0000894501

false

0000894501

2023-08-28

2023-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 28, 2023

GOLD ROCK HOLDINGS, INC.

(Name

of Small Business Issuer in its charter)

| |

|

|

|

|

| Nevada |

|

000-51074 |

|

87-0434297 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification No.) |

2020 General Booth Blvd.

Suite 230

Virginia Beach, VA 23454

(Address of principal executive offices)

Registrant’s

telephone number: (757) 306-6090

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item

1.01- Entry Into a Material Definitive Agreement

On

August 28, 2023, Gold Rock Holdings, Inc. (GRHI) entered into a non-binding Memorandum of Understanding (MOU) with Loot8, LLC. a Nevada

Limited Liabilty Corporation (GRHI and Loot8, LLC referred to hereinafter as the “Parties”)..

The

MOU outlines general terms and conditions for GRHI to pusue the possible acquistion of certain assets held by Loot8, LLC. And, Loot8

desires to sell certain assets to GRHI. It is agreed upon that if negoations become successful upon completing necessary due diligence

and verfiications, the parties would proceed accordingly with a definative agreement on cerrtain assets within 90-days of signing the

MOU.

Loot8,

an innovative enterprise-level content management platform, is redefining digital collectibles and fan experiences in the Web3 era. Integrating

a suite of advanced tools, the platform offers unique benefits like product drops, venue interactions, and sustained fan engagement.

Available in the App Store, Google Play Store and in the browser, Loot8 seamlessly bridges Web2 and Web3, providing a secure SaaS-like

transition into the future of digital content. With its ability to merge digital collectibles with real-world experiences, it’s adaptable

across events like concerts, conferences and sports.

Financial

Item 9.01 -Financial Statements and Exhibits.

(a)

Financial statements of business acquired. Not applicable.

(b)

Pro forma financial information. Not applicable.

(c)

Shell company transactions. Not applicable.

(d)

Exhibits.

| |

|

| Number |

Description |

| 10.1+

|

Non-binding Memorandum of Understanding (MOU) |

+Filed

herewith

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

| Date:

August 31, 2023 |

Gold

Rock Holdings, Inc. |

| |

|

| |

By /s/

Richard Kaiser |

| |

Director/

CFO |

Non-Binding MEMORANDUM OF UNDERSTANDING

This non-binding Memorandum of Understanding (“MOU”) dated August 28, 2023, is by and between Gold Rock Holdings, Inc. (GRHI), a Nevada Corporation and Loot8, LLC., a Nevada Limited Liability Corp. (GRHI and LOOT8 may individually referred to hereinafter as “Party” collectively referred to hereinafter as the “Parties”). This MOU sets forth the general terms and conditions to which the GRHI and the LOOT8 have jointly agreed.

A. Loot8 has specific assets.

B. LOOT8 (Seller) desires to sell certain Assets, and GRHI (Buyer) desires to purchase Assets from or controlled by LOOT8, and conduct business activities with the LOOT8 Assets.

This MOU contemplates the proposed transaction (the “Transaction”) between the Parties that provides for GRHI to acquire Assets controlled by GRHI. The general understating of the non-binding terms and conditions of the Transaction are set forth herein.

-1-

AGREEMENT

The following shall constitute an expression of the mutual intent of the Parties hereto and is contingent upon the successful negotiation, execution, and delivery of necessary documentations to hopefully proceed with a definitive agreement between GRHI and the LOOT8 which would set-forth in details the terms and conditions of the proposed transactions and agreements (the “Definitive Agreements”).

1. Understanding

1.1 Transaction. GRHI desires to acquire 100% of certain Assets that are owned by LOOT8 and LOOT8 desires to sell those Assets. The Parties contemplate that the principal terms and conditions of the Transaction shall be as follows:

(a) Terms: It is hopefully that within 90 business days of signing this non-binding MOU Agreement, GRHI and LOOT8 expects to enter into a Definitive Binding Agreement which will specifically outline the terms of the Asset sale.

1.2 Conditions to Consummation of the Transaction. The obligations of GRHI, with respect to the Transaction, shall be subject to the satisfaction of the conditions customary to transactions of this type, including without limitation: (a) confirmation that the representations and warranties of LOOT8 are true and accurate in all respects affecting the transaction; and (b) satisfactory completion of due diligence by GRHI.

1.3 Access to Relevant Documents and Properties. LOOT8 shall give GRHI and its representative’s full access to any personnel and all properties, documents, books, records, and operations relating to the LOOT8 within a reasonable amount of time from the date of any such request, but in each such case within ten (10) business days from the date of request. All such requests for access under this Section shall be delivered via email to an authorized agent or via facsimile to GRHI by LOOT8.

-2-

2. Agreement

2.1 Transaction. The undersigned agree to the terms of the Transaction as set forth above and each agree to cooperate in the negotiation, preparation of such possible Definitive Agreements, and other necessary documentation contemplated by the Transaction and agree to execute all documents consistent with the above terms to facilitate the consummation of such Transaction.

