| PROSPECTUS |

Registration No. 333-274293 |

| |

Filed pursuant to Rule 424(b)(4) |

Greenwave

Technology Solutions, Inc.

124,238,707

Shares

COMMON

STOCK

This

prospectus relates to the resale, from time to time, by the selling stockholders named herein (the “Selling Stockholders”)

of up to: (i) an aggregate of 114,795,915 shares of our common stock, par value $0.001 per share (“common stock”),

issuable upon the conversion of a new series of senior secured convertible notes in the aggregate original principal amount of $18,000,000

(the “Senior Notes”); (ii) an aggregate of 4,420,460 shares of our common stock issuable upon exercise of certain outstanding

warrants issued in connection with the Senior Notes (the “SN Warrants”); and (iii) an aggregate of 5,022,332 shares of our

common stock issuable upon exercise of certain outstanding warrants issued in a private placement conducted on August 21, 2023 concurrently

with a registered direct offering (the “RD Warrants” and together with the SN Warrants, the “Warrants”).

We

are not selling any securities under this prospectus and we will not receive proceeds from the sale of the shares of our common stock

by the Selling Stockholders. However, we may receive proceeds from the cash exercise of the Warrants, which, if exercised in cash at

the current applicable exercise price, with respect to all of the 9,442,792 shares of common stock, would result in gross proceeds to

us of approximately $5,166,983.

We

will pay the expenses of registering the shares of common stock offered by this prospectus, but all selling and other expenses incurred

by the Selling Stockholders will be paid by the Selling Stockholders. The Selling Stockholders may sell our shares of common stock offered

by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through

any other means described in this prospectus under “Plan of Distribution.” The prices at which the Selling Stockholders

may sell shares will be determined by the prevailing market price for our common stock or in negotiated transactions.

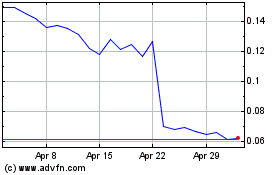

Our

common stock is listed on the Nasdaq Capital Market under the trading symbol “GWAV.” On August 30, 2023, the last

reported sale price of our common stock was $0.93 per share.

Our

principal executive office is located at 4016 Raintree Rd., Ste 300, Chesapeake, VA 23321, and our telephone number is (800) 490-5020.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus for a

discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus is dated September 12, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission (the “SEC”).

You should read this prospectus and the information and documents incorporated herein by reference carefully. Such documents contain

important information you should consider when making your investment decision. See “Where You Can Find More Information”

and “Information Incorporated by Reference” in this prospectus.

You

should rely only on the information contained in or incorporated by reference into this prospectus. Neither we nor the selling stockholders

named herein (the “Selling Stockholders”) have authorized anyone to provide you with information different from, or in addition

to, that contained in or incorporated by reference into this prospectus. This prospectus is an offer to sell only the securities offered

hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated by

reference into this prospectus is current only as of their respective dates or on the date or dates that are specified in those documents.

Our business, financial condition, results of operations and prospects may have changed since those dates.

The

Selling Stockholders are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale

is not permitted. Neither we nor the Selling Stockholders have done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe

any restrictions relating to this Offering and the distribution of this prospectus applicable to that jurisdiction.

If

required, each time the Selling Stockholders offer shares of our common stock, par value $0.001 per share (“common stock”),

we will provide you with, in addition to this prospectus, a prospectus supplement that will contain specific information about the terms

of that offering. We may also authorize the Selling Stockholders to use one or more free writing prospectuses to be provided to you that

may contain material information relating to that offering. We may also use a prospectus supplement and any related free writing prospectus

to add, update or change any of the information contained in this prospectus or in documents we have incorporated by reference. This

prospectus, together with any applicable prospectus supplements, any related free writing prospectuses and the documents incorporated

by reference into this prospectus, includes all material information relating to this offering. To the extent that any statement that

we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will

be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this prospectus and any prospectus

supplement together with the additional information described below under the section entitled “Information Incorporated by

Reference” before buying any of the securities offered.

As

used in this prospectus, unless context otherwise requires, the words “we,” “us,” “our,” “the

Company,” “Greenwave,” “Registrant” refer to Greenwave Technology Solutions, Inc. and its subsidiaries.

Additionally, any reference to (i) “Empire” refers to the Company’s wholly owned subsidiary, “Empire Services,

Inc.” and the assets used in its operation. Also, any reference to “common share” or “common stock,” refers

to our $0.001 par value common stock.

Unless

otherwise stated, the information which appears on our web site www.GWAV.com is not part of this report and is specifically not

incorporated by reference. Unless otherwise indicated, information contained in this prospectus or incorporated by reference herein concerning

our industry and the markets in which we operate is based on information from independent industry and research organizations, other

third-party sources (including industry publications, surveys and forecasts), and management estimates. Management estimates are derived

from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal

research, and are based on assumptions made by us upon reviewing such data and our knowledge of such industry and markets, which we believe

to be reasonable. Although we believe the data from these third-party sources is reliable, we have not independently verified any third-party

information. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our

future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Risk

Factors” and “Special Note Regarding Forward-Looking Statements.” These and other factors could cause results

to differ materially from those expressed in the estimates made by the independent parties and by us.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements in this prospectus, including the documents incorporated by reference in this prospectus, may constitute “forward-looking

statements” for purposes of the federal securities laws. Our forward-looking statements include, but are not limited to, statements

regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition,

any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,”

“could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “will,”

“would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that

a statement is not forward-looking. Forward-looking statements in this prospectus may include, for example, statements about:

| |

● |

our

ability to continue as a going concern; |

| |

|

|

| |

● |

our

reliance on third party vendors; |

| |

|

|

| |

● |

our

dependence on our executive officers; |

| |

|

|

| |

● |

our

financial performance guidance; |

| |

|

|

| |

● |

material

weaknesses in our internal control over financial reporting; |

| |

|

|

| |

● |

regulatory

developments in the United States and foreign countries; |

| |

|

|

| |

● |

the

impact of laws, regulations, accounting standards, regulatory requirements, judicial decisions and guidance issued by authoritative

bodies; |

| |

|

|

| |

● |

our

estimates regarding expenses, future revenue and cash flow, capital requirements and needs for additional financing; |

| |

|

|

| |

● |

our

financial performance; |

| |

|

|

| |

● |

the

ability to recognize the anticipated benefits of our business combination and/or divestitures; and |

| |

|

|

| |

● |

the

effect of COVID-19 on the foregoing. |

The

forward-looking statements contained or incorporated by reference in this prospectus are based on current expectations and beliefs concerning

future developments and their potential effects on us. There can be no assurance that future developments affecting us will be those

that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control)

or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section titled

“Risk Factors” and elsewhere in this prospectus, our most recent Annual Report on Form 10-K, as well as any subsequent

filings with the SEC. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect,

actual results may vary in material respects from those projected in these forward-looking statements. Some of these risks and uncertainties

may in the future be amplified by the ongoing COVID-19 pandemic and there may be additional risks that we consider immaterial or which

are unknown. It is not possible to predict or identify all such risks. We do not undertake any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities

laws.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere or incorporated by reference in this prospectus. This summary is not complete and

does not contain all of the information that you should consider before investing in our common stock. We urge you to read this entire

prospectus and the documents incorporated by reference herein carefully, including the financial statements and notes to those financial

statements incorporated by reference herein and therein. Please read the section of this prospectus entitled “Risk Factors”

for more information about important risks that you should consider before investing in our common stock.

