0000704172

false

FY

false

http://fasb.org/us-gaap/2023#InvestmentAdvisoryManagementAndAdministrativeServiceMember

http://fasb.org/us-gaap/2023#InvestmentAdvisoryManagementAndAdministrativeServiceMember

0000704172

2022-07-01

2023-06-30

0000704172

2023-10-13

0000704172

2023-06-30

0000704172

2022-06-30

0000704172

PHIL:ClassBSeriesIPreferredStockMember

2023-06-30

0000704172

PHIL:ClassBSeriesIPreferredStockMember

2022-06-30

0000704172

2021-07-01

2022-06-30

0000704172

2021-06-30

0000704172

us-gaap:CommonStockMember

2022-06-30

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2022-06-30

0000704172

us-gaap:PreferredStockMember

2022-06-30

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2022-06-30

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2022-06-30

0000704172

PHIL:CommonStockToBeCancelledMember

2022-06-30

0000704172

PHIL:CommonStockToBeIssuedMember

2022-06-30

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0000704172

us-gaap:RetainedEarningsMember

2022-06-30

0000704172

us-gaap:CommonStockMember

2022-12-31

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2022-12-31

0000704172

us-gaap:PreferredStockMember

2022-12-31

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2022-12-31

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2022-12-31

0000704172

PHIL:CommonStockToBeCancelledMember

2022-12-31

0000704172

PHIL:CommonStockToBeIssuedMember

2022-12-31

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0000704172

us-gaap:RetainedEarningsMember

2022-12-31

0000704172

2022-12-31

0000704172

us-gaap:CommonStockMember

2023-03-31

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2023-03-31

0000704172

us-gaap:PreferredStockMember

2023-03-31

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2023-03-31

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2023-03-31

0000704172

PHIL:CommonStockToBeCancelledMember

2023-03-31

0000704172

PHIL:CommonStockToBeIssuedMember

2023-03-31

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000704172

us-gaap:RetainedEarningsMember

2023-03-31

0000704172

2023-03-31

0000704172

us-gaap:CommonStockMember

2022-07-01

2022-12-31

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2022-07-01

2022-12-31

0000704172

us-gaap:PreferredStockMember

2022-07-01

2022-12-31

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2022-07-01

2022-12-31

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2022-07-01

2022-12-31

0000704172

PHIL:CommonStockToBeCancelledMember

2022-07-01

2022-12-31

0000704172

PHIL:CommonStockToBeIssuedMember

2022-07-01

2022-12-31

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-12-31

0000704172

us-gaap:RetainedEarningsMember

2022-07-01

2022-12-31

0000704172

2022-07-01

2022-12-31

0000704172

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0000704172

us-gaap:PreferredStockMember

2023-01-01

2023-03-31

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2023-01-01

2023-03-31

0000704172

PHIL:CommonStockToBeCancelledMember

2023-01-01

2023-03-31

0000704172

PHIL:CommonStockToBeIssuedMember

2023-01-01

2023-03-31

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0000704172

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0000704172

2023-01-01

2023-03-31

0000704172

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000704172

us-gaap:PreferredStockMember

2023-04-01

2023-06-30

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2023-04-01

2023-06-30

0000704172

PHIL:CommonStockToBeCancelledMember

2023-04-01

2023-06-30

0000704172

PHIL:CommonStockToBeIssuedMember

2023-04-01

2023-06-30

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0000704172

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000704172

2023-04-01

2023-06-30

0000704172

us-gaap:CommonStockMember

2023-06-30

0000704172

us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember

2023-06-30

0000704172

us-gaap:PreferredStockMember

2023-06-30

0000704172

us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember

2023-06-30

0000704172

PHIL:TreasuryStockCommonAndPreferredMember

2023-06-30

0000704172

PHIL:CommonStockToBeCancelledMember

2023-06-30

0000704172

PHIL:CommonStockToBeIssuedMember

2023-06-30

0000704172

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000704172

us-gaap:RetainedEarningsMember

2023-06-30

0000704172

PHIL:AsiaDiamondExchangeIncMember

2023-06-30

0000704172

PHIL:PHILUXCapitalAdvisorsIncMember

2023-06-30

0000704172

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0000704172

us-gaap:OtherCurrentAssetsMember

2023-06-30

0000704172

us-gaap:FairValueInputsLevel1Member

2023-06-30

0000704172

us-gaap:FairValueInputsLevel2Member

2023-06-30

0000704172

us-gaap:FairValueInputsLevel3Member

2023-06-30

0000704172

us-gaap:FairValueInputsLevel1Member

2022-06-30

0000704172

us-gaap:FairValueInputsLevel2Member

2022-06-30

0000704172

us-gaap:FairValueInputsLevel3Member

2022-06-30

0000704172

PHIL:PHILUXGlobalFundsMember

2023-06-30

0000704172

PHIL:PHILUXGlobalFundsMember

2022-06-30

0000704172

PHIL:AQuariusPowerIncMember

2023-06-30

0000704172

PHIL:AQuariusPowerIncMember

2022-06-30

0000704172

PHIL:AQuariusPowerIncMember

2022-07-01

2023-06-30

0000704172

PHIL:AsiaDiamondExchangeDevelopmentMember

2022-07-01

2023-06-30

0000704172

PHIL:ConvertiblePromissoryNotesMember

2023-06-30

0000704172

2023-01-01

2023-06-30

0000704172

PHIL:EuropeanPlasticJointStockCompanyMember

2023-06-30

0000704172

PHIL:SaigonPhoPalaceJointStockCompanyMember

2023-06-30

0000704172

PHIL:SinhNguyenCoLtdMember

2023-06-30

0000704172

PHIL:TeccoGroupMember

2023-06-30

0000704172

us-gaap:RelatedPartyMember

2023-06-30

0000704172

us-gaap:RelatedPartyMember

2022-06-30

0000704172

PHIL:HenryFahmanMember

us-gaap:RelatedPartyMember

2023-06-30

0000704172

PHIL:HenryFahmanMember

us-gaap:RelatedPartyMember

2022-06-30

0000704172

PHIL:TamBuiMember

us-gaap:RelatedPartyMember

2023-06-30

0000704172

PHIL:TamBuiMember

us-gaap:RelatedPartyMember

2022-06-30

0000704172

PHIL:ShortTermNotesPayableMember

2023-06-30

0000704172

PHIL:RegularShortTermNotesMember

2023-06-30

0000704172

PHIL:SBALoanMember

2023-06-30

0000704172

PHIL:MerchantCashMember

2023-06-30

0000704172

srt:MinimumMember

2023-06-30

0000704172

srt:MaximumMember

2023-06-30

0000704172

PHIL:VotingCommonStockMember

2017-09-20

0000704172

PHIL:NonVotingClassASeriesIPreferredStockMember

2017-09-20

0000704172

PHIL:NonVotingClassASeriesIIPreferredStockMember

2017-09-20

0000704172

PHIL:NonVotingClassASeriesIIIPreferredStockMember

2017-09-20

0000704172

PHIL:VotingClassASeriesIVPreferredStockMember

2017-09-20

0000704172

2020-06-25

0000704172

PHIL:ClassASeriesICumulativeConvertibleRedeemablePreferredStockMember

2023-06-30

0000704172

