false

0000319458

0000319458

2023-09-11

2023-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report September 11, 2023

(Date of earliest event reported)

Enservco Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36335

|

|

84-0811316

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

14133 County Road 9½

Longmont, Colorado 80504

(Address of principal executive offices) (Zip Code)

(303) 333-3678

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which

registered

|

|

Common Stock, $0.005 par value

|

ENSV

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Asset Purchase Agreement

On September 11, 2023, Enservco Corporation (the “Company”) and its wholly-owned subsidiary Heat Waves Hot Oil Service LLC (together with the Company, the “Purchaser” ) entered into and closed on an Asset Purchase Agreement (the “Asset Purchase Agreement”) with OilServ, LLC, a Delaware limited liability company (the “Owner”), and its wholly-owned subsidiaries, Rapid Hot Flow, LLC, a Colorado limited liability company and Rapid Pressure Services, LLC, a Delaware limited liability company (together, the “Sellers” and with the Owner, the “Selling Parties”), pursuant to which Purchaser agreed to acquire certain assets and assume certain liabilities of Sellers relating to its business of providing frac water heating services to the oil and gas industry in Ohio, Pennsylvania and West Virginia (the “Assets”).

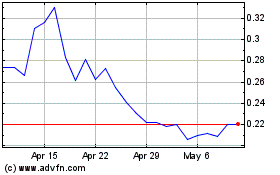

In consideration for the purchase of the Assets, the Company issued to the Owner 2,939,133 shares of the Company’s common stock (based on $0.3598 per share, which is the volume-weighted average price of the common stock for the 10 day period immediately preceding the closing date), of which 10% was deposited in escrow to satisfy the Selling Parties’ indemnifications obligations, if any, under the Asset Purchase Agreement. Under the Asset Purchase Agreement, the Company has agreed to file a registration statement with the SEC for the purpose of registering for resale the shares issued pursuant to the Asset Purchase Agreement. The Company is required to file such registration statement with the SEC within 60 days following the closing date.

The Asset Purchase Agreement contains customary representations, warranties, and covenants by each party. The Asset Purchase Agreement also contains post-closing indemnification rights for each of the Purchaser and Selling Parties for breaches of representations and warranties, covenants, as well as certain other matters, subject to certain specified limitations.

In connection with Asset Purchase Agreement, the Company entered into a two year employment agreement with Mike Lade, the former President and Chief Financial Officer of Rapid Hot Flow, LLC., to serve as Senior Vice President of the Company. As an inducement to his employment, the Company agreed to issue Mr. Lade options to acquire 250,000 share so the Company’s Common Stock at an exercise price of $.41 per share with 50% of such options vesting January 1, 2024 and the balance vesting January 1, 2025.

The foregoing description of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Asset Purchase Agreement, a copy of which is attached hereto as Exhibit 10.1 and the terms of which are incorporated by reference herein.

Note Purchase Agreement

On September 11, 2023 pursuant to a Note Purchase Agreement (the “Note Purchase Agreement”), the Company issued Convertible Promissory Notes (the “New Convertible Notes”) in the aggregate principal amount of $125,000 to Angel Capital Partners, LP (“Angel Capital”), an entity owned by Stephen D. Scott who is a principal of the Owner, and in aggregate principal amount of $187,500 to Equigen II, LLC (“Equigen”), an entity owned by Steven A. Weyel who is a principal of the Owner.. The Company expects to use the gross proceeds for general corporate purposes.

The Note Purchase Agreement contains certain covenants, including a covenant that, without the written approval of the holders of greater than 75% of the principal amount of the New Convertible Notes, restricts the Company’s ability to (a) incur any debt which is senior or pari passu to the New Convertible Notes, or (b) issue any securities subject to certain exceptions. In addition, the Company agreed to appoint Steven A. Weyel to the Board of Directors upon execution of the Asset Purchase Agreement.

Also on September 11, 2023, pursuant to the terms of certain promissory notes previously issued by the Company on September 1, 2023 (the “Prior Convertible Notes”), Cross River Partners, LP (“Cross River”), an entity controlled by Richard Murphy, our Chief Executive Officer and Chairman, exchanged its Prior Convertible Note in the aggregate principal amount of $750,000 for a New Convertible Note with the same principal amount, and Kevin Chesser , a director of the Company, exchanged his Prior Convertible Note in the aggregate principal amount of $50,000 for a New Convertible Note with the same principal amount.

Under the Note Purchase Agreement, within 45 days after the closing of the issuance of the New Convertible Notes, Cross River agreed to purchase an additional $250,000 in aggregate principal amount of New Convertible Notes, provided that Equigen and Angel Capital contemporaneously invest an additional $312,500 in aggregate principal amount of New Convertible Notes. The Company may issue New Convertible Notes representing up to the remaining balance of the maximum principal amount of $3,000,000 to additional investors

The New Convertible Notes have an eighteen (18) month term and accrue interest at 16.00% per annum. All outstanding principal and interest on the New Convertible Notes is due on the eighteen (18) month anniversary of their issuance (the “Maturity Date”). The Company is required to make interest only payments on a quarterly basis at the end of each calendar quarter, beginning with the quarter ending December 31, 2023. The first quarterly interest payment is payable in shares of the Company’s common stock based on the five (5) day moving average of the closing sales price of the common stock on the NYSE American immediately prior to December 31, 2023. For calendar quarters beginning March 31, 2024, the Company is required to make quarterly interest payments in cash within ten (10) days of the close of the quarter. The New Convertible Notes may not be prepaid by the Company.

If the Company closes on a new offering of equity securities (the “Equity Financing”) of a minimum of $5,000,000 before the Maturity Date, then, subject to any NYSE American shareholder approval requirements, the principal amount, together with all accrued but unpaid interest of the New Convertible Notes, will automatically convert into shares of the same class and type at the same price and on the same terms and provisions as the securities issued to the other participants in the Equity Financing on the closing date of such Equity Financing; provided, however, at the option of the holder, the New Convertible Notes may convert into such equity, (a) at $0.50 per share if the security sold in the Equity Financing is common stock or (b) at a share price which is 25% less than the lowest price per share of shares sold in the Equity Financing. Subject to any NYSE American shareholder approval requirements, the holders may convert their Convertible Notes at any time into the Company’s common stock at a conversion price of $0.50 per share.

If a change of control of the Company or a sale substantial portion of any of its assets occurs prior to the Maturity Date, the holder may elect to receive either (i) the principal amount plus accrued interest plus a premium that is equal to 25% of the principal amount or (ii) the right to convert the principal amount plus accrued but unpaid interest into the Company’s common stock at a conversion price equal to a 25% discount to the five (5) day moving average of the closing sales price of the common stock on the NYSE American immediately prior to the transaction which results in a change of control of the Company.

The foregoing description of the Note Purchase Agreement and New Convertible Notes does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Note Purchase Agreement and the form of the New Convertible Note, which are attached as Exhibits 10.2 and 10.3 to this Current Report on Form 8-K.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Note Purchase Agreement in Item 1.01 is hereby incorporated by reference into this Item 2.03.

|

Item 3.02

|

Unregistered Sales of Equity Securities

|

The information set forth in Item 1.01 is incorporated herein by reference into this Item 3.02. The shares of common stock issued pursuant to the Asset Purchase Agreement and the New Convertible Notes were issued to accredited investors without registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption provided by Section 4(a)(2) of the Securities Act as transactions not involving a public offering.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On September 11, 2023, the Board of Directors of the Company expanded the size of the Board to five directors and, in accordance with the Note Purchase Agreement, elected Steve Weyel as a director of the Company. For his services as a non-employee director of the Company, Mr. Weyel is entitled to quarterly payments of $12,500 the amount authorized in 2023 as compensation for independent members of the Board of Directors and is entitled on January 1 of each year, starting January 1, 2024 to an equity grant of the Company’s Common Stock equal to30,000 .

