0001606698FALSE00016066982023-09-062023-09-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED) September 6, 2023

Alpine 4 Holdings, Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-40913 | | 46-5482689 |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | | (COMMISSION FILE NO.) | | (IRS EMPLOYER IDENTIFICATION NO.) |

2525 E Arizona Biltmore Circle, Suite 237

Phoenix, AZ 85016

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

480-702-2431

(ISSUER TELEPHONE NUMBER)

(FORMER NAME OR FORMER ADDRESS, IF CHANGED SINCE LAST REPORT)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock | ALPP | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events

PHOENIX, AZ / September 06, 2023 / Alpine 4 Holdings, Inc. (Nasdaq: ALPP), a leading operator and owner of small market businesses and its Subsidiary, Morris Sheet Metal (MSM), are pleased to announce $5.1 Million in new contracts for a project headed by Stellantis Automobile Corporation and Samsung SDI, one of the world's largest battery manufacturers. MSM’s participation in this $2.5 Billion project represents its initial contribution to a state-of-the-art Lithium-ion battery plant and is expected to grow as the project advances into additional phases. The announcement comes as Morris Sheet Metal continues to report rising profit margins.

About the Contract:

This initial contract is for the mechanical installation for advanced production lines, and comprehensive HVAC safety measures that are compliant with national and international standards. This project has been designed for scalability to meet future market needs, leaving the door open for additional projects to be awarded to MSM.

Economic Impact and Community Benefits:

The construction of the battery plant is anticipated to stimulate economic growth in Indiana by creating new jobs. It also solidifies Morris Sheet Metal's reputation as a leader in technology-driven, sustainable industrial solutions.

Tom Laubhan, President of MSM commented: “After a challenging economic period, Morris Sheet Metal has shown remarkable resilience, posting rising profit margins over the past year. Our financial upswing offers us a strong foundation to undertake major projects such as this and the company is optimistic about maintaining this positive trajectory.”

"Over the past year, Tom and his team have helped advise Alpine 4’s other subsidiaries, Quality Circuit Assembly and Elecjet, on the mechanical needs of their pilot and small volume solid-state battery production facility currently under planning. Morris’s expertise in guiding its sister companies has been invaluable. We are truly grateful that MSM is expanding their work into this exciting new space and feel that this project embodies our commitment to innovative, high-quality solutions in the industrial space," said Kent Wilson, CEO, of Alpine 4.

Classified as stabilizer in Alpine 4 Holding’s diverse business ecosystem, Morris Sheet Metal's latest partnership underlines its contribution to Alpine 4’s overarching growth and stability plans for 2023 and 2024.

About Morris Sheet Metal: As a subsidiary of Alpine 4 Holdings, Morris Sheet Metal has established itself as an industry leader in mechanical & industrial fabrication and construction, focusing on innovation, quality, and sustainability.

About Alpine 4 Holdings: Alpine 4 Holdings, Inc. is a Nasdaq traded Holding Company (trading symbol: ALPP) that acquires business, wholly, that fit under one of several portfolios: Aerospace, Defense Services, Technology, Manufacturing or Construction Services as either a Driver, Stabilizer or Facilitator from Alpine 4's disruptive DSF business model. Alpine 4 works to vertically integrate the various subsidiaries with one another even if from different industries. Alpine 4 understands the nature of how technology and innovation can accentuate a business, focusing on how the adaptation of new technologies, even in brick-and-mortar businesses, can drive innovation. Alpine 4 also believes that its holdings should benefit synergistically from each other, have the ability to collaborate across varying industries, spawn new ideas, and create fertile ground for competitive advantages.

Four principles at the core of our business are Synergy. Innovation. Drive. Excellence. At Alpine 4, we believe synergistic innovation drives excellence. By anchoring these words to our combined experience and capabilities, we can aggressively pursue opportunities within and across vertical markets. We deliver solutions that not only drive industry standards, but also increase value for our shareholders.