Our

Business

We

were formed on April 26, 2013 as a technology platform developer under the name MassRoots, Inc. In October 2021, we changed our corporate

name from “MassRoots, Inc.” to “Greenwave Technology Solutions, Inc.” On September 30, 2021, we closed our acquisition

of Empire Services, Inc. (“Empire”), which operates 13 metal recycling facilities and 1 metal processing facility in Virginia,

North Carolina, and Ohio. The acquisition was deemed effective October 1, 2021 on the effective date of the Certificate of Merger in

Virginia.

In

December 2022, we began offering hauling services to corporate clients. We haul sand, dirt, asphalt, metal, and other materials in a

fleet of approximately 50 trucks which we own, manage, and maintain.

Upon

the acquisition of Empire, we transitioned into the scrap metal industry which involves collecting, classifying and processing appliances,

construction material, end-of-life vehicles, boats, and industrial machinery. We process these items by crushing, shearing, shredding,

separating, and sorting, into smaller pieces and categorize these recycled ferrous, nonferrous, and mixed metal pieces based on density

and metal prior to sale. In cases of scrap cars, we remove the catalytic converters, aluminum wheels, and batteries for separate processing

and sale prior to shredding the vehicle. We have designed our systems to maximize the value of metals produced from this process.

We

operate an automotive shredder at our Kelford, North Carolina location and a second automotive shredder at our Carrollton, Virginia is

expected to come online in the third quarter of 2023. Our shredders are designed to produce a denser product and, in concert with advanced

separation equipment, more refined recycled ferrous metals, which are more valuable as they require less processing to produce recycled

steel products. In totality, this process reduces large metal objects like auto bodies into baseball-sized pieces of shredded recycled

metal.

The

shredded pieces are then placed on a conveyor belt under magnetized drums to separate the ferrous metal from the mixed nonferrous metal

and residue, producing consistent and high-quality ferrous scrap metal. The nonferrous metals and other materials then go through a number

of additional mechanical systems which separate the nonferrous metal from any residue. The remaining nonferrous metal is further processed

to sort the metal by type, grade, and quality prior to being sold as products, such as zorba (mainly aluminum), zurik (mainly stainless

steel), and shredded insulated wire (mainly copper and aluminum).

In

July 2023, Greenwave commenced operation of a downstream processing system at its Kelford, NC location, enabling the Company to recover

millimeter-minus pieces of metal from the Company’s automotive shred residue or, “fluff,” as it is known in the industry.

Greenwave is on track to generate additional high-margin revenues of several hundred thousand dollars of revenue per month from the sale

of metals recovered by the downstream system. As Greenwave continues to optimize the operation of its downstream processing system, and

brings a copper extraction component online, the Company could be able to increase its recovery yields.

One

of our main corporate priorities is to open a facility with rail or deep-water port access to enable us to efficiently transport our

products to domestic steel mills and overseas foundries. Because this would greatly expand the number of potential buyers of our processed

scrap products, we believe opening a facility with port or rail access could result in an increase in both the revenue and profitability

of our existing operations.

Empire

is headquartered in Chesapeake, Virginia and has 146 full-time employees as of August 31, 2023.

Products

and Services

Our

main product is selling ferrous metal, which is used in the recycling and production of finished steel. It is categorized into heavy

melting steel, plate and structural, and shredded scrap, with various grades of each of those categorized based on the content, size

and consistency of the metal. All of these attributes affect the metal’s value.

We

also process nonferrous metals such as aluminum, copper, stainless steel, nickel, brass, titanium, lead, alloys and mixed metal products.

Additionally, we sell the catalytic converters recovered from end-of-life vehicles to processors which extract the nonferrous precious

metals such as platinum, palladium and rhodium.

We

provide metal recycling services to a wide range of suppliers, including large corporations, industrial manufacturers, retail customers,

and government organizations.

We

also provide hauling services to corporate clients, hauling sand, asphalt, metal and other materials to job sites.

Pricing

and Customers

Prices

for our ferrous and nonferrous products are based on prevailing market rates and are subject to market cycles, worldwide steel demand,

government regulations and policy, and supply of products that can be processed into recycled steel. Our main buyers adjust the prices

they pay for scrap metal products based on market rates usually on a monthly or bi-weekly basis. We are usually paid for the scrap metal

we deliver to customers within 14 days of delivery.

Based

on any price changes from our customers or our other buyers, we in turn adjust the price for unprocessed scrap we pay suppliers in order

to manage the impact on our operating income and cashflows.

The

spread we are able to realize between the sales prices and the cost of purchasing scrap metal is determined by a number of factors, including

transportation and processing costs. Historically, we have experienced sustained periods of stable or rising metal selling prices, which

allow us to manage or increase our operating income. When selling prices decline, we adjust the prices we pay customers to minimize the

impact to our operating income.

Prices

for hauling services are primarily based on the current demand and range from $85 to $120 per hour.

Sources

of Unprocessed Metal

Our

main sources of unprocessed metal we purchase are end-of-life vehicles, old equipment, appliances and other consumer goods, and scrap

metal from construction or manufacturing operations. We acquire this unprocessed metal from a wide base of suppliers including large

corporations, industrial manufacturers, retail customers, and government organizations who unload their metal at our facilities or we

pick it up and transport it from the supplier’s location. Currently, our operations and main suppliers are located in the Hampton

Roads and northeastern North Carolina markets. In the second quarter of 2023, we expanded our operations by opening a metal recycling

facility in Cleveland, Ohio.

Our

supply of scrap metal is influenced by the overall health of economic activity in the United States, changes in prices for recycled metal,

and, to a lesser extent, seasonal factors such as severe weather conditions, which may prohibit or inhibit scrap metal collection.

Technology

In

May 2021, we launched our new website. For the first time, Empire’s customers can see the current prices for each type of scrap

metal. Our website is also integrated with Google’s Business Profiles, listing many of Empire’s locations on Google for the

first time. In late May 2021, the Empire launched a junk car buying platform, where people looking to sell their scrap cars can get a

quote within minutes, and integrated Google Ads, enabling Empire to micro-target their advertising based on location, age, income, and

other factors.

Additionally,

during 2021, the Company moved the operations of each of their yards to WeighPay, a cloud-based Enterprise Resource Planning “ERP”

system, which enables management to track sales, inventory, and operations at each facility in real time, while also establishing stronger

internal controls and systems. Additionally, in 2021, the Company moved Empire’s accounting systems over to a cloud-based QuickBooks

to facilitate collaboration and further growth.