Steven A. Weyel served as Chief Executive Officer and Chairman of EnVen since 2015 until the merger of EnVen with Talos Energy (NYSE:TALO) in February 2023. Mr. Weyel was also a member of the Board of Directors of Energy Ventures GoM Holdings, LLC, its predecessor from July 2014 until November 2015. Previously, Mr. Weyel served as Chief Executive Officer of EnVen Energy Ventures, LLC since January 2013. Mr. Weyel is the founder and current Chairman of Equigen, LLC, an equity investment company focused on emerging market energy infrastructure and services. Until 2016, Mr. Weyel served on the Board of Directors of Rooster Energy Ltd., an integrated oil and natural gas company with an exploration and production business and a division which is a leading downhole and subsea well intervention and plugging and abandonment service provider. Mr. Weyel also formerly served as a director of Bahamas Petroleum Company PLC (AIM: “BPC”) from July 2011 through August 2014. Mr. Weyel co-founded and served as President, Chief Operating Officer and Director of Energy XXI (Bermuda) Limited (NASDAQ: EXXI) from its inception in October 2005 until August 2010. Mr. Weyel co-founded and served as a Principal, President and Chief Operating Officer of EnerVen LLC, a developer and supporter of strategic ventures in the emerging energy industry. From 1999 to 2002, Mr. Weyel served as President, Chief Operating Officer and Director of InterGen North America, a Shell-Bechtel joint venture that developed and operated large-scale independent power projects and managed gas pipelines, gas storage and associated energy commodity transactions in the merchant gas and power business. From 1994 to 1999, Mr. Weyel served in various executive leadership positions at Dynegy, Inc. including Executive Vice President—Integrated Energy and Senior Vice President—Power Development. Mr. Weyel currently serves on the Board of Directors of National Ocean Industries Association. Mr. Weyel earned a Master’s degree in Business Administration from the University of Texas at Austin and a Bachelor of Science in Industrial Distribution from Texas A&M University College of Engineering.

(d) Exhibits

Press releases attached hereto as Exhibit 99.1 and 99.2, and are incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on September 15, 2023.

| |

Enservco Corporation

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Richard A. Murphy

|

| |

|

Richard A. Murphy, Chair and CEO

|

Exhibit 10.1

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (“Agreement”) is made and entered into as of September 11, 2023, by and among OilServ, LLC, a Delaware limited liability company (the “Owner”), the Owner’s wholly-owned subsidiaries, Rapid Hot Flow, LLC, a Colorado limited liability company and Rapid Pressure Services, LLC, a Delaware limited liability company (each of the foregoing a “Seller” and collectively, the “Sellers”) and together with Owner, the “Selling Parties”), and Heat Waves Hot Oil Service LLC, a Colorado limited liability company, a wholly-owned subsidiary of Enservco Corporation, a Delaware corporation (“Enservco”) (“Purchaser”, and all of the foregoing, sometimes referred to individually as a “Party” and collectively as, the “Parties”).

RECITALS

A. Sellers are engaged in the business of providing frac water heating services to the oil and gas industry primarily in Ohio, Pennsylvania and West Virginia (the “Business”).

B. Owner owns 100% of the issued and outstanding equity of the Sellers.

C. The Selling Parties desire to sell to Purchaser, and Purchaser desires to purchase from the Selling Parties, the Business as a going concern and substantially all of the assets and rights owned and/or used by the Selling Parties in the Business (other than the Excluded Assets (as defined below)), upon the terms and conditions set forth in this Agreement.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual promises and conditions contained herein, the Parties hereby agree as follows:

1.1 Purchased Assets. On the Closing Date (defined herein), and subject to the terms and conditions set forth in this Agreement, the Selling Parties agree to sell, assign, transfer and deliver to Purchaser, and Purchaser agrees to purchase and accept from the Selling Parties, all right, title and interest in and to all assets owned by Sellers or used in the Business, which shall include, at a minimum, the properties, assets and rights set forth on Schedule 1.1 hereto, as well as all of the following properties, assets and rights relating to the Business existing as of the Closing Date, other than the Excluded Assets (collectively, the “Purchased Assets”):

(a) all furniture, fixtures, equipment, vehicles, trailers, machinery, computers and other tangible personal property used in the operation and maintenance of the Business;

(b) all inventory, finished goods, raw materials, work in progress, packaging, supplies, parts and other inventories of the Business (including any products used to perform the services performed in the Business) (collectively, the “Inventory”);

(c) all of Sellers’ intangible assets, including, without limitation, (i) all files, books, records, work papers, and other documents related to the Business; (ii) customer and supplier lists, files, and other information relating to the customers and suppliers of the Business, (iii) all rights under contracts and agreements, oral or written, that are used by Sellers in the conduct of the Business and are in effect as of the Closing Date (collectively, the “Contracts”); and (iv) all goodwill, going-concern value and other general intangibles of Sellers related to the Business;

(d) to the extent transferable, all permits, authorizations and licenses used by Sellers in the conduct of the Business, including, without limitation, Sellers’ license(s) to operate the Business;

(e) the telephone number(s), fax number(s), Internet domain name(s), and social media account(s) owned or used by Sellers in connection with the Business;

(f) all records of the Business relating to the Assumed Liabilities (as defined below), and the related deposits for rental facilities for the Assumed Liabilities;

(g) any and all other properties, assets and rights of Sellers that are used in the conduct of the Business and not expressly listed or referred to in Section 1.2 below.

1.2 Excluded Assets. The following properties, assets and rights (the “Excluded Assets”) shall not be transferred to Purchaser and shall not be included within the definition of Purchased Assets:

(a) all cash and cash equivalents (ii) prepaid expenses, and (iii) accounts receivable;

(b) Sellers’ rights under this Agreement or any other agreement between Sellers and Purchaser entered into on or after the Closing Date in accordance with the terms hereof and thereof, respectively; and

(c) Sellers’ minute books, stock ledger, and Tax Returns (as defined below).

1.3 Assumption of Liabilities. Subject to the terms and conditions hereof, Purchaser hereby agrees to assume only the specific obligations of Sellers identified on Schedule 1.3 (collectively, the “Assumed Liabilities”). Except for the Assumed Liabilities, Purchaser shall not and does not assume any liabilities or obligations of the Selling Parties. Notwithstanding anything in this Agreement to the contrary, the Selling Parties shall be responsible for all liabilities and obligations of the Selling Parties arising from ownership of the Purchased Assets and/or the operation of the Business and not hereby expressly assumed by Purchaser and Purchaser shall not assume, or in any way be liable or responsible for, any such liabilities or obligations (collectively, the “Excluded Liabilities”).

|

2.

|

PURCHASE PRICE; CLOSING.

|

2.1 Purchase Price. The aggregate “Purchase Price” shall be One Million Fifty Seven Thousand Five Hundred dollars ($1,057,500.00) to be paid in Shares of Enservco common stock (the “Transaction Shares”) which Enservco shall be issued to Owner on behalf of Seller based on the volume weighted moving average of Enservco Common Stock for the 10 day period immediately preceding the Closing Date.