PHIL:ClassASeriesICumulativeConvertibleRedeemablePreferredStockMember

2022-07-01

2023-06-30

0000704172

PHIL:ClassASeriesIICumulativeConvertibleRedeemablePreferredStockMember

2023-06-30

0000704172

PHIL:ClassASeriesIICumulativeConvertibleRedeemablePreferredStockMember

2022-07-01

2023-06-30

0000704172

PHIL:ClassASeriesIIICumulativeConvertibleRedeemablePreferredStockMember

2023-06-30

0000704172

PHIL:ClassASeriesIIICumulativeConvertibleRedeemablePreferredStockMember

2022-07-01

2023-06-30

0000704172

PHIL:ClassASeriesIVCumulativeConvertibleRedeemablePreferredStockMember

2023-06-30

0000704172

PHIL:SubsidiaryPHIGroupIncMember

2022-07-01

2023-06-30

0000704172

PHIL:AmericanPacificPlasticsIncMember

2023-06-30

0000704172

PHIL:BoardOfDirectorsMember

2022-07-01

2023-06-30

0000704172

PHIL:ClassBSeriesIPreferredStockMember

2022-07-01

2023-06-30

0000704172

us-gaap:TreasuryStockCommonMember

2023-06-30

0000704172

PHIL:ClassBSeriesIPreferredStockMember

2023-06-30

0000704172

us-gaap:CommonStockMember

PHIL:IssuancesForWarrantExercisesMember

2022-07-01

2023-06-30

0000704172

us-gaap:CommonStockMember

PHIL:IssuancesForConversionOfNotesMember

2022-07-01

2023-06-30

0000704172

us-gaap:CommonStockMember

PHIL:IssuancesForCashToCertainCurrentShareHoldersMember

2022-07-01

2023-06-30

0000704172

us-gaap:CommonStockMember

PHIL:CancellationOfSharesByLenderMember

2022-07-01

2023-06-30

0000704172

2015-03-18

0000704172

PHIL:HenryFahmanMember

2016-09-22

2016-09-23

0000704172

PHIL:TamBuiMember

2022-07-01

2023-06-30

0000704172

PHIL:TamBuiMember

2023-06-30

0000704172

PHIL:FrankHawkinsMember

2022-07-01

2023-06-30

0000704172

PHIL:FrankHawkinsMember

2023-06-30

0000704172

PHIL:HenryFahmanMember

2022-07-01

2023-06-30

0000704172

PHIL:HenryFahmanMember

2023-06-30

0000704172

PHIL:PresidentChiefExecutiveOfficerChiefOperatingOfficerAndSecretaryAndTreasurerMember

2023-06-30

0000704172

PHIL:ClassBSeriesPreferredStockMember

2023-06-30

0000704172

PHIL:EquityPurchaseAgreementMember

PHIL:MastHillFundLPMember

2022-03-01

0000704172

PHIL:EquityPurchaseAgreementMember

PHIL:MastHillFundLPMember

2022-03-01

2022-03-01

0000704172

PHIL:BusinessCooperationAgreementMember

PHIL:VinafilmsJointStockCompanyMember

2018-08-06

0000704172

PHIL:StockSwapAgreementMember

PHIL:VinafilmsJointStockCompanyMember

2018-09-20

0000704172

PHIL:StockSwapAgreementMember

PHIL:VinafilmsJointStockCompanyMember

us-gaap:CommonStockMember

2018-09-19

2018-09-20

0000704172

PHIL:StockSwapAgreementMember

PHIL:VinafilmsJointStockCompanyMember

PHIL:ClassASeriesIIICumulativeConvertibleRedeemablePreferredStockMember

2018-09-19

2018-09-20

0000704172

PHIL:TeccoGroupMember

2020-08-10

0000704172

PHIL:TeccoGroupMember

2020-08-10

0000704172

PHIL:TeccoGroupMember

2023-06-30

0000704172

PHIL:VietnameseAuthoritiesMember

2023-06-30

0000704172

PHIL:PHIGroupMember

2023-06-30

0000704172

PHIL:MrSmetMember

2023-06-30

0000704172

PHIL:FiveGrainTreasureSpiritsCoLtdMember

PHIL:AgreementOfPurchaseAndSaleMember

2022-01-18

0000704172

PHIL:PurchaseAndSalesAgreementMember

PHIL:KotaEnergyGroupLLCMember

2022-01-26

0000704172

PHIL:KotaConstructionLLCMember

PHIL:PurchaseAndSalesAgreementMember

2022-01-26

0000704172

PHIL:PurchaseAndSalesAgreementMember

2022-01-26

0000704172

PHIL:PurchaseAndSalesAgreementMember

PHIL:KotaEnergyGroupLLCMember

2022-08-03

0000704172

PHIL:PurchaseAndSalesAgreementMember

PHIL:KotaConstructionLLCMember

2022-08-03

0000704172

PHIL:GulfCooperationCouncilMember

PHIL:PartnershipAgreementMember

2022-07-08

0000704172

PHIL:MrTranDinhQuyenMember

PHIL:StockTransferAgreementMember

2022-08-13

0000704172

PHIL:MrTranDinhQuyenMember

PHIL:StockTransferAgreementMember

2022-08-12

2022-08-13

0000704172

PHIL:VanPhatDatJointStockMember

PHIL:PurchaseAndSaleMember

2022-08-16

0000704172

PHIL:PurchaseAndSaleMember

PHIL:VanPhatDatJointStockMember

2022-08-15

2022-08-16

0000704172

PHIL:ConvertiblePromissoryNoteMember

PHIL:VirginiaLimitedLiabilityMember

2023-03-03

0000704172

PHIL:ConvertiblePromissoryNoteMember

2023-03-03

0000704172

PHIL:ConvertiblePromissoryNoteMember

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2023-09-06

2023-09-06

0000704172

PHIL:ConvertiblePromissoryNoteMember

PHIL:MastHillFundLPMember

2023-03-14

0000704172

PHIL:ConvertiblePromissoryNoteMember

PHIL:MastHillFundLPMember

srt:MaximumMember

2023-03-14

0000704172

us-gaap:CommonStockMember

PHIL:MastHillFundLPMember

2023-03-14

0000704172

PHIL:ConvertiblePromissoryNoteMember

PHIL:VirginiaLimitedLiabilityMember

2023-06-01

0000704172

PHIL:ConvertiblePromissoryNoteMember

PHIL:VirginiaLimitedLiabilityMember

2023-06-01

2023-06-01

0000704172

PHIL:VirginiaLimitedLiabilityMember

srt:MinimumMember

2023-06-01

0000704172

PHIL:VirginiaLimitedLiabilityMember

2023-06-01

0000704172

PHIL:ConvertiblePromissoryNoteMember

PHIL:VirginiaLimitedLiabilityMember

2023-10-13

2023-10-13

0000704172

PHIL:SaigonSiliconCityJointStockMember

2023-02-21

0000704172

us-gaap:InvestorMember

2023-02-21

0000704172

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2023-02-21

0000704172

PHIL:SaigonSiliconCityJointStockMember

2023-02-20

2023-02-21

0000704172

PHIL:SaigonSiliconCityJointStockMember

2023-06-30

0000704172

PHIL:SaigonSiliconCityJointStockMember

2023-03-20

2023-03-21

0000704172

PHIL:SaigonSiliconCityJointStockMember

2023-06-04

2023-06-05

0000704172

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2023-06-05

0000704172

us-gaap:InvestorMember

2023-06-05

0000704172

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2023-06-05

0000704172

PHIL:JinshanLimitedLiabilityMember

2023-06-27

0000704172

PHIL:JinshanLimitedLiabilityMember

PHIL:PurchaseAndSaleMember

2023-06-26

2023-06-27

0000704172

PHIL:SSEGlobalGroupMember

2023-05-31

0000704172

PHIL:HoangDucThienCoMember

2023-05-22

2023-05-22

0000704172

PHIL:BusinessCooperationAgreementMember

2023-06-27

0000704172

PHIL:PhiluxGlobalGroupMember

2023-06-27

0000704172

PHIL:SaphiaAlkaliJointStockCompanyMember

2023-06-27

0000704172

PHIL:MastHillFundLPMember

us-gaap:SubsequentEventMember

2023-07-01

2023-09-30

0000704172

us-gaap:CommonStockMember

PHIL:ConvertiblePromissoryNoteMember

PHIL:MastHillFundLPMember

us-gaap:SubsequentEventMember

2023-07-01

2023-09-30

0000704172

us-gaap:SubsequentEventMember

PHIL:JinshanLimitedLiabilityMember

PHIL:PurchaseAndSaleMember

2023-07-01

2023-10-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:ha

iso4217:EUR

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

☒

ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended: JUNE 30, 2023

or

☐

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _________________________to _____________________________________

PHI

GROUP, INC.

