US Index Futures are slightly up in Monday’s pre-market, a day

with a light global agenda, with the whole week’s global focus

being on the U.S. interest rate decision on Wednesday.

At 6:52 AM, Dow Jones (DOWI:DJI) futures were up 35 points, or

0.10%. S&P 500 futures rose 0.14%, and Nasdaq-100 futures

increased by 0.17%. The yield on the 10-year Treasury bonds stood

at 4.345%.

In the commodities market, iron ore with a 62% concentration

level dropped by 0.17%, priced at $119.50 per ton, after recent

rises that saw the commodity surpass the $120 mark. West Texas

Intermediate crude oil for October rose 0.80% to $91.50 per barrel.

Brent crude for November went up 0.64% to around $94.53 per

barrel.

On Monday’s U.S. economic calendar, investors are awaiting, at

10:00 AM, NAHB housing market index, which forecasts 50 points for

September, the same figure as in August, indicating the sector’s

resilience. It’s worth noting that a reading below 50 points

indicates a contraction in activity. At 4 PM, the government will

release the foreign investment in bonds for July. In the

immediately preceding month, the figure was $66.40 billion.

In Europe, markets are starting the week with losses, reacting

to the 25 basis point increase in interest rates by the European

Central Bank (ECB) the previous week, set at 4.50% annually, aiming

to curb inflation.

In the European context, the financial sector faces challenges

after the new CEO of Societe Generale, France’s third-largest bank,

unveiled a strategic plan focused on cost-cutting to boost profits

by 2026. As a result, the bank’s shares dropped over 6%.

In Asia, market outcomes were mixed, reflecting the positive

indicators released in China the previous Friday. Data such as

retail sales and industrial production exceeded expectations,

demonstrating that recent incentives in the real estate and

financial sectors have benefited the economy, albeit modestly.

Interest rates from two Asian giants, Japan and China, will be

announced soon. Japan is trying to balance its expansive monetary

policy with rising inflation, while China is seeking to boost its

growth.

At Friday’s close, North American markets faced a pullback due

to the notable strike by auto workers in Detroit and the expiration

of options, intensifying market instability. Furthermore,

information has emerged about possible delays in deliveries by

Taiwan Semiconductor Manufacturing, negatively affecting the

technology sector and generating fears about inflationary impacts.

Dow Jones fell 288.87 points or 0.83% to 34,618.24 points. S&P

500 fell 54.78 points or 1.22% to 4,450.32. Nasdaq Composite fell

217.72 points or 1.56% to 13,708.33.

During the session, certain financial indicators were presented,

such as the University of Michigan’s consumer confidence index,

which indicated a positive advance and a reduction in inflationary

projections. Furthermore, there was an increase in industrial

production numbers. Now, the market’s attention turns to the

next Fed meeting, where, although an immediate interest rate

increase is not expected, there may be indications of an adjustment

at the next meeting.

On Wednesday’s corporate earnings front, investors will be

watching reports from GreenTree Hospitality Group (NYSE:GHG),

Stitch Fix (NASDAQ:SFIX) and Investcorp Credit Management BDC

(NASDAQ:ICMB).

Wall Street Corporate Highlights for Today

Alphabet (NASDAQ:GOOGL), Verizon (NYSE:VZ)

– In the antitrust trial against Google, Verizon’s Brian Higgins

will be the Justice Department’s star witness, discussing Google’s

deals with carriers to dominate smartphones. Google is accused

of securing dominant positions in devices through billion-dollar

deals, aiming for increased profits. However, Google maintains

that its agreements are aimed at quality and user

experience. The antitrust investigation questions whether

users stick with defaults or change them, with significant

implications for Big Tech.

Arm Holdings (NASDAQ:ARM) – Nasdaq will

begin listing options contracts from SoftBank’s Arm Holdings on

Monday, offering investors a new way to invest in the biggest

initial public offering of the year. Other exchanges have not

confirmed similar plans. The options listing could attract

traders due to interest in Arm’s IPO and AI technology. Arm

shares had significant fluctuations after the IPO. Experts

predict high demand for the options.

Klaviyo (KVYO) – Klaviyo raised its IPO

target to more than $550 million, adjusting the share price to $27

to $29. This could give the company a valuation of $8.7

billion. It will open on the NYSE on Tuesday under the symbol

“KVYO.”

Instacart (CART) – Grocery delivery

company Instacart is expected to begin trading Tuesday under the

ticker symbol “CART.” It was recently valued at US$9.6

billion, adjusting its price between US$28 and US$30 per

share. The company had revenue of $2.55 billion last year,

with significant growth in its advertising business. Still, it

faced losses in 2020 and 2021. The IPO market’s recent positivity

could benefit its debut.

Cisco Systems (NASDAQ:CSCO) – Cisco will

lay off 350 employees in Silicon Valley in October after cutting

700 jobs in March. Despite the increase in revenue, its

outlook for 2024 is cautious. Cisco shares have grown 18% this

year.

Ford Motor (NYSE:F), General

Motors (NYSE:GM) – Following the UAW strike at three

auto facilities, negotiations have resumed with the ‘Big Three’

automakers, leading to a modest rise in Ford and GM

shares. Shawn Fain, president of the UAW, rejected a pay raise

proposed by Stellantis. Ford announced Friday that it has laid

off 600 workers in Michigan.

