SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14 (c)

of the Securities Exchange Act of 1934

Check the appropriate box:

☐ Preliminary Information Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2))

☒ Definitive Information Statement

MITESCO, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

| |

1)

|

Title of each class of securities to which transactions applies:

|

| |

2)

|

Aggregate number of securities to which transactions applies:

|

| |

3)

|

Per unit price or other underlying value of transactions computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

4)

|

Proposed maximum aggregate value of transactions:

|

| |

5)

|

Total fee paid:

|

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No:

3) Filing Party:

4) Date Filed:

MITESCO, INC.

18202 Minnetonka Blvd.,

Suite 100 Deephaven, MN 55391

NOTICE OF ACTION BY WRITTEN CONSENT OF MAJORITY STOCKHOLDERS

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’

MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

To the Stockholders of Mitesco, Inc.:

The accompanying Information Statement (the “Information Statement”) is being furnished to the stockholders of Mitesco, Inc., a Delaware corporation (the “Company”, “we”, or “Mitesco”) to notify that on August 16, 2023, the Board of Directors (the “Board”) approved via unanimous written consent, and recommended that its stockholders approve, and on August 29, 2023, the record holders (the “Majority Stockholders”) of an aggregate of 247,224 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”), and 24,227 shares of Series X Preferred Stock, par value $0.01, (the “Series X Preferred Stock”), voting as a single class, collectively constituting approximately 66% of the voting power of the Company’s issued and outstanding voting capital stock, approved via written consent, in lieu of a meeting the following actions. The Board is not soliciting your proxy and you are requested not to send us a proxy. The purpose of this Information Statement is to notify you that the Company has received written consent in lieu of a meeting of stockholders (the “Written Consent”) from holders of shares of voting stock representing approximately 66% of the total voting power of the Company as of August 29, 2023 to grant the Board discretionary authority to re-domesticate the Company from a Delaware corporation to a Nevada corporation (the “Reincorporation”) by filing a Certificate of Conversion with the State of Delaware pursuant to Section 266 of the Delaware General Corporation Law and the Articles of Conversion with the State of Nevada pursuant to Chapter 92A.209 of the Nevada Revised Statutes.

The Reincorporation is more fully described in the accompanying Information Statement. The Written Consent was executed and delivered in accordance with the Delaware General Corporation Law (“DGCL”) and our bylaws, each of which permits that any action which may be taken by a majority of the voting power of the Company’s stockholders at a meeting of the stockholders may also be taken by the written consent of the holders of a majority of the voting power of the Company’s stockholders. The accompanying Information Statement is being furnished to all of our stockholders in accordance with Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”) thereunder, solely for the purpose of informing our stockholders of the Reincorporation by the Written Consent before it becomes effective.

We are furnishing this Information Statement to stockholders in satisfaction of the notice requirement under Section 228 of the DGCL. No additional action will be undertaken by us with respect to the receipt of written consents, and no dissenters’ rights with respect to the receipt of the written consents are afforded to stockholders as a result of the approval of the Reincorporation.

The entire cost of furnishing the Information Statement and related materials will be borne by the Company. The Company will request brokerage houses, nominees, custodians, fiduciaries, and other like parties to forward the notice to the beneficial owners of the Common Stock held of record by them. In accordance with Regulation 14C of the Exchange Act, August 29, 2023 has been fixed as the record date (the “Record Date”) for the determination of stockholders who are entitled to receive this Information Statement.

Pursuant to Rule 14c-2 promulgated under the Exchange Act, the earliest date that the Reincorporation will become effective is twenty (20) calendar days after this definitive Information Statement is first sent or given to the stockholders.

THE ACCOMPANYING INFORMATION STATEMENT WAS MAILED TO STOCKHOLDERS ON OR ABOUT SEPTEMBER 22, 2023. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

By Order of the Board of Directors

/s/ Lawrence Diamond

Lawrence Diamond

Chief Executive Officer and Director

September 22, 2023

MITESCO, INC.

18202 Minnetonka Blvd.,

Suite 100 Deephaven, MN 55391

INFORMATION STATEMENT

September 22, 2023

Action by Written Consent of Majority Stockholders

WE ARE NOT ASKING YOU FOR A

PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL INFORMATION

In this Information Statement we refer to Mitesco, Inc., a Delaware corporation, as the “Company”, “Mitesco”, “we”, “us”, or “our”.

This Information Statement is being furnished by the Board of Directors (the “Board”) of the Company, to inform the stockholders as of August 29, 2023 that on August 16, 2023, the Board approved and recommended the stockholders to approve, and on August 29, 2023 the holders of shares of voting stock representing approximately 66% of the voting power of the total issued and outstanding shares of voting stock of the Company (the “Majority Stockholders”) approved by written consent (the “Written Consent”) the following:

| |

●

|

To grant the Board discretionary authority to re-domesticate the Company from a Delaware corporation to a Nevada corporation (the “Reincorporation”) by filing a Certificate of Conversion with the State of Delaware pursuant to Section 266 of the Delaware General Corporation Law and the Articles of Conversion with the State of Nevada pursuant to Chapter 92A.209 of the Nevada Revised Statutes.

|

This Information Statement is being furnished to all of our stockholders in accordance with Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”) thereunder, solely for the purpose of informing our stockholders of the approval of the Redomestication before it becomes effective.

In accordance with Regulation 14C of the Exchange Act, we have fixed August 29, 2023 as the Record Date for the determination of stockholders who are entitled to receive this Information Statement. This Information Statement was mailed on or about September 22, 2023 to stockholders of record as of the Record Date.

This Information Statement contains a brief summary of the material aspects of the Redomestication approved by the Board and the Majority Stockholders of the Company.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY

THE REDOMESTICATION

Our Board has approved a proposal to redomesticate, by conversion, the Company from a corporation organized under the laws of the State of Delaware (the “Delaware Corporation”) to a corporation organized under the laws of the State of Nevada (the “Nevada Corporation”) (such conversion of the Delaware Corporation into the Nevada Corporation, the “Redomestication”). Upon the completion of the Redomestication, the Company will become a Nevada corporation and will continue to operate our business under the current name, “Mitesco, Inc.”

Reasons for the Redomestication

Our Board believes that there are several reasons the Redomestication is in the best interests of the Company and its stockholders. In particular, the Board believes that the Redomestication will allow the Company to take advantage of certain provisions of the corporate and tax laws of Nevada.

The Redomestication will eliminate our obligation to pay the annual Delaware franchise tax, which we expect will result in substantial savings to us over the long term.

