0001772720

false

0001772720

2023-09-28

2023-09-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(D)

OF THE SECURITIES EXCHANGE

ACT OF 1934

Date of Report

(Date of earliest event reported): September 28,

2023

SPRUCE POWER HOLDING CORPORATION

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-38971 |

|

83-4109918 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

2000 S Colorado Blvd, Suite 2-825

Denver, CO |

|

80222 |

| (Address of principal executive offices) |

|

(Zip Code) |

(866) 903-2399

(Registrant's telephone

number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share |

|

SPRU |

|

New York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On September 28, 2023, the U.S. Securities

and Exchange Commission (the “SEC”) issued an Order Instituting Cease-and-Desist Proceedings Pursuant to Section 8(a) of the

Securities Act of 1933 (the “Securities Act”) and Section 21(c) of the Securities Exchange Act of 1934 (the “Exchange

Act”), Making Findings, and Imposing a Cease-and-Desist Order (the “Settlement Order”) resolving the previously disclosed

SEC inquiry into Spruce Power Holding Corporation (the “Company”) related to, among other things, the Company’s

business combination with XL Hybrids, Inc. and the related private investment in public equity financing, the Company’s sales pipeline

and revenue projections, purchase orders, suppliers, California Air Resources Board approvals, fuel economy from Drivetrain products,

customer complaints, and disclosures and other matters in connection with the foregoing.

The Company has agreed to settle with the SEC, without admitting or denying

the allegations described in the Settlement Order. The Settlement Order requires the Company to (i) cease and desist from committing

or causing any violations and any future violations of Sections 17(a)(2) and 17(a)(3) of the Securities Act, Sections 13(a) and 14(a)

of the Exchange Act and Rules 12b-20, 13a-11, and 14a-9 thereunder, and (ii) pay, within 10 days of the entry of the Settlement Order,

a civil money penalty in the amount of $11,000,000 to the SEC. This civil money penalty will be

funded from corporate cash, which was approximately $192 million at June 30, 2023.

The foregoing description of the Settlement Order does not purport

to be complete and is qualified in its entirety by reference to the Settlement Order. The Settlement Order is filed as Exhibit 99.1 hereto

and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed

on its behalf by the undersigned hereunto duly authorized.

| |

SPRUCE POWER HOLDING CORPORATION |

| |

|

|

| Date: October 4, 2023 |

By: |

/s/ Jonathan Norling |

| |

Name: |

Jonathan Norling |

| |

Title: |

General Counsel |

2

Exhibit 99.1

UNITED STATES OF AMERICA

Before the

SECURITIES AND EXCHANGE COMMISSION

|

SECURITIES ACT OF 1933

Release No. 11247 / September 28, 2023 |

|

| |

|

SECURITIES EXCHANGE ACT OF 1934

Release No. 98612 / September 28, 2023 |

|

| |

|

ADMINISTRATIVE PROCEEDING

File No. 3-21748 |

|

| |

|

In the Matter

of

SPRUCE POWER HOLDING

CORPORATION,

Respondent.

|

ORDER INSTITUTING CEASE-AND-DESIST PROCEEDINGS PURSUANT TO SECTION 8A OF THE SECURITIES ACT OF 1933 AND SECTION 21C OF THE SECURITIES EXCHANGE ACT OF 1934, MAKING FINDINGS, AND IMPOSING A CEASE-AND-DESIST ORDER |

I.

The Securities and Exchange Commission (“Commission”)

deems it appropriate that cease-and-desist proceedings be, and hereby are, instituted pursuant to Section 8A of the Securities Act of

1933 (“Securities Act”), and Section 21C of the Securities Exchange Act of 1934 (“Exchange Act”), against Spruce

Power Holding Corporation (“Spruce Power” or “Respondent”), formerly known as XL Fleet Corp. (“XL Fleet”)

and Pivotal Investment Corporation II (“Pivotal”).

II.

