoice payment services when making customer payments, increased $345,000, or 3.1%. The increase in financial fee income was primarily due to the increase in short-term interest rates, partially offset by a decline in transportation dollar volumes of 19.8%.

Net Interest Income – Net interest income increased $577,000, or 3.6%. The Company’s net interest margin improved to 3.24% as compared to 2.90% in the same period last year. The increase in net interest income and margin was largely driven by the rise in market interest rates as compared to the same period last year, which is favorable for these financial metrics over the long-term. The positive impact of the increase in the net interest margin was partially offset by a decline in average interest-earning assets of $183.4 million, or 8.2%.

Net interest income increased $534,000, or 3.3%, as compared to the second quarter of 2023. The increase was driven by an increase in average interest-earning assets of $49.0 million, or 2.4%. The Company’s net interest margin declined 1 basis point to 3.24% from 3.25% primarily driven by the migration of certain non-interest bearing deposits to interest-bearing. The Company anticipates its net interest margin will expand in future quarters as a result of 72.4% of the Company’s average funding sources, consisting of deposits and accounts and drafts payable being non interest-bearing. The Company has $109.8 million in U.S. Treasury securities with a weighted average yield of 2.43% maturing at various dates from April through July of 2024. In addition, the recent success of winning new facility clients is expected to generate a significant average volume of non-interest bearing payment float which can be invested at current market interest rates.

Provision for Credit Losses - The Company recorded a provision for credit losses of $125,000 during the third quarter of 2023 as compared to $550,000 in the third quarter of 2022. The provision for credit losses for the third quarter of 2023 was driven by certain changes to assumptions in the Company’s CECL model, partially offset by a decrease in total loans of $16.2 million, or 1.5%, as compared to June 30, 2023.

Personnel Expenses - Personnel expenses increased $2.6 million, or 9.8%. Salaries and commissions increased $1.4 million, or 6.6%, as a result of merit increases and an increase in average full-time equivalent employees of 8.1% due to strategic investment in various technology initiatives. Pension expense increased $745,000. Despite the Company’s defined benefit pension plan being frozen in the first quarter of 2021 resulting in no service cost in subsequent periods, expense increased as a result of the accounting impact of the decline in plan assets during 2022 and corresponding decline in expected return on plan assets for 2023. Other benefits, such as 401(k) match, health insurance and payroll taxes, increased $776,000, or 17.6%, primarily due to the 8.1% increase in average FTEs as well as a significant increase in employer health insurance costs over prior year levels.

Non-Personnel Expenses - Non-personnel expenses rose $1.1 million, or 11.9%. Certain expense categories such as equipment, outside service fees and data processing are elevated as the Company invests in, and transitions to, improved technology. Multiple technology platforms are being maintained prior to switching over to what the Company believes will be more efficient technology platforms for data entry processing by the end of 2023.

Loans - When compared to December 31, 2022, ending loans decreased $43.3 million, or 4.0%. The Company has opted to be more selective in booking new loans as a result of the decline in deposits during the first half of 2023, focusing on building new client relationships rather than transactional opportunities like investment grade leases. The Company expects to experience a more normal level of loan growth in future quarters.

Payments in Advance of Funding – Average payments in advance of funding decreased $43.0 million, or 15.5%, primarily due to a 19.8% decrease in transportation dollar volumes, which led to fewer dollars advanced to freight carriers.

Deposits – Average deposits decreased $112.3 million, or 9.5%, when compared to the third quarter of 2022 but increased $10.0 million, or 0.9% from the second quarter of 2023. Total deposits at September 30, 2023 decreased $79.9 million, or 6.4% as compared to December 31, 2022. The Company experienced deposit attrition during the first six months of 2023 as larger commercial depository clients moved their funds to higher interest rate alternatives outside of Cass Commercial Bank. The Company has experienced a recent increase in its deposit balances as a result of an increase in its deposit rates and increased depositor confidence across the banking industry. During the third quarter of 2023, as compared to the second quarter of 2023, the Company experienced an increase in average interest-bearing deposits of $82.2 million and a decrease in non-interest bearing deposits of $72.2 million as a couple large depository clients transferred funds to interest-bearing accounts.

Accounts and Drafts Payable - Average accounts and drafts payable decreased $112.3 million, or 9.5%. The decrease in these balances, which are non-interest bearing, are primarily reflective of the decrease in transportation dollar volumes of 19.8%. Accounts and drafts payable are a stable source of funding generated by payment float from transportation and facility clients.

Liquidity - The Company maintained strong liquidity during the third quarter of 2023 with average short-term investments, primarily consisting of cash in a reserve account at the Federal Reserve Bank, of $310.8 million. In addition, all of the Company’s investment securities are classified as available-for-sale, and there were no outstanding borrowings at September 30, 2023.