Contact: Investor Relations

investorrelations@alpine4.com

www.alpine4.com

Forward-Looking Statements: Certain statements and information in this press release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private

Securities Litigation Reform Act of 1995. The information disclosed in this press release is made as of the date hereof and reflects Alpine 4’s most current assessment of its historical financial performance. Actual financial results filed with the SEC may differ from those contained herein due to timing delays between the date of this release and confirmation of final audit results. These forward-looking statements are not guarantees of future performance and are subject to uncertainties and other factors that could cause actual results to differ materially from those expressed in the forward-looking statements including, without limitation, the risks, uncertainties, including the uncertainties surrounding the current market volatility, and other factors the Company identifies from time to time in its filings with the SEC. Although Alpine 4 believes that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statements based on those assumptions also could be incorrect. You should not place undue reliance on these forward-looking statements. The forward-looking statements contained in this release are made as of the date hereof, and Alpine 4 disclaims any intention or obligation to update the forward-looking statements for subsequent events.

Other factors that may affect our businesses include global economic trends, competition and geopolitical risks, including changes in the rates of investment or economic growth in key markets we serve, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries, and related impacts on our businesses' global supply chains and strategies; market developments or customer actions that may affect demand and the financial performance of major industries and customers we serve, such as secular, cyclical and competitive pressures in our Technology, Construction and Manufacturing businesses; pricing, the timing of customer investment and other factors in these markets; demand for our products or other dynamics related to the COVID-19 pandemic; conditions in key geographic markets; and other shifts in the competitive landscape for our products and services; changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs, regulation and the effects of tax law changes; our decisions about investments in research and development, and new products, services and platforms, and our ability to launch new products in a cost-effective manner; our ability to increase margins through implementation of operational changes, restructuring and other cost reduction measures; the impact of actual or potential failures of our products or third-party products with which our products are integrated, and related reputational effects; the impact of potential information technology, cybersecurity, or data security breaches at Alpine 4, our subsidiaries or third parties; and the other factors that are described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated in our Quarterly Reports on Form 10-Q 2023.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 99 | | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

Alpine 4 Holdings, Inc.

By: /s/ Kent B. Wilson

Kent B. Wilson

Chief Executive Officer, President

(Principal Executive Officer)

Date: September 6, 2023

Morris Sheet Metal, a Subsidiary of Alpine 4 Holdings, Inc. (ALPP), Awarded $5.1 Million in New Contracts for Stellantis and Samsungs’ New Battery Production Facility

PHOENIX, AZ / ACCESSWIRE / September 06, 2023 / Alpine 4 Holdings, Inc. (Nasdaq: ALPP), a leading operator and owner of small market businesses and its Subsidiary, Morris Sheet Metal (MSM), are pleased to announce $5.1 Million in new contracts for a project headed by Stellantis Automobile Corporation and Samsung SDI, one of the world's largest battery manufacturers. MSM’s participation in this $2.5 Billion project represents its initial contribution to a state-of-the-art Lithium-ion battery plant and is expected to grow as the project advances into additional phases. The announcement comes as Morris Sheet Metal continues to report rising profit margins.

Contract Information:

This initial contract is for the mechanical installation for advanced production lines, and comprehensive HVAC safety measures that are compliant with national and international standards. This project has been designed for scalability to meet future market needs, leaving the door open for additional projects to be awarded to MSM.

Economic Impact and Community Benefits:

The construction of the battery plant is anticipated to stimulate economic growth in Indiana by creating new jobs. It also solidifies Morris Sheet Metal's reputation as a leader in technology-driven, sustainable industrial solutions.

Tom Laubhan, President of MSM commented: “After a challenging economic period, Morris Sheet Metal has shown remarkable resilience, posting rising profit margins over the past year. Our financial upswing offers us a strong foundation to undertake major projects such as this and the company is optimistic about maintaining this positive trajectory.”

"Over the past year, Tom and his team have helped advise Alpine 4’s other subsidiaries, Quality Circuit Assembly and Elecjet, on the mechanical needs of their pilot and small volume solid-state battery production facility currently under planning. Morris’s expertise in guiding its sister companies has been invaluable. We are truly grateful that MSM is expanding their work into this exciting new space and feel that this project embodies our commitment to innovative, high-quality solutions in the industrial space," said Kent Wilson, CEO, of Alpine 4.

