As filed with the Securities and Exchange Commission on August 28, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

B2GOLD CORP.

(Exact name of Registrant as Specified in its Charter)

| British Columbia, Canada |

Not Applicable |

(State or other jurisdiction of Incorporation or

Organization) |

(I.R.S. Employer Identification No.) |

Suite 3400, Park Place

666 Burrard Street

Vancouver, British Columbia V6C 2X8

(604) 681-8371

(Address of and Telephone Number of Principal Executive Offices)

CT Corporation System

28 Liberty Street

New York, New York 10005

(Name and address of agent for service)

(215) 590-9070

(Telephone number, including area code, of agent for service)

Copies to:

Randall Chatwin

Senior Vice President,

Legal & Corporate Communications

Suite 3400, Park Place

666 Burrard Street

Vancouver, British Columbia V6C 2X8

(604) 681-8371 |

David S. Stone

John J. Koenigsknecht

Neal, Gerber & Eisenberg LLP

Two North LaSalle Street

Suite 1700

Chicago, Illinois 60602

(312) 269-8000 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☒

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

B2Gold Corp.

129,693,690 Common Shares

DIVIDEND REINVESTMENT PLAN

On August 2, 2023, we adopted a Dividend Reinvestment Plan, which we refer to as the "Plan", to provide, among other things, eligible holders of our common shares, no par value ("Common Shares") with a means to reinvest dividends declared and payable to them as shareholders (less any withholding tax) in additional Common Shares ("Plan Shares"). The Plan permits participating shareholders to obtain additional Common Shares by reinvesting the cash dividends (less any withholding tax) paid on the Common Shares held by the participant. We currently pay dividends on a quarterly basis.

The Corporation will be responsible for all administrative costs of the Plan, including any brokerage commissions or the fees or other expenses of the Plan Agent (as defined below) payable in connection with the purchase of Plan Shares under the Plan. Except in the event an account for a participant who holds a certificate or certificates or a DRS Advice (as defined below) registered in his, her or its own name, in each case for Common Shares enrolled in the Plan (“Registered Participant”) is terminated by the Corporation or the Plan Agent, in accordance with the Plan, Participants shall be responsible for all applicable brokerage commissions and transfer taxes, if any, incurred in connection with the sale of fractional Plan Shares by the Plan Agent on behalf of any Participant.

The Common Shares acquired by the Plan Agent under the Plan will be newly issued Common Shares acquired from us (a “treasury acquisition”). The price allocated to each Plan Share acquired by the Plan Agent under the Plan (the “Average Market Price”) on each date on which the Corporation pays a cash dividend on its Common Shares (each a “Dividend Payment Date”) will be equal to the volume weighted average price of the Common Shares on the Toronto Stock Exchange for the five consecutive trading days immediately preceding the Dividend Payment Date, subject to a possible discount, in the Corporation’s sole discretion, of up to 5%. As dividends will be denominated in U.S. dollars, the Average Market Price will be converted to U.S. dollars using the indicative daily exchange rate reported by the Bank of Canada on the business day immediately preceding the Dividend Payment Date.

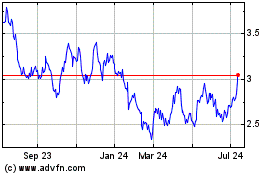

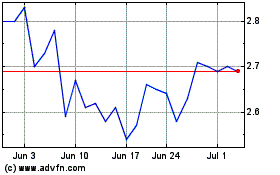

Our Common Shares are listed on the Toronto Stock Exchange under the symbol “BTO” and the NYSE American under the symbol “BTG”. On August 25, 2023, the closing price for our Common Shares on the Toronto Stock Exchange was C$4.12 and on the NYSE American was US$3.02.

The rate at which we pay dividends takes into account all factors that our board of directors considers relevant from the perspective of the Company, including our available cash flow, financial condition and capital requirements and are subject to, among other things, the factors and conditions described in this prospectus under the headings "Risk Factors" and "B2Gold Corp." While we currently expect to pay dividends on a quarterly basis, any decision to declare dividends is at the discretion of our board.

We will receive net proceeds from treasury acquisitions. We cannot estimate anticipated proceeds from the issuance of Common Shares pursuant to the Plan, which will depend upon the extent of shareholder participation in the Plan and the amount of quarterly dividends we pay, if any. We will not pay underwriting commissions in connection with the Plan and will be responsible for the ongoing administrative costs associated with the operation of the Plan.

Our principal executive offices are located at Suite 3400, Park Place, 666 Burrard Street, Vancouver, British Columbia V6C 2X8 and our telephone number is (604) 681-8371.

Investing in our Common Shares involves risks. See "Risk Factors" on page 1 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

The date of this prospectus is August 28, 2023.

TABLE OF CONTENTS

-i-

ABOUT THIS PROSPECTUS

You should rely only upon the information contained in or incorporated by reference into this prospectus and on other information included in the registration statement of which this prospectus forms a part. References to this prospectus include documents incorporated by reference into this prospectus. We have not authorized anyone to provide you with information that is different than the information included in or incorporated by reference into this prospectus. The information incorporated by reference into this prospectus is current only as of its date. We are not making an offer of Common Shares in any jurisdiction where the offer is not permitted by law.

In this prospectus (excluding the documents incorporated by reference into this prospectus), unless the context requires otherwise, references to "B2Gold Corp.", the "Corporation", the "Registrant", "we", "us" and "our" refer to B2Gold Corp. and the subsidiaries through which it conducts its business.

Our annual consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and are presented in United States dollars. Our condensed interim consolidated financial statements have been prepared in accordance with IFRS as applicable to interim financial reporting, including IAS 34, Interim Financial Reporting, and are also presented in United States dollars.

Before you invest, you should read this prospectus together with the information incorporated by reference into this prospectus and the additional information described below under the heading "Where You Can Find More Information." You should refer to the registration statement of which this prospectus forms a part and the exhibits to the registration statement for further information.

RISK FACTORS

Investing in our Common Shares involves risks. Before you decide to participate in the Plan and invest in our Common Shares, you should carefully consider the risk described below, together with all risks described in the documents incorporated by reference into this prospectus, including subsequent documents incorporated by reference into this prospectus. Discussions of certain risks and uncertainties affecting us are provided under the heading "Risk Factors" beginning on page 60 of our Annual Information Form, filed as Exhibit 99.1, to our Annual Report on Form 40-F for the fiscal year ended December 31, 2022, which was filed with the Securities and Exchange Commission (the "SEC") on March 16, 2023 and which is incorporated by reference into this prospectus, as such risk factors may be updated from time to time by our filings under the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), and other information contained in or incorporated by reference into this prospectus from time to time.

RISK RELATED TO THE PLAN

You will not know the price of the Common Shares you are purchasing under the Plan at the time you authorize the investment or elect to reinvest your dividends.

