0001320854false00013208542023-09-212023-09-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 21, 2023

_______________________________

FREIGHTCAR AMERICA, INC.

(Exact name of registrant as specified in its charter)

_______________________________

|

|

|

Delaware |

000-51237 |

25-1837219 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

125 S. Wacker Drive, Suite 1500

Chicago, Illinois 60606

(Address of Principal Executive Offices) (Zip Code)

(800) 458-2235

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

RAIL |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 — Registrant's Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

Third Amendment to Amended and Restated Loan and Security Agreement

On September 21, 2023, FreightCar North America, LLC (“Borrower” and together with FreightCar America, Inc. (the “Company”) and certain other subsidiary guarantors, collectively, the “Loan Parties”) entered into a Third Amendment to Amended and Restated Loan and Security Agreement, which amends the Amended and Restated Loan and Security Agreement, dated July 30, 2021, as amended by the First Amendment to Amended and Restated Loan and Security Agreement, dated February 23, 2022, and by the Second Amendment to Amended and Restated Loan and Security Agreement, dated May 22, 2023 (such original agreement as amended prior to the Third Amendment to Amended and Restated Loan and Security Agreement, the “Siena Loan Agreement”), by and among the Loan Parties and Siena Lending Group LLC (the “Revolving Loan Lender”). Pursuant to the Siena Loan Agreement, the Revolving Loan Lender provided an asset backed credit facility, in the maximum aggregate principal amount of up to $35.0 million (the “Maximum Revolving Facility Amount”), consisting of revolving loans (the “Revolving Loans”).

The Third Amendment to Amended and Restated Loan and Security Agreement, among other things, (i) extended the scheduled maturity date of the Siena Loan Agreement from October 8, 2023 to October 31, 2024, and (ii) increased the Maximum Revolving Facility Amount by $10.0 million to a total of $45.0 million, provided, however, that after giving effect to each Revolving Loan and each letter of credit made available to the Loan Parties, (A) the outstanding balance of all Revolving Loans and the Letter of Credit Balance (which is defined in the Siena Loan Agreement as the sum of (a) the aggregate undrawn face amount of all outstanding Letters of Credit and (b) all interest, fees and costs due or, in Lender’s estimation, likely to become due in connection therewith) will not exceed the lesser of (x) the Maximum Revolving Facility Amount and (y) the Borrowing Base (as defined in the Siena Loan Agreement, as amended by the Third Amendment to Amended and Restated Loan and Security Agreement), and (B) none of the other Loan Limits (as defined in the Siena Loan Agreement) for Revolving Loans will be exceeded.

The foregoing description of the Third Amendment to Amended and Restated Loan and Security Agreement does not purport to be complete and is qualified in its entirety by reference to a copy of the Third Amendment to Amended and Restated Loan and Security Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Section 2 — Financial Information

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth above in Item 1.01 is hereby incorporated by reference into this Item 2.03.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