Capital - The Company’s common equity tier 1, total risk-based capital and leverage ratios were 14.53%, 15.30% and 10.61% at September 30, 2023, respectively. Total shareholders’ equity has decreased $89,000 since December 31, 2022 as a result of an increase in accumulated other comprehensive loss of $7.6 million due to the increase in market interest rates and resulting negative impact on the fair value of available-for-sale investment securities, dividends of $11.9 million and the repurchase of Company stock of $5.2 million, partially offset by year-to-date 2023 earnings of $21.6 million. On October 17, 2023, the Company’s Board of Directors approved an increase in the quarterly dividend to $0.30 per share effective with the dividend payable on December 15, 2023 to shareholders of record on December 5, 2023. The Company’s Board of Directors also authorized the repurchase of up to 500,000 shares of common stock in future periods.

About Cass Information Systems

Cass Information Systems, Inc. is a leading provider of integrated information and payment management solutions. Cass enables enterprises to achieve visibility, control and efficiency in their supply chains, communications networks, facilities and other operations. Disbursing over $90 billion annually on behalf of clients, and with total assets of $2.5 billion, Cass is uniquely supported by Cass Commercial Bank. Founded in 1906 and a wholly owned subsidiary, Cass Commercial Bank provides sophisticated financial exchange services to the parent organization and its clients. Cass is part of the Russell 2000®. More information is available at www.cassinfo.com.

Forward Looking Information

This information contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include future financial and operating results, expectations, intentions, and other statements that are not historical facts. Such statements are based on current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. These risks and uncertainties include the impact of economic and market conditions, inflationary pressures, risks of credit deterioration, interest rate changes, governmental actions, market volatility, security breaches and technology interruptions, energy prices and competitive factors, among others, as set forth in the Company’s most recent Annual Report on Form 10-K and subsequent reports filed with the Securities and Exchange Commission. Actual results may differ materially from those set forth in the forward-looking statements.

Note to Investors

The Company has used, and intends to continue using, the Investors portion of its website to disclose material non-public information and to comply with its disclosure obligations under Regulation FD. Accordingly, investors are encouraged to monitor Cass’s website in addition to following press releases, SEC filings, and public conference calls and webcasts.

Consolidated Statements of Income (unaudited)

($ and numbers in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter

Ended

September 30, 2023 | | Quarter

Ended

June 30, 2023 | | Quarter

Ended

September 30, 2022 | | Nine-Months Ended September 30, 2023 | | Nine-Months Ended September 30, 2022 |

| Processing fees | $ | 19,939 | | $ | 19,386 | | $ | 18,964 | | $ | 58,838 | | $ | 57,184 |

| Financial fees | 11,597 | | 11,662 | | 11,252 | | 34,518 | | 32,406 |

| Total fee revenue | $ | 31,536 | | $ | 31,048 | | $ | 30,216 | | $ | 93,356 | | $ | 89,590 |

| | | | | | | | | |

| Interest and fees on loans | 12,863 | | 12,931 | | 10,006 | | 38,029 | | 27,890 |

| Interest and dividends on securities | 4,392 | | 4,677 | | 4,498 | | 13,863 | | 11,546 |

Interest on federal funds sold and

other short-term investments | 3,934 | | 2,100 | | 2,249 | | 9,147 | | 3,423 |

| Total interest income | $ | 21,189 | | $ | 19,708 | | $ | 16,753 | | $ | 61,039 | | $ | 42,859 |

| Interest expense | 4,641 | | 3,694 | | 782 | | 11,579 | | 1,344 |

| Net interest income | $ | 16,548 | | $ | 16,014 | | $ | 15,971 | | $ | 49,460 | | $ | 41,515 |

(Provision for) release of credit

losses | (125) | | 120 | | (550) | | 335 | | (850) |

(Loss) gain on sale of investment

securities | — | | (199) | | 13 | | (160) | | 15 |

| Other | 1,264 | | 1,224 | | 1,555 | | 3,784 | | 3,260 |

| Total revenues | $ | 49,223 | | $ | 48,207 | | $ | 47,205 | | $ | 146,775 | | $ | 133,530 |

| Salaries and commissions | 23,391 | | 23,617 | | 21,953 | | 69,613 | | 62,516 |

| Share-based compensation | 938 | | 909 | | 1,260 | | 3,796 | | 4,431 |

| Net periodic pension cost (benefit) | 129 | | 138 | | (616) | | 402 | | (1,847) |

| Other benefits | 5,178 | | 4,768 | | 4,402 | | 15,283 | | 12,650 |

| Total personnel expenses | $ | 29,636 | | $ | 29,432 | | $ | 26,999 | | $ | 89,094 | | $ | 77,750 |

| Occupancy | 908 | | 907 | | 970 | | 2,670 | | 2,801 |

| Equipment | 1,789 | | 1,749 | | 1,633 | | 5,188 | | 5,004 |

| Other | 7,730 | | 7,251 | | 6,719 | | 22,822 | | 16,233 |

| Total operating expenses | $ | 40,063 | | $ | 39,339 | | $ | 36,321 | | $ | 119,774 | | $ | 101,788 |