The

technology systems and improvements Empire implemented have resulted in a significant increase in new customers, hundreds of quotes and

dozens of purchases of junk cars, and we believe a material increase in Empire’s revenues as a result of these improvements. These

systems have also streamlined Empire’s accounting and internal operations to enable any future acquisitions to be closed quickly

and efficiently. Lastly, through the data-driven decision processes that have been introduced, Empire’s strategy on future locations

and pricing is being informed by accurate and relevant data.

Now

that strong foundational systems are in place, management has begun to repurpose Greenwave’s technology platform that it developed

from 2013 to 2020 into a marketing and CRM platform for scrap metal yards. This system will enable each facility to:

| |

● |

Send

text and email updates and special deals to their customers; |

| |

|

|

| |

● |

Implement

a points-based rewards system; |

| |

|

|

| |

● |

Enable

consumers to view scrap metal yards in their local area along with prices; |

| |

|

|

| |

● |

Receive

quotes for junk cars in real-time; |

| |

|

|

| |

● |

Leave

and respond to reviews of scrap yards; and |

| |

|

|

| |

● |

View

analytics and conversion data. |

Over

the past ten years, Greenwave has invested approximately $10 million developing these technologies which we believe we can re-purpose

for a fraction of the cost of development, give our metal recycling facilities and those who pay to use our platform a significant competitive

advantage, and grow our revenues and profits as a result.

There

are few companies developing technology solutions for the scrap metal industry and we believe that by focusing our experience and assets

on this highly-profitable but often overlooked industry, we can create significant value for our shareholders.

Competition

We

compete with several large, well-financed recyclers of scrap metal, steel mills which own their own scrap metal processing operations,

and with smaller metal recycling companies. Demand for metal products are sensitive to global economic conditions, the relative value

of the U.S. dollar, and availability of material alternatives, including recycled metal substitutes. Prices for recycled metal are also

influenced by tariffs, quotas, and other import restrictions, and by licensing and government requirements.

We

aim to create a competitive advantage through our ability to process significant volumes of metal products, our use of processing and

separation equipment, the number and location of our facilities, and the operating synergies we have been able to develop based on our

experience.

We

also compete with regional hauling companies.

Employees

and Human Capital Resources

Greenwave

has 146 full-time employees as of August 31, 2023.

We

view our diverse employee population and our culture as key to our success. Our company culture prioritizes learning, supports growth

and empowers us to reach new heights. We recruit employees with the skills and training relevant to succeed and thrive in their functional

responsibilities. We assess the likelihood that a particular candidate will contribute to the Company’s overall goals, and beyond

their specifically assigned tasks. Depending on the position, our recruitment reach can be local as well as national. We provide competitive

compensation and best in class benefits that are tailored specifically to the needs and requests of our employees. During 2021 and 2022,

we worked to manage through the effects of the COVID-19 pandemic and entered 2023 stronger than ever. As appropriate, others were provided

the option of working remotely or at our facilities with appropriate safeguards. We uphold our commitment to shareholders by working

hard and being thoughtful and deliberate in how we use resources.

Corporate

Information

Our

principal executive office is located at 4016 Raintree Rd., Ste 300, Chesapeake, VA 23321, and our telephone number is (800) 490-5020.

Our Internet website address is www.GWAV.com. We were incorporated in the State of Delaware on April 26, 2013.

The

Offering

| Securities

offered by the Selling Stockholders: |

|

124,238,707

shares of common stock, which includes up to:

(i) an aggregate of 114,795,915 shares of our common stock issuable upon the conversion of a new series of senior secured

convertible notes in the aggregate original principal amount of $18,000,000 (the “Senior Notes”); (ii) an aggregate of

4,420,460 shares of our common stock issuable upon exercise of certain outstanding warrants issued in connection with the Senior

Notes (the “SN Warrants”); and (iii) an aggregate of 5,022,332 shares of our common stock issuable upon exercise of certain

outstanding warrants issued in a private placement conducted on August 21, 2023 concurrently with a registered direct offering (the

“RD Warrants” and together with the SN Warrants, the “Warrants”). |

| |

|

|

| Common

stock outstanding prior to the offering: |

|

14,901,408

shares |

| |

|

|

| Common

stock to be outstanding after the offering assuming conversion of all of the Senior Notes and exercise of all Warrants: |

|

139,140,115

shares |

| |

|

|

| Use

of Proceeds: |

|

We

will not receive any proceeds from the sale by the Selling Stockholders of the shares of common stock being offered by this prospectus.

However, we may receive proceeds from the cash exercise of the Warrants, which, if exercised in cash at the current exercise price

with respect to all Warrants, would result in gross proceeds to us of approximately $5,166,983. The proceeds from such Warrant exercises,

if any, will be used for working capital and general corporate purposes. |

| |

|

|

| Risk

Factors: |

|

Investing

in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth

in the “Risk Factors” section on page 5 before deciding to invest in our securities. |

| |

|

|

| Trading

Symbol: |

|

Our

common stock is currently quoted on The Nasdaq Capital Market under the trading symbol “GWAV”. |

| |

(1) |

The

shares of common stock outstanding and the shares of common stock to be outstanding after this offering is based on 14,901,408 shares

outstanding as of August 28, 2023 and excludes: |

| |

● |

92,166

shares of common stock issuable upon the exercise of options of which 92,166 have vested at a weighted average exercise price of

$148.11 per share as of August 28, 2023; and |

| |

|

|

| |

● |

9,756,876

shares of common stock issuable upon the exercise of outstanding warrants (excluding the Warrants) of which 9,756,876 are

exercisable at a weighted average exercise price of $5.61 per share as of August 28, 2023. |

RISK

FACTORS

An

investment in our securities involves a number of risks. Before deciding to invest in our securities, you should carefully consider the

risks discussed under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year

ended December 31, 2022 and in our Quarterly Reports on Form 10-Q for the three-month period ended March 31, 2023 and the six-month period

ended June 30, 2023, which are incorporated by reference in this prospectus, the information and documents incorporated by reference

herein, and in any prospectus supplement or free writing prospectus that we have authorized for use in connection with an offering. If

any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be harmed. This could

cause the trading price of our common shares to decline, resulting in a loss of all or part of your investment. The risks described in

the document referenced above are not the only risks that we face. Additional risks not presently known to us or that we currently deem

immaterial may also affect our business.

PRIVATE

PLACEMENT

On

July 31, 2023, we entered into a Purchase Agreement (the “SN Purchase Agreement”) with certain of the Selling

Stockholders. Pursuant to the Purchase Agreement, the Company sold, and such Selling Stockholders purchased, approximately $18,000,000,

which consisted of approximately $13,468,750 in cash, $1,031,250 of existing debt of the Company which was exchanged

for the Senior Notes, $500,000 in commission, a $3,000,000 original issuance discount, and the SN Warrants issued in this

offering (collectively, the “SN Purchase Price”). The transaction closed on August 1, 2023.