FREIGHTCAR AMERICA, INC. |

|

|

|

|

|

|

Date: September 26, 2023 |

By: |

/s/ Michael A. Riordan |

|

|

Michael A. Riordan |

|

|

Vice President, Finance, Chief Financial Officer and Treasurer |

|

|

|

Exhibit 10.1

THIRD AMENDMENT TO AMENDED AND RESTATED

LOAN AND SECURITY AGREEMENT

THIS THIRD AMENDMENT TO AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT (this “Amendment”), dated as of September 21, 2023, is entered into by and among JAC Operations, Inc., a Delaware corporation (“JAC”), Freight Car Services, Inc., a Delaware corporation (“Freight”), JAIX Leasing Company, a Delaware corporation (“JAIX”), FreightCar Short Line, Inc., a Delaware corporation (“Short”), Johnstown America, LLC, a Delaware limited liability company (“Johnstown”), FreightCar Alabama, LLC, a Delaware limited liability company (“Alabama”), FreightCar Rail Services, LLC, a Delaware limited liability company (“Rail”), FreightCar Rail Management Services, LLC, a Delaware limited liability company (“Management”), FreightCar North America, LLC, a Delaware limited liability company (“FCNA”), FCA-Fasemex, LLC, a Delaware limited liability company (“FCA” and, together with JAC, Freight, JAIX, Short, Johnstown, Alabama, Rail, Management, FCNA, and any other Person who from time to time becomes a Borrower under the Loan Agreement, collectively, the “Borrowers” and each individually, a “Borrower”), each of the Guarantors signatory hereto and SIENA LENDING GROUP LLC (“Lender”). Terms used herein without definition shall have the meanings ascribed to them in the Loan Agreement defined below.

RECITALS

A. Lender, Borrowers and Guarantors have previously entered into that certain Amended and Restated Loan and Security Agreement dated July 30, 2021 (as amended, restated, modified or supplemented from time to time, the “Loan Agreement”), pursuant to which Lender has made certain loans and financial accommodations available to Borrowers.

B. Lender, Borrowers and Guarantors now wish to amend the Loan Agreement on the terms and conditions set forth herein.

C. The Loan Parties are entering into this Amendment with the understanding and agreement that, except as specifically provided herein, none of Lender’s rights or remedies as set forth in the Loan Agreement or any other Loan Document is being waived or modified by the terms of this Amendment.

AGREEMENT

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants herein contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1.Amendments to Loan Agreement.

(a)Repayments. Section 1.7 of the Loan Agreement is hereby amended to add the following new clause (e) at the end thereof:

“(e) Mandatory Prepayments. If on any day for any reason whatsoever on any date during any Specified Period, (a) Loans are outstanding and (b) the Consolidated Cash Balance as of the end of such day exceeds $10,000,000, then Borrowers shall, prior to the close of business on such day, prepay the Loans in an aggregate principal amount equal to such excess.”

(b)Voluntary Termination of Loan Facilities. Section 1.8 of the Loan Agreement is hereby amended and restated in its entirety to read as follows:

“1.8 Voluntary Termination of Loan Facilities. Borrowers may, on at least fifteen (15) days prior and irrevocable written notice received by Lender, permanently terminate the Loan facilities by repaying all of the outstanding Obligations, including all principal, interest and fees with respect to the Revolving Loans. If, on the date of a voluntary termination pursuant to this Section 1.8, there are any outstanding Letters of Credit, then on such date, and as a condition precedent to such termination, Borrowers shall provide to Lender cash collateral in an amount equal to 103% of the Letter of Credit Balance to secure all of the Obligations (including reasonable attorneys’ fees and other expenses) relating to said Letters of Credit, pursuant to a cash pledge agreement in form and substance reasonably satisfactory to Lender. From and after such date of termination, Lender shall have no obligation whatsoever to extend any additional Loans or Letters of Credit and all of its lending commitments hereunder shall be terminated.”

(c)Remedies with Respect to Lending Commitments/Acceleration/Etc. Section 7.2 of the Loan Agreement is hereby amended and restated in its entirety to read as follows:

“7.2 Remedies with Respect to Lending Commitments/Acceleration/Etc. Upon the occurrence and during the continuance of an Event of Default Lender may, in Lender’s sole discretion (a) terminate all or any portion of its commitment to lend to or extend credit to Borrowers under this Agreement and/or any other Loan Document, without prior notice to any Loan Party, and/or (b) demand payment in full of all or any portion of the Obligations (whether or not payable on demand prior to such Event of Default), and demand that the Letters of Credit be cash collateralized in the manner described in Section 1.7(c) and/or (c) take any and all other and further actions and avail itself of any and all rights and remedies available to Lender under this Agreement, any other Loan Document, under law and/or in equity including, without limitation, drawing under the Standby Letter of Credit. Notwithstanding the foregoing sentence, upon the occurrence of any Event of Default described in Section 7.1(f) or Section 7.1(g), without notice, demand or other action by Lender all of the Obligations shall immediately become due and payable whether or not payable on demand prior to such Event of Default. For the avoidance of doubt, Lender shall not have any right to draw on the Standby Letter of Credit unless an Event of Default has occurred and is continuing.”

