Bitcoin faces decline and strong dollar

Bitcoin (COIN:BTCUSD) opened at $26,000 on September 24, with a

significant weekly drop severely impacting its price

trajectory. Analysis shows uncertainty in BTC price after

briefly breaking $26,000 support. Analysts such as BaroVirtual

and Rekt Capital indicate a possible Bitcoin decline to the $22,000

to $20,000 range if resistance is not strengthened. Meanwhile,

the US Dollar Index (DXY) reaches new highs, creating a challenging

environment for risk assets and cryptocurrencies. Meanwhile,

the U.S. Dollar Index (DXY) is hitting new highs, creating a

challenging environment for risk assets and cryptocurrencies. On

Friday, 1.217 million Bitcoin and Ether options contracts, worth

$4.8 billion, will expire on Deribit. Approximately 10% are

Bitcoin, and the rest are Ether (COIN:ETHUSD). These contracts can

influence the markets and are closely watched by traders and

investors; they can appreciate or become worthless depending on the

price fluctuations of the cryptocurrencies by the end of the

week.

Token fraud causes Upbit exchange to temporarily suspend APT

services

A fraudulent token mimicking Aptos (COIN:APTUSD) led to the

temporary suspension of services for the APT token on Korean

exchange Upbit, after deposits and withdrawals of the counterfeit

asset were detected. The token comes from a fake airdrop

website and is in around 400,000 wallets. The failure at

Upbit, which allowed token acceptance, was due to a lack of

rigorous source code verification.

Transfer of unclaimed tokens to the Arbitrum treasury

The Arbitrum Foundation (COIN:ARBUSD) has relocated 69 million

unclaimed tokens, equivalent to $57 million, to its treasury DAO,

following near-unanimous community approval. The original

proposal intended these tokens for a time-constrained smart

contract, but the final decision aimed for an immediate

redirection, as per the AIP-7 Arbitration Improvement

Proposal. The tokens, initially made available as a reward for

early users of the Ethereum Layer 2 network, remained unclaimed

after a period of six months.

Vitalik Buterin’s move could impact the value of Ether

Vitalik Buterin, co-founder of Ethereum (COIN:ETHUSD),

transferred 400 ETH (about $630,000) to Coinbase (NASDAQ:COIN),

part of a series of recent transactions totaling more than 1,000

ETH. The motivation behind these transfers is unclear, often

signaling potential sales. Given the recent devaluation of

Ethereum, these movements could increase selling pressure. The

devaluation and inflation of Ether are linked to the reduction in

activity on the Ethereum network. Despite occasional sales

throughout the year, Buterin holds a significant 250,000 ETH.

Changes to Tether’s terms of service in Singapore raise concerns

Stablecoin issuer Tether (COIN:USDTUSD) has reportedly modified

its terms of service in Singapore, prompting Cake DeFi CEO Julian

Hosp to reveal an email about these changes. Tether appears to

have included restrictions that prevent certain groups, including

Singapore-based companies, from exchanging USDT for US

dollars. Despite confusion and speculation in the

cryptocurrency community, Tether CTO Paolo Ardoino called the

concern unfounded, noting that the policy has been in effect since

2020. These changes come amid a money laundering scandal in

Singapore.

Ceasing TerraUSD (USTC) minting on Terra Classic

Following a community vote, Terra Classic has decided to stop

the minting of TerraUSD (COIN:USTCUSD), a token that plummeted by

99% after the collapse of the Terra protocol in 2022. Central to

the price drop and issues in DeFi applications, the token is now

worth 1 cent. This move aims to protect users and investors by

permanently removing circulating tokens, potentially stabilizing

the USTC’s value. This change is part of a broader effort by

engineers and developers to revitalize the Terra Classic ecosystem

and appreciate the LUNC token (COIN:LUNCUSD).

Controversy at Chainlink: Security change in multisig wallet

generates discontent

Chainlink, a decentralized oracle network, is facing criticism

after silently changing the number of subscribers required in its

multisig wallet from 4 out of 9 to 4 out of 8, a change that has

been condemned by users on social media, especially on X. Chris

Blec, a cryptocurrency researcher, was one of those who questioned

Chainlink’s (COIN:LINKUSD) lack of transparency. However, a

Chainlink representative stated that this modification is part of a

standard subscriber switching procedure, maintaining the integrity

of Chainlink services.

MicroStrategy expands Bitcoin portfolio with purchase of US$147

million

MicroStrategy (NASDAQ:MSTR), a leader in business intelligence,

acquired an additional 5,455 Bitcoins, bringing its total holdings

to 158,245 BTC, worth about $4.68 billion. The recent

purchase, made between August 1 and September 24, was disclosed in

an 8-K form to the SEC on September 25, totaling an investment of

US$147.3 million, with an average price of US$27,053 per

BTC. Despite aggressive purchases, the company is operating at

a loss as the value of Bitcoin (COIN:BTCUSD) is currently below the

company’s average acquisition cost.