The

Senior Notes were issued with an original issue discount of 16.67%, do not bear interest, unless in the event of an event of default,

in which case the Senior Notes bear interest at the rate of 18% per annum until such default has been cured, and mature after 24 months,

on July 31, 2025. The Company will pay to such Selling Stockholders an aggregate of $1,000,000 per month beginning on the last business

day of the sixth (6th) full calendar month following the issuance thereof. The Senior Notes are convertible into shares of

the Company’s common stock, at a conversion price per share of $1.02 (as adjusted following the Offering), subject to further adjustment

under certain circumstances described in the Senior Notes. To secure its obligations thereunder and under the SN Purchase Agreement,

the Company has granted a security interest over substantially all of its assets to the collateral agent for the benefit of such Selling

Stockholders, pursuant to a security agreement and a related trademark security agreement. The Company has the option to redeem the Senior

Notes at a 10% redemption premium. The maturity date of the Senior Notes also may be extended by the holders under circumstances specified

therein. Danny Meeks, the Company’s Chief Executive Officer, and the Company’s subsidiaries each guaranteed the Company’s

obligations under the Senior Notes.

The

SN Warrants are exercisable for five (5) years to purchase an aggregate of 4,420,460 shares of common stock at an exercise price of $0.01,

subject to further adjustment under certain circumstances described in the SN Warrants.

In

addition, each of the directors and officers of the Company entered into lock-up agreements, which prohibit sales of the common stock

until the earlier of thirty (30) days following (i) the effective date of the registration statement registering the resale by such Selling

Stockholders of the shares issuable upon conversion of the Senior Notes and exercise of the SN Warrants described further below and (ii)

the date the shares issuable upon conversion of the Senior Notes and exercise of the SN Warrants are eligible to be sold, assigned or

transferred under Rule 144, subject to certain exceptions.

Certain

of the Selling Stockholders agreed to exchange original issue discount promissory notes issued by the Company to such Selling Stockholders

on July 2, 2023 in an aggregate principal amount of $1,031,250 for Senior Notes in an aggregate principal amount of $1,237,500 and SN

Warrants to purchase an aggregate of 303,904 shares of common stock.

The

issuance of the Senior Notes and SN Warrants was made in reliance on the exemption provided by Section 4(a)(2) of the Securities Act

of 1933, as amended (the “Securities Act”), for the offer and sale of securities not involving a public offering, and Regulation

D promulgated under the Securities Act. The Company has agreed to file a registration statement registering the resale by such Selling

Stockholders of the maximum number of shares issuable upon conversion of the Senior Notes and exercise of the SN Warrants.

REGISTERED

DIRECT OFFERING

On

August 21, 2023, we entered into a securities purchase agreement (the “RD Purchase Agreement”) with certain of the Selling

Stockholders, pursuant to which, the Company sold, and such Selling Stockholders purchased, an aggregate of 2,511,166 shares of common

stock, in a registered direct offering, and accompanying RD Warrants to purchase up to 5,022,332 shares of common stock in a concurrent

private placement, for gross proceeds of $3,189,181, before deducting the placement agent’s fees and other estimated offering expenses

(the “Offering”). The purchase price for each share and the accompanying RD Warrants was $1.27. The transaction closed on

August 24, 2023.

The

RD Warrants are exercisable immediately upon the date of issuance and have an exercise price of $1.02 per share. The RD Warrants will

expire five and one-half (5.5) years from the date of issuance. Each RD Warrant is subject to anti-dilution provisions to reflect stock

dividends and splits or other similar transactions, and following the approval of the Company’s stockholders, anti-dilution provisions

relating to future issuances or deemed issuances of the Company’s common stock at a price per share below the then-current exercise

price of the RD Warrants. The RD Warrants can be exercised on a cashless basis if there is no effective registration statement registering,

or no current prospectus available for, the resale of the shares of common stock underlying the RD Warrants.

The

issuance of the RD Warrants was made in reliance on the exemption provided by Section 4(a)(2) of the Securities Act, for the offer and

sale of securities not involving a public offering, and Regulation D promulgated under the Securities Act. The Company has agreed to

file a registration statement registering the resale by such Selling Stockholders of the maximum number of shares issuable upon exercise

of the RD Warrants.

USE

OF PROCEEDS

We

are not selling any securities under this prospectus and will not receive any proceeds from the sale of the common stock offered by this

prospectus by the Selling Stockholders. However, we may receive proceeds from the cash exercise of the Warrants, which, if exercised

in cash at the current exercise price, with respect to all Warrants, would result in gross proceeds to us of approximately $5,166,983.

The proceeds from such Warrant exercises, if any, will be used for working capital and general corporate purposes. We cannot predict

when or whether the Warrants will be exercised, and it is possible that some or all of the Warrants may expire unexercised. For information

about the Selling Stockholders, see “Selling Stockholders.”

The

Selling Stockholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage

or legal services or any other expenses incurred by the Selling Stockholders in disposing of the shares of common stock offered hereby.

We will bear all other costs, fees and expenses incurred in effecting the registration of the shares of common stock covered by this

prospectus, including all registration and filing fees and fees and expenses of our counsel and accountants.

DESCRIPTION

OF SECURITIES

The

following summary of certain provisions of our securities does not purport to be complete and is subject to our certificate of incorporation

and bylaws and the provisions of applicable law. Copies of our amended and restated certificate of incorporation and bylaws are filed

as exhibits to the registration statement of which this prospectus is a part.

Common

Stock

Authorized

Capitalization

General

The

total amount of our authorized share capital consists of 1,200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000

shares of preferred stock, par value $0.001 per share.

Common

Stock Rights

Voting

rights. Except as required by law or matters relating solely to the terms of preferred stock, each outstanding share of common

stock will be entitled to one vote on all matters submitted to a vote of stockholders. Holders of shares of our common stock shall have

no cumulative voting rights. Except in respect of matters relating to the election and removal of directors on our board of directors

and as otherwise provided in our Second Amended and Restated Certificate of Incorporation or required by law, all matters to be voted

on by our stockholders must be approved by a majority of the shares present in person or by proxy at the meeting and entitled to vote

on the subject matter. In the case of election of directors, all matters to be voted on by our stockholders must be approved by a plurality

of the voting power of the shares present in person or by proxy at the meeting and entitled to vote thereon.

Dividend

rights. Subject to preferences that may be applicable to any then outstanding preferred stock, holders of our common stock are

entitled to receive dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

Rights

upon liquidation. In the event of the liquidation, dissolution or winding up of our company, holders of our common stock are

entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts

and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then outstanding shares of preferred

stock.

Other

rights. No holder of shares of common stock is entitled to preemptive or subscription rights contained in our certificate of

incorporation or bylaws. There are no redemption or sinking fund provisions applicable to the common stock. The rights, preferences and

privileges of holders of the common stock will be subject to those of the holders of any shares of preferred stock with preferential

rights that we may issue in the future.