In anticipation of the institution of these proceedings,

Respondent has submitted an Offer of Settlement (the “Offer”), which the Commission has determined to accept. Solely for the

purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party,

and without admitting or denying the findings herein, except as to the Commission’s jurisdiction over Respondent and the subject

matter of these proceedings, which are admitted, Respondent consents to the entry of this Order Instituting Cease-and-Desist Proceedings

Pursuant to Section 8A of the Securities Act of 1933 and Section 21C of the Securities Exchange Act of 1934, Making Findings, and Imposing

a Cease-and-Desist Order (“Order”), as set forth below.

III.

On the basis of this Order and Respondent’s

Offer, the Commission finds that:

Summary

1. This

matter concerns materially misleading statements made by Respondent’s predecessor companies – Pivotal Investment Corporation

II (“Pivotal”), formerly a publicly traded special purpose acquisition company (“SPAC”), and XL Fleet Corp. (“XL

Fleet”), which provided hybrid electrical vehicle (“HEV”) or plug-in hybrid electric vehicle (“PHEV”) systems

for commercial fleet vehicles – about XL Fleet’s sales pipeline in marketing and promoting the business combination between

Pivotal and XL Fleet.

2. In

September 2020, Pivotal and XL Fleet announced their proposed business combination transaction via a merger agreement and a related private

investment in public equity (“PIPE”) offering.1

From the date of the merger announcement to January 2021, Pivotal and XL Fleet made public statements highlighting that XL Fleet had a

sales pipeline of over $220 million, which purportedly supported XL Fleet’s revenue growth projections from $21 million in 2020

to $75 million for 2021. Pivotal and XL Fleet also publicly stated that XL Fleet generated its revenue projections, including up to $1.4

billion by 2024, in part by applying a historical “conversion rate” of one-third of its sales pipeline.

3. The

statements about XL Fleet’s sales pipeline and its connection to XL Fleet’s revenue projections were materially misleading.

Over 90% of XL Fleet’s $220 million sales pipeline consisted of speculative sales opportunities, including (i) sales to potential

customers with whom XL Fleet had little or no contact; (ii) past or existing customers who had not indicated any interest in buying more

of XL Fleet’s products; (iii) customers in California to whom XL Fleet could not legally sell certain of its products; and (iv)

stale opportunities that had not been updated. Further, XL Fleet did not use a historical “conversion rate” of its sales pipeline,

much less a conversion rate of one-third. As a result, and contrary to Pivotal’s and XL Fleet’s claims, neither the sales

pipeline nor the purported “conversion rate” of sales from the pipeline provided support for XL Fleet’s revenue projections.

Pivotal and XL Fleet made these misleading statements in current reports, offering registration statements, and proxy materials filed

with the Commission, and in other public statements.

4. As

a result of the conduct described herein, Respondent violated Sections 17(a)(2) and 17(a)(3) of the Securities Act, and Sections 13(a)

and 14(a) of the Exchange Act and Rules 12b-20, 13a-11, and 14a-9 thereunder.

Respondent

5. Spruce

Power, formerly known as XL Fleet, is incorporated in Delaware and headquartered in Denver, Colorado. Spruce Power is an owner and operator

of distributed solar energy assets across the U.S., offering subscription-based services to residential customers. Spruce Power’s

common stock is registered pursuant to Section 12(b) of the Exchange Act and quoted under the ticker symbol “SPRU” on the

New York Stock Exchange (“NYSE”), and the company is required to file periodic reports with the Commission pursuant to Section

13(a) of the Exchange Act. Until November 10, 2022, Respondent was known as XL Fleet, which was a Delaware corporation headquartered in

Boston, Massachusetts, and whose common stock was registered pursuant to Section 12(b) of the Exchange Act. XL Fleet had emerged as the

surviving company in a merger with Pivotal in December 2020, as described below.

| 1 | Before the merger, XL Fleet’s registered corporate name

was XL Hybrids, Inc. (“Legacy XL”), but it was commercially known and doing business as XL Fleet. |

Facts

Background

6. Pivotal

was a SPAC incorporated in Delaware for the purpose of entering into a business combination with one or more businesses or entities. Pivotal

consummated an initial public offering of common stock and warrants in July 2019, and its common stock was registered pursuant to Section

12(b) of the Exchange Act and quoted under the ticker symbol “PIC” on the NYSE. Pivotal was required to file periodic reports

with the Commission pursuant to Section 13(a) of the Exchange Act.

