Filed

pursuant to Rule 424(b)(5)

Registration

No. 333-268027

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated November 30, 2022)

The

Glimpse Group, Inc.

1,885,715

Shares of Common Stock

The

Glimpse Group, Inc. is offering 1,885,715 shares of our common stock, par value $0.001 per share to accredited and institutional investors.

Our

common stock is quoted on the Nasdaq Capital Market, or Nasdaq, under the symbol “VRAR.” On September 28, 2023, the last

reported sales price of our common stock on Nasdaq was $3.25 per share. As of September 28, 2023, the aggregate market value of our outstanding

common stock held by non-affiliates, or the public float, was $38,578,505, which was calculated based on 10,398,519 shares of our outstanding

common stock held by non-affiliates at a price of $3.71 per share, the closing price of our common stock on July 31, 2023. During the

12 calendar months prior to, and including, the date of this prospectus, we have not sold any securities pursuant to General Instruction

I.B.6 of Form S-3.

Investing

in our securities involves significant risks. See “Risk Factors” beginning on page S-3 of this prospectus supplement and

in the documents incorporated by reference into this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

We

have engaged Kingswood Investments, division of Kingswood Capital Partners, LLC, or the placement agent, as our exclusive placement agent

in connection with this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase

or sale of any specific number or dollar amount of securities. We have agreed to pay the placement agent the placement agent fees set

forth in the table below. See “Plan of Distribution” for more information regarding these arrangements.

| | |

Per Share | | |

Total | |

| Offering price | |

$ | 1.75 | | |

$ | 3,300,001 | |

| Placement agent’s fees(1) | |

$ | 0.1225 | | |

$ | 231,000 | |

| Proceeds to us, before expenses | |

$ | 1.6275 | | |

$ | 3,069,001 | |

| (1) |

In

addition, we have agreed to reimburse the placement agent for certain expenses. See “Plan of Distribution” beginning

on page S-6 of this prospectus supplement for additional information with respect to the compensation we will pay the placement

agent. |

Delivery

of the securities being offered pursuant to this prospectus supplement and the accompanying prospectus is expected to occur on or about

October 3, 2023.

Kingswood

Investments, division of Kingswood Capital Partners, LLC

The

date of this prospectus supplement is September 28, 2023.

TABLE

OF CONTENTS

PROSPECTUS

You

should rely only on the information incorporated by reference or provided in this prospectus supplement and the accompanying prospectus.

Neither we nor the placement agent have authorized anyone to provide you with different information. If anyone provides you with different

or inconsistent information, you should not rely on it. This prospectus supplement and the accompanying prospectus do not constitute

an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement and the accompanying

prospectus in any jurisdiction where it is unlawful to make such offer or solicitation. You should assume that the information contained

in this prospectus supplement or the accompanying prospectus, or any document incorporated by reference in this prospectus supplement

or the accompanying prospectus, is accurate only as of the date of those respective documents. Neither the delivery of this prospectus

supplement nor any distribution of securities pursuant to this prospectus supplement shall, under any circumstances, create any implication

that there has been no change in the information set forth or incorporated by reference into this prospectus supplement or in our affairs

since the date of this prospectus supplement. Our business, financial condition, results of operations and prospects may have changed

since that date.

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of securities.

The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering.

The information included or incorporated by reference in this prospectus supplement also adds to, updates and changes information contained

or incorporated by reference in the accompanying prospectus. If information included or incorporated by reference in this prospectus

supplement is inconsistent with the accompanying prospectus or the information incorporated by reference therein, then this prospectus

supplement or the information incorporated by reference in this prospectus supplement will apply and will supersede the information in

the accompanying prospectus and the documents incorporated by reference therein.

This

prospectus supplement is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process, under the Securities Act of 1933, as amended, or the Securities Act.

Under

the shelf registration process, we may from time to time offer and sell any combination of the securities described in the accompanying

prospectus up to a total dollar amount of $100,000,000, of which this offering is a part.

In

this prospectus supplement and the accompanying prospectus, unless the context otherwise requires, the terms “we,” “us,”

“our,” “Glimpse,” or the “Company” refer to The Glimpse Group, Inc. and its wholly owned subsidiaries.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information about our company, this offering and information appearing elsewhere in this prospectus supplement,

in the accompanying prospectus, and in the documents we incorporate by reference. This summary is not complete and does not contain all

the information that you should consider before investing in our securities. You should read this entire prospectus supplement and the

accompanying prospectus carefully, including the “Risk Factors” contained in this prospectus supplement beginning on page

S-3 and the risk factors, financial statements and notes incorporated by reference herein, before making an investment decision. This

prospectus supplement may add to, update or change information in the accompanying prospectus.

Company

Overview

We

are an Immersive technology (Virtual Reality (“VR”), Augmented Reality (“AR”), Spatial Computing, Artificial

Intelligence (“AI”)) platform company, comprised of a diversified group of wholly-owned and operated Immersive technology

companies, providing enterprise-focused software, services and solutions. We believe that we offer significant exposure to the rapidly

growing and potentially transformative Immersive technology markets, while mitigating downside risk via our diversified model and ecosystem.

Our

platform of Immersive technology subsidiary companies, collaborative environment and diversified business model aims to simplify the

challenges faced by companies in the emerging Immersive technology industry, potentially improving each subsidiary company’s ability

to succeed, while simultaneously providing investors an opportunity to invest directly via a diversified infrastructure.

