As filed with the Securities and Exchange Commission

on August 25, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT

OF 1933

Immatics

N.V.

(Exact name of registrant as specified in its charter)

| The Netherlands |

|

|

Not Applicable |

| (State or other jurisdiction of incorporation or organization) |

|

|

(I.R.S. Employer Identification Number) |

Paul-Ehrlich-Straße 15

72076 Tübingen, Federal Republic of Germany

+49 (7071) 5397-0

(Address and telephone number of registrant’s principal executive offices)

Edward A. Sturchio

Immatics US, Inc.

2130 W. Holcombe Blvd., Suite 900

Houston, Texas 77030

(281) 810-7545

(Name, address and telephone number of agent for service)

Copies to:

Yasin Keshvargar

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450-4000 |

Paul van der Bijl

NautaDutilh N.V.

Beethovenstraat 400

1082 PR Amsterdam

T +31 20 71 71 000 |

Approximate date of commencement of proposed sale to the public:

From time to time after the effectiveness of this registration statement.

If only securities being registered on this Form are being offered

pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered

on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective

registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction

I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under

the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement

filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule

413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company ☒

If an emerging growth company that prepares its financial

statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the

Securities Act. ☐

† The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act,

or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to

said Section 8(a), may determine.

The information in this prospectus is not complete and

may be changed. The selling securityholder may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST

25, 2023

PROSPECTUS

IMMATICS N.V.

2,419,818 Ordinary Shares

This prospectus relates to the offer and sale from time to time by Bristol-Myers

Squibb Company (the “selling securityholder”) of up to 2,419,818 of our ordinary shares, €0.01 nominal value per share.

This prospectus also covers any additional securities that may become issuable by reason of share splits, share dividends or other similar

transactions.

The securities covered by this prospectus were issued to the selling

securityholder on July 21, 2023 in a private placement transaction. We are registering the offer and sale of the securities described

above to satisfy certain registration rights we have granted to the selling securityholder in connection with such transaction. The selling

securityholder may offer the securities from time to time if and to the extent as it may determine as described in the section entitled

“Plan of Distribution” at prevailing market prices, at prices different than prevailing market prices or at privately negotiated

prices.

All of the securities offered by the selling securityholder pursuant

to this prospectus will be sold by the selling securityholder for its account. We will not receive any of the proceeds from such sales.

We will pay certain expenses associated with the registration of the securities covered by this prospectus. If any securities are sold,

the selling securityholder will pay any brokerage commissions and/or similar charges incurred for the sale of such securities.

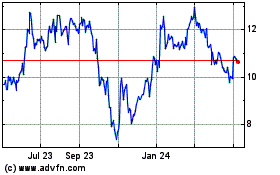

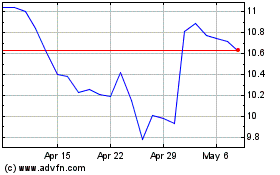

Our ordinary shares are listed on The Nasdaq Stock Market LLC (“Nasdaq”)

under the symbol “IMTX.” On August 24, 2023, the last reported sale price of our ordinary shares as reported on Nasdaq

was $12.23 per share.

We are an “emerging growth company” as defined under U.S.

federal securities laws and, as such, may elect to comply with reduced public company reporting requirements for this and future filings.

See “Our Company—Implications of Being an Emerging Growth Company.”

Investing in our securities involves a high degree of risk. See the

“Risk Factors” section beginning on page 5 of this prospectus and, if applicable, any risk factors described in any applicable

prospectus supplement and in our Securities and Exchange Commission (“SEC”) filings that are incorporated by reference in

this prospectus.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

Prospectus dated , 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed

with the SEC using a “shelf” registration process. Under this shelf registration process, the selling securityholder may,

from time to time, offer the securities described in this prospectus for resale in one or more offerings. This prospectus provides you

with a general description of us and the securities that may be offered by the selling securityholder. Because the selling securityholder

may be deemed to be an “underwriter” within the meaning of the Securities Act, each time securities are offered by the selling

securityholder pursuant to this prospectus, the selling securityholder may be required to provide you with this prospectus and, in certain

cases, a prospectus supplement that will contain specific information about the selling securityholder and the terms of the securities

being offered at that time. We may also provide you with a free writing prospectus that contains information about the specific terms

of that offering, including the prices at which the securities will be sold. Any prospectus supplement and any free writing prospectus

may also add, update or change information contained in this prospectus.

