0001376793

false

2023

FY

0001376793

2022-07-01

2023-06-30

0001376793

2022-12-31

0001376793

2023-09-26

0001376793

2023-06-30

0001376793

2022-06-30

0001376793

2021-07-01

2022-06-30

0001376793

us-gaap:CommonStockMember

2021-06-30

0001376793

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001376793

us-gaap:RetainedEarningsMember

2021-06-30

0001376793

2021-06-30

0001376793

us-gaap:CommonStockMember

2022-06-30

0001376793

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001376793

us-gaap:RetainedEarningsMember

2022-06-30

0001376793

us-gaap:CommonStockMember

2021-07-01

2022-06-30

0001376793

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2022-06-30

0001376793

us-gaap:RetainedEarningsMember

2021-07-01

2022-06-30

0001376793

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001376793

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0001376793

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0001376793

us-gaap:CommonStockMember

2023-06-30

0001376793

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001376793

us-gaap:RetainedEarningsMember

2023-06-30

0001376793

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

CVAT:DesmetBallestraMember

2022-07-01

2023-06-30

0001376793

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

CVAT:EWMember

2022-07-01

2023-06-30

0001376793

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

CVAT:DesmetBallestraMember

2021-07-01

2022-06-30

0001376793

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

CVAT:EWMember

2021-07-01

2022-06-30

0001376793

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

CVAT:EWMember

2022-07-01

2023-06-30

0001376793

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

CVAT:EWMember

2021-07-01

2022-06-30

0001376793

us-gaap:LeaseholdImprovementsMember

2022-07-01

2023-06-30

0001376793

us-gaap:FurnitureAndFixturesMember

2022-07-01

2023-06-30

0001376793

us-gaap:OfficeEquipmentMember

2022-07-01

2023-06-30

0001376793

us-gaap:EquipmentMember

2022-07-01

2023-06-30

0001376793

us-gaap:OtherMachineryAndEquipmentMember

2022-07-01

2023-06-30

0001376793

us-gaap:StockOptionMember

2022-07-01

2023-06-30

0001376793

us-gaap:StockOptionMember

2021-07-01

2022-06-30

0001376793

us-gaap:WarrantMember

2022-07-01

2023-06-30

0001376793

us-gaap:WarrantMember

2021-07-01

2022-06-30

0001376793

CVAT:DesmetBallestraMember

CVAT:NanoReactorSalesMember

2022-07-01

2023-06-30

0001376793

CVAT:DesmetBallestraMember

CVAT:NanoReactorSalesMember

2021-07-01

2022-06-30

0001376793

CVAT:DesmetBallestraMember

CVAT:GrossProfitShareMember

2021-07-01

2022-06-30

0001376793

CVAT:DesmetBallestraMember

2021-07-01

2022-06-30

0001376793

CVAT:DesmetBallestraMember

2021-06-30

0001376793

CVAT:DesmetBallestraMember

2022-06-30

0001376793

CVAT:DesmetBallestraMember

2022-07-01

2023-06-30

0001376793

CVAT:DesmetBallestraMember

2023-06-30

0001376793

CVAT:AmeredevMember

2021-07-01

2022-06-30

0001376793

CVAT:AmeredevMember

CVAT:ReactorSalesMember

2021-07-01

2022-06-30

0001376793

CVAT:AmeredevMember

CVAT:UsageFeesMember

2021-07-01

2022-06-30

0001376793

CVAT:AmeredevMember

2021-07-01

2022-06-30

0001376793

CVAT:AmeredevMember

2022-06-30

0001376793

CVAT:AmeredevMember

2022-07-01

2023-06-30

0001376793

CVAT:AmeredevMember

CVAT:AnnualLossFromInvestmentMember

2022-07-01

2023-06-30

0001376793

CVAT:AmeredevMember

2022-07-01

2023-06-30

0001376793

us-gaap:EquityMethodInvestmentsMember

2021-06-30

0001376793

us-gaap:EquityMethodInvestmentsMember

2022-07-01

2023-06-30

0001376793

us-gaap:EquityMethodInvestmentsMember

2021-07-01

2022-06-30

0001376793

us-gaap:EquityMethodInvestmentsMember

2022-06-30

0001376793

us-gaap:EquityMethodInvestmentsMember

2023-06-30

0001376793

us-gaap:LeaseholdImprovementsMember

2023-06-30

0001376793

us-gaap:LeaseholdImprovementsMember

2022-06-30

0001376793

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001376793

us-gaap:FurnitureAndFixturesMember

2022-06-30

0001376793

us-gaap:OfficeEquipmentMember

2023-06-30

0001376793

us-gaap:OfficeEquipmentMember

2022-06-30

0001376793

us-gaap:EquipmentMember

2023-06-30

0001376793

us-gaap:EquipmentMember

2022-06-30

0001376793

us-gaap:OtherMachineryAndEquipmentMember

2023-06-30

0001376793

us-gaap:OtherMachineryAndEquipmentMember

2022-06-30

0001376793

CVAT:PPP2Member

2023-06-30

0001376793

CVAT:PPP2Member

2022-06-30

0001376793

CVAT:EIDLMember

2023-06-30

0001376793

CVAT:EIDLMember

2022-06-30

0001376793

CVAT:PPP2Member

2021-05-25

2021-05-26

0001376793

CVAT:PPPMember

2021-07-02

2021-07-31

0001376793

CVAT:PPP2Member

2021-07-01

2022-06-30

0001376793

CVAT:EIDLMember

2020-07-01

2020-07-31

0001376793

CVAT:EIDLMember

2023-05-01

2023-05-31

0001376793

CVAT:StockIssuedForServicesMember

2022-07-01

2023-06-30

0001376793

CVAT:CommonStockAndWarrantsMember

2021-07-01

2022-06-30

0001376793

CVAT:CashlessExerciseOfWarrantsMember

2021-07-01

2022-06-30

0001376793

CVAT:CashlessExerciseOfOptionsMember

2021-07-01

2022-06-30

0001376793

CVAT:FormerAccruedPayrollMember

2021-07-01

2022-06-30

0001376793

CVAT:OtherLiabilityMember

2021-07-01

2022-06-30

0001376793

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001376793

CVAT:WarrantsMember

2022-07-01

2023-06-30

0001376793

CVAT:WarrantsMember

2021-07-01

2022-06-30

0001376793

CVAT:ConsultantMember

2021-08-01

0001376793

us-gaap:StockOptionMember

2021-06-30

0001376793

us-gaap:StockOptionMember

2021-07-01

2022-06-30

0001376793

us-gaap:StockOptionMember

2022-07-01

2023-06-30

0001376793

us-gaap:StockOptionMember

2022-06-30

0001376793

us-gaap:StockOptionMember

2023-06-30

0001376793

us-gaap:WarrantMember

2021-06-30

0001376793

us-gaap:WarrantMember

2021-07-01

2022-06-30

0001376793

us-gaap:WarrantMember

2022-06-30

0001376793

us-gaap:WarrantMember

2022-07-01

2023-06-30

0001376793

us-gaap:WarrantMember

2023-06-30

0001376793

CVAT:WarrantPrice1Member

2023-06-30

0001376793

CVAT:WarrantPrice1Member

2022-07-01

2023-06-30

0001376793

CVAT:WarrantPrice2Member

2023-06-30

0001376793

CVAT:WarrantPrice2Member

2022-07-01

2023-06-30

0001376793

CVAT:WarrantPrice3Member

2023-06-30

0001376793

CVAT:WarrantPrice3Member

2022-07-01

2023-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934. FROM THE TRANSITION PERIOD FROM _____ TO _______. |

For the fiscal year ended June 30, 2023

Commission file number 000-53239

Cavitation Technologies, Inc.