Anti-takeover

effects of provisions of our certificate of incorporation and bylaws and Delaware law

Certificate

of Incorporation and Bylaws

Provisions

of our Second Amended and Restated Certificate of Incorporation and Bylaws may delay or discourage transactions involving an actual or

potential change in our control or change in our management, including transactions in which stockholders might otherwise receive a premium

for their shares or transactions that our stockholders might otherwise deem to be in their best interests. Therefore, these provisions

could adversely affect the price of our common stock. Among other things, our Second Amended and Restated Certificate of Incorporation

and Bylaws:

| |

● |

permit

our board of directors to issue up to 10,000,000 shares of preferred stock, with any rights, preferences and privileges as they may

designate |

| |

|

|

| |

● |

provide

that the authorized number of directors may be changed only by resolution adopted by the board of directors; |

| |

● |

provide

that all vacancies, including newly created directorships, may, except as otherwise required by law or subject to the rights of holders

of preferred stock as designated from time to time, be filled by the affirmative vote of a majority of directors then in office,

even if less than a quorum; |

| |

|

|

| |

● |

provide

that stockholders seeking to present proposals before a meeting of stockholders or to nominate candidates for election as directors

at a meeting of stockholders must provide notice in writing in a timely manner and also specify requirements as to the form and content

of a stockholder’s notice; |

| |

|

|

| |

● |

do

not provide for cumulative voting rights (therefore allowing the holders of a majority of the shares of common stock entitled to

vote in any election of directors to elect all of the directors standing for election, if they should so choose); |

| |

|

|

| |

● |

provide

that special meetings of our stockholders may be called only by the board of directors or by holders of more than ten percent (10%)

of all shares entitled to vote at the meeting; |

| |

|

|

| |

● |

provide

that the Court of Chancery of the State of Delaware will be the sole and exclusive forum for any claims, including derivative actions,

brought by a stockholder (i) that are based upon a violation of a duty by a current or former director or officer or stockholder

in such capacity or (ii) as to which the Delaware General Corporation Law, of the DGCL, confers jurisdiction upon the Court of Chancery

of the State of Delaware; and |

| |

|

|

| |

● |

provide

the ability to our board of directors to authorize and designated undesignated preferred stock and issue such preferred stock with

voting or other rights or preferences that could impede the success of any attempt to acquire us. These and other provisions may

have the effect of deferring hostile takeovers or delaying changes in control or management of our company. |

Delaware

Anti-Takeover Law

We

are subject to Section 203 of the DGCL, or Section 203. Section 203 generally prohibits a public Delaware corporation from engaging in

a “business combination” with an “interested stockholder” for a period of three years after the date of the transaction

in which the person became an interested stockholder, unless:

| |

● |

prior

to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction

which resulted in the stockholder becoming an interested stockholder; |

| |

|

|

| |

● |

the

interested stockholder owned at least 85% of the voting stock of the corporation outstanding upon consummation of the transaction,

excluding for purposes of determining the number of shares outstanding (a) shares owned by persons who are directors and also officers

and (b) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether

shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

|

|

| |

● |

on

or subsequent to the consummation of the transaction, the business combination is approved by the board and authorized at an annual

or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting

stock which is not owned by the interested stockholder. |

Section

203 defines a business combination to include:

| |

● |

any

merger or consolidation involving the corporation and the interested stockholder; |

| |

|

|

| |

● |

any

sale, transfer, pledge or other disposition involving the interested stockholder of 10% or more of the assets of the corporation; |

| |

|

|

| |

● |

subject

to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of

any class or series of the corporation beneficially owned by the interested stockholder; |

| |

|

|

| |

● |

subject

to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the

interested stockholder; and |

| |

|

|

| |

● |

the

receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided

by or through the corporation. |

In

general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding voting

stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity or person.

Limitations

on Liability and Indemnification of Officers and Directors

Our

Second Amended and Restated Certificate of Incorporation limits the liability of our directors to the fullest extent permitted by the

DGCL, and our Bylaws provide that we will indemnify them to the fullest extent permitted by such law. We have entered and expect to continue

to enter into agreements to indemnify our directors, executive officers and other employees as determined by our board of directors.

Under the terms of such indemnification agreements, we are required to indemnify each of our directors and officers, to the fullest extent

permitted by the laws of the state of Delaware, if the basis of the indemnitee’s involvement was by reason of the fact that the

indemnitee is or was a director or officer of us or any of its subsidiaries or was serving at our request in an official capacity for

another entity. We must indemnify our officers and directors against all reasonable fees, expenses, charges and other costs of any type

or nature whatsoever, including any and all expenses and obligations paid or incurred in connection with investigating, defending, being

a witness in, participating in (including on appeal), or preparing to defend, be a witness or participate in any completed, actual, pending

or threatened action, suit, claim or proceeding, whether civil, criminal, administrative or investigative, or establishing or enforcing

a right to indemnification under the indemnification agreement. The indemnification agreements also require us, if so requested, to advance

within 10 days of such request all reasonable fees, expenses, charges and other costs that such director or officer incurred, provided

that such person will return any such advance if it is ultimately determined that such person is not entitled to indemnification by us.

Any claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims

against us and may reduce the amount of money available to us.

Exclusive

Jurisdiction of Certain Actions

Our

Second Amended and Restated Certificate of Incorporation requires, to the fullest extent permitted by law, unless we consent in writing

to the selection of an alternative forum, that actions, including derivative actions brought in our name, by stockholders (i) that are

based upon a violation of a duty by a current or former director or officer or stockholder in such capacity and (ii) as to which the

DGCL confers jurisdiction upon the Court of Chancery of the State of Delaware, may be brought only in the Court of Chancery in the State

of Delaware and, if brought outside of Delaware, the stockholder bringing the suit will be deemed to have consented to service of process

on such stockholder’s counsel; provided, however, that the foregoing provisions will not apply to any claims arising under the

Exchange Act or the Securities Act. Although we believe this provision benefits us by providing increased consistency in the application

of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against our

directors and officers.

Transfer

Agent and Registrar

The

transfer agent and registrar for our common stock and outstanding Series Z Preferred Stock is Equity Stock Transfer, Inc. The transfer

agent and registrar’s address is 237 W 37th St #602, New York, NY 10018, phone number (212) 575-5757. The transfer agent for any

series of preferred stock that we may offer under this prospectus will be named and described in the prospectus supplement related to

that series.

Listing

on the Nasdaq Capital Market

Our

common stock is listed on the Nasdaq Capital Market under the symbol “GWAV”.

SELLING

STOCKHOLDERS

The

shares of common stock being offered by the Selling Stockholders are those issuable to the Selling Stockholders upon conversion of the

Senior Notes, exercise of the SN Warrants, and exercise of the RD Warrants. For additional information regarding the issuance of the

Senior Notes and the SN Warrants, see “Private Placement” above. For additional information regarding the issuance

of the RD Warrants, see “Registered Direct Offering” above. We are registering the shares of common stock in order

to permit the Selling Stockholders to offer the shares of common stock for resale from time to time. Except for the ownership of the

Senior Notes and the SN Warrants issued pursuant to the SN Purchase Agreement, and the ownership of the shares of common stock and RD

Warrants issued pursuant to the RD Purchase Agreement, the Selling Stockholders have not had any material relationship with us within

the past three years.

