Study reveals only 3% of crypto professionals receive salaries in

cryptocurrencies

According to a study by Pantera Capital, 97% of professionals in

the crypto industry receive their salaries in fiat currencies,

while only 3% are paid in cryptocurrencies. The majority of

crypto earners opt for stablecoins like USDC and USDT, with 13%

choosing bitcoin. Cryptography engineers have an average

salary of $120,000 globally, with those in North America earning

$193,000, while executives earn between $147,363 and $335,400,

depending on the stage of their companies. Around 88% of roles

in the crypto industry are remote.

Chase UK bans cryptocurrency transactions to protect customers from

fraud

Chase UK, the UK arm of JPMorgan Chase & Co (NYSE:JPM),

announced a ban on cryptocurrency-related transactions from October

16. The decision was motivated by the increase in fraud and

scams involving digital assets. Customers will no longer be

able to use debit cards or bank transfers to purchase

cryptocurrencies in order to protect their funds against fraudulent

activity. This measure reflects a cautious and protective

approach amid the growing number of crypto frauds in the UK.

Bitget launches smart bot to rebalance cryptocurrency portfolios

Bitget, a crypto derivatives exchange, has introduced Smart

Portfolio, a bot that allows users to adjust their holdings based

on price volatility to increase profits. Smart Portfolio

dynamically rebalances positions within a user-chosen

cryptocurrency portfolio, reallocating between cryptocurrencies

based on market value. The tool aims to increase total

portfolio value over time by offering two rebalancing modes –

portfolio percentage and calendar rebalancing – to suit users’

investment strategies.

US SEC opposes Coinbase’s involvement in Celsius Network

reorganization plan

U.S. Securities and Exchange Commission (SEC) challenged Celsius

Network’s proposal to use Coinbase (NASDAQ:COIN) in its bankruptcy

and restructuring plan. SEC claimed that the agreement with

Coinbase is comprehensive and requires additional review, citing

concerns about Coinbase acting as an unregistered broker-dealer and

exchange. SEC also expressed concerns that this could result in

additional litigation as Coinbase faces an ongoing lawsuit with the

SEC. SEC requested full disclosure of the settlement and the

preparation of a new settlement that addresses its concerns.

Coinbase registers with Bank of Spain for crypto services

Coinbase announced on Monday its registration with the Bank of

Spain to offer crypto exchange and custody

services. Registration is a requirement for companies wishing

to operate in the crypto sector in the country and implies

adherence to anti-money laundering regulations. Although Spain

does not yet have a specific licensing system for crypto companies,

the European Union will require compliance with the MiCA regulation

from 2024.

Binance Japan and Mitsubishi UFJ Trust explore stablecoin issuance

to boost Web3; Binance resumes services in Belgium

Binance Japan e a Mitsubishi UFJ Trust and Banking Corporation

(NYSE:MUFG) are collaborating on a study to issue stablecoins

pegged to sovereign currencies, such as the Japanese yen, with the

aim of boosting Web3 adoption in the country. The study aims

to accelerate the mass adoption of Web3 in Japan, and relevant

operations are expected to begin by the end of next

year. However, the issuance of stablecoins is subject to

regulatory approvals. Progmat Coin platform, led by MUTB, will

enable the issuance of stablecoins on multiple

blockchains. Additionally, Binance has resumed registration

and access to its products and services in Belgium, after three

months of suspension due to an order from the Financial Services

and Markets Authority (FSMA). The company announced that

several of its products and services are once again available to

Belgian users who have accepted the new Terms of Use. Binance will

now serve its customers in Belgium through its Polish entity,

Binance Poland, following concerns from the FSMA about providing

services outside of the European Economic Area.

Gemini will invest US$24 million in expansion in India

Cryptocurrency exchange Gemini plans to invest around $24

million over the next two years to expand its presence in

India. The company has opened an office in Gurgaon and plans

to utilize India’s engineering hub for crypto innovation. With

over 70 professionals in Gurgaon, Gemini plays a crucial role in

developing global products and services. The decision to

expand in India coincides with the country’s efforts towards clear

crypto regulations, following the G20 consensus on a global

regulatory framework.

Kraken obtains license to expand cryptocurrency services in Europe

Cryptocurrency exchange Kraken has obtained an Electronic Money

Institution (EMI) License from the Central Bank of Ireland and a

Virtual Asset Service Provider (VASP) Registration from the Bank of

Spain. EMI enables Kraken to expand its euro cryptocurrency

trading services to 27 member states of the European Union and

countries in the European Economic Area. Additionally, VASP

registration in Spain allows Kraken to offer exchange and wallet

custody services to Spanish residents. The company also has

VASP registrations in Italy and Ireland, supporting over 200

trading pairs across multiple fiat currencies.

Court in Shanghai recognizes Bitcoin as unique and non-replicable

asset

The No. 2 Intermediate People’s Court of Shanghai, China, has

issued an official recognition of Bitcoin as a unique and

non-replicable digital asset, highlighting its scarcity and

intrinsic value. In a report released on September 25, the

court described Bitcoin (COIN:BTCUSD) as different from other

digital currencies, emphasizing its monetary characteristics and

global use. This decision, despite the Chinese government’s

hostile policies towards Bitcoin, strengthens the cryptocurrency’s

legal position in China and reinforces its classification as

legally protected property.