(d)Schedule A. Schedule A to the Loan Agreement is hereby amended and restated in its entirety and replaced with Schedule A attached hereto as Exhibit A.

(e)Standby Letter of Credit. The definition of “Standby Letter of Credit” set forth in Schedule B to the Loan Agreement is hereby amended and restated in its entirety to read as follows:

“Standby Letter of Credit” means that certain Irrevocable Standby Letter of Credit No. IS000211603U, dated on or about the date hereof, issued by the LC Issuer for the benefit of Lender with an original face amount of $25,000,000.00 and an expiry date of July 29, 2022, as amended by that certain Amendment to Irrevocable Standby Letter of Credit dated September 15, 2023, and as otherwise amended, restated, supplemented, extended or otherwise modified from time to time.”

(f)Additional Definitions. Schedule B to the Loan Agreement is hereby amended to add the following new defined terms in the appropriate alphabetical order:

“ “Consolidated Cash Balance” means, on any day, (a) the aggregate amount of cash and Cash Equivalents, in each case, held or owned by (either directly or indirectly), credited to the account of or would otherwise be required to be reflected as an asset on the balance sheet of the Borrowers less (b) the sum of (i) any restricted cash or Cash Equivalents to pay royalty obligations, working interest obligations, suspense payments, severance taxes, payroll, payroll taxes, other taxes, employee wage and benefit payments and trust and fiduciary obligations or other obligations of the Borrowers to third parties and for which the Borrowers have issued checks or have initiated wires or ACH transfers (or, in the Borrowers’ discretion, will issue checks or initiate wires or ACH transfers on or before close of business on such same day) in order to pay, (ii) other amounts for which the Borrowers have issued checks or have initiated wires or ACH transfers but have not yet been subtracted from the balance in the relevant account of the Borrowers and (iii) while and to the extent refundable, any cash or Cash Equivalents of the Borrowers constituting purchase price deposits held in escrow pursuant to a binding and enforceable purchase and sale agreement with a third party containing customary provisions regarding the payment and refunding of such deposits.”

“ “Specified Period” means any five (5) consecutive Business Day period commencing on the date that is five (5) consecutive Business Days immediately prior to the last day of each fiscal quarter.”

2.Effectiveness of this Amendment. This Amendment shall become effective upon the satisfaction, as determined by Lender, of the following conditions.

(a)Amendment. Lender shall have received this Amendment fully executed by all the parties hereto;

(b)Amendment to Standby Letter of Credit. Lender shall have received a duly executed and original copy of an amendment, in form and substance satisfactory to Lender, to the Standby Letter of Credit extending the expiry date thereof to a date occurring no earlier than November 15, 2024;

(c)Third Amended and Restated Fee Letter. Lender shall have received that certain Third Amended and Restated Fee Letter fully executed by all of the parties thereto;

(d)Amendment No. 6 to Intercreditor. Lender shall have received that certain Amendment No. 6 to Intercreditor Agreement fully executed by all of the parties thereto;

(e)Secretary’s Certificate. Lender shall have received a Secretary’s certificate, satisfactory to Lender, certifying to the effect that (x) attached thereto is a true and complete copy of resolutions duly adopted by the board of directors (or other applicable governing body) of the Borrowers authorizing the execution, delivery and performance of this Amendment, and that such resolutions have not been modified, rescinded or amended and are in full force and effect and (y) the certificate or articles of incorporation or organization of the Borrowers previously delivered to the Lender have not been amended since the date of the last amendment thereto furnished pursuant to the Loan Agreement, and that such certificate or articles are in full force and effect;