The price of our Common Shares may fluctuate between the time you decide to purchase Common Shares under the Plan and the time of actual purchase. In addition, during this time period, you may become aware of additional information that might affect your investment decision.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Exchange Act and, accordingly, file reports and other information with the SEC. Our filings are available electronically from the SEC's Electronic Data Gathering, Analysis and Retrieval System (EDGAR) at www.sec.gov, as well as from commercial document retrieval services. You may also want to visit our website at www.b2gold.com for further information. Any information that is included on or linked to our website is not a part of this prospectus.

We have filed under the United States Securities Act of 1933, as amended (the "Securities Act"), a registration statement on Form F-3 relating to the Plan. This prospectus forms a part of the registration statement. This prospectus does not contain all of the information included in the registration statement, certain portions of which have been omitted as permitted by the rules and regulations of the SEC. For further information about us and our Common Shares you are encouraged to refer to the registration statement and the exhibits that are incorporated by reference into it. Statements contained in this prospectus describing provisions of the Plan are not necessarily complete, and in each instance reference is made to the copy of the Plan that is included as an exhibit to the registration statement, and each such statement in this prospectus is qualified in all respects by such reference.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents filed with or furnished to the SEC are specifically incorporated by reference into, and form a part of, this prospectus:

(a) Our Annual Report on Form 40-F for the year ended December 31, 2022, which incorporates by reference as Exhibit 99.1 the Annual Information Form of the Corporation for the year ended December 31, 2022 and as Exhibit 99.2 the audited annual consolidated financial statements of the Corporation for the year ended December 31, 2022, filed with the Commission on March 16, 2023;

(b) Our condensed interim consolidated financial statements for the three months ended March 31, 2023 (incorporated by reference to Exhibit 99.1 of the Company’s Report on Form 6-K, as furnished to the Commission on May 9, 2023, and deemed filed herein);

(c) Our condensed interim consolidated financial statements for the three and six months ended June 30, 2023 (incorporated by reference to Exhibit 99.1 of the Company’s Report on Form 6-K, as furnished to the Commission on August 3, 2023, and deemed filed herein);

(d) Our Management’s Discussion and Analysis of the Company for the three months ended March 31, 2023 (incorporated by reference to Exhibit 99.2 of the Company’s Report on Form 6-K, as furnished to the Commission on May 9, 2023, and deemed filed herein);

(e) Our Management's Discussion and Analysis of the Company for the three and six months ended June 30, 2023 (incorporated by reference to Exhibit 99.2 of the Company's Report on Form 6-K, as furnished to the Commission on August 3, 2023, and deemed filed herein);

(f) Our Notice of Meeting and Management Information Circular of the Company dated May 15, 2023 in connection with the Registrant's annual general and special meeting of shareholders to be held on June 23, 2023 (incorporated by reference to Exhibit 99.1 of the Company's Report on Form 6-K, as furnished to the Commission on May 23, 2023, and deemed filed herein); and

(g) The description of the Registrant's securities contained in the Registrant's registration statement on Form 40-F filed under the Exchange Act on May 20, 2013.

In addition, all subsequent annual reports on Form 40-F filed by us pursuant to the Exchange Act prior to the termination of this offering will be incorporated by reference into this prospectus as of the date of the filing of such annual reports. Also, we may incorporate by reference future reports on Form 6-K that we furnish subsequent to the date of this prospectus by stating in those Form 6-Ks that they are being incorporated by reference into this prospectus.

Any statement contained in a document incorporated by reference into this prospectus shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus, in one of those other documents or in any other later filed document that is also incorporated by reference into this prospectus modifies or supersedes that statement. Any such statement so modified shall not be deemed, except as so modified, to constitute a part of this prospectus. Any such statement so superseded shall be deemed not to constitute a part of this prospectus.

Any person receiving a copy of this prospectus, including any beneficial owner, may obtain without charge, upon written or oral request, a copy of any of the documents incorporated by reference into this prospectus, except for the exhibits to those documents unless the exhibits are specifically incorporated by reference into those documents. Requests should be directed to our principal executive offices, Suite 3400, Park Place, 666 Burrard Street, Vancouver, British Columbia V6C 2X8, Attention: Legal, and our telephone number is (604) 681-8371.

ENFORCEABILITY OF CIVIL LIABILITIES

We are a corporation incorporated and existing under the laws of the Province of British Columbia. Many of our directors and officers, and some of the experts named in this prospectus, are residents of Canada or otherwise reside outside the United States, and all or a substantial portion of their assets, and a substantial portion of our assets, are located outside the United States. We have appointed an agent for service of process in the United States, but it may be difficult for holders of Common Shares who reside in the United States to effect service within the United States upon those directors, officers and experts who are not residents of the United States. It may also be difficult for holders of Securities who reside in the United States to realize in the United States upon judgments of courts of the United States predicated upon our civil liability and the civil liability of our directors, officers and experts under the United States federal securities laws. A final judgment for a liquidated sum in favour of a private litigant granted by a United States court and predicated solely upon civil liability under United States federal securities laws would, subject to certain exceptions identified in the law of individual provinces and territories of Canada, likely be enforceable in Canada if the United States court in which the judgment was obtained had a basis for jurisdiction in the matter that would be recognized by the domestic Canadian court for the same purposes. There is a significant risk that a given Canadian court may not have jurisdiction or may decline jurisdiction over a claim based solely upon United States federal securities law on application of the conflict of laws principles of the province or territory in Canada in which the claim is brought. We have appointed CT Corporation System, 28 Liberty Street, New York, New York 10005, as our agent in the United States upon which service of process against us may be made in any action based on this prospectus.

EXCHANGE RATE INFORMATION

Our financial statements are reported in U.S. dollars. All dollar amounts referenced in this prospectus, unless otherwise indicated, are expressed in U.S. dollars. A reference in this prospectus to:

- "C$" or "Canadian dollar" is to the lawful currency of Canada; and

- "$", "US$" or "U.S. dollar" is to the lawful currency of the United States.

The high, low, average and closing exchange rates for Canadian dollars in terms of U.S. dollars, as quoted by the Bank of Canada, for each period listed below, were as follows:

| |

Six months ended

June 30, 2023 |

|

Years ended December 31, |

| |

|

|

2022 |

|

2021 |

|

2020 |

| High |

US$ 0.7604 |

|

US$ |

0.8031 |

|

US$ |

0.8306 |

|

US$ |

0.7863 |

| Low |

US$ 0.7243 |

|

US$ |

0.7217 |

|

US$ |

0.7727 |

|

US$ |

0.6898 |

| Average for the Period |

US$ 0.7421 |

|

US$ |

0.7692 |

|

US$ |

0.7980 |

|

US$ |

0.7461 |

| End of Period |

US$ 0.7533 |

|

US$ |

0.7383 |

|

US$ |

0.7888 |

|

US$ |

0.7854 |

On August 25, 2023, the daily average rate of exchange for one Canadian dollar in U.S. dollars, as quoted by the Bank of Canada, was C$1.00 = US$0.7350 or US$1.00 = C$1.3606.

