0001644488

false

--03-31

0001644488

2023-08-31

2023-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) of the

SECURITIES

EXCHANGE ACT OF 1934

August

31, 2023

Date

of Report (Date of Earliest event reported)

SHARING

SERVICES GLOBAL CORPORATION

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

000-55997 |

|

30-0869786 |

(State

or other Jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 5200

Tennyson Parkway, Suite 400, Plano, Texas 75024 |

| (Address

of principal executive offices) |

| Registrant’s

telephone number, including area code: |

469-304-9400 |

(Former

Name or Former Address, If Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange in which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry Into a Material Definitive Agreement.

Exchange

Agreement

Effective

August 31, 2023, Sharing Services Global Corporation (the “Company”), entered into an Exchange Agreement (the “Exchange

Agreement”) with Decentralized Sharing System, Inc. (“DSSI”), pursuant to which, DSSI agreed to cancel the obligations

of the Company under that certain promissory note, dated June 15, 2022, between the Company and DSSI (the “Note”), including

the aggregate principal amount of the Note, together with unpaid interest of $26,169,367.33 in exchange for 26,000 shares of the Company’s

Series D Preferred Stock, par value $0.0001 per share (the “Series D Preferred Stock”, and such transaction, the “Exchange”).

The Exchange was consummated on August 31, 2023.

The

foregoing description of the Exchange Agreement does not purport to be complete and is qualified in its entirety by reference to the

full text of the Exchange Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Series

D Preferred Stock

The

Series D Preferred Stock consists of 26,000 shares. From the first date of issuance of any Series D Preferred Stock, each Holder of the

Series D Preferred Stock (each a “Holder”) shall be entitled to receive cumulative dividends be paid by the Company in cash

at the rate of twenty-five percent (25%) per annum of the operating income of the Company, before other dividends and bonuses from the

date of the first issuance of any shares of the Series D Preferred Stock. Accrued and unpaid dividends shall be payable in cash commencing

on August 31, 2024 and continuing each annual anniversary of such date until the redemption of the Series D Preferred Stock or the Company’s

satisfaction of its obligations to DSSI.

The

Holders may redeem the whole or any part of the outstanding Series D Preferred Stock starting September 1, 2028. Any such redemption

shall be pro rata with respect to all Holders. Upon redemption, the Company shall pay for each share redeemed the amount of (a) $1,000

per share, payable in cash, and (b) any unpaid accumulated dividends of the Series D Preferred Stock. Such redemption may be in part

or in whole.

So

long as the Series D Preferred Stock is outstanding, a majority of Holders (owning fifty percent (50%) or more) of Preferred D Stock

will be entitled to designate individuals to the board of directors of the Company (the “Board”) as necessary to maintain

a ratio of at least 28.5% of the filled Board seats, subject to confirmation by the Board, to fill any vacancy in such Board seats and

to remove and replace any individuals designated to fill such Board seats. Without the prior written consent of the holders of fifty

percent (50%) or more of the outstanding shares of the Series D Preferred Stock, the Company shall not (i) authorize or issue additional

or other capital stock that is of junior, equal or greater rank to the shares of the Series D Preferred Stock in respect of the preferences

as to distributions and payments upon the liquidation, dissolution and winding up of the Company, (ii) amend, alter, change or repeal

any of the powers, designations, preferences and rights of the Series D Preferred Stock, and (iii) directly or indirectly declare, pay

or make any dividends or other distributions upon any of the Common Stock, if any shares of the Series D Preferred Stock are outstanding.

The

foregoing description of the Series D Preferred Stock does not purport to be complete and is qualified in its entirety by reference to

the complete text of the Certificate of Designation, which is attached hereto as Exhibit 3.1 and incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

information set forth under Item 1.01 of this Current Report on Form 8-K with respect to the issuance of an aggregate of 26,000 shares

of Series D Preferred Stock is incorporated herein by reference. The issuance of the Series D Preferred Stock was not registered under

the U.S. Securities Act of 1933, as amended (the “Act”) or any state securities law, and such issuance was undertaken in

reliance upon the exemption from the registration requirements of the Act, pursuant to Section 3(a)(9).