7. On

September 17, 2020, Pivotal entered into a proposed business combination by merging with Legacy XL, a then-privately held Delaware corporation

that was in the business of providing vehicle electrification solutions. Legacy XL sold and distributed HEV and PHEV systems, comprising

an electric motor, power inverter, and a lithium-ion battery pack, for gasoline-or diesel-powered commercial fleet vehicles, including

trucks, vans, and buses. On October 2, 2020, Pivotal filed a registration statement, proxy statement, and prospectus on Form S-4 to solicit

proxies for the vote by Pivotal’s stockholders with respect to the merger and the offer and sale of up to 100 million shares of

Pivotal’s common stock, and of 15 million shares to certain investors in a PIPE offering related to the merger.

8. On

December 8, 2020, after certain amendments, Pivotal’s registration and proxy statements on Form S-4 as amended were declared effective.

On December 21, 2020, Pivotal closed its merger with Legacy XL, and Pivotal changed its name to XL Fleet, which became the surviving company

whose common stock was quoted under the ticker symbol “XL” on the NYSE. The merger resulted in XL Fleet receiving approximately

$350 million in proceeds – $200 million in cash held in Pivotal’s trust account, and $150 million from the PIPE offering.

On January 14, 2021, XL Fleet filed a registration statement on Form S-1 for the offer and sale of certain common stock and warrants,

as well as to register the resale of certain shares, including the shares sold in the PIPE offering. XL Fleet’s registration statement

on Form S-1 was declared effective on January 22, 2021.

9. XL

Fleet’s management prepared, reviewed, and/or approved the statements about its business in Pivotal’s SEC filings, including

the Form S-4 and amendments, and current reports on Form 8-K discussed below.

10. In

September 2022, after a strategic review of its overall business operations, XL Fleet acquired membership interests of certain entities

comprising Spruce Power, which was privately held at the time. In November 2022, XL Fleet changed its name to Spruce Power, and changed

its NYSE ticker symbol from XL to SPRU. By December 2022, Respondent had sold or otherwise ceased its business operations under XL Fleet,

including its fleet vehicle electrification solutions, to focus its operations on distributing solar energy assets, including residential

solar panels.

Pivotal and XL Fleet Made Materially Misleading

Statements

About XL Fleet’s Sales Pipeline

11. In

announcing their merger in September 2020, Pivotal and XL Fleet stated the companies had decided to merge to advance and accelerate the

market growth of XL Fleet’s products and expand its product offerings from HEV and PHEV to full-battery electric and hydrogen fuel

cell electric vehicle systems. The companies also highlighted the fact that XL Fleet, unlike other publicly traded peer companies at the

time, had a ten-year track record of selling products to a growing number of customers, and had an increasing sales pipeline from potential

or actual customers supporting substantial revenue growth, which, when combined with the capital contributed by Pivotal, resulted in an

implied enterprise value of $1 billion for XL Fleet.

12. Pivotal

and XL Fleet, however, made materially misleading statements about XL Fleet’s sales pipeline in SEC filings and other public statements

from September 2020 to January 2021.

XL Fleet’s Sales Pipeline

13. On

September 18, 2020, Pivotal and XL Fleet issued a joint press release stating that “XL has strong demand momentum with a $220 million

12-month sales pipeline and forecasted revenue of over $21 million in 2020 and $75 million in 2021.” Other marketing materials,

including an investor presentation slide deck and an investor call script, also highlighted XL Fleet’s $220 million sales pipeline.

Pivotal furnished these marketing materials in a current report on Form 8-K and also filed them as written communications in connection

with a business combination transaction pursuant to Rule 425 of the Securities Act.