Before buying any of the securities that the selling securityholder

may offer, you should carefully read both this prospectus, any prospectus supplement and any free writing prospectus with all of the information

incorporated by reference in this prospectus, as well as the additional information described under the heading “Where You Can Find

More Information” and “Information Incorporated by Reference.” These documents contain important information that you

should consider when making your investment decision. We have filed or incorporated by reference exhibits to the registration statement

of which this prospectus forms a part. You should read the exhibits carefully for provisions that may be important to you.

To the extent there is a conflict between the information contained

in this prospectus, on the one hand, and the information contained in any prospectus supplement, any free writing prospectus or in any

document incorporated by reference in this prospectus, on the other hand, you should rely on the information in this prospectus, provided

that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a prospectus supplement, a free writing prospectus or a document incorporated by reference in this prospectus—the statement in the

document having the later date modifies or supersedes the earlier statement.

The information contained in this prospectus, any applicable prospectus

supplement, any applicable free writing prospectus or any document incorporated by reference in this prospectus is accurate only as of

their respective dates, regardless of the time of delivery of this prospectus, any applicable prospectus supplement, any applicable free

writing prospectus or the documents incorporated by reference in this prospectus or the sale of any securities. Our business, financial

condition, results of operations and prospects may have changed materially since those dates.

Neither we, the selling securityholder nor any underwriters, dealers

or agents have authorized anyone to provide you with information that is different from that contained in this prospectus, any amendment

or supplement to this prospectus, or any free writing prospectus we may authorize to be delivered or made available to you. Neither we,

the selling securityholder nor any underwriters, dealers or agents take responsibility for, or provide assurance as to the reliability

of, any other information that others may give you. This prospectus does not constitute an offer to sell or the solicitation of an offer

to buy any securities other than the securities described in this prospectus or an offer to sell or the solicitation of an offer to buy

such securities in any circumstances in which such offer or solicitation is unlawful.

For investors outside the United States: Neither we, the selling securityholder

nor any underwriters, dealers or agents have taken any action that would permit the offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

described herein and the distribution of this prospectus outside the United States.

Unless otherwise indicated or the context otherwise requires, (i) all

references to the “company,” “we,” “our” or “us” or similar terms refer to Immatics N.V.,

together with its subsidiaries, including Immatics

Biotechnologies GmbH; (ii) references to “Immatics” refer solely to Immatics

N.V.; and (iii) references to “Immatics OpCo” refer solely to Immatics Biotechnologies GmbH. Immatics N.V. is a Dutch

public limited liability company (naamloze vennootschap) incorporated on March 10, 2020 and the holding company of Immatics

Biotechnologies GmbH, a German biopharmaceutical company incorporated in 2000 focused on the development of T cell receptor-based immunotherapies

for the treatment of cancer. Immatics Biotechnologies GmbH holds all material assets and conducts all business activities and operations

of Immatics N.V.

Trademarks

We own various trademark registrations and applications, and unregistered

trademarks, including Immatics®, XPRESIDENT®, ACTengine®, ACTallo®, ACTolog®,

XCEPTOR®, TCER®, AbsQuant®, IMADetect® and our corporate logo. All other trade

names, trademarks and service marks of other companies appearing in this prospectus are the property of their respective owners. Solely

for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ symbols,

but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under

applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a

relationship with, or endorsement or sponsorship of us by, any other companies.

Presentation of Financial Information

Our consolidated financial statements are presented in euros and have

been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board

(“IFRS”). None of the consolidated financial statements were prepared in accordance with generally accepted accounting principles

in the United States (“U.S. GAAP”). The terms “dollar,” “USD” or “$” refer to the U.S.

dollar and the term “euro,” “EUR” or “€” refer to the euro, unless otherwise indicated. The exchange

rate used for conversion between U.S. dollars and euros is based on the ECB euro reference exchange rate published by the European Central

Bank. We have made rounding adjustments to some of the figures included in this prospectus. Accordingly, any numerical discrepancies in

any table between totals and sums of the amounts listed are due to rounding.