Item

3.03 Material Modifications to Rights of Security Holders.

The

information set forth under Item 1.01 above and Item 5.03 below with respect to the Series D Preferred Stock is incorporated herein by

reference.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The

information set forth under Item 1.01 with respect to the Series D Preferred Stock is incorporated herein by reference. In connection

with the closing of the Exchange described under Item 1.01 above, on August 31, 2023 the Company filed with the Secretary of State of

the State of Nevada the Certificate of Designation, which became effective on August 31, 2023.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

September 5, 2023 |

SHARING SERVICES GLOBAL CORPORATION |

| |

|

|

| |

By: |

/s/ John

Thatch |

| |

|

John Thatch |

| |

|

Chief Executive Officer and Vice Chairman of the Board

of Directors |

Exhibit

3.1

Certificate

of Designation

of

Series

D Preferred Stock

of

Sharing

Services Global Corporation

Pursuant

to NRS 78.195 and 78.1955 this Nevada Profit Corporation adopts this Certificate of Designation for Series D Preferred Stock:

There

is hereby designated a Series D Preferred Stock, pursuant to NRS 78.1955.

ARTICLE

I. 1. Name of Corporation: Sharing Services Global Corporation

ARTICLE

II. By resolution of the board of directors (the “Board”) pursuant to a provision in the articles of incorporation, this

Certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative

rights of the following class or series of stock:

Series

D Preferred Stock, $0.0001 par value per share, to consist of twenty-six thousand (26,000) shares:

1.

Dividends. From and after the first date of issuance of any Series D Preferred Stock each Holder of Series D Preferred Stock shall be

entitled to receive dividends, which dividends shall be paid by the Corporation out of funds legally available therefor, payable, subject

to the conditions and other terms hereof, in cash valued at the rate of twenty-five percent (25%) per annum of the operating income of

the Corporation, before other dividends and bonuses from the date of the first issuance of any shares of the Series D Preferred Stock

(the “Initial Issuance Date”), which shall be cumulative and shall continue to accrue whether or not declared and whether

or not in any fiscal year there shall be operating income or surplus available for the payment of dividends in such fiscal year. Dividends

on the Series D Preferred Stock shall commence accumulating on the Initial Issuance Date and shall be computed on the basis of a 360-day

year and twelve 30-day months. Accrued and unpaid dividends shall be payable in cash commencing on August 31, 2024 and continuing each

annual anniversary of such date until the redemption of the Series D Preferred Stock or the Corporation’s satisfaction in full

of its obligations hereunder.

2.

Redemption Rights. Subject to the applicable provisions of Nevada law, the Corporation, the stockholders of the Series D Preferred Stock

may redeem the whole or any part of the outstanding Series D Preferred Stock starting in September 1, 2028. Any such redemption shall

be pro rata with respect to all of the holders of the Series D Preferred Stock. Upon redemption, the Corporation shall pay for each share

redeemed the amount of (a) $1,000 per share, payable in cash, the redemption amount being referred to as the “Redemption Price”,

and (b) any unpaid accumulated Preferred D dividends. Such redemption may be in part or in whole.

At

least 30 days previous notice by mail, postage prepaid, shall be given to the holders of record of the Series D Preferred Stock to be

redeemed, such notice to be addressed to each such stockholder at the address of such holder appearing on the books of the Corporation

or given by such holder to the Corporation for the purpose of notice, or if no such address appears or is given, at the place where the

principal office of the Corporation is located. Such notice shall state the date fixed for redemption and the redemption price and shall

call upon the holder to surrender to the Corporation on said date at the place designated in the notice such holder’s certificate

or certificates representing the shares to be redeemed. On or after the date fixed for redemption and stated in such notice, each bolder

of Series D Preferred Stock called for redemption shall surrender the certificate evidencing such shares to the Corporation at the place