Board changes: Michael Arrington leaves position at Celsius

successor company

Michael Arrington, founder of Arrington Capital, has resigned

from his position on the board of the company that will take over

the activities of failed crypto lender Celsius. He will be

replaced by Ravi Kava, partner at Fahrenheit and advisor to

Arrington Capital. Arrington cited disagreements over board

constitutions as the reason for his departure, but emphasized his

continued support for the agreement. The resignation comes

amid challenges to Celsius’ reorganization plan by a U.S.

administrator.

Bitwise submits market review to SEC in attempt to launch spot

Bitcoin ETF

Bitwise, the crypto asset manager, has submitted a comprehensive

review to the Securities and Exchange Commission (SEC) regarding

the interaction between the future and the spot market of bitcoin,

integrating an amended application for a spot bitcoin ETF by NYSE

Arca. So far, the SEC has only approved ETFs based on bitcoin

futures. The aim of the review is to address the SEC’s concerns

about the influence of the futures market on spot prices. Bitwise

maintains that there is academic consensus that the CME’s futures

market impacts the spot market and has been striving to clarify

this and other issues to gain approval.

Digital Euro: A project amid concerns and skepticism

The implementation of a digital euro is still at least two years

away, said the president of the European Central Bank, Christine

Lagarde. During conversations with lawmakers, concerns about

privacy and the disruptive nature of digital currency were

debated. Lagarde highlighted the need for privacy, but without

total anonymity, and stated that advances will only occur after

more tests and legislative approval. Members of the European

Parliament remain cautious, questioning the potential impact on the

banking system and users’ privacy.

Tourists in China: Easy use of digital yuan with Visa and

Mastercard

Tourists with plans to visit China can now preload their digital

wallets with yuan through Visa (NYSE:V) and Mastercard (NYSE:MA)

while updates continue to be made to the central bank’s digital

currency app, e- CNY, still in the testing phase. The app,

available for iOS and Google Play Store, allows the opening of

digital wallets in yuan, now with support for international cards,

in line with the start of the Asian Games and allowing easy

transactions for visitors using e-CNY.

Hong Kong SFC to release exchange license candidates after JPEX

case

Hong Kong’s SFC plans to reveal a list of applicants for

cryptocurrency exchange licenses, following an investigation into

JPEX that resulted in several arrests. This incident

highlighted the risks of operating with unregulated virtual asset

platforms and the need for adequate regulation to sustain market

confidence. Hong Kong Chief Executive John Lee reiterated the

importance of all platforms obtaining a license from the SFC to

ensure investor protection. To date, only OSL Digital

Securities Limited and Hash Blockchain Limited have been

licensed.

HTX mitigates US$7.9 million loss after hacker attack

Cryptocurrency exchange platform HTX (formerly Huobi) was the

victim of a cyberattack, leading to the loss of 5,000 Ether

(COIN:ETHUSD), equivalent to $7.9 million, as reported by Justin

Sun, a consultant at the company . Sun reassured customers via

X, revealing that losses have now been completely covered by

HTX. He downplayed the impact of the attack, contrasting the

value lost with the $3 billion in user assets and saying the stolen

amount represented only about two weeks of HTX’s revenue.

Hacker attack drains $200 million from Mixin Network

Mixin Network, a decentralized peer-to-peer network, suffered a

hacker attack, resulting in a loss of around US$200

million. The attack occurred on September 23, with deposit and

withdrawal services being suspended immediately after

discovery. Companies like SlowMist and Google were called in

to investigate. The hacker had a prior relationship with

Mixin, having received funds in 2022. Asset recovery and

vulnerability resolution are ongoing, but there is still no set

date for the full resumption of services.

Lazarus Group’s illicit cryptocurrency fortune

The Lazarus Group, a hacker collective linked to North Korea,

holds more than $47 million in cryptocurrencies, predominantly

Bitcoin (COIN:BTCUSD), according to a report from 21.co. The

data indicates the possession of crypto assets in wallets linked to

the group, totaling US$75 million at the time of the

report. The actual amount may be even higher. This group

is associated with several cyber attacks and cryptocurrency theft,

allegedly financing North Korea’s missile programs through its

cyber crimes.

Million-Dollar mistake: Australian to face charges for spending

after incorrect receipt of cryptocurrency

An Australian named Jatinder Singh is facing legal charges after

erroneously receiving AUD 10.5 million from Crypto.com and spending

the money on properties, automobiles, and art. This incident

occurred due to an employee’s mistake who incorrectly entered

Singh’s account number in a spreadsheet. He will be tried next

month, and his partner, Thevamanogari Manivel, has already been

sentenced to 18 months in prison after pleading guilty. The mistake

was discovered seven months later, but Singh had already

transferred part of the funds to other accounts.

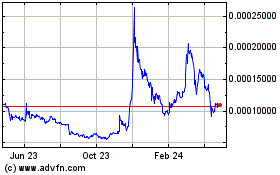

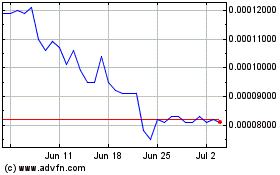

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024