(n/k/a

PHILUX GLOBAL GROUP INC)

(Exact

name of

registrant

as specified in its charter)

| Wyoming |

|

001-38255-NY |

|

90-0114535 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 2323

Main Street, Irvine, CA |

|

92614 |

| (Address of principal executive

offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: 714-465-4365

(Former

name or former address, if changed since last report)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common Stock |

|

PHIL |

|

OTC Markets |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has

been subject to such filing requirements for the past 90 days.

Yes

☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss.232.405 of this chapter) during the preceding 12

months (or for such shorter period that the registrant was required to submit and post such files).

Yes

☐ No ☒

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge, indefinitive proxy or information statement incorporated

by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Yes

☐ No ☒

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer

☐ |

| |

|

| Non-accelerated filer ☐ |

Smaller reporting company

☒ |

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

State

the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed fiscal quarter:

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: As of October

13, 2023, there were 42,705,215,171 shares of the registrant’s $0.001 par value Common Stock and 600,000 shares of Class B Series I Preferred

Stock issued and outstanding.

TABLE

OF CONTENTS

The

statements contained in this annual report that are not historical facts are “forward-looking statements” within the meaning

of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations and business,

which can be identified by the use of forward-looking terminology, such as “estimates,” “projects,” “plans,”

“believes,” “expects,” “anticipates,” “intends,” or the negative thereof or other variations

thereon, or by discussions of strategy that involve risks and uncertainties. All forward-looking statements are based largely on current

expectations and beliefs concerning future events that are subject to substantial risks and uncertainties. Actual results may differ

materially from the results suggested herein. Factors that may cause or contribute to such differences include, but are not limited to,

the company’s ability to develop and successfully market the products and services described in this report (and the costs associated

therewith); their acceptance in the marketplace; technical difficulties or errors in the products and/or services; the company’s

customer and active prospect base containing a substantially lower number of interested customers than the company anticipates; the failure

to consummate the pending acquisitions, joint ventures and/or strategic alliances at all (or on a timely basis) due to various reasons;

difficulty integrating or managing multiple companies from technology, operational and marketing aspects; the success (and cost) of new

marketing strategies as a result of mergers and acquisitions; unfavorable critical reviews; increased competition (including product

and price competition); entrance of new competitors into the market; timing and significance of additional new product and service introductions

by the company and its competitors; general economic and market factors, including changes in securities and financial markets; technology

obsolescence, the adequacy of working capital, cash flows and available financing to fund the company’s business model and the

proposed acquisitions or investments ; and other risks and uncertainties indicated throughout this report and from time to time in the

company’s releases and filings including without limitation filings with the Securities and Exchange Commission. As used in this

report, the terms “we,” “us,” “our,” the “company” and “PHI” mean PHI Group,

Inc. and the term “common stock” means PHI Group, Inc.’s common stock, $.001 par value per share (unless context indicates

a different meaning).

PART

I

ITEM

1. BUSINESS OVERVIEW

INTRODUCTION

PHI

Group, Inc. (n/k/a Philux Global Group Inc) (the “Company” or “PHI”) (www.philuxglobal.com) is primarily

engaged in mergers and acquisitions, advancing Philux Global Funds, SCA, SICAV-RAIF, a “Reserved Alternative Investment Fund”

(“RAIF”) under the laws of Luxembourg, and developing the Asia Diamond Exchange in Vietnam. Besides, the Company provides

corporate finance services, including merger and acquisition advisory and consulting services for client companies through our wholly

owned subsidiary Philux Capital Advisors, Inc. (formerly PHI Capital Holdings, Inc.) (www.philuxcapital.com) and invests in selective

industries and special situations aiming to potentially create significant long-term value for our shareholders. Philux Global Funds

intends to include a number of sub-funds for investment in select growth opportunities in the areas of renewable energy, real estate,

infrastructure, healthcare, agriculture, and the Asia Diamond Exchange in conjunction with the International Financial Center in Vietnam.

BACKGROUND

Originally

incorporated on June 8, 1982 as JR Consulting, Inc., a Nevada corporation, the Company applied for a Certificate of Domestication and

filed Articles of Domestication to become a Wyoming corporation on September 20, 2017. In the beginning, the Company was foremost engaged

in mergers and acquisitions and had an operating subsidiary, Diva Entertainment, Inc., which operated two modeling agencies, one in New

York and one in California. In January 2000, the Company changed its name to Providential Securities, Inc., a Nevada corporation, following

a business combination with Providential Securities, Inc., a California-based financial services company. In February 2000, the Company

then changed its name to Providential Holdings, Inc. In October 2000, Providential Securities withdrew its securities brokerage membership

and ceased its financial services business. Subsequently, in April 2009, the Company changed its name to PHI Group, Inc. From October

2000 to October 2011, the Company and its subsidiaries were engaged in various transactions in connection with mergers and acquisitions

advisory and consulting services, real estate and hospitality development, mining, oil and gas, telecommunications, technology, healthcare,

private equity, and special situations. In October 2011, the Company discontinued the operations of Providential Vietnam Ltd., Philand

Ranch Limited, a United Kingdom corporation (together with its subsidiaries Philand Ranch - Singapore, Philand Corporation - US, and

Philand Vietnam Ltd. - Vietnam), PHI Gold Corporation (formerly PHI Mining Corporation, a Nevada corporation), and PHI Energy Corporation

(a Nevada corporation), and mainly focused on acquisition and development opportunities in energy and natural resource businesses.

The

Company is currently focused on Philux Global Funds, SCA, SICAV-RAIF by launching Philux Global Select Growth Fund and potentially other

sub-funds for investment in real estate, renewable energy, infrastructure, agriculture, healthcare and the International Financial Center

and Asia Diamond Exchange in Vietnam. In addition, Philux Capital Advisors, Inc. (formerly Capital Holdings, Inc.), a wholly owned subsidiary

of the Company, continues to provide corporate and project finance services, including merger and acquisition (M&A) advisory and

consulting services for U.S. and international companies. The Company has also formed Philux Global Advisors, Inc. to serve as the investment

advisor to Philux Global Funds and other potential fund clients in the future.

The

Company had signed agreements to acquire majority equity interests in Kota Construction LLC and Kota Energy Group LLC (“KOTA”)

which are engaged in solar energy business (https://www.kotasolar.com), and Tin Thanh Group, a Vietnamese joint stock company

(www.tinthanhgroup.vn) (“TTG”). Whereas the scheduled closing dates for the KOTA and TTG transactions already expired, the

Company has continued to discuss with these companies and intends to renegotiate an revised agreement with each of them when the Company

successfully closes one or more of the pending asset management agreements and financing with certain investor groups and lenders. In

addition, the Company intends to amend the Purchase and Sale Agreement that was originally signed on January 18, 2022 with Five-Grain

Treasure Spirits Co., Ltd., a Chinese baiju distiller, to collaborate in launching American-made baiju products through Empire Spirits,

Inc., a subsidiary of the Company. The Company is in the process of establishing a subsidiary in the Dubai Multi-Commodities Centre in

United Arab Emirates to replace its former subsidiary CO2-1-0 (CARBON) Corp. to continue engaging in carbon emission mitigation using

blockchain and crypto technologies. In May 2023, the company signed a business cooperation agreement with SSE Global JSC, a Vietnamese

joint stock company, to establish SSE Global Group, Inc., a Wyoming corporation, (www.sseglobalgroup.com) to commercialize a self-sustainable

energy technology. In addition, in June 2023 the Company signed a business cooperation agreement with Saphia Alkali JSC, a Vietnamese

joint stock company, to form Sapphire Alkali Global Group in the United States to finance, manufacture, sell and distribute Saphia Alkali’s

proprietary products on a worldwide basis. These activities are disclosed in greater detail elsewhere in this report. No assurances can

be made that the Company will be successful in achieving its plans.