Income from operations before

income taxes | $ | 9,160 | | $ | 8,868 | | $ | 10,884 | | $ | 27,001 | | $ | 31,742 |

| Income tax expense | 1,766 | | 1,730 | | 2,085 | | 5,352 | | 6,123 |

| Net income | $ | 7,394 | | $ | 7,138 | | $ | 8,799 | | $ | 21,649 | | $ | 25,619 |

| Basic earnings per share | $ | .55 | | $ | .53 | | $ | .65 | | $ | 1.60 | | $ | 1.89 |

| Diluted earnings per share | $ | .54 | | $ | .52 | | $ | .64 | | $ | 1.56 | | $ | 1.86 |

| | | | | | | | | |

| Share data: | | | | | | | | | |

Weighted-average common

shares outstanding | 13,501 | | | 13,553 | | | 13,542 | | | 13,551 | | | 13,554 | |

Weighted-average common

shares outstanding assuming

dilution | 13,793 | | | 13,854 | | | 13,804 | | | 13,836 | | | 13,807 | |

Consolidated Balance Sheets

($ in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | (unaudited ) September 30, 2023 | | (unaudited ) June 30, 2023 | | December 31, 2022 | |

| Assets: | | | | | | |

| Cash and cash equivalents | $ | 408,435 | | $ | 270,473 | | $ | 200,942 | |

| Securities available-for-sale, at fair value | 615,855 | | 637,513 | | 754,468 | |

| Loans | 1,039,619 | | 1,055,848 | | 1,082,906 | |

| Less: Allowance for credit losses | (13,318) | | (13,194) | | (13,539) | |

| Loans, net | $ | 1,026,301 | | $ | 1,042,654 | | $ | 1,069,367 | |

| Payments in advance of funding | 258,587 | | 269,180 | | 293,775 | |

| Premises and equipment, net | 26,257 | | 24,320 | | 19,958 | |

| Investments in bank-owned life insurance | 48,857 | | 48,564 | | 47,998 | |

| Goodwill and other intangible assets | 20,849 | | 21,044 | | 21,435 | |

| Accounts and drafts receivable from customers | 28,710 | | 83,627 | | 95,779 | |

| Other assets | 71,027 | | 73,421 | | 69,301 | |

| Total assets | $ | 2,504,878 | | $ | 2,470,796 | | $ | 2,573,023 | |

| | | | | | |

| Liabilities and shareholders’ equity: | | | | | | |

| Deposits | | | | | | |

| Non-interest bearing | $ | 511,292 | | $ | 679,107 | | $ | 642,757 | |

| Interest-bearing | 666,050 | | 512,327 | | 614,460 | |

| Total deposits | $ | 1,177,342 | | $ | 1,191,434 | | $ | 1,257,217 | |

| Accounts and drafts payable | 1,082,224 | | 1,021,524 | | 1,067,600 | |

| Other liabilities | 39,076 | | 42,692 | | 41,881 | |

| Total liabilities | $ | 2,298,642 | | $ | 2,255,650 | | $ | 2,366,698 | |

| | | | | | |

| Shareholders’ equity: | | | | | | |

| Common stock | $ | 7,753 | | $ | 7,753 | | $ | 7,753 | |

| Additional paid-in capital | 207,663 | | 206,734 | | 207,422 | |

| Retained earnings | 141,444 | | 137,996 | | 131,682 | |

| Common shares in treasury, at cost | (83,704) | | (80,943) | | (81,211) | |

| Accumulated other comprehensive loss | (66,920) | | (56,394) | | (59,321) | |

| Total shareholders’ equity | $ | 206,236 | | $ | 215,146 | | $ | 206,325 | |

| Total liabilities and shareholders’ equity | $ | 2,504,878 | | $ | 2,470,796 | | $ | 2,573,023 | |

Average Balances (unaudited)

