Form 8-K - Current report

August 31 2023 - 4:01PM

Edgar (US Regulatory)

0001353538FALSE00013535382023-08-312023-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 31, 2023

Appgate, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-52776 | | 20-3547231 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification) |

2 Alhambra Plaza, Suite PH-1-B, Coral Gables, FL 33134

(Address of principal executive offices) (Zip Code)

(866) 524-4782

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On August 31, 2023, Appgate, Inc., a Delaware corporation (the “Company” or “Appgate”), released an Investor Presentation, dated August 31, 2023. A copy of Appgate’s Investor Presentation is attached hereto and furnished as Exhibit 99.1 and is incorporated by reference into this Item 7.01. A copy of the Investor Presentation is also available on Appgate’s investor relations website at ir.appgate.com.

Use of our Website and Social Media to Distribute Material Company Information

We use our website as a channel of distribution for important Company information. We routinely post on our website important information, including press releases, investor presentations and financial information, which may be accessed by clicking on the “Investor Relations” section of www.appgate.com. We also use our website to expedite public access to time-critical information regarding our Company in advance of or in lieu of distributing a press release or a filing with the SEC disclosing the same information. Therefore, investors should look to the “Investor Relations” section of our website for important and time-critical information. Visitors to our website can also register to receive automatic e-mail and other notifications alerting them when certain new information is made available on our website. Information contained on, or accessible through, our website is not a part of and is not incorporated by reference in this Current Report on Form 8-K.

The information in this Item 7.01, including the accompanying Exhibit 99.1, shall be deemed “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing made by Appgate under the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | |

| Investor Presentation dated August 31, 2023 (furnished solely for purposes of Item 7.01 of this Form 8-K) |

| |

| 104 | Cover Page Interactive Data File |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: August 31, 2023 | Appgate, Inc. |

| | |

| By: | /s/ Leo Taddeo |

| | Leo Taddeo |

| | Chief Executive Officer and President |

Q2’23 Investor Presentation August 31, 2023

This presentation contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Statements that do not relate strictly to historical or current facts are forward- looking and can be identified by the use of words such as “anticipate,” “estimate,” “could,” “would,” “should,” “will,” “may,” “forecast,” “approximate,” “expect,” “project,” “seek,” “predict,” “potential,” “intend,” “plan,” “believe,” the negatives of such terms and other words of similar meaning. Without limiting the generality of the foregoing, forward-looking statements contained in this presentation include statements regarding Appgate and its industry relating to matters such as anticipated future financial and operational performance and business prospects. The forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from projected results. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Appgate has based these forward- looking statements on current expectations and assumptions about future events, taking into account all information currently known by Appgate. While Appgate considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks and uncertainties, many of which are difficult to predict and beyond Appgate’s control. These risks and uncertainties include, but are not limited to: Appgate’s future financial performance, including Appgate’s expectations regarding its annual recurring revenue and other key business metrics, total revenue, cost of revenue, gross profit or gross margin, operating expenses, including changes in operating expenses and our ability to achieve and maintain future profitability; Appgate’s ability to continue as a going concern absent access to sources of liquidity; the effects of increased competition in Appgate’s markets and Appgate’s ability to compete effectively; growth in the total addressable market for Appgate’s products and services; market acceptance of Zero Trust solutions and technology generally; market acceptance of Appgate’s products and services and Appgate’s ability to increase adoption of its products; Appgate’s ability to maintain the security and availability of its products; Appgate’s ability to develop new products, or enhancements to existing products, and bring them to market in a timely manner; Appgate’s ability to maintain and expand its customer base, including by attracting new customers; Appgate’s ability to maintain, protect and enhance its intellectual property rights; Appgate’s ability to comply with laws and regulations that currently apply or become applicable to its business both in the United States and internationally; Appgate’s ability to maintain an effective system of disclosure controls and internal control over financial reporting; SIS Holdings’ significant influence over Appgate’s business and affairs; the future trading prices and liquidity of Appgate’s common stock; Appgate’s indebtedness, which may increase risk to Appgate’s business; and other risks and uncertainties, including those described under the section entitled “Risk Factors” in Appgate’s Form 10-K for the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission (“SEC”) on March 31, 2023, as updated by any subsequent filings which Appgate makes with the SEC. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Appgate will not and does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. In this presentation, we present certain financial measures that are not calculated in accordance with accounting principles generally accepted in the United States of America (“GAAP”), such measures are referred to herein as “non-GAAP.” You should review the reconciliation included elsewhere in this presentation carefully in connection with your consideration of such non-GAAP measures and note that the way in which we calculate these measures may not be comparable to similarly titled measures employed by other companies. Specifically, we make use of the non- GAAP financial measures “Non-GAAP Gross Margin,” “Non-GAAP Operating Margin,” “Non- GAAP Gross Profit,” and “Non-GAAP Loss from Operations.” These non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered a substitute for financial information presented in accordance with GAAP and may be different from similarly titled non-GAAP measures used by other companies. A reconciliation is provided elsewhere in this presentation for each non-GAAP financial measure to the most directly comparable financial measure determined in accordance with GAAP. You are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure. See slide 13 of this presentation. 2 Cautionary Statements