(f)Representations and Warranties. The representations and warranties set forth herein and in the Loan Agreement must be true and correct in all material respects on and as of the date of this Amendment with the same effect as though made on and as of such date, except to the extent such representations and warranties expressly relate to an earlier date (in which case such representations and warranties shall be true and correct in all material respects as of such earlier date); provided that any

representation and warranty qualified by “materiality”, “Material Adverse Effect” or similar language shall be true and correct (after giving effect to any qualification therein) in all respects;

(g)Payment of Expenses. Lender shall have received payment or reimbursement for its reasonable and documented out-of-pocket attorneys’ fees and expenses in connection with the preparation, negotiation and execution of this Amendment and the documents provided for herein or related hereto (the “Fees and Expenses”). Borrowers hereby authorize Lender to charge as a Revolving Loan the amount of the Fees and Expenses all when due and payable in satisfaction thereof, and request, to the extent that Borrowers have not separately reimbursed Lender, that Lender makes one or more Revolving Loans on or after the date hereof in an aggregate amount equal to the total amount of such Fees and Expenses, and that Lender disburses the proceeds of such Revolving Credit Loan(s) in satisfaction thereof; and

(h)Other Required Documentation. All other documents and legal matters in connection with the transactions contemplated by this Amendment shall have been delivered or executed or recorded, as reasonably required by Lender.

3.Representations and Warranties. Each Loan Party represents and warrants as follows:

(a)Authority. Such Loan Party has the requisite corporate or limited liability company, as applicable, power and authority to execute and deliver this Amendment, and to perform its obligations hereunder, under the Loan Agreement (as amended or modified hereby) and under the other Loan Documents to which it is a party. The execution, delivery and performance by such Loan Party of this Amendment have been duly approved by all necessary corporate or limited liability company, as applicable, action and no other corporate or limited liability company, as applicable, proceedings are necessary to consummate such transactions.

(b)Enforceability. This Amendment has been duly executed and delivered by each Loan Party. This Amendment, the Loan Agreement (as amended or modified hereby) and each other Loan Document is the legal, valid and binding obligation of each Loan Party, enforceable against each Loan Party in accordance with its terms, and is in full force and effect, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting creditors’ rights generally, regardless of whether considered in a proceeding in equity or at law.

(c)Representations and Warranties. The representations and warranties contained in the Loan Agreement and each other Loan Document (other than any such representations or warranties that, by their terms, are specifically made as of a date other than the date hereof) are correct in all material respects on and as of the date hereof as though made on and as of the date hereof, except to the extent such representations and warranties expressly relate to an earlier date (in which case such representations and warranties shall be true and correct in all material respects as of such earlier date); provided that any representation and warranty qualified by “materiality”, “Material Adverse Effect” or similar language shall be true and correct (after giving effect to any qualification therein) in all respects.

(d)Due Execution. The execution, delivery and performance of this Amendment are within the power of each Loan Party, have been duly authorized by all necessary corporate or limited liability company, as applicable, action, have received all necessary governmental approval, if any, and do not contravene any applicable law or any material contractual restrictions binding on any Loan Party.

(e)No Default. No event has occurred and is continuing that constitutes a Default or an Event of Default.

4.Choice of Law. THIS AMENDMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED THEREIN WITHOUT REGARD TO CONFLICT OF LAW PRINCIPLES (EXCEPT SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATION LAW). FURTHER, THE LAW OF THE STATE OF NEW YORK SHALL APPLY TO ALL DISPUTES OR CONTROVERSIES ARISING OUT OF OR CONNECTED TO OR WITH THIS AMENDMENT AND ALL SUCH RELATED LOAN DOCUMENTS WITHOUT REGARD TO CONFLICT OF LAW PRINCIPLES (EXCEPT SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATION LAW).

5.Counterparts; Facsimile Signatures. This Amendment may be executed in any number of and by different parties hereto on separate counterparts, all of which, when so executed, shall be deemed an original, but all such counterparts shall constitute one and the same agreement. Any signature delivered by a party by e-mail, Docusign, facsimile or other similar form of electronic transmission shall be deemed to be an original signature hereto. For the avoidance of doubt, the authorization under this paragraph may include, without limitation, a manually signed paper document which has been converted into electronic form (such as scanned into PDF format or transmitted via facsimile), or an electronically signed document converted into another format, for transmission, delivery and/or retention.