14. On

September 24, 2020, an XL Fleet officer stated in a media interview, “[w]ith over three thousand vehicles deployed thus far and

over $220 million in our current sales pipeline, ... [m]oving forward with a SPAC made the most sense for our business[] ....” On

October 26, 2020, an XL Fleet officer stated in a SPAC-oriented webinar, “we’ve got a 12 months sales pipeline that now is

over $240 million, which we feel is going to support our forecast for next year of $75 million in revenue.” Pivotal and XL Fleet

also issued a joint press release on the same date stating, “[XL] is revenue-generating today with strong demand momentum, including

a $220 million 12-month sales pipeline and forecasted revenue of over $21 million in 2020 and $75 million in 2021.” Pivotal furnished

the webinar transcript and press release in current reports on Forms 8-K and filed them pursuant to Rule 425.

15. On

November 12, 2020, XL Fleet issued a press release stating, “XL continues to grow its sales opportunity pipeline for 2021 to $220

million as of today, which supports XL’s current revenue forecast of $75 million for fiscal year 2021.” Pivotal filed the

press release on Form 425 as a communication in connection with a business combination transaction under Rule 425.

16. These

statements were materially misleading because XL Fleet’s sales pipeline did not “support” its revenue forecasts or indicate

“strong demand momentum” for its products. XL Fleet’s sales pipeline was derived from a customer relationship management

database (“CRM”), which XL Fleet used as a tool to organize and motivate its sales function, and was not designed to make

revenue projections. XL Fleet’s salespeople entered into the CRM sales opportunities for XL Fleet’s products from various

sources. These sales opportunities included the salespeople’s estimates of sales to potential customers, and potential additional

sales to past or existing customers, each weighted by the probability of a sale ranging from 5% to 95%. The $220 million sales pipeline

included approximately $20 million in existing sales or purchase orders as of August 2020. Nearly 70% of these existing sales or purchase

orders, however, were from just two customers. Excluding that $20 million in existing sales or purchase orders, $194 million (or 97%)

of the remaining $200 million were sales opportunities that XL Fleet’s salespeople had categorized as having merely a 5% ($133 million)

or 25% ($61 million) probability of resulting in a sale.

17. The

5% probability opportunities included potential customers who had not been contacted by XL Fleet’s salespeople, or who had been

contacted for an indication of interest in XL Fleet’s products but had not responded. These were speculative opportunities, including

companies and municipalities whom XL Fleet’s salespeople had identified from online or other research merely as having fleet vehicles

with environmental sustainability goals. The 25% probability opportunities included potential customers who had requested a quote for

an XL Fleet product, or prior or existing customers for whom XL Fleet had not received a new quote request or any other indication of

interest to purchase additional products. Certain of these sales opportunities also included stale entries created by XL Fleet’s

salespeople who were terminated in the first half of 2020. For these reasons, the $220 million sales pipeline did not support XL’s

estimated revenues of $75 million for 2021.

XL Fleet’s Inability to Sell New

Model Year Systems Into California

18. XL

Fleet’s sales pipeline also included sales opportunities in California. Before January 2019, XL Fleet had sold its HEV and PHEV

systems to California customers under Executive Orders issued by the California Air Resources Board (“CARB”), which administers

California’s vehicle emissions requirements, for each applicable vehicle group and model year. The Executive Orders required XL

Fleet to submit certain testing and use data for its systems to demonstrate compliance with emissions requirements. XL Fleet had planned

to increase sales in California, in part, by taking advantage of financial incentives available for owners and operators of HEVs and PHEVs.

19. In

or around January 2019, CARB had suspended consideration of XL Fleet’s applications for new Executive Orders for future XL Fleet

products to be sold in California because XL Fleet had not submitted the required testing and use data under existing Executive Orders.

Although XL Fleet had submitted the data by January 2020 to regain compliance with the Executive Orders, XL Fleet had little visibility

as to when CARB would issue Executive Orders to allow XL Fleet to sell products for post-2019 model year vehicles in the state. As a result,

certain California customers in XL Fleet’s sales pipeline had canceled or deferred purchase orders for XL Fleet’s products

in 2020 until it could secure Executive Orders for later model year vehicles.

