As

filed with the Securities and Exchange Commission on September 1, 2023

Registration

No. 333-269088

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT

NO. 1

TO

FORM

S-3

ON

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Qualigen

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

26-3474527 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

5857

Owens Avenue, Suite 300

Carlsbad,

California 92008

(760)

452-8111

(Address,

including zip code, and telephone number, including area code of registrant’s principal executive offices)

Michael

S. Poirier

Chief

Executive Officer

Qualigen

Therapeutics. Inc.

5857

Owens Avenue, Suite 300

Carlsbad,

California 92008

(760)

452-8111

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Ashok

W. Mukhey, Esq.

Reed

Smith LLP

1901

Avenue of the Stars, Suite 700

Los

Angeles, California 90067

(310)

734-5200

From

time to time after the effective date of this Registration Statement

(Approximate

date of commencement of proposed sale to the public)

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| |

|

|

|

|

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

|

|

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

Qualigen

Therapeutics, Inc. (the “Registrant”) filed a registration statement on Form S-3 (Registration No. 333-269088) with the Securities

and Exchange Commission (the “SEC”) on December 30, 2022, which registration statement was declared effective on January

5, 2023 (the “Original Registration Statement”). The Original Registration Statement registered the resale by the selling

stockholder named therein (the “Selling Stockholder”) of up to 5,157,087 shares of common stock of the Registrant, which

could be issued to the Selling Stockholder pursuant to the terms of an 8% Senior Convertible Debenture in the aggregate principal amount

of $3,300,000 issued to the Selling Stockholder on December 22, 2022 (the “Debenture”) and the warrant (the “Warrant”)

issued to the Selling Stockholder in connection with the issuance of the Debenture.

The

Registrant is not currently eligible to use the Original Registration Statement as a result of its failure to timely file its annual

report on Form 10-K for the fiscal year ended December 31, 2022. The Registrant is filing this Post-Effective Amendment No. 1 to Form

S-3 on Form S-1 (the “Registration Statement”) in order to maintain the registration of the resale by the Selling Stockholder

of up to 3,958,537 shares of the Registrant’s common stock, which are issuable from time to time under the Debenture and the Warrant.

Relative to the number of shares of common stock of the Registrant covered by the Original Registration Statement, the number of shares

of common stock covered by this Registration Statement has been adjusted to reflect (i) the repayment of a portion of the principal

amount of the Debenture and (ii) the sale of by the selling stockholder pursuant to the Original Registration Statement of 841,726

shares of common stock issued upon a partial conversion of the Debenture, since the date of the Original Registration Statement.

All filing fees payable in connection with the registration of the shares of common stock covered by this Registration Statement were

previously paid in connection with the filing of the Original Registration Statement.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities or accept an offer to

buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state where such offer or sale

is not permitted.

SUBJECT

TO COMPLETION, DATED SEPTEMBER 1, 2023

PRELIMINARY

PROSPECTUS

3,958,537

Shares

Common

Stock

This

prospectus relates to the resale or other disposition from time to time by the selling stockholder named herein of up to an aggregate

of 3,958,537 shares of our common stock, par value $0.001 per share (the “Resale Shares”), which may be issued to the selling

stockholder pursuant to the terms of an 8% Senior Convertible Debenture in the aggregate principal amount of $3,300,000 issued to the

selling stockholder on December 22, 2022 (the “Debenture”) and the warrant (the “Warrant”) issued to such selling

stockholder in connection with the issuance of the Debenture.

The

selling stockholder may offer and sell or otherwise dispose of the Resale Shares described in this prospectus from time to time through

public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated

prices. The selling stockholder will bear all underwriting fees, commissions and discounts, if any, attributable to the sales of Resale

Shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the Resale Shares.

See “Plan of Distribution” for more information on how the selling stockholder may sell or dispose of its Resale Shares.

We

will not receive any proceeds from the sale of the Resale Shares by the selling stockholder.

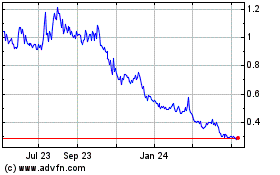

Our

common stock is listed on The Nasdaq Capital Market under the trading symbol “QLGN.” On August 31, 2023, the closing

price of our common stock was $1.04 per share.

Investing

in shares of our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described in the

section titled “Risk Factors” on page 5 of this prospectus and any similar section contained in the applicable prospectus

supplement and in any free writing prospectuses we have authorized for use in connection with a specific offering, and under similar

headings in the documents that are incorporated by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”).

The selling stockholder referred to in this prospectus may from time to time sell the shares of common stock described in this prospectus

in one or more offerings or otherwise as described under “Plan of Distribution.”

Neither

we nor the selling stockholder has authorized anyone to provide any information other than that contained or incorporated by reference

in this prospectus or in any related prospectus supplement or any free writing prospectus that we have authorized. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. The shares are not being

offered in any jurisdiction where the offer is not permitted. You should not assume that the information contained in or incorporated

by reference in this prospectus is accurate as of any date other than the respective dates of such document. Our business, financial

condition, results of operations and prospects may have changed since those dates.

Throughout

this prospectus, the terms “we,” “us,” “our,” and our “company” refer to Qualigen Therapeutics,

Inc. and its subsidiaries.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). These statements relate to future events or to our future operating or financial

performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements

to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

Forward-looking statements may include, but are not limited to, statements about:

| |

● |

our

ability to successfully develop any drugs or therapeutic devices; |

| |

|

|

| |

● |

our

ability to progress our drug candidates through preclinical and clinical development; |

| |

|

|

| |

● |

our

ability to obtain the requisite regulatory approvals for our clinical trials and to begin and complete such trials according to any

projected timeline; |

| |

|

|

| |

● |

our

ability to complete enrollment in our clinical trials as contemplated by any projected timeline; |

| |

|

|

| |

● |

the

likelihood that future clinical trial data will be favorable or that such trials will confirm any improvements over other products

or lack negative impacts; |

| |

|

|

| |

● |

our

ability to successfully commercialize any drugs; |

| |

|

|

| |

● |

our

ability to procure or earn sufficient working capital to complete the development, testing and launch of our prospective therapeutic

products; |

| |

|

|

| |

● |

the

likelihood that patents will issue on our owned and in-licensed patent applications; |

| |

|

|

| |

● |

our

ability to protect our intellectual property; and |

| |

|

|

| |

● |

our

ability to compete. |

In

some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,”

“estimates,” “intends,” “may,” “plans,” “potential,” “will,”

“would,” or the negative of these terms or other similar expressions. These statements reflect our current views with respect

to future events and are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place

undue reliance on these forward-looking statements as predictions of future events. We discuss in greater detail many of these risks

in our most recent Annual Report on Form 10-K and in our most recent Quarterly Report on Form 10-Q, as well as any amendments thereto

reflected in subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety. Also, these

forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future

events or developments.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These

statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms

a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate

that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are

inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You

should read this prospectus, together with the documents we have filed with the SEC that are incorporated by reference, any prospectus

supplement and any free writing prospectus that we may authorize completely and with the understanding that our actual future results

may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these

cautionary statements.