The

table below lists the Selling Stockholders and other information regarding the beneficial ownership (as determined under Section 13(d)

of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder) of the shares of common stock held by each

of the Selling Stockholders. The second column lists the number of shares of common stock beneficially owned by the Selling Stockholders,

based on their respective ownership of shares of common stock, Senior Notes, and Warrants, as of August 28, 2023, assuming conversion

of the Senior Notes and exercise of the Warrants held by each such Selling Stockholder on that date without taking account of any

limitations on conversion and exercise set forth therein.

The

third column lists the shares of common stock being offered by this prospectus by the Selling Stockholders and does not take in account

any limitations on (i) conversion of the Senior Notes set forth therein or (ii) exercise of the Warrants set forth therein.

In

accordance with the terms of a registration rights agreement with the holders of the Senior Notes and the SN Warrants, this prospectus

generally covers the resale of the sum of (i) the maximum number of shares of common stock issued or issuable pursuant to the Senior

Notes, including payment of interest on the Senior Notes through July 31, 2025, and (ii) the maximum number of shares of common stock

issued or issuable upon exercise of the SN Warrants, in each case, determined as if the outstanding Senior Notes (including interest

on the Senior Notes through July 31, 2025) and SN Warrants were converted or exercised (as the case may be) in full (without regard to

any limitations on conversion or exercise contained therein solely for the purpose of such calculation) at the $0.196 floor price of

the Senior Notes or the exercise price of the SN Warrants then in effect (as the case may be) calculated as of the trading day immediately

preceding the date this registration statement was initially filed with the SEC. Because the conversion price and alternate conversion

price of the Senior Notes may be adjusted, the number of shares that will actually be issued may be more or less than the number of shares

being offered by this prospectus. The fourth column assumes the sale of all of the shares offered by the Selling Stockholders pursuant

to this prospectus.

Under

the terms of the Senior Notes, the SN Warrants, and the RD Warrants, a Selling Stockholder may not convert the Senior Notes or exercise

the SN Warrants or the RD Warrants to the extent (but only to the extent) such Selling Stockholder or any of its affiliates would beneficially

own a number of shares of our common stock which would exceed 4.99% of the outstanding shares of the Company. The number of shares in

the second and fourth columns do not reflect these limitations, but the percentages set forth in the fifth column do give effect to such limitations. The Selling Stockholders may sell all, some or none of their

shares in this offering. See “Plan of Distribution.”