Tesla (NASDAQ:TSLA) – Turkish President

Tayyip Erdogan asked Elon Musk, CEO of Tesla, to build a factory in

Turkey. Musk mentioned he already has Turkish suppliers and

considers Turkey as a potential location for a new

factory. During the meeting in New York, Erdogan invited Musk

to a technology festival in Turkey.

Ferrari (NYSE:RACE) – Ferrari has renewed

its multi-year partnership with Puma, which will be its premium

partner next year. Puma will continue as a licensee of Ferrari

products and an apparel supplier to the F1 team, continuing the

collaboration that began in 2005.

Nikola (NASDAQ:NKLA) – Nikola announced an

expansion in Canada through a partnership with ITD

Industries. The company, which has faced problems such as

vehicle fires and recalls due to battery leaks, assured that such

issues would not affect the production or delivery of its fuel cell

vehicles. Deliveries are scheduled for the end of September

and beginning of October.

Starbucks (NASDAQ:SBUX) – Starbucks named

Molly Liu executive vice president and co-CEO of Starbucks China,

effective October 2. Liu, chief operating officer since 2021,

will co-lead with Belinda Wong, current CEO.

Clorox (NYSE:CLX) – Clorox shares fell in

premarket trading Monday after revealing a cyberattack in August

that will affect its fiscal first-quarter results. The full

financial impact is still uncertain. The attack crippled its IT

infrastructure, causing major disruptions to operations.

Alibaba (NYSE:BABA) – Alibaba plans to

invest US$2 billion in Turkey, as informed by the company’s

president, Michael Evans, to Turkish President Tayyip

Erdogan. Previously, Alibaba invested $1.4 billion in Turkish

platform Trendyol. New investments will include a logistics

center in Ankara and export operations in Istanbul.

Pfizer (NYSE:PFE), Seagen (NASDAQ:SGEN)

– The European Commission will decide whether to approve Pfizer’s

$43 billion bid for Seagen by October 19, and may require further

investigation.

JPMorgan Chase (NYSE:JPM) – On Friday,

JPMorgan and ANZ adjusted their China growth forecasts for 2023

following signs of economic stabilization in August. They

raised GDP expectations to 5% and 5.1%, respectively, citing retail

sales and services activity. Despite the recovery, concerns

about the real estate sector

persist. Goldman Sachs

(NYSE:GS) maintained its forecast at 4.9%, highlighting the

challenges facing the Chinese economy. Additionally, India

expects to raise more than $30 billion annually through equity

sales starting in 2024, according to JPMorgan. Abhinav Bharti

of JPMorgan believes in the growing willingness of Indian companies

to raise funds. IPO activity in India declined in 2023 but

could revive after the 2024 elections.

Goldman Sachs (NYSE:GS) – Goldman Sachs

strategists raised forecasts for Japanese stocks, anticipating that

the yen will not strengthen significantly. They forecast

profit growth in the Topix index at 12% this fiscal year and 8% and

7% in subsequent years. They also claim that strong

fundamentals and structural changes in Japan will drive the market

through 2023. Optimism is bolstered by strong earnings and value

stocks outperforming highly valued ones.

Wells Fargo (NYSE:WFC) – Carrie Tolstedt,

former head of Wells Fargo retail banking, received three years

probation, six months of home confinement and a $100,000 fine in

connection with the fake accounts scandal. She admitted

obstructing an investigation into misconduct at the

bank. Wells Fargo paid $3 billion in 2020 for inappropriate

sales practices. Tolstedt also accepted an industry ban and

paid $20 million in fines.

SVB Financial Group (NASDAQ:SIVB) – SVB

Financial Group plans to sell SVB Capital to avoid bankruptcy, as

reported by the Wall Street Journal. SkyBridge Capital, Atlas

Merchant Capital and Vector Capital are competing for the

business.

KKR and Company (NYSE:KKR) – KKR will

acquire 20% of SingTel’s regional data center business for $806.87

million, valuing it at $4.03 billion. The funds will assist in

the expansion of data centers in Southeast Asia. KKR’s David

Luboff highlighted the importance of robust digital infrastructure

for the region. The Southeast Asian data center market is

expected to grow 17% over the next five years. The transaction

will close by the fourth quarter of 2023.

Nexstar (NASDAQ:NXST) – DirecTV and

Nexstar have agreed to temporarily restore signals from Nexstar and

NewsNation stations. In July, DirecTV had removed these

signals due to distribution agreement disagreements, affecting

several major US markets.

Valero Energy (NYSE:VLO) – Refinery Valero

Energy approved a share buyback of up to $2.5 billion,

supplementing the $2.5 billion authorized in February, with no set

deadline for completion.

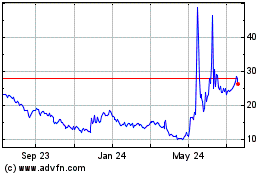

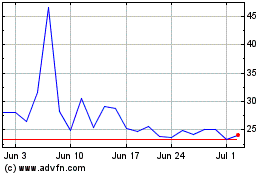

GameStop (NYSE:GME), Foot

Locker (NYSE:FL), Five

Below (NASDAQ:FIVE), Dick’s Sporting

Goods (NYSE:DKS) – After declines in retailer

stocks, insiders are buying. Shares of GameStop, Foot Locker,

Five Below and Dick’s have fallen this year. Directors of

GameStop, CEO of Foot Locker, CEO of Five Below and vice president

of Dick’s recently acquired shares.

GameStop (NYSE:GME)

Historical Stock Chart

From Mar 2024 to Apr 2024

GameStop (NYSE:GME)

Historical Stock Chart

From Apr 2023 to Apr 2024