Market and Industry Data

This prospectus contains industry, market and competitive position data

that are based on general and industry publications, surveys and studies conducted by third parties, some of which may not be publicly

available, and our own internal estimates and research. Third-party publications, surveys and studies generally state that they have obtained

information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. These data involve

a number of assumptions and limitations and contain projections and estimates of the future performance of the industries in which we

operate that are subject to a high degree of uncertainty.

OUR COMPANY

Overview

We are a clinical-stage biotechnology company dedicated to the development

of T cell receptor (“TCR”)-based immunotherapies for the treatment of cancer. Our purpose is to deliver a meaningful impact

on the lives of cancer patients by developing novel TCR-based immunotherapies that are designed to achieve effect beyond an incremental

clinical benefit. Our focus is the development of product candidates for the treatment of patients with solid tumors, who are inadequately

served by existing treatment modalities. We strive to become an industry leading, fully integrated global biopharmaceutical company engaged

in developing, manufacturing and commercializing TCR immunotherapies for the benefit of cancer patients, our employees, our shareholders

and our partners.

By utilizing TCR-based therapeutics, we are able to direct T cells to

intracellular cancer targets that are not accessible through classical antibody-based or CAR-T therapies. We believe that by identifying

what we call true cancer targets and the right TCRs, we are well positioned to transform current solid tumor treatment paradigms

by delivering cellular and bispecific product candidates that have the potential to substantially improve the lives of cancer patients.

We are developing our targeted immunotherapy product candidates through

two distinct treatment modalities: TCR-engineered autologous (“ACTengine”) or allogeneic (“ACTallo”) Adoptive

Cell Therapies (“ACT”) and antibody-like Bispecifics, also called T cell Engaging Receptors (“TCER”). Each modality

is designed with distinct attributes and mechanisms of action to produce the desired therapeutic effect for a variety of cancer patient

populations with different unmet medical needs. Our current pipeline shown below comprises several proprietary TCR-based product candidates

in clinical and preclinical development. In addition to our proprietary pipeline, we are collaborating with industry-leading partners,

including Bristol-Myers Squibb Company (“BMS”), Editas Medicine and Genmab, to develop multiple additional therapeutic programs

covering ACT and Bispecifics.

Company and Corporate Information

We were incorporated as a Dutch private limited liability company (besloten

vennootschap met beperkte aansprakelijkheid) under the name Immatics B.V. on March 10, 2020 solely for the purpose of effectuating

the business combination (the “Business Combination”) between us, ARYA Sciences Acquisition Corp., a Cayman Islands exempted

company (“ARYA”), Immatics Biotechnologies GmbH, a German limited liability company, Immatics Merger Sub 1, a Cayman Islands

exempted company, and Immatics Merger Sub 2, a Cayman Islands exempted company. Upon the closing of the Business Combination on July 1,

2020, we converted into a Dutch public limited liability company (naamloze vennootschap) and changed our name to Immatics N.V.

We are registered in the Commercial Register of the Chamber of Commerce

(Kamer van Koophandel) in the Netherlands under number 77595726. We have our corporate seat in Amsterdam, the Netherlands and our

registered office is at Paul-Ehrlich-Straße 15, 72076 Tübingen, Federal Republic of Germany, and our telephone number is +49

(7071) 5397-0. Our executive office in the United States is located at Immatics US, Inc., 2130 W. Holcombe Boulevard, Houston,

Texas, 77030 and our telephone number is +1 (346) 204-5400. Our website is www.immatics.com. The reference to our website

is an inactive textual reference only, and information contained therein or connected thereto is not incorporated into this prospectus

or the registration statement of which it forms a part.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in

the Jumpstart our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of

specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| · | an exemption from the auditor attestation requirement in the assessment of

our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act of 2002; and |

| · | to the extent that we no longer qualify as a foreign private issuer, (i) reduced

disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirements

of holding a non-binding advisory vote on executive compensation, including golden parachute compensation. |

We may take advantage of these exemptions until such time as we are

no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (i) the last day of

the fiscal year during which the market value of our ordinary shares held by non-affiliates equals or exceeds $700 million as of any June

30, (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant

to an effective registration statement, (iii) the last day of the fiscal year during which we had total annual gross revenues of $1.235

billion or more, (iv) the date on which we have issued more than $1.0 billion in non-convertible debt during the previous three-year period.