PROSPECTUS

SUMMARY

This

summary highlights some information from this prospectus. It may not contain all the information important to making an investment decision.

You should read the following summary together with the more detailed information regarding our Company and the securities being sold

in this offering, including “Risk Factors” and other information incorporated by reference herein.

Overview

We

are a clinical stage therapeutics company focused on developing treatments for adult and pediatric cancers with potential for Orphan

Drug designation.

Our

cancer therapeutics pipeline includes QN-302, our Pan-RAS Inhibitor platform (formerly RAS-F) and QN-247.

Our

lead oncology therapeutics program, QN-302, is a small molecule selective transcription inhibitor with strong binding affinity to G4s

prevalent in cancer cells, which binding could, by stabilizing the G4s against “unwinding,” help inhibit cancer cell proliferation.

QN-302 has received Investigational New Drug (IND) clearance from the U.S. Food and Drug Administration (FDA) to proceed with its Phase

1 clinical trial. Earlier this year, QN-302 also received Orphan Drug Designation (ODD) from FDA for the indication of pancreatic cancer.

Our

Pan-RAS portfolio consists of a family of Pan-RAS oncogene protein-protein interaction inhibitor small molecules believed to inhibit

or block mutated RAS genes’ proteins from binding to their effector proteins. Preventing this binding could stop tumor growth,

especially in RAS-driven tumors such as pancreatic, colorectal and lung cancers.

Our

investigational QN-247 compound binds nucleolin, a key multi-functional regulatory phosphoprotein that is overexpressed in cancer cells.

Such binding could inhibit the cancer cells’ proliferation. The foundational aptamer of QN-247 is QN-165 (formerly referred to

as AS1411), which we have deprioritized as a drug candidate for treating COVID-19 and other viral-based infectious diseases. This is

conjugated to a Gold Nanoparticle (GNP).

Therapeutics

Pipeline

Our

lead drug compound QN-302 (formerly SOP1812) is being developed to target regulatory regions of cancer genes that down-regulate gene

expression in multiple cancer pathways for potential treatment of G4-targeted tumors (e.g., pancreatic cancer).

The

investigational compounds within our Pan-RAS Inhibitor portfolio are designed to suppress the interaction of endogenous RAS with c-RAF,

upstream of the KRAS, HRAS and NRAS effector pathways, and is being developed for the potential treatment of RAS-driven tumors.

Our

anticancer drug candidate, QN-247 (formerly referred to as ALAN or AS1411-GNP) is aptamer-based and currently in development to treat

a variety of cancer types, including liquid and solid tumors.

On

May 26, 2022, we acquired a 52.8% interest in NanoSynex, Ltd. (“NanoSynex”). NanoSynex is a micro-biologics diagnostic company

domiciled in Israel. NanoSynex’s technology is an Antimicrobial Susceptibility Testing (AST) that aims to enable better targeting

of antibiotics for their most suitable uses to ultimately result in faster and more efficacious treatment, hence reducing hospitals mortality

and morbidity rates. As described below, we have recently reduced our ownership interest in NanoSynex to below 50%.

Recent

Developments

FDA

IND Clearance to Initiate Phase 1 Clinical Trial of QN-302

On

August 1, 2023, we announced that FDA has cleared our IND application for QN-302. Based on this clearance, we plan to initiate the Phase

1 clinical trial in the second half of 2023 and will enroll patients with advanced or metastatic solid tumors. The proposed Phase 1 clinical

trial is a multicenter, open-label, dose escalation, safety, pharmacokinetic, and pharmacodynamic study with dose expansion to evaluate

safety, tolerability, and antitumor activity of QN-302 in patients with advanced solid tumors that have not responded to or that have

recurred following treatment with available therapies. We anticipate the dosing of at least 24 patients in Phase 1a can be completed

in 2024, funded in part by proceeds received by the divestiture of the Company’s diagnostics business in July 2023.

Sale

of Diagnostics Business

On

July 20, 2023, we sold all of the issued and outstanding shares of common stock of Qualigen, Inc., a wholly-owned subsidiary and the

legal entity operating our FastPack™ diagnostic business, to Chembio Diagnostics, Inc. (the “Buyer”), a subsidiary

of Biosynex, S.A. (the “Transaction”). As consideration for the shares of Qualigen, Inc., we received a cash payment of approximately

$4.7 million, which payment is subject to post-closing adjustments. An additional $450,000 was delivered by the Buyer to an escrow account

to satisfy our indemnification obligations. Any amounts remaining in the escrow account that have not been offset or reserved for claims

will be released to us within five business days following the date that is 18 months after the closing of the Transaction. Following

the consummation of the Transaction, Qualigen, Inc. became a wholly-owned subsidiary of the Buyer.

Amendment

and Settlement Agreement with NanoSynex Ltd.

On

July 20, 2023, we entered into an Amendment and Settlement Agreement with NanoSynex (the “NanoSynex Amendment”), which amended

the Master Funding Agreement for the Operational and Technology Funding of Nanosynex Ltd., dated May 26, 2022, by and between us and

NanoSynex (the “Original NanoSynex Agreement”), to, among other things, provide for the further funding of NanoSynex, as

contemplated by the Original NanoSynex Agreement.