2.2 Sales Taxes and Expenses. Sellers shall pay all Taxes associated with (i) the operation of the Business prior to the Closing and (ii) the sale and conveyance of the Purchased Assets pursuant to this Agreement. Except as otherwise expressly provided in this Agreement, Sellers and Purchaser shall each pay their own respective costs and expenses in connection with this Agreement and the Transaction (as defined below).

2.3 Closing. The consummation of the transactions contemplated by this Agreement (the “Closing”) shall take place via an electronic exchange of documents, simultaneously on the date hereof, or at such other time or place or in such other manner as the Parties may mutually agree upon in writing (the “Closing Date”). Closing shall be effective as of 12:01am Central Time on the Closing Date. The Parties agree to use commercially reasonable efforts to achieve the Closing.

2.4 Purchased Asset Transfer Fees. Purchaser shall pay the transfer fees or excise taxes related to the transfer of the vehicles and other Purchased Assets.

2.5 Final Payroll. Sellers shall be responsible for the final payroll and all accrued employee obligations (including, but not limited to, accrued paid time off) and associated payroll taxes (collectively, the “Final Payroll Obligations”) immediately prior to the Closing Date. If the Parties agree that the Closing shall occur at such other time than at the end of a payroll period, then the Purchaser shall reimburse Seller by the amount necessary to cover the Final Payroll Obligations accrued through the day prior to Closing Date, as a post-closing adjustment made within seven days of Closing. In addition and notwithstanding Seller's Employment Obligations as provided in Section 5.1 below, Purchaser shall also reimburse Seller for (i) pro-rated health and welfare payroll benefits through the end of the month in which Closing occurs, (ii) pro-rated September rent for leases included in Assumed Liabilities and (ii) deposits related to the leases included as Assumed Liabilities as a post-closing adjustment. The foregoing reimbursements shall be made via a cash payment within seven days from the date of Closing.

2.6 Closing Deliverables.

(a) At the Closing, the Selling Parties shall deliver, or shall cause to be delivered, as applicable, the following:

(i) a bill of sale, assignment and assumption agreement, in the form attached hereto as Exhibit A (the “Bill of Sale, Assignment and Assumption Agreement”), duly executed by the Selling Parties;

(ii) an employment agreement between Michael Lade and Purchaser, in the form attached hereto as Exhibit B (the “Employment Agreement”) duly executed;

(iii) resolutions of the board of directors (or equivalent) and Owner, which authorize the execution, delivery and performance of the Transaction Documents (as defined below) to which each Seller is a party, and the consummation of the transactions contemplated thereby;

(iv) evidence, in form and substance reasonably satisfactory to Purchaser, that of all security interests, mortgages, pledges, liens (statutory or other), charges, encumbrances, community property interests, conditions, equitable interests, options, restrictions on use, and claims of any kind or nature (“Liens”) set forth on Schedule 2.6(a)(iv) have been released;

(v) evidence, in form and substance reasonably satisfactory to Purchaser, that all governmental and regulatory approvals and consents requisite or appropriate to the consummation of the Transaction (including, without limitation, consents required under the Contracts) shall have been obtained (or all applicable waiting periods shall have expired), and that such consents or approvals remain in full force and effect;

(vi) evidence, in form and substance reasonably satisfactory to Purchaser, that Sellers have terminated the employment of Sellers’ employees as contemplated by Section 5.1 below;

(vii) evidence, in form and substance reasonably satisfactory to Purchaser, that the Sellers have agreed to terminate Seller’s 401-K plan; and

(viii) such other customary instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to Purchaser (collectively with this Agreement, the Bill of Sale, Assignment and Assumption Agreement, and the Employment Agreement, the “Transaction Documents”), as may be required to give effect to the Transaction Documents and the transactions contemplated thereby (collectively, the “Transaction”).

(b) At the Closing, Purchaser shall deliver, as applicable, the following:

(i) Evidence of the issuance of ninety percent (90%) of the Transaction Shares;

(ii) the Bill of Sale, Assignment and Assumption Agreement, duly executed by Purchaser;

(iii) the Employment Agreement, duly executed by Purchaser;

(iv) a certificate of the Secretary (or equivalent officer) of Purchaser certifying as to (A) the resolutions of the board of directors (or equivalent) which authorize the execution, delivery and performance of the Transaction Documents, and the consummation of the transactions contemplated thereby, (B) the names and signatures of the officers of Purchaser authorized to sign the Transaction Documents, and (C) the appointment of Steve Weyel to the Enservco Corporation board of directors; and

(v) such other customary and reasonable instruments of transfer, assumption, filings or documents, in form and substance reasonably satisfactory to the Selling Parties, as may be required to give effect to the Transaction.

2.7 Escrow. Notwithstanding anything herein to the contrary, Purchaser shall retain ten percent (10%) of the Transaction Shares (the “ Escrow Amount”) at the Closing. The Escrow Amount shall be issued to Owner following the sixth month anniversary of the Closing (the “Escrow Period”) subject to the indemnification provisions as provided in Section 6 hereof. Subject to any indemnification, the balance of the Escrow Amount, if any, shall be issued to the Owner within ten (10) business days of when the Escrow Period ends.

2.8 Transaction Shares. The Selling Parties acknowledge and agree that the Transaction Shares will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or qualified under the securities laws of any state (“Blue Sky Laws”) on the grounds that the offering and sale of the Transaction Shares contemplated by this Agreement are exempt from registration under the Securities Act and the Blue Sky Laws. The Selling Parties acknowledge and agree that, subject to registration under the Securities Act and Blue Sky Laws or an exemption to such registration, the Transaction Shares are not transferable, except that Owner may assign to its members the Transaction Shares during the liquidation process for dissolving the Selling Parties. Any certificate representing the Transaction Shares shall contain the following legends:

(a) “THE SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) AND ARE “RESTRICTED SECURITIES” AS DEFINED IN RULE 144 PROMULGATED UNDER THE ACT. THE SECURITIES MAY NOT BE SOLD OR OFFERED FOR SALE OR OTHERWISE DISTRIBUTED EXCEPT (i) IN CONJUNCTION WITH AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE ACT OR (ii) IN COMPLIANCE WITH RULE 144, OR (iii) PURSUANT TO AN OPINION OF COUNSEL, REASONABLY SATISFACTORY TO THE CORPORATION, THAT SUCH REGISTRATION OR COMPLIANCE IS NOT REQUIRED AS TO SAID SALE, OFFER OR DISTRIBUTION.”

|

3.

|

REPRESENTATIONS AND WARRANTIES OF THE SELLING PARTIES. The Selling Parties hereby represent, warrant and covenant, on a joint and several basis, to Purchaser, as of the Closing Date, as follows:

|

3.1 Due Formation. Sellers are duly qualified and organized, and are validly existing and in good standing under the laws of each state of formation and have the power and authority and all authorizations, licenses, permits and certifications necessary to own and operate its properties and to properly carry on the Business. Sellers are qualified or otherwise authorized to transact business as a foreign corporation in each jurisdiction in which the nature and operation of the Business requires such qualification.

3.2 Authorization of Agreements; Validity; No Conflict. The execution and delivery of the Transaction Documents by the Selling Parties, and the performance by the Selling Parties of their respective obligations thereunder, has been duly authorized by all requisite action, including required corporate action and approval by Selling Parties’ members, managers, governors and/or board of directors, constitutes the legal, valid, and binding obligations of such parties, and will not (a) violate any federal, state, local, municipal, foreign or other laws, regulations or legal requirements, including, without limitation, any order of any court or other governmental body, to which any Selling Party or any of the Purchased Assets are bound or subject, (b) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default by any Selling Party under any agreement to which such Selling Party or any of the Purchased Assets are bound or subject; or (c) except as set forth on Schedule 3.13, require any consent under any such agreement or result in the creation or imposition of any Lien or encumbrance of any kind upon the Business or the Purchased Assets.