We may choose to take advantage of some but not all of these reduced burdens. For example, Section 107 of the JOBS Act also provides that

an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards

applicable to public companies. This provision allows an emerging growth company to delay the adoption of certain accounting standards

until those standards would otherwise apply to private companies. This transition period is only applicable under U.S. GAAP. As a result,

we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required or permitted by

the International Accounting Standards Board.

Implications of Being a Foreign Private Issuer

We are also considered a “foreign private issuer.” Accordingly,

we report under the Exchange Act of 1934, as amended (the “Exchange Act”), as a non-U.S. company with foreign private issuer

status. This means that, even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer

under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies,

including:

| · | the sections of the Exchange Act regulating the solicitation of proxies, consents

or authorizations in respect of a security registered under the Exchange Act; |

| · | the sections of the Exchange Act requiring insiders to file public reports

of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

|

| · | the rules under the Exchange Act requiring the filing with the SEC of quarterly

reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence

of specified significant events. |

We may take advantage of these exemptions until such time as we are

no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting

securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers

or directors are U.S. citizens or residents, (ii) more than 50% of our assets are located in the United States or (iii) our

business is administered principally in the United States.

In this prospectus and in the documents incorporated by reference in

this prospectus, we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company

and a foreign private issuer. Accordingly, the information contained in this prospectus and in the documents incorporated by reference

in this prospectus may be different than the information you receive from other public companies in which you hold equity securities.

RISK FACTORS

Investing in our securities involves risk. Before making a decision

to invest in our securities, you should carefully consider the risks described under “Risk Factors” in any applicable prospectus

supplement and in our then-most recent Annual Report on Form 20-F, and any updates to those risk factors in our reports on Form 6-K incorporated

by reference in this prospectus, together with all of the other information appearing or incorporated by reference in this prospectus

and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances. Although we discuss

key risks in our discussion of risk factors, new risks may emerge in the future, which may prove to be significant. We cannot predict

future risks or estimate the extent to which they may affect our business, results of operations, financial condition and prospects.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and the documents incorporated by reference in this

prospectus contain statements that constitute forward-looking statements within the meaning of Section 21E of the Exchange Act and Section

27A of the Securities Act of 1933, as amended (the “Securities Act”). All statements other than statements of historical facts,

including statements regarding our future results of operations and financial position, business and commercial strategy, potential market

opportunities, products and product candidates, research pipeline, ongoing and planned preclinical studies and clinical trials, regulatory

submissions and approvals, research and development costs, timing and likelihood of success, as well as plans and objectives of management

for future operations are forward-looking statements. Many of the forward-looking statements contained in this prospectus can be identified

by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,”

“should,” “plan,” “intend,” “estimate,” “will” and “potential,”

among others.

Forward-looking statements are based on our management’s beliefs

and assumptions and on information available to our management at the time such statements are made. Such statements are subject to risks

and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various

factors, including, but not limited to, those identified under the “Risk Factors” section of this prospectus and in the documents

incorporated by reference in this prospectus. Forward-looking statements speak only as of the date on which they were made. Because forward-looking

statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond

our control, you should not rely on these forward-looking statements as predictions of future events. Moreover, we operate in an evolving

environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk

factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements,

whether as a result of any new information, future events, changed circumstances or otherwise. You should read this prospectus, the documents

incorporated by reference in this prospectus and the documents that we have filed as exhibits to the registration statement of which this

prospectus is a part completely and with the understanding that our actual future results may be materially different from what we expect.

In addition, statements that “we believe” and similar statements

reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of

such statements, and while we believe such information forms a reasonable basis for such statements, such information may be limited or

incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially

available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

USE OF PROCEEDS

We will not receive any proceeds from the sale of securities by the

selling securityholder from time to time pursuant to this prospectus. If any securities are sold, the selling securityholder will pay

any brokerage commissions and/or similar charges incurred for the sale of such shares. We will bear all other costs, fees and expenses

incurred in effecting the registration of the securities covered by this prospectus, including all registration and filing fees and fees

and expenses of our counsel and accountants.