Pursuant

to the terms of the NanoSynex Amendment, we agreed to advance to NanoSynex an aggregate amount of $1,610,000 as follows: (i) $380,000

within five business days of the execution of the NanoSynex Amendment, (ii) $560,000 on or before November 30, 2023, against which NanoSynex

will issue a promissory note to us with a face value in the amount of such funding, and (iii) $670,000 on or before March 31, 2024, against

which NanoSynex will issue a promissory note to us with a face value in the amount of such funding. The NanoSynex Amendment further provides

that the initial payment of $380,000 would be satisfied by our surrender of the 281,000 Preferred B Shares of NanoSynex then held by

us, and such share surrender has resulted in our ownership in NanoSynex being reduced from approximately 52.8% to approximately 49.97%

of the issued and outstanding voting equity of NanoSynex. The NanoSynex Amendment supersedes any payments contemplated by the Original

NanoSynex Agreement, such that except as described in the NanoSynex Amendment, we will have no further payment obligations to NanoSynex

under the Original NanoSynex Agreement or otherwise (including by way of equity investment, loan financing or credit lines).

Transaction

with the Selling Stockholder

On

December 21, 2022, we entered into a Securities Purchase Agreement (“Agreement”) with the selling stockholder, pursuant to

which, on December 22, 2022, we issued to the selling stockholder in a private placement (the “Private Placement”) an 8%

Senior Convertible Debenture (the “Debenture”) in the aggregate principal amount of $3,300,000 for a purchase price of $3,000,000.

The Debenture is convertible, at any time, and from time to time, at the selling stockholder’s option, into shares of our common

stock, at a price equal to $1.32 per share, subject to adjustment as described in the Debenture (the “Conversion Price”)

and the other terms and conditions described in the Debenture, including our receipt of the necessary stockholder approvals, which we

obtained at our 2023 annual meeting of stockholders. As of August 31, 2023, the Debenture is convertible into 1,458,537 shares of our

common stock.

Pursuant

to the terms of the Agreement, we also issued to the selling stockholder on December 22, 2022 a common stock purchase warrant (the “Warrant”)

to purchase up to 2,500,000 shares of our common stock (the “Warrant Shares,”), at a price of $1.65 per share, subject to

adjustment as described in the Warrant (the “Exercise Price”). The Warrant may be exercised, in whole or in part, at any

time on or after June 22, 2023 and before June 22, 2028, subject to the terms and conditions described in the Warrant, including our

receipt of the necessary stockholder approvals, which we obtained at our 2023 annual meeting of stockholders.

Commencing

June 1, 2023 and continuing on the first day of each month thereafter until the earlier of (i) December 22, 2025 (i.e., the Maturity

Date) and (ii) the full redemption of the Debenture (each such date, a “Monthly Redemption Date”), we will redeem $110,000

plus accrued but unpaid interest, liquidated damages and any amounts then owing under the Debenture (the “Monthly Redemption Amount”).

The Monthly Redemption Amount will be paid in cash; provided that after the first two monthly redemptions, we may elect to pay all or

a portion of a Monthly Redemption Amount in shares of our common stock, based on a conversion price equal to the lesser of (i) the then

Conversion Price of the Debenture and (ii) 85% of the average of the VWAPs (as defined in the Debenture) for the five consecutive trading

days ending on the trading day that is immediately prior to the applicable Monthly Redemption Date. We may also redeem some or all of

the then outstanding principal amount of the Debenture at any time for cash in an amount equal to 105% of the then outstanding principal

amount of the Debenture being redeemed plus accrued but unpaid interest, liquidated damages and any amounts then owing under the Debenture.

These monthly redemption and optional redemptions are subject to the satisfaction of the terms and conditions described in the Debenture,

including our receipt of the necessary stockholder approvals, which we obtained at our 2023 annual meeting of stockholders.

The

Debenture accrues interest at the rate of 8% per annum, which does not begin accruing until December 1, 2023, and will be payable on

a quarterly basis. Interest may be paid in cash or shares of our common stock or a combination thereof at our option; provided that interest

may only be paid in shares if the Equity Conditions (as defined in the Debenture) have been satisfied.

Both

the Debenture and the Warrant provide for adjustments to the Conversion Price and Exercise Price, respectively, in connection with stock

dividends and splits, subsequent equity sales and rights offerings, pro rata distributions, and certain fundamental transactions. Both

the Debenture and the Warrant include a beneficial ownership blocker of 9.99%, which may only be waived by the selling stockholder upon

61 days’ notice to us.

The

issuance of the Debenture and the Warrant to the selling stockholder was exempt from the registration requirements of the Securities

Act pursuant to the exemption for transactions by an issuer not involving any public offering under Section 4(a)(2) of the Securities

Act.

Pursuant

to the terms of the Agreement, we entered into a registration rights agreement with the selling stockholder on December 22, 2022 (the

“Registration Rights Agreement”), pursuant to which we agreed to file one or more registration statements, as necessary,

and to the extent permissible, to register under the Securities Act the resale of (a) all shares of our common stock issued and issuable

upon conversion in full of the Debenture (without regard to any conversion limitations therein), (b) all shares of our common stock issued

and issuable as interest or principal on the Debenture (assuming all permissible interest and principal payments are made in shares of

our common stock and the Debenture is held until maturity), (c) all Warrant Shares then issued and issuable upon exercise of the Warrant

(without regard to any exercise limitations therein), (d) any additional shares of our common stock issued and issuable in connection

with any anti-dilution provisions in the Debenture or the Warrant (in each case, without giving effect to any limitations on conversion

set forth in the Debenture or limitations on exercise set forth in the Warrant) and (e) any securities issued or then issuable upon any

stock split, dividend or other distribution, recapitalization or similar event with respect to the foregoing. Under the terms of the

Registration Rights Agreement, we agreed to use commercially reasonable efforts to keep the registration statement continuously effective

under the Securities Act until the earliest date that all Registrable Securities (as defined in the Registration Rights Agreement) covered

by such registration statement (i) have been sold, thereunder or pursuant to Rule 144, or (ii) may be sold without volume or manner-of-sale

restrictions pursuant to Rule 144 and without the requirement for us to be in compliance with the current public information requirement

under Rule 144, as determined by our counsel pursuant to a written opinion letter to such effect, addressed and acceptable to our transfer

agent.