($ in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter

Ended

September 30, 2023 | | Quarter

Ended

June 30, 2023 | | Quarter

Ended

September 30, 2022 | | Nine-Months Ended September 30, 2023 | | Nine-Months Ended September 30, 2022 |

| Average interest-earning assets | $ | 2,059,801 | | $ | 2,010,771 | | $ | 2,243,219 | | $ | 2,077,392 | | $ | 2,196,704 |

| Average loans | 1,045,967 | | 1,075,891 | | 984,105 | | 1,065,915 | | 972,698 |

| | | | | | | | | |

| Average securities available-for-sale | 634,835 | | 686,777 | | 776,162 | | 681,820 | | 740,654 |

| Average short-term investments | 310,770 | | 185,230 | | 431,516 | | 263,774 | | 451,562 |

| Average payments in advance of funding | 234,684 | | 254,869 | | 277,683 | | 243,458 | | 283,431 |

| Average assets | 2,395,264 | | 2,370,359 | | 2,617,814 | | 2,421,274 | | 2,587,760 |

| Average non-interest bearing deposits | 480,472 | | 552,718 | | 586,872 | | 528,677 | | 594,994 |

| Average interest-bearing deposits | 591,556 | | 509,319 | | 597,458 | | 563,994 | | 598,801 |

| Average borrowings | 11 | | 3,199 | | 11 | | 2,993 | | 11 |

| Average interest-bearing liabilities | 591,567 | | 512,518 | | 597,469 | | 566,987 | | 598,812 |

| Average accounts and drafts payable | 1,070,057 | | 1,049,281 | | 1,182,373 | | 1,071,414 | | 1,135,673 |

| Average shareholders’ equity | $ | 212,591 | | $ | 214,066 | | $ | 207,247 | | $ | 212,159 | | $ | 216,827 |

Consolidated Financial Highlights (unaudited)

($ and numbers in thousands, except ratios)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter

Ended

September 30, 2023 | | Quarter

Ended

June 30, 2023 | | Quarter

Ended

September 30, 2022 | | Nine-Months Ended September 30, 2023 | | Nine-Months Ended September 30, 2022 |

| Return on average equity | 13.80% | | 13.37% | | 16.84% | | 13.64% | | 15.80% |

Net interest margin (1) | 3.24% | | 3.25% | | 2.90% | | 3.24% | | 2.61% |

Average interest-earning assets yield (1) | 4.13% | | 3.98% | | 3.04% | | 3.98% | | 2.69% |

| Average loan yield | 4.88% | | 4.82% | | 4.03% | | 4.77% | | 3.83% |

Average investment securities yield (1) | 2.62% | | 2.64% | | 2.35% | | 2.63% | | 2.22% |

| Average short-term investment yield | 5.02% | | 4.55% | | 2.07% | | 4.64% | | 1.01% |

| Average cost of total deposits | 1.72% | | 1.38% | | 0.26% | | 1.42% | | 0.15% |

| Average cost of interest-bearing deposits | 3.11% | | 2.88% | | 0.52% | | 2.72% | | 0.30% |

| Average cost of interest-bearing liabilities | 3.11% | | 2.89% | | 0.52% | | 2.73% | | 0.30% |

| Allowance for credit losses to loans | 1.28% | | 1.25% | | 1.26% | | 1.28% | | 1.26% |

| Non-performing loans to total loans | —% | | —% | | —% | | —% | | —% |

| Net loan charge-offs (recoveries) to loans | —% | | —% | | —% | | —% | | —% |

| | | | | | | | | |

| Transportation invoice volume | 8,925 | | 9,193 | | 9,385 | | 27,216 | | 27,633 |

| Transportation dollar volume | $ | 9,263,453 | | $ | 9,711,801 | | $ | 11,549,980 | | $ | 29,243,706 | | $ | 33,818,573 |

| Facility expense transaction volume | 3,417 | | 3,467 | | 3,315 | | 10,352 | | 9,794 |

| Facility expense dollar volume | $ | 5,096,882 | | $ | 4,578,490 | | $ | 5,485,783 | | $ | 14,988,757 | | $ | 14,699,903 |

(1) Yields are presented on tax-equivalent basis assuming a tax rate of 21%. |

The Power to Deliver Solutions Around the world, leading enterprises rely on Cass for our vertical expertise, processing power, and global payment network to execute critical financial transactions while driving greater control and efficiency across critical business expenses. Q3 2023 INVESTOR PRESENTATION

Forward-Looking Statements Cass at a Glance Financial Performance Revenue & Expenses Balance Sheet Capital ESG Highlights Leadership and Shareholder Information TABLE OF CONTENTS 2 3 4 6 9 14 19 20 www.cassinfo.com / © 2023 Cass Information Systems 21