| Name of Selling Stockholder |

|

Number

of Shares

of Common

Stock Owned

Prior to

Offering |

|

|

Maximum

Number of

Shares of

Common Stock

to be Sold

Pursuant

to this

Prospectus(1) |

|

|

Number of

Shares of

Common Stock

of Owned

After Offering(2) |

|

|

Percentage

of Shares

of Common

Stock of

Owned After

Offering(36) |

|

| 32 Entertainment, LLC(3) |

|

|

772,034 |

|

|

|

1,986,939 |

|

|

|

448,360 |

|

|

|

2.65 |

% |

| 3i, LP(4) |

|

|

1,702,268 |

|

|

|

7,947,758 |

|

|

|

407,571 |

|

|

|

1.78 |

% |

| Andy Arno(5) |

|

|

40,459 |

|

|

|

248,367 |

|

|

|

- |

|

|

|

* |

|

| Anson East Master Fund LP(6) |

|

|

2,044,697 |

|

|

|

8,447,758 |

|

|

|

250,000 |

|

|

|

1.07 |

% |

| Anson Investments Master Fund LP(7) |

|

|

8,722,217 |

|

|

|

33,791,034 |

|

|

|

1,543,428 |

|

|

|

3.17 |

% |

| Brio Capital Master Fund, Ltd.(8) |

|

|

2,464,908 |

|

|

|

8,262,720 |

|

|

|

855,249 |

|

|

|

3.69 |

% |

| David Jenkins(9) |

|

|

88,048 |

|

|

|

397,388 |

|

|

|

23,313 |

|

|

|

* |

|

| Dawson James Securities, LLC(10) |

|

|

443,224 |

|

|

|

794,776 |

|

|

|

313,754 |

|

|

|

2.00 |

% |

| Empery Debt Opportunity Fund, LP(11) |

|

|

1,776,586 |

|

|

|

7,152,985 |

|

|

|

611,356 |

|

|

|

2.77 |

% |

| Empery Master Onshore(12) |

|

|

102,281 |

|

|

|

627,873 |

|

|

|

- |

|

|

|

* |

|

| Empery Tax Efficient, LP(13) |

|

|

291,621 |

|

|

|

166,903 |

|

|

|

264,432 |

|

|

|

1.75 |

% |

| Gregory Castaldo(14) |

|

|

1,599,415 |

|

|

|

2,260,797 |

|

|

|

1,001,883 |

|

|

|

5.84 |

% |

| HB Fund LLC(15) |

|

|

960,225 |

|

|

|

4,247,848 |

|

|

|

38,908 |

|

|

|

* |

% |

| Intracoastal Capital, LLC(16) |

|

|

91,907 |

|

|

|

397,388 |

|

|

|

27,172 |

|

|

|

* |

|

| Iroquois Master Fund Ltd. (17) |

|

|

299,414 |

|

|

|

20,000 |

|

|

|

279,414 |

|

|

|

1.87 |

% |

| Jaime Taicher(18) |

|

|

160,337 |

|

|

|

238,694 |

|

|

|

87,970 |

|

|

|

* |

|

| JAK Opportunities IV LLC(19) |

|

|

647,349 |

|

|

|

3,973,880 |

|

|

|

- |

|

|

|

* |

|

| James Satloff(20) |

|

|

48,551 |

|

|

|

298,041 |

|

|

|

- |

|

|

|

* |

|

| James Satloff trustee Dustin Nathaniel Satloff Trust u/a 6/1/1993(21) |

|

|

48,551 |

|

|

|

298,041 |

|

|

|

- |

|

|

|

* |

|

| James Satloff trustee Emily U Satloff Family Trust u/a 3/25/1993(22) |

|

|

97,102 |

|

|

|

596,082 |

|

|

|

- |

|

|

|

* |

|

| James Satloff trustee Theodore Jean Satloff Trust u/a 8/7/1996(23) |

|

|

48,551 |

|

|

|

298,041 |

|

|

|

- |

|

|

|

* |

|

| Jonathan Schechter(24) |

|

|

853,862 |

|

|

|

1,192,164 |

|

|

|

659,657 |

|

|

|

4.10 |

% |

| Joseph Reda(25) |

|

|

2,187,817 |

|

|

|

2,786,939 |

|

|

|

1,064,143 |

|

|

|

6.02 |

% |

| L1 Capital Global Opportunities Master Fund(26) |

|

|

1,054,920 |

|

|

|

3,973,880 |

|

|

|

407,571 |

|

|

|

2.16 |

% |

| Leonard Warner(27) |

|

|

240,797 |

|

|

|

1,311,380 |

|

|

|

27,172 |

|

|

|

* |

|

| Matthew Arno(28) |

|

|

40,459 |

|

|

|

248,367 |

|

|

|

- |

|

|

|

* |

|

| Rampart Capital Group, LLC(29) |

|

|

889,932 |

|

|

|

3,795,055 |

|

|

|

271,714 |

|

|

|

1.45 |

% |

| Richard Molinsky(30) |

|

|

210,228 |

|

|

|

834,776 |

|

|

|

40,758 |

|

|

|

* |

|

| Sabby Volatility Warrant Master Fund, Ltd. (31) |

|

|

2,616,834 |

|

|

|

8,454,754 |

|

|

|

815,141 |

|

|

|

3.49 |

% |

| Seafield Brothers Holdings, LLC(32) |

|

|

78,321 |

|

|

|

397,388 |

|

|

|

13,586 |

|

|

|

* |

|

| Sixth Borough Capital Fund, LP(33) |

|

|

652,786 |

|

|

|

2,199,487 |

|

|

|

116,564 |

|

|

|

* |

|

| Timothy Tyler Berry(34) |

|

|

138,374 |

|

|

|

238,694 |

|

|

|

66,007 |

|

|

|

* |

|

| Walleye Capital, LLC(35) |

|

|

2,299,704 |

|

|

|

14,117,204 |

|

|

|

- |

|

|

|

* |

|

| * |

Represents

beneficial ownership of less than 1% of the outstanding shares of our common stock |

| |

|

| (1) |

This

column represents the amount of shares that will be held by the Selling Stockholders after completion of this offering based on the

assumptions that (a) all securities registered for sale by the registration statement of which this prospectus is part of will be

sold, and (b) no other shares of common stock are acquired or sold by the Selling Stockholders prior to completion of this offering.

However, the Selling Stockholders are not obligated to sell all or any portion of the shares of our common stock offered pursuant

to this prospectus. |

| (2) |

For

the purposes of the calculations of common stock to be sold pursuant to the prospectus we are assuming (i) conversion of 100% of

the Senior Notes held by the Selling Stockholders at the current conversion price, $1.02, and (ii) the exercise of 100% of all of

the Warrants held by the Selling Stockholders, without regard to any limitations set forth therein. |

| |

|

| (3) |

Robert

Wolf, the Founder of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by this Selling

Stockholder. The address of this Selling Stockholder is 9 Westerleigh Road, Purchase, NY 10577. |

| |

|

| (4) |

The

business address of 3i, LP is 140 Broadway, 38th Floor, New York, NY 10005. 3i, LP’s principal business is that of a private

investor. Maier Joshua Tarlow is the manager of 3i Management, LLC, the general partner of 3i, LP, and has sole voting control and

investment discretion over securities beneficially owned directly or indirectly by 3i Management, LLC and 3i, LP. Mr. Tarlow disclaims

any beneficial ownership of the securities beneficially owned directly by 3i, LP and indirectly by 3i Management, LLC. The address

of this Selling Stockholder is 140 Broadway - 38th Floor, New York, NY 10005. |

| |

|

| (5) |

The

address of this Selling Stockholder is 240

Riverside Boulevard PH2B, New York, NY 10069. |

| |

|

| (6) |

Anson

Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson East Master Fund LP (“Anson”), hold voting and dispositive power over the Common Shares held by Anson.

Bruce Winson is the manager of Anson Management GP LLC, which is the general partner of Anson Funds Management LP. Moez Kassam and Amin

Nathoo are directors of Anson Advisors Inc. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares

except to the extent of their pecuniary interest therein. The principal business address of Anson is Maples Corporate Services Limited,

PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. |

| |

|

| (7) |

Anson

Advisors Inc and Anson Funds Management LP, the Co-Investment Advisers of Anson Investments Master Fund LP (“Anson”),

hold voting and dispositive power over the Common Shares held by Anson. Bruce Winson is the manager of Anson Management GP LLC,

which is the general partner of Anson Funds Management LP. Moez Kassam and Amin Nathoo are directors of Anson Advisors Inc. Mr. Winson,

Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these Common Shares except to the extent of their pecuniary interest

therein. The principal business address of Anson is Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104,

Cayman Islands. |

| |

|

| (8) |

Shaye

Hirsch, the Director of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by this

Selling Stockholder. The address of this Selling Stockholder is 100 Merrick Road Suite 401W, Rockville Centre, NY 11570. |

| |

|

| (9) |

The

address of this Selling Stockholder is 9611 North US Hwy 1 Box 390, Sebastian, FL 32958. |

| |

|

| (10) |

Robert

D. Keyser, Jr., the CEO of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by this

Selling Stockholder. The address of this Selling Stockholder is 101 N Federal Hwy, Suite 600, Boca Raton, FL, 33432. |

| |

|

| (11) |

Empery

Asset Management LP, the authorized agent of Empery Debt Opportunity Fund, LP (“EDOF”), has discretionary authority to

vote and dispose of the shares held by EDOF and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane,

in their capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting

power over the shares held by EDOF. EDOF, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. The address

of this Selling Stockholder is c/o Empery Asset Management LP 1 Rockefeller Plaza, Suite 1205, New York, NY 10020. |

| |

|

| (12) |

Empery Asset Management LP, the authorized agent

of Empery Master Onshore, LLC (“EMO”), has discretionary authority to vote and dispose of the shares held by EMO and may be

deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their capacity as investment managers of Empery Asset

Management LP, may also be deemed to have investment discretion and voting power over the shares held by EMO. EMO, Mr. Hoe and Mr. Lane

each disclaim any beneficial ownership of these shares.

|

| |

|

| (13) |

Empery

Asset Management LP, the authorized agent of Empery Tax Efficient, LP (“ETE”), has discretionary authority to vote and

dispose of the shares held by ETE and may be deemed to be the beneficial owner of these shares. Martin Hoe and Ryan Lane, in their

capacity as investment managers of Empery Asset Management LP, may also be deemed to have investment discretion and voting power

over the shares held by ETE. ETE, Mr. Hoe and Mr. Lane each disclaim any beneficial ownership of these shares. The address of this

Selling Stockholder is c/o Empery Asset Management LP 1 Rockefeller Plaza, Suite 1205, New York, NY 10020. |

| |

|

| (14) |

The

address of this Selling Stockholder is 3776 Steven James Drive, Garnet Valley, PA 19060. |

| |

|

| (15) |

Hudson

Bay Capital Management LP, the investment manager of HB Fund LLC, has voting and investment

power over these securities. Sander Gerber is the managing member of Hudson Bay Capital GP

LLC, which is the general partner of Hudson Bay Capital Management LP. Each of HB Fund LLC

and Sander Gerber disclaims beneficial ownership over these securities. The address of this