By

leveraging our platform, we strive to cultivate and manage the business operations of our Immersive technology subsidiary companies,

with the goal of allowing each underlying company to better focus on mission-critical endeavors, collaborate with the other subsidiary

companies, reduce time to market, optimize costs, improve product quality and leverage joint go-to-market strategies. Subject to operational,

market and financial developments and conditions, we intend to carefully add to our current portfolio of subsidiary companies via a combination

of organic expansion and/or outside acquisition.

The

Immersive technology industry is an early-stage technology industry with nascent markets. We believe that this industry has significant

growth potential across verticals, may be transformative and that our diversified platform and ecosystem create important competitive

advantages. Our subsidiary companies currently target a wide array of industry verticals, including but not limited to: Corporate Training,

Education, Healthcare, Government & Defense, Branding/Marketing/Advertising, Retail, Financial Services, Food & Hospitality,

Media & Entertainment, Architecture/Engineering/Construction (“AEC”), Corporate Events and Presentations, Beauty and

Cosmetics, and Social VR support groups and therapy. We do not currently target direct-to-consumer (“B2C’) customers, we

focus primarily on the business-to-business (“B2B”) and business-to-business-to-consumer (“B2B2C”) segments.

In addition, we are hardware agnostic.

THE

OFFERING

| Securities

we are offering |

|

1,885,715

shares of common stock. |

| |

|

|

| |

|

|

| Common

stock to be outstanding after the offering |

|

16,619,905

shares |

| |

|

|

| Offering

price |

|

$1.75

per share |

| |

|

|

| Use

of proceeds |

|

We

estimate the net proceeds to us from this offering will be approximately $3.0 million after deducting placement agent fees and estimated

offering expenses payable by us. We intend to use the net proceeds from the sale of the securities offered by this prospectus for

working capital and general corporate purposes. |

| |

|

|

| Nasdaq

symbol for common stock |

|

Our

common stock is listed on Nasdaq under the symbol “VRAR.” |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves significant risks. See “Risk Factors” beginning on page S-3 of this prospectus

supplement. |

The

number of shares of common stock shown above to be outstanding after this offering is based on 14,734,190 shares outstanding as of September

28, 2023, and excludes, as of that date:

| |

● |

837,500

shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $13.83; and |

| |

● |

Approximately

3,817,190 shares issuable upon exercise of outstanding options with a weighted average exercise price of $4.05. |

RISK

FACTORS

Any

investment in our securities involves a high degree of risk. Investors should carefully consider the risks described below and all of

the information contained or incorporated by reference in this prospectus, including the risk factors described in our Annual Report

on Form 10-K/A for the year ended June 30, 2023, before deciding whether to purchase the securities offered hereby. Our business, financial

condition, results of operations and prospects could be materially and adversely affected by these risks.

Risks

Related to our Common Stock and this Offering

You

will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

Since

the offering price per share of our common stock being offered in this offering is substantially higher than the net tangible book value

per share of our common stock, you will suffer substantial dilution with respect to the net tangible book value of the common stock you

purchase in this offering. Based on the offering price per share of common stock being sold in this offering of $1.75, and our net tangible

(negative) book value per share of ($0.33) as of June 30, 2023, if you purchase shares of common stock in this offering, you will suffer

immediate and substantial dilution of $1.87 per share with respect to the net tangible book value of the common stock. See

the section entitled “Dilution” for a more detailed discussion of the dilution you will incur if you purchase common stock

in this offering.

Management

will have broad discretion in determining how to use the proceeds of this offering.

Our

management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering

in ways our stockholders may not agree with or that do not yield a favorable return, if at all. We currently intend to use the net proceeds

from this offering for general corporate purposes, including general working capital purposes. If we do not invest or apply the proceeds

of this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could cause the

market price of our common stock to decrease.

Additional

stock offerings in the future may dilute then existing stockholders’ percentage ownership of our company.

Given

our plans and expectations that we will need additional capital, we anticipate that we will need to issue additional shares of common

stock or securities convertible or exercisable for shares of common stock. The issuance of additional securities in the future will dilute

the percentage ownership of then existing stockholders.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934, or the Exchange Act. Forward-looking statements give current expectations or forecasts of future

events or our future financial or operating performance. We may, in some cases, use words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or the negative of those

terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements.

These

forward-looking statements reflect our management’s beliefs and views with respect to future events, are based on estimates and

assumptions as of the date of this prospectus supplement and are subject to risks and uncertainties, many of which are beyond our control,

that could cause our actual results to differ materially from those in these forward-looking statements. We discuss many of these risks

in greater detail in this prospectus under “Risk Factors” and in our Annual Report on Form 10-K/A filed with the SEC on September

29, 2023, as well as those described in the other documents we file with the SEC. Moreover, new risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering, after deducting placement agent fees and estimated offering expenses payable by us,

will be approximately $3.0 million.

We

intend to use the net proceeds from this offering for working capital and general corporate purposes.

As

of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses of the proceeds from this offering.

We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in using these proceeds.

Investors will be relying on our judgment regarding the use of the net proceeds from this offering. Pending the use of proceeds as described

above, we plan to invest the net proceeds that we receive in short-term and intermediate-term interest-bearing obligations, investment-grade

investments, certificates of deposit or direct or guaranteed obligations of the U.S. government. We cannot predict whether the invested

proceeds will yield a favorable return.