6.Reference to and Effect on the other Loan Documents.

(a)Upon and after the effectiveness of this Amendment, each reference in the Loan Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Loan Agreement, and each reference in the other Loan Documents to “the Loan Agreement”, “thereof” or words of like import referring to the Loan Agreement, shall mean and be a reference to the Loan Agreement as modified and amended hereby.

(b)Except as specifically amended above, the Loan Agreement and all other Loan Documents, are and shall continue to be in full force and effect and are hereby in all respects ratified and confirmed and shall constitute the legal, valid, binding and enforceable obligations of Borrowers to Lender, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting creditors’ rights generally, regardless of whether considered in a proceeding in equity or at law.

(c)The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the Lender under the Loan Agreement or any of the other Loan Documents, nor constitute a waiver of any provision of the Loan Agreement or any of the other Loan Documents.

(d)To the extent that any terms and conditions in any of the other Loan Documents shall contradict or be in conflict with any terms or conditions of the Loan Agreement, after giving effect to this Amendment, such terms and conditions are hereby deemed modified or amended accordingly to reflect the terms and conditions of the Loan Agreement as modified or amended hereby.

7.Estoppel. To induce Lender to enter into this Amendment and to continue to make advances to Borrowers under the Loan Agreement, each Loan Party hereby acknowledges and agrees that, as of the date hereof, there exists no right of offset, defense, counterclaim or objection in favor of Borrowers as against Lender with respect to the Obligations.

8.Integration. This Amendment, together with the Loan Agreement and the other Loan Documents, incorporates all negotiations of the parties hereto with respect to the subject matter hereof and is the final expression and agreement of the parties hereto with respect to the subject matter hereof.

9.Severability. If any part of this Amendment is contrary to, prohibited by, or deemed invalid under Applicable Laws, such provision shall be inapplicable and deemed omitted to the extent so contrary, prohibited or invalid, but the remainder hereof shall not be invalidated thereby and shall be given effect so far as possible.

10.Submission of Amendment. The submission of this Amendment to the parties or their agents or attorneys for review or signature does not constitute a commitment by Lender to waive any of its rights and remedies under the Loan Agreement or any other Loan Document, and this Amendment shall have no binding force or effect until all of the conditions to the effectiveness of this Amendment have been satisfied as set forth herein.

11.Guarantors’ Acknowledgment. With respect to the amendments to the Loan Agreement effected by this Amendment, each Guarantor hereby acknowledges and agrees to this Amendment and confirms and agrees that its Guaranty (as modified and supplemented in connection with this Amendment) is and shall continue to be, in full force and effect and is hereby ratified and confirmed in all respects except that, upon the effectiveness of, and on and after the date of this Amendment, each reference in such Guaranty to the Loan Agreement, “thereunder”, “thereof” or words of like import referring to the Loan Agreement, shall mean and be a reference to the Loan Agreement as amended or modified by this Amendment. Although Lender has informed the Guarantors of the matters set forth above, and each Guarantor has acknowledged the same, each Guarantor understands and agrees that Lender has no duty under the Loan Agreement, any Guaranty or any other agreement with any Guarantor to so notify any Guarantor or to seek such an acknowledgement, and nothing contained herein is intended to or shall create such a duty as to any transaction hereafter.