3. Costs and Expenses

All costs and expenses incurred by GRHI or LOOT8 in connection with the continued negotiation of the Transaction shall be borne individually of the parties.

4. Exclusive Negotiating Rights

In order to induce Company to commit the resources, forego other potential opportunities, and incur the legal, accounting and incidental expenses necessary properly to evaluate the transaction, described above, and to negotiate the terms of, and consummate, the Transaction contemplated hereby, LOOT8 agrees that up to November 26, 2023, LOOT8, or its affiliates and their respective officers, directors, employees and agents shall not initiate, solicit, encourage, directly or indirectly, or accept any offer or proposal, regarding the possible acquisition by any person other than GRHI, including, without limitation, by way of a purchase of shares, purchase of assets or merger, of all or any substantial part of its equity securities or assets, and shall not (other than in the ordinary course of business as heretofore conducted) provide any confidential information regarding LOOT8’s Assets or business to any person other than GRHI and its duly appointed representatives.

5. Termination

Termination of negotiations by Company prior to any execution and delivery of a Definitive Agreements shall be without liability and no Party hereto shall be entitled to any form of relief whatsoever, including without limitation, injunctive relief, or damages. Termination by LOOT8 can only be made if GRHI fails to perform under this MOU and after a ten (10) day notice period has not been remedied.

-3-

6. Governing Law

This MOU shall be governed by and construed in accordance with the laws of the State of Virginia applicable to agreements made and to be performed entirely within such State and without regard to its choice of law principles.

7.Confidentiality.

Except as provided herein, the existence and the terms of this MOU, Parties shall be maintained in confidence by the Parties hereto and their respective officers, directors, and employees. Except as compelled to be disclosed by judicial or administrative process or by other requirements of law, legal process, rule or regulation (including to the extent required in connection with any filings made by the Parties or their controlling affiliates with the Securities and Exchange Commission) all public announcements, notices or other communications regarding such matters to third parties, including without limitation any disclosure regarding the transactions contemplated hereby, shall require the prior approval of all Parties hereto.

8. Amendment.

Any amendment(s) to this non-binding MOU shall be in writing and signed by all Parties hereto.

9. Miscellaneous.

9.1 Authority. The execution, delivery and performance by LOOT8 of this MOU (a) has been duly authorized by all requisite corporate and, if required, majority ownership action on the part of LOOT8(b) and this MOU will not (i) violate (A) any provision of law, statute, rule or regulation, or of the certificate or articles of incorporation or other constitutive documents or by-laws of LOOT, (B) any order of any Governmental Authority or (C) any provision of any indenture, agreement or other instrument to which LOOT8is a party or by which it or any of the Assets is or may be bound, (ii) result in the creation or imposition of any Lien upon or with respect to LOOT’s Assets, and assets of its subsidiaries.

-4-

9.2 indemnity.

(a) GRHI and LOOT8 shall each indemnify each other, and the other Party’s directors, officers, partners, employees and agents (each such Person being called an “Indemnity”) against, and to hold each Indemnity harmless from, any and all losses, claims, damages, liabilities and related expenses, including reasonable counsel fees, charges and disbursements, incurred by or asserted against any Indemnities arising out of in any way connected with, or as a result of (i) the execution or delivery of this MOU or any agreement or instrument contemplated hereby, the performance by the Parties thereto of their respective obligations hereunder or the consummation of the Definitive Agreements and the other transactions contemplated thereby, and (ii) any claim, litigation investigation or proceeding relating to any of the foregoing, whether or not any Indemnity is a party thereto.

(b) The provisions of this Section 9.2 shall remain operative and in full force and effect regardless of the expiration of the term of this MOU the consummation of the transactions contemplated hereby, the invalidity or unenforceability of any term or provision of this MOU, or any investigation made by or on behalf of GRHI.

9.3 Agreement to Perform Necessary Acts. GRHI and LOOT8 agree to perform any further acts and execute and deliver any documents that may be reasonably necessary to carry out the provisions and intent of this non-binding MOU; if, not, the Section 5 above takes precedence.

10. Counterparts and/or Facsimile Signature.

This non-binding MOU may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original but all of which when taken together shall constitute a single contract and shall become effective. Delivery of an executed signature page to this Agreement by facsimile transmission or email correspondence shall be as effective as delivery of a manually signed counterpart of this Agreement.

IN WITNESS WHEREOF, the Parties hereto, intending to be legally bound hereby, have each caused to be affixed hereto its or his/her hand and seal the day indicated.

Gold Rock Holdings, Inc.

/s/ Richard Kaiser _

Richard Kaiser - Director/CFO

Date: August 28, 2023

Loot8, LLC.

/s/ Marcus Daley

Marcus Daley – CEO/Co-Founder

Date: August 28, 2023

-5-

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

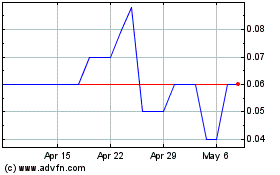

Gold Rock (PK) (USOTC:GRHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gold Rock (PK) (USOTC:GRHI)

Historical Stock Chart

From Apr 2023 to Apr 2024