CAPITALIZATION

The

following table sets forth our cash, as well as our capitalization, as of June 30, 2023, as follows:

| |

● |

on

an actual basis; and |

| |

|

|

| |

● |

on

an as adjusted basis, giving effect to the sale by us of 1,885,715 shares of common stock in this offering at the offering price

of $1.75 per share, after deducting the placement agent fees and other estimated offering expenses payable by us. |

You

should read this table in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

and our financial statements for the year ended June 30, 2023, and the related notes thereto, included in our annual report on Form 10-K/A

for the year ended June 30, 2023 and incorporated by reference in this prospectus supplement.

| | |

Actual | | |

As Adjusted | |

| Cash and cash equivalents | |

$ | 5,619,083 | | |

$ | 8,603,084 | |

| Total liabilities | |

$ | 13,054,575 | | |

$ | 13,054,575 | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value: 20,000,000 shares authorized, 0 shares issued and outstanding | |

$ | 0 | | |

$ | 0 | |

| Common stock, $0.001 par value, 300,000,000 authorized shares, 14,701,929 shares issued and outstanding, actual, 16,857,644 shares issued and outstanding, as adjusted | |

$ | 14,702 | | |

$ | 16,588 | |

| Additional paid-in capital | |

$ | 67,854,108 | | |

$ | 70,836,223 | |

| Accumulated deficit | |

$ | (56,644,978 | ) | |

$ | (56,644,978 | ) |

| Total stockholders’ equity | |

$ | 11,223,832 | | |

$ | 14,207,833 | |

The

number of shares to be outstanding immediately after giving effect to this offering as shown above is based on 14,701,929 shares outstanding

as of June 30, 2023, and excludes, as of such date:

| |

● |

837,500

shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $13.83; and |

| |

● |

3,741,523

shares issuable upon exercise of outstanding options with a weighted average exercise price of $3.96. |

DILUTION

If

you invest in our common stock, your interest will be diluted immediately to the extent of the difference between the offering price

per share and the as adjusted net tangible book value per share of our common stock after this offering.

Our

net tangible (negative) book value as of June 30, 2023 was approximately ($4,925,000), or ($0.33) per share of common stock. Net tangible

negative book value per share is determined by dividing our total tangible assets, less total liabilities, by the number of our shares

of common stock outstanding as of that date.

After

giving effect to the sale of the 1,885,715 shares of common stock in this offering at the offering price of $1.75 per share and after

deducting placement agent fees and estimated offering expenses payable by us, our as adjusted net tangible (negative) book value as of

June 30, 2023 would have been approximately ($1,941,000) or ($0.12) per share of common stock. This represents an immediate increase

in net tangible book value of $0.21 per share to our existing stockholders and an immediate dilution in net tangible book value of $1.87

per share to the investors in this offering. The following table illustrates this dilution per share to the investor in this offering:

| Offering price per share | |

$ | 1.75 | |

| Historical net tangible (negative) book value per share as of June 30, 2023 | |

$ | (0.33 | ) |

| Increase in net tangible book value, as adjusted, per share attributable to this offering | |

$ | 0.21 | |

| As adjusted net tangible (negative) book value per share as of June 30, 2023, after giving effect to this offering | |

$ | (0.12 | ) |

| Dilution per share to new investors purchasing shares in this offering | |

$ | 1.87 | |

The

information above is based on 14,701,929 shares outstanding as of June 30, 2023, and excludes, as of such date:

| |

● |

837,500

shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $13.83; and |

| |

● |

3,741,523

shares issuable upon exercise of outstanding options with a weighted average exercise price of $3.96. |

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

In

this offering, we are offering 1,885,715 shares of our common stock. The material terms and provisions of our common stock are described

under the caption “Description of Common Stock” beginning on page 3 of the accompanying prospectus.

PLAN

OF DISTRIBUTION

We

have entered into a securities purchase agreement with investors pursuant to which we will sell to such purchasers 1,885,715 shares of

common stock.

The

securities purchase agreement contains customary representations, warranties and covenants for transactions of this type.

We

engaged Kingswood Investments, division of Kingswood Capital Partners, LLC, to act as our placement agent for the offering pursuant to

a placement agency agreement dated September 28, 2023, to solicit offers to purchase the securities in this offering. The placement agent

is not purchasing or selling any of the securities we are offering, and it is not required to arrange the purchase or sale of any specific

number of securities or dollar amount, but has agreed to use reasonable best efforts to arrange for the sale of the securities.

The

placement agent proposes to arrange for the sale of the securities we are offering pursuant to this prospectus supplement to investors

through a securities purchase agreement directly between the purchasers and us. We established the price following negotiations with

the placement agent and prospective investors and with reference to the prevailing market price of our common stock, recent trends in

such price and other factors. We anticipate that the sale of the securities will be completed on the date indicated on the cover page

of this prospectus supplement, subject to customary closing conditions. On the closing date, the following will occur:

| |

● |

We

will receive funds in the amount of the aggregate purchase price; |

| |

|

|

| |

● |

The

placement agent will receive the placement agent fees; and |

| |

|

|

| |

● |

We

will deliver the securities to the investors. |

We

have agreed to pay the placement agent a cash fee of 7.0% of the gross proceeds the Company receives in the offering. We also agreed

to pay the placement agent up to $30,000 for its actual expenses in connection with the offering.

We

estimate the total expenses of this offering paid or payable by us, other than the placement agent fees and expense reimbursements, will

be approximately $55,000.

We

have agreed to indemnify the placement agent and specified other persons against certain liabilities relating to or arising out of the

placement agent’s activities under the placement agency agreement, including liabilities under the Securities Act, and to contribute

to payments that the placement agent may be required to make in respect of such liabilities.

The

placement agent may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act and any fees received

by it and any profit realized on the sale of the securities by it while acting as principal might be deemed to be underwriting discounts

or commissions under the Securities Act. The placement agent will be required to comply with the requirements of the Securities Act and

the Exchange Act including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit

the timing of purchases and sales of our securities by the placement agent. Under these rules and regulations, the placement agent may

not (i) engage in any stabilization activity in connection with our securities; and (ii) bid for or purchase any of our securities or

attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until they have completed

their participation in the distribution.