(Exact name of Registrant as Specified in its

Charter)

| Nevada |

|

20-4907818 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

10019 CANOGA AVENUE, CHATSWORTH, CALIFORNIA 91311

(Address, including Zip Code, of Principal Executive Offices)

(818) 718-0905

(Registrant’s Telephone Number, Including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b)

OF THE ACT:

NONE

SECURITIES REGISTERED PURSUANT TO SECTION 12(g)

OF THE ACT:

| Title of Each Class: |

|

Name of Each Exchange on Which Registered: |

| Common Stock, $0.001 par value |

|

Over the Counter (Bulletin Board) |

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant

to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive

proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large

accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on

and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

No

State the aggregate market value of the voting and non-voting common

equity held by non-affiliates of the registrant by reference to the price at which the common equity was last sold, or of the average

bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal

quarter: $5,395,000 as of December 31, 2022 based on the closing price of $0.02 per share and 269,739,850 shares outstanding.

The

registrant had 284,289,740

shares of common stock outstanding on September 26,

2023.

DOCUMENTS INCORPORATED BY REFERENCE:

None

CAVITATION TECHNOLOGIES, INC.

FORM 10-K ANNUAL REPORT

FOR THE YEAR ENDED JUNE 30, 2023

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K and the exhibits

attached hereto contain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of

1995. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration

and development of our properties, plans related to our business and matters that may occur in the future. These statements relate to

analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions

of management. We use words like “expects,” “believes,” “intends,” “anticipates,” “plans,”

“targets,” “projects” or “estimates” in this annual report. When used, these words and other, similar

words and phrases or statements that an event, action or result “will,” “may,” “could,” or “should”

result, occur, be taken or be achieved, identify “forward-looking” statements. Such forward-looking statements are subject

to certain risks and uncertainties, both known and unknown, and assumptions.

Management has included projections and estimates

in this annual report, which are based primarily on management’s experience in the industry, assessments of our results of operations,

discussions and negotiations with third parties and a review of information filed by our competitors with the Securities and Exchange

Commission or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which

speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or

circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required

by law. We qualify all of the forward-looking statements contained in this annual report by the foregoing cautionary statements.

PART I

ITEM 1. BUSINESS

Cavitation Technologies, Inc. (referred to herein,

unless otherwise indicated, as “the Company,” “CTi,” “we,” “us,” and “our”)

is a Nevada corporation originally incorporated under the name Bio Energy, Inc. We are a process and product development firm that has

developed, patented, and commercialized environmentally friendly technology-based systems that are designed to serve large, growing,

global markets such as vegetable oil refining, renewable fuels, water treatment, wines and spirits enhancement, algae oil extraction,

water-oil emulsions and crude oil yield improvement. Our systems are designed to process industrial liquids at a reduced processing time,

lower operating cost, improved yield while operating in environmentally friendly manner. Our patented Nano Reactor® and LPN™

are the critical components of our business and we have generated all of our revenue while utilizing these components.

Vegetable Oil Refining

Our first commercial application for our technology

has been the CTi Nano Neutralization® System which has been utilized to improve edible vegetable oil refining process. Our

environmentally friendly process has been shown to reduce refining costs, increase oil yield, and limit the number of chemical additives

used in chemical refining of vegetables oils. This patented process (US Patent # 7,762,715 and # 8,042,989) is designed to be incorporated

into new and existing soybean, rapeseed, canola and palm vegetable oil refineries.

Our first pilot test of our CTi NANO Neutralization®

System was conducted in 2010 at Carolina Soya, a 200-metric ton/day crude soy oil refining plant in Estill, South Carolina. Our second

system, which became operational in fiscal 2011, has been continuously utilized since 2011 at the plant that processes approximately 450

metric tons per day of soy oil. Further, we have successfully shipped over 50 systems domestically and internationally. We also continuously

focus on developing additional Nano Reactor® applications and managing the intellectual property issues associated with new

processes and applications.

The global consumption of vegetable oils has grown

consistently at a rate of about 4.1% p.a. from 90.5 million metric tons (MMT) in 2001 to approximately 213 million metric tons (MMT) in

2021-2022. In 2021-2022 consumption of vegetable oil was 213.2 MMT compared to 206.4 MMT in 2020-2021, an increase approximately 3% (https://www.statista.com/statistics/263978/global-vegetable-oil-production-since-2000-2001/).

It is also a highly competitive commodity market in which the lowest-cost producer has the advantage.

Desmet Ballestra Agreement

On May 14, 2012, we signed a global R&D,

Marketing and Technology License Agreement with Desmet Ballestra Group s.a. (Desmet), a Belgian company that is actively marketing

the NANO Neutralization® System, the key component of which is our Nano Reactor® to soybean and other vegetable

oil refiners. The Agreement provided Desmet (licensee) a limited, exclusive license and right to develop, design and supply our NANO

Neutralization® System which incorporates Nano Reactor® devices on a global basis tools and fats and oleo chemical

applications. The agreement expired in May 2015.

On January 22, 2016, Desmet and the Company executed

a new three year License Agreement with essentially the same terms with the May 2012 agreement that was effective August 1, 2015. As part

of the agreement, Desmet provided, under certain conditions, limited monthly advance payments of $50,000 to be applied against gross profit

share from future sales. The agreement expired in August 2018.

On October 1, 2018, Desmet and the Company executed

a new three year License Agreement with essentially the same terms with the January 2016 agreement. As part of the agreement, Desmet provided

us under certain conditions, limited monthly advances of $50,000 through October 1, 2021, to be applied against gross profit share from

future sales. The agreement expired in October 2021.

On November 1, 2021, Desmet and the Company executed

a new three-year License Agreement with essentially the same terms with the January 2018 agreement. As part of the agreement, Desmet provides

the Company monthly advances of $40,000 through November 1, 2024, to be applied against from future reactor sales, however, the Company

is no longer entitled to gross profit share from future sales.

Desmet, together with its affiliates, is a global

engineering and equipment supply firm engaged in the development, design and supply of process equipment for oils and fats processing

facilities including vegetable oil refining, biofuel, oleo chemical, seed crushing, surfactant and detergent markets. Desmet supplies

these markets with services based on the latest globally sourced technologies. Desmet has relationships with major refiners globally A

significant portion of global vegetable oil refineries include major refiners such as Archer Daniels Midland Company, Cargill, Inc. and

Bunge Limited. Desmet has more than 40 sales representatives selling in North America, South America, Europe, and Asia. Since its founding

in 1946, Desmet reports that it has built a global network that includes 1,300 employees, 17 global and 8 representative offices, and

more than 6,000 lines in a variety of applications. Desmet operates a separate division for each of the above markets and the Desmet Oils

& Fats division has supplied small and large plants to approximately 1,900 oil millers in 150 countries, covering over 6,300 process

sections.