FORWARD LOOKING STATEMENTS

This prospectus and the exhibits incorporated by reference herein contain "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and U.S. securities laws, respectively (collectively, "forward-looking statements"), which may include, but are not limited to: projections; outlook; guidance; forecasts; estimates; and other statements regarding future or estimated financial and operational performance, gold production and sales, revenues and cash flows, capital costs (sustaining and non-sustaining) and operating costs, including projected cash operating costs and all-in sustaining costs, and budgets on a consolidated and mine by mine basis, which if they occur, would have on our business, our planned capital and exploration expenditures; future or estimated mine life, metal price assumptions, ore grades or sources, gold recovery rates, stripping ratios, throughput, ore processing; statements regarding anticipated exploration, drilling, development, construction, permitting and other activities or achievements of the Company; and including, without limitation: remaining well positioned for continued strong operational and financial performance for 2023; projected gold production, cash operating costs and all-in sustaining costs on a consolidated and mine by mine basis in 2023; total consolidated gold production of between 1,000,000 and 1,080,000 ounces in 2023, with cash operating costs of between $670 and $730 per ounce and all-in sustaining costs of between $1,195 and $1,255 per ounce; the Company's continued prioritization of developing the Goose project in a manner that recognizes Indigenous input and concerns and brings long-term socio-economic benefits to the area; the capital cost to complete the construction of the Goose Project being approximately C$550 million; the Goose Project producing more than 300,000 ounces of gold per year for the first five years and the Umwelt crown pillar containing over 150,000 ounces of gold; the Company's consolidated gold production to be relatively consistent throughout 2023 with the exception of the Otjikoto mine, where it will be weighted 60% to the second half of the year; the Company's total capitalized stripping expenditures moderating in 2024; the potential for Fekola Regional (Anaconda area) to provide saprolite material to feed the Fekola mill; the timing and results of a study for the Fekola Regional (Anaconda area) to review the project economics of a stand-alone oxide mill; the impact of any new mining code in Mali; the potential for first gold production in the first quarter of 2025 from the Goose Project; the potential payment of future dividends, including the timing and amount of any such dividends, and the expectation that quarterly dividends will be maintained at the same level; and B2Gold's attributable share of Calibre's operations. All statements in this prospectus or incorporated by reference herein that address events or developments that we expect to occur in the future are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, although not always, identified by words such as "expect", "plan", "anticipate", "project", "target", "potential", "schedule", "forecast", "budget", "estimate", "intend" or "believe" and similar expressions or their negative connotations, or that events or conditions "will", "would", "may", "could", "should" or "might" occur. All such forward-looking statements are based on the opinions and estimates of management as of the date such statements are made.

Forward-looking statements are inherently subject to known and unknown risks, uncertainties and other factors, many of which are beyond our ability to control, that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. As a result, actual actions, events or results may differ materially from those described in the forward-looking statements, and there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended including, without limitation, those referred to in our Annual Information Form (incorporated by reference as Exhibit 99.1 to our Annual Report on Form 40-F filed on March 16, 2023) under the heading "Risk Factors" and elsewhere.

Forward-looking statements necessarily involve assumptions, risks and uncertainties, certain of which are beyond our control, including risks associated with or related to: the volatility of metal prices and our common shares; changes in tax laws; the dangers inherent in exploration, development and mining activities; the uncertainty of reserve and resource estimates; not achieving production, cost or other estimates; actual production, development plans and costs differing materially from the estimates in our feasibility and other studies; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; the ability to replace mineral reserves and identify acquisition opportunities; the unknown liabilities of companies acquired by the Company; the ability to successfully integrate new acquisitions; fluctuations in exchange rates; the availability of financing; financing and debt activities, including potential restrictions imposed on our operations as a result thereof and the ability to generate sufficient cash flows; operations in foreign and developing countries and the compliance with foreign laws, including those associated with operations in Mali, Namibia, the Philippines and Colombia and including risks related to changes in foreign laws and changing policies related to mining and local ownership requirements or resource nationalization generally; remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; the lack of sole decision-making authority related to Filminera Resources Corporation, which owns the Masbate Gold Project; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; competition with other mining companies; community support for our operations, including risks related to strikes and the halting of such operations from time to time; conflicts with small scale miners; failures of information systems or information security threats; the ability to maintain adequate internal controls over financial reporting as required by law, including Section 404 of the Sarbanes-Oxley Act; compliance with anti-corruption laws, and sanctions or other similar measures; social media and our reputation; risks affecting Calibre having an impact on the value of the Company's investment in Calibre, and potential dilution of our equity interest in Calibre; as well as other factors identified and as described in more detail under the heading "Risk Factors" in our most recent Annual Information Form, our current Form 40-F Annual Report and our other filings with Canadian securities regulators and the SEC. The list is not exhaustive of the factors that may affect our forward-looking statements.

Forward-looking statements are based on the opinions and estimates of our management and reflect their current expectations regarding future events and operating performance. We do not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking statements, there may be other factors that cause actual results to differ materially from those which are anticipated, estimated, or intended. There can be no assurance that forward-looking statements will prove to be accurate, and actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, no assurance can be given that any events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what benefits or liabilities we will derive therefrom. For the reasons set forth above, undue reliance should not be placed on forward-looking statements. All the forward-looking statements contained in this prospectus or incorporated by reference herein are qualified by these cautionary statements.

The forward-looking statements herein are made as of the date of this prospectus only and we do not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Our forward-looking statements contained in the documents incorporated by reference into this prospectus are made as of the respective dates set forth in such exhibits. Such forward-looking statements are based on the beliefs, expectations and opinions of management on the date the statements are made. In preparing this prospectus, we have not updated such forward-looking statements to reflect any change in circumstances or in management's beliefs, expectations or opinions that may have occurred subsequent to the date thereof, nor do we assume any obligation to update such forward-looking statements in the future, except as required by applicable law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

CAUTIONARY NOTE REGARDING MINERAL RESERVE AND RESOURCE ESTIMATES

This prospectus and the documents incorporated by reference herein and therein, have been prepared in accordance with Canadian standards for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United States securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced in this prospectus and the documents incorporated by reference herein are Canadian mineral disclosure terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”).

For United States reporting purposes, the SEC has adopted amendments to its disclosure rules (the "SEC Modernization Rules") to modernize the mining property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. The SEC Modernization Rules more closely align the SEC's disclosure requirements and policies for mining properties with current industry and global regulatory practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that were included in Industry Guide 7 under the U.S. Securities Act. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the MJDS, the Corporation is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and provides disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource information contained in this prospectus and the documents incorporated by reference herein may not be comparable to similar information disclosed by United States companies.

As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources." In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding CIM Definition Standards that are required under NI 43-101. While the above terms are "substantially similar" to CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance that any mineral reserves or mineral resources that the Corporation may report as "proven mineral reserves", "probable mineral reserves", "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Corporation prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. Further, estimates of inferred mineral resources have significant geological uncertainty and it should not be assumed that all or any part of an inferred mineral resource will be converted to the measured or indicated categories. Mineral resources that are not mineral reserves do not meet the threshold for reserve modifying factors, such as estimated economic viability, that would allow for conversion to mineral reserves.