From

time to time, the placement agent may provide in the future various advisory, investment and commercial banking and other services to

us in the ordinary course of business, for which it may receive customary fees and commissions.

LEGAL

MATTERS

The

validity of the securities being offered under this prospectus by us will be passed upon for us by Sichenzia Ross Ference Carmel LLP,

New York, New York. The placement agent is being represented by Lucosky Brookman LLP, New York, New York.

EXPERTS

The

financial statements of The Glimpse Group, Inc. as of and for the years ended June 30, 2023 and 2022 appearing in The Glimpse Group,

Inc.’s Annual Report on Form 10-K for the year ended June 30, 2023, as amended by our Form 10-K/A for the year ended June 30, 2023,

have been audited by Hoberman & Lesser CPA’s, LLP, as set forth in its report thereon, included therein, and incorporated herein

by reference. Such financial statements are incorporated herein by reference in reliance upon such report given on the authority of such

firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the reporting requirements of the Exchange Act and file annual, quarterly and current reports, and other information with

the SEC. These reports, proxy statements and other information are available at the SEC’s website at http://www.sec.gov.

This

prospectus supplement and the accompanying prospectus are only part of a registration statement on Form S-3 that we have filed with the

SEC under the Securities Act and therefore omit certain information contained in the registration statement. We have also filed exhibits

and schedules with the registration statement that are excluded from this prospectus supplement and the accompanying prospectus, and

you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract or other

document. The registration statement, including the exhibits and schedules, without charge, are available at the SEC’s website.

We

also maintain a website at www.theglimpsegroup.com, through which you can access our SEC filings. The information set forth on our website

is not part of this prospectus supplement or the accompanying prospectus.

INCORPORATION

OF DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information that we file with them, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered

to be part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information.

The following documents are incorporated by reference and made a part of this prospectus:

| |

● |

Our

annual report on Form 10-K filed with the SEC on September 28, 2023, as amended by our annual report on Form 10-K/A filed with the

SEC on September 29, 2023; |

| |

|

|

| |

● |

The

description of our common stock which is contained in a Registration Statement on Form 8-A filed with the SEC on June 29, 2021 (File

No. 001-40556), including any amendment or report filed for the purpose of updating such description; and |

| |

|

|

| |

● |

all

reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the

date of this prospectus and prior to the termination of this offering. |

Nothing

in this prospectus shall be deemed to incorporate information furnished but not filed with the SEC (including without limitation, information

furnished under Item 2.02 or Item 7.01 of Form 8-K, and any exhibits relating to such information).

Any

statement contained in this prospectus or in a document incorporated or deemed to be incorporated by, reference in this prospectus shall

be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in the applicable

prospectus supplement or in any other subsequently filed document which also is or is deemed to be incorporated by reference modifies

or supersedes the statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by reference.

You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: 15 West 38th St, 12th Fl, New York,

NY 10018, (917) 292-2685.

$100,000,000

The

Glimpse Group, Inc.

Common

Stock

Preferred

Stock

Warrants

Rights

Units

We

may issue securities from time to time in one or more offerings, in amounts, at prices and on terms determined at the time of offering.

This prospectus describes the general terms of these securities and the general manner in which these securities will be offered. We

will provide the specific terms of these securities in supplements to this prospectus, which will also describe the specific manner in

which these securities will be offered and may also supplement, update or amend information contained in this prospectus. You should

read this prospectus and any applicable prospectus supplement before you invest. The aggregate offering price of the securities we sell

pursuant to this prospectus will not exceed $100,000,000.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “VRAR”. On October 26, 2022, the last reported

sale price of our common stock was $4.76.

The aggregate market value

of our outstanding common stock held by non-affiliates is $50,071,666 based on 13,593,734 shares of outstanding common stock,

of which 2,940,188 shares are held by affiliates, and a per share price of $4.70, which was the closing sale price of our common

stock as quoted on The Nasdaq Capital Market on November 8, 2022. Pursuant to General Instruction I.B.6

of Form S-3, in no event will we sell securities registered on the registration statement of which this prospectus is a part with a value

of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the

aggregate market value of our common stock held by non-affiliates is less than $75,000,000. During the 12 calendar month period

that ends on, and includes, the date of this prospectus, we have not offered and sold any of our securities pursuant to General Instruction

I.B.6 of Form S-3.

We

are an “emerging growth company,” as defined under the federal securities laws, and, as such, may elect to comply with certain

reduced public company reporting requirements for future filings.

Investing

in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks

of investing in our securities in the section titled “Risk Factors” beginning on page 3 of this prospectus, an in any similar

section contained or incorporated by reference herein or in the applicable prospectus supplement.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 30,

2022

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”)

using the “shelf” registration process. Under this shelf registration process, we may from time to time sell any combination

of the securities described in this prospectus in one or more offerings for an aggregate offering price of up to $100,000,000.

This

prospectus provides you with a general description of the securities that may be offered. Each time that we offer and sell securities,

we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and

sold and the specific terms of that offering and, to the extent appropriate, any updates to the information about us contained in this

prospectus. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating

to these offerings. The prospectus supplement may also add, update or change information contained in this prospectus with respect to

that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you

should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable

prospectus supplement, together with the additional information described under the headings “Where You Can Find More Information”

and “Incorporation by Reference.”

We

have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus,

any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you.

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that

the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on

its respective cover or as otherwise specified therein and that any information incorporated by reference is accurate only as of the

date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

This

prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain or incorporate by reference,

market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information.

Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not

independently verified this information. Although we are not aware of any misstatements regarding the market and industry data presented

in this prospectus and the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject

to change based on various factors, including those discussed under the heading “Risk Factors” contained or incorporated

by reference in this prospectus, the applicable prospectus supplement and any related free writing prospectus and under similar headings

in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on

this information.

As

used in this prospectus and unless otherwise indicated, the terms “we,” “us,” “our,” “Glimpse,”

or the “Company” refer to The Glimpse Group, Inc. and its wholly owned subsidiaries.

THE

COMPANY

Overview

We

are a Virtual (“VR”) and Augmented (“AR”) Reality platform company, comprised of a diversified group of wholly-owned

and operated VR and AR companies, providing enterprise-focused software, services and solutions. We believe that we offer significant

exposure to the rapidly growing and potentially transformative VR and AR markets, while mitigating downside risk via our diversified

model and ecosystem.

Our

platform of VR/AR subsidiary companies, collaborative environment and diversified business model aims to simplify the challenges faced

by companies in the emerging VR/AR industry, potentially improving each subsidiary company’s ability to succeed, while simultaneously

providing investors an opportunity to invest directly into the emerging VR/AR industry via a diversified infrastructure.

Leveraging

our platform, we strive to cultivate and manage the business operations of our VR/AR subsidiary companies, with the goal of allowing

each underlying company to better focus on mission-critical endeavors, collaborate with the other subsidiary companies, reduce time to

market, optimize costs, improve product quality and leverage joint go-to-market strategies. Subject to operational, market and financial

developments and conditions, we intend to carefully add to our current portfolio of subsidiary companies via a combination of organic

expansion and/or outside acquisition.

The

VR/AR industry is an early-stage technology industry with nascent markets. We believe that this industry has significant growth potential

across verticals, may be transformative and that our diversified platform and ecosystem create important competitive advantages. Our

subsidiary companies currently target a wide array of industry verticals, including but not limited to: Corporate Training, Education,

Healthcare, Branding/Marketing/Advertising, Retail, Financial Services, Food & Hospitality, Media & Entertainment, Architecture/Engineering/Construction

(“AEC”) and Social VR support groups and therapy. We do not currently target direct-to-consumer (“B2C’) VR/AR

software or services, only business-to-business (“B2B”) and business-to-business-to-consumer (“B2B2C”), and we

are hardware agnostic.

Our

Corporate Information

The

Glimpse Group, Inc. was incorporated on June 15, 2016, under the laws of the State of Nevada and is headquartered in New York, New York.

Our executive offices are located at 15 West 38th St, 9th Fl, New York, NY 10018, and our telephone number is 917-292-2685.

We maintain a corporate website at www.theglimpsegroup.com. The information on our website is not part of this prospectus. We have included

our website address as a factual reference and do not intend it to be active link to our website.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, or the Exchange Act. Forward-looking statements give current expectations or forecasts of future events or our

future financial or operating performance. We may, in some cases, use words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or the negative of those

terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements.

These

forward-looking statements reflect our management’s beliefs and views with respect to future events, are based on estimates and

assumptions as of the date of this prospectus and are subject to risks and uncertainties, many of which are beyond our control, that

could cause our actual results to differ materially from those in these forward-looking statements. We discuss many of these risks in

greater detail in this prospectus under “Risk Factors” and in our Annual Report on Form 10-K filed with the SEC on September

28, 2022, as well as those described in the other documents we file with the SEC. Moreover, new risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

We

undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments

or otherwise, except as may be required by applicable laws or regulations.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks, uncertainties

and other factors described in our most recent Annual Report on Form 10-K, as supplemented and updated by subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K that we have filed or will file with the SEC, which are incorporated by reference into this

prospectus.

Our

business, affairs, prospects, assets, financial condition, results of operations and cash flows could be materially and adversely affected

by these risks. For more information about our SEC filings, please see “Where You Can Find More Information”.

USE

OF PROCEEDS

We

will retain broad discretion over the use of the net proceeds from the sale of the securities offered hereby. Unless otherwise indicated

in a prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus for general corporate

purposes, including working capital.

DESCRIPTION

OF COMMON STOCK

General

We

are authorized to issue 300,000,000 shares of common stock, $0.001 par value per share.

Holders

of the Company’s common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of

common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election

of directors can elect all of the directors to our board of directors. Holders of the Company’s common stock representing one-third

(33 1/3%) of the voting power of the Company’s common stock issued, outstanding and entitled to vote, represented in person or

by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority of the Company’s

outstanding shares is required to effectuate certain fundamental corporate changes such as a liquidation, merger or an amendment to the

Company’s articles of incorporation.

Subject

to the rights of preferred stockholders (if any), holders of the Company’s common stock are entitled to share in all dividends

that the Board of Directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or

winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities

and after providing for each class of stock, if any, having preference over the common stock. The Company’s common stock has no

pre-emptive rights, no conversion rights, and there are no redemption provisions applicable to the Company’s common stock.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock is ClearTrust, LLC.

Listing

Our

common stock is currently quoted on The Nasdaq Capital Market under the symbol “VRAR”.

DESCRIPTION

OF PREFERRED STOCK

We

are authorized to issue up to 20,000,000 shares of preferred stock, par value $0.001 per share, from time to time, in one or more series.

We do not have any outstanding shares of preferred stock.

Our

articles of incorporation authorizes our board of directors to issue preferred stock from time to time with such designations, preferences,

conversion or other rights, voting powers, restrictions, dividends or limitations as to dividends or other distributions, qualifications

or terms or conditions of redemption as shall be determined by the board of directors for each class or series of stock. Preferred stock

is available for possible future financings or acquisitions and for general corporate purposes without further authorization of stockholders

unless such authorization is required by applicable law, or any securities exchange or market on which our stock is then listed or admitted

to trading.