In addition, the Redomestication will provide potentially greater protection from unmeritorious litigation for directors and officers of the Company. Delaware law permits a corporation to adopt provisions limiting or eliminating the liability of a director or an officer to a company and its stockholders for monetary damages for breach of fiduciary duty, provided that the liability does not arise from certain proscribed conduct, including breach of the duty of loyalty, acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law. By contrast, Nevada law permits a broader exclusion of individual liability of officers and directors to a company, providing for an exclusion of any damages as a result of any act or failure to act in his or her capacity as a director or officer unless the presumption that the director or officer acted in good faith, on an informed basis and with a view to the interests of the company, has been rebutted, and it is proven that the director's or officer's act or failure to act constituted a breach of his or her fiduciary duties as a director or officer, and such breach involved intentional misconduct, fraud or a knowing violation of law. The Redomestication will result in the elimination of any liability of an officer or director for a breach of the duty of loyalty unless arising from intentional misconduct, fraud or a knowing violation of law. There is currently no known pending claim or litigation against any of our directors or officers for breach of fiduciary duty related to their service as directors or officers of the Company. The directors and officers of the Company have an interest in the Redomestication to the extent that they will be entitled to such limitation of liability. The Board was aware of these interests and considered them, among other matters, in reaching its decision to approve the Redomestication and to recommend that our stockholders vote in favor of this proposal.

Also, by reducing the risk of lawsuits being filed against the Company and its directors and officers, the Redomestication may help us attract and retain qualified management. As previously discussed and for the reasons described below, we believe that, in general, Nevada law provides greater protection to our directors, officers, and the Company than Delaware law. The increasing frequency of claims and litigation directed towards directors and officers has greatly expanded the risks facing directors and officers of public companies in exercising their duties. The amount of time and money required to respond to these claims and to defend these types of litigation matters can be substantial. Delaware law provides that every person becoming a director or an officer of a Delaware corporation consents to the personal jurisdiction of the Delaware courts in connection with any action concerning the corporation. Accordingly, both directors and officers can be personally sued in Delaware, even though the director or officer has no other contacts with the state. Similarly, Nevada law provides that every person who accepts election or appointment, including reelection or reappointment, as a director or officer of a Nevada corporation consents to the personal jurisdiction of the Nevada courts in connection with all civil actions or proceedings brought in Nevada by, on behalf of or against the entity in which the director or officer is a necessary or proper party, or in any action or proceeding against the director or officer for a violation of a duty in such capacity, whether or not the person continues to serve as a director or officer at the time the action or proceeding is commenced. Though Delaware corporate law has recently been amended to, among other things, increase protections for officers of a corporation, we believe Nevada is more advantageous than Delaware because Nevada has pursued a statute-focused approach that does not depend upon judicial interpretation, supplementation and revision, and is intended to be stable, predictable and more efficient, whereas much of Delaware corporate law still consists of judicial decisions that migrate and develop over time.

Further, the Redomestication is expected to provide corporate flexibility in connection with certain corporate transactions. However, note that the Redomestication is not being effected to prevent a change in control, nor is it in response to any present attempt known to our Board to acquire control of the Company or obtain representation on our Board. In connection with the Redomestication, the Nevada Corporation will opt out of certain Nevada statutes that may discourage unsolicited takeovers. Nevertheless, certain effects of the proposed Redomestication may be considered to have anti-takeover implications by virtue of being subject to Nevada law. See “Anti-Takeover Implications of the Redomestication” below for additional information.

Principal Terms of the Redomestication

The Redomestication would be effected through a conversion pursuant to Section 266 of the Delaware General Corporation Law (“DGCL”) as set forth in the Plan of Conversion, which is included as Annex A to this Proxy Statement. Approval of this Proposal 1 will constitute approval of the Plan of Conversion. The Plan of Conversion provides that we will convert from a Delaware corporation into a Nevada corporation pursuant to Section 266 of the DGCL and Sections 92A.195 and 92A.205 of the Nevada Revised Statutes, as amended (“NRS”).

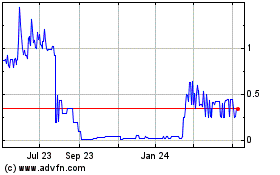

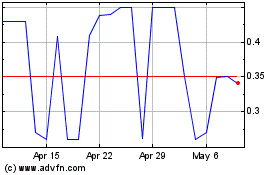

The Plan of Conversion provides that, upon the Redomestication, (i) each outstanding share of common stock of the Delaware Corporation will be automatically converted into one outstanding share of common stock of the Nevada Corporation, and (ii) each outstanding share of Series D, Series, F, and Series X preferred stock of the Delaware Corporation will be automatically converted into one outstanding share of the Series D, Series, F, and Series X preferred stock of the Nevada Corporation. Securityholders will not have to exchange their existing stock certificates for new stock certificates. At the same time, upon the Redomestication, each outstanding restricted stock unit, option or right to acquire shares of common stock of the Delaware Corporation will automatically become a restricted stock unit, option or right to acquire an equal number of shares of common stock of the Nevada Corporation under the same terms and conditions. At the Effective Time (as defined herein) of the Redomestication, the common stock will continue to be quoted on The OTC Expert market under the symbol “MITI.” There is not expected to be any interruption in the trading of the common stock as a result of the Redomestication.

The Board currently intends that the Redomestication will occur as soon as practicable following the 20 day waiting period after the filing of this Information Statement. It is anticipated that the Redomestication will become effective at the date and time (the “Effective Time”) specified in each of (i) the Articles of Conversion to be executed and filed with the office of the Nevada Secretary of State in accordance with NRS 92A.205 and (ii) the Certificate of Conversion to be executed and filed with the Office of the Secretary of State of Delaware in accordance with Section 266 of the DGCL. However, the Redomestication may be delayed by our Board or the Plan of Conversion may be terminated and abandoned by action of our Board at any time prior to the Effective Time of the Redomestication, if our Board determines for any reason that the consummation of the Redomestication should be delayed or would be inadvisable or not in the best interests of the Company and its stockholders, as the case may be.

Effects of the Redomestication

Following the Redomestication, we will be governed by the NRS instead of the DGCL, and we will be governed by the form of Nevada Articles of Incorporation (the “Nevada Charter”) and the form of Nevada Bylaws (the “Nevada Bylaws”), included as Annex B and Annex C, respectively, to this Information Statement. Approval of this Proposal 1 will constitute approval of the Nevada Charter and Nevada Bylaws. Our current Certificate of Incorporation, as amended (the “Delaware Charter”) and our current Amended and Restated Bylaws (as amended, the “Delaware Bylaws”) will no longer be applicable following completion of the Redomestication. Copies of the Delaware Charter and Delaware Bylaws are available to the public over the internet at the SEC's website at http://www.sec.gov.

Apart from being governed by the Nevada Charter, Nevada Bylaws and the NRS, following completion of the Redomestication, the Company will continue to exist in the form of a Nevada corporation. By virtue of the Redomestication, all of the rights, privileges, and powers of the Delaware Corporation, and all property, real, personal, and mixed, and all debts due to the Delaware Corporation, as well as all other things and causes of action belonging to the Delaware Corporation, will remain vested in the Nevada Corporation and will be the property of the Nevada Corporation. In addition, all debts, liabilities, and duties of the Delaware Corporation will remain attached to the Nevada Corporation and may be enforced against the Nevada Corporation.

There will be no change in our business, properties, assets, obligations, or management as a result of the Redomestication. Our directors and officers immediately prior to the Redomestication will serve as our directors and officers following the completion of the Redomestication. We will continue to maintain our headquarters in Minnesota.