B2GOLD CORP.

We are an international, responsible, senior gold producer based in Vancouver, British Columbia, with a strategic focus on acquiring and developing interests in mineral properties with demonstrated potential for hosting economic mineral deposits, with gold deposits as the primary focus. We conduct gold mining operations and exploration and drilling campaigns to define and develop mineral resources and mineral reserves on our properties with an intention of developing, constructing and operating mines on such properties.

Our corporate objective is to continue to maximize profitable production from our mines, grow as a profitable and responsible gold producer through further advancement of our pipeline of development and exploration projects, evaluate new exploration, development and production opportunities, make accretive acquisitions, irrespective of the gold price, and continue to pay an industry leading dividend yield.

We were incorporated under the Business Corporations Act (British Columbia) (the "BCBCA") on November 30, 2006. Our head office is located at Suite 3400, Park Place, 666 Burrard Street, Vancouver, British Columbia, Canada V6C 2X8 and our registered office is located at Suite 1600 - 925 West Georgia Street, Vancouver, British Columbia, Canada V6C 3L2. A significant portion of our business is carried on through our subsidiaries.

BUSINESS

We are an international, responsible senior gold producer based in Vancouver, Canada with three operating mines (one mine in each of Mali, Namibia and the Philippines) and a fourth mine in construction in Canada. In addition, we have a portfolio of other development and exploration projects in several countries including Mali, Finland and Uzbekistan.

We currently operate the following three mines:

-

Fekola mine (80% ownership), an open pit gold mine located approximately 40 kilometres ("km") south of the city of Kéniéba, Mali (the "Fekola Mine");

-

Otjikoto mine (90% ownership), an open pit mine and underground gold mine located approximately 300 km north of Windhoek, the capital of Namibia (the "Otjikoto Mine"); and

-

Masbate gold project (ownership as described under "Material Properties - Masbate Gold Project" in our Annual Information Form for the year ended December 31, 2022), an open pit gold mine, located near the northern tip of the island of Masbate, 360 km southeast of Manila, the capital of the Philippines (the "Masbate Gold Project").

On April 19, 2023, we completed the acquisition of Sabina Gold & Silver Corp. ("Sabina"), the 100% owner of the Back River Gold District located in Nunavut, Canada, which is comprised of five mineral claims blocks along an 80 km belt (the "Back River Gold District"). The most advanced project in the Back River Gold District is the Goose Project.

See our Annual Information Form for the year ended December 31, 2022 (incorporated by reference as Exhibit 99.1 to our Annual Report on Form 40-F filed on March 16, 2023) "General Development of the Business” “Description of the Business” and “Corporate Structure” and our Management’s Discussion and Analysis of the Company for the three and six months ended June 30, 2023 (incorporated by reference to Exhibit 99.2 of the Company’s Report on Form 6-K, as furnished to the Commission on August 3, 2023) “Review of Mining Operations and Development Projects,” for more information.

USE OF PROCEEDS

We will receive net proceeds from the sale of Common Shares pursuant to the Plan. We have no basis for estimating precisely either the number of Common Shares that may be issued under the Plan or the prices at which the Common Shares may be sold. The amount of net proceeds that we will receive will depend upon the extent of the participation in the Plan and the amount of the quarterly dividends that we pay, if any. The net proceeds from the sale of the Common Shares will be used for general corporate purposes.

THE PLAN

The following is a summary of the material attributes of the Plan. The summary does not purport to be complete and is subject to, and qualified in its entirety by, reference to the complete Plan that is filed as an exhibit to the registration statement of which this prospectus forms a part. Capitalized terms in this section not otherwise defined shall have the meaning set forth in the Plan.

Purpose of the Plan

The purpose of our Plan is to permit eligible holders of Common Shares to automatically reinvest cash dividends paid on some or all of those Common Shares into additional Common Shares at the applicable Average Market Price.

Common Shares will be acquired by Computershare Trust Company of Canada, the agent for the Plan (the "Plan Agent") directly from the treasury of the Corporation on the Dividend Payment Date. In no event will interest be paid to Participants on any funds held for reinvestment under the Plan. Common Shares held by the Plan will be registered in the name of the Plan Agent, or its nominee, as Agent for the Participants.

The payment of dividends on our Common Shares is not assured, and is within the sole and absolute discretion of our Board, taking into account, among other things, economic conditions, business performance, financial condition, growth plans, expected capital requirements, compliance with our constating documents, all applicable laws, including the rules and policies of any applicable stock exchange, as well as any contractual restrictions on such dividends, including any agreements entered into with our lenders, and any other factors that the Board deems appropriate at the relevant time. There can be no assurance that we will be in a position to declare any future dividends or the amount of any future dividends.

Participation in the Plan

Shareholders residing in Canada or the United States (or in certain other eligible jurisdictions) are eligible to participate in the Plan. Dividends to be reinvested by shareholders outside of Canada will continue to be subject to withholding under applicable tax laws and the amount reinvested will be reduced by the amount of tax withheld. The extent to which you may directly participate in the Plan will depend on the manner in which you hold your Common Shares. Shareholders in other eligible jurisdictions may be allowed to participate in the Plan only if the Corporation determines, in its sole discretion, that it is able to comply, without undue cost and burden, with the laws relating to the offering and the sale of Common Shares in the jurisdiction of those shareholders and that such laws do not subject the Plan or the Corporation to additional legal or regulatory requirements. In making such determination, we may request such documentation as we deem necessary, including an opinion of legal counsel or undertakings from any intermediary.

Beneficial shareholders in the United States whose Common Shares are registered through The Depository Trust Company ("DTC") are not currently eligible for participation in the Plan as DTC does not participate in dividend reinvestment plans for Canadian issuers. If a beneficial owner of Common Shares (a "Beneficial Shareholder") holds Common Shares registered in the name of DTC, he, she or it may participate in the Plan by: (a) directing his, her or its broker to transfer all or any number of whole Common Shares into his, her or its name and then enrolling such Common Shares in the Plan; or (b) making appropriate arrangements with the intermediary who holds Common Shares registered in their own name on behalf of the Beneficial Shareholder (a "Nominee") to transfer all or any number of whole Common Shares into CDS Clearing and Depository Services Inc. ("CDS") and enroll in the Plan on the Beneficial Shareholder's behalf.

To become a Participant in the Plan, eligible shareholders may enroll all or any portion of their Common Shares in the Plan at any time by enrolling online through the Plan Agent's self-service web portal at www.investorcentre.com or by downloading the enrollment form available on the Plan Agent's web portal and completing and delivering it to the Plan Agent by no later than 4:00 p.m. (Toronto time) on the fifth Business Day prior to a Dividend Record Date for it to be effective on such Dividend Payment Date. Dividend Record Dates will be announced by the Corporation in advance. Any enrollment form received after such time will be processed for the next applicable Dividend Record Date. Registered shareholders may also obtain an enrollment form by contacting the Plan Agent in any of the manners specified in the Plan.