Reverse

Stock Split

Effective

as of November 23, 2022, we completed a 1-for-10 reverse stock split of our common stock in order to regain compliance with Nasdaq Listing

Rule 5550(a)(2), which requires a minimum bid price of $1.00 per share. As a result of the reverse stock split, each 10 shares of our

common stock issued and outstanding as of 12:01 a.m. Eastern Time on November 23, 2022 were combined and converted into one share of

common stock. On December 9, 2022, we received written notice from the Listing Qualifications Department of The Nasdaq Stock Market LLC

stating that because our shares of common stock had a closing bid price at or above $1.00 per share for a minimum of 10 consecutive business

days, the Company has regained compliance with the minimum bid price requirement of $1.00 per share for continued listing on The Nasdaq

Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2), and that the matter is now closed. All references to numbers of shares

of Common Stock and per-share information in this prospectus have been adjusted retroactively, as appropriate, to reflect the 1-for-10

reverse stock split.

Corporate

Background

Ritter

Pharmaceuticals, Inc. (our predecessor) was formed as a Nevada limited liability company on March 29, 2004 under the name Ritter Natural

Sciences, LLC. In September 2008, this company converted into a Delaware corporation under the name Ritter Pharmaceuticals, Inc. On May

22, 2020, upon completing a “reverse recapitalization” transaction with Qualigen, Inc., Ritter Pharmaceuticals, Inc. was

renamed Qualigen Therapeutics, Inc. Qualisys Diagnostics, Inc. was formed as a Minnesota corporation in 1996, reincorporated to become

a Delaware corporation in 1999, and then changed its name to Qualigen, Inc. in 2000. Qualigen, Inc. was a wholly-owned subsidiary of

the Company. On July 20, 2023, we sold all of the issued and outstanding shares of common stock of Qualigen, Inc. to Chembio Diagnostics,

Inc. (“Chembio”), a wholly-owned subsidiary of Biosynex, S.A. Following the consummation of this transaction, Qualigen, Inc.

became a wholly-owned subsidiary of Chembio.

Our

principal executive offices are located at 5857 Owens Avenue, Suite 300, Carlsbad, CA 92008. Our telephone number is (760) 452-8111.

THE

OFFERING

| Issuer |

|

Qualigen

Therapeutics, Inc. |

| |

|

|

| Common

stock offered by the selling stockholder |

|

3,958,537

shares issuable upon exercise of the Debenture and the Warrants (the “Resale Shares”). |

| |

|

|

| Terms

of the offering |

|

The

selling stockholder and any of its pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their

shares covered hereby on Nasdaq or any other stock exchange, market or trading facility on which the shares are traded or in private

transactions. These sales may be at fixed or negotiated prices. See “Plan of Distribution.” |

| |

|

|

| Common

stock to be outstanding after this offering |

|

9,011,000

shares. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any of the proceeds from the sale of our common stock by the selling stockholder pursuant to this prospectus. However,

we will receive the proceeds of any cash exercise of the Warrants. If all of the Warrants were exercised for cash, we would receive

aggregate proceeds of approximately $4.1 million. We expect to use any proceeds received by us from the cash exercise of Warrants

to advance our QN-302 Investigative New Drug candidate towards clinical trials and for other working capital purposes. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

QLGN |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves a high degree of risk. See “Risk Factors” on page 5 of this prospectus to read about factors

that you should consider carefully before buying our securities. |

The

number of shares of common stock to be outstanding after this offering is based on 5,052,463 shares of common stock outstanding on August

31, 2023, includes all of the Resale Shares, and excludes:

| |

● |

439,549

shares of common stock issuable upon the exercise of options outstanding as of August 31, 2023, at a weighted average exercise price

of $35.05 per share; |

| |

|

|

| |

● |

1,619,934

shares of common stock issuable upon the exercise of warrants outstanding as of August 31, 2023, at a weighted average exercise price

of $3.15 per share, excluding the Warrants; |

| |

|

|

| |

● |

316,153

shares of common stock available for future issuance under our 2020 Stock Equity Incentive Plan (as amended, the “2020 Plan”),

as of August 31, 2023; and |

| |

|

|

| |

● |

100,000

shares of common stock available for future issuance under the 2022 Employee Stock Purchase Plan (the “ESPP”) as of August

31, 2023, which plan has been temporarily suspended. |

Unless

otherwise indicated, all information in this prospectus gives effect to the 1-for-10 reverse stock split effectuated on November 23,

2022.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider the risks described in the documents incorporated by

reference in this prospectus and any prospectus supplement, as well as other information we include or incorporate by reference into

this prospectus and any applicable prospectus supplement, before making an investment decision. Our business, financial condition or

results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities

could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and

the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results

could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks

described in the documents incorporated herein by reference, including our Annual Report on Form 10-K for the fiscal year ended December

31, 2022, filed with the SEC on May 2, 2023, as amended on July 7, 2023, our most recent quarterly report on Form 10-Q for the fiscal

quarter ended June 30, 2023 filed with the SEC on August 14, 2023, our current reports on Form 8-K and other documents we file with the

SEC from time to time that are deemed incorporated by reference into this prospectus.

The

sale of a substantial number of our shares of common stock in the public market, including resale of the Resale Shares issued to the

selling stockholder, could adversely affect the prevailing market price for our common stock and result in dilution to our stockholders.

We

are registering for resale up to 3,958,537 Resale Shares issuable to the selling stockholder upon the conversion of the Debenture and

exercise of the Warrant. Sales of substantial amounts of our shares of common stock in the public market, or the perception that such

sales might occur, could adversely affect the market price of our common stock. We cannot predict if and when the selling stockholder

may sell such shares in the public market. Furthermore, in the future, we may issue additional shares or other equity or debt securities

exercisable for, or convertible into, our common stock. To the extent that additional shares are issued or convertible securities are

exercised or converted, our stockholders will experience dilution. We may also consider from time to time various strategic alternatives

that could involve issuances of additional shares, including but not limited to acquisitions and business combinations, but do not currently

have any definitive plans to enter into any of these transactions.

USE

OF PROCEEDS

We

will not receive any of the proceeds from the sale of shares of our common stock in this offering. The selling stockholder will receive

all of the proceeds from the sale of shares of common stock hereunder.

We

may, however, receive cash proceeds equal to the exercise price of the Warrants that the selling stockholder may exercise, to the extent

any such Warrants are exercised for cash. The Warrants may be exercised, in whole or in part, for cash or by means of cashless exercise

if, at the time of exercise, there is no effective registration statement registering, or the prospectus contained therein is not available

for, the resale of the Warrant Shares by the selling stockholder. If all of the Warrants are exercised for cash, then we will receive

gross proceeds of approximately $4.1 million, subject to any adjustments. We expect to use any proceeds received by us from the cash

exercise of these Warrants to advance our QN-302 Investigative New Drug candidate towards clinical trials and for other working capital

purposes.

