Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

October 11 2023 - 4:08PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 Issuer Free Writing Prospectus dated October 11, 2023 Relating to Prospectus Supplement dated

May 31, 2023 and Prospectus dated December 22, 2021 Registration No. 333-261398 $150,000,000 Series A Cumulative Redeemable Preferred Stock Offering FINANCING FOR LOWER MIDDLE MARKET COMPANIES

RISK FACTORS An investment in shares of Gladstone Capital Corp. Series A Cumulative Redeemable Preferred Stock involves a high degree of risk. In consultation with your own financial and legal advisers, you should carefully consider, among other

matters, the risk factors summarized on page 4 of this brochure and delineated in the “Risk Factors” sections of the prospectus supplement and in our most recent Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q and other information we will file from time to time with the SEC before deciding whether an investment in shares of Gladstone Capital Series A Cumulative Redeemable Preferred

Stock is suitable for you.

About Gladstone Capital Founded in 2001, Gladstone Capital was one of the first Business Development Companies (BDCs) focused on making

secured loans to lower middle market U.S. businesses. With a conservatively leveraged capital base and strong earning profile, Gladstone provides strong asset and dividend coverage supporting the Preferred Stock rating of BBB+ by Egan Jones.1 $715

Million LOAN PORTFOLIO2 as of June 30, 2023 52 companies 12 industries 77% backed by private equity (PE) sponsors CONSERVATIVE PORTFOLIO 91% secured loans 75% lower risk 1st lien loans 92% floating rate loans $2.6 Billion CUMULATIVE INVESTMENT

EXPERIENCE of loans/investments in 273 companies Approximately $377 Million EQUITY MARKET CAPITALIZATION ABOUT GLADSTONE MANAGEMENT CORPORATION • Privately-held investment adviser • 22-year operating

history • Manages more than $4.0 billion • More than 75 professionals GLADSTONE CAPITAL’S INVESTMENT FOCUS A BDC with a diversified portfolio of directly originated debt investments focusing on senior loans to established

growth-oriented lower middle market U.S.-based businesses with near term revenue visibility and proven cashflows to mitigate credit risk. Attractive Lower Middle Market Dynamics Vast number of businesses drive consistent flow of investment

opportunities Reduced lender competition supports higher yields and lower losses LMM opportunity growing with recent regional bank issues Diversified Portfolio Diversified secured loan portfolio generating interest income to support distributions

Growing businesses lead to organic deleveraging and enhanced exit valuation Issuer Protections Strong collateral and dividend coverage & priority over publicly traded common (FMV $377 million) and associated dividends Disciplined

Underwriting Cashflow lender focused on growing businesses with strong revenue visibility, free cashflow & competitive barriers Multi-disciplinary “equity-like” team underwriting mostly senior lending position Directly sourced and

agented loans to control lender protections and remedies Management Team Established investment adviser with multiple public funds Investment team dedicated to sourcing and ongoing deal management and aligned with investor interest Regulatory

Requirements SEC regulations of BDCs require asset diversity, leverage limitations, FMV valuation and public filings 1 Egan Jones re-affirmed A- Corporate and Senior

Notes rating and issued BBB+ Series A Preferred Stock rating on June 8, 2023. Ratings are opinions that reflect the creditworthiness of an issuer and/or a security. Creditworthiness is determined by assessing coverage of the estimated loss via

current and forward-looking measurements that assess an issuer’s ability and willingness to make payments on ultimate obligations (including principal, interest, dividend or other types of distributions) per the terms of an obligation. An

‘A’ rating indicates a high level of creditworthiness with low sensitivity to evolving credit conditions. A ‘BBB+’ rating indicates a moderate level of creditworthiness with moderate sensitivity to evolving credit conditions. 2

At fair value.

Opportunity to invest in an investment gra with 22 years of lower middle market cash experience via a preferred stock with stabl and a

6.25% annual cash dividend paid mon Investment Highlights SEC REGULATED BDCs are regulated by the SEC under the Investment C 1940, which imposes leverage limitations among other r LIQUIDITY4 The issuer intends to make quarterly repurchases thr

offering, including repurchases at par after a three-year EXPERIENCED Established operator with 22-year track record and seasoned and diversified loan portfolio to support distributions MONTHLY INCOME

POTENTIAL 6.25% annualized dividend, paid monthly ahead of common stock dividends. There is no guarantee of continuous dividends DIVIDEND COVERAGE Preferred stock supported by strong asset coverage and priority over public traded common equity

(>$350mm) STABLE VALUE Issuer pays all upfront fees, so there is no fee impact on the statement value of the Shares The value of the underlying assets will fluctuate. The investor may not have liquidity 1 Egan Jones

re-affirmed A- Corporate and Senior Notes rating and issued BBB+ Series A Preferred Stock rating on June 8, 2023. Ratings are opinions that reflect the

creditworthiness of an issuer and/or a security. Creditworthiness is determined by assessing coverage of the estimated loss via current and forward-looking measurements that assess an issuer’s ability and willingness to make payments on

ultimate obligations (including principal, interest, dividend or other types of distributions) per the terms of an obligation. An ‘A’ rating indicates a high level of creditworthiness with low sensitivity to evolving credit conditions. A

‘BBB+’ rating indicates a moderate level of creditworthiness with moderate sensitivity to evolving credit conditions. 2 The value of the underlying assets will fluctuate. The investor may not have liquidity. 3 There is no guarantee of

continuous dividends. 4 See “Description of the Series A Preferred Stock—Share Repurchase Program” in our Prospectus Supplement dated May 31, 2023. Gladstone Capital’s obligation to repurchase Series A Preferred Stock is

limited to the extent that its Board of Directors determines that it does not have sufficient funds available or it is restricted by applicable law from making such repurchase.

