An

offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission.

Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor

may offers to buy be accepted prior to the time an Offering Circular which is not designated as a Preliminary Offering Circular is delivered

and the Offering Circular filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any sales of these securities in any state in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the laws of any such state. We may elect to satisfy our obligation

to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains

the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY

OFFERING CIRCULAR DATED April 10, 2023, SUBJECT TO COMPLETION

ETHEMA

HEALTH CORPORATION

950

Evernia Street

West

Palm Beach, Florida 33401

561-

500-0020

www.ethemahealth.com

UP

TO 4,166,666,660 SHARES OF COMMON STOCK THROUGH 416,666,666 UNITS OF 100 SHARES OF COMMON STOCK PER UNIT

Ethema

Health Corporation, a Colorado corporation (the “Company,” “Ethema,” “we,” “us,” and

“our”), is offering up to 4,166,666,660 shares (“Shares”) of its common stock, par value of $0.01 per share (“Common

Stock”) sold in Units of 100 Shares of Common Stock (“Units”) on a “best efforts” basis without any minimum

offering amount pursuant to Regulation A promulgated under the Securities Act of 1933, as amended (the “Securities Act”),

for Tier 2 offerings (the “Offering”). We expect that the fixed initial public offering price per Unit will be $0.12 (equivalent

of per share of Common Stock will be $0.0012) upon qualification of the Offering Statement of which this Offering Circular is a part

by the United States Securities and Exchange Commission (“SEC”). We expect to commence the sale of the Units within two calendar

days of the date on which the Offering Statement of which this Offering Circular is a part is declared qualified by the SEC. The Offering

is expected to expire on the earlier of (i) the date on which all of the Units offered are sold; or (ii) the date on which this Offering

is earlier terminated by us in our sole discretion. For avoidance of doubt, potential investors will only be able to purchase Shares

in Units. There will be no fractional Units sold.

We

have engaged DealMaker Securities LLC (the “Broker”), a broker-dealer registered with the U.S. Securities and Exchange Commission

(the “SEC”) and a member of Financial Industry Regulatory Authority (“FINRA”), to perform certain administrative

and compliance related functions in connection with this Offering, but not for underwriting or placement agent services. Potential investors

may at any time make revocable offers to subscribe to purchase Units with each containing 100 shares of our Common Stock. Such revocable

offers will become irrevocable when both the Offering Statement is qualified by the SEC and we accept your subscription. We may close

on investments on a “rolling” basis (so not all investors will receive their Shares on the same date). Funds will be promptly

refunded without interest, for sales that are not consummated. Upon closing under the terms as set out in this Offering Circular, funds

will be immediately available to us (where the funds will be available for use in our operations in a manner consistent with the “Use

of Proceeds” in this Offering Circular) and the Shares for such closing will be issued to investors. See “Plan

of Distribution” of this Offering Circular for more information.

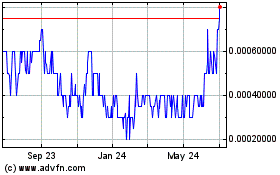

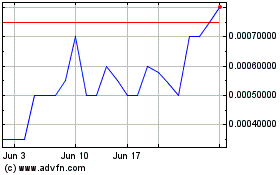

Our

Common Stock currently trades on the OTC Pink Open Market under the symbol “GRST” and the closing price of our Common

Stock on April 6, 2023 was $0.0004. Our Common Stock currently trades on a sporadic and limited basis.

An

investment in the Units (each containing 100 Shares) is subject to certain risks and should be made only by persons or entities able

to bear the risk of and to withstand the total loss of their investment. Prospective investors should carefully consider and review the “Risk

Factors” beginning on page 8.

| |

|

Price

to Public |

|

Dealer

Commissions & Fees (2) |

|

Proceeds

to the Company (3) |

| Per Unit |

|

$ |

0.12 |

|

|

$ |

.0012 |

|

|

$ |

.1188 |

|

| Maximum Offering (1) |

|

$ |

5,000,000 |

|

|

$ |

450,000 |

|

|

$ |

4,550,000 |

|

(1)

Reflects the proceeds to be received by the Company pursuant to the sale of Units under the subscription agreement. There is no minimum

Offering amount. See “Risk Factors” at page 8.

(2)

DealMaker Securities LLC, referred to herein as the Broker, is engaged to provide administrative and compliance related services in connection

with this Offering, but not for underwriting or placement agent services. Broker will receive a cash commission equal to one percent

(1%) of the amount raised in the Offering. Additionally, the Broker and its affiliates will receive certain other fees. The cash commissions

and certain other fees in aggregate shall not exceed a maximum compensation limit for this offering of nine percent (9%).

(3) Does

not include expenses of the Offering, including without limitation, legal, accounting, escrow

agent, transfer agent, other professional, printing, advertising, travel, marketing, and other expenses of this Offering.

After

the qualification by the SEC of the Offering Statement, this Offering will be conducted through our website at invest.ethemahealth.com,

whereby investors will receive, review, executed, and deliver subscription agreements electronically. Payment of the purchase price will

be made through a third-party processor by ACH debit transfer or wire transfer or credit card to an account designated by the Company.

We estimate total maximum fees related to this Offering would be approximately $450,000 assuming a fully subscribed offering. See “Use

of Proceeds” and “Plan of Distribution” for more details.

The

Broker is not participating as an underwriter or placement agent in this offering and will not solicit any investments, recommend our

securities, provide investment advice to any prospective investor, or distribute this Offering Circular or other offering materials to

potential investors. All inquiries regarding this offering should be made directly to the Company.

GENERALLY,

NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME

OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION

THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR

GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE

UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE

SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT

DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This

Offering Circular follows the disclosure format prescribed by Part II of Form 1-A.

TABLE

OF CONTENTS[1]

| Summary |

6 |

| Risk Factors |

7 |

| Dilution |

13 |

| Plan of Distribution

and Selling Shareholders |

14 |

| Use of Proceeds to Issuer |

19 |

| The Company’s

Business |

20 |

| The Company’s

Property |

34 |

| Management’s Discussion

and Analysis of Financial Condition and Results of Operations |

35 |

| Directors, Executive

Officers and Significant Employees |

42 |

| Compensation of Directors

and Officers |

43 |

| Security Ownership of

Management and Certain Shareholders |

43 |

| Interest of Management

and Others in Certain Transactions |

43 |

| Securities Being Offered |

44 |

| Financial Statements |

F-1 |

In

this Offering Circular, the term “Ethema”, “we”, “us”, “our”, or “the company”

refers to Ethema Health Corporation. and our subsidiaries on a consolidated basis.