Along with Desmet, we have been working together

to accelerate appropriate sales goals and installation process. Our CTi Nano Neutralization® Systems is designed to be used

as an add-on process to an existing neutralization system within soybean and other vegetable oil refineries. Desmet’s focus has

been on marketing our CTi Nano Neutralization® Systems to vegetable oil refiners to help them increase profits through cost

savings and improved oil yields. Desmet purchases our CTi Nano Neutralization® Systems from us and installs them at the refinery

as part of an integrated neutralization system. Based on successful commercial implementations, Desmet guarantees minimum economic benefits

to a facility that installs our CTi Nano Neutralization® Systems. We are therefore substantially dependent on Desmet to identify

prospects, complete sales contracts, install the system and manage relationships with end-users.

Additionally, in fiscal 2017 Desmet installed

our first Nano Reactor® at a bio-diesel production plant in South America. Bio-diesel industry has been under pricing pressure

for a considerable period of time and slow to adopt to newer technologies. We are continuously working with Desmet pursuing additional

sales opportunities in Asia and South America, however, the acceptance of our technology has been slow and there were no sales generated

in our Fiscal 2023 and 2022.

Enviro Watertek, LLC

In April 2019, the Company and Delaware Water

Company, LLC (Delaware) formed a limited liability company called Enviro WaterTek LLC (“Enviro” ,“EW”). Enviro

is owned 50% by the Company and 50% by Delaware, and the Company accounts for its investment in Enviro under the equity method of accounting.

From 2019 to 2023, Enviro had insignificant operations. This agreement covers our first commercial entrance into industrial treatment

of produced and frac water. Fracking industry has seen a significant growth over the past ten years, reaching daily water consumption

volume of over 58 million barrels per day. Our newly designed Low Pressure Nano Reactor (LPN™) was specifically developed

to be integrated into produced water treatment system along with our proprietary chemical formulations, and has depicted measurable and

quantifiable advantages over industry standard processes and equipment. Our agreement with EW provides for sales on LPN™

plus recurring revenue stream based on processing of produced and frac water volumes and utilization. Our agreement with EW has a fifteen-year

term. In March 2020, global pandemic of COVID-19 has taken an unexpected negative impact on the oil and gas industry worldwide, and has

consequently impaired our ability to rapidly accelerate LPN™ sales and recurring revenue stream. While the industry has gone

through a major overhaul, we are seeing a gradual recovery in the industry. Our current system installations can handle approximately

25,000 barrels per day (BPD), and we received $20,000 and $46,000 in total revenue in Fiscal 2023 and 2022, respectively, from sale of

reactors and usage fee.

Alchemy Beverages, Inc

In fiscal 2014, Roman Gordon, one of our shareholders

and a former officer, formed a company, Cameo USA LLC (Cameo). Since its formation, Cameo has had no revenue, no operations, and has had

no assets or liabilities. On June 4, 2018, Mr. Gordon contributed his 100% interest in Cameo to Cavitation Technologies, Inc. As Mr. Gordon

had no reasonable and objectively supportable basis in the valuation of his investment in Cameo, there was no value assigned to the contribution

of Cameo.

On June 29, 2018, we agreed to license Cameo to

Alchemy Beverages Inc. (“ABI”). In addition, we have agreed to provide certain licensing rights related to our miniature low

pressure nano-reactor (MLPN) to be used in developing and manufacturing of small home appliances to enhance alcoholic beverages. In consideration

for these ABI has agreed to issue 19.9% of ABI’s outstanding common shares to us (limited to 20 million shares of ABI). ABI is a

private company and in the business of producing and selling alcoholic beverages, equipment, and home appliances. Prior to this agreement,

ABI was independent of CTI and had no relation to us nor to our management.

Pursuant to the licensing agreements, ABI will

have the exclusive global marketing and distribution rights of Cameo and our patented and patent pending technologies for the processing

of alcoholic beverages. We have agreed to assist in the installation and maintenance of the MLPN to ABI and will receive royalty payments

ranging from 1% to 3% on all net revenues, as defined in our license agreement for the life of the applicable patents. In addition, we

will receive leasing, consulting, and manufacturing fees as defined in the licensing agreement.

As of June 30, 2023 and the date of this report,

ABI has not generated any sales under Cameo brand. Since June 2018, the Company and ABI have developed a small table top home appliance

unit Barmuze® utilizing MLPN , allowing consumers to experience a new way of enjoying wines and spirits, utilizing CTi’s patented

and patent pending technologies to molecularly restructure alcohol, convert harsh acids to pleasant tasting esters, and reduce levels

of certain impurities commonly present in alcohol.

During fiscal 2022 and 2021, we have received

approval for several patent applications, protecting our technology and processing rights, expanding our broad portfolio of patents.

During fiscals 2023 and 2022, there were no sales

or royalties generated pertaining to our agreement with Alchemy Beverages, Inc. The investment in ABI has no value assigned to it, which

approximates its fair value.

Customers Dependence

We continue to sell our industrial capacity Nano

Reactor® and Nano Neutralization® System through our strategic partner Desmet and most of our revenue for the

fiscal years ended June 30, 2023 and 2022, was derived from sales of reactors to Desmet and the corresponding gross profit share. We

have generated minimal revenue pertaining to our licensing agreement with EW in our fiscal 2023. We had no revenue of LPN™

due to COVID-19, whereas oil production in US has negative impact on oil & gas industry. Oil and gas industry has seen a

recovery, while price of oil has spiked to around $100 per barrel, and we foresee a great opportunity for our technology providing a

significant upside potential both at the point of sale and recurring revenue stream.

Sources and availability of raw materials and

the names of principal suppliers

We have historically sourced reactor components

from various domestic and international suppliers. We do not have any long-term contracts, agreements, or commitments with any supplier.

We believe it would take approximately 30 days to find a new supplier, if necessary.

Competition

Our competitors who sell equipment and engineering

services for the vegetable oil refining business are a myriad of companies both large and small that provide equipment and technology

to oil refiners. These include known companies that have longer operating histories, more experience, and stronger financial capabilities.

Competitors include Alfa Laval, and Crown Iron Works as well as many firms that provide advice and services to small and regional firms.

In addition, Arisdyne Systems, a designer of cavitation devices, is marketing a system using similar technology. The vegetable oil refining

business is a highly competitive commodity market in which the lowest-cost producer has the advantage. We intend to compete by offering

solutions that help our clients remain or become a low-cost producer. Because the industry in which we compete has had limited new technology

introduced in the last 50 years, we believe our CTi Nano Neutralization® Systems provide a unique opportunity for refiners

to increase margins. We seek to differentiate ourselves by offering solutions based on our proprietary and patented designs, processes,

and applications to help our clients described in our issued and patent pending applications. We compete by offering solutions that we

believe can reduce operating expenses and increase oil yield vs currently applied technologies.