3.3 Ownership. The Owner owns 100% of the outstanding equity and other ownership interests, if any, in the Sellers. There are no outstanding subscriptions, options, warrants, calls, contracts, demands, commitments, convertible securities or other agreements or arrangements of any character or nature pursuant to which the Sellers are obligated to issue any securities or rights similar thereto of any kind of the Sellers. There are no outstanding subscriptions, options, warrants, calls, contracts, demands, commitments, convertible securities or other agreements or arrangements of any character or nature pursuant to which the Owner is obligated to issue any securities or rights similar thereto of any kind of the Owner.

3.4 Financial Information. Attached hereto as Schedule 3.4 are: (a) complete copies of the unaudited financial statements consisting of the balance sheet of the Business as at December 31 in each of the years, 2021 and 2022 and the related statements of income and retained earnings, owner equity and cash flow (if any) for the years then ended (the “Historical Financial Statements”), and unaudited financial statements consisting of the balance sheet of the Business as at June 30, 2023 and the related statements of income for the three (3) month period then ended (the “Interim Financial Statements” and together with the Historical Financial Statements, the “Financial Statements”). The Financial Statements are based on the books and records of the Business, are prepared consistent with past practices of the Business and fairly present the financial condition of the Business as of the respective dates they were prepared and the results of the operations of the Business for the periods indicated.

3.5 Assumed Liabilities. The Assumed Liabilities were incurred by Sellers in the ordinary course consistent with past practice and are directly related to the Business.

3.6 No Undisclosed Liabilities. Sellers have no debts, liabilities or obligations, except for (i) liabilities specifically identified on the face of the balance sheet contained in the most recent Financial Statements, and (ii) liabilities that have arisen since the date of such balance sheet in the ordinary course of business. None of such known debts, liabilities or obligations result from, arise out of, relate to, are in the nature of, or were caused by any breach of contract, breach of warranty, tort, infringement, or violation of law, and none of such known debts, liabilities or obligations, individually or in the aggregate, will have a material adverse effect on the business, assets, properties, condition (financial or otherwise), results of operations or prospects of Sellers taken as a whole (a “Material Adverse Effect”). There has been no event, occurrence, development or circumstance which would reasonably be expected to have a Material Adverse Effect.

3.7 Conduct of the Business. Since the date of the Interim Financial Statements through the Closing Date, no Selling Party has engaged in any practice, taken any action or entered into any transaction with respect to any of the Purchased Assets outside the ordinary course of business. Without limiting the foregoing, no Selling Party has engaged in any practice, taken any action or entered into any transaction with respect to the Business which could, to Sellers’ knowledge, have a Material Adverse Effect or entered into any agreement to do any of the foregoing.

3.8 Business Relationships. Within the past twelve (12) months: (i) no Affiliate (as defined below) of Sellers, the Owner, nor any Affiliate of the Owner (collectively, the “Interested Parties”) has been involved in any material business arrangement or relationship with Sellers; and (ii) no managers, officers or employees (or their respective family members) of Sellers have been involved in any material business arrangement or relationship with Sellers other than employment as properly reflected in the Financial Statements. No Interested Party, nor any managers, officers or employees of Sellers (nor their respective family members), own any asset that is used in the Business. For purposes of this Agreement, “Affiliate” means, with respect to a Person, any other Person that directly or indirectly, controls, is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise. For purposes of this Agreement, “Person” means any individual, sole proprietorship, partnership, limited liability company, joint venture, trust, unincorporated association, corporation, other entity or governmental authority.

3.9 Title; Condition of Assets. Sellers are the owner of and have good and marketable title to the Purchased Assets (which constitute all of the properties and assets necessary or appropriate for the continued conduct of the Business in substantially the same manner as conducted immediately prior to the Closing), free of all restrictions on transfer or assignment and all Liens. The Purchased Assets comprising tangible personal property are in the same condition as when they were examined by the Purchaser on July 20, 2023 and repair, ordinary wear and tear excepted. Following normal and customary pre-season repairs and maintenance the Purchased Assets are usable in the ordinary course of the Business.

3.10 Personal Property Leases. True and complete copies of all Sellers’ leases relating to leased personal property (the “Leased Personal Property”) have been delivered to Purchaser, and such leases are not in default and are valid, binding and enforceable against the respective parties thereto.

3.11 Litigation. There are no legal actions, suits, or proceedings pending or, to the knowledge of Sellers, threatened against Sellers or against the Business, and no Selling Party is aware of any facts that are likely to result in or form the basis for any such action, suit or other proceeding.

3.12 Contracts. Sellers and, to the knowledge of Sellers, each other party to the Contracts, have performed all obligations required to be performed under the Contracts and are not in default under any Contract that would be reasonably expected to have a Material Adverse Effect. The Contracts are each in full force and effect, and Sellers have not waived or assigned to any other individual or entity any of its rights thereunder. The Parties acknowledge that the Contracts are not assignable to Purchaser without the consent of third parties. The Parties do not expect there to be any adverse impact to the process of gaining consent following the Closing Date.

3.13 Customers and Suppliers.

(a) Schedule 3.13(a) sets forth with respect to the Business (i) each customer who has paid aggregate consideration to Sellers for goods or services rendered in an amount greater than or equal to $50,000 for each of the two (2) most recent fiscal years (collectively, the “Material Customers”); and (ii) the amount of consideration paid by each Material Customer during such periods. Sellers have not received any notice, and have no reason to believe, that any Material Customer intends to terminate or materially reduce its relationship with the Business after the Closing.

(b) Schedule 3.13(b) sets forth with respect to the Business (i) each supplier to whom Sellers have paid consideration for goods or services rendered in an amount greater than or equal to $20,000 for each of the two (2) most recent fiscal years (collectively, the “Material Suppliers”); and (ii) the amount of purchases from each Material Supplier during such periods. Sellers have not received any notice, and have no reason to believe, that any of the Material Suppliers intends to terminate or materially reduce its relationship with the Business. The prices that Sellers pay to their suppliers to purchase services is not based on, in whole or in part, the promise to continue to do business with such supplier in the future.

3.14 Taxes. All taxes, federal, state and local, (“Tax” and with corresponding meaning “Taxes”) for all periods prior to the Closing Date have been paid, and Sellers have timely filed (or have had timely filed on its behalf) all returns, declarations, reports, estimates, information returns and statements (“Tax Returns”) required under applicable laws, and all such Tax Returns are true, correct and complete in all material respects. Sellers represent and warrant that the preceding representation will be true as of the Closing, as if made at that time. Neither the Business nor the Purchased Assets are subject to any Lien resulting from unpaid Taxes, and to the knowledge of Sellers, no taxing authority has any present right to file any such Lien against the Business or the Purchased Assets. All material elections with respect to Taxes affecting Sellers or the Purchased Assets have been disclosed to Purchaser.

3.15 Compliance with Laws; Permits. To Sellers’ knowledge, the Selling Parties have materially complied with all applicable federal, state, and local statutes, laws, and regulations affecting Sellers’ properties or the operation of the Business. The Selling Parties are not required to acquire any consents or approvals by any governmental authority to execute, deliver, and perform their obligations under any of the Transaction Documents. Sellers have all necessary licenses, permits and certifications required to operate the Business and own the Purchased Assets, and all such licenses, permits and certifications are in full force and effect.