This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements contain words such as “anticipate,” “believe,” “can,” “would,” “should,” “could,” “may,” “predict,” “seek,” “potential,” “will,” “estimate,” “target,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “intend” or similar expressions that relate to the Company’s strategy, plans or intentions. Forward-looking statements involve certain important risks, uncertainties, and other factors, any of which could cause actual results to differ materially from those in such statements. Such factors include, without limitation, the “Risk Factors” referenced in our most recent Form 10-K filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, and the following factors: ability to execute our business strategy; business and economic conditions; effects of a prolonged government shutdown; economic, market, operational, liquidity, credit and interest rate risks associated with the Company’s business; effects of any changes in trade, monetary and fiscal policies and laws; changes imposed by regulatory agencies to increase capital standards; effects of inflation, as well as, interest rate, securities market and monetary supply fluctuations; changes in the economy or supply-demand imbalances affecting local real estate values; changes in consumer and business spending; the Company's ability to realize anticipated benefits from enhancements or updates to its core operating systems from time to time without significant change in client service or risk to the Company's control environment; the Company's dependence on information technology and telecommunications systems of third-party service providers and the risk of systems failures, interruptions or breaches of security; the Company’s ability to achieve organic fee income, loan and deposit growth and the composition of such growth; changes in sources and uses of funds; increased competition in the payments and banking industries; the effect of changes in accounting policies and practices; the share price of the Company’s stock; the Company's ability to realize deferred tax assets or the need for a valuation allowance; ability to maintain or increase market share and control expenses; costs and effects of changes in laws and regulations and of other legal and regulatory developments; technological changes; the timely development and acceptance of new products and services; the Company’s continued ability to attract, hire and maintain qualified personnel; ability to implement and/or improve operational management and other internal risk controls and processes and reporting system and procedures; regulatory limitations on dividends from the Company's bank subsidiary; changes in estimates of future loan reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; widespread natural and other disasters, pandemics, dislocations, political instability, acts of war or terrorist activities, cyberattacks or international hostilities; impact of reputational risk; and success at managing the risks involved in the foregoing items. The Company can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved, and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of original publication of this presentation, and the Company does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. This presentation is a high-level summary of our recent and historical financial results and current business developments. For more detailed information, please refer to our press releases and filings with the SEC. FORWARD LOOKING STATEMENTS 3www.cassinfo.com / © 2023 Cass Information Systems

4www.cassinfo.com / © 2023 Cass Information Systems CASS AT A GLANCE

+ Cass is an information services company that processes freight and facility payments for a number of the largest global companies + The information systems business has a 70-year legacy + As a result of its $90B of payments, Cass generates $1B+ of average non-interest bearing float + Cass continues to operate a strong and profitable commercial bank founded in 1906 Note: Balance sheet metrics as of September 30, 2023. Income statement metrics are through period ended September 30, 2023 as indicated. Market. Cap. $500M Assets $2.5B YTD ROE 13.6% TTM NI $30.9M YTD % Fees/ Rev. 66.2% % NIB Funding 70.5% INFORMATION SYSTEMS / PAYMENTS + Transportation information systems provides freight invoice audit and payment services in the contract market + Facilities expense management provides payments for the energy, telecom, and waste services + CassPay provides complex treasury management and payment services for fintech and other payment companies COMMERCIAL BANK + Commercial bank operates in three primary niches ‒ St. Louis C&I market ‒ Faith based organizations across the U.S. ‒ McDonalds’ franchisees + Strong track record of asset quality $90B Annual payments volume 50M Annual invoice volume $129M TTM fee revenue $1.1B YTD average float $1.0B Loans $1.2B Deposits 1.42% YTD cost of deposits $0 Charge-offs OVERVIEW 5www.cassinfo.com / © 2023 Cass Information Systems

6www.cassinfo.com / © 2023 Cass Information Systems FINANCIAL PERFORMANCE

Q3 2023 FINANCIAL HIGHLIGHTS 7www.cassinfo.com / © 2023 Cass Information Systems $8.80M $7.39M Q3 '22 Q3 '23 $0.64 $0.54 Q3 '22 Q3 '23 16.84% 13.80% Q3 '22 Q3 '23 NET INCOME DILUTED EPS RETURN ON EQUITY + Net income of $7.4 million + Diluted EPS of $0.54 + Return on average equity of 13.80% + Quarterly revenue of $49.2 million + Expanding net interest margin + Exceptional credit quality + Continued progress on technology initiatives + New facilities clients expected to increase facility transaction and dollar volumes 30-40% + Repurchased 73,272 shares of stock $47.2M $49.2M Q3 '22 Q3 '23 FACILITY TRANSACTION VOLUME TOTAL REVENUES 2.90% 3.24% Q3 '22 Q3 '23 NET INTEREST MARGIN 3.32M 3.42M Q3 '22 Q3 '23