DIVIDEND POLICY

We have never declared or paid any cash dividends and have no plan to

declare or pay any dividends on our ordinary shares in the foreseeable future. We currently intend to retain any earnings for future operations

and expansion of our business.

We will be able to make distributions to our shareholders only to the

extent that our equity exceeds the aggregate amount of issued share capital and reserves that must be maintained pursuant to Dutch law

or under our articles of association. We may not make any distribution of profits on shares held as treasury shares and such treasury

shares will not be taken into account when determining the profit entitlement of our shareholders. Our articles of association prescribe

that profits in any financial year will be distributed first to holders of our financing preferred shares, if any are outstanding. Any

remaining profits may be reserved by our board of directors. Any profits remaining thereafter and reserves may be distributed as dividends

to the holders of our ordinary shares, subject to the appropriate record date. The general meeting is authorized to declare distributions

upon the proposal of our board of directors. Our board of directors determines whether and how much of the profits shown in the adopted

annual accounts will be reserved and the manner and date of any dividend. In addition, our board of directors is permitted, subject to

certain requirements, to declare interim dividends without the approval of our shareholders. We may reclaim any distributions, whether

interim or not interim, made in contravention of certain restrictions of Dutch law from shareholders that knew or should have known that

such distribution was not permissible. In addition, on the basis of Dutch case law, if after a distribution we are not able to pay our

due and collectable debts, then our shareholders or directors who at the time of the distribution knew or reasonably should have foreseen

that result may be liable to our creditors.

Since we are a holding company, our ability to pay dividends will be

dependent upon the financial condition, liquidity and results of operations of, and the receipt of dividends, loans or other funds from,

our subsidiaries. Our subsidiaries are separate and distinct legal entities and have no obligation to make funds available to us. In addition,

there are various statutory, regulatory and contractual limitations and business considerations on the extent, if any, to which our subsidiaries

may pay dividends, make loans or otherwise provide funds to us.

DESCRIPTION OF SHARE CAPITAL AND ARTICLES OF

ASSOCIATION

The Company

We were incorporated on March 10, 2020 as a private limited liability

company (besloten vennootschap met beperkte aansprakelijkheid) under Dutch law, and upon the consummation of the Business Combination,

we converted into a Dutch public limited liability company (naamloze vennootschap).

We are registered in the Commercial Register of the Chamber of Commerce

(Kamer van Koophandel) in the Netherlands under number 77595726. We have our corporate seat in Amsterdam, the Netherlands and our

registered office is at Paul-Ehrlich-Straße 15, 72076 Tübingen, Federal Republic of Germany.

Share Capital

Authorized Share Capital

Our authorized share capital consists of 285,000,000 ordinary shares,

nominal value of €0.01 per share, and 15,000,000 financing preferred shares. The financing preferred shares are divided into five

series, each consisting of 3,000,000 financing preferred shares. As of December 31, 2022, there were 76,670,699 ordinary shares outstanding

and no preferred shares outstanding, whereas as of December 31, 2021, there were 62,926,816 ordinary shares outstanding and no preferred

shares outstanding.

The financing preferred shares may, at the request of the holder, be

converted into ordinary shares pursuant to a resolution of our board of directors. The conditions for conversion and the further terms

and conditions related to the financing preferred shares will be determined by our board of directors, our general meeting and the meeting

of holders of the series of financing preferred shares concerned, if such series of financing preferred shares have been issued and are

held by persons other than us. The preceding sentence applies by analogy to any adjustment to the conditions.