THIS

OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS

BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND

INFORMATION CURRENTLY AVAILABLE TO OUR MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,”

“BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY

FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH

RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE OUR ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE

CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS,

WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. WE DO NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING

STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

You

should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including

in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking

statements. These factors include, among other things:

| |

· |

Our ability to effectively

execute our business plan, including without limitation our ability to respond to the highly competitive and rapidly evolving marketplace

and health and regulatory environments in which we intend to operate; |

| |

· |

Our ability to manage our

expansion, growth, and operating expenses; |

| |

· |

Our ability to evaluate

and measure our business, prospects and performance metrics, and our ability to differentiate our business model and service offerings; |

| |

· |

Our ability to compete,

directly and indirectly, and succeed in the highly competitive and evolving addiction treatment market; and |

| |

· |

Our ability to respond

and adapt to changes in technology, treatment techniques, and customer behavior. |

STATEMENTS

REGARDING FORWARD-LOOKING STATEMENTS

______

This

Offering Circular contains various "forward-looking statements." You can identify forward-looking statements by the use of

forward-looking terminology such as "believes," "expects," "may," "would," "could,"

“should," "seeks," "approximately," "intends," "plans," "projects," "estimates"

or "anticipates" or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking

statements by discussions of strategy, plans or intentions. These statements may be impacted by a number of risks and uncertainties.

Although

the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account

all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No

assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or

that deviations from them will not be material and adverse. We undertake no obligation, other than as may be required by law, to re-issue

this Offering Circular or otherwise make public statements updating our forward-looking statements.

IMPORTANT

INFORMATION ABOUT THIS OFFERING CIRCULAR

Please

carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively

as the offering circular. You should rely only on the information contained in this Offering Circular. We have not authorized anyone

to provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should

not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other

dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This

offering circular is part of an offering statement that we filed with the SEC, using a continuous offering process. Periodically, as

we have material developments, we will provide an offering circular supplement that may add, update or change information contained in

this offering circular. Any statement that we make in this offering circular will be modified or superseded by any inconsistent statement

made by us in a subsequent offering circular supplement. The offering statement we filed with the SEC includes exhibits that provide

more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related

exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports,

semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled

“Additional Information” below for more details.

We,

and if applicable, those selling Common Stock on our behalf in this offering, will be permitted to make a determination that the purchasers

of Common Stock in this offering are “qualified purchasers” in reliance on the information and representations provided by

the purchaser regarding the purchaser’s financial situation. Before making any representation that your investment does not exceed

applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A (“Regulation A”) under the Securities

Act of 1933, as amended (the “Securities Act”). For general information on investing, we encourage you to refer to www.investor.gov.

STATE

LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our

Common Stock is being offered and sold only to “qualified purchaser” (as defined in Regulation A). As a Tier 2 offering pursuant

to Regulation A, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements

and complying with certain anti-fraud provisions, to the extent that our Common Stock offered hereby is offered and sold only to “qualified

purchasers” or at a time when our Common Stock is listed on a national securities exchange. “Qualified purchasers”

include: (i) “accredited investors” under Rule 501(a) of Regulation D under the Securities Act (“Regulation D”)

and (ii) all other investors so long as their investment in our Common Stock does not represent more than 10% of the greater of their

annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural

persons).

To

determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified

purchaser” definition, the investor must be a natural person who has:

| |

1. |

an individual net worth,

or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the

primary residence of such person; or |

| |

2. |

earned income exceeding

$200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation

of the same income level in the current year. |

If

the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For

purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated

as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases

should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

SUMMARY

This

summary highlights information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all of

the information that you should consider before deciding to invest in our Common Stock. You should read this entire Offering Circular

carefully, including the risks associated with an investment in us discussed in the “Risk Factors” section of this Offering

Circular, before making an investment decision.

Summary

Ethema

Health Corporation aims to develop world class centers of excellence in addiction treatment for adults. We specialize in the treatment

of substance use disorders. By working with doctors and researchers, we strive to develop better assessment and treatment modalities

for the industry. We operate the Addiction Recovery Institute of America, a 41-bed addiction treatment facility located in West Palm

Beach, Florida. This facility is a three-story building with unfinished commercial space on the first floor and two floors of mixed commercial

and residential space where clients are treated and sleep. The first-floor space is being completed at which time it will allow the center

to expand to 52 beds by moving existing treatment space from the 2nd floor to the 1st Floor.

Through

this Offering, we are looking to expand our operations through acquisition of, and partnership with, other treatment facilities. By integrating

operations and reducing redundancies, we can offer an efficient and effective treatment plan to service the unique and varying needs

of our patients.

The

Offering

The

offering is for Common Stock of Ethema Health Corporation The rights of the Common Stock are described more fully in “Securities

Being Offered.”

| Securities offered |

|

Maximum of 4,166,666,660

shares of Common Stock, through the sale of 416,666,666 Units of 100 shares of Common Stock per Unit (1) |

| |

|

|

| Shares of Common Stock outstanding before the offering

(2) |

|

3,729,053,805 shares |

| |

|

|

| Shares of Common Stock outstanding after the offering

(1) |

|

7,895,720,471 shares |

| |

|

|

| Delivery of the Shares |

|

Shares will be delivered by book entry. |

| |

|

|

| Use of proceeds |

|

The net proceeds of this

offering will be used primarily for acquisitions and to cover other ancillary marketing costs and operating expenses. The details

of our plans are set forth in our “Use of Proceeds” section. |

| |

|

|

| |

|

(1) This

represents the shares available to be offered as of the date of this Offering Circular, based upon this Offering being for up

to $5 million. The rolling 12-month maximum offering amount for Tier 2 offering issuers is $75 million. We have not made any

other offerings pursuant to Regulation A in the past twelve (12) months.

(2) As

of November 16, 2022. |

This

Offering is being made on a “best efforts” basis through the use of DealMaker Securities LLC (“Broker”) as the

Broker, which will be acting as broker-dealer for the Offering. Novation Solutions, Inc. (o/a DealMaker (“DealMaker”), an

affiliate of Broker, is providing the platform and related services being used to obtain subscriptions.