Dividends to be reinvested under the Plan on behalf of Participants who are residents of the U.S. (or other eligible jurisdictions) will be subject to applicable Canadian non-resident withholding tax. See "Canadian Income Tax Considerations Relating to the Plan - Canadian Federal Income Tax Considerations" in this prospectus.

Once a Participant has enrolled in the Plan, participation will continue automatically unless terminated in accordance with the Plan. If you participate in the Plan indirectly through CDS or a Nominee, you should consult your Nominee to confirm the Nominee's policies concerning continued participation in the Plan following your initial enrollment.

Participants should note that Common Shares acquired outside of the Plan may not be registered in exactly the same name or manner as Common Shares enrolled in the Plan and therefore may not be automatically enrolled in the Plan. Participants purchasing additional Common Shares outside of the Plan are advised to contact the Plan Agent to ensure that all Common Shares owned by them are enrolled in the Plan.

If you are a Beneficial Shareholder and wish to participate in the Plan, then you must determine whether your Nominee allows participation in the Plan. Please note that not all Nominees will allow, nor is any Nominee required to allow, your participation in the Plan. If you wish to participate and your Nominee does not allow it, it is your responsibility to either transfer your Common Shares to a different Nominee allowing participation in the Plan, or into your own name and enroll in the Plan directly. If you wish to participate and your Nominee does allow it, you must arrange for your Nominee to enroll in the Plan on your behalf. If you choose to enroll in the Plan, your Nominee may be required to elect to participate on your behalf every dividend period.

The Corporation may, in its sole discretion, determine from time to time that any shareholder or group of shareholders may not participate or continue to participate in the Plan. Without limiting the generality of the foregoing, the Corporation may deny the right to participate in the Plan to any shareholder if the Corporation deems it to be advisable under any laws or regulations. Further, the Corporation may deny the right to participate in the Plan to any shareholder if the Corporation has reasons to believe that such shareholder has been engaging in market activities, or has been artificially accumulating securities of the Corporation, for the purpose of taking undue advantage of the Plan to the detriment of the Corporation.

Your participation in the Plan will commence with the first dividend payment after which you or your Nominee submitted your enrollment form, provided that:

(i) if you are a registered shareholder, the Plan Agent received the form not later than 4:00 p.m. (Toronto time) five (5) business days preceding the record date for the dividend; or

(ii) if you are a Beneficial Shareholder, the Plan Agent received appropriate instructions from CDS or other Nominee not later than such time as may be agreed from time to time between such depository or Nominee and the Plan Agent in accordance with custom and practice relating to such depository's or Nominee's system. The depository must in turn receive appropriate instructions from the Nominee holders that are depository participants not later than such deadline as may be established by the depository from time to time.

If the enrollment form or instructions, as applicable, are not received by the Plan Agent by the stipulated deadline, any dividend will be paid to you in the usual manner and participation in the Plan will commence with the next dividend.

Method of Purchase

On each Dividend Payment Date, cash dividends payable (less applicable withholding tax) on Common Shares enrolled in the Plan will be aggregated and then used by the Plan Agent to acquire Common Shares for Participants. Common Shares acquired by the Plan Agent under the Plan will be newly issued Common Shares acquired from the Corporation treasury. Dividends paid that are invested will be subject to any applicable withholding tax.

A Participant's account will be credited with the number of Common Shares, including fractions computed to six decimal places, which is equal to the dividends (less applicable withholding tax) reinvested for such Participant divided by the applicable purchase price.

Common Shares purchased pursuant to the Plan will be registered in the name of the Plan Agent or its nominee, as agent for Participants.

Dividends on Common Shares otherwise payable to Participants will be paid to the Plan Agent as agent for such Participants and will be applied to the purchase of Common Shares by the Plan Agent. In no event will interest be paid to Participants on any funds held for investment under the Plan.

Limit of Reinvestments in Certain Events

We may limit the maximum number of Common Shares that may be issued under the Plan. If issuing Common Shares under the Plan would result in the Corporation exceeding any such limit and we determine not to issue Common Shares in respect of a particular Dividend Payment Date, Participants will receive from the Plan Agent cash dividends for the dividends that are not reinvested in Common Shares (without interest or deduction thereon, except for any applicable withholding taxes). We will be under no obligation to issue Common Shares to any Participants under the Plan where the Corporation exceeds the maximum number of Common Shares that may be issued under the Plan. We will be under no obligation to issue Common Shares on a pro rata basis to Participants under the Plan where the Corporation exceeds the maximum number of Common Shares that may be issued under the Plan. The Corporation is not required to facilitate market purchases of Common Shares for any dividends not reinvested due to a limit on the number of Common Shares issuable under the Plan.

Purchase Price

We do not control the price of Common Shares acquired under the Plan. The purchase price allocated for each common share acquired by the Plan Agent on each Dividend Payment Date (the "Average Market Price") will be equal to the volume weighted average price of the Common Shares on the Toronto Stock Exchange for the five consecutive trading days immediately preceding the Dividend Payment Date, subject to a possible discount, in the Corporation's sole discretion, of up to 5%. As dividends will be denominated in U.S. dollars, the Average Market Price will be converted to U.S. dollars using the indicative daily exchange rate reported by the Bank of Canada on the Dividend Payment Date.

Rights Offerings, Stock Splits and Stock Dividends

If the Corporation makes available to holders of record of its Common Shares rights to subscribe for additional Common Shares or other securities, Participants will be forwarded rights certificates pertaining to their whole Common Shares held by the Plan Agent on their behalf, subject to the terms and conditions of the rights offering. No such rights will be made available in respect of fractions of Common Shares held by the Plan Agent. Each Participant's account will be adjusted for any stock splits or stock dividends declared on Common Shares.

Beneficial Shareholders should contact their Nominee with questions regarding the procedures for rights offerings, stock splits and stock dividends.

Administration

The Plan Agent acts as the plan agent for the Participants under the Plan pursuant to an agreement which may be terminated by the Corporation or the Plan Agent in accordance with the agreement between the Corporation and the Plan Agent. On each Dividend Payment Date, we shall pay to the Plan Agent on behalf of the Participants all cash dividends payable in respect of such Participants' Common Shares (less any applicable withholding taxes). The Plan Agent shall use such funds to purchase Common Shares from the Corporation's treasury for the Participants. Common Shares purchased under the Plan will be registered in the name of the Plan Agent, as plan agent for Participants in the Plan. Should Computershare Trust Company of Canada cease to act as Plan Agent under the Plan, another plan agent will be designated by us, in our discretion.

Participants' Accounts and Reports

The Plan Agent will maintain an account for each Participant in the Plan. A statement of account regarding purchases under the Plan will be mailed to each Registered Participant on a quarterly basis setting out, among other things, the number of Plan Shares purchased through the Plan and the applicable Average Market Price per Plan Share. The statement of account will be mailed as soon as practicable after each Dividend Payment Date. Such statements will constitute a Registered Participant's continuing record of the date and valuation of the acquisition of Plan Shares and should be retained for income tax purposes. Registered Participants' tax information will be mailed annually.