Our

board of directors may authorize the issuance of preferred stock with voting or conversion rights that could adversely affect the voting

power or other rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with

possible acquisitions and other corporate purposes could, under some circumstances, have the effect of delaying, deferring or preventing

a change-in-control of the Company.

A

prospectus supplement relating to any series of preferred stock being offered will include specific terms relating to the offering. Such

prospectus supplement will include:

| |

● |

the

title and stated or par value of the preferred stock; |

| |

|

|

| |

● |

the

number of shares of the preferred stock offered, the liquidation preference per share and the offering price of the preferred stock; |

| |

|

|

| |

● |

the

dividend rate(s), period(s) and/or payment date(s) or method(s) of calculation thereof applicable to the preferred stock; |

| |

|

|

| |

● |

whether

dividends shall be cumulative or non-cumulative and, if cumulative, the date from which dividends on the preferred stock shall accumulate; |

| |

|

|

| |

● |

the

provisions for a sinking fund, if any, for the preferred stock; |

| |

|

|

| |

● |

any

voting rights of the preferred stock; |

| |

|

|

| |

● |

the

provisions for redemption, if applicable, of the preferred stock; |

| |

|

|

| |

● |

any

listing of the preferred stock on any securities exchange; |

| |

|

|

| |

● |

the

terms and conditions, if applicable, upon which the preferred stock will be convertible into our common stock, including the conversion

price or the manner of calculating the conversion price and conversion period; |

| |

|

|

| |

● |

if

appropriate, a discussion of Federal income tax consequences applicable to the preferred stock; and |

| |

|

|

| |

● |

any

other specific terms, preferences, rights, limitations or restrictions of the preferred stock. |

The

terms, if any, on which the preferred stock may be convertible into or exchangeable for our common stock will also be stated in the preferred

stock prospectus supplement. The terms will include provisions as to whether conversion or exchange is mandatory, at the option of the

holder or at our option, and may include provisions pursuant to which the number of shares of our common stock to be received by the

holders of preferred stock would be subject to adjustment.

DESCRIPTION

OF WARRANTS

We

may issue warrants for the purchase of preferred stock or common stock. Warrants may be issued independently or together with any preferred

stock or common stock, and may be attached to or separate from any offered securities. Each series of warrants will be issued under a

separate warrant agreement to be entered into between a warrant agent specified in the agreement and us. The warrant agent will act solely

as our agent in connection with the warrants of that series and will not assume any obligation or relationship of agency or trust for

or with any holders or beneficial owners of warrants. This summary of some provisions of the warrants is not complete. You should refer

to the warrant agreement, including the forms of warrant certificate representing the warrants, relating to the specific warrants being

offered for the complete terms of the warrant agreement and the warrants. The warrant agreement, together with the terms of the warrant

certificate and warrants, will be filed with the SEC in connection with the offering of the specific warrants.

The

applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus

is being delivered:

| |

● |

the

title of the warrants; |

| |

|

|

| |

● |

the

aggregate number of the warrants; |

| |

|

|

| |

● |

the

price or prices at which the warrants will be issued; |

| |

|

|

| |

● |

the

designation, amount and terms of the offered securities purchasable upon exercise of the warrants; |

| |

|

|

| |

● |

if

applicable, the date on and after which the warrants and the offered securities purchasable upon exercise of the warrants will be

separately transferable; |

| |

|

|

| |

● |

the

terms of the securities purchasable upon exercise of such warrants and the procedures and conditions relating to the exercise of

such warrants; |

| |

|

|

| |

● |

any

provisions for adjustment of the number or amount of securities receivable upon exercise of the warrants or the exercise price of

the warrants; |

| |

|

|

| |

● |

the

price or prices at which and currency or currencies in which the offered securities purchasable upon exercise of the warrants may

be purchased; |

| |

|

|

| |

● |

the

date on which the right to exercise the warrants shall commence and the date on which the right shall expire; |

| |

|

|

| |

● |

the

minimum or maximum amount of the warrants that may be exercised at any one time; |

| |

|

|

| |

● |

information

with respect to book-entry procedures, if any; |

| |

|

|

| |

● |

if

appropriate, a discussion of Federal income tax consequences; and |

| |

|

|

| |

● |

any

other material terms of the warrants, including terms, procedures and limitations relating to the exchange and exercise of the warrants. |

Warrants

for the purchase of common stock or preferred stock will be offered and exercisable for U.S. dollars only. Warrants will be issued in

registered form only.

Upon

receipt of payment and the warrant certificate properly completed and duly executed at the corporate trust office of the warrant agent

or any other office indicated in the applicable prospectus supplement, we will, as soon as practicable, forward the purchased securities.

If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will be issued for the

remaining warrants.

Prior

to the exercise of any warrants to purchase preferred stock or common stock, holders of the warrants will not have any of the rights

of holders of the common stock or preferred stock purchasable upon exercise, including in the case of warrants for the purchase of common

stock or preferred stock, the right to vote or to receive any payments of dividends on the preferred stock or common stock purchasable

upon exercise.