BUSINESS

STRATEGY

PHI’s

strategy is to:

1.

Identify, build, acquire, commit and deploy valuable resources with distinctive competitive advantages;

2.

Identify, evaluate, acquire, participate and compete in attractive businesses that have large, growing market potential;

3.

Build an attractive investment that includes points of exit for investors through capital appreciation or spin-offs of business units.

SUBSIDIARIES:

As

of October 13, 2023, the Company has the following subsidiaries: (1) Asia Diamond Exchange, Inc., a Wyoming corporation (100%), (2)

American Pacific Resources, Inc., a Wyoming corporation (100%, (3) Empire Spirits, Inc., a Nevada corporation (85% - formerly

Provimex, Inc.) (4) Philux Global Funds SCA, SICAV-RAIF, a Luxembourg Reserved Alternative Investment Fund (100%), (5) Philux

Luxembourg Development S.A., a Luxembourg corporation (100%), (6) PHI Luxembourg Holding SA, a Luxembourg corporation (100%), (7)

Philux Global General Partners SA, a Luxembourg corporation (100%), (8) Philux Capital Advisors, Inc., a Wyoming corporation (100%),

(9) Philux Global Advisors, Inc., a Wyoming corporation (100%), (10) Philux Global Healthcare, Inc., a Wyoming corporation (100%),

(11) Philux Global Trade Inc., a Wyoming corporation (100%), (12) Philux Global Energy Inc., a Wyoming corporation (100%), and (13)

Philux Global Vietnam Investment and Development Company Ltd., a Vietnamese limited liability company (100%).

AMERICAN

PACIFIC RESOURCES, INC.

American

Pacific Resources, Inc. (“APR”) is a Wyoming corporation established in April 2016 as a subsidiary of the Company to serve

as a holding company for various natural resource projects. On September 2, 2017, APR entered into an Agreement of Purchase and Sale

with Rush Gold Royalty, Inc. (“RGR”), a Wyoming corporation, to acquire a 51% ownership in twenty-one mining claims over

an area of approximately 400 acres in Granite Mining District, Grant County, Oregon, U.S.A., in exchange for a total purchase price of

twenty-five million U.S. Dollars ($US 25,000,000) to be paid in a combination of cash, convertible demand promissory note and PHI Group,

Inc.’s Class A Series II Convertible Cumulative Redeemable Preferred Stock (“Preferred Stock”). This transaction was

closed effective October 3, 2017. Following the first amendment dated April 19, 2018 and the second amendment dated September 29, 2018

retroactively effective April 20, 2018, to the afore-mentioned Agreement of Purchase and Sale, PHI Group, Inc. paid ten million shares

of its Class A Series II Convertible Cumulative Redeemable Preferred Stock to Rush Gold Royalty, Inc.. As of June 30, 2020, the Company

recorded $462,000 paid for this transaction as expenses for research and development in connection with the Granite Mining Claims project.

The value of these mining claims is expected to be adjusted later after a new valuation of these mining assets is conducted by an independent

third-party valuator.

The

Company has passed several resolutions with respect to the declaration of a twenty percent (20%) special stock dividend in American Pacific

Resources, Inc. to shareholders of Common Stock of the Company. Due to the continued adverse effects of the coronavirus pandemic and

other factors that have delayed the development of APR, it has deemed necessary for the Company to suspend the distribution of the APR

special stock dividend until later on in order to allow APR additional time to reach certain milestones that would make the spin-off

of APR and this special stock dividend distribution economically beneficial for the Company’s shareholders. The Company will provide

an update regarding the new Record Date for this special dividend when certain conditions are met.

ASIA

DIAMOND EXCHANGE AND INTERNATIONAL FINANCIAL CENTER IN VIETNAM

Along

with the establishment of Philux Global Funds, the Company has worked with the Authority of Chu Lai Open Economic Zone in Central Vietnam

and the Provinces of Quang Nam and Dong Nai, Vietnam, to develop the Asia Diamond Exchange for lab-grown, rough and polished diamond

together with a multi-commodities and logistics centers.

Mr.

Ben Smet who successfully established the Dubai Diamond Exchange in 2002-2005 has been leading fulltime a group of experts for the setup

of the Asian Diamond Exchange since January 2018. He has brought together the 11 main trading players in the rough diamond industry to

come to Vietnam. He has established a partnership with the biggest player in the rough trading and polishing group, the Mehta Family

Group. Other main international diamond trading groups as the Mody Group, Diamac etc. have joined the overall venture.

Furthermore,

together with the groups, a full Kimberly Process Certification Scheme (KPC) to prevent ‘conflicting diamond’ trading was

established and is aligned from time to time. Also, the new lab grown diamond KPC scheduling is already implemented. A unique and KPC

approved structure has been established where under the PHI Vietnam umbrella, in collaboration with KPC Mum- bai (India), a ‘Public-Private-Partnership

(PPP)’ is established in which the Vietnamese authorities hold 15% and PHI (or its local corporate entity) holds 85% of the voting

rights. For the lab grown diamond segment, this will be in the Chu Lai Free Economic Zone and for the Rough and Polished Diamond Parcel

Trade, this is being planned to be on Thanh Da Island, about 5 kilometers from the center of Ho Chi Minh City, Vietnam.

The

Company has taken the decision to move the greater part of the ADE rough and polishing venture, first to an Industrial Zone to be established

close to the new international Airport in Long Thanh District, Dong Nai Province, Vietnam and this year to the Thanh Da Island. This

location change has caused that the entire KPC Process and administration had to be adapted and redone with renewed financial input,

mostly carried by Mr. Smet.

A

rough diamond trading export flow to Vietnam was negotiated and concluded by Mr. Smet with the DMCC and Dubai Diamond Exchange. This

year, an international diamond trading platform was created by Mr. Smet to unify the trading efforts of Alrosa and De Beers/Bonas. Mr.

Smet was advised and counselled thereto by Mr. A. Mehta, the senior board member of the Alrosa Group. Together with Mr. A. Mehta, Mr.

Smet has also covered the financial backbone of the diamond trading venture via the setup of a financial institution in Botswana. It

is the intention of Mr. Smet to donate 50% of his own voting shares of the institution to PHI the moment all budgets for the venture

are arranged by PHI and all financial obligations and reimbursements by PHI to him are met. It is the intention of the parties involved

to establish a subsidiary of the financial institution in the ADE Vietnam and have local banking partners join this initiative.

Mr.

Smet had also established a collaboration partnership with the Antwerp Diamond Exchange (Belgium), the Dubai Diamond Exchange and the

Tel-Aviv Diamond Exchange. Negotiations have started to involve a new economic free-zone in Jordan into the ongoing project.

Recently,

Mr. Smet has started a structuring project, in order for PHI to set up and establish an International Financial Center on the Thanh Da

Island in connection with the Asian Diamond Exchange. This will be similar as what Mr. Smet has established successfully for Dubai in

2002-2005 and this now incorporating the international changes of the last decade.

Once the Company has effectuated all budgeting and

all financial requirements and obligations, the ongoing process will effectively materialize and Mr. Smet then shall transfer the entire

venture to Philux Global Group, Inc.

The

Company has incorporated Asia Diamond Exchange, Inc., a Wyoming corporation, ID number 2021-001010234, as the holding company for the

development of the Asia Diamond Exchange in Vietnam.