Beneficial Shareholders who have enrolled in the Plan may receive statements of account from their Nominee in accordance with the Nominee's administrative practices. Such statements will constitute a Beneficial Shareholder's continuing record of the date and valuation of the acquisition of Plan Shares and should be retained for income tax purposes. Beneficial Shareholders should contact their Nominee to determine the procedures for requesting current statements.

Registration, Withdrawal or Disposition of Common Shares

Common Shares purchased under the Plan and held under the Plan by the Plan Agent for the account of Participants other than CDS will be registered in the name of the Plan Agent or its nominee or in accounts designated by it for the account of Participants other than CDS. A Direct Registration System Advice ("DRS Advice") evidencing book-entry registered ownership of such Common Shares will only be issued to the Participant if the Plan or the Participant's participation therein is terminated or if the Participant withdraws Common Shares from its account.

A Plan Participant may, without terminating participation in the Plan, withdraw from its account under the Plan, and have a DRS Advice issued and registered in the Participant's name for, any number of whole shares held for its account under the Plan by delivering to the Plan Agent a duly completed withdrawal portion of the voucher located on the reverse of the statement of account issued by the Plan Agent. A withdrawal request may also be obtained from the Plan Agent at the address below. Alternatively, Participants may follow the instructions at the Plan Agent's self-service web portal at www.investorcentre.com/b2gold. The withdrawal of Common Shares and issuance of a DRS Advice will generally be completed within three weeks following receipt of the withdrawal request. A Participant who withdraws Common Shares from the Plan but does not terminate participation in the Plan will continue to participate in the Plan for the Common Shares withdrawn. Any remaining shares (including a residual fraction of a share) will continue to be held by the Plan Agent for the Plan Participant's account under the Plan.

Common Shares being held for a Participant in the Plan may not be pledged, sold or otherwise disposed of by a Participant. Participants wishing to do so must request a DRS Advice, or contact their broker or nominee.

Commissions and Administrative Costs

Except as otherwise specifically provided in the Plan, the Corporation will be responsible for all administrative costs of the Plan, including any brokerage commissions or the fees or other expenses of the Plan Agent payable in connection with the purchase of Common Shares under the Plan. Except in the event of termination of a Registered Participant's account by the Corporation or the Plan Agent in accordance with the Plan, Participants shall be responsible for all applicable brokerage commissions and transfer taxes, if any, incurred in connection with the sale of fractional Plan Shares by the Plan Agent on behalf of any Participant. Beneficial Shareholders may be charged additional fees by the Nominee through which their Plan Shares are held.

Responsibilities of the Corporation and the Plan Agent

Neither we nor the Plan Agent shall be liable for any act or any omission to act in connection with the operation of the Plan. Participants should recognize that neither we nor the Plan Agent can assure a profit or protect against loss as a result of their purchase of Common Shares under the Plan.

Termination of Participation

Participants may terminate their participation in the Plan by referencing the instructions on the reverse of the Participant's periodic statement of account, or by notifying the Plan Agent. Any written notice provided to the Plan Agent must be signed by the Participant or his, her or its agent. Participants may also terminate from the Plan at the Plan Agent's self-service web portal at www.investorcentre.com.

The Plan Agent will issue a DRS Advice for the number of whole Common Shares held in such Participant's account and a cash payment for any fraction of a Plan Share remaining in the Participant's account as soon as practicable and generally within three weeks of receipt by the Plan Agent of a Participant's written request. The amount of payment for any such fraction will be calculated using the Termination Price.

Beneficial Shareholders who have enrolled in the Plan should contact their Nominee to determine the procedures for terminating their participation in the Plan.

Participation in the Plan will be terminated upon receipt by the Plan Agent of appropriate evidence of the death of a Registered Participant from such Participant's duly appointed legal representative and written instructions to terminate such Participant's participation in the Plan. Proof of the legal representative's authority to act must accompany the evidence of death. The Plan Agent will terminate the account for such deceased Participant and issue a DRS Advice, and a cash payment for a fractional Plan Share as the case may be, in the name of an estate. The amount of payment for any such fraction will be calculated using the Termination Price. The Corporation or the Plan Agent may terminate any Registered Participant's account upon written notice to the Participant at any time if the Participant has less than one whole Plan Share or if the Plan is terminated. The amount of payment for any such fraction will be calculated using the Termination Price.

All payments of cash under the Plan will be made in either Canadian or U.S. dollars. Unless a Participant requests otherwise in writing, the Plan Agent will make payments in Canadian dollars where the Participant has a Canadian mailing address and in U.S. dollars where the Participant has a non-Canadian mailing address, in each case, as such address is showing on the records of the Plan Agent.

Shareholder Voting

Participants may vote whole Common Shares held by the Plan Agent on their behalf, in the same manner as any other Common Shares of the Corporation, either by proxy or in person. The Plan Agent will forward any proxy solicitation materials to Participants. Beneficial Shareholders should contact their Nominee to determine the procedures for voting Plan Shares. A fractional Common Share does not carry the right to vote.

Amendment or Termination of Plan and/or Plan Agent

Subject to any required regulatory or stock exchange approval, the Corporation may amend or suspend, in whole or in part, or terminate the Plan at any time upon notice thereof to all Participants, without their consent or approval. The Corporation shall issue a news release advising shareholders of the suspension or termination of the Plan. All amendments to the Plan must be pre-cleared by the TSX.

If the Plan is terminated by the Corporation, the Plan Agent will remit to each Registered Participant a DRS Advice for whole Plan Shares held for such Participant under the Plan, together with the proceeds for any fraction of such shares. The amount of payment for any such fraction will be calculated using the Termination Price. In the event of suspension of the Plan, (a) any request from a Participant to enroll in the Plan will not be processed, but such requests will be returned to the Participant with an explanation of the suspension of the Plan, and (b) the Plan Agent will make no investments on any Dividend Payment Date following the effective date of such suspension and all dividends will be paid in cash during such suspension.

Beneficial Shareholders should contact their Nominee with questions regarding the procedures of the Nominee in the event of the suspension or termination of the Plan.

The Corporation may from time to time appoint a Plan Agent to administer the Plan on behalf of the Corporation and the Participants, pursuant to the agreement between the Corporation and the Plan Agent. Such agreement may be terminated by the Corporation or the Plan Agent in accordance with its terms. The Plan Agent may resign as Plan Agent under the Plan in accordance with the agreement between the Corporation and the Plan Agent, in which case the Corporation will appoint another agent as the Plan Agent.

Withholdings

The Plan is subject to any withholding obligations that we may have with respect to taxes or other charges under applicable laws, and any amounts to be reinvested hereunder shall be net of any amounts required to be withheld.

Notices

Registered Participants must notify the Plan Agent promptly in writing of any change of address. Notices or statements from the Plan Agent to Registered Participants will be mailed at the last address of record for each Participant in the Plan, and any such notice or statement will be deemed received when received by the Participant or within five Business Days after mailing, whichever occurs earlier.

