Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

September 15 2023 - 4:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

Capri Holdings Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

The following communication was sent to employees of Capri Holdings Limited on September 15, 2023:

tapestry CAPRI Dear Capri Team, A month ago, we announced Tapestry’s planned acquisit ion of Capri. By uniting our six,

complementary and differentiated brands, we will create a new, powerful house of global iconic luxury and fashion brands. We know there are a lot of questions about what happens next. To ensure transparent communication throughout this process, we

are committed to providing monthly updates until the deal closes—what we refer to as ‘Day 1’—through this new series called ‘Integration Information.’ Getting Started on Integration Planning While we must continue to

operate as two separate companies until the deal closes, anticipated sometime in calendar 2024, we can begin planning for how we will operate as one company post Day 1. We have set up a joint Integration Management Office (IMO) which includes

leaders from Tapestry and Capri who are planning for an effective Day 1. Last week, our respective CEOs, Joanne Crevoiserat and John Idol, met with the IMO and workstream senior leaders along with our consulting partner EY, for the first time to

officially kick-off our integration work. During the meeting, the CEOs reiterated their commitment to doing it right by ensuring we bring together the best-in-class people and practices from both organizations. What is Integration Planning? Integration planning is about preparing us for operating as one company. The IMO is made up of various workstreams

from back-office areas of the business- such as HR, IT, Finance and Legal, to name a few- that are focused on the tools, processes, and operations we’ll need in place for Day 1.

Right now, we’re focused on information sharing to understand how we work similarly, and the ways in which we’ll continue to

work differently. While the IMO’s immediate focus is getting us set up for success on Day 1, the work to integrate our two companies is expected to be a multi-year journey. We understand there are questions around job security and how the

organizational structure will change. What we know today is that on Day 1, all employees will understand who they report to, ultimately rolling up to Tapestry CEO, Joanne Crevoiserat. As we move through the integration roadmap, the workstreams will

identify how the organization should evolve to reflect the best of both companies. Our goal is to be thoughtful about how we define the future organization, while maintaining the unique DNA of our six brands. This will be an on-going process, extending beyond Day 1. Integration Guiding Principles We know Tapestry and Capri may sometimes work in different ways. To guide us as we work on integration planning, we stand by five important

principles: 1. Protect Employee and Customer Experience: Rigorously manage the impact of integration activities on individuals’ experiences and escalate issues quickly. 2. Do No Harm to Brand Operations: Safeguard brands’ “Business as

Usual” operations, ensuring protection of brand value and brand DNA. 3. Address The ‘Must Haves’ First: Focus on ‘must have’ items pre-close and ensure that Day 1 is clear before

exploring longer-term decisions. 4. Be Open to Improving Operations Regardless of Where They Come From: Bring together great ideas from both organizations. 5. Prioritize Integration Activities Based on Value Creation: Do not integrate for the sake

of integrating; drive actions with the most tangible value creation. Power ofour People The IMO is led by Debbie Meyer, SVP, Business Integration at Tapestry, and Tom Edwards, Executive Vice President, Chief Financial Officer and Chief Operating

Officer at Capri. Get to know them below: Prior to being appointed Head of Integration, Debbie led Tapestry’s Transformation Management Office, where she was responsible for driving the Acceleration Program, a multi-year initiative to drive

profitable growth across Tapestry’s brands. From 2016-2019, Debbie served as the business lead for Tapestry’s SAP S/4 Implementation. Debbie was the CFO of Stuart Weitzman from 2015-2016 and prior to that, held a variety of roles within

Coach finance. Debbie’s deep knowledge of the organization and the way Tapestry works will be invaluable as she and the other members of the IMO lead this integration journey. DEBBIE MEYER SVP, Business Integration Tapestry

Fun Fact: Debbie is celebrating 20 years at Tapestry this month! On the weekends, she is her kids’ #1 sports fan and believes life

is better at the beach. Tom is the Executive Vice President, Chief Financial Officer, Chief Operating Officer of Capri Holdings Limited and has been with the Company since April 2017. Previously, from March 2015 to April 2017, Tom served as

Executive Vice President and Chief Financial Officer of Brinker International, Inc. Prior to that, he held numerous positions within finance at Wyndham Worldwide from 2007 to 2015, including having served as Executive Vice President and Chief

Financial Officer of the Wyndham Hotel Group from March 2013 to March 2015. Tom has also held a number TOM EDWARDS of financial and operational leadership positions in the consumer EVP, CFO and COO goods industry, including as Vice President,