designated in such notice and shall thereupon be entitled to receive payment of the redemption price. If less than all the shares represented

by any such surrendered certificate are redeemed, a new certificate shall be issued representing the unredeemed shares. If such notice

of redemption shall have been duly given, and if on the date fixed for redemption funds necessary for the redemption shall be available

therefore, notwithstanding that the certificates evidencing any Series D Preferred Stock called for redemption shall not have been surrendered,

the dividends with respect to the shares so called for redemption shall forthwith after such date cease and determine, except only the

right of the holders to receive the redemption price without interest upon surrender of their certificates thereof.

If,

on or prior to any date fixed for redemption of Series D Preferred Stock, the Corporation deposits, with any bank or trust company as

a trust fund, a sum sufficient to redeem, on the date fixed for redemption thereof, the shares called for redemption, with irrevocable

instructions and authority to the bank or trust company to give the notice of redemption thereof (or to complete the giving of such notice

if theretofore commenced) and to pay, or deliver, on or after the date fixed for redemption or prior thereto, the redemption price of

the shares to their respective holders upon the surrender of their share certificates, then from and after the date of the deposit (although

prior to the date fixed for redemption), the shares so called shall be redeemed and any dividends on those shares shall cease to accrue

after the date fixed for redemption. The deposit shall constitute full payment of the shares to their holders, and from and after the

date of the deposit the shares shall no longer be outstanding and the holders thereof shall cease to be stockholders with respect to

such shares, and shall have no rights with respect thereto except the right to receive from the bank or trust company payment of the

redemption price of the shares without interest, upon the surrender of their certificates thereof. Any interest accrued on any funds

so deposited shall be the property of, and paid to, the Corporation. If the holders of Series D Preferred Stock so called for redemption

shall not, at the end of [six] years from the date fixed for redemption thereof, have claimed any funds so deposited, such bank or trust

company shall thereupon pay over to the Corporation such unclaimed funds, and such bank or trust company shall thereafter be relieved

of all responsibility in respect thereof to such holders and such holders shall look only to the Corporation for payment of the redemption

price.

3.

Board Designation Rights. So long as Series D Preferred Stock is outstanding, a majority of holders (owning fifty percent (50%) or more)

of Preferred D Stock will be entitled to designate individuals to the Board as necessary to maintain a ratio of at least 28.5% of

the filled Board seats, subject to confirmation by the Board, to fill any vacancy in such Board seats and to remove and replace any

individuals designated to fill such Board seats. Such additional directors shall have all voting and other rights (including for purposes

of determining the existence of a quorum) as the other individuals serving on the Board. Upon the termination of the Series D Preferred

Stock, the term of office on the Board of all individuals who may have been designated as directors hereunder shall cease (and such individuals

shall promptly resign from the Board.

4.

Reissuance of Certificates. In the event of a redemption of less than all of the shares of the Series D Preferred Stock represented by

a particular Preferred Stock Certificate, the Corporation shall promptly cause to be issued and delivered to the holder of such Series

D Preferred Stock a new Series D Preferred Stock Certificate representing the remaining shares of the Series D Preferred Stock which

were not corrected.

5.

Preferred Status. Without the prior written consent of the holders of fifty percent (50%) or more of the outstanding shares of the Series

D Preferred Stock, the Corporation shall not hereafter authorize or issue additional or other capital stock that is of junior, equal

or greater rank to the shares of the Series D Preferred Stock in respect of the preferences as to distributions and payments upon the

liquidation, dissolution and winding up of the Corporation described above.

6.

Restriction on Dividends. If any shares of the Series D Preferred Stock are outstanding, the Corporation shall not, without the prior

written consent of the holders of fifty percent (50%) or more of the then outstanding shares of the Series D Preferred Stock, directly

or indirectly declare, pay or make any dividends or other distributions upon any of the Common Stock.

7.