In addition, our competitors in produced and frac

water treatment application range from local service providers to multi-national global corporations with considerable financial resources,

engineering expertise, established and proven technologies. We believe that LPN™ is a conceptually new technology that has

not been introduced in the field of water treatment applications up to now. LPN™ has demonstrated exceptional results in

treating produced and frac water commercially, significantly reducing the usage of hazards chemicals during the process, meanwhile, achieving

desirable water quality for industrial re-use or disposal.

Patents

Our Cavitation Generator patent was issued during

fiscal 2011. In addition, we have a patent for our Multi-Stage Cavitation Device Nano Reactor® that was issued on October 25,

2011. In the fiscal 2014 we received approvals for another apparatus patent and 2 additional process patents in the US. As of June 30,

2023, our portfolio of patents included 19 issued patents in the United States and 12 issued patents internationally. Our patents cover

multiple process and applications of our technology in vegetable oil refining, production of biodiesel, treatment of process and industrial

water, upgrade of hydrocarbons and enhancing of alcoholic beverages. We continuously develop new technologies and applications, as we

have filed new patent applications for Low Pressure Nano-Reactors LPN™. LPN™ is a highly efficient homogenizer

and emulsifier that can be utilized in multiple fluids processing applications. Recently, we have filed a patent application for a small

home appliance. This new product is designed directly with consumer in mind and the first step for our company to introduce our technology

outside of the industrial sector where we typically sell our products.

Issued

| US |

|

Cavitation Generator |

|

7,762,715 |

| |

|

|

|

|

| US |

|

Multi-Stage Cavitation Device |

|

8,042,989 |

| |

|

|

|

|

| US |

|

Process for Producing Biodiesel Through Lower Molecular Weight Alcohol-Targeted Cavitation |

|

8,603,198 |

| |

|

|

|

|

| US |

|

High-Throughput Cavitation and Electro Coagulation Apparatus |

|

8,673,129 |

| |

|

|

|

|

| US |

|

Extraction of Oil from Algae by Hydrodynamic Cavitation for Biodiesel Production |

|

8,709,750 |

| |

|

|

|

|

| US |

|

Flow-Through Cavitation-Assisted Rapid Modification of Crude Oil |

|

8,894,273 |

| |

|

|

|

|

| US |

|

Method for Cavitation-Assisted Refining, Degumming and Dewaxing of Oil and Fat |

|

8,911,808 |

| |

|

|

|

|

| US |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

8,945,644 |

| |

|

|

|

|

| US |

|

Process for Producing Biodiesel Through Lower Molecular Weight Alcohol-Targeted Cavitation |

|

8,981,135 |

| |

|

|

|

|

| US |

|

Process for Removing Waxes and Phospholipids from Vegetable Oils and Increasing Production of Food Grade Lecithin Therefrom |

|

9,357,790 |

| |

|

|

|

|

| US |

|

Method and Flow Through Hydrodynamic Cavitational Apparatus for Alterations of Beverages |

|

9,474,301 |

| |

|

|

|

|

| US |

|

Method for Cavitation-Assisted Refining, Degumming and Dewaxing of Oil and Fat |

|

9,481,853 |

| |

|

|

|

|

| US |

|

Process for Extracting Carbohydrates from Biomass and Converting the Carbohydrates into Biofuels |

|

9,611,496 |

| |

|

|

|

|

| US |

|

Flow-Through Cavitation-Assisted Rapid Modification of Crude Oil |

|

9,719,025 |

| |

|

|

|

|

| US |

|

Processes for Increasing Bioalcohol Yield from Biomass |

|

9,944,964 |

| |

|

|

|

|

| US |

|

Processes for Increasing Bioalcohol Yield from Biomass |

|

9,988,651 |

| |

|

|

|

|

| US |

|

Processes for Extracting Carbohydrates from Biomass and Converting the Carbohydrates into Biofuels |

|

10.093.953 |

| |

|

|

|

|

| US |

|

Variable Flow Through Cavitation Device |

|

10,507,442 |

| US |

|

System and Method for Purification of Drinking Water, Ethanol and Alcohol Beverages of Impurities |

|

10,781,113 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Ar AR083000B1 |

| |

|

|

|

|

| Int’l |

|

Cavitation Generator |

|

Br - PI0919602-1 |

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Ca - 2,809,236 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Malaysia MY164311A |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Mexico – MX/E/2013/015504 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Singapore P187241 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Mexico – MX/a/2016/006201 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

EU 10 857 392.4 |

| |

|

|

|

|

| Int’l |

|

Method for Cavitation-Assisted Refining, Degumming and Dewaxing of Oil and Fat |

|

Br PI0919602-1 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Fr E 2 616 156 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

Gr 2 616 156 |

| |

|

|

|

|

| Int’l |

|

Process to Remove Impurities from Triacylglycerol Oil |

|

UK 2 616 156 |

| |

|

|

|

|

| US |

|

System and Method for Purification of Alcohol

Beverages of Impurities |

|

US 10781113

|

| |

|

|

|

|

| US |

|

Method and Device for Producing of High-Quality

Alcoholic Beverages |

|

US 10876084

|

Patent Pending Update

| US |

|

Tabletop Beverage Cavitation Device |

| |

|

|

| US |

|

Method for Purification of Drinking Water, Ethanol and Alcohol Beverages of Impurities |

| |

|

|

| US |

|

Process for Increasing Plant Protein Yield from Biomass |

| |

|

|

| Br |

|

Process to Remove Impurities from Triacylglycerol Oil |

| |

|

|

| Eu |

|

System and Method for Purification of Drinking Water, Ethanol and Alcohol Beverages of Impurities |

| |

|

|

| Br |

|

Process to Remove Impurities from Triacylglycerol Oil |

We plan on continuing to invest in research and

development and file for new and improved patents.

Royalty Agreements

On July 1, 2008, our wholly owned subsidiary entered

into Patent Assignment Agreements with two parties, our President as well as our former Chief Executive Officer (CEO) who currently serves

as our Technology Senior Manager, where certain devices and methods involved in our hydrodynamic cavitation processes invented by the

President and former CEO/current Technology Senior Manager have been assigned to the subsidiary. In exchange, that subsidiary agreed to

pay a royalty of 5% of gross revenues to each of the President and former CEO/current Technology Senior Manager for licensing of the technology

and leasing of the related equipment embodying the technology. These agreements were subsequently assumed by us on May 13, 2010, from

our subsidiary. Our former CEO/current Technology Senior Manager and President both waived their rights to receive royalty payments

that have accrued, or that may accrue, on any gross revenue generated through June 30, 2023.

On April 30, 2008 and as amended on November 22,

2010, our wholly owned subsidiary entered into an employment agreement with its former Director of Chemical and Analytical Department

(the “Inventor”) to pay, in the first year, an amount equal to 5% of actual gross revenue received by us on any patent for

which the Inventor was a legally named inventor, and, in each subsequent year, 3% of actual gross revenue received by us on any such patent.

Since entering into that employment agreement, and during the term of this employment agreement, we have not received any revenue on any

patents for which the Inventor was a legally named inventor.

