Will the Tech-Sell Off Continue This Week for the S&P 500?

September 11 2023 - 5:46AM

Finscreener.org

On Friday, stocks experienced a

slight uptick amidst growing concerns that the Federal Reserve

might implement steeper rate hikes than previously

anticipated.

The

S&P 500 broke its

three-day descent, inching up by 0.14% to close at 4,457.49.

The

Dow Jones Industrial Average advanced by 75.86 points, marking a 0.22% rise,

settling at 34,576.59. Meanwhile, the Nasdaq Composite secured a marginal increase of 0.09%, ending the

day at 13,761.53.

However, it wasnU+02019t all

positive news, as the week saw the major indices in the red. The

S&P and Nasdaq declined by 1.3% and 1.9%, respectively,

marking their first weekly drop in the past three weeks. The Dow

rounded off the week with a decline of approximately

0.8%.

The latest economic indicators,

notably the initial jobless claims coming in below expectations,

have sparked renewed apprehension about potential rate hikes. As of

Friday, market

participants, as per CME Group’s Fed Watch tool, are estimating

over a 40% likelihood of a rate bump in November, following an

expected hold in September.

AppleU+02019s Upcoming Showcase

On Tuesday,

Apple (NASDAQ: AAPL)

is set to host its signature fall event. Enthusiasts anticipate the

debut of several new gadgets, including the iPhone 15, iPhone 15

Pro, Apple Watch Series 9, and Ultra 2, along with other tech

innovations.

AAPL stock is down 6% in the last

two trading sessions as China banned the use of iPhones by

government officials. China is the second largest market for Apple,

and sales in this region have tripled in the last ten

years.

Inflation Insights Incoming

The upcoming week begins with an

updated snapshot of inflation. Due Wednesday, the Consumer Price

Index (CPI) figures suggest a monthly jump of 0.4% - the steepest

since January.

Year-over-year, itU+02019s

predicted to surge 3.4%, a tad higher than July’s 3.2%. The core

CPI, steering clear of fluctuating food and energy costs, is

forecast to increase by 0.2% monthly and 4.3% annually, marking a

two-year low and a drop from JulyU+02019s 4.7%.

Thursday brings the Producer

Price Index (PPI) from the Bureau of Labor Statistics, which

provides insight into manufacturers and wholesalersU+02019

inflationary pressure. Predictions show a 0.4% monthly increase, a

slight bump from JulyU+02019s 0.3%, and a yearly rate of 1.3%,

surpassing July’s 0.8%. 2

Retail Report for August

The U.S. Census Bureau will shed

light on AugustU+02019s retail sales this Thursday. Sales,

displayed without inflation adjustments, are believed to have risen

by 0.4%, a dip from July’s 0.7%. It suggests a consistent

five-month growth trend, indicating consumers are still spending

despite mounting borrowing costs and continued

inflation.

ECBU+02019s Rate Rundown

On Thursday, the European Central

Bank (ECB) convenes for a pivotal monetary policy discussion. After

nine consecutive rate increases since last summer, a pause is

expected this time around. Emulating the U.S. Federal

ReserveU+02019s aggressive stance, the ECB has been proactive

against inflation, elevating its foundational deposit rate to a

two-decade high of 3.75% from an all-time low of -0.5% in early

2022.

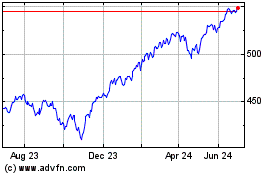

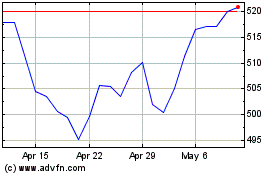

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024