3.16 Environmental Matters. Sellers are, and at all times has been, in full compliance with, and have not been in violation of or liable under, any applicable local, state and/or federal environmental law, order, or regulation, and Sellers have no basis to expect, nor have Sellers received, any actual or threatened order, notice or other communication from any governmental body (or private citizen acting in the public interest) of any actual or potential violations or failure to comply with any such environmental law.

3.17 Insurance. To Sellers’ knowledge, all insurance policies maintained by Sellers with respect to the Purchased Assets (collectively, “Sellers’ Insurance Policies”) are in full force and effect, and there has been no failure to pay premiums on such policies when due. Sellers’ Insurance Policies are of the type and in the amounts customarily carried by Persons conducting a business similar to the Business and are sufficient for compliance with all applicable laws and the Contracts. Neither Sellers nor any of their Affiliates are in default under, or has otherwise failed to comply with, in any material respect, any provision contained in any Sellers’ Insurance Policy.

3.18 Employment Matters. Sellers have complied in all material respects with all laws relating to employment, equal employment opportunity, nondiscrimination, immigration, wages, hours, benefits, collective bargaining, the payment of social security and similar taxes, occupational safety and health, and plant closing. To the knowledge of Sellers, no key employee or group of employees has any intention to terminate employment with Sellers. Sellers are not a party to or bound by any collective bargaining agreement. Sellers have not committed any unfair labor practice. Sellers have no knowledge of any organizational effort presently being made or threatened by or on behalf of any labor union with respect to employees of either Seller. Sellers have not suffered a labor shortage that adversely impacts Sellers or the Business. Sellers have not received any complaints or claims for failing to provide a safe working environment or accommodation to its employees in relation to COVID-19, and Sellers have complied with all public health protocols and guidelines regarding the COVID-19 pandemic. Sellers do not have nor have they ever had any employee benefit plan, as defined in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended.

3.19 Brokers. No third party shall be entitled to receive any brokerage commissions, finder’s fees, fees for financial advisory services or similar compensation in connection with the transactions contemplated by this Agreement based on any arrangement or agreement made by or on behalf of the Selling Parties.

3.20 Intellectual Property.

(a) Definitions. “Intellectual Property” means the collective reference to all rights, priorities and privileges relating to intellectual property, whether arising under United States, multinational or foreign laws or otherwise, including but not limited to copyrights, copyright licenses, patents, patent licenses, trademarks, logos, brands, trademark licenses, internet domain names and social media account or user names, websites, technology, know-how and processes, all other intellectual property and proprietary rights, and all rights to sue at law or in equity for any infringement or other impairment thereof, including the right to receive all proceeds and damages therefrom. “Intellectual Property Assets” means all Intellectual Property that is owned by Sellers and used or held for use in the conduct of the Business, including, without limitation, any rights in or to the “Rapid Hot Flow” and “Rapid Pressure Services” trade names and any related trademark(s) (whether nor not registered), including, without limitation, all logos and slogans used in connection with the Business.

(b) Scheduled Intellectual Property. Schedule 3.20(b) contains a correct, current, and complete list of all Intellectual Property of the Business as currently conducted, specifying as to each, as applicable: the title, mark, or design; the jurisdiction by or in which it has been issued, registered, or filed; the patent, registration, or application serial number; the issue, registration, or filing date; and the current status of any efforts of Sellers to obtain additional Intellectual Property rights in any Intellectual Property Assets.

(c) The Sellers own and have good, valid, and exclusive title to, or has exclusive and assignable licenses to use, each item of Intellectual Property listed in Schedule 3.20(b) free and clear of all Liens and adverse claims of title, and such Intellectual Property is valid and enforceable, and the rights of the Sellers therein will not be terminated, canceled or modified as a result of the Transaction. The conduct of the Business as currently conducted does not infringe or otherwise violate the Intellectual Property rights of any third party. Immediately following the Closing, all Intellectual Property Assets, and (to the extent assignable, and validly assigned hereunder) licensed Intellectual Property, will be owned or available for use by Purchaser on substantially the same terms as they were owned or available for use by Sellers immediately prior to the Closing.

3.21 Disclosure. The Selling Parties have presented to Purchaser true, complete, and correct information and documents regarding the Business, Purchased Assets and Transaction, and none of the information or documents so provided contains an untrue statement of material fact or omits to state a material fact.

3.22 Investment Representations. The Owner is acquiring the Transaction Shares for its own account with the present intention of holding such securities for investment purposes and not with a view to, or for sale in connection with, any distribution of such securities in violation of any federal or state securities Laws. The Owner is an “accredited investor” as defined in Regulation D promulgated by the Securities and Exchange Commission under the Securities Act, and acknowledges that it is informed as to the risks of the transactions contemplated hereby and of ownership of the Transaction Shares.

|

4.

|

REPRESENTATIONS AND WARRANTIES OF PURCHASER. Purchaser hereby represents and warrants to the Selling Parties, as of the Closing Date, as follows:

|

4.1 Due Incorporation; Authorization of Agreements; No Conflict. Purchaser is duly qualified and organized, and is validly existing and in good standing, under the laws of its state of formation. The execution and delivery of the Transaction Documents by the Purchaser has been duly authorized by all requisite action, constitutes the legal, valid and binding obligations of the Purchaser, and will not violate any laws or conflict with or result in a violation of or default under any material agreements to which Purchaser is a party.

4.2 Brokers. No third party shall be entitled to receive any brokerage commissions, finder’s fees, fees for financial advisory services or similar compensation in connection with the transactions contemplated by this Agreement based on any arrangement or agreement made by or on behalf of Purchaser.

4.3 Transaction Shares. The Transaction Shares, upon issuance, will be duly authorized, fully paid, validly issued and non-assessable.

4.4 SEC Reports; Financial Statements. Purchaser has filed all required registration statements, reports, schedules, forms, statements and other documents required to be filed by it with the SEC (collectively, as they have been amended since the time of their filing and including all exhibits thereto, the “SEC Reports”). The audited financial statements and unaudited interim financial statements (including, in each case, the notes and schedules thereto) included in the SEC Reports complied as to form in all material respects with the published rules and regulations of the SEC with respect thereto, were prepared in accordance with Generally Accepted Accounting Principles applied on a consistent basis during the periods involved (except as may be indicated therein or in the notes thereto and except with respect to unaudited statements as permitted by Form 10-Q of the SEC) and fairly present (subject, in the case of the unaudited interim financial statements included therein, to normal year-end adjustments and the absence of complete footnotes) in all material respects the financial position of Buyer as of the respective dates thereof and the results of their operations and cash flows for the respective periods then ended.