Governmental Approval and Regulations and Environmental

Compliance

Due to the nature of our products, we have incurred

no costs with respect to environmental compliance with federal, state, and local laws. To our knowledge, our products do not require governmental

approval, and we do not foresee that governmental regulations will have a material impact on our business.

Employees

As of June 30, 2023, we had four full-time employees

and had engaged several consultants and independent contractors over the past year. Members of our technical team are comprised of experienced

professionals who are chemists, civil, chemical, and mechanical engineers with expertise in hydrodynamic cavitation, nano technology and

water treatment. These individuals hold degrees in Civil, Chemical, and Mechanical Engineering.

Research and Development Expenditures

During the fiscal years ended June 30, 2023 and

2022, we spent $3,000 and $17,000, respectively, on research and development activities.

ITEM 1A. RISK FACTORS

Not applicable for smaller reporting companies.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our corporate headquarter is located in Chatsworth,

California, with an area of approximately 5,000 square foot facility, which includes office space and an area to conduct research and

development. Our lease agreement for this space will end in February 2025. Our monthly rent payments approximate $6,000 up to $7,000.

We do not anticipate any material difficulties with the renewal of our rental agreement when it expires or in securing replacement facilities

on commercially reasonable terms.

ITEM 3. LEGAL PROCEEDINGS

The Company may be involved in certain legal proceedings

that arise from time to time in the ordinary course of its business. The Company records accruals for contingencies to the extent that

management concludes that the occurrence is probable and that the related amounts of loss can be reasonably estimated. Legal expenses

associated with the contingency are expensed as incurred.

The Company is not aware of any pending litigations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S

COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

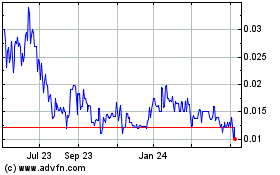

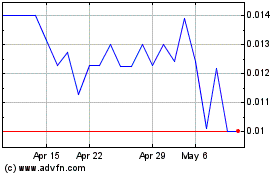

Our Common Stock is traded on the OTCQB Market

under the symbol CVAT. The following table sets forth the high and low price per share based on the closing price of our Common Stock

for the periods indicated.

| | | |

| |

HIGH | | |

LOW | |

| | | |

| |

| | |

| |

| | Fiscal 2022 | | |

First Quarter | |

$ | 0.11 | | |

$ | 0.05 | |

| | | | |

Second Quarter | |

| 0.12 | | |

| 0.06 | |

| | | | |

Third Quarter | |

| 0.12 | | |

| 0.04 | |

| | | | |

Fourth Quarter | |

| 0.06 | | |

| 0.04 | |

| |

|

|

|

HIGH |

|

|

LOW |

|

| |

|

|

|

|

|

|

|

|

| Fiscal 2023 |

|

First Quarter |

|

$ |

0.05 |

|

|

$ |

0.04 |

|

| |

|

Second Quarter |

|

|

0.04 |

|

|

|

0.02 |

|

| |

|

Third Quarter |

|

|

0.03 |

|

|

|

0.01 |

|

| |

|

Fourth Quarter |

|

|

0.03 |

|

|

|

0.01 |

|

We became a public company through a share exchange

that was affected in October 2008. The first day of public trading of our stock was November 11, 2008. Since our fiscal year end was changed

to June 30, public trading of our stock began in the second quarter of fiscal 2009. As of September 23, 2023, there were approximately

100 holders of record of our Common Stock. This does not reflect the number of persons or entities who hold stock in nominee or “street”

name through various brokerage firms. The closing price of our common stock on September 23, 2023 was $0.02.

Dividend Policy

We have neither declared nor paid any dividends

on our Common Stock in the preceding two fiscal years. We currently intend to retain future earnings, if any, to fund ongoing operations

and finance the growth and development of our business and, therefore, do not anticipate declaring or paying cash dividends on our Common

Stock for the foreseeable future. Any future decision to declare or pay dividends will be at the discretion of the Board of Directors

and will be dependent upon our financial condition, results of operations, capital requirements, and such other factors as the Board of

Directors deems relevant.

Securities Authorized for Issuance under Equity

Compensation Plans

None.

Recent Sales of Equity Securities and Use of

Proceeds

We have not sold equity securities during the

years ended June 30, 2023 and 2022.

Issuer Purchases of Equity Securities

None.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable for smaller reporting companies.

ITEM 7. MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should

be read in conjunction with our financial statements and the related notes. This discussion contains forward-looking statements based

upon current expectations that involve risks and uncertainties, such as its plans, objectives, expectations and intentions. Its actual

results and the timing of certain events could differ materially from those anticipated in these forward-looking statements.

Overview of Our Business

We are a Nevada corporation originally incorporated

under the name Bio Energy, Inc. On January 29, 2007, we incorporated a wholly owned subsidiary, Hydrodynamic Technology, Inc. as a California

corporation.

We have developed, patented, and commercialized

proprietary technology that can be used for processing of various industrial and consumer-oriented fluids. Our patented Nano Reactor®

is the critical components of the CTi Nano Neutralization® System which has been shown to reduce operating costs and increase

yields in processing oils and fats. CTi holds and applied for numerous patents covering technology and various processes in US and Internationally,

covering vegetable and crude oil refining, processed and frac water treatment, algae oil extraction, and alcoholic beverage enhancement.

During our Fiscal 2022, we have continuously worked on developing additional technologies and products related to low pressure nano reactor

(LPN™). LPN™ is designed to become a highly efficient mixer and homogenizer. We believe that LPN™

has a great commercial utilization opportunity by providing efficient and cost-effective solution in multiple fluid processing industries.

LPN™ has a number of advantages over current mechanically operated mixers and homogenizers. Industrial application of our

technology in produced and frac water treatment system, LPN™ along with our proprietary chemical formulations have depicted

measurable and quantifiable advantages over industry standard processes and equipment. Additionally, our miniature low pressure nano reactor

MLPN has become an integral part of Barmuze®, a small home appliance device for enhancing taste and extracting unwanted impurities

typically present in alcoholic beverages.

During the year ended June 30, 2023, we recorded

revenue of $433,000 and incurred a net loss of $2,040,000, respectively.

Inflation and potential recession

We are, and our suppliers are experiencing significant

broad-based inflation of manufacturing and distribution costs as well as transportation challenges, partially as a result of the pandemic.

Although we do not believe that inflation has had a material effect on our business, financial condition or results of operations, it

may in the future. We are monitoring cost structures and evaluating to what extent any such costs can be passed on to customers, taking

into account the overall impact of increasing inflation and interest rate pressures on consumers. We expect input cost inflation to continue

at least throughout 2023. If we are unable to successfully manage the effects of inflation, our business, operating results, cash flows

and financial condition may be adversely affected. Additionally, there have been various economic indicators that the United States economy

may be entering a recession in upcoming quarters. An economic recession could potentially impact the general business environment and

the capital markets, which may have a material negative impact on our financial results.

Management’s Plan of Operation

We are continuously engaged in manufacturing of

our Nano Reactor® and Nano Neutralization® Systems which are designed to help refine vegetable oils such as soybean,

canola and rapeseed. Additionally, we have developed LPN™’s that provide commercial opportunity in industrial water

treatment, enhancement of alcoholic beverages, and MLPN being utilized in a consumer small home appliance.