See

“Plan of Distribution” for more information. As there is no minimum Offering, upon the approval of any subscription to this

Offering Circular, the Company shall immediately deposit said proceeds, after deducting applicable Offering commissions, fees and expenses,

into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Risks

Related to Our Business and Strategy

Our

ability to successfully operate our business is subject to numerous risks, including those that are generally associated with operating

in the addiction treatment industry. Any of the factors set forth under “Risk Factors”

below may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth

in this Offering Circular and, in particular, you should evaluate the specific factors set forth under “Risk

Factors” below in deciding whether to invest in our Common Stock. Risks relating to our business and our ability to execute

our business strategy include:

| |

· |

we may not effectively manage our growth; |

| |

· |

we operate in a highly competitive industry and our

failure to compete effectively could adversely affect our market share, revenues and growth prospects; |

| |

· |

unfavorable publicity or consumer perception of our

services could adversely affect our reputation and the demand for our services; |

| |

· |

if the services we provide do not comply with applicable

regulatory and legislative requirements, we may be required to suspend our services; |

| |

· |

if we do not meet certain provider credentialing or

service metrics, we may lose relationships with insurance providers and limit our ability to offer services to certain patients;

and |

| |

· |

changes in our management team could adversely affect

our business strategy and adversely impact our performance. |

RISK

FACTORS

The

SEC requires the company to identify risks that are specific to its business and its financial condition. The company is still subject

to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating

to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking).

Additionally, early-stage companies are inherently more risky than more developed companies. You should consider general risks as well

as specific risks when deciding whether to invest.

Risk

Factors Related to the Company and its Business

Our

financials were prepared on a “going concern” basis.

Our

unaudited condensed consolidated financial statements have been prepared in accordance with US GAAP applicable to a going concern, which

assumes that we will be able to meet our obligations and continue its operations in the normal course of business. As of September 30,

2021, the Company has a working capital deficiency of approximately $15,440,821 and accumulated deficit of approximately $45,978,688.

Management believes that current available resources will not be sufficient to fund our planned expenditures over the next 12 months.

Accordingly, we will be dependent upon the raising of additional capital through placement of common shares, and/or debt financing in

order to implement its business plan, and generating sufficient revenue in excess of costs. If we raise additional capital through the

issuance of equity securities or securities convertible into equity, stockholders will experience dilution, and such securities may have

rights, preferences or privileges senior to those of the holders of common stock or convertible senior notes. If we raise additional

funds by issuing debt, we may be subject to limitations on its operations, through debt covenants or other restrictions. If we obtain

additional funds through arrangements with collaborators or strategic partners, we may be required to relinquish its rights to certain

geographical areas, or techniques that it might otherwise seek to retain. There is no assurance that we will be successful with future

financing ventures, and the inability to secure such financing may have a material adverse effect on our financial condition. These factors

create substantial doubt about our ability to continue as a going concern. These unaudited condensed consolidated financial

statements do not include any adjustments relating to the recoverability or classification of recorded assets and liabilities or other

adjustments that may be necessary should we not be able to continue as a going concern.

Any

valuation of the Company at this stage is difficult to assess.

We

established the valuation for the Offering. Unlike actively-traded companies that are valued publicly through market-driven stock prices,

the valuation of limited trading companies, especially startups, is difficult to assess and you may risk overpaying for your investment.

This is especially true with companies engaging in new product offerings.

We

operate in a regulatory environment that is evolving and uncertain.

The

healthcare and addiction treatment market is subject to various and changing regulatory schemes both federally and at the state level.

These regulatory schemes are politically influenced with changes of control of our government and the composition of our state and local

governments. In 2020, the United States experienced federal elections that resulted in a change in the control of both the executive

and legislative branches of the federal government and some of the state governments of states in which we may look to operate. As these

changes have just occurred, it is unclear what regulatory changes, if any, will be made by the new administration running the executive

branch of the federal government.

We

operate in a highly regulated industry.

We

are subject to extensive regulation and failure to comply with such regulation could have an adverse effect on our business. Of significant

note, we are subject to numerous patient privacy laws and regulations. These include federal regulations like the Health Insurance Portability

and Accountability Act (HIPAA) and 42 CFR Part 2. Among other things, these regulations govern circumstances

where information about a patient can be disclosed and protects all records relating to a patient’s identity, diagnosis, prognosis

or treatment in a substance abuse program related or linked to the federal government. Failure to follow these regulations can result

in significant fines and other penalties that may make it impossible to operate and provide our services. In addition, some of

the restrictions and rules applicable to our subsidiaries could adversely affect and limit some of our business plans.

We

have an evolving business model.

Our

business model is one of innovation, including continuously working to expand our patient capacity and treatment techniques; see the

“The Company’s Business.” It is unclear whether our expansion plans

will be successful. Further, we continuously try to adapt new methods and techniques to treat our patients, and we cannot offer any assurance

that any of them will be successful. We cannot offer any assurance that any of the expansion plans or any other modifications to our

footprint and treatment techniques will be successful or will not result in harm to the business. We may not be able to manage growth

effectively, which could damage our reputation, limit our growth, and negatively affect our operating results.

We

are reliant on one main type of service.

All

of current services are variants on one type of service — providing addiction treatment for adults. Our growth and future financial

performance will depend on its ability to demonstrate to prospective buyers and users the value of our services. There can be no assurance

that we will be successful in this effort. Furthermore, competing alternatives may be seen to have, or may actually have, certain advantages

over our services.

We

depend on key personnel and face challenges recruiting needed personnel.

Our

future success depends on the efforts of a small number of key personnel, including our CEO, CFO, and Chairman Shawn Leon. In addition,

due to our limited financial resources and the specialized expertise required, we may not be able to recruit the individuals needed for

our business needs. There can be no assurance that we will be successful in attracting and retaining the personnel we require to operate

and meet the needs of our patients.

Our

revenues and profits are subject to fluctuations.

It

is difficult to accurately forecast our revenues and operating results, and these could fluctuate in the future due to a number of factors.

These factors may include adverse changes in: number of investors and amount of investors’ dollars, the success of securities markets,

general economic conditions, our ability to market our services to patients and other service providers, headcount and other operating

costs, and general industry and regulatory conditions and requirements. Our operating results may fluctuate from year to year due to

the factors listed above and others not listed. At times, these fluctuations may be significant and could impact our ability to operate

our business. Our revenue model is new and evolving, and it cannot be certain that it will be successful. The potential profitability

of its business model is unproven and there can be no assurance that we can achieve profitable operations. Our ability to generate revenues

depends, among other things, on its ability to generate revenues relating to helping customers engage cleaner living in an ecological

community. Accordingly, we cannot assure investors that its business model will be successful or that it can sustain revenue growth,

or achieve or sustain profitability.

If

we cannot raise sufficient funds, we will not succeed.