Vote to Change the Terms of the Series D Preferred Stock. Without the prior written consent of the holders of or fifty percent (50%)

or more of the outstanding shares of the Series D Preferred Stock, the Corporation shall not amend, alter, change or repeal any of the

powers, designations, preferences and rights of the Series D Preferred Stock.

8.

Lost or Stolen Certificates. Upon receipt by the Corporation of evidence satisfactory to the Corporation of the loss, theft, destruction

or mutilation of any Preferred Stock Certificates representing shares of the Series D Preferred Stock, and, in the case of loss, theft

or destruction, of any indemnification undertaking or bond, in the Corporation’s discretion, by the holder to the Corporation and,

in the case of mutilation, upon surrender and cancellation of the Preferred Stock Certificate(s), the Corporation shall execute and deliver

new Series D Preferred Stock Certificate(s) of like tenor and date.

9.

This Agreement is to be construed and enforced in accordance with and shall be governed by the laws of the State of Nevada applicable

to contracts executed in and to be fully performed in that state.

Dated:

August 31, 2023

Exhibit

10.1

DEBT

EXCHANGE AGREEMENT

THIS

DEBT EXCHANGE AGREEMENT (this “Agreement”) is effective as of August 31, 2023 by and among Sharing Services Global

Corporation, a Nevada Corporation (the “Issuer”) and Decentralized Sharing System, Inc., a Nevada corporation (the

“Investor”).

RECITALS

A.

The Investor has heretofore made a loan to the Issuer pursuant to that certain Promissory Note, made by the Issuer in favor of the Investor,

dated June 15, 2022 (the “Note”);

B.

The Issuer desires to cause the Note to be repaid, and the obligations of the Issuer represented thereby to be cancelled, by exchanging

26,000 shares of Series D Preferred Stock, $0.0001 par value per share (the “Preferred Stock”) of the Issuer for the

Note, as set forth herein;

C.

The Investor desires to accept shares of the Preferred Stock in exchange for the satisfaction and cancellation of the Note; and

D.

The Issuer and the Investor are entering into this Agreement to set forth the terms and conditions applicable to the exchange of the

Note for shares of Preferred Stock;

NOW,

THEREFORE, for good and valuable consideration, the receipt of which is hereby acknowledged by the parties hereto, the parties hereby

agree as follows:

Article

1

EXCHANGE

OF STOCK AND DEBT SECURITIES

1.1

Exchange.

(a)

The Investor hereby agrees, subject to the terms and conditions set forth herein, to exchange the aggregate principal amount of the Note

together with all unpaid interest, totaling $26,169,367.33, as of the effective date of this Agreement, for shares of the Preferred Stock

(the “Exchange Shares”) (such exchange the “Debt Exchange”).

(b)

Subject to the terms and conditions of this Agreement, the consummation of the Debt Exchange shall take place at the principal offices

of the Company (the “Closing”), or at such other time, date or place as the parties hereto may mutually agree upon.

At the Closing, the Investor shall deliver the Note for cancellation and the Issuer shall deliver to the Investor certificates representing

the Exchange Shares.

(c)

The Exchange Shares will be issued in full satisfaction and payment of the Note, and from and after the consummation of the Debt Exchange

the Note shall represent solely the right to receive the Exchange Shares. In the event that as a result of the Debt Exchange, fractional

shares of Preferred Stock would be required to be issued, such fractional shares shall be rounded up or down to the nearest whole share.

The Issuer shall pay any documentary, stamp or similar issue or transfer tax due with respect to the Debt Exchange.

1.2

Legend. Any certificate or certificates representing the Preferred Shares (or any part thereof) will bear the following legend, together

with any and all other legends as may be required pursuant to applicable law (and the Issuer may issue appropriate corresponding stop

transfer instructions to any transfer agent for any of such securities):

“The

securities represented by this certificate have not been registered under the Securities Act of 1933, as amended, or under any applicable

state law and may not be transferred, sold or otherwise disposed of unless registered under such act and applicable state laws or unless

an exemption from the registration requirements under such act or applicable state law requirements is available.”