Venezuela extends period of reorganization of Sunacrip, its crypto

oversight body

Venezuela announced the extension of the forced reorganization

period of the National Cryptoactive Superintendence (Sunacrip),

which was closed in March 2023 due to a corruption

scandal. The extension, ordered by President Nicolás Maduro,

extends the period until March 24, 2024. Sunacrip was established

in 2018 to oversee crypto-related activities in the country,

including the implementation of the petro, a cryptocurrency linked

to Venezuela’s oil reserves. The previous closure caused

disruption to the state-linked Venezuelan crypto industry.

FTX founder again requests temporary release from prison before

trial

Lawyers for Sam Bankman-Fried, founder of the now-defunct

cryptocurrency exchange FTX, have filed a new request with the

district court for his temporary release ahead of his trial

scheduled for next month. They argue that the temporary

release is necessary to adequately prepare their defense, due to

the access restrictions currently in place. Bankman-Fried

faces multiple charges, including fraud, and could be sentenced to

more than 100 years in prison if found guilty. This is the

latest attempt by his lawyers to secure his temporary release from

prison before trial.

Layer 2 Optimism announces third OP token airdrop for community

The Layer 2 Optimism Network (COIN:OPUSD) has launched its third

airdrop of OP tokens, targeting over 31,000 eligible addresses, as

part of its efforts to engage the community. The airdrop will

distribute approximately $26 million in OP tokens directly to

qualified wallets, without the need to claim through

websites. The initiative aims to reward participants in the

DAO Optimism Collective’s delegation activity and includes x2

bonuses for those who actively delegated participation in the

governance criteria. The process has generated enthusiasm on

social media. Optimism is a layer 2 solution for Ethereum

scalability.

Lumerin Marketplace on the Arbitrum Network facilitates Bitcoin

hash power trading

Lumerin Hashpower Marketplace, launched on the Arbitrum network,

allows Bitcoin miners to easily buy and sell hash power. This

allows buyers to increase their chances of earning Bitcoin rewards

without the need to purchase expensive equipment that quickly

depreciates. Negotiations occur through smart contracts,

specifying value, duration and price of hash power. Sellers,

especially miners in places with low electricity costs, can

arbitrage prices and sell contracts at market prices, retaining the

difference.

Circle Internet Financial extends use of EURC stablecoin to Stellar

blockchain

Stablecoin issuer Circle Internet Financial has expanded its

euro-pegged stablecoin EURC to the Stellar (COIN:XLMUSD) blockchain

in addition to Ethereum and Avalanche networks, as announced in a

press release. Digital payments company Ripio, mainly focused

on Latin America and recently licensed to operate in Spain, was the

first to make payments, deposits and withdrawals in EURC available

on the Stellar network for its users. This move aims to

improve European remittance corridors, cross-border payments and

treasury management. Although euro stablecoins have not yet

gained widespread adoption, they play a crucial role in the digital

asset economy, especially for people in countries with unstable

currencies.

Paradigm launches Policy Lab to boost cryptography research and

advocacy in cryptocurrency

Cryptocurrency investment firm Paradigm has revealed the launch

of its Policy Lab, touting it as the first forum of its kind for

academics, policy experts, lawyers and technologists. Policy

Lab co-directors Rodrigo Seira and Brendan Malone say the lab will

produce cutting-edge research, analysis, and advocacy on critical

policy issues in cryptography and advanced

technologies. Paradigm also named two inaugural academic

fellows to study “regulatory equivalence.” The laboratory aims

to fill the lack of technical data-based research in US

cryptographic policy. Additionally, it will host a Research

Center open to the public and offer funding for relevant

research.

Cartesi introduces Honeypot on the Ethereum network to test

security

Application rollup protocol Cartesi has launched its first

decentralized application, Honeypot, on the Ethereum

network. Honeypot challenges developers and ethical hackers to

test the security of the underlying code and earn up to 1.77

million Cartesi tokens ($220,000) after one year. This helps

verify Cartesi’s code on the mainnet and promotes its use in other

dapps. Cartesi (COIN:CTSIUSD) is a Layer 2 network that

facilitates the creation of powerful dapps, enabling off-chain

calculations in a Linux environment, expanding the possibilities

for web3 developers.

Walmart will sell NFT Pudgy Penguins toys in 2,000 stores

Walmart (NYSE:WMT) plans to make the Pudgy Penguins NFT toy

collection available in its 2,000 U.S. stores. Each Pudgy toy

will provide access to Pudgy World, a digital social platform based

on the Ethereum Layer 2 zkSync Era blockchain network. Walmart will

offer 26 Pudgy toy models, with exclusive Ice Chrome, Gold Chrome

and Clip-On Plush surprises in mysterious igloos. Prices range

from $2.99 to $11.97, aiming to meet customer demands for

innovation and affordable fun.

Fhenix raises $7M to develop encrypted smart contracts

Fhenix, a privacy-focused blockchain, has raised $7 million in a

round led by Multicoin Capital and Collider Ventures. These

funds will be used to launch Fhenix’s confidential smart contract

platform on the public testnet called “Renaissance” and support the

development of the ecosystem following the launch of the private

devnet in July. Fhenix utilizes fully homomorphic encryption

to enable computation of encrypted data without exposing underlying

information, addressing data confidentiality concerns in the

Ethereum ecosystem.

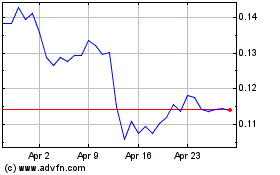

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024