DESCRIPTION

OF RIGHTS

The

following description, together with the additional information we include in any applicable prospectus supplement, summarizes the general

features of the rights that we may offer under this prospectus. We may issue rights to our stockholders to purchase shares of our common

stock and/or any of the other securities offered hereby. Each series of rights will be issued under a separate rights agreement to be

entered into between us and a bank or trust company, as rights agent. When we issue rights, we will provide the specific terms of the

rights and the applicable rights agreement in a prospectus supplement. Because the terms of any rights we offer under a prospectus supplement

may differ from the terms we describe below, you should rely solely on information in the applicable prospectus supplement if that summary

is different from the summary in this prospectus. We will incorporate by reference into the registration statement of which this prospectus

is a part, the form of rights agreement that describes the terms of the series of rights we are offering before the issuance of the related

series of rights. The applicable prospectus supplement relating to any rights will describe the terms of the offered rights, including,

where applicable, the following:

| |

● |

the

date for determining the persons entitled to participate in the rights distribution; |

| |

|

|

| |

● |

the

exercise price for the rights; |

| |

|

|

| |

● |

the

aggregate number or amount of underlying securities purchasable upon exercise of the rights; |

| |

|

|

| |

● |

the

number of rights issued to each stockholder and the number of rights outstanding, if any; |

| |

|

|

| |

● |

the

extent to which the rights are transferable; |

| |

|

|

| |

● |

the

date on which the right to exercise the rights will commence and the date on which the right will expire; |

| |

|

|

| |

● |

the

extent to which the rights include an over-subscription privilege with respect to unsubscribed securities; |

| |

|

|

| |

● |

anti-dilution

provisions of the rights, if any; and |

| |

|

|

| |

● |

any

other terms of the rights, including terms, procedures and limitations relating to the distribution, exchange and exercise of the

rights. |

Holders

may exercise rights as described in the applicable prospectus supplement. Upon receipt of payment and the rights certificate properly

completed and duly executed at the corporate trust office of the rights agent or any other office indicated in the prospectus supplement,

we will, as soon as practicable, forward the securities purchasable upon exercise of the rights. If less than all of the rights issued

in any rights offering are exercised, we may offer any unsubscribed securities directly to persons other than stockholders, to or through

agents, underwriters or dealers or through a combination of such methods, including pursuant to standby underwriting arrangements, as

described in the applicable prospectus supplement.

DESCRIPTION

OF UNITS

As

specified in the applicable prospectus supplement, we may issue units consisting of shares of common stock, shares of preferred stock,

warrants or rights or any combination of such securities.

The

applicable prospectus supplement will specify the following terms of any units in respect of which this prospectus is being delivered:

| |

● |

the

terms of the units and of any of the common stock, preferred stock, rights and warrants comprising the units, including whether and

under what circumstances the securities comprising the units may be traded separately; |

| |

● |

a

description of the terms of any unit agreement governing the units; and |

| |

|

|

| |

● |

a

description of the provisions for the payment, settlement, transfer or exchange of the units. |

PLAN

OF DISTRIBUTION

We

may sell the securities offered through this prospectus (i) to or through underwriters or dealers, (ii) directly to purchasers, including

our affiliates, (iii) through agents, or (iv) through a combination of any these methods. The securities may be distributed at a fixed

price or prices, which may be changed, market prices prevailing at the time of sale, prices related to the prevailing market prices,

or negotiated prices. The prospectus supplement will include the following information:

| |

● |

the

terms of the offering; |

| |

|

|

| |

● |

the

names of any underwriters or agents; |

| |

|

|

| |

● |

the

name or names of any managing underwriter or underwriters; |

| |

|

|

| |

● |

the

purchase price of the securities; |

| |

|

|

| |

● |

any

over-allotment options under which underwriters may purchase additional securities from us; |

| |

|

|

| |

● |

the

net proceeds from the sale of the securities; |

| |

|

|

| |

● |

any

delayed delivery arrangements; |

| |

|

|

| |

● |

any

underwriting discounts, commissions and other items constituting underwriters’ compensation; |

| |

|

|

| |

● |

any

initial public offering price; |

| |

|

|

| |

● |

any

discounts or concessions allowed or reallowed or paid to dealers; |

| |

|

|

| |

● |

any

commissions paid to agents; and |

| |

|

|

| |

● |

any

securities exchange or market on which the securities may be listed. |

Sale

Through Underwriters or Dealers

Only

underwriters named in the prospectus supplement are underwriters of the securities offered by the prospectus supplement.

If

underwriters are used in the sale, the underwriters will acquire the securities for their own account, including through underwriting,

purchase, security lending or repurchase agreements with us. The underwriters may resell the securities from time to time in one or more

transactions, including negotiated transactions. Underwriters may sell the securities in order to facilitate transactions in any of our

other securities (described in this prospectus or otherwise), including other public or private transactions and short sales. Underwriters

may offer securities to the public either through underwriting syndicates represented by one or more managing underwriters or directly

by one or more firms acting as underwriters. Unless otherwise indicated in the prospectus supplement, the obligations of the underwriters

to purchase the securities will be subject to certain conditions, and the underwriters will be obligated to purchase all the offered

securities if they purchase any of them. The underwriters may change from time to time any initial public offering price and any discounts

or concessions allowed or reallowed or paid to dealers.

If

dealers are used in the sale of securities offered through this prospectus, we will sell the securities to them as principals. They may

then resell those securities to the public at varying prices determined by the dealers at the time of resale. The prospectus supplement

will include the names of the dealers and the terms of the transaction.

Direct

Sales and Sales Through Agents

We

may sell the securities offered through this prospectus directly. In this case, no underwriters or agents would be involved. Such securities

may also be sold through agents designated from time to time. The prospectus supplement will name any agent involved in the offer or

sale of the offered securities and will describe any commissions payable to the agent. Unless otherwise indicated in the prospectus supplement,

any agent will agree to use its reasonable best efforts to solicit purchases for the period of its appointment.

We

may sell the securities directly to institutional investors or others who may be deemed to be underwriters within the meaning of the

Securities Act with respect to any sale of those securities. The terms of any such sales will be described in the prospectus supplement.