SELLING

STOCKHOLDER

We

have prepared this prospectus to allow the selling stockholder to offer and sell from time to time up to an aggregate of 3,958,537 Resale

Shares for its own account, consisting of (i) 1,458,537 shares of our common stock issuable upon conversion of the Debenture, based on

the initial conversion price of $1.32, and (iii) 2,500,000 Warrant Shares issuable upon exercise of the Warrant (without regard to any

exercise limitations therein) at the initial exercise price of $1.65.

We

are registering the offer and sale of the Resale Shares to satisfy certain registration rights that we granted the selling stockholder

in connection with the issuance of the Debenture and the Warrant.

The

following table sets forth (i) the name of the selling stockholder, (ii) the number of shares beneficially owned by the selling stockholder,

(iii) the number of Resale Shares that may be offered under this prospectus, and (iv) the number of shares of our common stock to be

beneficially owned by the selling stockholder after the offering assuming all of the Resale Shares covered by this prospectus are sold.

The

number of shares of common stock set forth in the following table for the selling stockholder does not take into account the exercise

limitations set forth in the Debenture and the Warrant, or the fact that the conversion price of the Debenture and the exercise price

of the Warrant may be adjusted from time to time in accordance with their terms. As a result, the actual number of Resale Shares that

may be issued to and sold by the selling stockholder could be materially less or more than the estimated numbers in the column titled

“Number of Shares Being Offered” depending on factors which cannot be predicted by us at this time. In addition, we do not

know how long the selling stockholder will hold the Resale Shares before selling them, and we currently have no agreements, arrangements

or understandings with the selling stockholder regarding the sale or other disposition of any Resale Shares.

Except

as described in this prospectus, the selling stockholder does not have, nor has it had during the three years prior to the date of this

prospectus, any position, office or other material relationships with us or any of our predecessors or affiliates. To our knowledge,

except as set forth in the table below, the selling stockholder is not a broker-dealer or affiliated with a broker-dealer, nor at the

time of the acquisition of the Debenture and the Warrant did it have direct or indirect agreements or understandings with any person

to distribute any common stock, including the Resale Shares.

The

information set forth in the table below is based upon information obtained from the selling stockholder. Beneficial ownership of the

selling stockholder is determined in accordance with Rule 13d-3(d) under the Exchange Act. The percentages of shares beneficially

owned prior to and after the offering are based on 5,052,463 shares of our common stock outstanding as of August 31, 2023,

and gives effect to the issuance of an aggregate of 3,958,537 Resale Shares.

Under

the terms of the Debenture and the Warrants, the selling stockholder may not exercise the Debenture or the Warrants to the extent such

exercise would cause such selling stockholder, together with its affiliates, to beneficially own a number of shares which would exceed

9.99% of our then outstanding shares following such conversion or exercise, excluding for purposes of such determination shares not yet

issued. The number of ordinary shares reflected in the table does not reflect this limitation.

As

used in this prospectus, the term “selling stockholder” includes the selling stockholder listed in the table below, together

with any additional selling stockholder listed in a prospectus supplement, and their donees, pledgees, assignees, transferees, distributees

and successors-in-interest that receive Resale Shares in any non-sale transfer after the date of this prospectus.

| | |

Shares

of Common Stock Beneficially Owned Prior

to this Offering | | |

Number

of Shares Being Offered | | |

Shares

of Common Stock Beneficially Owned After

this Offering | |

| Name

of Selling Stockholder | |

Number(1) | | |

Percent | | |

| | |

Number(2) | | |

Percent | |

| Alpha Capital

Anstalt | |

| 4,072,840 | | |

| 44.75 | % | |

| 3,958,537 | | |

| 114,303 | | |

| 1.26 | % |

(1) Includes (i) 22,985

shares of common stock held by the selling stockholder, (ii) 3,958,537 Resale Shares issuable to the selling stockholder pursuant

to the conversion of the Debenture and the exercise of the Warrant, and (iii) 91,318 shares of common stock issuable upon

the exercise of warrants held by the selling stockholder prior to the Private Placement which will continue to be held by the

selling stockholder after this offering, assuming (i) none of the aforementioned warrants or the Warrant is exercised by means of

the cashless exercise, and (ii) none of the limitations on the conversion of the Debenture and on exercise of the Warrant, as set

forth therein, apply. The address of Alpha Capital Anstalt is Altenbach 8, 9490 Vaduz, Liechtenstein.

(2) Assumes

the sale of all shares of common stock being offered pursuant to this prospectus.

PLAN

OF DISTRIBUTION

We

are registering the Resale Shares that may be issued to the selling stockholder pursuant to the terms of the Debenture and the Warrant

to permit the resale of these Resale Shares by the selling stockholder from time to time after the date of this prospectus. We will not

receive any of the proceeds from the sale of Resale Shares by the selling stockholder, other than the exercise price of the Warrant if

paid in cash.

The

selling stockholder and any of its donees, pledgees, assignees and successors-in-interest may, from time to time, sell, transfer or otherwise

dispose of any or all of the Resale Shares covered hereby on the principal trading market or any other stock exchange, market or trading

facility on which our common stock is then traded or in private transactions. These dispositions may be at fixed prices, at prevailing

market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale,

or at negotiated prices. The selling stockholder may use any one or more of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the Resale Shares as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its own account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholder to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling stockholder may also sell the Resale Shares under Rule 144 or any other exemption from registration under the Securities Act,

if available, rather than under this prospectus.