5.1 No Requirement to Hire Employees; Pre-Closing Matters. Except as otherwise specifically provided in this Section 5.1, Purchaser shall not be required to assume the obligation to provide any compensation, fringe benefit, severance, retirement or other benefit heretofore provided by Sellers. Notwithstanding the foregoing, Purchaser agrees to initially hire, on the Closing Date, all employees of Sellers, on an “at-will” basis and, except as provided in the Employment Agreement, provide said employees with the same rate of pay they received from Sellers immediately prior to their termination as set forth below and materially equivalent benefits, which compensation shall be subject to periodic review and adjustment in Purchaser’s sole discretion. Sellers will terminate the employment of Sellers’ employees, effective as of 11:59 p.m. prevailing Central Time on the date immediately preceding the Closing Date. Purchaser shall not assume any of Sellers’ employment obligations, wage or salary payment obligations, including, without limitation, those arising under any pension, profit sharing, deferred compensation, severance, welfare, sick leave, accrued or earned vacation, wage or other employee benefit plan, procedure, policy or practice of Sellers (“Sellers’ Employment Obligations”) regardless of whether such plan, procedure, policy or practice is disclosed pursuant to this Agreement. Sellers shall pay or otherwise satisfy, at or prior to the Closing Date, all accrued and unpaid (or unsatisfied) Sellers’ Employment Obligations as of such time, regardless of whether the Sellers’ Employment Obligations are disclosed by Sellers or otherwise mentioned in this Agreement. Sellers will further comply with all state, federal or local employee notification laws or rules, including, without limitation, the federal Worker Adjustment and Retraining Notification Act, as the same may be applicable.

5.2 Name Change. Simultaneously with the Closing, the Selling Parties shall cease using the names “Rapid Hot Flow” and “Rapid Pressure Services” or any similar name and, within fifteen (15) business days after the Closing, shall file with the Colorado Secretary of State and Delaware Secretary of State respectively, and in any other applicable state, documentation to amend Sellers’ name to a name that is not similar to or confusing with “Rapid Hot Flow” and “Rapid Pressure Services” or any other name or mark used by Purchaser.

5.3 Confidentiality of Transaction. Any documentation, surveys, appraisals, reports or any other information regarding this Agreement that are disclosed by a party hereto, either orally, in writing or otherwise, the results of all inspections, analyses, studies and similar reports relating to the Purchased Assets and the details of the Transaction shall be considered to be confidential information and will not be disclosed to third parties except as may be necessary for the Parties to analyze and document the transaction and to consummate the Closing, operate, finance or sell the Business or as required by applicable law; provided, however, the following materials or information shall not be considered confidential information for purposes of this Section 5.3: (i) materials or information that were publicly known and made generally available in the public domain prior to the time of disclosure; (ii) materials or information that become publicly known and made generally available after disclosure through no action or inaction of the Parties; or (iii) is in the possession of the receiving party, without confidentiality restrictions, at the time of disclosure. Except as required by law, no party hereto shall make any press release or public statement concerning the matters addressed in or contemplated by this Agreement without the prior written approval of the other party, which will not be unreasonably withheld or delayed. All such confidential information of Sellers shall become part of the Purchased Assets on the Closing Date. The obligations contained in this Section 5.3 shall survive the expiration or termination of this Agreement in the event that the Closing does not occur for any reason.

5.4 Registration of Transaction Shares. Enservco shall file a Registration Statement of Form S-1 with the U.S. Securities and Exchange Commission covering the resale of the Transaction Shares within sixty (60) days from Closing and shall use its best efforts to have such registration statement be declared effective within ninety (90) days of closing.

6.1 Selling Parties Indemnification Obligations. The Selling Parties shall, on a joint and several basis, indemnify, defend (at Purchaser’s option) and hold harmless Purchaser and its directors, officers, employees, agents, attorneys, consultants, representatives, Affiliates, successors, transferees and assigns (collectively, the “Purchaser Indemnitees”) promptly upon demand, from, against and in respect of any and all demands, claims, losses, damages, judgments, liabilities, assessments, suits, actions, proceedings, interest, penalties and expenses (collectively, “Losses”) for both third-party claims and direct claims between the Parties, incurred or suffered, directly or indirectly, in connection with, arising out of or as a result of any of the following: (i) any breach (whether material or not), inaccuracy, untruth or incompleteness of a covenant, obligation, agreement, representation or warranty made by any Selling Party in any Transaction Document or any other agreement or document contemplated by this Agreement; (ii) any Excluded Liability, including but not limited to liabilities and obligations arising from ownership of the Purchased Assets or the operation of the Business on or prior to the Closing Date; (iii) any liability for, or claim from, Seller’s past or current (as of the Closing Date) employees relating to periods prior to the Closing Date; (iv) any and all liabilities and obligations of the Selling Parties, other than the Assumed Liabilities, arising from the ownership of the Purchased Assets, the operation of the Business, and any incidents and occurrences related thereto, on or prior to the Closing Date; and (v) the failure to qualify to do business in any state (the “Special Indemnity”).

6.2 Purchaser Indemnification Obligations. Purchaser shall indemnify, defend and hold harmless the Selling Parties and their directors, officers, employees, agents, attorneys, consultants, representatives, Affiliates, successors, transferees and assigns (collectively, the “Selling Party Indemnitees”) from, against and in respect of any and all Losses, for both third-party claims and direct claims between the Parties, incurred or suffered, directly or indirectly, in connection with, arising out of or as a result of any of the following: (i) any inaccuracy, misrepresentation or untruth in or any breach of or default in a covenant, obligation, agreement, representation or warranty made by Purchaser in this Agreement or any other Transaction Document; (ii) any of the Assumed Liabilities, including but not limited to liabilities and obligations arising from ownership of the Purchased Assets or the operation of the Business after the Closing Date; and (iii) the ownership or operation of the Business or the Purchased Assets related to the period of time after the Closing Date.

6.3 Procedure for Indemnification.

(a) Each party will give the other party prompt written notice of any third-party claim to which these indemnification provisions apply; provided, however, that the failure to provide such notice will not release the Selling Parties from any of their obligations under this Article 6, except to the extent that such failure has actually prejudiced the Selling Parties’ rights in such third-party claim.

(b) If a party is the subject of a third-party claim for which it will seek indemnification from the other party under this Article 6, it may either defend such claim or tender the defense to the indemnifying parties. If a party tenders the defense of any third-party claim to the other party, then (i) the indemnified party shall have the right to consent to the selection of legal counsel in its sole discretion and (ii) the indemnifying party will not enter into any settlement, defense discharge, admission of liability or compromise of any claim or litigation without obtaining approval, which the indemnified party can provide or withhold in its sole discretion. If the indemnified party elects to defend such third-party claim, then (1) the indemnified party shall have the full right to independently control the defense and settlement of such matter, which actions shall not negatively impact the indemnified party’s right to indemnification and to be held harmless under this Article 6 by the indemnifying party, and (2) the indemnifying party shall, at the request of the indemnified party, if any, cooperate and assist the indemnified party in the defense of such third-party claim.

(c) Upon request of the indemnified party in a matter where the indemnifying party is defending such claim, the indemnifying party will allow the indemnified party, at the indemnified party’s own cost and expense (including, without limitation, legal fees), to participate in such defense; provided, however, the indemnified party reserves the right to seek reimbursement and payment of defense costs and attorneys’ fees if the indemnified party’s defense or position in such claim is different from or in conflict with the indemnifying party’s defense or position, as determined by the indemnified party, in its sole discretion.

(d) Purchaser or the Selling Parties pursuant to this Article 6 shall be effected by wire transfer of immediately available funds from Purchaser or the Selling Parties, as the case may be, to an account designated by Purchaser or the Selling Parties, as the case may be, within five (5) business days after the determination thereof by mutual agreement of the parties or by the entry of a final unappealable order of a court or another dispute resolution authority having proper jurisdiction, provided that Purchaser may, in its sole discretion, and notwithstanding anything herein to the contrary, offset any Losses subject to indemnification by the Selling Parties hereunder against the Escrow Amount.