[Remainder of page Intentionally Blank]

IN WITNESS WHEREOF, the parties have entered into this Amendment as of the date first above written.

|

|

BORROWERS: |

[JAC OPERATIONS, INC. |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

[FREIGHT CAR SERVICES, INC. |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

[JAIX LEASING COMPANY |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

[FREIGHTCAR SHORT LINE, INC. |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

[JOHNSTOWN AMERICA, LLC |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

|

|

[FREIGHTCAR ALABAMA, LLC |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

|

|

[FREIGHTCAR RAIL SERVICES, LLC |

[Signature Page for Third Amendment to Loan and Security Agreement]

|

|

|

|

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

FREIGHTCAR RAIL MANAGEMENT SERVICES, LLC |

By: |

/s/ James R. Meyer |

Name: |

James R. Meyer |

Title: |

President |

|

|

|

[FREIGHTCAR NORTH AMERICA, LLC |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

[FCA-FASEMEX, LLC |

By: |

/s/ James R. Meyer |

Name: |

James R. Meyer |

Title: |

President |

|

|

GUARANTORS: |

[FREIGHTCAR AMERICA, INC. |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

[FCA-FASEMEX, S. DE R.L. DE C.V. |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

|

|

|

FCA-FASEMEX ENTERPRISE, S. DE R.L. DE C.V. |

By: |

/s/ Michael Riordan |

Name: |

Michael Riordan |

[Signature Page for Third Amendment to Loan and Security Agreement]

|

|

Title: |

Vice President, Finance; Chief Financial Officer & Treasurer |

[Signature Page for Third Amendment to Loan and Security Agreement]

|

|

|

SIENA LENDING GROUP LLC |

By: |

/s/ Keith Holler |

Name: |

Keith Holler |

Title: |

Authorized Signatory |

|

|

By: |

/s/ Steve Sanicola |

Name: |

Steve Sanicola |

Title: |

Authorized Signatory |

[Signature Page for Third Amendment to Loan and Security Agreement]

Exhibit A

Schedule A

Description of Certain Terms

|

|

1. Loan Limits for Revolving Loans

and Letters of Credit: |

|

(a) Maximum Revolving Facility Amount: |

$45,000,000 |

(b) Availability Block: |

3.00% of the issued and undrawn amount under the Standby Letter of Credit |

(c) Accounts Advance Rate: |

85%; provided, that if Dilution exceeds 3%, Lender may, at its option (A) reduce such advance rate by the number of full or partial percentage points compromising such excess or (B) establish a Reserve on account of such excess (the “Dilution Reserve”). |

(d) Accounts Sublimit: |

$20,000,000 |

3. Interest Rates: |

|

(b) Revolving Loans made in respect of Excess Availability arising from clause (b) of the definition of Borrowing Base |

1.50% per annum in excess of the Base Rate |

(a) All other Revolving Loans |

2.00% per annum in excess of the Base Rate |

4. Maximum Days re Eligible Accounts: |

|

(a) Maximum days after original invoice date for Eligible Accounts: |

Ninety (90) days |

(b) Maximum days after original invoice due date for Eligible Accounts: |

Sixty (60) days |

5. Lender’s Bank: |

Wells Fargo Bank, National Association and its affiliates

Siena Lending Group Depository Account

Account # [***]

ABA Routing # [***]

Reference: JAC Operations, Inc.

(which bank may be changed from time to time by notice from Lender to Borrowers) |

|

|

6. Scheduled Maturity Date: |

October 31, 2024 |

v3.23.3

Document And Entity Information

|

Sep. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 21, 2023

|

| Entity Registrant Name |

FREIGHTCAR AMERICA, INC.

|

| Entity Central Index Key |

0001320854

|

| Entity File Number |

000-51237

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

25-1837219

|

| Entity Address, Address Line One |

125 S. Wacker Drive

|

| Entity Address, Address Line Two |

Suite 1500

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60606

|

| City Area Code |

800

|

| Local Phone Number |

458-2235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

RAIL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

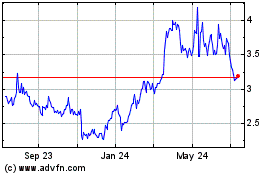

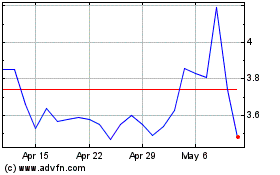

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Apr 2023 to Apr 2024