0001281984

false

0001281984

2023-09-29

2023-09-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 29, 2023

Decentral

Life, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-55961 |

|

46-0495298 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

Number) |

| 6400

S. Fiddlers Green Cir., Suite 1180, |

|

|

| Greenwood

Village, CO |

|

80111 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(855)

933-3277

Registrant’s

telephone number, including area code:

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Decentral

Life, Inc. is referred to herein as “we”, “us” or “us”.

Item

1.01 Entry into a Material Definitive Agreement

Binding

Letter of Intent with Mjlink.com, Inc.

On

September 29, 2023, we completed a Binding Letter of Intent (attached hereto as Exhibit 99.1) with MjLink.com, Inc (“MjLink”)

to acquire 100% of MjLink via a Share Exchange and a PCAOB audit of MjLink.

ITEM

9.01. EXHIBITS

(a)

Exhibits. The following exhibit is filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

October 2, 2023

| Decentral

Life, Inc. |

|

| |

|

|

| By: |

/s/

Ken Tapp |

|

| |

Ken

Tapp, |

|

| |

Chief

Executive Officer |

|

Exhibit

99.1

MJLINK.COM,

INC.

6400

S. Fiddlers Green Circle, Suite 1180

Greenwood

Village, Colorado, 80111

VIA

EMAIL

Ken@wdlf.ai

Ken

Tapp, Chief Executive Officer

Decentral

Life, Inc.

6400

S Fiddlers Green Cir Ste. 1180

Greenwood

Village, Colorado 80111

Dear

Mr. Markey:

This

Binding Letter of Intent (“LOI”) is made between MjLink.com, Inc. (“MjLink” or the “Seller’) and

Decentral Life, Inc. in which the Buyer, subject to a Definitive Purchase Agreement (“Definitive

Agreement”), will purchase the business, materials, services or matters set forth in this Letter from the Seller. The Buyer and

the Seller are collectively referred to herein as the “Parties”. This LOI outlines terms and conditions that a Definitive

Agreement will include and provides for the exchange of information and documents between the Parties in advance of the Definitive Agreement

and its material terms. .

1.

Prospective Transaction

The

transaction contemplated hereby is one in which the Parties have expressed a mutual interest in involving the transfer by the Seller

of MjLink and all of its assets and liabilities to the Buyer (“Transaction”).

2.

Purchase Price

The

Transaction shall include the following terms: (a) Following a PCAOB audit of MjLink, Buyer’s Common Stock shall be exchanged for

the Seller’s Common Stock, the specific amounts of which shall be determined after a completed PCAOB audit and valuation of MjLink;

(b) Following a PCAOB audit of MjLink, Buyer’s Preferred Stock shall be exchanged for the Seller’s Preferred Stock, the specific

amounts of which shall be determined after a completed PCAOB audit and valuation of MjLink; and (c) Neither the Buyer or the Seller’s

Class B stock will be exchanged.

3.

Liabilities of Seller

3.1

Seller(s) shall remain liable for any (known or unknown) liabilities or obligations not expressly assumed by Buyer, which arose before

the consummation of the Definitive Agreement, and in connection therewith the Seller shall pay and discharge all known liabilities and

obligations prior to the closing.

3.2

Buyer shall assume the following liabilities or obligations of the Seller Seller(s): Current liabilities and obligations, listed on the

P&L report dated September 30th, 2023 for MjLink.com, Inc.

4.

Due Diligence

4.1

Buyer will be entitled to inspect and analyze the Seller’s assets and inventory as well as its business and operations, including

its books and records, customer orders, liabilities and prospects until the closing, or termination of this Letter of Intent.

4.2

Seller shall provide all information requested by the Buyer.

4.3

Buyer agrees to execute a Confidentiality Agreement and to not contact Seller’s customers or suppliers unless authorized by the

Seller.

5.

Contingencies

5.1

Before consummation of the Definitive Agreement, the Buyer must be satisfied with the due diligence review and information and documents

provided by the Seller.

5.2

Before consummation of the Definitive Agreement the Seller will provide the Buyer with an authorization from the landlord providing for

the Buyer to assume the Buyer’s lease, negotiate employment agreements of the Seller.

6.

Definitive Agreement

The

Definitive Agreement will be structured as a purchase and sale of MjLink’s assets to the Seller and will include customary covenants,

conditions and warranties.

7.

Binding Agreement

Except

for the paragraphs entitled “Exclusivity” and “Public Announcements and Confidentiality Agreement,” the provisions

in the LOI are binding on all Parties. The Transaction requires further negotiation and documentation, including preparing and executing

a final agreement. This letter does not require either party to proceed to the completion of a binding Definitive Agreement. The Parties

shall not be contractually bound to the sale, purchase or transfer listed above unless and until they enter into a written Definitive

Agreement, which agreement must be in the form and content satisfactory to both Parties and their legal counsel.

8.

Exclusivity

The

Parties agree to Exclusivity for a period of 90 days from the date the last signature is affixed hereto, which consideration for such

exclusivity agreement is the time and expense involved in drafting this Letter of Intent and conducting the due diligence review.

9.

Public Announcements and Confidentiality Agreement

The

Parties agree not to release any information to the public with regards to the LOI or the Definitive Agreement without the separate written

consent of both Parties. All parties agree that the terms of this LOI and any negotiations related thereto shall remain confidential

between the Parties and their respective legal counsel.

10.

Authority to Enter Letter of Intent

The

Officers or representative of the Parties signing this LOI affirm they are an authorized representative of their respective company and

have authority to sign this LOI.

11.

Closing, Termination of LOI

Closing

shall occur no later than 90 days from the date the last signature is affixed hereto unless mutually extended by the Parties. The LOI

terminates if the Closing does not occur within the 90-day period or has not been extended by written agreement of both Parties or in

the event that either Party provides written notice of termination. If the LOI terminates, the paragraphs entitled “Exclusivity”

and “Public Announcements and Confidentiality Agreement” survive termination and continue to bind the Parties, as does any

separately executed Confidentiality Agreement.

12.

Expenses Associated with this LOI and Due Diligence

The

Parties agree to bear their own expenses, including attorney’s and professional fees associated with any due diligence or any other

matter associated with the Transaction.

13.

Governing Law

This

letter shall be governed by the laws of the State of Colorado.

CONFIRMED

AND AGREED:

Agreed

to by Buyer

| /s/

Ken Tapp |

|

| By: |

Ken

Tapp / Director |

|

| Date

executed: |

September

29th 2023 |

|

Agreed

to by Seller

| /s/

Todd Markey |

|

| By: |

Todd

Markey / Director |

|

| Date

executed: |

September

29th 2023 |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

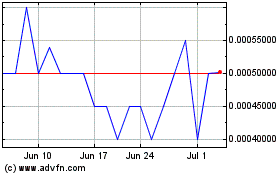

Decentral Life (PK) (USOTC:WDLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

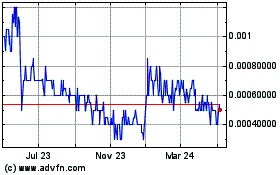

Decentral Life (PK) (USOTC:WDLF)

Historical Stock Chart

From Apr 2023 to Apr 2024