During the year ended June 30, 2023, we incurred

net loss of $2,040,000 and used cash in operating activities of $423,000. As of June 30, 2023, we have a working capital deficiency of

$846,000 and a stockholders’ deficit of $919,000.

Management’s plan is to generate income

from operations by licensing our technology globally through Desmet Ballestra Group (Desmet), agreements with EnviroWaterTek and Alchemy

Beverages, Inc. In October 2018, we signed a three-year global R and D, Marketing and Technology License Agreement with Desmet

for the sale and licensing of our Nano Reactor® and Nano Neutralization® Systems. This agreement is a continuation

of the original agreement we signed with Desmet in May 2012. As part of the agreement, Desmet is also obligated to provide us with monthly

advances of $40,000 to be applied against the sale of reactors. During the year ended June 30, 2023, advances received from Desmet amounted

to $724,000 and revenues totaled $413,000. These funds service operational expenses on monthly basis.

There was no revenue produced in relationship

to our agreement with Alchemy Beverages, Inc.

We anticipate that we may need additional funding,

and we may attempt to raise additional debt and/or equity financing to fund operations and to provide additional working capital. However,

there is no assurance that such financing will be consummated or obtained in sufficient amounts necessary to meet our needs, or that we

will be able to meet our future contractual obligations. Should management fail to obtain such financing, we may curtail its operations.

Critical Accounting Policies and Revenue Recognition

Our discussion and analysis of our financial condition

and results of operations are based upon our consolidated financial statements which have been prepared in accordance with accounting

principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires management

to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and the reported amounts of revenues

and expenses. The accounting policies and estimates described below are those we consider most critical in preparing its consolidated

financial statements. The following is a review of the accounting policies and estimates that include significant judgments made by management

using information available at the time the estimates are made. However, these estimates could change materially if different information

or assumptions were used instead.

Note 1 of the accompanying consolidated financial

statements includes a summary of significant accounting policies, estimates, and methods used in the preparation of our financial statements.

Accounting estimates are an integral part of the preparation of financial statements and are based on judgments by management using its

knowledge and experience about the past and current events and assumptions regarding future events, all of which we consider to be reasonable.

These judgments and estimates reflect the effects of matters that are inherently uncertain and that affect the carrying value of our assets

and liabilities, the disclosure of contingent liabilities and reported amounts of expenses during the reporting period.

Revenue Recognition

The Company follows the guidance of Accounting

Standards Codification (ASC) 606, Revenue from Contracts with Customers. ASC 606 creates a five-step model that requires entities

to exercise judgment when considering the terms of contracts, which includes (1) identifying the contracts or agreements with a customer,

(2) identifying our performance obligations in the contract or agreement, (3) determining the transaction price, (4) allocating the transaction

price to the separate performance obligations, and (5) recognizing revenue as each performance obligation is satisfied. The Company only

applies the five-step model to contracts when it is probable that the Company will collect the consideration it is entitled to in exchange

for the services it transfers to its clients.

Revenue from sale of our Nano Reactor®

and LPN™ is recognized when products are shipped from our manufacturing facilities as this is our sole performance obligation

under these contracts and we have no continuing obligation to the customer.

The Company also recognizes revenue from its share

of gross profit to be earned from distributors, as defined, which we treat as variable consideration and recognize using the most likely

amount method. Estimates are available from our distributor which are considered in the determination of the most likely amount. However,

given the lack of control over the sale to the end customer and the lack of history of prior sales, the amount of gross profit revenue

recognized is limited to the actual amount of cash received under the contract which the Company has determined is not refundable and

that a significant future reversal of cumulative revenue under the contract will not occur.

In addition, the Company also recognizes revenues

from usage fees of certain reactors. Usage fees are recognized based on actual usage by the customer.

Leases

The Company accounts for leases under guidance

of Accounting Standards Codification (“ASC”) 842, which requires an entity to recognize a right-of-use asset and a lease liability

for virtually all leases. Leases with an initial term of 12 months or less are not recorded on the balance sheet. The Company accounts

for the lease and non-lease components of its office lease as a single lease component. Lease expense is recognized on a straight-line

basis over the lease term.

Equity Method Investment

The Company accounts for investments in entities

in which the Company has significant influence over the entity’s financial and operating policies, but does not control, using the

equity method of accounting. The equity method investments are initially recorded at cost, and subsequently increased for capital contributions

and allocations of net income, and decreased for capital distributions and allocations of net loss. Equity in net income (loss) from the

equity method investment is allocated based on the Company’s economic interest. The Company assesses its investment in equity method

investments for recoverability, and if it is determined that a loss in value of the investment is other than temporary, the Company writes

down the investment to its fair value. Based on Management’s assessment, the value of its equity method investment was impaired

as of June 30, 2023 and as such, recorded an impairment charge of $1,112,000. As of June 30, 2023, the remaining value of its investments

was $1,000.

Share-Based Compensation

The Company periodically issues stock options

and warrants to employees and non-employees in non-capital raising transactions for services and for financing costs. The Company accounts

for stock option and warrant grants issued and vesting to employees based on the authoritative guidance provided by the Financial Accounting

Standards Board whereas the value of the award is measured on the date of grant and recognized over the vesting period. The Company accounts

for stock option and warrant grants issued and vesting to non- employees in accordance with the authoritative guidance of the Financial

Accounting Standards Board whereas the value of the stock compensation is based upon the measurement date as determined at either a) the

date at which a performance commitment is reached, or b) at the date at which the necessary performance to earn the equity instruments

is complete. Non-employee stock-based compensation charges generally are amortized over the vesting period on a straight-line basis. In

certain circumstances where there are no future performance requirements by the non-employee, option grants are immediately vested and

the total stock-based compensation charge is recorded in the period of the measurement date.

Recent Accounting Pronouncements

See Note 1 of the financial statements for discussion

of recent accounting pronouncements.

Results of Operations

Below is summary comparing fiscal 2023 and fiscal

2022.

| | |

For the Years Ended | | |

| | |

| |

| | |

June 30, | | |

| | |

| |

| | |

2023 | | |

2022 | | |

$ Change | | |

% Change | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 413,000 | | |

$ | 1,619,000 | | |

$ | (1,186,000 | ) | |

| (74 | )% |

| Revenue-related party | |

| 20,000 | | |

| 46,000 | | |

| (26,000 | ) | |

| (57 | )% |

| Cost of revenue | |

| (121,000 | ) | |

| (41,000 | ) | |

| (80,000 | ) | |

| 195% | |

| Gross profit | |

| 312,000 | | |

| 1,624,000 | | |

| (1,312,000 | ) | |

| (81 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 1,195,000 | | |

| 1,728,000 | | |

| (533,000 | ) | |

| (31 | )% |

| Impairment of equipment | |

| – | | |

| 178,000 | | |

| (178,000 | ) | |

| (100 | )% |

| Research and development expenses | |

| 3,000 | | |

| 17,000 | | |

| (14,000 | ) | |

| (82 | )% |

| Total operating expenses | |

| 1,198,000 | | |

| 1,923,000 | | |

| (725,000 | ) | |

| (38 | )% |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (886,000 | ) | |