To

date, we have experienced a continuing need for capital to execute our business model. We are offering securities in the amount of up

to $5 million in this offering, and may close on any investments that are made. The amount we can raise in any 12-month period pursuant

to Regulation A is limited to $75 million. Even if the maximum amount is raised (in this 12-month period or in subsequent periods), we

are likely to need additional funds in the future in order to grow, and if we cannot raise those funds for whatever reason, including

reasons relating to us or to the broader economy, we may not survive. If we manage to raise only a portion of funds sought, we will have

to find other sources of funding for some of the plans outlined in “Use of Proceeds.”

We do not have any alternative sources of funds committed.

There

is no minimum amount set as a condition to closing this offering.

Because

this is a “best effort” offering with no minimum, we will have access to any funds tendered. This might mean that any investment

made could be the only investment in this offering, leaving us without adequate capital to pursue our business plan or even to cover

the expenses of this offering.

Natural

disasters and other events beyond our control could materially adversely affect us.

Natural

disasters or other catastrophic events may cause damage or disruption to our operations, commerce and the global economy, and thus could

have a strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power shortages,

pandemics and other events beyond our control. Although we maintain crisis management and disaster response plans, such events could

make it difficult or impossible for us to deliver our services to our customers and could decrease demand for our services. In the spring

of 2020, large segments of the U.S. and global economies were impacted by COVID-19, a significant portion of the U.S. population are

subject to “stay at home” or similar requirements. The extent of the impact of COVID-19 and any subsequent “breakouts”

of COVID-19, on our operational and financial performance will depend on certain developments, including the duration and spread of the

outbreak, impact on our customers, impact on our customer, employee or industry events, and effect on our vendors, all of which are uncertain

and cannot be predicted. At this point, the extent to which COVID-19 may impact our financial condition or results of operations is uncertain.

To the extent COVID-19 continues to wreak havoc on the economy and the ability to remain open may have a significant impact on our results

and operations.

We

a short operating history and limited working capital.

We

have a limited relevant operating history upon which investors can evaluate performance and prospects and is not certain that it will

maintain sustained profitability. Our business is subject to all of the risks inherent in the establishment of a new business enterprise,

including, but not limited to, limited capital, need to expand its workforce, unanticipated costs, uncertain markets, adverse changes

in technology and the absence of a significant operating history. We will need to maintain significant revenues to achieve and maintain

profitability and we may not be able to do so. Even if we do achieve profitability, we may not be able to sustain or increase profitability

in the future. If our revenues grow more slowly than we anticipate or if its operating expenses exceed expectations, our financial performance

will be adversely affected. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered

by companies in their early stages of development. We cannot assure investors that it will be successful in addressing the risks it may

encounter, and its failure to do so could have a material adverse effect on its business, prospects, financial condition and results

of operations. Failure to meet our objectives would have a material adverse effect on our operations. In particular, insufficient market

demand would have a material adverse effect on our business, financial condition and results of operations.

Growth

strategy

Our

business model may require an effective execution of its growth strategy over a short period of time in order to scale operations quickly

and establish market presence. Achieving our growth strategy may be critical in order for its business to achieve profitability. If we

are unable to effectively implement its growth strategy ahead of its competition, our business, financial condition or results of operation

could be materially and adversely affected.

Competition

Our

market space is competitive. If we are unable to successfully compete with competitors (including both existing and new companies that

enter this market space), our business, financial condition or results of operations could be materially and adversely affected. The

market for our products and services is rapidly changing. Competitors may develop products and/or services that are better, less expensive

or otherwise more attractive than those offered by us.

We

may be unable to maintain its relationships.

We

cannot assure investors that it will be successful in maintaining relationships with its customers and counterparties. Our inability

to maintain these relationships could have a material adverse effect on its business, results of operations and financial condition.

Damage

to our reputation could damage its businesses.

Maintaining

a positive reputation is critical to us attracting and maintaining customers, counterparties, investors and employees. Damage to its

reputation can therefore cause significant harm to our business and prospects. Harm to our reputation could arise from numerous sources,

including, among others, employee misconduct, litigation or regulatory outcomes, compliance failures, unethical behavior and the activities

of customers and counterparties. Further, negative publicity regarding us, whether or not true, may also result in harm to its prospects.

Market

changes.

Our

success may be dependent upon our ability to develop our market and change our business model as may be necessary to react to changing

market conditions. Our ability to modify or change its business model to fit the needs of a changing marketplace may be critical to our

success, and our inability to do so could have a material adverse effect on our business, liquidity and financial condition.

Risk

Factors Related to the Offering

There

is uncertainty as to the amount of time it will take for us to deliver securities to investors under this offering.

The

process for issuance of Common Stock is set out in “Plan of Distribution.”

There may be a delay between the time you execute your subscription agreement and tender funds and the time securities are delivered

to you. Although investors who provide the information required by the subscription agreement and give accurate instructions for the

payment of the subscription price typically should receive their securities promptly after a complete submission, we cannot guarantee

that you will receive your securities by a specific date or within a specific timeframe.

The

exclusive forum provision in the subscription agreements may have the effect of limiting an investor’s ability to bring legal action

against us and could limit an investor’s ability to obtain a favorable judicial forum for disputes.

Section 6

in each of the subscription agreements for this offering includes a forum selection provision that requires any claims against

us based on the subscription agreement be brought in a court of competent jurisdiction in the State of Florida. The forum selection

provision will not be applicable to lawsuits arising from the federal securities laws. The provision may have the effect of limiting

the ability of investors to bring a legal claim against us due to geographic limitations. There is also the possibility that the exclusive

forum provision may discourage stockholder lawsuits with respect to matters arising under laws other than the federal securities laws,

or limit stockholders’ ability to bring such claims in a judicial forum that they find favorable for disputes with us and our officers

and directors. Alternatively, if a court were to find this exclusive forum provision inapplicable to, or unenforceable in respect of,

one or more of the specified types of actions or proceedings, we may incur additional costs associated with resolving such matters in

other jurisdictions, which could adversely affect our business and financial condition.

Investors

in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreements, which could result

in less favorable outcomes to the plaintiff(s) in any action under the agreements.

Investors

in this offering will be bound by the subscription agreements, each of which includes a provision under which investors waive the right

to a jury trial of any claim they may have against us arising out of or relating to the subscription agreement, including any claims

made under the federal securities laws.

If

we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and

circumstances of that case in accordance with the applicable state and federal law. We believe that a contractual pre-dispute jury

trial waiver provision is generally enforceable, including under the laws of the State of Florida, which governs the subscription agreement,

in a court of competent jurisdiction in the State of Florida. In determining whether to enforce a contractual pre-dispute jury

trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement

is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that

this is the case with respect to the subscription agreement. You should consult legal counsel regarding the jury waiver provision before

entering into the subscription agreement.