6.4 Tax Treatment of Indemnification Payments. All indemnification payments made under this Agreement shall be treated by the Parties as an adjustment to the Purchase Price for Tax purposes, unless otherwise required by law.

6.5 Non-Exclusive Remedy; Limits on Indemnification. The indemnification obligations of the parties in this Article 6 shall apply both to direct claims of a party against the other party and claims of a party related to claims by third parties. In the event the Selling Parties are required to satisfy any indemnification obligations under this Article 6, Owner may provide notice to Purchaser of Owner’s election to satisfy such indemnification obligations by the redemption by Purchaser of such Transaction Shares, as a dollar for dollar credit against such indemnification obligations, at the then-current fair market value of the Transaction Shares as reasonably determined by the Board of Directors of Purchaser. The above indemnification provisions are in addition to, and not in derogation of, any statutory, equitable or common law remedy any party may have with respect to any other party, or the transactions contemplated by this Agreement. The aggregate amount of all Losses for which the Selling Parties, on the one hand, and Purchaser, on the other, shall be liable pursuant to this Article 6 shall not exceed the Purchase Price. The Selling Parties, on the one hand, and Purchaser, on the other, shall not be liable for indemnification under this Article 6 until the aggregate amount of all Losses to be indemnified by such Party hereunder exceeds Thirty Five Thousand Dollars ($35,000) (the “Basket Amount”), in which event the applicable indemnifying party shall pay or be liable for only those Losses in excess of such amount. Notwithstanding anything to the contrary set forth herein, the limitations set forth in this Section 6.5 shall not limit the rights of the Purchaser Indemnitees to indemnification with respect to (i) claims arising from or based on fraud, criminal misconduct or intentional or willful misrepresentation or intentional or willful breach of any Transaction Document, (ii) claims arising from Selling Parties’ breach of any covenants, (iii) claims for breach of Fundamental Representations (as defined in Section 7.3), and (iv) the Special Indemnity. Notwithstanding anything to the contrary contained in this Agreement, nothing in this Article 6 shall operate to bar or limit (and for the avoidance of doubt, no cap, basket or deductible shall limit) any claim or the Losses arising from or based on fraud, criminal misconduct, or intentional misconduct.

6.6 Effect of Investigation. The Purchaser Indemnitees’ right to indemnification for any representations, warranties, or covenants within this Agreement shall not be affected by any inspection, investigation or knowledge acquired by any Purchaser Indemnitee (or that could have been acquired by any Purchaser Indemnitee).

7.1 Further Acts and Assurances; Transition Matters. Each Selling Party and Purchaser shall take any and all steps reasonably necessary to effectuate the intended purposes of this Agreement, including, without limitation, with respect to the transfer of title to any motor vehicles included in the Purchased Assets.

7.2 Guaranty of Obligations. Owner guarantees all obligations of Sellers under the terms of this Agreement, including, without limitation, Sellers’ obligations under Article 6, without requiring Purchaser to first seek recourse from Sellers.

7.3 Survival. Subject to the limitations and other provisions of this Agreement, the representations and warranties contained herein shall survive the Closing and shall remain in full force and effect until the date that is (i) six (6) years from the Closing Date for the representations in Sections 3.1, 3.2, 3.9, 3.13(a), 3.14, and 3.16 (the “Fundamental Representations”), and (ii) (2) years from the Closing Date for all other representations and warranties herein (the “Non-Fundamental Representations”). All covenants and agreements of the Parties contained herein shall survive the Closing indefinitely or for the period explicitly specified herein. Notwithstanding the foregoing, any claims asserted in good faith with reasonable specificity (to the extent known at such time) and in writing by notice from the non-breaching party to the breaching party prior to the expiration date of the applicable survival period shall not thereafter be barred by the expiration of the relevant representation or warranty and such claims shall survive until finally resolved.

7.4 Notices. All notices given under this Agreement must be in writing. A notice is effective upon receipt and shall be sent via one of the following methods: delivery in person, overnight courier service, certified or registered mail, postage prepaid, return receipt requested, sent to the following addresses (or as designated by either party upon notice to the other party in accordance with this Section 7):

If to Purchaser, to:

Enservco Corporation

Attention: Richard Murphy

Email: rmurphy@enservco.com

with a copy to (which shall not constitute notice hereunder):

Maslon LLP

3300 Wells Fargo Center

90 South 7th Street

Minneapolis, MN 55402

Attention: Doug Holod

Email: doug.holod@maslon.com

If to any Selling Party:

Looper Goodwine, P.C.

1300 Post Oak Blvd., Suite 1250

Houston, Texas 77056

Attention: Donald R. Looper

Email: dlooper@loopergoodwine.com

7.5 Construction; Choice of Law. This Agreement has been negotiated by the parties and their respective legal counsel, and the language hereof shall not be construed for or against any Party. When a reference is made in this Agreement to Exhibits, such reference shall be to an Exhibit to this Agreement unless otherwise indicated. When a reference is made in this Agreement to Sections, such reference shall be to a Section of this Agreement unless otherwise indicated. The words “include,” “includes” and “including” when used herein shall be deemed in each case to be followed by the words “without limitation,” unless clearly indicated otherwise in such context. The headings contained in this Agreement are only for reference purposes and shall not affect in any way the meaning or interpretation of this Agreement. Reference to the subsidiaries of an entity shall be deemed to include all direct and indirect subsidiaries of such entity. Reference herein to a law, statute, regulation, document or agreement is deemed in each case to include all amendments thereto. This Agreement shall be construed in accordance with and governed by the laws of the State of Colorado without regard to conflicts of law principles.

7.6 Mediation; Arbitration.

(a) Prior to invoking the provisions of Section 7.6(b), any dispute arising out of or relating to this Agreement shall be resolved in the following manner: (i) any party may at any time deliver to the others a written dispute notice setting forth a brief description of the relevant issue(s) (the “Disputed Issue(s)”); (ii) during the thirty (30) day period following the delivery of the notice (the “Negotiation Period”) appropriate representatives of the various parties will meet and seek to resolve the Disputed Issue(s) through negotiation, (iii) if such representatives are unable to resolve the Disputed Issue(s) through negotiation, then within ten (10) days after the Negotiation Period (the “Referral Period”), the parties will refer the Disputed Issue(s) to mediation. Should the parties fail to agree on a mediator within fifteen (15) days following the Referral Period, the District Court of Denver County, Colorado shall select the mediator to be used. The parties shall attend a mediation and attempt in good faith to mediate such dispute within thirty (30) days following the selection of a mediator. Notwithstanding the foregoing, the request by either party for preliminary or permanent injunctive relief shall not be subject to mediation and may be adjudicated by any jurisdiction where jurisdiction and venue are proper.

(b) In the event not resolved pursuant to the provisions of Section 7.6(a), each of the Parties agrees that any claim, dispute or conflict arising from or connected with this Agreement shall be solely resolved by binding arbitration pursuant to the Commercial Arbitration Rules of the American Arbitration Association; provided, however, that Purchaser may seek injunctive relief to protect or enforce its rights under this Agreement or any Transaction Document without first resorting to such arbitration. Any such arbitration shall be held in Denver, Colorado. Any arbitration award will be final and non-appealable, and judgment thereon may be entered in any court of competent jurisdiction. The arbitrator shall have the authority to grant any equitable and legal remedies, except punitive damages, that would be available in any judicial proceeding. EACH PARTY HERETO HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT IT MAY LEGALLY AND EFFECTIVELY DO SO, TRIAL BY JURY IN ANY SUIT, ACTION OR PROCEEDING ARISING HEREUNDER.

