Gold Stabilizes Near One-Month Highs as U.S. Interest Rate Hike Expectations

August 31 2023 - 8:43AM

IH Market News

Gold (AMEX:GLD) maintained its position near one-month highs on

Thursday, cushioning the losses incurred over the course of this

month. This shift came as the likelihood of another U.S. interest

rate hike was diminished by recent data indicating a slowdown in

the labor market. Traders are closely monitoring the imminent

inflation report.

Around 1003 GMT, spot gold (CCOM:GOLD) edged 0.1% higher,

reaching $1,944.74 per ounce, closely approaching its August 2 peak

of $1,948.79 recorded on Wednesday. Meanwhile, U.S. gold futures

experienced a marginal decline of 0.1%, settling at $1,971.50.

The U.S. economy’s growth during the second quarter was slightly

less robust than anticipated. Private payrolls experienced a 50%

reduction in August compared to July, and job openings hit a

2.5-year low last month.

Ole Hansen, Saxo Bank’s Head of Commodity Strategy, remarked

that the weaker-than-expected data has hastened the market’s belief

that peak interest rates might occur sooner than the Federal

Reserve would prefer.

The U.S. dollar is on track for its first monthly gain in three

months, while benchmark 10-year Treasury yields are poised for a

fourth consecutive monthly climb. These factors have contributed to

a 1% decline in gold prices throughout August.

However, despite this decline, the non-interest-bearing precious

metal managed to recoup some of its losses in the latter half of

the month, aided by the recent retreat in U.S. bond yields from

their 2007 highs.

Prices are currently positioned below a crucial resistance level

of $1,950, which Ole Hansen referred to as “the next battleground.”

He added that any weakness observed in the Personal Consumption

Expenditures (PCE) index, favored by the Federal Reserve to gauge

inflation, would bolster a potential upward movement for gold.

Silver retreated by 0.4% to $24.54 per ounce after reaching a

more than one-month high on Wednesday.

Platinum inched up by 0.1% to $974.27, set for its second

consecutive monthly gain. Meanwhile, palladium increased by 0.4% to

$1,227.22, yet it was on track for a 4% fall over the month.

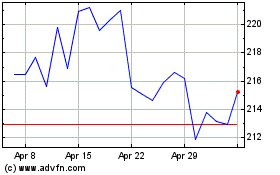

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

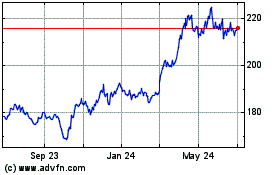

SPDR Gold (AMEX:GLD)

Historical Stock Chart

From Apr 2023 to Apr 2024