Notices to the Plan Agent shall be addressed as follows:

Computershare Trust Company of Canada

100 University Avenue, 8th Floor, North Tower

Toronto, Ontario M5J 2Y1

Attention: Dividend Reinvestment Department

Or the National Contact Center at:

North America: 1-800-564-6253

Outside of North America: 514-982-7555

Or by facsimile to: 1-866-249-7775

Or by visiting www.Investorcentre.com/service

Notices to us shall be addressed as follows:

B2Gold Corp.

Park Place, Suite 3400 - 666 Burrard Street

Vancouver, British Columbia V6C 2X8

Attention: Cori Compton

Telephone: 604 681-8371

Facsimile: 604 681-6209

Governing Law

The Plan will be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

Rules

The Corporation may make rules and regulations to facilitate the administration of the Plan and reserves the right to regulate and interpret the Plan text as the Corporation deems necessary or desirable. The Corporation may adopt rules and regulations concerning the establishment of Internet-based or other electronic mechanisms with respect to the enrollment in the Plan, the communication of information concerning the Plan to the Participants and any other aspects of the Plan.

INCOME TAX CONSIDERATIONS RELATING TO THE PLAN

Canadian Federal Income Tax Considerations

The following is a summary of the principal Canadian federal income tax considerations generally applicable to a Participant who, at all relevant times, for purposes of the application of the Income Tax Act (Canada) (the "Tax Act") and the Income Tax Regulations (the "Regulations"): (i) deals at arm's length with and is not affiliated with the Corporation; (ii) holds, and will hold, all Common Shares acquired under the Plan as capital property; and (iii) has cash dividends paid on Common Shares reinvested in Common Shares under the Plan.

This summary is based upon the current provisions of the Tax Act and the Regulations, and all specific proposals to amend the Tax Act and the Regulations publicly announced by the Minister of Finance (Canada) prior to the date hereof (the "Proposed Amendments"), and the current published administrative policies and assessing practices of the Canada Revenue Agency (the "CRA"). This summary assumes that all Proposed Amendments will be enacted in the form proposed. However, no assurances can be given that the Proposed Amendments will be enacted as proposed, or at all. This summary is not exhaustive of all possible Canadian federal income tax considerations, and does not take into account Canadian provincial or territorial income tax laws, or foreign tax considerations.

This summary does not apply to: (i) a Participant who is subject to the "mark-to-market" rules under the Tax Act applicable to certain "financial institutions"; (ii) a Participant that is a "specified financial institution"; (iii) a Participant an interest in which is a "tax shelter investment"; (iv) a Participant who makes or has made a functional currency reporting election pursuant to section 261 of the Tax Act; or (v) a Participant who has entered into or will enter into a "derivative forward agreement" with respect to their Common Shares (all as defined in the Tax Act). Such Participants should consult their own tax advisors.

This summary is of a general nature only and is not, and is not intended to be, legal or tax advice to any particular Participant under the Plan. This summary is not exhaustive of all Canadian federal income tax considerations. Accordingly, prospective participants should consult their own tax advisers having regard to their own particular circumstances.

For the purposes of the Tax Act and the Regulations, all amounts relating to the acquisition, holding or disposition of Common Shares must be expressed in Canadian dollars including any dividends, adjusted cost base, and proceeds of disposition. For purposes of the Tax Act, amounts denominated in a currency other than the Canadian dollar generally must be converted into Canadian dollars using appropriate exchange rate determined in accordance with the detailed rules in the Tax Act in that regard. As a result, the amount required to be included in the income of a Participant may be affected by virtue of fluctuations in the value of the U.S. dollar relative to the Canadian dollar.

Canadian Residents

This portion of the summary is generally applicable to a Participant who, at all relevant times, for purposes of the application of the Tax Act, is, or is deemed to be, resident in Canada (a "Resident Participant").

All cash dividends paid on Common Shares that are reinvested on behalf of a Participant will generally be subject to the tax treatment normally applicable to taxable dividends (including "eligible dividends" as defined in the Tax Act) from a "taxable Canadian corporation", as defined in the Tax Act. For example, in the case of a Resident Participant who is an individual, such dividends will be subject to the normal gross-up and dividend tax credit rules or, in the case of a Resident Participant who is a private corporation or one of certain other corporations, a refundable tax will apply to the amount of the dividend. Other taxes could apply depending on the circumstances of the Resident Participant.

Based on the CRA's administrative policy, the purchase by a Resident Participant of Common Shares from the investment of cash dividends at a discount that is no greater than 5% should not result in a taxable benefit under the Tax Act to such Resident Participant.

A Resident Participant should not realize any taxable income when the Resident Participant receives certificates or DRS Advices, as applicable, for whole Common Shares credited to the Resident Participant's account, whether upon the Resident Participant's request, upon termination of participation in the Plan, or upon termination of the Plan.

The cost to a Resident Participant of Common Shares acquired under the Plan will be the price paid for such shares by the Resident Participant. For the purpose of computing the adjusted cost base of such shares to the Resident Participant, the cost of such shares will be averaged with the adjusted cost base of all Common Shares held by the Resident Participant as capital property.

A Resident Participant may realize a capital gain or capital loss on the disposition of Common Shares acquired through the Plan.

Non-Residents of Canada

This portion of the summary is generally applicable to a Participant under the Plan who, at all relevant times, for purposes of the application of the Tax Act, is not, and is not deemed to be, resident in Canada, and who does not use or hold and is not deemed to use or hold Common Shares in the course of carrying on business in Canada (a "Non-Resident Participant"). Special rules, which are not discussed in this summary, may apply to a Participant who is not resident in Canada and who is an insurer that carries on an insurance business in Canada and elsewhere.

All cash dividends paid on Common Shares that are reinvested on behalf of a Non-Resident Participant will be subject to Canadian withholding tax at the rate of 25%, subject to any reduction in the rate of withholding to which the Participant is entitled under any applicable income tax treaty or convention between Canada and the country in which the Non-Resident Participant is resident. For example, where a Non-Resident Participant is a U.S. resident entitled to the full benefits under the Canada-U.S. Income Tax Convention (1980), as amended, and is the beneficial owner of the dividends, the applicable rate of Canadian withholding tax is generally reduced to 15%. The amount of dividends to be invested under the Plan will be reduced by the amount of tax withheld.

Based on the CRA's administrative policy, the purchase by a Non-Resident Participant of Common Shares from the investment of cash dividends at a discount that is no greater than 5% should not result in a taxable benefit under the Tax Act to such Non-Resident Participant.

A Non-Resident Participant should not realize any taxable income when the Non-Resident Participant receives certificates or DRS Advices, as applicable, for whole Common Shares credited to the Non-Resident Participant's account, whether upon the Non-Resident Participant's request, upon termination of participation in the Plan, or upon termination of the Plan.

A Non-Resident Participant will not be subject to tax under the Tax Act on any capital gain realized on a disposition of Common Shares unless those Common Shares constitute "taxable Canadian property" (as defined in the Tax Act) of the Non-Resident Participant at the time of the disposition and the Non-Resident Participant is not entitled to relief under any applicable income tax treaty or convention between Canada and the country in which the Non-Resident Participant is resident.