Classified as stabilizer in Alpine 4 Holding’s diverse business ecosystem, Morris Sheet Metal's latest partnership underlines its contribution to Alpine 4’s overarching growth and stability plans for 2023 and 2024.

About Morris Sheet Metal: As a subsidiary of Alpine 4 Holdings, Morris Sheet Metal has established itself as an industry leader in mechanical & industrial fabrication and construction, focusing on innovation, quality, and sustainability.

About Alpine 4 Holdings: Alpine 4 Holdings, Inc. is a Nasdaq traded Holding Company (trading symbol: ALPP) that acquires businesses, wholly, that fit under one of several portfolios: Aerospace, Defense Services, Technology, Manufacturing or Construction Services as either a Driver, Stabilizer or Facilitator from Alpine 4's disruptive DSF business model. Alpine 4 works to vertically integrate the various subsidiaries with one another even if from different industries. Alpine 4 understands the nature of how technology and innovation can accentuate a business, focusing on how the adaptation of new technologies, even in brick-and-mortar businesses, can drive innovation. Alpine 4 also believes that its holdings should benefit synergistically from each other, have the ability to collaborate across varying industries, spawn new ideas, and create fertile ground for competitive advantages.

Four principles at the core of our business are Synergy. Innovation. Drive. Excellence. At Alpine 4, we believe synergistic innovation drives excellence. By anchoring these words to our combined experience and capabilities, we can aggressively pursue opportunities within and across vertical markets. We deliver solutions that not only drive industry standards, but also increase value for our shareholders.

Contact: Investor Relations

investorrelations@alpine4.com

www.alpine4.com

Forward-Looking Statements: Certain statements and information in this press release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. The information disclosed in this press release is made as of the date hereof and reflects Alpine 4’s most current assessment of its historical financial performance. Actual financial results filed with the SEC may differ from those contained herein due to timing delays between the date of this release and confirmation of final audit results. These forward-looking statements are not guarantees of future performance and are subject to uncertainties and other factors that could cause actual results to differ materially from those expressed in the forward-looking statements including, without limitation, the risks, uncertainties, including the uncertainties surrounding the current market volatility, and other factors the Company identifies from time to time in its filings with the SEC. Although Alpine 4 believes that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate and, as a result, the forward-looking statements based on those assumptions also could be incorrect. You should not place undue reliance on these forward-looking statements. The forward-looking statements contained in this release are made as of the date hereof, and Alpine 4 disclaims any intention or obligation to update the forward-looking statements for subsequent events.

Other factors that may affect our businesses include global economic trends, competition and geopolitical risks, including changes in the rates of investment or economic growth in key markets we serve, or an escalation of sanctions, tariffs or other trade tensions between the U.S. and China or other countries, and related impacts on our businesses' global supply chains and strategies; market developments or customer actions that may affect demand and the financial performance of major industries and customers we serve, such as secular, cyclical and competitive pressures in our Technology, Construction and Manufacturing businesses; pricing, the timing of customer investment and other factors in these markets; demand for our products or other dynamics related to the COVID-19 pandemic; conditions in key geographic markets; and other shifts in the competitive landscape for our products and services; changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs, regulation and the effects of tax law changes; our decisions about investments in research and development, and new products, services and platforms, and our ability to launch new products in a cost-effective manner; our ability to increase margins through implementation of operational changes, restructuring and other cost reduction measures; the impact of actual or potential failures of our products or third-party products with which our products are integrated, and related reputational effects; the impact of potential information technology, cybersecurity, or data security breaches at Alpine 4, our subsidiaries or third parties; and the other factors that are described in “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated in our Quarterly Reports on Form 10-Q 2023.

SOURCE: Alpine 4 Holdings, Inc.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

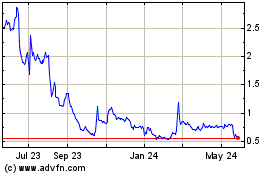

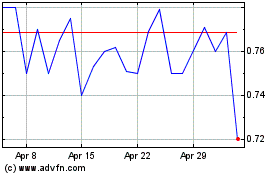

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpine 4 (NASDAQ:ALPP)

Historical Stock Chart

From Apr 2023 to Apr 2024