20. Further,

Pivotal’s October 2, 2020 Form S-4 stated in relevant part, “XL has obtained a number of [Executive Orders for the sale of

XL’s systems] for prior model years [of vehicles with XL’s systems] and is in the process of conducting testing against CARB

issued test orders for future products to be introduced into the Californian market.” This statement was materially misleading because

it omitted to state that XL Fleet was not in compliance with CARB regulations for post-January 2019 models because XL Fleet, as described

above, had failed to submit the testing and use data required under the existing Executive Orders. Pivotal’s amended registration

statements on Forms S-4/A filed on November 12, 2020, and December 4, 2020 also contained the same statement about the Executive Orders

as in the October 2, 2020 Form S-4, and omitted to disclose XL Fleet’s noncompliance with existing Executive Orders.

Sales Pipeline Conversion Rate

21. On

November 12, 2020, after Pivotal highlighted XL Fleet’s $220 million sales pipeline in previous filings as supporting its 2021 revenue

projection of $75 million, Pivotal filed an amended registration statement, proxy statement, and prospectus on Form S-4/A stating in relevant

part:

XL has a backlog of 961 firm purchase orders representing 12.3M

in revenue.... XL’s sales and marketing team uses a software tool [the CRM] to track all sales opportunities to existing and potential

customers, identifying specific vehicles and XL systems for such vehicles. This is used by XL management to create projections about future

aggregate sales pipeline opportunities for its existing products. XL management reviews its sales opportunity pipeline data and applies

its historic[al] conversion rates of sales pipeline and historical experience with respect to lead time to create revenue projections.

XL management believes that its revenue estimates and committed backlog are important indicators of expected future performance. (Emphasis

added.)

22. The

statement about the historical conversion rates of sales pipeline was materially misleading because XL Fleet did not use a historical

conversion rate of sales pipeline into revenues to estimate revenue projections, including XL Fleet’s projected revenue of $1.4

billion by 2024. XL Fleet’s officers used the software tool (CRM) to organize and motivate its sales efforts, and the tool was not

designed to be used – and was not in fact used – to project revenue. Although XL Fleet’s officers had directed its salespeople

to increase the sales pipeline by three to five times a given annual revenue target as a sales tool, XL Fleet did not calculate revenue

projections by multiplying a historical conversion or any other percentage rate to the sales pipeline number.

23. Pivotal

and XL Fleet’s claims to have applied a purported historical conversion rate of sales pipeline to project revenue provided misleading

support for XL Fleet’s 2021 revenue projection of $75 million, or roughly one-third of the $220 million sales pipeline, as they

created the impression that the projection was based on XL Fleet’s historical experience of converting one-third of its sales pipeline

into revenue. Further, these statements created the misleading impression that one-third of the sales pipeline in 2020 contained sales

opportunities that were at least more likely than not to result in sales, when in fact, as discussed above, the vast majority of the sales

opportunities at the time merely were speculative opportunities with as little as a 5% probability of resulting in a sale. Pivotal’s

amended Form S-4/A filed on December 4, 2020, and XL Fleet’s registration statement on Form S-1 filed on January 14, 2021, also

included these misleading statements about XL Fleet’s historical conversion rate.

Violations

24. As

a result of the conduct described above, the Commission finds that Respondent violated Sections 17(a)(2) and 17(a)(3) of the Securities

Act, which make unlawful for any person in the offer or sale of any securities, directly or indirectly, to obtain money or property by

means of any untrue statement of a material fact or any omission to state a material fact necessary in order to make the statements made,

in light of the circumstances under which they were made, not misleading, and to engage in any transaction, practice, or course of business

which operates or would operate as a fraud or deceit upon the purchaser.

25. As

a result of the conduct described above, the Commission finds that Respondent violated Section 14(a) of the Exchange Act and Rule 14a-9

thereunder, which make unlawful for any person to solicit any proxy in respect of any security by means of a proxy statement or other

communication containing a materially false or misleading statement.

26. As

a result of the conduct described above, the Commission finds that Respondent violated Section 13(a) of the Exchange Act and Rules 13a-11

and 12b-20 thereunder, which require every issuer of a security registered pursuant to Section 12 of the Exchange Act to file with the

Commission, among other things, current reports as the Commission may require, and require that Exchange Act reports contain such further

material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are

made, not misleading.