CO2-1-0

(CARBON) CORP

In

August 2022, PHI Group signed a Letter of Intent with Indonesia-based CYFS Group, headed by Mr. Choky Fernando Simanjuntak, to sponsor

and co-found CO2-1-0 (CARBON) CORP to implement a new disruptive carbon mitigation initiative through environmentally sustainable projects

starting in Indonesia, Vietnam, other ASEAN countries, and worldwide. On September 21, 2022 CO2-1-0 (CARBON) CORP was incorporated as

a Wyoming corporation to manage this program. The Company has contributed the development budget for CO2-1-0 (CARBON) CORP) and plans

to establish a subsidiary in the Dubai Multi-Commodities Centre to the United Arab Emirates to replace CO2-1-0 (CARBON).

EMPIRE

SPIRITS, INC. (FORMERLY PROVIMEX, INC.)

Provimex,

Inc. was originally incorporated as a Nevada corporation on September 23, 2004, Entity Number C25551-4, as a subsidiary of the Company

to engage in international trade. On 9/26/2021, Provimex, Inc. changed its name to Empire Spirits, Inc. as the holding company for the

acquisition of a majority ownership in Five-Grain Treasure Spirits Company, Ltd., a baiju distiller in Jilin Province. The Company is

in the process of amending the Purchase and Sale Agreement that was originally signed on January 18, 2022 with Five-Grain Treasure Spirits

Co. Ltd., to collaborate in launching American-made baiju products through Empire Spirits, Inc.

Baijiu

is a white spirit distilled from sorghum. It is similar to vodka but with a fragrant aroma and taste. It is currently the most consumed

spirit in the world. Mainly consumed in China, it is gaining popularity in the rest of the world.

Five-Grain

specializes in the production and sales of spirits and the development of proprietary spirit production processes. It also possesses

a patented technology to grow red sorghum for baiju manufacturing. The patented grain produces superior yield and quality. Five-Grain

is a reputable bulk alcohol supplier to some of the largest spirits companies in the world.

PHILUX

GLOBAL FUNDS SCA, SICAV-RAIF

On

June 11, 2020, the Company received the approval from the Luxembourg Commission de Surveillance du Secteur Financier (CSSF) and successfully

established and activated PHILUX GLOBAL FUNDS SCA, SICAV-RAIF (the “Fund”), Registration No. B244952, a Luxembourg bank fund

organized as a Reserved Alternative Investment Fund in accordance with the Luxembourg Law of July 23, 2016 relative to reserved alternative

investment funds, Law of August 23, 2016 relative to commercial companies, and Modified Law of July 12, 2013 relative to alternative

investment fund managers.

The

following entities had been engaged to support the Fund’s operations: a) Custodian Bank: Hauck & Aufhauser Privatbankiers AG,

b) Administrative Registrar & Transfer Agent: Hauck & Aufhauser Alternative Investment Services S.A., c) Fund Manager: Hauck

& Aufhauser Fund Services S.A., d) Fund Attorneys: DLP Law Firm SARL and VCI Legal, e) Investment Advisor: PHILUX Capital Advisors,

Inc., f) Fund Auditors: E&Y Luxembourg and E&Y Vietnam, g) Fund Tax Advisor: ATOZ Tax Management, Luxembourg, h) Fund Independent

Asset Valuator: Cushman & Wakefield, Vietnam. Currently the Fund is in the process of changing the custodian bank, administrative

registrar & transfer agent, investment advisor and the fund manager.

The

Fund is an umbrella fund intended to contain one or more sub-fund compartments for investing in select opportunities in the areas of

real estate, infrastructure, renewable energy, agriculture, healthcare and especially the Asia Diamond Exchange and Multi-Commodities

and Logistics Center in Vietnam.

Other

subsidiaries of the Company that are established in conjunction with PHILUX Global Funds include PHI Luxembourg Development S.A., PHILUX

Global General Partners SA, and PHI Luxembourg Holding SA. Website: www.philuxfunds.com.

PHILUX

CAPITAL ADVISORS, INC.

Philux

Capital Advisors, Inc. was originally incorporated under the name of “Providential Capital, Inc.” in 2004 as a Nevada corporation

and wholly owned subsidiary of the Company to provide merger and acquisition (M&A) advisory services, consulting services, project

financing, and capital market services to clients in North America and Asia. In May 2010, Providential Capital, Inc. changed its name

to PHI Capital Holdings, Inc. It was re-domiciled as a Wyoming corporation on September 20, 2017 and changed its name to “PHILUX

Capital Advisors, Inc.” on June 03, 2020. This subsidiary has successfully managed merger plans for a number of privately held

and publicly traded companies and continues to focus on serving the Pacific Rim markets in the foreseeable future. This subsidiary also

arranges debt financing for international clients. Website: www.philuxcapital.com.

PHILUX

GLOBAL ADVISORS, INC.

Incorporated

in April 2022 as a Wyoming corporation, Philux Global Advisors, Inc. will serve as the investment advisor for Philux Global Funds SCA

SICAV-RAIF.

PHILUX

GLOBAL HEALTHCARE, INC.

Philux

Global Healthcare, Inc., a Wyoming corporation, was established in February 2023 to replace Phivitae Healthcare, Inc., as a subsidiary

of the Company to cooperate with Dr. Dung Anh Hoang of Belgium and his affiliates to develop a software management system for intensive

care units in Vietnam and launch medical bioplastic products that have ready buyers in Europe and Africa. The Company intends

to use this subsidiary as a holding company to acquire and consolidate targets in the healthcare industry.

PHILUX

GLOBAL ENERGY, INC.

On

January 3, 2022, the Company filed “Profit Corporation Articles of Incorporation” with the Wyoming Secretary of State to

incorporate “PHILUX GLOBAL ENERGY, INC.” – Original ID: 2020-001066221, as a wholly-owned subsidiary of the Company

to serve as the holding company for the contemplated acquisition of fifty-point one percent (50.10%) ownership in both Kota Energy Group

LLC and Kota Construction LLC, both of which are California limited liability companies. The Company intends to develop its energy-related

business through this subsidiary in the future.

PHILUX

FIDELITY GLOBAL GROUP

Philux

Fidelity Global Group is a Wyoming corporation incorporated on June 30, 2022 with the intent to serve as the holding company for business

cooperation between Tin Thanh Group (www.tinthanhgroup.vn) and the Company.

PHILUX

GLOBAL TRADE INC.

Established

on August 19, 2022 in Wyoming, USA as a subsidiary of the Company to serve as the holding company for the acquisition of Vietnam-based

Van Phat Dat JSC, Philux Global Trade Inc. is currently developing trade commerce between Vietnam and other countries.

ITEM

1A. RISK FACTORS

RISK

FACTORS

Investment

in our securities is subject to various risks, including risks and uncertainties inherent in our business. The following sets forth factors

related to our business, operations, financial position or future financial performance or cash flows which could cause an investment

in our securities to decline and result in a loss.

General

Risks Related to Our Business

Our

success depends on our management team and other key personnel, the loss of any of whom could disrupt our business operations.

Our

future success will depend in substantial part on the continued service of our senior management and certain external experts. The loss

of the services of one or more of our key personnel and/or outside experts could impede implementation and execution of our business

strategy and result in the failure to reach our goals. We do not carry key person life insurance for any of our officers or employees.

Our future success will also depend on the continued ability to attract, retain and motivate highly qualified personnel in the diverse

areas required for continuing our operations. We cannot assure that we will be able to retain our key personnel or that we will be able

to attract, train or retain qualified personnel in the future.

Risks

Related to Mergers and Acquisitions

Our

strategy in mergers and acquisitions involves a number of risks and we have a limited history of successful acquisitions. Even when an

acquisition is completed, we may have to continue our service for integration that may not produce results as positive as management

may have projected.