WHY ZERO TRUST? I m p l i c i t t r u s t R e a c t i v e t o b r e a c h e s N e t w o r k i s e x p o s e d N e v e r t r u s t , a l w a y s v e r i f y A s s u m e b r e a c h N e t w o r k i s i n v i s i b l e Traditional Security IS OUTDATED Zero Trust IS A MODERN APPROACH VS 3

4 To empower and protect how people work and connect We achieve our mission by providing a Pure-play Zero Trust Platform O U R M IS S IO N

Zero Trust Network Access Secure Consumer Access Threat Advisory Services • Easily integrates with current architecture • Makes day-to-day easier for IT • Enables secure, anywhere, anytime access on any device • Ensures better overall experience for users • Intelligently permits risk-based access • Enhanced protection without compromising experience • Digital threat monitoring, warning and protection • Know where you’re vulnerable • Real-world adversary simulations • Advanced penetration testing What we do 5

Quarterly Revenue 6 (8%) Financial Highlights Q2 2023 | $ In Millions 1 Revenue variance and annual recurring revenue (ARR) growth represents Q2 2023 year over year change 2 Represents dollar-based net retention rate at June 30, 2023. See slide 12 for definition 3 See slide 13 for a reconciliation between GAAP and Non-GAAP financial measures Revenue Q2 Revenue Variance1 6% Q2 ARR Growth1 65% Q2 Non-GAAP Gross Margin3 (57)% Q2 Non-GAAP Operating Margin3 95% Dollar-Based Net Retention Rate2 $33.2 $43.0 $42.7 $42.0 2020 2021 2022 LTM $9.4 $11.2 $12.4 $11.1 $11.1 $10.6 $9.9 $11.3 $10.2 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

7 Annual Recurring Revenue (ARR) Note: See slide 12 for definition of Annual Recurring Revenue $ In Millions +6.1% year-over-year $28.7 $30.8 $31.1 $30.8 $31.8 $34.1 $33.7 $33.5 $33.8 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

8 Subscription Revenue Q2 2023 | $ In Millions RevenueQuarterly Revenue Subscription Perpetual Licenses & Services and Other 84% 78% 82% 84% $8.5 16% 22% 18% 16% $1.7 $11.1 $10.6 $9.9 $11.3 $10.2 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 71% 80% 81% 82% 29% 20% 19% 18% $33.2 $43.0 $42.7 $42.0 2020 2021 2022 LTM

9 Net Retention Rate Note: See slide 12 for definition of Net Retention Rate 129% 130% 114% 106% 93% 94% 96% 97% 95% Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

10 Total Customers Note: Appgate stopped offering our Compliance Sheriff (CSH) product which accounted for less than 5% of our total revenue for 2021. As a result of our one-time voluntary sunsetting of our Compliance Sheriff product and its respective customers, customer count trends on Customers Excluding CSH are more reflective of business trends. Customers Excluding CSH CSH only customers 580 591 607 596 599 624 647 650 658 63 59 45 643 650 652 596 599 624 647 650 658 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

11 Customers with ARR over $100K Note: See slide 12 for definition of Annual Recurring Revenue 54 64 66 69 70 64 68 69 69 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23

Appgate’s management reviews a number of key performance indicators, each as described below, to evaluate the business of Appgate, measure its performance, identify trends affecting its business, formulate business plans and make strategic decisions. • Annual recurring revenue (ARR) is defined as the annualized value of software-as-a-service (“SaaS”), subscription, and term- based license and maintenance contracts from Appgate’s recurring software products in effect at the end of a given period. • Dollar-based net retention rate (or net retention) reflects customer renewals, expansion, contraction, and customer attrition within Appgate’s ARR base. Appgate calculates dollar-based net retention rate by dividing the numerator by the denominator as set forth below: • Denominator: As of the end of a reporting period, ARR as of the last day of the same reporting period in the prior year. • Numerator: ARR for that same cohort of customers as of the end of the reporting period in the current year, including any expansion and net of contraction and customer attrition over the trailing 12 months, excluding ARR from new subscription customers in the current period. Key Business Metric Definitions 12

13 GAAP to Non-GAAP Reconciliations $ in Thousands Non-GAAP Operating MarginNon-GAAP Gross Margin

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

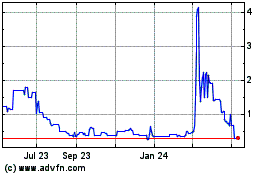

Appgate (PK) (USOTC:APGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

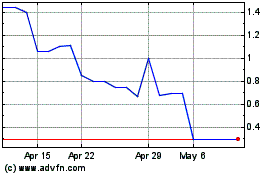

Appgate (PK) (USOTC:APGT)

Historical Stock Chart

From Apr 2023 to Apr 2024