No Securities Act Consequences

The Company will continue to be a publicly held company following completion of the Redomestication, and its common stock will continue to be quoted on the OTC Expert market and traded under the symbol “MITI.” The Company will continue to file required periodic reports and other documents with the SEC. There is not expected to be any interruption in the trading of the common stock as a result of the Redomestication. We and our stockholders will be in the same respective positions under the federal securities laws after the Redomestication as we and our stockholders were prior to the Redomestication.

Key Differences Between Delaware Charter and Bylaws and the Nevada Charter and Bylaws

Following completion of the Redomestication, the Company will be governed by the NRS instead of the DGCL as well as the Nevada Charter and Nevada Bylaws, forms of which are included as Annex B and Annex C, respectively, to this Proxy Statement. Approval of Proposal 1 will constitute approval of the Nevada Charter and Nevada Bylaws. Our current Delaware Charter and Delaware Bylaws will no longer be applicable following completion of the Redomestication. Copies of the Delaware Charter and Delaware Bylaws are available as exhibits to our public filings on EDGAR, available to the public over the internet at the SEC's website at http://www.sec.gov.

The Nevada Charter and Nevada Bylaws differ in a number of respects from the Delaware Charter and Delaware Bylaws, respectively. Set forth below is a table summarizing certain material differences in the rights of our stockholders under Nevada and Delaware law under the respective charters and bylaws. This chart does not address each difference, but focuses on some of those differences which we believe are most relevant to our stockholders. This chart is qualified in its entirety by reference to the Nevada Charter, the Nevada Bylaws, the Delaware Charter and the Delaware Bylaws.

|

Provision

|

Delaware

|

Nevada

|

|

Charter Regarding Limitation of Liability

|

The Delaware Charter provides that, to the fullest extent permitted by the DGCL, a director or officer of the Company shall not be liable to the Company or its stockholders for monetary damages for breach of fiduciary duty, except for (i) acts or omissions which involve intentional misconduct, fraud or knowing violations of law; or (ii) the payment of distributions in violation of the General Corporation Law of Delaware. Further, the DGCL does not permit elimination or limitation of liability (a) for any breach of duty of loyalty to the corporation or its stockholders; or (b) for any transaction in which the director or officer received an improper personal benefit.

|

The Nevada Charter provides that, to the fullest extent permitted by the NRS, the liability of directors and officers of the Company shall be eliminated or limited. Note that, under the NRS, this provision does not exclude exculpation for breaches of duty of loyalty.

|

| |

|

|

|

Charter Regarding Indemnitee's Right to Advanced Payment of Expenses

|

The Delaware Charter does not specify whether an indemnitee's right to advanced payment of expenses related to a proceeding is subject to the satisfaction of any standard of conduct nor is it conditioned upon any prior determination that the indemnitee is entitled to indemnification with respect to the related proceeding (or the absence of any prior determination to the contrary).

|

The Nevada Charter specifically provides that an indemnitee's right to advance payment of expenses related to a proceeding is not subject to the satisfaction of any standard of conduct and is not conditioned upon any prior determination that the indemnitee is entitled to indemnification with respect to the related proceeding or the absence of any prior determination to the contrary.

|

| |

|

|

|

Charter Regarding Forum Adjudication for Disputes

|

The Delaware Charter does not specify the form for adjudication of disputes.

|

Under the Nevada Charter, the Eighth Judicial District Court of Clark County, Nevada shall be the sole and exclusive forum for (1) any derivative action or proceeding brought on behalf of the Company, (2) any action asserting a claim of breach of a fiduciary duty owed by any director or officer of the Company to the Company or the Company's stockholders, (3) any action asserting a claim against the Company arising pursuant to any provision of the NRS or the Nevada Charter or Nevada Bylaws, or (4) any action asserting a claim against the Company governed by the internal affairs doctrine.

|

| |

|

|

|

Bylaws Regarding Proxies

|

Under the DGCL, no proxy authorized by a stockholder shall be valid after three years from the date of its execution unless the proxy provides for a longer period.

|

The Nevada Bylaws provide that no proxy shall be voted or acted upon after six months from its date, unless the proxy provides for a longer period, which may not exceed seven years. Under the NRS, proxies are valid for six months from the date of creation unless the proxy provides for a longer period of up to seven years.

|

|

Provision

|

Delaware

|

Nevada

|

|

Bylaws Regarding Removal of Directors

|

The Delaware Bylaws provide that any director or the entire Board of Directors may at any time be removed effective immediately, with or without cause, by the vote, either in person or represented by proxy, of a majority of the voting power of shares of stock issued and outstanding of the class or classes that elected such director and entitled to vote at a special meeting held for such purpose or by the written consent of a majority of the voting power of shares of stock issued and outstanding of the class or classes that elected such director.

|

The Nevada Bylaws provide that any director or the entire Board may at any time be removed effective immediately, with or without cause, by the vote, either in person or represented by proxy, of not less than two-thirds of the voting power of the issued and outstanding shares of stock of the class or classes that elected such director and entitled to vote at a special meeting held for such purpose or by the written consent of not less than two-thirds of the voting power of the issued and outstanding shares of stock of the class or classes that elected such director, which is the lowest permitted voting threshold for director removal permitted under the NRS.

|

| |

|

|

|

Bylaws Regarding Advance Notice

|

The DGCL does not have a statutory requirement with regard to advance notice procedures required of stockholders in order to properly bring business or director nominations before a meeting of stockholders, but a corporation is permitted to include such requirements in its bylaws. The Delaware Charter provides for advance notice requirements that stockholders must satisfy to bring a proposal at an annual or special meeting. It does not specifically set forth special requirements for stockholder nomination for election as directors.

|

The NRS does not have any statutory advance notice requirements but a Nevada corporation is permitted to set forth such requirements in its bylaws; the Nevada Bylaws establish advance notice procedures for stockholder proposals and the nomination, other than by or at the direction of the Board, of candidates for election as directors. These procedures generally provide that the notice of stockholder proposals and stockholder nominations for the election of directors at an annual meeting must be in writing and received by our secretary at least 90 days but not more than 120 days prior to the first anniversary of our preceding year's annual meeting.

|

| |

|

|

|

Bylaws Regarding Annual Meetings of Stockholders

|

The annual meeting of stockholders for the election of directors and for the transaction of such other business as may properly come before the meeting shall be held at such time and date as shall be designated from time to time by the Board. The Corporation must hold its annual meeting within 30 days of the designated date, or if no date was designated, within 13 months from the last annual meeting.

|

The annual meeting of stockholders for the election of directors and for the transaction of such other business as may properly come before the meeting shall be held at such time and date as shall be designated from time to time by the Board and stated in the Company's notice of the meeting. If a corporation fails to elect directors within 18 months after the last election of directors required by the Nevada Corporations Act, one or more stockholders holding at least 15% of the Corporation's voting power may make a demand in writing to any officer of the Corporation that a meeting be held for that purpose.

|

| |

|

|

|

Bylaws Regarding Quorum

|

The Delaware Bylaws provide that one third of all issued and outstanding shares of the Company's capital stock entitled to vote thereat, present in person or represented by proxy, constitutes a quorum for the transaction of business.

|

The Nevada Bylaws provide that one third of the voting power of all issued and outstanding shares of the Company's capital stock entitled to vote thereat, present in person or represented by proxy, constitutes a quorum for the transaction of business.

|

|

Provision

|

Delaware

|

Nevada

|

|

Bylaws Regarding Conduct of Stockholder Meetings

|

Delaware bylaws are silent on procedures relating to conduct of a stockholder meeting.

|

The meetings of the stockholders shall be presided over by the Chairman of the Board, or if he or she is not present, by a chairman elected by a resolution adopted by the majority of the Board. The Secretary will act as secretary of the meeting, but in the Secretary's absence, the chairman of the meeting may appoint any person to act as secretary of the meeting.