Such

legend and the stop transfer instructions shall be removed and the Issuer shall issue a certificate representing such securities without

such legend to the holder thereof if (i) such securities are registered under the Securities Act of 1933, or (ii) if such securities

are sold pursuant to Rule 144 under the Securities Act of 1933, or (iii) if such securities are eligible for transfer under Rule 144(k)

under the Securities Act of 1933, and, in the case of (ii) or (iii), when the Investor has furnished to the Issuer evidence to such effect

that Issuer finds reasonably satisfactory which may include, without limitation, an opinion of counsel reasonably acceptable to issuer

(as to form and substance and counsel).

Article

2

REPRESENTATIONS

AND WARRANTIES OF THE ISSUER

The

Issuer hereby represents and warrants to the Investor that:

2.1

Corporate Status. The Issuer is a corporation duly organized, validly existing and in good standing under the laws of the State of

Nevada and has all requisite corporate or other power and authority to carry on its business as now being conducted.

2.2

Capitalization. The authorized capital stock of the Issuer consists (or will consist upon the filing with the Secretary of State

of the State of Nevada and effectiveness of the Certificate of Designation creating the Preferred Stock) of 2,200,000,000 shares, consisting

of 2,000,000,000 shares of common stock, par value $0.0001 per share (the “Common Stock”), and 200,000,000 shares

of preferred stock, of which 26,000 shares are designated as Series D Preferred Stock. As of the date of this Agreement, 347,451,880

shares of Class A Common Stock are issued and outstanding, no shares of Class B Common Stock or Series B Preferred Stock are issued or

outstanding and 3,100,000 shares Series A Preferred Stock; and 3,220,000 shares of its Series C Preferred Stock are issued and outstanding

respectively.

2.3

Power and Authority; Binding Agreement. The Issuer has the requisite corporate power and authority to execute and deliver, and when

the Certificate of Designation has been adopted and filed with the Secretary of State of the State of Nevada, to perform its obligations

under, this Agreement, and the Issuer has taken all necessary corporate action to authorize the execution, delivery and performance of

this Agreement and the consummation of the Debt Exchange. This Agreement has been duly executed and delivered by the Issuer and, assuming

the due authorization, execution and delivery by each of the other parties hereto, constitutes the valid and binding agreement of the

Issuer enforceable against the Issuer in accordance with its terms.

2.4

Consents and Governmental Approvals. No consent, approval, order or authorization of, action by or in respect of, or registration,

declaration or filing with, any federal, state, local or foreign government, any court, administrative, regulatory or other governmental

agency, commission, body or authority or any non-governmental self-regulatory agency, commission, body or authority (each a “Governmental

Entity”) is required by the Issuer in connection with the execution and delivery of this Agreement by the Issuer or the consummation

by the Issuer of the Debt Exchange or the other transactions contemplated by this Agreement, except for the filing of the Certificate

of Designation with the Secretary of State of the State of Nevada, and such other consents, approvals, orders or authorizations the failure

of which to be made or obtained, individually or in the aggregate, is not reasonably likely to have a material adverse effect on the

Issuer.

2.5

Valid Issuance. When issued pursuant to this Agreement in connection with the Debt Exchange, the Exchange Shares will be duly authorized,

validly issued, fully paid and nonassessable, and the Investor will receive good title to such shares, free and clear of any liens, claims,

security interest or encumbrances.

Article

3

REPRESENTATIONS

AND WARRANTIES OF THE INVESTOR

The

Investor represents and warrants to the Issuer that:

3.1

Authority. The Investor has all requisite power and authority to execute and deliver, and perform its obligations under, this Agreement.

All acts required to be taken by the Investor to enter into this Agreement and consummate the transactions contemplated hereby have been

properly taken.

3.2

Title to the Note. The Investor is the record and beneficial holder of the Note, and holds the Note free and clear of all claims,

liens, security interests, title defects and objections or any other encumbrances of any kind or nature whatsoever.