The

Company continues evaluating various opportunities and negotiating to acquire other companies, assets and technologies. Acquisitions

entail numerous risks, including difficulties in the assimilation of acquired operations and products, diversion of management’s

attention from other business concerns, amortization of acquired intangible assets and potential loss of key employees of acquired companies.

We have limited experience in assimilating acquired organizations into our operations. Although potential synergy may be achieved by

acquisitions of related technologies and businesses, no assurance can be given as to the Company’s ability to integrate successfully

any operations, personnel, services or products that have been acquired or might be acquired in the future. Failure to successfully assimilate

acquired organizations could have a material adverse effect on the Company’s business, financial condition and operating results.

Acquisitions

involve a number of special risks, including:

| ● |

failure of the acquired

business to achieve expected results; |

| ● |

diversion of management’s

attention; |

| ● |

failure to retain key personnel

of the acquired business; |

| ● |

additional financing, if

necessary and available, could increase leverage, dilute equity, or both; |

| ● |

the potential negative

effect on our financial statements from the increase in goodwill and other intangibles; and |

| ● |

the high cost and expenses

of completing acquisitions and risks associated with unanticipated events or liabilities. |

These

risks could have a material adverse effect on our business, results of operations and financial condition since the values of the securities

received for the consulting service at the execution of the acquisition depend on the success of the company involved in acquisition.

In addition, our ability to further expand our operations through acquisitions may be dependent on our ability to obtain sufficient working

capital, either through cash flows generated through operations or financing activities or both. There can be no assurance that we will

be able to obtain any additional financing on terms that are acceptable to us, or at all.

Risks

associated with private equity (PE) funds

There

are, broadly, five key risks to private equity investing:

1.

Operational risk: The risk of loss resulting from inadequate processes and systems supporting the organization. It is a

key consideration for investors regardless of the asset classes that funds invest into.

2.

Funding risk: This is the risk that investors are not able to provide their capital commitments and is effectively the

‘investor default risk’. PE funds typically do not call upon all the committed investor capital and only draw capital once

they have identified investments. Funding risk is closely related to liquidity risk, as when investors are faced with a funding shortfall

they may be forced to sell illiquid assets to meet their commitments.

3.

Liquidity risk: This refers to an investor’s inability to redeem their investment at any given time. PE investors

are ‘locked-in’ for between five and ten years, or more, and are unable to redeem their committed capital on request during

that period. Additionally, given the lack of an active market for the underlying investments, it is difficult to estimate when the investment

can be realized and at what valuation.

4.

Market risk: There are many forms of market risk affecting PE investments, such as broad equity market exposure, geographical/sector

exposure, foreign exchange, commodity prices, and interest rates. Unlike in public markets where prices fluctuate constantly and are

marked-to-market, PE investments are subject to infrequent valuations and are typically valued quarterly and with some element of subjectivity

inherent in the assessment. However, the market prices of publicly listed equities at the time of sale of a portfolio company will ultimately

impact realization value.

5.

Capital risk: The capital at risk is equal to the net asset value of the unrealized portfolio plus the future undrawn commitments.

In theory, there is a risk that all portfolio companies could experience a decline in their current value, and in the worst-case drop

to a valuation of zero. Capital risk is closely related to market risk. Whilst market risk is the uncertainty associated with unrealized

gains or losses, capital risk is the possibility of having a realized loss of the original capital at the end of a fund’s life.

There

are two main ways that capital risk brings itself to bear - through the failure of underlying companies within the PE portfolio and suppressed

equity prices which make exits less attractive. The former is impacted by the quality of the fund manager, i.e. their ability to select

portfolio companies with good growth prospects and to create value, hence why fund manager selection is key for investors. The condition,

method, and timing of the exit are all factors that can affect how value can be created for investors.

Risks

Associated with Building and Operating a Diamond Exchange

Fundamentally,

the key requirements for a successful diamond exchange include the following:

1.

Supply: One of the most important things for a successful trading hub is the ability to secure ample, stable, and sustainable

supply of commodities. In the case of a diamond exchange, adequate supply of rough diamond must be secured to make it successful.

2.

Capital: Besides the infrastructure, facilities, systems, and amenities to operate the diamond exchange, the organizers

must be able to arrange very large amounts of capital to facilitate the trade and other business activities related to the exchange.

3.

Participants: The organizers must be able to attract a large number of international diamonteers to participate in the

exchange. There is no guarantee that people will come when the exchange is built.

4.

Venue: The venue must be able to provide competitive advantages compared with existing diamond exchanges in the world in

terms of (a) modern facilities, latest technologies and state-of-the-art provisions, (b) tax relief, (c) financial facilitating network

from big investors, (d) retail banking, lending institutions and foreign exchange facilities, (e) licenses and registrations, (f) global

multi-commodities trading flatform, and (g) other amenities.

Risks

Associated with International Markets

As

some of our business activities are currently involved with international markets, any adverse change to the economy or business environment

in these countries could significantly affect our operations, which would lead to lower revenues and reduced profitability.

Some

of our business activities are currently involved with non-US countries. Because of this presence in specific geographic locations, we

are susceptible to fluctuations in our business caused by adverse economic or other conditions in this region, including stock market

fluctuation. A stagnant or depressed economy in these countries generally, or in any of the other markets that we serve, could adversely

affect our business, results of operations and financial condition.

Risks

Related to Our Securities

Insiders

have substantial control over the company, and they could delay or prevent a change in our corporate control, even if our other stockholders

wanted such a change to occur.

Though

our executive officers and directors as of the date of this report, in the aggregate, only hold a small portion of our outstanding common

stock, we have the majority voting rights associated with the Company’s Class B Series I Preferred Stock, which decision may allow

the Board of Directors to exercise significant control over all matters requiring stockholder approval, including the election of directors

and approval of significant corporate transactions. This could delay or prevent an outside party from acquiring or merging with us even

if our other stockholders wanted it to occur.

The

price at which investors purchase our common stock may not be indicative of the prevailing market price.

The

stock market often experiences significant price fluctuations that are unrelated to the operating performance of the specific companies

whose stock is traded. These market fluctuations could adversely affect the trading price of our shares. Investors may be unable to sell

their shares of common stock at or above their purchase price, which may result in substantial losses.

Since

we do not currently meet the requirements for our stock to be quoted on NASDAQ, NYSE MKT LLC or any other senior exchange, the tradability

in our securities will be limited under the penny stock regulations.

Under

the rules of the Securities and Exchange Commission, as the price of our securities on the OTCQB or OTC Markets is below $5.00 per share,

our securities are within the definition of a “penny stock.” As a result, it is possible that our securities may be subject

to the “penny stock” rules and regulations. Broker-dealers who sell penny stocks to certain types of investors are required

to comply with the Commission’s regulations concerning the transfer of penny stock. These regulations require broker-dealers to:

*Make

a suitability determination prior to selling penny stock to the purchaser;

*Receive

the purchaser’s written consent to the transaction; and

*Provide

certain written disclosures to the purchaser.

These

requirements may restrict the ability of broker/dealers to sell our securities, and may affect the ability to resell our securities.

Our

compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls may be time consuming, difficult and costly for us.

It

may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by

the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop

and implement appropriate internal controls and reporting procedures. If we are unable to comply with the internal controls requirements

of the Sarbanes-Oxley Act, we may not be able to obtain the independent accountant certifications that the Sarbanes-Oxley Act requires

publicly traded companies to obtain.

ITEM

1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM

2. DESCRIPTION OF PROPERTIES

As

of June 30, 2023, the Company did not own any realty or equipment.

ITEM

3. LEGAL PROCEEDINGS

The

Company is currently not a party to any material pending legal proceedings and, to the best of its knowledge, no such action by or against

Company has been threatened.