The Board may adopt by resolution rules and regulations as it may deem appropriate for the conduct of any meeting of stockholders.

The chairman of any meeting of stockholders shall have the authority to convene, recess and/or adjourn the meeting, to prescribe such rules, regulations and procedures and to do all such acts as are appropriate for the proper conduct of the meeting. The chairman, in addition to making any other determinations that may be appropriate to the conduct of the meeting, shall determine whether a matter or business was not properly brought before the meeting.

|

| |

|

|

|

Bylaws Regarding Officers

|

The officers of the Company shall be chosen by the Board and shall consist of a Chairman, President, a Secretary, and a Treasurer.

|

The officers of the Company shall be chosen by the Board and shall include a President, a Treasurer, and a Secretary or their equivalents. The Board, in its discretion, may also appoint such additional officers as the Board may deem necessary or desirable, each of whom shall hold office for such period, have such authority and perform such duties as the Board may from time to time determine.

|

Comparison of Stockholder Rights under Delaware and Nevada Law

The rights of our stockholders are currently governed by the DGCL, the Delaware Charter and the Delaware Bylaws. Following completion of the Redomestication, the rights of our stockholders will be governed by the NRS, the Nevada Charter and the Nevada Bylaws. The statutory corporate laws of Nevada, as governed by the NRS, are similar in many respects to those of Delaware, as governed by the DGCL. However, there are certain differences that may affect your rights as a stockholder, as well as the corporate governance of the Company. The following are brief summaries of material differences between the current rights of stockholders of the Company and the rights of stockholders of the Company following completion of the Redomestication. The following discussion does not provide a complete description of the differences that may affect you. This summary is qualified in its entirety by reference to the NRS and DGCL as well as the Delaware Charter and Delaware Bylaws and the Nevada Charter and Nevada Bylaws.

Increasing or Decreasing Authorized Capital Stock

The NRS allows the board of directors of a corporation, unless restricted by the articles of incorporation, to increase or decrease the number of authorized shares in a class or series of the corporation's shares and correspondingly effect a forward or reverse split of any class or series of the corporation's shares (and change the par value thereof) without a vote of the stockholders, so long as the action taken does not adversely change or alter any right or preference of the stockholders and does not include any provision or provisions pursuant to which only money will be paid or scrip issued to stockholders who hold 10% or more of the outstanding shares of the affected class and series, and who would otherwise be entitled to receive fractions of shares in exchange for the cancellation of all of their outstanding shares. Delaware law has no similar provision.

Classified Board of Directors

The DGCL permits any Delaware corporation to classify its board of directors into as many as three classes with staggered terms of office. If this is done, the stockholders elect only one class each year and each class would have a term of office of three years; however, neither the Delaware Charter nor Delaware Bylaws provide for a classified board of directors. The NRS also permits any Nevada corporation to classify its board of directors into any number of classes with staggered terms of office, so long as at least one-fourth of the total number of directors is elected annually; however neither the Nevada Charter nor Nevada Bylaws provide for a classified board of directors.

Cumulative Voting

Cumulative voting for directors entitles each stockholder to cast a number of votes that is equal to the number of voting shares held by such stockholder multiplied by the number of directors to be elected and to cast all such votes for one nominee or distribute such votes among as many candidates as there are positions to be filled. Cumulative voting may enable a minority stockholder or group of stockholders to elect at least one representative to the board of directors where such stockholders would not be able to elect any directors without cumulative voting.

Although the DGCL does not generally grant stockholders cumulative voting rights, a Delaware corporation may provide in its certificate of incorporation for cumulative voting in the election of directors. The NRS also permits any Nevada corporation to provide in its articles of incorporation the right to cumulative voting in the election of directors as long as certain procedures are followed. The Delaware Charter does not provide for cumulative voting in the election of directors. Similarly, the Nevada Charter does not provide for cumulative voting.

Vacancies

Under both the DGCL and the NRS, subject to the certificate or articles of incorporation and bylaws, vacancies on the board of directors, including those resulting from any increase in the authorized number of directors, may be filled by the affirmative vote of a majority of the remaining directors then in office, even if less than a quorum. Any director so appointed will hold office for the remainder of the term of the director no longer on the board. The Delaware Charter provides that a director replacement will hold office until the next annual meeting of the shareholders.

Removal of Directors

Under the DGCL, the holders of a majority of shares of each class entitled to vote at an election of directors may vote to remove any director or the entire board without cause unless (i) the board is a classified board, in which case directors may be removed only for cause, or (ii) the corporation has cumulative voting, in which case, if less than the entire board is to be removed, no director may be removed without cause if the votes cast against his or her removal would be sufficient to elect him or her. The NRS requires the vote of the holders of at least two-thirds of the voting power of the shares or class or series of shares of the issued and outstanding stock entitled to vote at an election of directors in order to remove a director or all of the directors. The articles of incorporation may provide for a voting threshold higher than two-thirds, but not lower. Furthermore, the NRS does not make a distinction between removals for cause and removals without cause.

Fiduciary Duties and Business Judgment

Nevada, like most jurisdictions, requires that directors and officers of Nevada corporations exercise their powers in good faith and with a view to the interests of the corporation but, unlike some other jurisdictions, fiduciary duties of directors and officers are codified in the NRS. As a matter of law, directors and officers are presumed to act in good faith, on an informed basis and with a view to the interests of the corporation in making business decisions. In performing such duties, directors and officers may exercise their business judgment through reliance on information, opinions, reports, financial statements and other financial data prepared or presented by corporate directors, officers or employees who are reasonably believed to be reliable and competent. Reliance may also be extended to legal counsel, public accountants, advisers, bankers or other persons reasonably believed to be competent, and to the work of a committee (on which the particular director or officer does not serve) if the committee was established and empowered by the corporation's board of directors, and if the committee's work was within its designated authority and was about matters on which the committee was reasonably believed to merit confidence. However, directors and officers may not rely on such information, opinions, reports, books of account or similar statements if they have knowledge concerning the matter in question that would make such reliance unwarranted.

Under Delaware law, members of the board of directors or any committee designated by the board of directors are similarly entitled to rely in good faith upon the records of the corporation and upon such information, opinions, reports and statements presented to the corporation by corporate officers, employees, committees of the board of directors or other persons as to matters such member reasonably believes are within such other person's professional or expert competence, provided that such other person has been selected with reasonable care by or on behalf of the corporation. Such appropriate reliance on records and other information protects directors from liability related to decisions made based on such records and other information. Both Delaware and Nevada law extend the statutory protection for reliance on such persons to corporate officers.