Consumer Innovation Capri Holdings and Marketing Services at Kraft Foods and Vice President, Finance at Nabisco Food Service Company. Fun Fact: Tom is never short on company! He and his wife of 32 years have 4 children, 7 grandchildren, 15 chickens,

2 cats and 1 dog. This important work is just getting started and we are energized by the road ahead. We will continue to keep you informed by providing updates on a regular cadence. Our Integration Information series will work best with your

ongoing feedback, so if you have any questions or suggestions, please email us at capriinternalcommunications@capriholdings.com. Until next time! Forward-Looking Statements This communication contains statements which are, or may be deemed to be,

“forward-looking statements.” Forward-looking statements are prospective in nature and are not based on historical facts, but rather on current expectations and projections of the management of Capri Holdings limited (the

“Company”) about future events and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. All statements other

than statements of historical facts included herein, may be forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “plans”, “believes”, “expects”,

“intends”, “will”, “should”, “could”, “would”, “may”, “anticipates”, “might” or similar words or phrases, are forward-looking statements. Such forward-looking statements

involve known and unknown risks and uncertainties that could significantly affect expected results and are based on certain key assumptions, which could cause actual results to differ materially from those projected or implied in any forward-looking

statements, including regarding the proposed transaction. These risks, uncertainties and other factors include the impact of the COVID-19 pandemic; changes in consumer traffic and retail trends; the timing,

receipt and terms and conditions of any required governmental and regulatory approvals for the proposed transaction that could delay or result in the termination of the proposed transaction, the occurrence of any other event, change or other

circumstances that could give rise to the termination of the merger agreement entered into in connection with the proposed transaction, the possibility that the Company’s shareholders may not approve the proposed transaction, the risk that the

parties to the merger agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the proposed transaction, the

risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the Company’s ordinary shares, the risk of any unexpected costs or

expenses resulting from the proposed transaction, the risk of any litigation relating to the proposed transaction, the risk that the

proposed transaction and its announcement could have an adverse effect on the ability of the Company to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, shareholders and other

business relationships and on its operating results and business generally, and the risk the pending proposed transaction could divert the attention of the Company’s management; as well as those risks that are outlined in the Company’s

disclosure filings and materials, which you can find on http://www.capriholdings.com, such as its Form 10-K, Form 10-Q and Form 8-K reports that have been filed with the Securities and Exchange Commission. Please consult these documents for a more

complete understanding of these risks and uncertainties. Any forward-looking statement in this press release speaks only as of the date made and the Company disclaims any obligation to update or revise any forward-looking or other statements

contained herein other than in accordance with legal and regulatory obligations. Additional Information and Where to Find It This communication relates to the proposed transaction involving Capri Holdings Limited (“Capri”). In connection

with the proposed transaction, Capri will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Capri’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication is

not a substitute for the Proxy Statement or for any other document that Capri may file with the SEC and send to its shareholders in connection with the proposed transaction. The proposed transaction will be submitted to Capri’s shareholders for

their consideration. Before making any voting decision, Capri’s shareholders are urged to read all relevant documents filed or to be filed with the SEC, including the Proxy Statement, as well as any amendments or supplements to those documents,

when they become available because they will contain important information about the proposed transaction. Capri’s shareholders will be able to obtain a free copy of the Proxy Statement, as well as other filings containing information about

Capri, without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the filings with the SEC that will be incorporated by reference therein can also be obtained, without charge, by directing a request to Capri Holdings

Limited, 90 Whitfield Street, 2nd Floor, London, United Kingdom W1T 4EZ, Attention: Investor Relations; telephone +1 (201) 514-8234, or from Capri’s website www.capriholdings.com. Participants in the Solicitation Capri and certain of its

directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Capri’s directors and executive officers is available in Capri’s

proxy statement for its 2023 annual meeting of shareholders, which was filed with the SEC on June 15, 2023. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in connection with the proposed transaction when they become available. Free copies of the Proxy Statement and such other materials

may be obtained as described in the preceding paragraph.

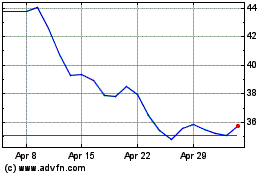

Capri (NYSE:CPRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

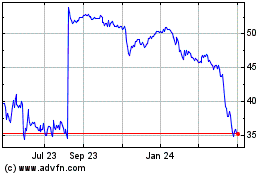

Capri (NYSE:CPRI)

Historical Stock Chart

From Apr 2023 to Apr 2024