Changes in Our Share Capital

In this section, share amounts are presented as of the date of the relevant

transaction. Since the completion of the Business Combination, our share capital has changed as follows:

| · | On October 12, 2022, we completed an SEC-registered equity offering, pursuant

to which we issued and sold 10,905,000 ordinary shares, resulting in increases in share capital of €109 thousand and share premium

of €106.1 million; |

| · | During the year ended December 31, 2022, we issued and sold approximately

2.8 million ordinary shares under the sales agreement with Leerink Partners LLC, resulting in increases in share capital of €28 thousand

and share premium of €20.2 million; |

| · | Since January 1, 2023, we issued and sold approximately 5.5 million ordinary

shares under the sales agreement with Leerink Partners LLC, resulting in increases in share capital of €55 thousand and share premium

of €57.0 million; and |

| · | On July 21, 2023, we issued and sold 2,419,818 ordinary shares to BMS, resulting

in increases in share capital of €24 thousand and share premium of €32.2 million. |

Issuance of Ordinary Shares

Under Dutch law, shares are issued and rights to subscribe for shares

are granted pursuant to a resolution of our general meeting. Our articles of association provide that the general meeting may only resolve

to issue shares upon the proposal of our board of directors. The general meeting may authorize our board of directors to issue new ordinary

shares or grant rights to subscribe for ordinary shares. The authorization can be granted and extended, in each case for a period not

exceeding five years. For as long as, and to the extent, that such authorization is effective, our general meeting will not have

the power to issue ordinary shares.

Pursuant to a resolution of the general meeting dated June 30,

2020, our board of directors is irrevocably authorized for a period of five years from July 1, 2020, to issue ordinary shares

or financing preferred shares up to the amount of the authorized share capital (from time to time).

Preemptive Rights

Subject to restrictions in our articles of association, holders of ordinary

shares have preemptive rights in relation to newly issued ordinary shares under Dutch law.

Under our articles of association, the preemptive rights in respect

of newly issued ordinary shares may be restricted or excluded by a resolution of our general meeting upon the proposal of our board of

directors, which resolution requires a two-thirds majority of the votes cast if less than half of the issued share capital is present

or represented at the meeting. The general meeting may authorize our board of directors to limit or exclude the preemptive rights in respect

of newly issued ordinary shares, which resolution requires a two-thirds majority of the votes cast if less than half of the issued share

capital is present or represented at the meeting. Such authorization for our board of directors can be granted and extended, in each case

for a period not exceeding five years.

Pursuant to a resolution of the general meeting dated June 30,

2020, our board of directors is irrevocably authorized for a period of five years from July 1, 2020 to limit or exclude preemptive

rights on ordinary shares up to 100% of the number of ordinary shares in our authorized share capital (from time to time).

Preemptive rights do not exist with respect to (a) the issuance

of ordinary shares or grant of rights to subscribe for ordinary shares to our employees or a “group” company of ours, and

(b) the issuance of ordinary shares against a contribution in kind. Preemptive rights do not exist with respect to the issuance of

financing preferred shares and holders of financing preferred shares have no preemptive right to acquire newly issued ordinary shares.

Transfer of Ordinary Shares

Under Dutch law, transfers of ordinary shares (other than in book-entry

form) require a written deed of transfer and, unless the company is a party to the deed of transfer, and acknowledgement by or proper

service upon the company to be effective.

Under our articles of association, if one or more ordinary shares are

admitted to trading on Nasdaq or any other regulated foreign stock exchange located in the United States, we may, by resolution of our

board of directors, determine that the laws of the State of New York will apply to the property law aspects of the ordinary shares included

in the part of the register of shareholders kept by the relevant transfer agent. Such resolution, as well as the revocation thereof, will

be made public as required by law and will be made available for inspection at our office and the Dutch trade register. Our management

has adopted such resolution effective as of July 1, 2020.

Form of Ordinary Shares

Pursuant to our articles of association, the ordinary shares are registered

shares.

Purchase and Repurchase of Ordinary Shares

Under Dutch law, we may not subscribe for newly issued ordinary shares.

We may acquire ordinary shares, subject to applicable provisions and restrictions of Dutch law and our articles of association, to the

extent that:

| · | such ordinary shares are fully paid up; |

| · | such repurchase would not cause our shareholders’ equity to fall below

an amount equal to the sum of the paid-up and called-up part of the issued share capital and the reserves we are required to maintain

pursuant to Dutch law or our articles of association; and |

| · | immediately after the acquisition of such ordinary shares, we and our subsidiaries

would not hold, or would not hold as pledgees, shares having an aggregate nominal value that exceeds 50% of our then-current issued share

capital. |

Other than ordinary shares acquired for no valuable consideration or

under universal title of succession (onder algemene titel) (e.g., through a merger or spin-off) under statutory Dutch or other

law, we may acquire ordinary shares only if our general meeting has authorized our board of directors to acquire ordinary shares. An authorization

by our general meeting for the acquisition of ordinary shares can be granted for a maximum period of 18 months. Such authorization

must specify the number of ordinary shares that may be acquired, the manner in which these shares may be acquired and the price range

within which the shares may be acquired. No authorization of our general meeting is required if ordinary shares are acquired by us on