Flexibility for Decisions, including Takeovers

Nevada provides directors with more discretion than Delaware in making corporate decisions, including decisions made in takeover situations. Under Nevada law, director and officer actions taken in response to a change or potential change in control are granted the benefits of the business judgment rule. However, in the case of an action to resist a change or potential change in control that impedes the rights of stockholders to vote for or remove directors, directors will only be given the benefit of the presumption of the business judgment rule if the directors have reasonable grounds to believe a threat to corporate policy and effectiveness exists and the action taken that impedes the exercise of the stockholders' rights is reasonable in relation to such threat.

In exercising their powers, including in response to a change or potential change of control, directors and officers of Nevada corporations may consider all relevant facts, circumstances, contingencies or constituencies, which may include, without limitation, the effect of the decision on several corporate constituencies in addition to the stockholders, including the corporation's employees, suppliers, creditors and customers, the economy of the state and nation, the interests of the community and society in general, and the long-term as well as short-term interests of the corporation and its stockholders, including the possibility that these interests may be best served by the continued independence of the corporation. To underscore the discretion of directors and officers of Nevada corporations, the NRS specifically states that such directors and officers are not required to consider the effect of a proposed corporate action upon any constituent as a dominant factor. Further, a director may resist a change or potential change in control of the corporation if the board of directors determines that the change or potential change of control is opposed to or not in the best interest of the corporation upon consideration of any relevant facts, circumstances, contingencies or constituencies, including that there are reasonable grounds to believe that, within a reasonable time the corporation or any successor would be or become insolvent subjected to bankruptcy proceedings.

The DGCL does not provide a similar list of statutory factors that corporate directors and officers may consider in making decisions. In a number of cases and in certain situations, Delaware law has been interpreted to provide that fiduciary duties require directors to accept an offer from the highest bidder regardless of the effect of such sale on the corporate constituencies other than the stockholders. Thus, the flexibility granted to directors of Nevada corporations when making business decisions, including in the context of a hostile takeover, are greater than those granted to directors of Delaware corporations.

Limitation on Personal Liability of Directors and Officers

The NRS and the DGCL each, by way of statutory provisions or permitted provisions in corporate charter documents, eliminate or limit the personal liability of directors and officers to the corporation or their stockholders for monetary damages for breach of a director's fiduciary duty, subject to the differences discussed below.

The DGCL precludes liability limitation for acts or omissions not in good faith or involving intentional misconduct and for paying dividends or repurchasing stock out of other than lawfully available funds. Under the NRS, in order for a director or officer to be individually liable to the corporation or its stockholders or creditors for damages as a result of any act or failure to act, the presumption of the business judgment rule must be rebutted and it must be proven that the director's or officer's act or failure to act constituted a breach of his or her fiduciary duties as a director or officer and that the breach of those duties involved intentional misconduct, fraud or a knowing violation of law. Unlike the DGCL, however, the limitation on director and officer liability under the NRS does not distinguish the duty of loyalty or transaction from which a director derives an improper personal benefit, but does, pursuant to NRS 78.300, impose limited personal liability on directors for distributions made in violation of NRS 78.288. Further, the NRS permits a corporation to renounce in its articles of incorporation any interest or expectancy to participate in specific or specified classes or categories of business opportunities. Both the DGCL and the NRS permit limitation of liability which applies to both directors and officers, though the NRS expressly also applies this limitation to liabilities owed to creditors of the corporation. Furthermore, under the NRS, it is not necessary to adopt provisions in the articles of incorporation limiting personal liability of directors or officers as this limitation is provided by statute. However, under Delaware law, the exculpation of officers (namely, the chief executive officer, president, chief financial officer, chief operating officer, chief legal officer, controller, treasurer and chief accounting officer, as well as any other persons identified as “named executive officers” in the Company's most recent SEC filings) is authorized only in connection with direct claims brought by stockholders, including class actions; however, it does not eliminate monetary liability of officers for breach of fiduciary duty arising out of claims brought by the corporation itself or for derivative claims brought by stockholders in the name of the corporation.

As described above, the NRS provides broader protection from personal liability for directors and officers than the DGCL. Both the Delaware Charter and the Nevada Charter provide a limitation to director liability to the fullest extent permitted by Delaware and Nevada law, respectively.

Indemnification

The NRS and the DGCL each permit corporations to indemnify directors, officers, employees and agents in similar circumstances, subject to the differences discussed below.

In suits that are not brought by or in the right of the corporation, both jurisdictions permit a corporation to indemnify current and former directors, officers, employees and agents for attorneys' fees and other expenses, judgments and amounts paid in settlement that the person actually and reasonably incurred in connection with the action, suit or proceeding. The person seeking indemnity may recover as long as he or she acted in good faith and believed his or her actions were either in the best interests of or not opposed to the best interests of the corporation. Under the NRS, the person seeking indemnity may also be indemnified if he or she is not liable for breach of his or her fiduciary duties. Similarly, with respect to a criminal proceeding, the person seeking indemnification must not have had any reasonable cause to believe his or her conduct was unlawful.

In derivative suits, a corporation in either jurisdiction may indemnify its directors, officers, employees or agents for expenses that the person actually and reasonably incurred. A corporation may not indemnify a person if the person was adjudged to be liable to the corporation unless a court otherwise orders.

No corporation may indemnify a party unless it decides that indemnification is proper. Under the DGCL, the corporation through its stockholders, directors or independent legal counsel will determine whether the conduct of the person seeking indemnity conformed with the statutory provisions governing indemnity. Under the NRS, the corporation through its stockholders, directors or independent counsel must determine that the indemnification is proper.

Under the NRS, the indemnification pursuant to the statutory mechanisms available under the NRS, as described above, does not exclude any other rights to which a person seeking indemnification or advancement of expenses may be entitled under the articles of incorporation or any bylaw, agreement, vote of stockholders or disinterested directors or otherwise, but unless ordered by a court, indemnification may not be made to or on behalf of any director or officer finally adjudged by a court of competent jurisdiction, after exhaustion of any appeals taken therefrom, to be liable for intentional misconduct, fraud or a knowing violation of law, and such misconduct, fraud or violation was material to the cause of action.

Both the Delaware Charter and the Nevada Charter provide for indemnification to the fullest extent permitted by the respective laws.

Advancement of Expenses

Although the DGCL and NRS have substantially similar provisions regarding indemnification by a corporation of its officers, directors, employees and agents, the NRS provides broader indemnification in connection with stockholder derivative lawsuits, in particular with respect to advancement of expenses incurred by an officer or director in defending a civil or criminal action, suit or other proceeding.

The DGCL provides that expenses incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay the amount if it is ultimately determined that he or she is not entitled to be indemnified by the corporation. A Delaware corporation has the discretion to decide whether or not to advance expenses, unless its certificate of incorporation or bylaws provide for mandatory advancement. In contrast, under the NRS, unless otherwise restricted by the articles of incorporation, the bylaws or an agreement made by the corporation, the corporation may pay advancements of expenses in advance of the final disposition of the action, suit or proceeding upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined that he or she is not entitled to be indemnified by the corporation.