ITEM

4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None

PART

II

ITEM

5. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The

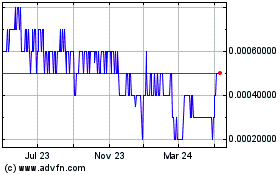

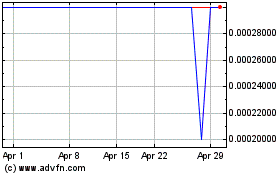

Company’s Common Stock is currently trading on the OTC Markets under the symbol “PHIL”. The following sets forth the

high and low prices of the Company’s Common Stock in the US for the most recent month, two most recent quarters and each quarter

during the preceding two fiscal years.

The

prices for the Company’s common stock quoted by brokers are not necessarily a reliable indication of the value of the Company’s

common stock.

| Per Share Common Stock Prices for the Month | |

High | | |

Low | |

| Ended September 30, 2023 | |

| 0.0006 | | |

| 0.0004 | |

| Per Share Common Stock Prices for the Quarter | |

High | | |

Low | |

| Quarter Ended June 30, 2023 | |

| 0.0008 | | |

| 0.0005 | |

Per

Share Common Stock Prices by Quarter

For

the Fiscal Year Ended June 30, 2023

| | |

High | | |

Low | |

| Quarter Ended June 30, 2023 | |

| 0.0008 | | |

| 0.0005 | |

| Quarter Ended March 31, 2023 | |

| 0.0025 | | |

| 0.0001 | |

| Quarter Ended December 31, 2022 | |

| 0.0020 | | |

| 0.0008 | |

| Quarter Ended September 30, 2022 | |

| 0.0026 | | |

| 0.0005 | |

Per

Share Common Stock Prices by Quarter

For

the Fiscal Year Ended June 30, 2022

| | |

High | | |

Low | |

| Quarter Ended June 30, 2022 | |

| 0.0019 | | |

| 0.0005 | |

| Quarter Ended March 31, 2022 | |

| 0.0055 | | |

| 0.0016 | |

| Quarter Ended December 31, 2021 | |

| 0.0093 | | |

| 0.0047 | |

| Quarter Ended September 30, 2021 | |

| 0.0150 | | |

| 0.0047 | |

Holders

of Common Equity:

As

of October 13, 2023 there are approximately 1,605 shareholders of record of the Company’s common stock, of which 1,299 are active.

Dividends:

Cash

dividend: The Company has not declared or paid a cash dividend to common stock shareholders since the Company’s inception. The

Board of Directors presently intends to retain any earnings to finance company operations and does not expect to authorize cash dividends

to common shareholders in the foreseeable future. Any payment of cash dividends in the future will depend upon Company’s earnings,

capital requirements and other factors.

Share

dividend: On March 12, 2012 the Board of Directors of the Company declared a special stock dividend to shareholders of Common Stock of

the Company with the following stipulations: (a) Declaration date: March 16, 2012; (b) Record date: June 15, 2012; (c) Payment date:

September 17, 2012; (d) Dividend ratio: All eligible shareholders of Common Stock of the Company as of the Record date shall receive

three new shares of Common Stock of the Company for each share held by such shareholders as of the referenced record date. The purpose

of this special stock dividend was to partially mitigate the impact of the dilution in connection with the 1-for-1,500 reverse split

of the Common Stock on the Company’s long-term shareholders and reward them for staying with the Company. On June 6, 2012, the

Company’s Board of Directors passed a resolution to change the record date for the special stock dividend to July 31, 2012 and

the distribution date to November 30, 2012. The Company has reserved a total of 5,673,327 shares of Common Stock for this special dividend

distribution and will reset a new distribution date when the market price of the Company’s Common Stock makes the special stock

dividend economically meaningful for such shareholders and a registration statement for the dividend shares is declared effective by

the Securities and Exchange Commission.

ITEM

6. SELECTED FINANCIAL DATA

| June 30, | |

2023 | | |

2022 | | |

2021 | |

| Net revenues | |

$ | 25,000.00 | | |

$ | 30,000 | | |

$ | 61,000 | |

| Income (loss) from operations | |

$ | (1,000,623.31 | ) | |

$ | (16,899,928 | ) | |

$ | (582,616 | ) |

| Net other income (expense) | |

$ | (4,608,523.04 | ) | |

$ | (4,254,515 | ) | |

$ | (5,700,562 | ) |

| Net income (loss) | |

$ | (5,609,146.35 | ) | |

$ | (21,154,443 | ) | |

$ | (6,553,178 | ) |

| Net income (loss) per share | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| Total assets | |

$ | 294,215.12 | | |

$ | 469,963 | | |

$ | 927,796 | |

| Total liabilities | |

$ | 8,516,216.62 | | |

$ | 7,013,465 | | |

$ | 6,925,185 | |

ITEM

7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Except

for the audited historical information contained herein, this report specifies forward-looking statements of management of the Company

within the meaning of Section 27a of the Securities Act of 1933 and Section 21e of the Securities Exchange Act of 1934 (“forward-looking

statements”) including, without limitation, forward-looking statements regarding the Company’s expectations, beliefs, intentions

and future strategies. Forward-looking statements are statements that estimate the happening of future events and are not based on historical

facts. Forward- looking statements may be identified by the use of forward-looking terminology, such as “could”, “may”,

“will”, “expect”, “shall”, “estimate”, “anticipate”, “probable”,

“possible”, “should”, “continue”, “intend” or similar terms, variations of those terms

or the negative of those terms. The forward-looking statements specified in this report have been compiled by management of the Company

on the basis of assumptions made by management and considered by management to be reasonable. Future operating results of the Company,

however, are impossible to predict and no representation, guaranty, or warranty is to be inferred from those forward-looking statements.

The assumptions used for purposes of the forward-looking statements specified in this report represent estimates of future events and

are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification

and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives

require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated

or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In addition,

those forward-looking statements have been compiled as of the date of this report and should be evaluated with consideration of any changes

occurring after the date of this report. No assurance can be given that any of the assumptions relating to the forward-looking statements

specified in this report are accurate and the Company assumes no obligation to update any such forward-looking statements.

RESULTS

OF OPERATIONS FOR THE YEARS ENDED JUNE 30, 2023 AND JUNE 30, 2022

Revenues:

The

Company received $25,000 from consulting services for the fiscal year ended June 30, 2023 as compared to $30,000 from consulting services

for the fiscal year ended June 30, 2022.

Operating

Expenses:

The

Company incurred total operating expenses of $1,025,623 for the fiscal year ended June 30, 2023 as compared to $16,929,928 for the year

ended June 30, 2022. The decrease of operating expenses between the two fiscal periods $15,904,305 includes a decrease of $97,841 in

general and administrative expenses, a decrease of $553,803 for the development costs of the Asia Diamond Exchange and a decrease of

$15,252,661 in professional services. The amount of professional services during the previous period was mainly due the issuances of

the Company’s stock for the development and launching of an Asia Diamond Exchange (ADE) blockchain token.

Income

(loss) from operations:

The

Company had a loss from operations of $1,000,623 for the fiscal year ended June 30, 2023 as compared to a loss from operations of $16,899,928

for the fiscal year ended June 30, 2022. This represents a decrease of $15,899,305 in loss from operations during the current fiscal

year as compared to that of the precious year. This was mainly due to a decrease of $97,841 in general and administrative expenses, a

decrease of $553,803 for the development costs of the Asia Diamond Exchange and a decrease of $15,252,661 in professional services as

mentioned above.