Broker-dealers

engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121. In connection with the sale of the Resale Shares or interests therein, the selling stockholder

may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the

Resale Shares in the course of hedging the positions they assume. The selling stockholder may also sell the Resale Shares short and deliver

the Resale Shares to close out its short positions, or loan or pledge the Resale Shares to broker-dealers that in turn may sell the Resale

Shares. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions

or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the Resale

Shares offered by this prospectus, which Resale Shares such broker-dealer or other financial institution may resell pursuant to this

prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholder may, from time to time, pledge or grant a security interest in some or all of the Resale Shares owned by it and,

if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the Resale Shares, from

time to time, under this prospectus, or under an amendment to the registration statement of which this prospectus forms a part amending

the list of selling stockholder to include the pledgee, transferee or other successors in interest as selling stockholders under this

prospectus. The selling stockholder may also transfer the Resale Shares in other circumstances, in which case the pledgees, transferees

or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The

selling stockholder and any broker-dealers or agents that are involved in selling the Resale Shares may be deemed to be “underwriters”

within the meaning of Section 2(11) of the Securities Act in connection with such sales. In such event, any discounts, commissions, concessions

or profits received by such broker-dealers or agents and any profit on the resale of the Resale Shares purchased by them may be deemed

to be underwriting commissions or discounts under the Securities Act. Selling stockholders who are “underwriters” within

the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act. The

selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with

any person to distribute the Resale Shares.

To

the extent required, the Resale Shares to be sold, the names of the selling stockholder, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, and any applicable commissions or discounts with respect to a particular offer

will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement

that includes this prospectus.

The

Resale Shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws.

In addition, in certain states, the Resale Shares covered hereby may not be sold unless they have been registered or qualified for sale

in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the Resale Shares. Discounts, concessions,

commissions and similar selling expenses attributable to the sale of Resale Shares covered by this prospectus will be borne by the selling

stockholder. We have agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities

under the Securities Act, relating to the registration of the Resale Shares offered by this prospectus.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the selling stockholder

without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for

us to be in compliance with the current public information under Rule 144 under the Securities Act or (ii) all of the securities have

been sold pursuant to this prospectus or Rule 144 under the Securities Act.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the Resale Shares may not simultaneously

engage in market making activities with respect to the Resale Shares for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Resale

Shares by the selling stockholder or any other person.

We

will make copies of this prospectus available to the selling stockholder for the purpose of satisfying the requirement to deliver a copy

of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities

Act).

DESCRIPTION

OF OUR CAPITAL STOCK

The

following description of the terms of our securities is not complete and is qualified in its entirety by reference to our Certificate

of Incorporation, and our amended and restated bylaws (the “Bylaws”), both of which are filed as exhibits to our Annual Report

on Form 10-K.

Under

our Certificate of Incorporation and Bylaws, we are authorized to issue 240,000,000 shares of capital stock, consisting of 225,000,000

shares of common stock, par value $0.001 per share, and 15,000,000 shares of preferred stock, $0.001 par value per share, including 7,000

shares that have been designated as Series Alpha Preferred Stock. As of August 31, 2023, there were 5,052,463 shares of our common stock

outstanding and no shares of our Series Alpha Preferred Stock outstanding.

Common

Stock

Pursuant

to the terms of our Certificate of Incorporation, the holders of common stock are entitled to one vote per share on all matters to be

voted upon by the stockholders, except on matters relating solely to terms of preferred stock. Subject to preferences that may be applicable

to any outstanding preferred stock, the holders of common stock will be entitled to receive ratably such dividends, if any, as may be

declared from time to time by our Board of Directors out of funds legally available therefor. In the event of liquidation, dissolution

or winding up, the stockholders will be entitled to share ratably in all assets remaining after payment of liabilities, subject to prior

distribution rights of preferred stock, if any, then outstanding. The holders of our common stock will have no preemptive or conversion

rights or other subscription rights. There will be no redemption or sinking fund provisions applicable to our common stock.

Preferred

Stock

Pursuant

to the terms of our Certificate of Incorporation, our Board of Directors has the authority to issue preferred stock in one or more classes

or series and to fix the designations, powers, preferences and rights, and the qualifications, limitations or restrictions thereof, including

dividend rights, conversion right, voting rights, terms of redemption, liquidation preferences and the number of shares constituting

any class or series, without further vote or action by the stockholders.

The

issuance of shares of preferred stock, or the issuance of rights to purchase such shares, may decrease the amount of earnings and assets

available for distribution to the holders of common stock, could adversely affect the rights and powers, including voting rights, of

the common stock, and could have the effect of delaying, deterring or preventing a change of control of us or an unsolicited acquisition

proposal.

Stock

Options

As

of August 31, 2023, we had outstanding options to acquire 439,549 shares of our common stock, having a weighted-average exercise price

of $35.05 per share.

Warrants

As

of August 31, 2023, we had outstanding warrants to purchase an aggregate of 4,119,934 shares of our common stock, having a weighted-average

exercise price of $2.24 per share.

Debenture

The

Debenture held by the selling stockholder has a maturity date of December 22, 2025 and is convertible, at any time, and from time to

time, until the Debenture is no longer outstanding, at the selling stockholder’s option, into shares of our common stock, at a

price equal to $1.32 per share, subject to adjustment as described in the Debenture and other terms and conditions described in the Debenture,

including our receipt of the necessary stockholder approvals, which we obtained at our 2023 annual meeting of stockholders.

Between

January 9 and 12, 2023, the Company issued 841,726 shares of common stock upon the selling stockholder’s partial conversion of

the Debenture at $1.32 per share for a total of $1,111,078 principal. As of August 31, 2023, the Company paid an aggregate of $330,000

as the Monthly Redemption Amounts (as defined below) under the Debenture in cash for June, July and August. As of August 31, 2023, the

Debenture was convertible into 1,458,537 shares of our common stock. The Debenture includes a beneficial ownership blocker of 9.99%,

which may only be waived by the selling stockholder upon 61 days’ notice to us.

If

at any time while the Debenture is outstanding, we or any of our subsidiaries as listed in the Agreement, as applicable, sells or grants

any option to purchase or sells or grants any right to reprice, or otherwise disposes of or issues (or announces any sale, grant or any

option to purchase or other disposition), any shares of our common stock or common stock equivalents entitling any person to acquire

shares of our common stock (the “Common Stock Equivalents”) at an effective price per share that is lower than the then Conversion

Price (such lower price, the “Base Conversion Price” and such issuances, collectively, a “Dilutive Issuance”),

then simultaneously with the consummation (or, if earlier, the announcement) of each Dilutive Issuance, the Conversion Price will be

reduced to equal the Base Conversion Price, provided that the Base Conversion Price will not be less than $0.260 (subject to adjustment

for reverse and forward stock splits, recapitalizations and similar transactions following the date of the Agreement).