| (299,000 | ) | |

| (587,000 | ) | |

| 196% | |

| | |

| | | |

| | | |

| | | |

| | |

| Gain on forgiveness of PPP Loan | |

| – | | |

| 104,000 | | |

| (104,000 | ) | |

| (100 | )% |

| Loss on settlement of liabilities | |

| – | | |

| (371,000 | ) | |

| 371,000 | | |

| (2,292 | )% |

| Loss from equity method investment | |

| (1,148,000 | ) | |

| (48,000 | ) | |

| (1,100,000 | ) | |

| (100 | )% |

| Interest expense | |

| (6,000 | ) | |

| (5,000 | ) | |

| (1,000 | ) | |

| 20% | |

| Net income (loss) | |

$ | (2,040,000 | ) | |

$ | (619,000 | ) | |

$ | (1,422,000 | ) | |

| 230% | |

Revenue

During the year ended June 30, 2023, revenue decreased

to $433,000 due primarily from reduced sales of our Nano Reactor® and CTi Nano Neutralization Systems to Desmet of $413,000.

In addition, the Company also recorded an aggregate revenue of $20,000 from water processing usage fees to Enviro Watertek, LLC.

During the year ended June 30, 2022, our revenue

was $1,665,000 and it was derived from the sale of our Nano Reactor® and CTi Nano Neutralization Systems to Desmet of

$592,000 and share in gross margin share of $1,027,000, of which, the Company is no longer entitled in fiscal 2023. In addition, we recorded

an aggregate revenue of $46,000 from the sale of LPN™ and water processing usage fee to Enviro Watertek, LLC.

Cost of Sales

During the year ended June 30, 2023 and June 30,

2022, cost of sales was $121,000 and $41,000, respectively, an increase of $80,000. 60%, or $48,000, of the increase was associated with

the Company writing off inventory determined no longer sellable and the remaining $32,000 was for services associated with our sales to

Desmet.

Operating Expenses

Operating expenses for fiscal 2023 amounted to

$1,198,000 versus $1,923,000 in fiscal 2022, a decrease of $725,000 or 38%. The decrease in operating expenses was attributed to a decrease

in advertising expenses of $63,000 a decrease in consulting fees of $33,000, legal fees of $17,000, accounting fees of $12,000, non-cash

stock based compensation expense of $66,000, and payroll expenses of $322,000. In addition, there was an impairment charge of $178,000

on equipment in fiscal 2022 that did not occur in fiscal 2023. The decrease in Research and Development expenses of $14,000 was offset

by increases in various professional service fees paid during the fiscal 2023 year.

Operating expenses for fiscal 2022 amounted to

$1,923,000 versus $1,285,000 in fiscal 2021, an increase of $638,000 or 50%. The increase in operating expenses was attributed to an increase

in advertising expenses of $95,000, an impairment charge of $178,000 on equipment, an increase in consulting fees of $99,000, an increase

in legal fees of $54,000, non-cash stock based compensation expense of $352,000.

Net Loss

Our reporting net loss in fiscal 2023 was $2,040,000

compared to $619,000 in fiscal 2022.

Liquidity and Capital Resources

Our cash balance at June 30, 2023 was $18,000,

a decrease of $423,000 compared to $441,000 at June 30, 2022.

For the year ended June 30, 2023 cash used in

operating activities was $423,000.

For the year ended June 30, 2022 cash used in

operating activities was $484,000, cash used in investing activities was $1,223,000, and cash provided by financing activities was $785,000.

Going concern

During the year ended June 30, 2023, we incurred

a net loss of $2,040,000 and used cash in operating activities of $423,000. These factors, among others, raise substantial doubt about

our ability to continue as a going concern within one year of the date that the financial statements are issued. In addition, the Company’s

independent registered public accounting firm, in its report on our June 30, 2023 financial statements, has raised substantial doubt about

the Company’s ability to continue as a going concern. The Company’s financial statements do not include any adjustments that

might result from the outcome of this uncertainty be necessary should we be unable to continue as a going concern.

Management’s plan is to generate income

from operations by continuing to license its technology globally, including our agreements with EW and ABI.

We may also attempt to raise additional debt and/or

equity financing to fund operations and to provide additional working capital. There is no assurance that such financing will be available

in the future or obtained in sufficient amounts necessary to meet our needs, that we will be able to achieve profitable operations or

that we will be able to meet our future contractual obligations. Should management fail to obtain such financing, we may curtail its operations.

Off-balance Sheet Arrangements

We have no off-balance sheet arrangements that

have or are reasonably likely to have a current or future effect on its financial condition, revenues or expenses, results of operations,

liquidity, capital expenditures or capital resources.

ITEM 7A. Quantitative and Qualitative

Disclosures about Market Risk.

Not applicable for Smaller Reporting Companies.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Stockholders and Board of Directors

Cavitation Technologies, Inc.

Chatsworth, CA

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated

balance sheets of Cavitation Technologies, Inc. (the “Company”) as of June 30, 2023 and 2022, the related consolidated statements

of operations, changes in stockholders’ equity (deficit), and cash flows for the years then ended, and the related notes (collectively

referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly,

in all material respects, the financial position of the Company as of June 30, 2023 and 2022, and the results of their operations and

their cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Going Concern

The accompanying consolidated financial statements

have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1, the Company has incurred recurring

operating losses, used cash in operations since inception and has a stockholders’ deficit at June 30, 2023. These matters raise

substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters

are also described in Note 1 to the financial statements. These consolidated financial statements do not include any adjustments that

might result from the outcome of this uncertainty.

Basis for Opinion

These consolidated financial statements are the

responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial

statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United

States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated

financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding

of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess

the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures

that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the

financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management,

as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for

our opinion.

Critical Audit Matter

Critical audit matters

are matters arising from the current-period audit of the financial statements that were communicated or required to be communicated to

the audit committee and that (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our

especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

We have served as the Company’s auditor

since 2013.

/s/ Weinberg & Company, P.A.

Los Angeles, California

October 3, 2023

PCAOB

#572

572

CAVITATION TECHNOLOGIES, INC.

