UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 14, 2023

Commission File Number 001-34984

FIRST MAJESTIC SILVER CORP.

(Translation of registrant's name into English)

925 West Georgia Street, Suite 1800, Vancouver BC V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [x] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| FIRST MAJESTIC SILVER CORP. | |

| | |

| By: | |

| | |

| /s/ Samir Patel | |

| Samir Patel | |

| General Counsel & Corporate Secretary | |

| | |

| September 14, 2023 | |

NEWS RELEASE

| | | | | |

| TSX - FR | September 14, 2023 |

| NYSE - AG | |

| Frankfurt – FMV | |

First Majestic Announces the Opening of a Minting Facility

Vancouver, BC, Canada - First Majestic Silver Corp. (“First Majestic” or the “Company”) is pleased to announce the launch of its 100%-owned and operated minting facility, First Mint, LLC (“First Mint”). Located in the State of Nevada, United States, First Mint will expand upon First Majestic’s existing bullion sales through vertically integrating the production of investment-grade fine silver bullion. This will allow First Majestic to sell a substantially greater portion of its silver production directly to its shareholders and bullion customers.

“The decision to open our own mint was made to ensure our bullion store has adequate supplies in order to fulfill customers demand,” stated Keith Neumeyer, President & CEO. “Last year, we sold over 440,000 ounces of silver bullion, generating over $11 million in revenue. However, sales could have been substantially higher had we not been constrained by limited supply from our minting partners due to the incredible demand the silver industry is currently experiencing. By minting our own silver, we are able to reduce unit production costs and expedite delivery time to our customers. In time, our goal is to sell 100% of the silver we produce directly to the physical market.”

First Mint, LLC will operate some of the most innovative processing equipment in the precious metals industry, including an environmentally friendly flameless tunnel, which uses significantly less electricity and releases fewer emissions when compared to traditional minting processes. The high efficiency equipment will allow us to turn several million ounces of our own silver into an array of finished bullion products, as well as offer manufacturing capacity for third-party demand.

The Company expects the new mint to begin production of silver bullion products in the fourth quarter of 2023. Shortly thereafter, the mint will seek ISO 9001:2015 certification, allowing for its silver to be IRA eligible. Along with this certification comes a quality commitment: the mint will fully guarantee the weight, purity, and content of its bullion products.

Shareholders with at least 100 shares are reminded that they qualify for a silver discount of $0.50 per ounce from our posted price through the Shareholder Benefits program.

Retailers and other dealers interested in distributing First Mint products may contact us at customersupport@firstmajestic.com.

MANAGEMENT CHANGES

In alignment with First Majestic’s growth strategy, we are pleased to announce Vice President changes. Mani Alkhafaji has accepted the role of Vice President of Corporate Development & Investor Relations, under the leadership of Keith Neumeyer. Mani joined the Company in 2015 and most recently was Vice President of Business Planning & Procurement. Todd Anthony has decided to pursue other opportunities. We wish Todd all the best in his future endeavours and thank him for being an integral part of the team and our growth over the past years.

ABOUT THE COMPANY

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver Mine, as well as a portfolio of development and exploration assets, including the Jerritt Canyon Gold Mine located in northeastern Nevada.

First Majestic is proud to offer a portion of its silver production for sale to the public. Bars, ingots, coins and medallions are available for purchase online the Company's Bullion Store at some of the lowest premiums available.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking Statements

This news release contains “forward-looking information” and “forward-looking statements” under applicable Canadian and United States securities laws (collectively, “forward-looking statements”). These statements relate to future events or the Company’s future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management's experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements in this news release include, but are not limited to, statements with respect to: (i) First Mint expanding upon the Company’s existing bullion sales and allowing the Company to sell a substantially greater portion of its silver production directly to its shareholders and bullion customers; (ii) the Company’s goal to sell 100% of the silver it produces directly to the physical market; (iii) First Mint operating some of the most innovative processing equipment in the precious metals industry; (iv) First Mint commencing production of silver bullion products in Q4 2023; (v) First Mint’s plans to seek ISO 9001:2015 certification shortly after commencing operations; and (vi) any quality commitments offered by First Mint.

Actual results may vary from forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: the duration and effects of the coronavirus and COVID-19, and any other pandemics or epidemics on our operations and workforce, and the effects on global economies and society; general economic conditions including inflation risks; actual results of exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; commodity prices; variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour relations; relations with local communities; changes in national or local governments; changes in applicable legislation or application thereof; delays in obtaining approvals or financing or in the completion of development or construction activities; exchange rate fluctuations; requirements for additional capital; government regulation; environmental risks; reclamation expenses; outcomes of pending litigation; limitations on insurance coverage as well as those factors discussed in the section entitled “Description of the Business - Risk Factors” in the Company’s most recent Annual Information Form for the year ended December 31, 2022 filed with the Canadian securities regulatory authorities under the Company’s SEDAR+ profile at www.sedarplus.ca, and in the Company’s Annual Report on Form 40-F for the year ended December 31, 2022 filed with the United States Securities and Exchange Commission on EDGAR at www.sec.gov/edgar. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward- looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

The Company believes that the expectations reflected in these forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward- looking statements, except as required by applicable laws.

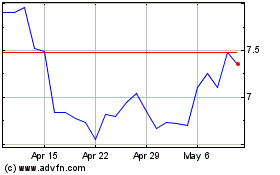

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Mar 2024 to Apr 2024

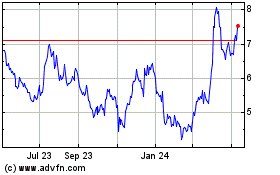

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Apr 2023 to Apr 2024