3.3

Investment Intent. Investor is acquiring the Exchange Shares being delivered to Investor under this Agreement for its own account

and with no present intention of distributing or selling any of them in violation of the Securities Act of 1933 or any applicable state

securities law. Investor will not sell or otherwise dispose of any of such Exchange Shares unless such sale or other disposition has

been registered or is exempt from registration under the Securities Act of 1933 and has been registered or qualified or is exempt from

registration or qualification under applicable state securities laws. Investor understands that the Exchange Shares it is acquiring under

this Agreement have not been registered under the Securities Act of 1933 by reason of their contemplated issuance in transactions exempt

from the registration and prospectus delivery requirements of the Securities Act of 1933 and that the reliance of the Issuer on this

exemption is predicated in part on these representations and warranties of Investor. Investor acknowledges and agrees that a restrictive

legend consistent with the foregoing has been or will be placed on the certificates for the Exchange Shares and related stop transfer

instructions will be noted in the transfer records of the Issuer and/or its transfer agent for the Exchange Shares, and that such Investor

will not be permitted to sell, transfer or assign any of the Exchange Shares acquired hereunder until such Exchange Shares are registered

or an exemption from the registration and prospectus delivery requirements of the Securities Act of 1933 is available.

3.4

Investor Status. Investor (i) is either (x) a “Qualified Institutional Buyer” as such term is defined in Rule

144A under the Securities Act of 1933 or (y) an “accredited investor” as such term is defined in Rule 501 of Regulation

D promulgated under the Securities Act of 1933; (ii) has such knowledge and experience in financial and business matters that it is capable

of evaluating the merits and risks of the investments to be made by it hereunder; (iii) has the ability to bear the economic risks of

its investments for an indefinite period of time; and (iv) has sole investment discretion with respect to the Debt Exchange; and (v)

has been given an opportunity to obtain such information from the Issuer as Investor deems necessary or appropriate with respect to the

Debt Exchange.

Article

4

CONDITIONS

4.1

Issuer’s Conditions. The obligations of the Issuer to consummate the transactions contemplated by this Agreement shall be subject

to fulfillment of the following conditions on or prior to the date of Closing:

(a)

The representations and warranties of the Investor set forth in Article 3 shall be true and correct on and as of the date of Closing.

(b)

All proceedings, corporate or otherwise, required to be taken by the Investor on or prior to the date of Closing in connection with this

Agreement, and the Debt Exchange contemplated hereby, shall have been duly and validly taken, and all necessary consents, approvals or

authorizations required to be obtained by the Investor on or prior to the Closing shall have been obtained.

(c)

The Investor shall have delivered the Note to the Issuer for cancellation.

(d)

The Investor shall have delivered to the Issuer such other documents, certificates or other information as the Issuer or its counsel

may reasonably request.

4.2

Investor’s Conditions. The obligations of the Investor to consummate the transaction contemplated by this Agreement shall be

subject to fulfillment of the following conditions on or prior to the date of Closing:

(a)

The representations and warranties of the Issuer set forth in Article 2 shall be true and correct on and as of the date of Closing.

(b)

All proceedings, corporate or otherwise required to be taken by the Issuer on or prior to the date of Closing in connection with this

Agreement, and the Debt Exchange contemplated hereby, shall have been duly and validly taken, and all necessary consents, approvals or

authorizations required to be obtained by the Issuer on or prior to the Closing shall have been obtained.

(c)

A copy of the Certificate of Designation, as filed with, and certified as of a recent date by, the Secretary of State of the State of

Nevada, shall have been delivered to the Investor.

(d)

The Issuer shall have issued and delivered, or cause to be issued and delivered, to the Investor, stock certificates, registered in the

name of the Investor, representing duly authorized, validly issued, fully paid and non-assessable Exchange Shares.

(e)

The Issuer shall have delivered to the Investor such other documents, certificates or other information as the Investor or its counsel

may reasonably request.