If

you bring a claim against us in connection with matters arising under the subscription agreement, including claims under federal securities

laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits

against us. If a lawsuit is brought against us under the subscription agreement, it may be heard only by a judge or justice of the applicable

trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury

would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless,

if the jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement

with a jury trial. No condition, stipulation, or provision of the subscription agreement serves as a waiver by any holder of common shares

or by us of compliance with any provision of the federal securities laws and the rules and regulations promulgated under those laws.

In

addition, when shares of our Common Stock are transferred, the transferee is required to agree to all the same conditions, obligations

and restrictions applicable to those securities or to the transferor with regard to ownership of those securities, that were in effect

immediately prior to the transfer of the Common Stock, including but not limited to the subscription agreement. Therefore, purchasers

in secondary transactions will be subject to this provision.

Future

fundraising may affect the rights of investors.

In

order to expand, we are likely to raise funds again in the future, either by offerings of securities (including post-qualification amendments

to this offering) or through borrowing from banks or other sources. The terms of future capital raising, such as loan agreements, may

include covenants that give creditors greater rights over our financial resources.

Holders

of our Preferred Stock may be entitled to potentially significant liquidation preferences over holders of our Common Stock if we are

liquidated, including upon a sale of our company.

Holders

of our outstanding Preferred Stock may have liquidation preferences over holders of Common Stock being offered in this offering. This

liquidation preference is paid if the amount a holder of Preferred Stock would receive under the liquidation preference is greater than

the amount such holder would have received if such holder’s shares of Preferred Stock had been converted to Common Stock immediately

prior to the liquidation event.

Our

Common Stock is thinly traded.

Our

Common Stock trades on the OTC Markets. It has low daily trading volume and is thinly traded. While this may change as demand for our

services and Common Stock changes, there is no guarantee that adequate demand exists. Even if we seek an up-listing on the OTC Markets

or another alternative trading system or “ATS,” there may not be frequent trading and therefore a lack of liquidity for the

Common Stock.

You

will need to keep records of your investment for tax purposes.

As

with all investments in securities, if you sell the Common Stock, you will probably need to pay tax on the long- or short-term

capital gains that you realize if sold at a profit or set any loss against other income. If you do not have a regular brokerage account,

or your regular broker will not hold the Common Stock for you (and many brokers refuse to hold Regulation A securities for their customers)

there will be nobody keeping records for you for tax purposes and you will have to keep your own records, and calculate the

gain on any sales of any securities you sell.

The

price for our Common Stock may be volatile.

The

market price of our Common Stock is likely to be highly volatile and could fluctuate widely in price in response to various factors,

many of which are beyond our control, including the following:

·

The size and volume of our trading market.

·

Having adequate capital to fulfill any reporting obligations.

·

Inability to successfully compete against current or future competitors

·

Adverse regulations from regulators.

·

Departures of key personnel.

In

addition, the securities markets have from time-to-time experienced significant price and volume fluctuations that are unrelated to the

operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of

our securities. As a result, you may be unable to resell your securities at a desired price.

RISKS

SPECIFIC TO THE BEHAVIORAL HEALTHCARE INDUSTRY

Regulation

is and licensing is very stringent.

The

State regulatory body in Florida is the Department of Children and Families (DCF). Facilities must comply with rigid guidelines to obtain

and continue to keep its licensing. In addition, many insurance companies will not pay a provider unless they are Joint Commission accredited.

This accreditation is by a national provider of accreditation to healthcare facilities. ARIA is both DCF licensed and Joint Commission

accredited. In addition, ARIA is legit script certified which allows the company to market itself through google pay per click advertising.

There are stringent guidelines to become legit script certified and ARIA has its certification form Legit Script. ARIA must comply with

all of the national healthcare laws and HIPPA requirements. There are national laws protecting individuals from patient brokering which

ARIA must strictly comply with.

Limited

Ability to Set Prices for Services Provided.

Behavioral

healthcare providers depend upon reimbursement for services from insurance companies and other funders, including government funders,

and have only a limited ability to set and negotiate prices for the services provided. Therefore, there is no guarantee that reimbursement

for the services provided will either meet the costs of providing them or generate an operating profit. In addition, providers must negotiate

reimbursement rates with each insurance company and funder, thus substantially increasing administrative costs and overhead.

Insurance

Companies and Funders Determine What Providers They Choose to Contract for Services.

Even

as a fully licensed behavioral healthcare provider, insurance companies and government funders are under no obligation whatsoever to

choose to use ARIA– or any other provider - as a contracted service provider. Insurance Companies and Funders choose providers

and may cancel contracts and service relationships at their discretion.

The

Need for Highly Differentiated, Customizable Treatment is Expensive.

Providing

effective behavioral healthcare requires clinical expertise to a diverse population with many different diagnoses, symptoms, needs, and

wants. Effective providers need to therefore offer a broad array of customizable treatment platforms and justify their effectiveness

to clients and funders alike. Customizing treatment and services is expensive, requiring providers to attract, retain, and train skilled

staff who are specialized in treating many specific disorders. Therefore, more staff and more expensive staff is required to treat a

diverse population, thereby increasing the cost of staffing and the cost of providing treatment.

Insurance

Companies Push for Lower Levels of Care and Shorter Stays.

Because

a provider recommends a particular level of care and treatment regimen does not equate to an insurance company or funder agreeing to

pay for the provider’s recommendation with respect to level of care, services and treatment needed, or length of stay. For the

past 25 years, managed care (insurance companies) has consistently pushed for lower levels of care with shorter stays. Insurance companies

consistently report they are not dictating treatment, but rather only authorizing the reimbursement of treatment they are willing to

pay for. In turn, providers must either spend more time and effort obtaining authorization for treatment, decline clients for further

treatment or refer them elsewhere or provide treatment without insurance reimbursement or only partial reimbursement, all of which result

in increased operating costs and/or decreased revenue and profitability.

Higher

Acuity Patients Are Managed at the Outpatient Level.

As

a result of insurance companies and funders pushing for lower levels of care and shorter stays (which reduce insurance companies’

reimbursement costs), providers are managing higher acuity patients at lower levels of care. Higher acuity patients require more staff

and better trained staff which increase operating expenses and present additional risk management challenges to the organization. These

operating realities add to administrative costs and management oversight responsibilities, and negatively impact the organization’s

ability to operate at a profit.

DILUTION

Dilution

means a reduction in value, control or earnings of the shares the investor owns.

