UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16

or 15d-16

UNDER

the Securities Exchange Act of 1934

For

the month of October 2023

Commission

File No.: 001-40359

Uranium

Royalty Corp.

(Translation

of registrant’s name into English)

Suite

1830, 1188 West Georgia Street

Vancouver,

British Columbia, V6E 4A2, Canada

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☐ Form

40-F ☒

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Uranium

Royalty Corp. |

| |

|

|

| Date:

October 17, 2023 |

By: |

/s/

Josephine Man |

| |

Name:

|

Josephine

Man |

| |

Title:

|

Chief

Financial Officer |

EXHIBIT

INDEX

Exhibit

99.1

FOR

IMMEDIATE RELEASE

Uranium

Royalty Announces CLOSING OF BOUGHT DEAL FINANCING

DESIGNATED

NEWS RELEASE

Vancouver,

British Columbia – October 17, 2023 – Uranium Royalty Corp. (NASDAQ: UROY, TSX: URC) (“URC”

or the “Company”) has closed its previously announced bought deal financing for a total of 10,205,000 common shares

(the “Common Shares”) sold at a price of US$2.94 per Common Share for aggregate gross proceeds to the Company of approximately

US$30,002,700 (the “Offering”).

The

Company plans to use the net proceeds of the Offering to fund future purchases of physical uranium by the Company, for potential acquisitions

of uranium royalty, stream or similar interests and for general working capital purposes.

The

Offering was made through a syndicate of underwriters led by BMO Capital Markets. The Offering was completed by way of a prospectus supplement

dated October 11, 2023 and an accompanying base shelf prospectus dated July 20, 2023, in all of the provinces and territories of Canada,

other than Québec, and in the United States pursuant a prospectus supplement dated October 11, 2023 and accompanying base shelf

prospectus dated July 20, 2023, under an effective registration statement filed with the U.S. Securities and Exchange Commission under

the Canada/U.S. multi-jurisdictional disclosure system (File No. 333-272534).

This

news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Common Shares

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the

securities laws of that jurisdiction.

A

copy of the prospectus supplement relating to the Offering and accompanying base shelf prospectus can be found in Canada under the Company’s

profile on SEDAR+ at www.sedarplus.ca, and a copy of the prospectus supplement and accompanying base shelf prospectus can be found in

the United States on EDGAR at www.sec.gov.

Uranium

Energy Corp. (“UEC”), an insider of the Company, purchased 1,930,750 Common Shares under the Offering.

The

issuance of Offered Shares to UEC constitutes a related-party transaction under Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI 61-101”). The sale of Offered Shares to UEC is exempt

from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI

61-101 as neither the fair market value of any securities issued to, nor the consideration paid by, UEC exceeded 25.0% of the Company’s

market capitalization. The board of directors of the Company has approved the Offering, the related party transaction with UEC and all

ancillary matters. The Company did not file a material change report 21 days prior to closing of the Offering, as the aforementioned

insider participation had not been confirmed at that time and the Company wished to close the transaction as soon as practicable for

sound business reasons.

About

Uranium Royalty Corp.

Uranium

Royalty Corp. (URC) is the world’s only uranium-focused royalty and streaming company and the only pure-play uranium listed company

on the NASDAQ. URC provides investors with uranium commodity price exposure through strategic acquisitions in uranium interests, including

royalties, streams, debt and equity in uranium companies, as well as through trading of physical uranium. The Company is well positioned

as a capital provider to an industry needing massive investments in global productive capacity to meet the growing need for uranium as

fuel for carbon-free nuclear energy. URC has deep industry knowledge and expertise to identify and evaluate investment opportunities

in the uranium industry. The Company’s management and the Board include individuals with decades of combined experience in the

uranium and nuclear energy sectors, including specific expertise in mine finance, project identification and evaluation, mine development

and uranium sales and trading.

Contact:

Scott

Melbye – Chief Executive Officer

Email:

smelbye@uraniumroyalty.com

Investor

Relations:

Toll

Free: 1.855.396.8222

Email:

info@uraniumroyalty.com

Website:

www.UraniumRoyalty.com |

Corporate

Office:

1188

West Georgia Street, Suite 1830,

Vancouver,

BC, V6E 4A2

Phone:

604.396.8222 |

Cautionary

Note Regarding Forward-Looking Statements and Forward-Looking Information

Certain

statements in this news release may constitute “forward-looking information”, including those regarding the intended use

of proceeds raised from the Offering. Forward-looking information includes statements that address or discuss activities, events or developments

that the Company expects or anticipates may occur in the future. When used in this news release, words such as “estimates”,

“expects”, “plans”, “anticipates”, “will”, “believes”, “intends”

“should”, “could”, “may” and other similar terminology are intended to identify such forward-looking

information. Statements constituting forward-looking information reflect the current expectations and beliefs of the Company’s

management. These statements involve significant uncertainties, known and unknown risks, uncertainties and other factors and, therefore,

actual results, performance or achievements of the Company and its industry may be materially different from those implied by such forward-looking

statements. They should not be read as a guarantee of future performance or results, and will not necessarily be an accurate indication

of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from such forward-looking

information, including, without limitation, risks inherent to royalty companies, uranium price volatility, risks related to the operators

of the projects underlying the Company’s existing and proposed interests and those other risks described in filings with Canadian

securities regulators and the U.S. Securities and Exchange Commission. These risks, as well as others, could cause actual results and

events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking information and the Company

undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

None

of the TSX, its Regulatory Services Provider (as that term is defined in policies of the TSX) or the Nasdaq Stock Market LLC accepts

responsibility for the adequacy or accuracy of this press release.