Commencing

June 1, 2023 and continuing on each Monthly Redemption Date until the earlier of (i) December 22, 2025 (i.e., the Maturity Date)

and (ii) the full redemption of the Debenture, we will redeem $110,000 plus accrued but unpaid interest, liquidated damages and any amounts

then owing under the Debenture (the “Monthly Redemption Amount”). The Monthly Redemption Amount will be paid in cash; provided

that after the first two monthly redemptions, we may elect to pay all or a portion of a Monthly Redemption Amount in shares of our common

stock, based on a conversion price equal to the lesser of (i) the then Conversion Price of the Debenture and (ii) 85% of the average

of the VWAPs (as defined in the Debenture) for the five consecutive trading days ending on the trading day that is immediately prior

to the applicable Monthly Redemption Date. We may also redeem some or all of the then outstanding principal amount of the Debenture at

any time for cash in an amount equal to 105% of the then outstanding principal amount of the Debenture being redeemed plus accrued but

unpaid interest, liquidated damages and any amounts then owing under the Debenture. These monthly redemption and optional redemptions

are subject to the satisfaction of the terms and conditions described in the Debenture, including our receipt of the necessary stockholder

approvals, which we obtained at our 2023 annual meeting of stockholders.

The

Debenture accrues interest at the rate of 8% per annum, which does not begin accruing until December 1, 2023, and will be payable on

a quarterly basis. Interest may be paid in cash or shares of our common stock or a combination thereof at our option; provided that interest

may only be paid in shares if the Equity Conditions (as defined in the Debenture) have been satisfied.

Except

as otherwise set forth in the Debenture, we may not prepay any portion of the principal amount of the Debenture without the selling stockholder’s

prior written consent.

Registration

Rights

We

entered into a registration rights agreement with the selling stockholder in December 2022 (the “Registration Rights Agreement”),

pursuant to which we agreed to file one or more registration statements, as necessary, and to the extent permissible, to register under

the Securities Act the resale of (a) all shares of our common stock issued and issuable upon conversion in full of the Debenture (without

regard to any conversion limitations therein), (b) all shares of our common stock issued and issuable as interest or principal on the

Debenture (assuming all permissible interest and principal payments are made in shares of our common stock and the Debenture is held

until maturity), (c) all Warrant Shares then issued and issuable upon exercise of the Warrant (without regard to any exercise limitations

therein), (d) any additional shares of our common stock issued and issuable in connection with any anti-dilution provisions in the Debenture

or the Warrant (in each case, without giving effect to any limitations on conversion set forth in the Debenture or limitations on exercise

set forth in the Warrant) and (e) any securities issued or then issuable upon any stock split, dividend or other distribution, recapitalization

or similar event with respect to the foregoing. Under the terms of the Registration Rights Agreement, we agreed to use commercially reasonable

efforts to keep the registration statement continuously effective under the Securities Act until the earliest date that all Registrable

Securities covered by such registration statement (i) have been sold, thereunder or pursuant to Rule 144, or (ii) may be sold without

volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement for us to be in compliance with the current public

information requirement under Rule 144, as determined by our counsel pursuant to a written opinion letter to such effect, addressed and

acceptable to our transfer agent.

We

filed a resale registration statement on Form S-3 pursuant to the requirements of the Registration Rights Agreement on December 2022

(File Number 333-269088), which registration statement was declared effective by the SEC on January 5, 2023, and are now filing this

post-effective amendment to the registration statement, of which this prospectus forms a part.

Anti-Takeover

Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

The

provisions of Delaware law and our Certificate of Incorporation and Bylaws could discourage or make it more difficult to accomplish a

proxy contest or other change in our management or the acquisition of control by a holder of a substantial amount of our voting stock.

It is possible that these provisions could make it more difficult to accomplish, or could deter, transactions that stockholders may otherwise

consider to be in their best interests or in our best interests. These provisions are intended to enhance the likelihood of continuity

and stability in the composition of our board of directors and in the policies formulated by the board of directors and to discourage

certain types of transactions that may involve an actual or threatened change of our control. These provisions are designed to reduce

our vulnerability to an unsolicited acquisition proposal and to discourage certain tactics that may be used in proxy fights. Such provisions

also may have the effect of preventing changes in our management.

Delaware

Statutory Business Combinations Provision. We are subject to the anti-takeover provisions of Section 203 of the Delaware General

Corporation Law (the “DGCL”). Section 203 prohibits a publicly-held Delaware corporation from engaging in a “business

combination” with an “interested stockholder” for a period of three years after the date of the transaction in which

the person became an interested stockholder, unless the business combination is, or the transaction in which the person became an interested

stockholder was, approved in a prescribed manner or another prescribed exception applies. For purposes of Section 203, a “business

combination” is defined broadly to include a merger, asset sale or other transaction resulting in a financial benefit to the interested

stockholder, and, subject to certain exceptions, an “interested stockholder” is a person who, together with his or her affiliates

and associates, owns, or within three years prior, did own, 15% or more of the corporation’s voting stock.

Election

and Removal of Directors. Except as may otherwise be provided by the DGCL, any director or the entire board of directors may be removed,

with or without cause, at an annual meeting or a special meeting called for that purpose, by the holders of a majority of the shares

then entitled to vote at an election of directors, provided a quorum is present. Vacancies on our board of directors resulting from the

removal of directors and newly created directorships resulting from any increase in the number of directors may be filled solely by the

affirmative vote of a majority of the remaining directors then in office (although less than a quorum) or by the sole remaining director.

This system of electing and removing directors may discourage a third party from making a tender offer or otherwise attempting to obtain

control of us, because it generally makes it more difficult for stockholders to replace a majority of our directors. Our Certificate

of Incorporation and Bylaws do not provide for cumulative voting in the election of directors.

Advance

Notice Provisions for Stockholder Proposals and Stockholder Nominations of Directors. Our Bylaws provide that, for nominations to

the board of directors or for other business to be properly brought by a stockholder before a meeting of stockholders, the stockholder

must first have given timely notice of the proposal in writing to our Secretary. For an annual meeting, a stockholder’s notice

generally must be delivered not less than 90 days or more than 120 days before the anniversary of the previous year’s annual meeting.

Special

Meetings of Stockholders. Special meetings of the stockholders may be called at any time only by the board of directors, the Chairman

of the board of directors, the Chief Executive Officer or the President, subject to the rights of the holders of any series of preferred

stock then outstanding.