QUARTERLY FINANCIAL PERFORMANCE 8www.cassinfo.com / © 2023 Cass Information Systems $47.2M $48.9M $49.3M $48.2M $49.2M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $8.80M $9.29M $7.12M $7.14M $7.39M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 16.84% 18.96% 13.76% 13.37% 13.80% Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $0.64 $0.67 $0.51 $0.52 $0.54 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 TOTAL REVENUE NET INCOME RETURN ON EQUITY DILUTED EPS + Revenue improved in 3Q2023 as compared to 2Q2023 primarily a result of an increase in interest- earning assets and higher processing fees + Technology initiatives designed to improve operational efficiency and facilitate client acquisition and growth are driving expenses higher and short-term earnings lower while running duplicate production environments

9www.cassinfo.com / © 2023 Cass Information Systems REVENUE & EXPENSES

FINANCIAL FEES 10www.cassinfo.com / © 2023 Cass Information Systems + Despite a decline in transportation dollar volumes which led to a lower average balance of payments in advance of funding, financial fees were up over the same period last year due to the increase in short-term interest rates + Transportation dollar volumes declined due to lower fuel costs and overall freight rates $11.5B $10.9B $10.3B $9.7B $9.3B Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $5.49B $4.81B $5.31B $4.58B $5.10B Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $277.7M $262.6M $240.9M $254.9M $234.7M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 TRANSPORTATION DOLLAR VOLUMES FACILITY DOLLAR VOLUMES AVERAGE PAYMENTS IN ADVANCE OF FUNDING $11.3M $11.4M $11.3M $11.7M $11.6M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 FINANCIAL FEES

PROCESSING FEES 11www.cassinfo.com / © 2023 Cass Information Systems + The change quarter to quarter is generally correlated to transportation and facility invoice volumes. + Processing fees increased as compared to 3Q 2022 due to an increase in ancillary fees and facility invoice volumes. The Company has experienced recent success in winning facility clients with high transaction volumes. + Transportation invoice volumes declined due to the on-going freight recession. 9.39M 9.17M 9.10M 9.19M 8.93M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 3.32M 3.20M 3.47M 3.47M 3.42M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $19.0M $19.3M $19.5M $19.4M $19.9M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 TRANSPORTATION INVOICE VOLUMES FACILITY INVOICE VOLUMES PROCESSING FEES

NET INTEREST INCOME 12www.cassinfo.com / © 2023 Cass Information Systems + The increase in short-term interest rates has had a positive impact on net interest income and margin, jumping from 2.90% during 3Q 2022 up to 3.24% in 3Q 2023. + Average interest-earning assets have declined as compared to the third quarter of 2022 as a result of a decrease in payment float generated from transportation clients due to a decline in freight rates and a decrease in deposit balances generated from Bank clients. + The Company anticipates net interest margin improvement in future quarters as the Company’s interest-earning assets, funded by 72.4% noninterest bearing sources, continue to re-price to current market interest rates. In addition, the recent success of winning new facility clients is expected to generate a significant amount of non- interest bearing payment float which can be invested at current market interest rates. $16.0M $17.3M $16.9M $16.0M $16.5M Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 $2.24B $2.23B $2.16B $2.01B $2.06B Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 2.90% 3.15% 3.23% 3.25% 3.24% Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 NET INTEREST INCOME AVERAGE INTEREST-EARNING ASSETS NET INTEREST MARGIN

OPERATING EXPENSE 13www.cassinfo.com / © 2023 Cass Information Systems + Salaries and commissions as well as other benefits have increased due to average FTEs being up 8.1% as compared to 3Q 2022, primarily due to technology initiatives. + Despite the pension plan being frozen resulting in no service cost, expense is up due to the accounting impact of the decline in plan assets during 2022. + Other operating expenses are also elevated as Cass invests in, and transitions to, improved technology which Cass anticipates will result in improved operating leverage in future quarters. Expense 3Q2022 4Q2022 1Q2023 2Q2023 3Q2023 Salaries and commissions 22.0 23.0 22.6 23.6 23.4 Share-based compensation 1.3 2.3 2.0 0.9 0.9 Net periodic pension cost (benefit) (0.6) (0.6) 0.1 0.1 0.1 Other benefits 4.3 4.0 5.3 4.8 5.2 Total personnel expense 27.0 28.7 30.0 29.4 29.6 Occupancy expense 1.0 0.9 0.9 0.9 0.9 Equipment expense 1.6 1.7 1.7 1.7 1.8 Other expense 6.7 6.5 7.8 7.3 7.8 Total operating expense 36.3 37.8 40.4 39.3 40.1 ($$ in millions)