The Nevada Charter specifically provides that an indemnitee's right to advanced payment of expenses related to a proceeding is not subject to the satisfaction of any standard of conduct and is not conditioned upon any prior determination that the indemnitee is entitled to indemnification with respect to the related proceeding or the absence of any prior determination to the contrary. The Delaware Charter does not include similar provision.

Director Compensation

The DGCL does not have a specific statute on the fairness of director compensation. In contrast, the NRS provides that, unless otherwise provided in the articles of incorporation or bylaws, the board of directors, without regard to personal interest, may establish the compensation of directors for services in any capacity. If the board of directors so establishes the compensation of directors, such compensation is be presumed to be fair to the corporation unless proven unfair by a preponderance of the evidence.

Action by Written Consent of Directors

Both the DGCL and NRS provide that, unless the articles or certificate of incorporation or the bylaws provide otherwise, any action required or permitted to be taken at a meeting of the directors or a committee thereof may be taken without a meeting if all members of the board or committee, as the case may be, consent to the action in writing.

Neither the Delaware Charter or Delaware Bylaws nor the Nevada Charter or Nevada Bylaws limit a Board action by written consent.

Actions by Written Consent of Stockholders

Both the DGCL and NRS provide that, unless the articles or certificate of incorporation provides otherwise, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if the holders of outstanding stock having at least the minimum number of votes that would be necessary to authorize or take the action at a meeting of stockholders consent to the action in writing. In addition, the DGCL requires the corporation to give prompt notice of the taking of corporate action without a meeting by less than unanimous written consent to those stockholders who did not consent in writing. There is no equivalent requirement under the NRS.

The NRS also permits a corporation to prohibit stockholder action by written consent in lieu of a meeting of stockholders by including such prohibition in its articles of incorporation or bylaws.

Neither the Delaware Charter or Delaware Bylaws nor the Nevada Charter or Nevada Bylaws limit stockholder action by written consent.

Dividends and Distributions

Delaware law is more restrictive than Nevada law with respect to dividend payments. Unless further restricted in the certificate of incorporation, the DGCL permits a corporation to declare and pay dividends out of either (i) surplus, or (ii) if no surplus exists, out of net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year (provided that the amount of capital of the corporation is not less than the aggregate amount of the capital represented by the issued and outstanding stock of all classes having a preference upon the distribution of assets). The DGCL defines surplus as the excess, at any time, of the net assets of a corporation over its stated capital. In addition, the DGCL provides that a corporation may redeem or repurchase its shares only when the capital of the corporation is not impaired and only if such redemption or repurchase would not cause any impairment of the capital of the corporation.

The NRS provides that no distribution (including dividends on, or redemption or purchases of, shares of capital stock or distributions of indebtedness) may be made if, after giving effect to such distribution, (i) the corporation would not be able to pay its debts as they become due in the usual course of business, or, (ii) except as otherwise specifically permitted by the articles of incorporation, the corporation's total assets would be less than the sum of its total liabilities plus the amount that would be needed at the time of a dissolution to satisfy the preferential rights of preferred stockholders. Directors may consider financial statements prepared on the basis of accounting practices that are reasonable in the circumstances, a fair valuation, including but not limited to unrealized appreciation and depreciation, and any other method that is reasonable in the circumstances.

Restrictions on Business Combinations

Both Delaware and Nevada law provide certain protections to stockholders in connection with certain business combinations. These protections can be found in NRS 78.411 to 78.444, inclusive, and Section 203 of the DGCL.

Under Section 203 of the DGCL, certain “business combinations” with “interested stockholders” of the Company are subject to a three-year moratorium unless specified conditions are met. For purposes of Section 203, the term “business combination” is defined broadly to include (i) mergers with or caused by the interested stockholder; (ii) sales or other dispositions to the interested stockholder (except proportionately with the corporation's other stockholders) of assets of the corporation or a subsidiary equal to 10% or more of the aggregate market value of either the corporation's consolidated assets or its outstanding stock; (iii) the issuance or transfer by the corporation or a subsidiary of stock of the corporation or such subsidiary to the interested stockholder (except for transfers in a conversion or exchange or a pro rata distribution or certain other transactions, none of which increase the interested stockholder's proportionate ownership of any class or series of the corporation's or such subsidiary's stock); or (iv) receipt by the interested stockholder (except proportionately as a stockholder), directly or indirectly, of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation or a subsidiary.

The three-year moratorium imposed on business combinations by Section 203 of the DGCL does not apply if: (i) prior to the time on which such stockholder becomes an interested stockholder the board of directors approves either the business combination or the transaction which resulted in the person becoming an interested stockholder; (ii) upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (a) by persons who are directors and also officers and (b) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or (iii) at or after the time on which such stockholder becomes an interested stockholder, the board approves the business combination and it is also approved at a stockholder meeting by at least two-thirds (66-2/3%) of the outstanding voting stock not owned by the interested stockholder.

In contrast, the NRS imposes a maximum moratorium of two years versus Delaware's three-year moratorium on business combinations. However, NRS 78.411 to 78.444, inclusive, regulate combinations more stringently. First, an interested stockholder is defined as a beneficial owner of 10% or more of the voting power (compared to 15% under the State of Delaware). Second, the two-year moratorium can be lifted only by advance approval of the combination or the transaction by which such person first becomes an interested stockholder by a corporation's board of directors or unless the combination is approved by the board and 60% of the corporation's voting power not beneficially owned by the interested stockholder, its affiliates and associates, as opposed to Delaware's provision that allows interested stockholder combinations with stockholder approval at the time of such combination. Finally, after the two-year period, a combination remains prohibited unless (i) it is approved by the board of directors, the disinterested stockholders or a majority of the outstanding voting power not beneficially owned by the interested stockholder and its affiliates and associates or (ii) the interested stockholders satisfy certain fair value requirements. But note that these statutes do not apply to any combination of a corporation and an interested stockholder after the expiration of four years after the person first became an interested stockholder. The combinations statutes in Nevada apply only to Nevada corporations with 200 or more stockholders of record.

Companies are entitled to opt out of the business combination provisions of the DGCL and NRS. The Company has not opted out of the business combination provisions of Section 203 of the DGCL, nor does the Company plan to opt out of the business combination provisions of NRS 78.411 to 78.444, inclusive, under the Nevada Charter. Any opt-out of the business combinations provisions of the NRS must be contained in an amendment to the Nevada Charter approved by a majority of the outstanding voting power not then owned by interested stockholders, but the amendment would not be effective until 18 months after the vote of the stockholders to approve the amendment, and would not apply to any combination with a person who first became an interested stockholder on or before the effective date of the amendment.

Acquisition of Controlling Interests

In addition to the restrictions on business combinations with interested stockholders, Nevada law also protects the corporation and its stockholders from persons acquiring a “controlling interest” in a corporation. The provisions can be found in NRS 78.378 to 78.3793, inclusive. Delaware law does not have similar provisions.