Selling Stockholder is c/o Hudson Bay Capital Management LP, 28 Havemeyer Place, 2nd Floor,

Greenwich, CT 06830. |

| |

|

| (16) |

Mitchell

P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital LLC

(“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are held

by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under Section

13(d) of the Exchange Act) of the securities reported herein that are held by Intracoastal. The address of this Selling Stockholder is

245 Palm Trail, Delray Beach, FL 33483. |

| |

|

| (17) |

Iroquois

Capital Management L.L.C. is the investment manager of Iroquois Master Fund, Ltd. Iroquois Capital Management, LLC has voting control

and investment discretion over securities held by Iroquois Master Fund. As Managing Members of Iroquois Capital Management, LLC , Richard

Abbe and Kimberly Page make voting and investment decisions on behalf of Iroquois Capital Management, LLC in its capacity as investment

manager to Iroquois Master Fund Ltd. As a result of the foregoing, Mr. Abbe and Mrs. Page may be deemed to have beneficial ownership

(as determined under Section 13(d) of the Exchange Act) of the securities held by Iroquois Capital Management and Iroquois Master Fund.

The address of this Selling Stockholder is 125 Park Ave., 25th Fl., New York, NY 10017. |

| (18) |

The

address of this Selling Stockholder is 475 2nd Street N, Unit 204, Saint Petersburg, FL 33701. |

| |

|

| (19) |

The Selling Stockholder is affiliated with ATW Partners Opportunities Management,

LLC (the “Adviser”), which holds voting and dispositive power over such shares. Antonio Ruiz-Gimenez and Kerry Propper serve

as the managing members of the Adviser and as managing members and general partners of the Selling Stockholder and, as such, may be deemed

to have beneficial ownership over the shares. The principal business address of the Adviser is 17 State Street, Suite 2130, New York,

New York 10004. |

| |

|

| (20) |

The

address of this Selling

Stockholder is 10 Gracie Square Apt 9E, New York, NY 10028. |

| |

|

| (21) |

The

address of this Selling Stockholder is 10

Gracie Square Apt 9E, New York, NY 10028. |

| |

|

| (22) |

The

address of this Selling Stockholder is 10

Gracie Square Apt 9E, New York, NY 10028. |

| |

|

| (23) |

The

address of this Selling Stockholder is 10

Gracie Square Apt 9E, New York, NY 10028. |

| |

|

| (24) |

The

address of this Selling Stockholder is 135 Sycamore Drive, Roslyn, NY 11576. |

| |

|

| (25) |

The

address of this Selling Stockholder is 1324 Manor Circle, Pelham, NY 10803. |

| |

|

| (26) |

David

Feldman, the Portfolio Manager of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held

by this Selling Stockholder. The address of this Selling Stockholder is 161A Shedden Road, 1 Artillery Court, PO Box 10085, Grand

Cayman KY1-1001, Cayman Islands. |

| |

|

| (27) |

The

address of this Selling Stockholder is 220 Victory Drive, Massapequa Park, NY 11762. |

| |

|

| (28) |

The

address of this Selling Stockholer is 240

Riverside Boulevard PH2B, New York, NY 10069. |

| |

|

| (29) |

Peter

Abskharon, the Partner of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by this

Selling Stockholder. The address of this Selling Stockholder is 6111 W 74th Street, Westchester, CA 90045. |

| |

|

| (30) |

The

address of this Selling Stockholder is 329 Chestnut Hill Road, Unit 2, Norwalk, CT 06883. |

| |

|

| (31) |

Sabby

Management, LLC serves as the investment manager of Sabby Volatility Warrant Master Fund, Ltd. Hal Mintz is the manager of Sabby

Management, LLC and has voting and investment control of the securities held by Sabby Volatility Warrant Master Fund, Ltd. Each of

Sabby Management, LLC and Hal Mintz disclaims beneficial ownership over the securities beneficially owned by Sabby Volatility Warrant

Master Fund, Ltd., except to the extent of their respective pecuniary interest therein.The address of this Selling Stockholder is

c/o Sabby Mgt. LLC, 10 Mountainview Rd., Suite 205, Upper Saddle River, NJ 07458. |

| |

|

| (32) |

Robert

Haag, the Managing Member of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by

this Selling Stockholder. The address of this Selling Stockholder is 720 N.4th Street, Montpelier, ID 83254. |

| |

|

| (33) |

Robert

D. Keyser, Jr., the CEO of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by this

Selling Stockholder. The address of this Selling Stockholder is 1515 N. Federal Highway Suite 300, Boca Raton, FL 33431. |

| |

|

| (34) |

The

address of this Selling Stockholder is 4 Millers Way, Old Lyme, CT 06371. |

| |

|

| (35) |

William

England, the CEO of this Selling Stockholder, holds voting and dispositive power over the shares of common stock held by this Selling

Stockholder. The address of this Selling Stockholder is 2800 Niagara Lane North Plymouth, MN 55447. |

| |

|

| (36) |

The

percentages in the table have been calculated on the basis of treating as outstanding for a particular person, all shares of our

capital stock outstanding on August 29, 2023. On August 29, 2023, there were 14,901,408 shares of our common stock outstanding. To

calculate a stockholder’s percentage of beneficial ownership, we include in the numerator and denominator the common stock

outstanding and all shares of our common stock issuable to that person in the event of the exercise of outstanding warrants and conversion

of Senior Notes owned by that person which are exercisable or convertible within 60 days of August 29, 2023. Warrants and Senior

Notes held by other stockholders are disregarded in this calculation. Therefore, the denominator used in calculating beneficial ownership

amount our stockholders may differ. Unless we have indicated otherwise, each person named in the table has sole voting power and

sole investment power for the shares listed opposite such person’s name. |

PLAN

OF DISTRIBUTION

We

are registering the shares of common stock issuable upon conversion of the Senior Notes and exercise of the Warrants to permit the resale

of these shares of common stock by the Selling Stockholders from time to time after the date of this prospectus. We will not receive

any of the proceeds from the sale by the Selling Stockholders of the shares of common stock, although we will receive the exercise price

of any Warrants not exercised by the Selling Stockholders on a cashless exercise basis. We will bear all fees and expenses incident to

our obligation to register the shares of common stock.

The

Selling Stockholders may sell all or a portion of the shares of common stock held by them and offered hereby from time to time directly

or through one or more underwriters, broker-dealers or agents. If the shares of common stock are sold through underwriters or broker-dealers,

the Selling Stockholders will be responsible for underwriting discounts or commissions or agent’s commissions. The shares of common

stock may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices

determined at the time of sale or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block

transactions, pursuant to one or more of the following methods:

| |

● |

on

any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale; |

| |

|

|

| |

● |

in

the over-the-counter market; |

| |

|

|

| |

● |

in

transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| |

|

|

| |

● |

through

the writing or settlement of options, whether such options are listed on an options exchange or otherwise; |

| |

|

|

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as