Immediate

dilution

An

emerging growth company typically sells its shares (or grants options exercisable for its shares) to its founders and early employees

at a very low cash cost because they are, in effect, putting their “sweat equity” into the company. When the company seeks

cash investments from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders

or earlier investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and

you paid more than earlier investors for your shares.

The

following table illustrates the per share dilution to new investors discussed above, assuming the sale of, respectively, $1,000,000.00,

$2,000,000.00, $4,000,000.00, and $5,000,000.00 of the shares offered for sale in this Offering (before our estimated offering expenses

of $50,000.00) and based on an offering price of $0.0012 per share($0.12 per Unit). The below table reflects the dilution based upon

each share of Common Stock sold instead of Units to better reflect the impact on investors:

| | |

$1,000,000

Raise | |

$2,000,000

Raise | |

$4,000,000

Raise | |

$5,000,000

Raise |

| Net Value | |

$ | 880,000 | | |

$ | 1,760,000 | | |

$ | 3,620,000 | | |

$ | 4,550,000 | |

| # Total Shares | |

| 833,333,334 | | |

| 1,666,666,667 | | |

| 3,333,333,334 | | |

| 4,166,666,667 | |

| Net Tangible Book Value Per Share | |

$ | (.0022 | ) | |

$ | (0.0017 | ) | |

$ | (0.0010 | ) | |

$ | (0.0008 | ) |

| Increase in Tangible book value per share | |

$ | 0.0008 | | |

$ | 0.0013 | | |

$ | 0.0020 | | |

$ | 0.0022 | |

| Dilution to new shareholders | |

$ | (0.0034 | ) | |

$ | (0.0029 | ) | |

$ | (0.0022 | ) | |

$ | (0.0020 | ) |

| Percentage Dilution to New Investors | |

| (286.7 | )% | |

| (242.4 | )% | |

| (185.2 | )% | |

| (165.6 | )% |

Future

dilution

Another

important way of looking at dilution is the dilution that happens due to future actions by the company. The investor’s stake in

a company could be diluted due to the company issuing additional shares. In other words, when

the

company issues more shares, the percentage of the company that you own will go down, even though the value of the company may go up.

You will own a smaller piece of that company. This increase in number of shares outstanding could result from a stock offering (such

as an initial public offering, a subsequent Regulation A offering, a venture capital round, or angel investment), employees exercising

stock options, or by conversion of certain instruments (e.g., convertible bonds, preferred shares or warrants) into stock.

If

the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before,

and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a

reduction in the amount earned per share (though this typically occurs only if the company offers dividends, and most early-stage and

emerging growth companies are unlikely to offer dividends, preferring to invest any earnings into the company).

This

type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes issued

by emerging growth companies provide that note holders may be able to convert the balance of their convertible notes into shares at a

discounted price, or a premium is added to the note allowing for a higher principal balance to be converted into shares than was initially

invested. Either way, the holders of the convertible notes get more shares for their money than new investors. In the event that the

price drops below the offering price in this offering, the holders of the convertible notes will dilute existing equity holders, even

more than the new investors do, because they get more shares for their money. Investors should pay careful attention to the total amount

of the convertible notes that the company has issued (and may issue in the future), and the terms of those notes.

If

you are making an investment expecting to own a certain percentage of us or expecting each share to hold a certain amount of value, it’s

important to realize how the value of those shares can decrease by actions taken by us. Dilution can make drastic changes to the value

of each share, ownership percentage, voting control, and earnings per share.

PLAN

OF DISTRIBUTION

We

seeking to raise up to $5 million in total. The company will raise the money through the sale of up to 4,166,666,660 shares of Common

Stock through the sale of 416,666,666 Units with each Unit containing 100 shares of Common Stock. Under a Tier 2 offering pursuant to

Regulation A, we may only offer $75,000,000.00 in securities during a rolling 12-month period. As of the date of this Offering Circular,

we have not offered or sold any securities pursuant to Regulation A in the past twelve (12) months. From time to time, we may seek to

qualify additional shares.

We

are offering a maximum of 4,166,666,660 shares of Common Stock through the sale of 416,666,666 Units with each Unit containing 100 shares

of Common Stock on a “best effort” basis.

DealMaker

Securities LLC

We

entered into an agreement with DealMaker Securities LLC, which has been engaged to provide the administrative and compliance related

functions in connection with this offering, and as broker-dealer of record, but not for underwriting or placement agent services. The

term of the agreement commenced on March 8, 2023 and will terminate following completion of this Offering. However, the Broker may terminate

the agreement if we default on our obligations thereunder. The Broker is not purchasing any of the Units in this Offering and is not

required to sell any specific number or dollar amount of the Units. We have been advised by the Broker that it will only assist us with

this Offering in jurisdictions where it is registered or licensed as a broker-dealer in compliance with applicable federal and state

securities laws and the rules of self-regulatory organizations including FINRA.

Commissions

and Discounts

The

Broker will receive a cash commission equal to one percent (1%) of the amount raised in the Offering. Additionally, the Broker and its

affiliates will receive certain other fees described specifically in the agreement with Broker filed as an exhibit to the Offering Statement

of which this Offering Circular forms a part, based on the actual number of investors accepted into the Offering and the methods of payment

in connection therewith. Total payment processing expenses incurred in connection with the Offering, which are payable to

an affiliate of the Broker, are expected to be approximately six and 94/100 percent (6.94%) of the Offering proceeds. The

aggregate fees payable to the Broker and its affiliates will not exceed nine percent (9%) of the Offering, or a maximum of $450,000,

in the event that the Offering is fully subscribed.

Other

Terms

DealMaker

Securities, LLC, the Broker, a broker-dealer registered with the Commission and a member of FINRA, has been engaged to provide the administrative

and compliance related functions in connection with this offering, and as broker-dealer of record, but not for underwriting or placement

agent services:

| |

● |

Reviewing

investor information, including identity verification, performing Anti-Money Laundering (“AML”) and other compliance

background checks, and providing issuer with information on an investor in order for issuer to determine whether to accept such investor

into the Offering; |

| |

● |

If

necessary, discussions with us regarding additional information or clarification on a Company-invited investor; |

| |

● |

Coordinating

with third party agents and vendors in connection with performance of services; |

| |

● |

Reviewing

each investor’s subscription agreement to confirm such investor’s participation in the Offering and provide a recommendation

to us whether or not to accept the subscription agreement for the investor’s participation; |

| |

● |

Contacting

and/or notifying us, if needed, to gather additional information or clarification on an investor; |

| |

● |

Providing

a dedicated account manager; and |

| |

● |

Providing

ongoing advice to us on compliance of marketing material and other communications with the public, including with respect to applicable

legal standards and requirements. |

Such

services shall not include providing any investment advice or any investment recommendations to any investor.