14www.cassinfo.com / © 2023 Cass Information Systems BALANCE SHEET

LOANS 15www.cassinfo.com / © 2023 Cass Information Systems + Cass has opted to be more selective in booking new loans as a result of the decline in deposits during the first half of 2023, focusing solely on new client relationships. + Cass has not incurred a loan charge-off since 2015 Portfolio Composition 9/30/22 12/31/22 3/31/23 6/30/23 9/30/23 Franchise 230.9 223.3 223.7 224.6 221.8 Faith-Based 373.4 395.3 386.2 386.1 385.4 Leases 136.0 160.7 145.0 134.2 127.7 Other C&I 172.4 177.6 180.2 175.3 167.9 Other CRE 124.4 126.0 135.3 135.6 136.8 Ending Loans 1,037.1 1,082.9 1,070.4 1,055.8 1,039.6 Loan Yield 4.03% 4.37% 4.61% 4.82% 4.88% ACL/Loans 1.26% 1.25% 1.24% 1.25% 1.28% Net Charge-Offs — — — — — Non-Performing Loans/Loans — 0.11% — — — Franchise 21% Faith-Based 37% Leases 13% Commercial and Industrial 16% Commercial Real Estate 13% PORTFOLIO COMPOSITION 9/30/23 ($$ in millions)

INVESTMENT PORTFOLIO COMPOSITION 16www.cassinfo.com / © 2023 Cass Information Systems + All investment securities are classified as available-for-sale. The overall weighted-average repricing term is 4.0 years and the average yield for 3Q2023 was 2.62%. The portfolio had unrealized losses of $80.5 million at September 30, 2023 resulting in a total fair value for the portfolio of $615.9 million. + All of the $109.8 million of U.S. Treasury bonds mature by July 31, 2024. + The asset-backed securities are backed by student loans in the FFELP program with a minimum 97% guaranty by the U.S. Department of Education. Theses securities have long maturities but are floating rate assets. + Of the total $111.2 million portfolio of high-quality corporate bonds, $57.0 million are floating rate. + The mortgage-backed securities portfolio has an estimated average life of 5.2 years. + 99% of the municipal securities are an investment grade of “A” or higher. PORTFOLIO COMPOSITION (BOOK VALUE) State and Political $241.2M MBS $192.2M US Treasuries $109.8M Corporate Bonds $111.2M Asset-Backed $42.0M

FUNDING 17www.cassinfo.com / © 2023 Cass Information Systems + For 3Q 2023, 72.4% of average funding was non-interest bearing, a strategic advantage in current rate environment + The Company experienced deposit attrition during the first half of 2023 as larger commercial clients moved their funds to higher interest rate alternatives outside of Cass Commercial Bank. Average deposits improved during the third quarter. + Payment float has declined from 3Q2022 due to lower fuel costs and overall freight rates but was up compared to 2Q2023. AVERAGE DEPOSITS AND ACCOUNTS & DRAFT PAYABLE FUNDING COMPOSITION $1.7B IN NON- INTEREST FUNDING $1.18B $1.16B $1.10B $1.05B $1.07B $1.18B $1.18B $1.14B $1.06B $1.07B Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 AVERAGE DEPOSITS AVERAGE ACCOUNTS & DRAFTS PAYABLE $2.36B $2.34B $2.24B $2.14B$2.11B Int-DDA, MM, Savings $589.1M Non-Interest $511.3M Accts & Drafts Payable $1,082.2M Time Deposits $76.9M

KEY FUNDING POINTS 18www.cassinfo.com / © 2023 Cass Information Systems + Accounts and drafts payable represents float generated by our payments businesses and have proven a very stable source of funding over a long period of time. + Deposits are generated from core Bank and CassPay clients. These deposits almost entirely consist of operating accounts from core faith-based and other C&I clients as well as CassPay clients where the Company generates float. + The cost of deposits for the third quarter of 2023 was 1.72%. + The Bank participates in the CDARS and ICS programs offered by Promontory Interfinancial Network, LLC, enabling FDIC insurance up to $100 million on money market accounts and $50 million on certificates of deposit. + There are no brokered deposits or wholesale borrowings. + The Bank has a $208 million secured line of credit with the FHLB collateralized by commercial mortgage loans. + The Company has $250.0 million of unused lines of credit collateralized by investment securities.