Provided that the Common Shares are then listed on a "designated stock exchange" (as defined in the Tax Act), the Common Shares generally will not constitute "taxable Canadian property" of a Non-Resident Participant at the time of the disposition unless, at any time during the 60-month period immediately preceding the disposition both of the following conditions are met: (i)(A) the Non-Resident Participant, (B) persons with whom the Non-Resident Participant did not deal at arm's length, (C) partnerships in which the Non-Resident Participant or a person described in (i)(B) holds a membership interest directly or indirectly through one or more partnerships, or (D) one or any combination of persons or partnerships described in (i)(A) to (a)(C), owned 25% or more of the issued shares of any class of the capital stock of the Corporation, and (ii) more than 50% of the fair market value of the Common Shares was derived directly or indirectly from one or any combination of: (A) real or immovable property situated in Canada; (B) "Canadian resource properties" (as defined in the Tax Act); (C) "timber resource properties" (as defined in the Tax Act); and (D) options in respect of, or interests in, or for civil law rights in, property described in (A) to (C), whether or not the property exists. Non-Resident Participants whose Common Shares are, or may be, taxable Canadian property should consult their own tax advisors.

United States Income Tax Considerations for U.S. Participants

The following discussion summarizes certain United States federal income tax considerations relating to participation in the Plan by U.S. Participants (as defined below) that hold Common Shares, acquired pursuant to the Plan, as capital assets (generally, property held for investment). For purposes of this discussion, a "U.S. Participant" generally means a beneficial owner of Common Shares enrolled in the Plan that is, for United States federal income tax purposes, any of the following:

-

a citizen or individual resident of the United States;

-

a corporation, or other entity treated as a corporation for United States federal income tax purposes, created in, or organized under the laws of, the United States, any state thereof or the District of Columbia;

-

an estate whose income is subject to United States federal income tax regardless of its source; or

- a trust if either (a) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all substantial decisions of the trust or (b) the trust has a valid election in effect to be treated as a United States person under applicable Treasury regulations.

THIS DISCUSSION IS INCLUDED HEREIN AS GENERAL INFORMATION ONLY. ACCORDINGLY, PROSPECTIVE U.S. PARTICIPANTS IN THE PLAN ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR UNITED STATES FEDERAL, STATE, LOCAL AND NON-UNITED STATES INCOME AND OTHER TAX CONSIDERATIONS APPLICABLE TO THEM RELATING TO PARTICIPATION IN THE PLAN.

This discussion is based on the United States Internal Revenue Code of 1986, as amended (the "Code"), its legislative history, United States Treasury regulations promulgated under the Code, judicial opinions, published positions of the United States Internal Revenue Service (the "IRS"), and other applicable authorities, all as in effect as of the date hereof, and any of which are subject to change (possibly with retroactive effect), or differing interpretations, so as to result in United States federal income tax consequences different from those discussed herein. No ruling has been requested, or will be obtained, from the IRS regarding the U.S. federal income tax consequences of the acquisition, ownership and disposition of Common Shares acquired pursuant to the Plan. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. In addition, because the authorities on which this summary is based are subject to various interpretations, the IRS and the U.S. courts could disagree with one or more of the conclusions described in this summary.

This discussion does not address all aspects of United States federal income taxation that may be relevant to a particular U.S. Participant in light of that U.S. Participant's individual circumstances, nor does it address any aspects of United States federal estate and gift, state, local, or non-United States taxes or the 3.8% tax imposed on certain net investment income. This discussion does not apply, in whole or in part, to particular U.S. Participants subject to special treatment under the United States federal income tax laws, such as:

- insurance companies;

- tax-exempt organizations (including private foundations), qualified retirement plans, individual retirement accounts, or other tax-deferred accounts;

- banks and other financial institutions;

- brokers or dealers in securities or currencies;

- regulated investment companies;

- real estate investment trusts;

- U.S. Participants that hold, or will hold, Common Shares as part of a straddle, hedge, appreciated financial position, conversion transaction or other risk reduction strategy;

- persons that hold an interest in an entity that holds, or will hold, the Common Shares;

- persons liable for alternative minimum tax;

- persons that have a "functional currency" other than the U.S. dollar;

- persons that generally mark their securities to market for United States federal income tax purposes;

- persons that acquired the Common Shares in connection with the exercise of employee stock options or otherwise as compensation for services;

- persons that own, or have owned, directly, indirectly or constructively, 10% or more of the Corporation's common stock (by vote or value) for United States federal income tax purposes; and

- United States expatriates.

If a partnership (or other entity or arrangement treated as a partnership for United States federal income tax purposes) participates in the Plan, the tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. Any such partner or partnership should consult its tax advisor as to the particular United States federal income tax considerations relating to participation in the Plan.

Tax Considerations Relating to Dividend Reinvestment

Upon a purchase of Plan Shares, a U.S. Participant generally will be treated as receiving a distribution for United States federal income tax purposes in an amount equal to the fair market value on the applicable Dividend Payment Date of the Common Shares purchased with reinvested dividends plus the amount of any Canadian withholding tax withheld therefrom. The fair market value of the Common Shares purchased from the Corporation on the applicable Dividend Payment Date may be higher or lower than the price used to determine the number of Common Shares so purchased pursuant to the Plan. The amount of any such distribution to a U.S. Participant (reduced by any Canadian tax withheld from such distribution) generally will be such U.S. Participant's tax basis in the Common Shares purchased. A U.S. Participant's holding period for these Common Shares will begin on the day following the date of purchase.

Any distribution to a U.S. Participant described in the preceding paragraph generally will be subject to United States federal income tax in the same manner as cash distributions described below. See " - Tax Considerations Relating to the Acquisition, Ownership and Disposition of Common Shares - Distributions on Common Shares; - Backup Withholding Tax and Information Reporting."

If United States backup withholding tax applies to any dividends paid that are to be reinvested in Common Shares, the number of Common Shares credited to a U.S. Participant's account will be reduced as a result of such backup withholding tax. See " - Tax Considerations Relating to the Acquisition, Ownership and Disposition of Common Shares - Backup Withholding Tax and Information Reporting."

Tax Considerations Relating to the Acquisition, Ownership and Disposition of Common Shares

Distributions on Common Shares

In general, subject to the passive foreign investment company ("PFIC") rules discussed below, the gross amount of any distribution made to a U.S. Participant on Common Shares (including amounts withheld to pay Canadian withholding taxes) will constitute a dividend for United States federal income tax purposes to the extent paid out of the Corporation's current or accumulated earnings and profits, as determined for United States federal income tax purposes. To the extent the amount of such distribution exceeds the Corporation's current and accumulated earnings and profits, it will be treated first as a non−taxable return of capital to the extent of such U.S. Participant's tax basis in such Common Shares and thereafter will be treated as gain from the sale or exchange of such Common Shares. The Corporation does not intend to calculate its earnings and profits under United States federal income tax rules. Accordingly, U.S. Participants should expect that a distribution generally will be treated as a dividend for United States federal income tax purposes.