Article

5

MISCELLANEOUS

5.1

Notices. All notices, requests and demands to or upon the respective parties hereto to be effective must be in writing and, unless

otherwise expressly provided herein, are deemed to have been duly given or made when delivered by hand or by courier, or by certified

mail, or, when transmitted by facsimile and a confirmation of transmission printed by sender’s facsimile machine. A copy of any

notice given by facsimile also must be mailed, postage prepaid, to the addressee. Notices to the respective parties hereto must be addressed

as follows:

| |

If

to the Investor: |

Decentralized

Sharing Services, Inc. |

| |

|

1400

Broadfield, Suite 100 |

| |

|

Houston,

Texas 77084 |

| |

|

Attention:

Frank D. Heuszel, President |

| |

|

|

| |

|

With

a copy to: |

| |

|

|

| |

|

Sichenzia

Ross Ference LLP |

| |

|

1185

Avenue of the Americas, 31st Floor |

| |

|

New

York, New York 10036 |

| |

|

Attention:

Darrin Ocasio, Esq. |

| |

|

Tel:

(212) 930-9700 |

| |

|

|

| |

If

to the Issuer: |

Sharing

Services Global Corporation

5200

Tennyson Parkway, Suite 400

Plano,

Texas 75024 |

| |

|

Attention:

John “JT” Thatch, CEO |

| |

|

Telephone:

(469) 304-9400 |

| |

|

|

| |

|

With

a copy to: |

| |

|

|

| |

|

Sichenzia

Ross Ference LLP |

| |

|

1185

Avenue of the Americas, 31st Floor

New

York, New York 10036 |

| |

|

Attention:

Darrin Ocasio, Esq. |

| |

|

Tel:

(212) 930-9700 |

Any

party may alter the address to which communications or copies are to be sent by giving notice of the change of address under this Section.

5.2

Headings. The headings in this Agreement are for purposes of reference only and are not to be considered in construing this Agreement.

5.3

Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered constitutes

an original and all together shall constitute one Agreement.

5.4

Enforceability. If any term or provision of this Agreement, or the application thereof to any person or circumstance, is, to any

extent, invalid or unenforceable, the remaining terms and provisions of this Agreement or application to other Persons and circumstances

are not invalidated thereby, and each term and provision hereof is to be construed with all other remaining terms and provisions hereof

to effect the intent of the parties hereto to the fullest extent permitted by law.

5.5

Law Governing. This Agreement is to be construed and enforced in accordance with and shall be governed by the laws of the State of

Nevada applicable to contracts executed in and to be fully performed in that state.

5.6

Confidentiality. Until the Issuer makes a public announcement about the Exchange, the Investor will maintain the confidentiality

of the Debt Exchange and the terms of the Debt Exchange.

[Signatures

on following page]

IN

WITNESS WHEREOF, the parties have caused this Agreement to be duly executed and delivered as of the day and year first above written.

Executed

on the date(s) acknowledged below to be effective August 31, 2023.

| |

SHARING

SERVICES GLOBAL CORPORATION |

| |

|

| |

|

/s/

John “JT” Thatch |

| |

Name:

|

John

“JT” Thatch |

| |

Title:

|

Chief

Executive Officer |

| |

|

|

| |

DECENTRALIZED

SHARING SYSTEMS, INC. |

| |

|

|

| |

By:

|

/s/

Frank D. Heuszel |

| |

Name:

|

Frank

D. Heuszel |

| |

Title:

|

President

|

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

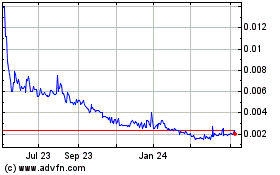

Sharing Services Global (PK) (USOTC:SHRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

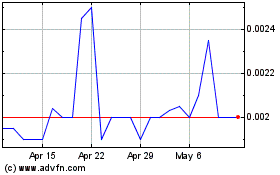

Sharing Services Global (PK) (USOTC:SHRG)

Historical Stock Chart

From Apr 2023 to Apr 2024