Keep An Eye Out: Pre-Market Movers And Recommendations

October 10 2023 - 7:02AM

IH Market News

Don’t Trade Without Seeing

The Orderbook

ANALYST RECOMMENDATIONS:

Alnylam Pharmaceuticals (NASDAQ:ALNY):

Bernstein maintains its outperform recommendation and reduces the

target price from $237 to $218.

Aon (NYSE:AON): Evercore ISI maintains its

in-line recommendation with a price target raised from $322 to

$323.

Chubb (NYSE:CB): Evercore ISI maintains

its outperform rating and raises the target price from $239 to

$241.

Coty (NYSE:COTY): Piper Sandler cut the target

to $14 from $16. Maintains overweight rating.

Dollar General (NYSE:DG): BNP Paribas Exane

starts coverage at neutral with a target price of $116.

Dollar Tree (NASDAQ:DLTR): BNP Paribas

Exane starts coverage at outperform with a target price of

$139.

Estee Lauder (NYSE:EL): Piper Sandler & Co

maintains a neutral recommendation with a price target reduced from

$164 to $155.

Hartford (NYSE:HIG): Evercore ISI maintains its

in-line recommendation with a price target raised from $78 to

$79.

Iqvia Holdings (NYSE:IQV): Mizuho Securities

maintains its buy recommendation and reduces the target price from

$250 to $229.

Juniper (NYSE:JNPR): JPMorgan downgrades

to neutral from overweight. PT up 8.1% to $29.

ResMed (NYSE:RMD): JPMorgan downgrades to

neutral from overweight. PT up 8.1% to $29.

Skyworks (NASDAQ:SWKS): Citi downgrades to sell

from neutral. PT down 11% to $87.

Splunk (NASDAQ:SPLK): Daiwa Securities

downgrades to neutral from outperform with a price target raised

from $135 to $157.

Tesla (NASDAQ:TSLA): BNP Paribas Exane

maintains its underperform recommendation and reduces the target

price from $130 to $120.

Ulta Beauty (NASDAQ:ULTA): Piper Sandler &

Co maintains its overweight recommendation and reduces the target

price from $575 to $540.

Walgreens Boots (NASDAQ:WBA): Mizuho Securities

maintains its neutral recommendation with a price target reduced

from $31 to $25.

Willis Towers (NASDAQ:WTW): Evercore ISI

maintains its in-line recommendation with a target price reduced

from $236 to $233.

US Options Trader

Live Realtime Streaming: US Options (OPRA), NYSE, NASDAQ, AMEX

prices + Dow Jones and S&P indices – and our innovative Options

Tools, featuring Live Options Flow.

Plethora of Fed speakers due

Fed Vice Chair Philip Jefferson said on Monday that the central

bank could “proceed carefully” in deciding whether any further

increases are warranted, while Dallas Fed President Lorie Logan

indicated rising Treasury yields could steer the Fed from further

rate increases.

This was accompanied by a drop in yields, with the benchmark

10-year U.S. Treasury yield dropping from its 16-year peak on

Tuesday as trading resumed in the U.S. bond market after Columbus

Day, on a combination of these comments and demand for safe assets

given the turmoil in the Middle East.

There are a number of Fed officials due to speak later Tuesday,

including Raphael Bostic, Christopher Waller, Neel Kashkari and

Mary Daly.

Their views on the path of interest rates for the remainder of

the year will be in focus ahead of Wednesday’s release of the

minutes from the last Fed meeting in September.

PepsiCo lifts annual profit forecast

In corporate news, the third quarter earnings season is at its

infancy, with PepsiCo (NASDAQ:PEP) the highlight Tuesday.

The soft drinks giant lifted its annual profit forecast for a

third time this year, banking on multiple price increases and

resilient demand for its snacks and beverages. Its stock rose 2.4%

premarket.

Other companies set to report during the week include Delta Air

Lines (NYSE:DAL) on Thursday as well as the banking giants JPMorgan

Chase (NYSE:JPM), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) on

Friday.

Crude supply outlook in focus

Oil prices slipped lower Tuesday, handing back some of the previous

session’s sharp gains with traders keeping a wary eye on the

conflict between Israel and Hamas and the potential for supply

disruptions.

By 06:40 ET, the U.S. crude futures traded 0.4% lower at $86.00

a barrel, while the Brent contract dropped 0.4% to $87.78 a

barrel.

Both benchmarks surged more than 4% on Monday as traders worried

the potential for the conflict to escalate, hitting Middle East

supply and making an already tight supply picture worse.

Additionally, gold futures rose 0.4% to $1,870.85/oz, while

EUR/USD traded 0.3% higher at 1.0596.

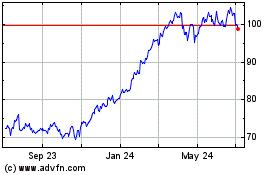

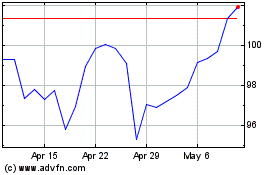

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2023 to Apr 2024