We

have agreed to pay Broker and its affiliates fees consisting of the following:

| |

○● |

A

one-time $35,000 advance against accountable expenses anticipated to be incurred, and refunded

to extent no actually incurred for fees to assist the Company with the following:

o Reviewing

and performing due diligence on our Company and our management and principals and consulting with us regarding same;

o Consulting

with our Company on best business practices regarding this raise in light of current market conditions and prior self-directed capital

raises;

o White

labelled platform customization to capture investor acquisition through the Broker’s platform’s analytic and communication

tools;

o Consulting

with our Company on question customization for investor questionnaire;

o Consulting

with our Company on selection of webhosting services;

o

Consulting with our Company on completing template for the Offering campaign page;

o

Advising us on compliance of marketing materials and other communications with the public with applicable legal standards

and requirements;

o

Providing advice to our Company on preparation and completion of this Offering Circular;

o

Advising our Company on how to configure our website for the Offering working with prospective investors;

o

Provide extensive, review, training and advice to our Company and our personnel on how to configure and use the electronic

platform for the Offering powered by DealMaker.tech, an affiliate of the Broker;

o

Assisting our Company in the preparation of state, Commission and FINRA filings related to the Offering; and

o

Working with our personnel and counsel in providing information to the extent necessary |

| · | A

Monthly Platform Hosting and Maintenance Fee of $1,500 per month for use of DealMaker.tech

software, tracking, and full analytics suite, not to exceed a maximum fee of $18,000. |

| · | For

each subscription processed, there are also the following Transaction Fees relating to the

processing of payments through third-party processors: |

| o | $15

per electronic signature executed on DealMaker platform |

| o | $15

per payment reconciled via DealMaker platform |

| o | 2.00%

of total for Secure bank-to-bank payments |

| o | 4.50%

of total for Credit Card processing |

| o | 1.00%

of total for express wires |

| o | $50.00

for investor refunds |

| o | $5.00

for failed payment fee |

| o | $250

for a full reconciliation report |

| o | $2.50

for Individual searches |

| o | $5.00

for Corporate searches |

The

transaction fees described above associated with General, Payment Processing and AML Searches will not exceed 347,000 (6.94 %) of the

maximum fees paid to Broker.

All

forms of compensation paid to Broker are subject to the provisions of the maximum fees in the Offering not exceeding $450,000 or 9% if

fully subscribed.

Offering

Period and Expiration Date

This

Offering will start on or after the Qualification Date and will terminate at our discretion or, on the Termination Date.

Procedures

for Subscribing

After

the Commission has qualified the Offering Statement, the Offering will be conducted using the online subscription processing platform

of Novation Solutions Inc. O/A DealMaker, an affiliate of the Broker, through the website: invest.ethemahealth.com whereby investors

in the Offering will receive, review, execute, and deliver subscription agreements electronically. Payment of the purchase price for

the Shares will be made through a third-party processor by ACH debit transfer or wire transfer or credit card to an account designated

by us. The Broker is not participating as an underwriter or placement agent in the Offering and will not solicit any investments, recommend

our securities, provide investment advice to any prospective investor, or distribute the Offering Circular or other offering materials

to potential investors. All inquiries regarding the Offering should be made directly to our Company.

Right

to Reject Subscriptions. After we receive your complete, executed subscription agreement and the funds required under the subscription

agreement have been deposited to the Company’s account, we have the right to review and accept or reject your subscription in whole

or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest

or deduction.

Acceptance

of Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the Shares

subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription

or request your subscription funds. All accepted subscription agreements are irrevocable.

No

Escrow

The

proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best effort’s basis. As

there is no minimum offering, upon the approval of any subscription to this Offering Circular, we will immediately deposit said proceeds

into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds at Management’s discretion.

Investment

Limitations

Generally,

no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income

or net worth (please see below on how to calculate your net worth). Different rules apply to accredited investors and non-natural persons.

Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C)

of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

Because

this is a Tier 2, Regulation A Offering, most investors must comply with the 10% limitation on investment in the Offering. The only investor

in this Offering exempt from this limitation is an “accredited investor” as defined under Rule 501 of Regulation D under

the Securities Act (an “Accredited Investor”). If you meet one of the following tests you should qualify as an Accredited

Investor:

| |

(i) |

You are a natural person

who has had individual income in excess of $200,000 in each of the two most recent years, or joint income with your spouse in excess

of $300,000 in each of these years, and have a reasonable expectation of reaching the same income level in the current year; |

| |

(ii) |

You are a natural person

and your individual net worth, or joint net worth with your spouse, exceeds $1,000,000 at the time you purchase Offered Shares (please

see below on how to calculate your net worth); |

| |

(iii) |

You are an executive officer

or general partner of the issuer or a manager or executive officer of the general partner of the issuer; |

| |

(iv) |

You are an organization

described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, or the Code, a corporation, a Massachusetts or similar

business trust or a partnership, not formed for the specific purpose of acquiring the Offered Shares, with total assets in excess

of $5,000,000; |

| |

(v) |

You are a bank or a savings

and loan association or other institution as defined in the Securities Act, a broker or dealer registered pursuant to Section 15

of the Exchange Act, an insurance company as defined by the Securities Act, an investment company registered under the Investment

Company Act of 1940 (the “Investment Company Act”), or a business development company as defined in that act, any Small

Business Investment Company licensed by the Small Business Investment Act of 1958 or a private business development company as defined

in the Investment Advisers Act of 1940; |

| |

(vi) |

You are an entity (including

an Individual Retirement Account trust) in which each equity owner is an accredited investor; |

| |

(vii) |

You are a trust with total

assets in excess of $5,000,000, your purchase of Offered Shares is directed by a person who either alone or with his purchaser representative(s)

(as defined in Regulation D promulgated under the Securities Act) has such knowledge and experience in financial and business matters

that he is capable of evaluating the merits and risks of the prospective investment, and you were not formed for the specific purpose

of investing in the Offered Shares; or |

| |

(viii) |

You are a plan established

and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions,

for the benefit of its employees, if such plan has assets in excess of $5,000,000. |

Issuance

of Shares

The

information regarding the ownership of the Common Stock will be recorded with the stock transfer agent.

Jury

Trial Waiver

The

subscription agreement provides that subscribers waive the right to a jury trial of any claim they may have against us arising out of

or relating to the subscription agreement, including any claim under federal securities laws. If we opposed a jury trial demand

based on the waiver, a court would determine whether the waiver was enforceable given the facts and circumstances of that case in accordance

with applicable case law. See “RISK FACTORS.”