7.7 Succession and Assignment. This Agreement shall be binding upon and shall inure to the benefit of the Parties and their successors and assigns. Neither Party may assign its rights or delegate its duties under this Agreement without the other Party’s prior written consent.

7.8 No Third-Party Beneficiaries. Except for those third parties entitled to indemnification pursuant to Article 6, this Agreement does not confer any rights or remedies upon any Person (including, without limitation, employees of Sellers) other than the Parties and their respective successors and permitted assigns.

7.9 Severability. Any provision hereof that is prohibited or unenforceable in any jurisdiction will, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction will not invalidate or render unenforceable such provision in any other jurisdiction.

7.10 Entire Agreement. This Agreement, together with the Schedules and Exhibits attached hereto, as well as the Transaction Documents, constitutes the complete agreement between the Parties, and supersedes any prior or contemporaneous oral or written agreements between the Parties respecting the sale and purchase described in this Agreement except for any confidentiality agreement entered into between the any of the Parties prior to the date of this Agreement, which shall survive until the Closing.

7.11 Amendment; Waiver; Counterparts. This Agreement may be amended or modified only by a written agreement signed by each of the Parties. No party shall be deemed to have waived any provision of this Agreement or the exercise of any rights held under this Agreement unless such waiver is made expressly and in writing. This Agreement may be executed electronically (by DocuSign, an exchange of signed PDFs, or otherwise) and in one or more counterparts, each of which shall for all purposes be deemed to be an original and all of which shall constitute the same instrument.

[The remainder of this page is intentionally left blank.]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered, all on and as of the date first written above.

THE SELLING PARTIES:

Rapid Hot Flow, LLC

By: /s/ Steve Weyel

Name: Steve Weyel

Title: Managing Member

Rapid Pressure Services, LLC

By: /s/ Steve Weyel

Name: Steve Weyel

Title: Managing Member

OilServ, LLC ("Owner")

By: /s/ Steve Weyel

Name: Steve Weyel

Title: Managing Member

PURCHASERS:

HEAT WAVES HOT OIL SERVICE LLC

By: /s/ Richard Murphy

Name: Richard Murphy

Title: Chief Executive Officer

ENSERVCO CORPORATION

By: /s/ Richard Murphy

Name: Richard Murphy

Title: Chief Executive Officer

Exhibit 10.2

NOTE PURCHASE AGREEMENT

This NOTE PURCHASE AGREEMENT (this “Agreement” or “Note Purchase Agreement”) is made effective as of September 11, 2023 (the “Effective Date”), by and among ENSERVCO CORPORATION, a Delaware corporation (the “Company”), Cross River Partners, LP, a Delaware limited liability company (“Cross River”), Equigen II, LLC, a Texas limited liability company, and Angel Capital Partners, LP, a Texas limited partnership (collectively, the “OilServ Investors”) and investors indicated on Schedule A attached hereto (individually, the “Investor” and collectively, the “Investors”).

WHEREAS, the Company desires to raise capital to fund its ongoing operations and obligations by offering and issuing promissory notes convertible into a certain proposed series of equity securities to an aggregate amount of a minimum principal amount of $1,062,500 (the “Minimum Amount”) and a maximum principal amount of $3,000,000 (the “Maximum Amount”), subject to the conditions specified herein (the “Offering”);and

WHEREAS, the Company issued on September 1, 2023 promissory notes aggregating $800,000 which, on their terms, are convertible into the securities offered in the Offering;

For and in consideration of the foregoing and the mutual promises and covenants herein contained, the Company and the Investor agree as follows:

1. Purchase of Note. Subject to the terms and conditions of this Agreement, the Investor agrees to purchase, and the Company agrees to sell and issue to the Investor, an unsecured convertible promissory note, in substantially the form attached hereto as Exhibit A (the “Note”), in exchange for the amount indicated on Schedule A (the “Purchase Price”). All capitalized terms used but not otherwise defined herein shall have the meaning set forth in the Note. The terms of the Note are incorporated herein by reference.

2. Closing; Closing Mechanics.

2.1. Closing. The closing of the sale and issuance of the Note (the “Closing”) to the Investor shall take place on the Effective Date, or at such other time as the Company and the Investor may mutually agree (such date is hereinafter referred to as the “Closing Date”).

2.2. Subsequent Sales of Notes. Up to forty five (45) days after the Closing, Cross River agrees to purchase an additional $250,000 principal amount of Notes provided that the OilServ Investors contemporaneously invest an additional $312,500 principal amount of Notes (such event to be the “Second Closing”). Additionally, the Company may issue Notes, as defined at the end of this Section 2.2, representing up to the balance of the Maximum Amount not sold at the Closing and the Second Closing to additional investors (the “Additional Investors”). All such sales made at any additional closings (each an “Additional Closing”) shall be made on the terms and conditions set forth in this Agreement and (a) the representations and warranties of the Company set forth in Section 3 hereof shall speak as of the Closing, and the Company shall have no obligation to update any disclosure related thereto, and (b) the representations and warranties of the Additional Investors in Section 4 hereof shall speak as of such Additional Closing. This Agreement may be amended by the Company without the consent of the Investors to include any Additional Investors upon the execution by such Additional Investors of a counterpart signature page hereto. Any Notes sold pursuant to this Section 2.2 shall be deemed to be “Notes,” for all purposes under this Agreement and any Additional Investors thereof shall be deemed to be “Investors” for all purposes under this Agreement.

2.3. Closing Deliverables. At the Closing and each Additional Closing, (a) each Investor shall deliver to the Company the Purchase Price set forth in this Agreement (the “Consideration Amount”) via wire transfer of immediately available funds to an account designated by the Company, (b) the Company shall issue and deliver to each Investor an executed Note in favor of such Investor in the principal amount equal to the Consideration Amount, (c) each Investor shall deliver a countersigned Note, accepting and acknowledging the delivery of the Note, and (d) the Company shall record each Investor as the owner of the applicable Note in the Company’s books and records.

3. Representations and Warranties of Company. The Company represents and warrants to the Investor that the following representations and warranties are true and complete as of the Effective Date.

3.1. Organization and Qualification. The Company and each of the subsidiaries of the Company as set forth in the Exhibit 21.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and any direct or indirect subsidiary of the Company formed or acquired after the date hereof (the “Subsidiary” or “Subsidiaries”) is an entity duly incorporated or otherwise organized, validly existing, and, if applicable under the laws of the jurisdiction in which they are formed, in good standing under the laws of the jurisdiction of its incorporation or organization, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. Neither the Company nor any Subsidiary is in violation or default of any of the provisions of its respective memorandum of association, articles of association, certificate or articles of incorporation, bylaws, operating agreement, or other organizational or charter documents that would constitute a Material Adverse Effect (defined below). Each of the Company and the Subsidiaries is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, could not have or reasonably be expected to result in: (i) a material adverse effect on the legality, validity or enforceability of this Agreement and any other documents or agreements executed in connection with the transactions contemplated hereunder, including but not limited to the form of convertible promissory note (the “Transaction Documents”), (ii) material adverse effect on the results of operations, assets, business, prospects or condition (financial or otherwise) of the Company and the Subsidiaries, taken as a whole, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under any Transaction Document (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

3.2. Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and each of the other Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement and each of the other Transaction Documents by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further action is required by the Company.. This Agreement and each other Transaction Document to which it is a party has been (or upon delivery will have been) duly executed by the Company and, when delivered in accordance with the terms hereof and thereof, will constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies, and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.