Pursuant to NRS 78.379, any person who acquires a controlling interest in a corporation may not exercise voting rights on any control shares unless such voting rights are conferred by a majority vote of the disinterested stockholders of the issuing corporation at a special meeting of such stockholders held upon the request and at the expense of the acquiring person. NRS 78.3785 provides that a “controlling interest” means the ownership of outstanding voting shares of an issuing corporation sufficient to enable the acquiring person, individually or in association with others, directly or indirectly, to exercise (i) one fifth or more but less than one third, (ii) one third or more but less than a majority or (iii) a majority or more of the voting power of the issuing corporation in the election of directors, and once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares” to which the voting restrictions described above apply. In the event that the control shares are accorded full voting rights and the acquiring person acquires control shares with a majority or more of all the voting power, any stockholder, other than the acquiring person, who does not vote in favor of authorizing voting rights for the control shares is entitled to demand payment for the fair value of such person's shares, and the corporation must comply with the demand.

NRS 78.378(1) provides that the control share statutes of the NRS do not apply to any acquisition of a controlling interest in an issuing corporation if the articles of incorporation or bylaws of the corporation in effect on the 10th day following the acquisition of a controlling interest by the acquiring person provide that the provisions of those sections do not apply to the corporation or to an acquisition of a controlling interest specifically by types of existing or future stockholders, whether or not identified. In addition, NRS 78.3788 provides that the controlling interest statutes apply as of a particular date only to a corporation that has 200 or more stockholders of record, at least 100 of whom have addresses in Nevada appearing on the corporation's stock ledger at all times during the 90 days immediately preceding that date, and which does business directly or indirectly in Nevada. NRS 78.378(2) provides that the corporation may impose stricter requirements if it so desires.

Corporations are entitled to opt out of the above controlling interest provisions of the NRS. In the Nevada Charter, the Company opts out of these provisions.

Stockholder Vote for Mergers and Other Corporate Reorganizations

Under the DGCL, unless the certificate of incorporation specifies a higher percentage, the stockholders of a corporation that is being acquired in a merger or selling substantially all of its assets must authorize such merger or sale of assets by vote of an absolute majority of outstanding shares entitled to vote. The corporation's board of directors must also approve such transaction. Similarly, under the NRS, a merger or sale of all assets requires authorization by stockholders of the corporation being acquired or selling its assets by at least a majority of the voting power of the outstanding shares entitled to vote, as well as approval of such corporation's board of directors. Although a substantial body of case law has been developed in Delaware as to what constitutes the “sale of substantially all of the assets” of a corporation, it is difficult to determine the point at which a sale of virtually all, but less than all, of a corporation's assets would be considered a “sale of all of the assets” of the corporation for purposes of Nevada law. It is possible that many sales of less than all of the assets of a corporation requiring stockholder authorization under Delaware law would not require stockholder authorization under Nevada law.

The DGCL and NRS have substantially similar provisions with respect to approval by stockholders of a surviving corporation in a merger. The DGCL does not require a stockholder vote of a constituent corporation in a merger (unless the corporation provides otherwise in its certificate of incorporation) if (i) the plan of merger does not amend the existing certificate of incorporation, (ii) each share of stock of such constituent corporation outstanding immediately before the effective date of the merger is an identical outstanding share after the effective date of merger and (iii) either no shares of the common stock of the surviving corporation and no shares, securities or obligations convertible into such stock are to be issued or delivered under the plan of merger, or the authorized unissued shares or treasury shares of the common stock of the surviving corporation to be issued or delivered under the plan of merger plus those initially issuable upon conversion of any other shares, securities or obligations to be issued or delivered under such plan do not exceed 20% of the shares of common stock of such constituent corporation outstanding immediately prior to the effective date of the merger. The NRS does not require a stockholder vote of the surviving corporation in a merger under substantially similar circumstances.

The Delaware Charter does not require a higher percentage to vote to approve certain corporate transactions. The Nevada Charter also does not specify a higher percentage.

Appraisal or Dissenter's Rights

In both jurisdictions, dissenting stockholders of a corporation engaged in certain major corporate transactions are entitled to appraisal rights. Appraisal or dissenter's rights permit a stockholder to receive cash generally equal to the fair value of the stockholder's shares (as determined by agreement of the parties or by a court) in lieu of the consideration such stockholder would otherwise receive in any such transaction.

Under Section 262 of the DGCL, appraisal rights are generally available for the shares of any class or series of stock of a Delaware corporation in a merger, consolidation or conversion, provided that no appraisal rights are available with respect to shares of any class or series of stock if, at the record date for the meeting held to approve such transaction, such shares of stock, or depositary receipts in respect thereof, are either (i) listed on a national securities exchange or (ii) held of record by more than 2,000 holders, unless the stockholders receive in exchange for their shares anything other than shares of stock of the surviving or resulting corporation (or depositary receipts in respect thereof), or of any other corporation that is listed on a national securities exchange or held by more than 2,000 holders of record, cash in lieu of fractional shares or fractional depositary receipts described above or any combination of the foregoing.

In addition, Section 262 of the DGCL allows beneficial owners of shares to file a petition for appraisal without the need to name a nominee holding such shares on behalf of such owner as a nominal plaintiff and makes it easier than under Nevada law to withdraw from the appraisal process and accept the terms offered in the merger, consolidation or conversion. Under the DGCL, no appraisal rights are available to stockholders of the surviving or resulting corporation if the merger did not require their approval. The Delaware Charter and Delaware Bylaws do not provide for appraisal rights in addition to those provided by the DGCL.

Under the NRS, a stockholder is entitled to dissent from, and obtain payment for, the fair value of the stockholder's shares in the event of (i) certain acquisitions of a controlling interest in the corporation, (ii) consummation of a plan of merger, if approval by the stockholders is required for the merger, regardless of whether the stockholder is entitled to vote on the merger or if the domestic corporation is a subsidiary and is merged with its parent, or if the domestic corporation is a constituent entity in a merger pursuant to NRS 92A.133, (iii) consummation of a plan of conversion to which the corporation is a party, (iv) consummation of a plan of exchange in which the corporation is a party, (iv) any corporate action taken pursuant to a vote of the stockholders, if the articles of incorporation, bylaws or a resolution of the board of directors provides that voting or nonvoting stockholders are entitled to dissent and obtain payment for their shares, or (v) any corporate action to which the stockholder would be obligated, as a result of the corporate action, to accept money or scrip rather than receive a fraction of a share in exchange for the cancellation of all the stockholder's outstanding shares, except where the stockholder would not be entitled to receive such payment pursuant to NRS 78.205, 78.2055 or 78.207.

Holders of covered securities (generally those that are listed on a national securities exchange), any shares traded in an organized market and held by at least 2,000 stockholders of record with a market value of at least $20,000,000, and any shares issued by an open end management investment company registered under the Investment Company Act of 1940 and which may be redeemed at the option of the holder at net asset value are generally not entitled to dissenter's rights. However, this exception is not available if (i) the articles of incorporation of the corporation issuing the shares provide that such exception is not available, (ii) the resolution of the board of directors approving the plan of merger, conversion or exchange expressly provides otherwise or (iii) the holders of the class or series of stock are required by the terms of the corporate action to accept for the shares anything except cash, shares of stock or other securities as described in NRS 92A.390(3) or any combination thereof. The NRS prohibits a dissenting stockholder from voting his or her shares or receiving certain dividends or distributions after his or her dissent. The Nevada Charter and Nevada Bylaws do not provide for dissenter's rights in addition to those provided by the NRS.