Selling

Shareholders

No

securities are being sold for the account of shareholders; all net proceeds of this offering will go to the company.

USE

OF PROCEEDS TO ISSUER

We

estimate that if we sell the maximum amount under this Offering of $5 million from the sale of Common Stock through the sale of the Units,

the net proceeds to us in this offering will be approximately $4,550,000, after deducting the estimated offering expenses of approximately

$450,000.00 (including payment to marketing, legal and accounting professional fees and other expenses).

The

table below shows the net proceeds we would receive from this offering assuming an offering size of $1 million, $2 million and $5 million,

and the intended use of those proceeds. There is no guarantee that we will be successful in selling any of the shares we are offering.

| | |

If $1,250,000.00 of the

Offering is Raised | |

If $2,500,000.00 of the

Offering is Raised | |

If $5,000,000.00 of the

Offering is Raised |

| Cost of the Offering (1) | |

| 150,000 | | |

| 250,000 | | |

| 450,000 | |

| Net Proceeds | |

| 1,100,000 | | |

| 2,250,000 | | |

| 4,550,000 | |

| Acquisitions | |

$ | 100,000 | | |

$ | 500,000 | | |

$ | 2,250,000 | |

| Debt Repayment | |

$ | 750,000 | | |

$ | 1,150,000 | | |

$ | 1,200,000 | |

| Brand protection | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Business administration & operational costs | |

$ | 50,000 | | |

$ | 100,000 | | |

$ | 100,000 | |

| Equipment | |

$ | 50,000 | | |

$ | 100,000 | | |

$ | 100,000 | |

| Inventory | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Marketing | |

$ | 0 | | |

$ | 100,000 | | |

$ | 100,000 | |

| Product development | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Professional fees (including Offering Costs | |

$ | 20,000 | | |

$ | 50,000 | | |

$ | 50,000 | |

| Public company expense | |

$ | 30,000 | | |

$ | 50,000 | | |

$ | 50,000 | |

| Salaries | |

$ | 100,000 | | |

$ | 200,000 | | |

$ | 200,000 | |

| Travel & accommodations | |

$ | 0 | | |

$ | 0 | | |

$ | 0 | |

| Warehouse & office Purchase | |

$ | 0 | | |

$ | 0 | | |

$ | 500,000 | |

| TOTAL | |

$ | 1,100,000 | | |

$ | 2,250,000 | | |

$ | 5,000,000 | |

| (1) |

|

Represents

legal and accounting fees, and other Offering commissions, fees and expenses including amounts payable to the Broker, and the Technology

Provider. For more information on the fees and related services, see the cover page and “Plan of Distribution.” |

We

anticipate acquisitions to be our largest expected expenditure. We are looking to acquire facilities to increase the number of patients

we can treat and expand the geographical footprint of our product offerings. These acquisition-related costs may consist of acquiring

ownership of facilities, leasing existing facilities, acquiring existing operations in areas, in which, we hope to expand our operations.

As our facilities and footprint expand, we expect to hire additional product development and quality assurance specialists. These employees

will assist with improving our ability to service the needs of our patients.

We

reserve the right to change the above use of proceeds if management believes it is in our best interest.

The

allocation of the net proceeds of the offering set forth above represents our estimates based upon our current plans, assumptions we

have made regarding the industry and general economic conditions and our future revenues (if any) and expenditures.

Investors

are cautioned that expenditures may vary substantially from the estimates above. Investors will be relying on the judgment of our management,

who will have broad discretion regarding the application of the proceeds from this offering. The amounts and timing of our actual expenditures

will depend upon numerous factors, including market conditions, cash generated by our operations (if any), business developments and

the rate of our growth. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes.

In

the event that we do not raise the entire amount we are seeking, then we may attempt to raise additional funds through private offerings

of our securities or by borrowing funds. We do not have any committed sources of financing.

THE

COMPANY’S BUSINESS

Business

Model and Strategy

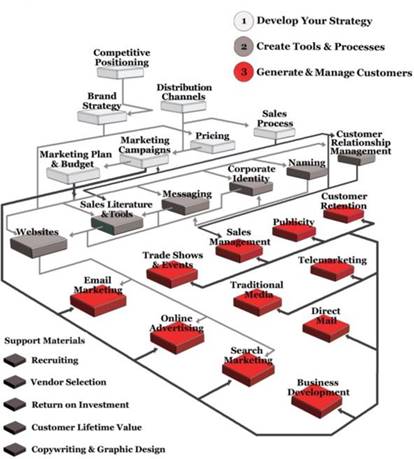

The

ARIA Business Model and Strategy has been developed through a critical examination of current industry best- practice practices, emerging

market trends, and the ARIA leadership team’s 12+ year track record of launching and operating successful addition treatment facilities.

The ARIA Business Model and Strategy is built on a secure foundation of six key fundamental factors and strategies.

The

Six ARIA Fundamental Business Model & Strategy Factors

| |

1. |

ARIA

knows business and the business of behavioral health. Our skilled, multidisciplinary entrepreneurial leadership team has a proven

track record creating and operating profitable addiction treatment facilities, is currently running a 41-bed addiction treatment

facility providing five different levels of care delivering high-impact treatments and services. |

Clearly,

our primary service is expert behavioral health services for our clients, and that requires credentialed, experienced, and committed

healthcare professionals throughout the continuum of care. Our established competencies to select, hire, and retain exceptional staff

is central to our success and our Personnel Plan reflects the time, thought, and energy we have committed and provides us another competitive

advantage.

Our

expert medical and clinical team is one half of the ARIA success equation. The other factor in the equation is the staff needed to operate

the business side of the house. From marketing to billing, accounting to facility management, IT to human resources, the business and

administrative leaders and staff provide the critical business acumen to realize our growth, revenue, and income objectives.

Finally,

the ARIA business model demonstrates seamless integration, collaboration, and coordination across the entire organization. While our

clinical staff must focus and prioritize their clinical work, they do so with an understanding of the exigencies of our business model.

Similarly, administrative staff recognize our primary business is delivering behavioral healthcare services, and service delivery takes

precedence. Our organizational structure and core operating protocols support specialization of function while encouraging collaboration

and integration.

| |

2. |

ARIA

is poised for rapid response in a diverse market with new opportunities. The market is primed for innovative, for-profit,

professional organizations that have the vision, resources, and expertise to meet the behavioral health needs of a changing population.

For example, recent researchi indicates a 445% overall increase in substance abuse treatment admissions for abuse of pain