CONSOLIDATED BALANCE SHEETS

| | |

| | |

| |

| | |

June 30,2023 | | |

June 30, 2022 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 18,000 | | |

$ | 441,000 | |

| Accounts receivable | |

| – | | |

| 1,000 | |

| Inventory | |

| – | | |

| 48,000 | |

| Prepaid expenses | |

| – | | |

| 38,000 | |

| Total current assets | |

| 18,000 | | |

| 528,000 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,000 | | |

| 4,000 | |

| Equity method investment | |

| 1,000 | | |

| 1,149,000 | |

| Operating lease right-of-use asset | |

| 113,000 | | |

| 180,000 | |

| Other assets | |

| 10,000 | | |

| 10,000 | |

| Total assets | |

$ | 143,000 | | |

$ | 1,871,000 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 120,000 | | |

$ | 135,000 | |

| Accrued payroll and payroll taxes – related parties | |

| 280,000 | | |

| 280,000 | |

| Notes payable | |

| 5,000 | | |

| – | |

| Customer advances | |

| 391,000 | | |

| 80,000 | |

| Operating lease liability, current portion | |

| 68,000 | | |

| 63,000 | |

| Total current liabilities | |

| 864,000 | | |

| 558,000 | |

| | |

| | | |

| | |

| Notes payable, non-current | |

| 145,000 | | |

| 150,000 | |

| Operating lease liability, non-current portion | |

| 53,000 | | |

| 127,000 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| – | | |

| – | |

| | |

| | | |

| | |

| Stockholders' equity (deficit): | |

| | | |

| | |

| Preferred stock, $0.001 par value, 10,000,000 shares authorized, no shares issued and outstanding as of June 30, 2023 and 2022, respectively | |

| – | | |

| – | |

| Common stock, $0.001 par value, 1,000,000,000 shares authorized, 284,289,740 and 276,698,831 shares issued and outstanding as June 30, 2023 and 2022, respectively | |

| 284,000 | | |

| 277,000 | |

| Additional paid-in capital | |

| 26,083,000 | | |

| 26,005,000 | |

| Accumulated deficit | |

| (27,286,000 | ) | |

| (25,246,000 | ) |

| Total liabilities and stockholders' equity (deficit) | |

$ | 143,000 | | |

$ | 1,871,000 | |

See accompanying notes to the consolidated financial

statements

CAVITATION TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

| | |

| |

| | |

For the Years Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenue | |

$ | 413,000 | | |

$ | 1,619,000 | |

| Revenue – related party | |

| 20,000 | | |

| 46,000 | |

| Cost of revenue | |

| (121,000 | ) | |

| (41,000 | ) |

| Gross profit | |

| 312,000 | | |

| 1,624,000 | |

| | |

| | | |

| | |

| General and administrative expenses | |

| 1,195,000 | | |

| 1,728,000 | |

| Impairment of equipment | |

| – | | |

| 178,000 | |

| Research and development expenses | |

| 3,000 | | |

| 17,000 | |

| Total operating expenses | |

| 1,198,000 | | |

| 1,923,000 | |

| | |

| | | |

| | |

| Loss from operations | |

| (886,000 | ) | |

| (299,000 | ) |

| | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | |

| Gain on forgiveness of PPP Loan | |

| – | | |

| 104,000 | |

| Loss on settlement of liabilities | |

| – | | |

| (371,000 | ) |

| Loss from equity method investment | |

| (1,148,000 | ) | |

| (48,000 | ) |

| Interest expense | |

| (6,000 | ) | |

| (5,000 | ) |

| Other, net | |

| (1,154,000 | ) | |

| (320,000 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| – | | |

| – | |

| Net Loss | |

$ | (2,040,000 | ) | |

$ | (619,000 | ) |

| Net loss per share, | |

| | | |

| | |

| Basic and diluted | |

$ | (0.01 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding, | |

| | | |

| | |

| Basic and diluted | |

| 281,693,701 | | |

| 248,736,262 | |

See accompanying notes to the consolidated financial

statements

CAVITATION TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

YEARS ENDED JUNE 30, 2023 AND 2022

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common

Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Total | |

| Balance at June 30, 2021 | |

| 208,267,444 | | |

$ | 208,000 | | |

$ | 24,008,000 | | |

$ | (24,627,000 | ) | |

$ | (411,000 | ) |

| Common stock issued for cash | |

| 12,071,785 | | |

| 12,000 | | |

| 773,000 | | |

| – | | |

| 785,000 | |

| Cashless exercise of warrants | |

| 33,715,228 | | |

| 34,000 | | |

| (34,000 | ) | |

| – | | |

| – | |

| Cashless exercise of options | |

| 6,181,818 | | |

| 6,000 | | |

| (6,000 | ) | |

| – | | |

| – | |

| Fair value of warrants granted for services | |

| – | | |

| – | | |

| 40,000 | | |

| – | | |

| 40,000 | |

| Fair value of common stock issued upon exercise of warrants and options | |

| 778,609 | | |

| 1,000 | | |

| 86,000 | | |

| – | | |

| 87,000 | |

| Fair value of common stock issued for services | |

| 4,500,000 | | |

| 5,000 | | |

| 220,000 | | |

| – | | |

| 225,000 | |

| Fair value of common stock issued to settle liabilities | |

| 11,183,947 | | |

| 11,000 | | |

| 918,000 | | |

| – | | |

| 929,000 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (619,000 | ) | |

| (619,000 | ) |

| Balance at June 30, 2022 | |

| 276,698,831 | | |

| 277,000 | | |

| 26,005,000 | | |

| (25,246,000 | ) | |

| 1,036,000 | |

| Cashless exercise of warrants | |

| 4,090,909 | | |

| 4,000 | | |

| (4,000 | ) | |

| – | | |

| – | |

| Fair value of common stock issued for services | |

| 3,500,000 | | |

| 3,000 | | |

| 82,000 | | |

| – | | |

| 85,000 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (2,040,000 | ) | |

| (2,040,000 | ) |

| Balance at June 30, 2023 | |

| 284,289,740 | | |

$ | 284,000 | | |

$ | 26,083,000 | | |

$ | (27,286,000 | ) | |

$ | (919,000 | ) |

See accompanying notes to the consolidated financial

statements

CAVITATION TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

| | |

| |

| | |

Years Ended June 30, | |

| | |

2023 | | |

2022 | |

| Operating activities: | |

| | | |

| | |

| Net loss | |

$ | (2,040,000 | ) | |

$ | (619,000 | ) |

| Adjustments to reconcile net loss to net cash (used in) operating activities: | |

| | | |

| | |

| Depreciation | |

| 3,000 | | |

| – | |

| Fair value of common stock issued upon exercise of warrants and options | |

| – | | |

| 87,000 | |

| Fair value of warrants granted for services | |

| – | | |

| 40,000 | |

| Fair value of common stock issued for services | |

| 85,000 | | |

| 225,000 | |

| Gain on forgiveness of PPP note payable | |

| – | | |

| (104,000 | ) |

| Loss on settlement of liabilities | |

| – | | |

| 371,000 | |

| Impairment of equipment | |

| – | | |

| 178,000 | |

| Inventory reserve | |

| 48,000 | | |

| – | |

| Loss from equity method investment | |

| 1,148,000 | | |

| 48,000 | |

| Distribution from equity method investment | |

| – | | |

| 26,000 | |

| Effect of changes in: | |

| | | |

| | |

| Accounts receivable | |

| 1,000 | | |

| 5,000 | |

| Inventory | |

| – | | |

| (23,000 | ) |

| Prepaid expenses | |

| 38,000 | | |

| (38,000 | ) |

| Operating lease right-of-use assets | |

| 67,000 | | |

| 65,000 | |

| Accounts payable and accrued expenses | |

| (15,000 | ) | |

| (3,000 | ) |

| Accrued payroll and payroll taxes – related parties | |

| – | | |

| (33,000 | ) |

| Related party payable | |

| – | | |

| (1,000 | ) |

| Customer advances | |

| 311,000 | | |

| (647,000 | ) |

| Operating lease liabilities | |

| (69,000 | ) | |

| (61,000 | ) |