The mechanics and timing procedures vary somewhat between Delaware and Nevada, but both require technical compliance with specific notice and payment protocols.

Special Meetings of the Stockholders

The DGCL permits special meetings of stockholders to be called by the board of directors or by any other person authorized in the certificate of incorporation or bylaws to call a special stockholder meeting. In contrast, the NRS permits special meetings of stockholders to be called by the entire board of directors, any two directors or the President, unless the articles of incorporation or bylaws provide otherwise.

Under the Delaware Bylaws, a special meeting of stockholders may be called by the Chairman of the Board or a majority of the Board. The Nevada Bylaws contain a substantially similar provision.

Special Meetings Pursuant to Petition of Stockholders

The DGCL provides that a director or a stockholder of a corporation may apply to the Court of Chancery of Delaware if the corporation fails to hold an annual meeting for the election of directors or there is no written consent to elect directors in lieu of an annual meeting for a period of 30 days after the date designated for the special meeting or, if there is no date designated, within 13 months after the last annual meeting.

Under the NRS, stockholders having not less than 15% of the voting interest may petition the district court to order a meeting for the election of directors if a corporation fails to call a meeting for that purpose within 18 months after the last meeting at which directors were elected.

Adjournment of Stockholder Special Meetings

Under the DGCL, if a meeting of stockholders is adjourned due to lack of a quorum and the adjournment is for more than 30 days, or if after the adjournment a new record date is fixed for the adjourned meeting, notice of the adjourned meeting must be given to each stockholder of record entitled to vote at the meeting. At the adjourned meeting the corporation may transact any business that might have been transacted at the original meeting.

In contrast, under the NRS, a corporation is not required to give any notice of an adjourned meeting or of the business to be transacted at an adjourned meeting, other than by announcement at the meeting at which the adjournment is taken, unless the board of directors of the corporation fixes a new record date for the adjourned meeting or the meeting date is adjourned to a date more than 60 days later than the date set for the original meeting, in which case a new record date must be fixed and notice given.

Duration of Proxies

Under the DGCL, a proxy executed by a stockholder will remain valid for a period of three years, unless the proxy provides for a longer period.

Under the NRS, a proxy is effective only for a period of six months, unless it is coupled with an interest or unless otherwise provided in the proxy, which duration may not exceed seven years. The NRS also provides for irrevocable proxies, without limitation on duration, in limited circumstances.

Quorum and Voting

The DGCL provides that the certificate of incorporation and bylaws may establish quorum and voting requirements, but in no event shall quorum consist of less than one-third of the shares entitled to vote. If the certificate of incorporation and bylaws are silent as to specific quorum and voting requirements: (a) a majority of the shares entitled to vote shall constitute a quorum at a meeting of stockholders; (b) in all matters other than the election of directors, the affirmative vote of the majority of shares present at the meeting and entitled to vote on the subject matter shall be the act of the stockholders; (c) directors shall be elected by a plurality of the votes of the shares present at the meeting and entitled to vote on the election of directors; and (d) where a separate vote by a class or series is required, a majority of the outstanding shares of such class or series shall constitute a quorum entitled to take action with respect to that vote on that matter and, in all matters other than the election of directors, the affirmative vote of the majority of shares of such class or series present at the meeting shall be the act of such class or series or classes or series. A bylaw amendment adopted by stockholders which specifies the votes that shall be necessary for the election of directors shall not be further amended or repealed by the board. The Delaware Bylaws provide that the holders of shares representing a third of the voting power of the Company entitled to vote shall constitute a quorum at all meetings of the stockholders for the transaction of business, provided, however, that where a separate vote by a class or series or classes or series is required, a majority of the outstanding shares of such class or series or classes or series shall constitute a quorum with respect to such vote.

The NRS provides that, unless the articles of incorporation or bylaws provide otherwise, a majority of the voting power of the corporation, present in person or by proxy at a meeting of stockholders (regardless of whether the proxy has authority to vote on any matter), constitutes a quorum for the transaction of business. Under the NRS, unless the articles of incorporation or bylaws provide for different proportions, action by the stockholders on a matter other than the election of directors is approved if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action. Unless provided otherwise in the corporation's articles of incorporation or bylaws, directors are elected at the annual meeting of stockholders by plurality vote. The Nevada Bylaws provide that unless otherwise required by law or the articles of incorporation of the Company, the holders of a third of the voting power of the outstanding shares of capital stock of the Company entitled to vote thereat shall constitute a quorum at all meetings of the stockholders for the transaction of business. The Nevada Bylaws provide that, except as otherwise provided by law, in the articles of incorporation or bylaws of the corporation, that action by the stockholders on a matter other than the election of directors is approved if a majority of the voting power of the shares present in person or represented by proxy at the meeting and entitled to vote on the matter approve the action.

Stockholder Inspection Rights

The DGCL grants any stockholder or beneficial owner of shares the right, upon written demand under oath stating the proper purpose thereof, either in person or by attorney or other agent, to inspect and make copies and extracts from a corporation's stock ledger, list of stockholders and its other books and records for any proper purpose. A proper purpose is one reasonably related to such person's interest as a stockholder.

Inspection rights under Nevada law are more limited. The NRS grants any person who has been a stockholder of record of a corporation for at least six months immediately preceding the demand, or any person holding, or thereunto authorized in writing by the holders of, at least 5% of all of its outstanding shares, upon at least five days' written demand the right to inspect in person or by agent or attorney, during usual business hours (i) the articles of incorporation and all amendments thereto, (ii) the bylaws and all amendments thereto and (iii) a stock ledger or a duplicate stock ledger, revised annually, containing the names, alphabetically arranged, of all persons who are stockholders of the corporation, showing their places of residence, if known, and the number of shares held by them respectively. A Nevada corporation may require a stockholder to furnish the corporation with an affidavit that such inspection is for a proper purpose related to his or her interest as a stockholder of the corporation.

In addition, the NRS grants certain stockholders the right to inspect the books of account and records of a corporation for any proper purpose. The right to inspect the books of account and all financial records of a corporation, to make copies of records and to conduct an audit of such records is granted only to a stockholder who owns at least 15% of the issued and outstanding shares of a Nevada corporation, or who has been authorized in writing by the holders of at least 15% of such shares. However, these requirements do not apply to any corporation that furnishes to its stockholders a detailed annual financial statement or any corporation that has filed during the preceding 12 months all reports required to be filed pursuant to Section 13 or Section 15(d) of the Exchange Act.

Business Opportunities

Under Delaware law, the corporate opportunity doctrine holds that a corporate officer or director may not generally and unilaterally take a business opportunity for his or her own if: (i) the corporation is financially able to exploit the opportunity; (ii) the opportunity is within the corporation's line of business; (iii) the corporation has an interest or expectancy in the opportunity; and (iv) by taking the opportunity for his or her own, the corporate fiduciary will thereby be placed in a position inimical to his duties to the corporation. The DGCL permits a Delaware corporation to renounce, in its certificate of incorporation or by action of the board of directors, any interest or expectancy of the corporation in, or being offered an opportunity to participate in, specified business opportunities or specified classes or categories of business opportunities that are presented to the corporation or one or more of its officers, directors or stockholders.