Delayed

Delivery Contracts

If

the prospectus supplement indicates, we may authorize agents, underwriters or dealers to solicit offers from certain types of institutions

to purchase securities at the public offering price under delayed delivery contracts. These contracts would provide for payment and delivery

on a specified date in the future. The contracts would be subject only to those conditions described in the prospectus supplement. The

applicable prospectus supplement will describe the commission payable for solicitation of those contracts.

Continuous

Offering Program

Without

limiting the generality of the foregoing, we may enter into a continuous offering program equity distribution agreement with a broker-dealer,

under which we may offer and sell shares of our common stock from time to time through a broker-dealer as our sales agent. If we enter

into such a program, sales of the shares of common stock, if any, will be made by means of ordinary brokers’ transactions on the

Nasdaq Capital Market or other market on which our shares may then trade at market prices, block transactions and such other transactions

as agreed upon by us and the broker-dealer. Under the terms of such a program, we also may sell shares of common stock to the broker-dealer,

as principal for its own account at a price agreed upon at the time of sale. If we sell shares of common stock to such broker-dealer

as principal, we will enter into a separate terms agreement with such broker-dealer, and we will describe this agreement in a separate

prospectus supplement or pricing supplement.

Market

Making, Stabilization and Other Transactions

Unless

the applicable prospectus supplement states otherwise, other than our common stock, all securities we offer under this prospectus will

be a new issue and will have no established trading market. We may elect to list offered securities on an exchange or in the over-the-counter

market. Any underwriters that we use in the sale of offered securities may make a market in such securities, but may discontinue such

market making at any time without notice. Therefore, we cannot assure you that the securities will have a liquid trading market.

Any

underwriter may also engage in stabilizing transactions, syndicate covering transactions and penalty bids in accordance with Rule 104

under the Securities Exchange Act. Stabilizing transactions involve bids to purchase the underlying security in the open market for the

purpose of pegging, fixing or maintaining the price of the securities. Syndicate covering transactions involve purchases of the securities

in the open market after the distribution has been completed in order to cover syndicate short positions.

Penalty

bids permit the underwriters to reclaim a selling concession from a syndicate member when the securities originally sold by the syndicate

member are purchased in a syndicate covering transaction to cover syndicate short positions. Stabilizing transactions, syndicate covering

transactions and penalty bids may cause the price of the securities to be higher than it would be in the absence of the transactions.

The underwriters may, if they commence these transactions, discontinue them at any time.

General

Information

Agents,

underwriters, and dealers may be entitled, under agreements entered into with us, to indemnification by us against certain liabilities,

including liabilities under the Securities Act. Our agents, underwriters, and dealers, or their affiliates, may be customers of, engage

in transactions with or perform services for us, in the ordinary course of business.

LEGAL

MATTERS

The

validity of the issuance of the securities offered by this prospectus will be passed upon for us by Sichenzia Ross Ference LLP, New York,

New York.

EXPERTS

The

financial statements of The Glimpse Group, Inc. as of and for the years ended June 30, 2022 and 2021 appearing in The Glimpse Group,

Inc.’s Annual Report on Form 10-K for the year ended June 30, 2022, have been audited by Hoberman & Lesser CPA’s, LLP,

as set forth in its report thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated

herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and special reports, along with other information with the SEC. The SEC maintains an Internet site that contains

reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Our SEC filings

are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

This

prospectus is part of a registration statement on Form S-3 that we filed with the SEC to register the securities offered hereby under

the Securities Act of 1933, as amended. This prospectus does not contain all of the information included in the registration statement,

including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement from the

SEC’s internet site.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information in documents we file with it, which means

that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered

to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information.

Any statement contained in any document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in or omitted from this prospectus or any accompanying

prospectus supplement, or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein,

modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded,

to constitute a part of this prospectus.

We

incorporate by reference the documents listed below and any future documents that we file with the SEC (excluding any portion of such

documents that are furnished and not filed with the SEC) under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (i) after the date

of the initial filing of the registration statement of which this prospectus forms a part prior to the effectiveness of the registration

statement and (ii) after the date of this prospectus until the offering of the securities is terminated:

| |

● |

The information in our Definitive Proxy Statement on

Schedule 14A

filed with the SEC on October 31, 2022; |

| |

● |

Our

Annual Report on Form 10-K for the year ended June 30, 2022 as filed with the SEC on September 28, 2022; |

| |

● |

Current

Reports on Form 8-K filed with the SEC on July 19, 2022, August 2, 2022 and as amended on October 11, 2022, and September 28, 2022;

and |

| |

● |

The

description of the Registrant’s common stock which is contained in a Registration Statement on Form 8-A filed on June 29, 2021

(File No. 001-40556) under the Exchange Act, including any amendment or report filed for the purpose of updating such description. |

1,885,715

Shares of Common Stock

The

Glimpse Group, Inc.

PROSPECTUS

SUPPLEMENT

Kingswood

Investments, division of Kingswood Capital Partners, LLC

September

28, 2023

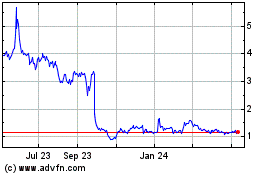

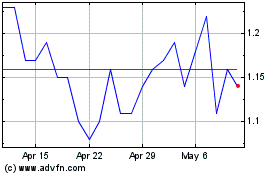

Glimpse (NASDAQ:VRAR)

Historical Stock Chart

From Apr 2024 to May 2024

Glimpse (NASDAQ:VRAR)

Historical Stock Chart

From May 2023 to May 2024