Respondent’s Remedial Efforts

27. In

determining to accept the Offer, the Commission considered remedial acts undertaken by Respondent and cooperation afforded the Commission

staff.

IV.

In view of the foregoing, the Commission deems

it appropriate and in the public interest to impose the sanctions agreed to in Respondent’s Offer.

Accordingly, it is hereby ORDERED that:

A. Pursuant

to Section 8A of the Securities Act, and Section 21C of the Exchange Act, Respondent cease and desist from committing or causing any violations

and any future violations of Sections 17(a)(2) and 17(a)(3) of the Securities Act, and Sections 13(a) and 14(a) of the Exchange Act and

Rules 12b-20, 13a-11, and 14a-9 thereunder.

B. Respondent

shall, within 10 days of the entry of this Order, pay a civil money penalty in the amount of $11,000,000 to the Securities and Exchange

Commission. The Commission may distribute civil money penalties collected in this proceeding if, in its discretion, the Commission orders

the establishment of a Fair Fund pursuant to 15 U.S.C. § 7246, Section 308(a) of the Sarbanes-Oxley Act of 2002. The Commission will

hold funds paid pursuant to this paragraph in an account at the United States Treasury pending a decision whether the Commission, in its

discretion, will seek to distribute funds or, subject to Exchange Act Section 21F(g)(3), transfer them to the general fund of the United

States Treasury. If timely payment is not made, additional interest shall accrue pursuant to 31 U.S.C. § 3717.

Payment must be made in one of the following ways:

| (1) | Respondent may transmit payment electronically to the Commission, which will provide detailed ACH transfer/Fedwire instructions upon

request; |

| (2) | Respondent may make direct payment from a bank account via Pay.gov through the SEC website at http://www.sec.gov/about/offices/ofm.htm;

or |

| (3) | Respondent may pay by certified check, bank cashier’s check, or United States postal money order, made payable to the Securities

and Exchange Commission and hand-delivered or mailed to: |

Enterprise Services Center

Accounts Receivable Branch

HQ Bldg., Room 181, AMZ-341

6500 South MacArthur Boulevard

Oklahoma City, OK 73169

Payments by check or money order must be accompanied

by a cover letter identifying Spruce as a Respondent in these proceedings, and the file number of these proceedings; a copy of the cover

letter and check or money order must be sent to D. Mark Cave, Associate Director, Division of Enforcement, Securities and Exchange Commission,

100 F Street N.E., Washington, DC 20549.

C. Regardless

of whether the Commission in its discretion orders the creation of a Fair Fund for the penalties ordered in this proceeding, amounts ordered

to be paid as civil money penalties pursuant to this Order shall be treated as penalties paid to the government for all purposes, including

all tax purposes. To preserve the deterrent effect of the civil penalty, Respondent agrees that in any Related Investor Action, it shall

not argue that it is entitled to, nor shall it benefit by, offset or reduction of any award of compensatory damages by the amount of any

part of Respondent’s payment of a civil penalty in this action (“Penalty Offset”). If the court in any Related Investor

Action grants such a Penalty Offset, Respondent agrees that it shall, within 30 days after entry of a final order granting the Penalty

Offset, notify the Commission’s counsel in this action and pay the amount of the Penalty Offset to the Securities and Exchange Commission.

Such a payment shall not be deemed an additional civil penalty and shall not be deemed to change the amount of the civil penalty imposed

in this proceeding. For purposes of this paragraph, a “Related Investor Action” means a private damages action brought against

Respondent by or on behalf of one or more investors based on substantially the same facts as alleged in the Order instituted by the Commission

in this proceeding.

By the Commission.

| |

Vanessa A. Countryman |

| |

Secretary |

8

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

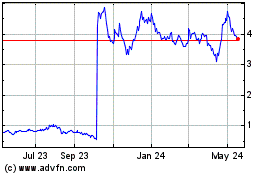

Spruce Power (NYSE:SPRU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spruce Power (NYSE:SPRU)

Historical Stock Chart

From Apr 2023 to Apr 2024