Exhibit 99.2

Form

51-102F3

Material

Change Report

| Item 1 | Name

and Address of Company |

Uranium

Royalty Corp. (“URC” or the “Company”)

Suite

1830 – 1188 West Georgia Street

Vancouver,

BC

V6E

4A2

| Item 2 | Date

of Material Change |

October

17, 2023.

On

October 10, 2023, a news release in respect of the material change was disseminated through Globe Newswire and a copy thereof has been

filed on SEDAR.

| Item 4 | Summary

of Material Change |

On

October 17, 2023, the Company completed its previously announced bought deal public offering of 10,205,000 common shares of the Company

(the “Offered Shares”) at a price of U.S.$2.94 per Offered Share (the “Offering Price”), for gross

proceeds of U.S.$30,002,700 (the “Offering”). The Offering was completed pursuant to an underwriting agreement dated

October 11, 2023 (the “Underwriting Agreement”) among the Company, BMO Nesbitt Burns Inc., as lead underwriter and

sole bookrunner, and Canaccord Genuity Corp. (the “Underwriters”).

| Item 5 | Full

Description of Material Change |

On

October 10, 2023, the Company announced that it had entered into an agreement with the Underwriters, under which the Underwriters agreed

to purchase, on a bought deal basis, the Offered Shares at the Offering Price, for gross proceeds of approximately U.S.$30 million, subject

to the Company receiving all necessary regulatory approvals.

On

October 11, 2023, the Company entered into the Underwriting Agreement with the Underwriters to sell the Offered Shares at the Offering

Price. The Company agreed to pay the Underwriters a cash commission equal to 5.5% of the gross proceeds of the Offering, including proceeds

received from the exercise of the Over-Allotment Option (as defined below), if any, at the closing of the Offering or subsequent closing

of the Over-Allotment Option exercise, if any.

The

Offering closed on October 17, 2023. Net proceeds of the Offering to the Company were U.S.$28,219,950.86 after deducting the Underwriters’

cash commission and expenses related to the Offering. Proceeds are anticipated to be used to fund future purchases of physical uranium

by the Company, for potential acquisitions of uranium royalty, stream or similar interests and for general working capital purposes,

as more fully described in the Prospectus.

The

Company granted the Underwriters an option (the “Over-Allotment Option”), exercisable in whole or in part, in the

sole discretion of the Underwriters, for a period of 30 days following the closing of the Offering, to purchase up to an additional 1,530,750

common shares of the Company at the Offering Price. If the Over-Allotment Option is exercised in full, the total gross proceeds to the

Company will be U.S.$34,503,105.

The

Offered Shares were offered in all of the provinces and territories of Canada, other than Quebec, pursuant to a prospectus supplement

dated October 11, 2023 to the Company’s base shelf prospectus dated July 20, 2023 (together, the “Prospectus”),

and in the United States pursuant a prospectus supplement to the prospectus contained in an effective registration statement filed under

the Canada/U.S. multi-jurisdictional disclosure system (File No. 333-272534).

Uranium

Energy Corp. (“UEC”), an insider of the Company, purchased 1,930,750 Offered Shares, representing approximately 19%

of the number of Offered Shares. UEC acquired such Offered Shares, on the same terms as the Offering, in order to retain its proportionate

ownership interest in the Company. After completion of the Offering, UEC holds approximately 15% of the issued and outstanding common

shares of the Company.

The

issuance of Offered Shares to UEC constitutes a related-party transaction under Multilateral Instrument 61-101 – Protection

of Minority Security Holders in Special Transactions (“MI 61-101”). The sale of Offered Shares to UEC is exempt

from the formal valuation and minority shareholder approval requirements of MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI

61-101 as neither the fair market value of any securities issued to, nor the consideration paid by, UEC exceeded 25.0% of the Company’s

market capitalization. The board of directors of the Company has approved the Offering, the related party transaction with UEC and all

ancillary matters. The Company did not file this material change report 21 days prior to closing of the Offering, as the aforementioned

insider participation had not been confirmed at that time and the Company wished to close the transaction as soon as practicable for

sound business reasons.

| Item 6 | Reliance

on subsection 7.1(2) of National Instrument 51-102 |

Not

applicable.

| Item 7 | Omitted

Information |

None.

The

following executive officer of the Company is knowledgeable about the material change and this report:

Scott

Melbye

Chief

Executive Officer

Phone:

604-396-8222

October

17, 2023.

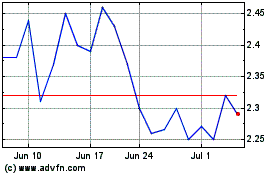

Uranium Royalty (NASDAQ:UROY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Uranium Royalty (NASDAQ:UROY)

Historical Stock Chart

From Apr 2023 to Apr 2024