Other

income (expense):

The

Company had net other expenses of $4,608,523 for the fiscal year ended June 30, 2023 as compared to net other expenses of $4,254,515

for the fiscal year ended June 30, 2022. The net variance of $354,008 between the two fiscal periods was primarily due to decrease of

$1,117,707 in other income, a decrease in interest expenses in the amount of $657,685 and a decrease in other expenses in the amount

of $106,014. The Company recognized $488 as other income from gain on sale of security and bank interest. As for other expenses, the

Company incurred $3,674,139 under this category during the fiscal year ended June 30, 2023, primarily due to a loss in the amount of

$976,290 in connection with cashless warrant exercises, penalties of $500,295 from loans and notes payable, and total financing costs

of $1,668,057, as compared to $3,780,153 in other expenses during the previous fiscal year. Interest expenses for the current fiscal

year is $934,872 as compared to interest expenses of $1,592,557 for the previous fiscal year.

Net

income (loss):

The

Company had a net loss of $5,609,146 for the fiscal ended June 30, 2023, as compared to a net loss of $21,154,443 for the fiscal year

ended June 30, 2022, representing a variance of $15,545,297 in net loss between the two fiscal years. The net loss per share based on

the basic and diluted weighted average number of common shares outstanding for the fiscal years ended June 30, 2023 and June 30, 2022

was both $(0.00).

CASH

FLOWS

We

had in cash and cash equivalents of $17,765 as of June 30, 2023 as compared to $67,896 in cash and cash equivalents as of June 30, 2022,

respectively.

Net

cash used in our operating activities was $1,572,400 for the fiscal year ended June 30, 2023 as compared to cash used in operating activities

of $ 1,545,570 for the fiscal year ended June 30, 2022. The variance in cash used in operating activities between the two fiscal periods

was $26,830.

There

was $3,557 cash provided by investing activities during the fiscal year ended June 30, 2023, compared to $410,438 cash used in investing

activities during the same period ended June 30, 2022.

Net

cash provided by financing activities was $1,520,712 for the fiscal year ended June 30, 2023 as compared with net cash provided by financing

activities of $1,107,288 for the fiscal year ended June 30, 2022. The net cash provided by financing activities for the current fiscal

year primarily came from net notes payable in the amount of $29,352 and $1,540,795 from issuances of common stock.

HISTORICAL

FINANCING ARRANGEMENTS

SHORT

TERM NOTES PAYABLE AND ISSUANCE OF COMMON STOCK

In

the course of its business, the Company has obtained short-term loans from individuals and institutional investors and from time to time

raised money by issuing restricted common stock of the Company under the auspices of Rule 144. These notes bear interest rates ranging

from 0% to 36% per annum. (Notes 8 & 11).

CONVERTIBLE

PROMISSORY NOTES

The

Company has also from time to time issued convertible promissory notes to various private investment funds for short-term working capital

and special projects. Typically, these notes bear interest rates from 5% to 12% per annum, mature within one year, are convertible to

common stock of the Company at a discount ranging from 42% to 50%, and may be repaid within 180 days at a prepayment premium ranging

from 130% to 150%. (Note 8)

COMPANY’S

PLAN OF OPERATION FOR THE FOLLOWING 12 MONTHS

In

the next twelve months the Company’s goals are to advance the Philux Global Select Growth Fund under Philux Global Funds SCA, SICAV-RAIF,

develop the Asia Diamond Exchange and International Financial Center in Vietnam as well as carry out merger and its acquisition program

by acquiring target companies for a roll-up strategy and also invest in special situations. We will also continue to provide advisory

and consulting services to international clients through our wholly owned subsidiary Philux Capital Advisors, Inc.

In

addition, the Company and its subsidiaries have entered into loan financing agreements, asset management agreements, joint venture agreement,

and memorandum of understanding with seven international investor groups for a total of six billion four hundred ninety million U.S.

dollars, as reported in various 8-K filings with the Securities and Exchange Commission. The Company has been intensely focused on closing

some of these transactions and expects to begin receiving capital through these sources in the near future to support its investment

programs and merges and acquisitions.

FINANCIAL

PLANS

MATERIAL

CASH REQUIREMENTS: We must raise substantial amounts of capital to fulfill our plans for Philux Global Funds and for acquisitions. We

intend to use equity, debt and project financing to meet our capital needs for acquisitions and investments.

Management

has taken action and formulated plans to meet the Company’s operating needs through June 30, 2024 and beyond. The working capital

cash requirements for the next 12 months are expected to be generated from operations and additional financing. The Company plans to

generate revenues from its consulting services, merger and acquisition advisory services, and acquisitions of target companies with positive

cash flows.

AVAILABLE

FUTURE FINANCING ARRANGEMENTS: The Company may use various sources of funds, including short-term loans, long-term debt, equity capital,

and project financing as may be necessary. The Company believes it will be able to secure the required capital to implement its business

plan.

EQUITY

LINE OF CREDIT WITH INSTITUTIONAL INVESTOR

On

March 01, 2022, the Company entered into an equity purchase agreement with an institutional investor (“The Investor”) as

follows:

The

Investor will provide an equity line of up to $10,000,000 to the Company, pursuant to which the Company has the right, but not the obligation,

during the 24 months after an effective registration of the underlying shares, to issue a notice to the Investor (each a “Drawdown

Notice”) which shall specify the amount of registered shares of common stock of the Company (the “Put Shares”) that

the Company elects to sell to the Investor, from time to time, up to an aggregate amount equal to $10,000,000.

The

pricing period of each put will be the 7 trading days immediately following receipt of the Put Shares (the “Pricing Period”).

The

purchase price per share shall mean 90% of the average of the 2 lowest volume-weighted average prices of the Common Stock during the

Pricing Period, less clearing fees, brokerage fees, other legal, and transfer agent fees incurred in the deposit (the “Net Purchase

Amount”). The Investor shall pay the Net Purchase Amount to the Company by wire for each Drawdown Notice within 2 business days

of the end of the Pricing Period.

The

put amount in each Drawdown Notice shall not be less than $50,000 and shall not exceed the lesser of (i) $500,000 or (ii) 200% of the

average dollar trading volume of the Common Stock during the 7 trading days immediately before the Put Date, subject to Beneficial Ownership

cap.

There

shall be a 7 trading day period between the receipt of the Put Shares and the next put.

The

Company intends to file an S-1 Registration Statement with the Securities and Exchange Commission for this Equity Line of Credit.

ITEM

7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The

following discussion about PHI Group Inc.’s market risk involves forward-looking statements. Actual results could differ materially

from those projected in the forward-looking statements.

Currency

Fluctuations and Foreign Currency Risk

Some

of our acquisition targets and partner companies are located outside of the United States and use currencies other than the U.S. dollar

as the official currencies of those countries. The fluctuations of exchange rates in these countries may affect the value of our business.

Interest

Rate Risk

We

do not have significant interest rate risk, as most of our debt obligations are primarily short-term in nature to individuals, with fixed

interest rates.

Valuation

of Securities Risk

Since

some of our income in the past was paid with the marketable securities, the value of our assets may fluctuate significantly depending

on the market value of the securities we hold.

ITEM

8. FINANCIAL STATEMENTS

PHI

GROUP, INC.

INDEX

TO FINANCIAL STATEMENTS

|

M.S.

Madhava Rao Chartered Accountant

316,

1st cross, 7th block, 4th phase,

BSK

3rd Stage, Bengaluru, India 56085

Tel

No: +91 8861838006, email: mankalr@yahoo.com

|

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(To

be provided)

PHI GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (AUDITED)

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 19,765 | | |

$ | 67,896 | |

| Marketable securities | |

| 420 | | |

| 546 | |

| Other current assets | |

| 241,426 | | |

| 365,360 | |

| Total current assets | |

| 261,611 | | |

| 433,802 | |

| Other assets: | |

| | | |

| | |

| Investments | |

| 32,604 | | |

| 36,161 | |

| Total Assets | |

| 294,215 | | |

| 469,963 | |

| | |

| | | |

| | |