LEARN MORE: 833.849.5993 | info@gladstonesecurities.com RISK FACTORS Please consult the prospectus supplement for this offering for a

recitation of the risk factors of this offering. If any of the risks contained in or incorporated by reference into the prospectus supplement or the accompanying prospectus actually occur, our business, financial condition or results of operations

could be materially adversely affected. If that happens, we may be unable to timely pay the dividends accrued on the Series A Preferred Stock (the “Shares”), the value of the Shares could decline and you may lose all or part of your

investment. We believe the risk factors described below are the principal risk factors associated with an investment in our Shares as well as those factors generally associated with an investment company with investment objectives, investment

policies, capital structure or trading markets similar to ours. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. Some statements in the

prospectus supplement, including statements in the risk factors, constitute forward-looking statements. See the “Forward-Looking Statements” and “Risk Factors” sections in the prospectus supplement, the accompanying prospectus

and in our regular filings with the SEC for additional risks which may affect us or the Shares. • There will be no public market for the Shares as we do not intend to apply for listing on a national securities exchange unless the Share

Repurchase Program is terminated. • Dividend payments on the Shares are not guaranteed. • We will be required to terminate this offering if our common stock is no longer listed on Nasdaq or another national securities exchange. • The

Shares will bear a risk of redemption by us. • Your option to request that your Shares be repurchased is subject to a 5% quarterly limitation, the continuation of the Share Repurchase Program and our availability of funds, and may also be

limited by law. • Our ability to pay dividends on and/or repurchase Shares may be limited by Maryland law, the 1940 Act and the terms of our debt facilities as well as future agreements we may enter. • The cash distributions you receive

may be less frequent or lower in amount than you expect. • If you elect to participate in the Share Repurchase Program, the cash payment that you receive as a result of your optional repurchase request may be a substantial discount to the price

that you paid for the Shares in this offering. • Holders of the Shares will be subject to inflation risk. • An investment in the Shares bears interest rate risk. • Holders of the Shares will bear reinvestment risk. • Our

management will have broad discretion in the use of the net proceeds from this offering and may allocate the net proceeds from this offering in ways that you and other stockholders may not approve. • We may be unable to invest a significant

portion of the net proceeds of this offering on acceptable terms. • We may authorize, establish, create, issue and sell shares of one or more additional series of Preferred Stock while the Shares are outstanding without the vote or consent of

the holders thereof. • We finance certain of our investments with borrowed money and capital from the issuance of senior securities (which would include the Series A Preferred Stock), which magnifies the potential for gain or loss on amounts we

invest and may increase your risk of investing in us. The use of leverage is generally considered a speculative investment technique and increases the risks associated with investing in our securities. • The stability of the price of the Shares

does not indicate stability in the value of the underlying assets. The value of the company’s asset portfolio will fluctuate over time and may be worth less than the price paid for the Series A Preferred Stock. The investor may not be able to

sell the investment. • The ratings on our Company and Series A Preferred Stock reflect opinions based on the quantitative and qualitative analysis of information sourced and received by Egan-Jones, which information is not audited or verified

by Egan-Jones. Ratings are not buy, hold or sell recommendations and do not address the market price of a security. Ratings may be upgraded, downgraded, placed under review, confirmed and discontinued. • Gladstone Securities, the dealer manager

in this offering, is our affiliate, and we established the offering price and other terms for the Shares pursuant to discussions between us and our affiliated dealer manager; as a result, the actual value of your investment may be substantially less

than what you pay. • If you fail to meet the fiduciary standards and other requirements under ERISA or Section 4975 of the Code as a result of an investment in this offering, you could be subject to liability and penalties, including

excise taxes. Gladstone Capital Corporation (“GLAD”) has filed a registration statement (including a prospectus) and a prospectus supplement with the SEC for the offering to which this communication relates. Before you invest, you should

read the prospectus in that registration statement, the prospectus supplement and other documents that GLAD has filed with the SEC for more complete information about GLAD and this offering. You may get these documents for free by visiting EDGAR on

the SEC website at www.sec. gov. Alternatively, Gladstone Securities, GLAD’s dealer manager for this offering, will arrange to send you the prospectus and prospectus supplement if you request it by calling toll-free at (833) 849-5993. Securities offered through the Dealer Manager, Gladstone Securities, LLC, Member FINRA/SIPC.

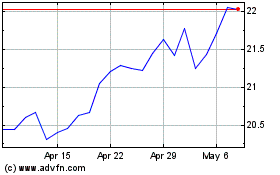

Gladstone Capital (NASDAQ:GLAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

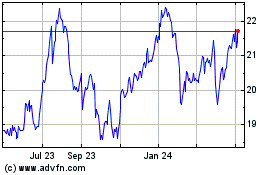

Gladstone Capital (NASDAQ:GLAD)

Historical Stock Chart

From Apr 2023 to Apr 2024