Blank-Check

Preferred Stock. Our board of directors is authorized to issue, without stockholder approval, preferred stock, the rights of which

will be determined at the discretion of the board of directors and that, if issued, could operate as a “poison pill” to dilute

the stock ownership of a potential hostile acquirer to prevent an acquisition that our board of directors does not approve.

Transfer

Agent

The

transfer agent and registrar for our common stock is Equiniti Trust Company. Its address is P.O. Box 64945, Saint Paul MN 55164-0945

and its telephone number is (800) 468-9716.

Listing

Our

common stock is listed on The Nasdaq Capital Market under the symbol “QLGN.”

LEGAL

MATTERS

Reed

Smith LLP, Los Angeles, California, will pass upon the validity of the shares of common stock offered hereby.

EXPERTS

The

consolidated financial statements of Qualigen Therapeutics, Inc. for the year ended December 31, 2022 incorporated in this Registration

Statement and Prospectus have been so incorporated in reliance on the report of Baker Tilly US, LLP, an independent registered public

accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

have filed with the SEC a registration statement on Form S-1 under the Securities Act for the shares of common stock, pre-funded warrants

and accompanying common stock warrants being offered by this prospectus. This prospectus, which is part of the registration statement,

does not contain all of the information included in the registration statement and the exhibits. For further information about us and

the common stock, pre-funded warrants and accompanying common warrants offered by this prospectus, you should refer to the registration

statement and its exhibits. References in this prospectus to any of our contracts or other documents are not necessarily complete, and

you should refer to the exhibits attached to the registration statement for copies of the actual contract or document. Additionally,

we file annual, quarterly and current reports, proxy statements and other information with the SEC.

The

SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file

electronically with the SEC, including us, at http://www.sec.gov. We make available, free of charge, on our website at www.qlgntx.com,

our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports and statements

as soon as reasonably practicable after they are filed with the SEC. The contents of our and the SEC’s websites are not part of

this prospectus, and the reference to our and the SEC’s websites do not constitute incorporation by reference into this prospectus

of the information contained at those sites, other than documents we file with the SEC that are specifically incorporated by reference

into this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information

in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part

the information or documents listed below that we have filed with the SEC (Commission File No. 001-37428):

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on May 2, 2023, as amended on Form 10-K/A filed on July 7, 2023; |

| |

|

|

| |

● |

Our

Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023 and June 30, 2023, as filed with the SEC on May 15,

2023 and August 14, 2023, respectively; |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on January 10, 2023, January 20, 2023, April 24, 2023, May 5, 2023, May 19, 2023,

June 26, 2023, July 13, 2023, July 26, 2023, August 1, 2023 and August 4, 2023; and |

| |

|

|

| |

● |

the

description of our common stock, which is registered under Section 12 of the Exchange Act, in our registration statement on Form 8-A, filed with the SEC on June 15, 2015, as updated by Exhibit 4.9 to Amendment No. 1 to our Annual Report on Form 10-K for the

fiscal year ended December 31, 2022, filed on July 7, 2023. |

All

filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus

is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective

amendment that indicates the termination of the offering of the shares of our common stock made by this prospectus and will become a

part of this prospectus from the date that such documents are filed with the SEC. Information in such future filings updates and supplements

the information provided in this prospectus. Any statements in any such future filings will automatically be deemed to modify and supersede

any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference

to the extent that statements in the later filed document modify or replace such earlier statements.

You

can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Qualigen

Therapeutics, Inc.

5857

Owens Avenue, Suite 300

Carlsbad,

California 92008

(760)

452-8111

Attn:

Secretary

You

may also access the documents incorporated by reference in this prospectus through our website www.qlgntx.com. Except for the specific

incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in this prospectus

or the registration statement of which it forms a part.

3,958,537

Shares

Common

Stock

Prospectus

,

2023

PART

II INFORMATION NOT REQUIRED IN PROSPECTUS

Item

13. Other Expenses of Issuance and Distribution

The

following table sets forth an estimate of the fees and expenses payable by us in connection with the sale of the securities being registered.

| | |

Amount | |

| SEC registration fees | |

$ | 514.75 | * |

| Accounting fees and expenses** | |

| 10,000.00 | |

| Legal fees and expenses** | |

| 32,000.00 | |

| Miscellaneous fees and expenses** | |

| 485.25 | |

| Total | |

$ | 43,000.00 | |

*

Previously paid.

**

Except for the SEC registration fee, estimated solely for the purposes of this Item 13. Actual expenses may vary.

Item

14. Indemnification of Directors and Officers

Our

amended and restated certificate of incorporation provides that we shall indemnify, to the fullest extent authorized by the Delaware

General Corporation Law (“DGCL”), each person who is involved in any litigation or other proceeding because such person is

or was a director or officer of Qualigen Therapeutics, Inc. or is or was serving as an officer or director of another entity at our request,

against all expense, loss or liability reasonably incurred or suffered in connection therewith. Our amended and restated certificate

of incorporation provides that the right to indemnification includes the right to be paid expenses incurred in defending any proceeding

in advance of its final disposition, provided, however, that such advance payment will only be made upon delivery to us of an undertaking,

by or on behalf of the director or officer, to repay all amounts so advanced if it is ultimately determined that such director is not

entitled to indemnification. If we do not pay a proper claim for indemnification in full within 30 days after we receive a written claim

for such indemnification, our certificate of incorporation and our bylaws authorize the claimant to bring an action against us and prescribe

what constitutes a defense to such action.

Section

145 of the Delaware General Corporation Law permits a corporation to indemnify any director or officer of the corporation against expenses

(including attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with

any action, suit or proceeding brought by reason of the fact that such person is or was a director or officer of the corporation, if

such person acted in good faith and in a manner that he reasonably believed to be in, or not opposed to, the best interests of the corporation,

and, with respect to any criminal action or proceeding, if he or she had no reason to believe his or her conduct was unlawful. In a derivative

action, (i.e., one brought by or on behalf of the corporation), indemnification may be provided only for expenses actually and reasonably

incurred by any director or officer in connection with the defense or settlement of such an action or suit if such person acted in good

faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests of the corporation, except that

no indemnification shall be provided if such person shall have been adjudged to be liable to the corporation, unless and only to the

extent that the court in which the action or suit was brought shall determine that the defendant is fairly and reasonably entitled to

indemnity for such expenses despite such adjudication of liability.

Pursuant