CAPITAL 19www.cassinfo.com / © 2023 Cass Information Systems + Repurchased 73,272 shares of Company stock during 3Q2023 + Maintain excess capital to support organic balance sheet growth and opportunistic acquisitions + Quarterly dividend of $0.30 per share and Cass has continuously paid regularly scheduled cash dividends since 1934 Tier 1 leverage ratio at 9/30/23 10.61% Common equity tier 1 risk- based ratio at 9/30/23 14.53% Tier 1 risk-based ratio at 9/30/23 14.53% Total risk-based ratio at 9/30/23 15.30%

During March 2023, we published our annual ESG report, a copy of which is available on our Investor Relations site. To read more from the Cass ESG report, please follow this link to cassinfo.com ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) HIGHLIGHTS 20www.cassinfo.com / © 2023 Cass Information Systems

LEADERSHIP AND SHAREHOLDER INFORMATION 21www.cassinfo.com / © 2023 Cass Information Systems

BOARD OF DIRECTORS 22 Eric H. Brunngraber Executive Chairman Ralph W. Clermont Retired Managing Partner, KPMG LLP, Saint Louis, Missouri Robert A. Ebel Retired Chief Executive Officer, Universal Printing Company Wendy J. Henry Retired Managing Partner, BKD, LLP James J. Lindemann Retired Executive Vice President, Emerson Sally H. Roth Retired Area President — Upper Midwest, Regions Bank Joseph D. Rupp Lead Director and Retired Chairman, President, and Chief Executive Officer, Olin Corporation Randall L. Schilling Chief Executive Officer, OPO Startups, LLC Franklin D. Wicks, Jr., Ph.D. Retired Executive Vice President and President, Applied Markets, Sigma-Aldrich Benjamin F. (Tad) Edwards, IV Chairman, Chief Executive Officer, and President, Benjamin F. Edwards & Company www.cassinfo.com / © 2023 Cass Information Systems Ann W. Marr Executive Vice President of Global Human Resources, World Wide Technology Martin H. Resch President and Chief Executive Officer

LEADERSHIP COUNCIL 23 Cory J. Bricker Vice President - CassPay Carl N. Friedholm Vice President and General Manager - Telecom Expense Management Christi A. Reiter Vice President - Human Resources Nicole M. Jennings Vice President - Internal Audit Martin H. Resch President and Chief Executive Officer Mark A. Campbell Senior Vice President Jeanne M. Scannell Chief Credit Officer - Cass Commercial BankJames M. Cavellier Executive Vice President and Chief Information Officer Teresa D. Meares Vice President and General Manager - Waste Expense Management Matthew S. Schuckman Executive Vice President, General Counsel, and Corporate Secretary Dwight D. Erdbruegger President, Cass Commercial Bank Michael J. Normile Executive Vice President and Chief Financial Officer Anthony G. Urban Executive Vice President - Transportation Information Services www.cassinfo.com / © 2023 Cass Information Systems Ross M. Miller Vice President and General Manager - TouchPoint Sean M. Mullins Vice President – Infrastructure, Security, and Risk Todd J. Wills Senior Vice President and General Manager - Utility Expense Management

SHAREHOLDER INFORMATION 24www.cassinfo.com / © 2023 Cass Information Systems CORPORATE HEADQUARTERS Cass Information Systems, Inc. 12444 Powerscourt Drive, Suite 550 Saint Louis, Missouri 63131 314.506.5500 www.cassinfo.com INVESTOR RELATIONS ir@cassinfo.com COMMON STOCK The company’s common stock trades on the NASDAQ stock market under the symbol CASS. INDEPENDENT AUDITORS KPMG LLP 10 South Broadway, Suite 900 Saint Louis, Missouri 63102 TRANSFER AGENT Shareholder correspondence should be mailed to: Computershare P.O. Box 43006 Providence, RI 02940-3006 Overnight correspondence should be mailed to: Computershare 150 Royall St, Suite 101 Canton, MA 02021 SHAREHOLDER WEBSITE www.computershare.com/investor SHAREHOLDER ONLINE INQUIRIES www-us.computershare.com /investor/Contact TOLL-FREE PHONE 866.323.8170

Thank You for Your Time

v3.23.3

Cover

|

Oct. 19, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 19, 2023

|

| Entity Registrant Name |

CASS INFORMATION SYSTEMS, INC.

|

| Entity Incorporation, State or Country Code |

MO

|

| Entity File Number |

000-20827

|

| Entity Tax Identification Number |

43-1265338

|

| Entity Address, Address Line One |

12444 Powerscourt Drive

|

| Entity Address, Address Line Two |

Suite 550

|

| Entity Address, City or Town |

St. Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63131

|

| City Area Code |

314

|

| Local Phone Number |

506-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.50 per share

|

| Trading Symbol |

CASS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000708781

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

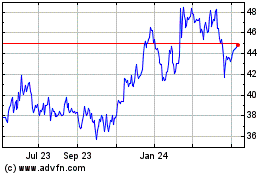

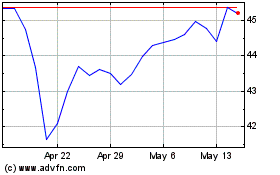

Cass Information Systems (NASDAQ:CASS)

Historical Stock Chart

From Apr 2024 to May 2024

Cass Information Systems (NASDAQ:CASS)

Historical Stock Chart

From May 2023 to May 2024