Nasdaq with the intention of transferring such ordinary shares to our employees or employees of a group company pursuant to an arrangement

applicable to them. We cannot derive any right to any distribution from ordinary shares, or voting rights attached to ordinary shares,

acquired by us.

Pursuant to a resolution of the general meeting dated June 20,

2023, our board of directors is irrevocably authorized for a period of 18 months from June 20, 2023 to resolve for us to acquire

fully paid-up ordinary shares or depositary receipts thereof up to the maximum number of ordinary shares permitted pursuant to applicable

law and our articles of association from time to time, through repurchases negotiated in the open market or privately, in self-tender

offers, or through accelerated repurchase arrangements, at prices ranging from the nominal value of the ordinary shares up to 110% of

the market price of the ordinary shares, provided that: (i) for open market or privately negotiated repurchases, the market price

shall be the price for ordinary shares on Nasdaq at the time the transaction is agreed upon by us, (ii) for self-tender offers, the

market price shall be the volume weighted average price for the ordinary shares on Nasdaq during a period, determined by our board of

directors, of no less than one and no more than five consecutive trading days immediately prior to the expiration of the tender offer,

and (iii) for accelerated repurchase arrangements, the market price shall be the volume weighted average price of the ordinary shares

on Nasdaq over the term of the arrangement; the volume weighted average price for any number of trading days shall be calculated as the

arithmetic average of the daily volume weighted average price on those trading days.

Capital Reduction

At a general meeting, our shareholders may resolve on the proposal of

our board of directors to reduce our issued share capital by (i) cancelling ordinary shares or (ii) reducing the nominal value

of the ordinary shares by amending our articles of association. In either case, this reduction would be subject to applicable statutory

provisions. A resolution to cancel ordinary shares may only relate to (i) ordinary shares held by us or in respect of which we hold

the depository receipts, or (ii) all financing preferred shares of a class if approved by the holders of all shares of that class.

In order to be approved by our general meeting, a resolution to reduce the capital requires a two-thirds majority of the votes cast if

less than half of the issued share capital is present or represented at the meeting. A reduction of the nominal value of ordinary shares

without repayment and without release from the obligation to pay up the ordinary shares must be effectuated proportionally on shares of

the same class (unless all affected shareholders agree to a disproportional reduction).

A resolution that would result in a reduction of capital requires approval

by a majority of the votes cast of each group of shareholders of the same class whose rights are prejudiced by the reduction. In addition,

a reduction of capital involves a two-month waiting period during which creditors have the right to object to a reduction of capital under

specified circumstances.

General Meeting of Shareholders and Voting Rights

General Meeting of Shareholders

General meetings are held in Amsterdam, Rotterdam, The Hague, Arnhem,

Utrecht, or in the municipality of Haarlemmermeer (Schiphol Airport), the Netherlands. All of our shareholders and others entitled to

attend our general meetings are authorized to address the meeting and, in so far as they have such right, to vote, either in person or

by proxy.

We will hold at least one general meeting each year, to be held within

six months after the end of our financial year. A general meeting will also be held within three months after our board of directors

has determined it to be likely that our equity has decreased to an amount equal to or lower than half of its paid-up and called-up capital,

in order to discuss the measures to be taken if so required. If our board of directors fails to hold such general meeting in a timely

manner, each shareholder and other person entitled to attend our general meeting may be authorized by the Dutch court to convene our general

meeting.

Our board of directors may convene additional extraordinary general

meetings of shareholders at its discretion, subject to the notice requirements described below. Pursuant to Dutch law, one or more shareholders

and/or others entitled to attend general meetings of shareholders, alone or jointly representing at least 10% of our issued share capital,

may on their application be authorized by the Dutch court to convene a general meeting. The Dutch court will disallow the application

if (i) the applicants have not previously requested in writing that our board of directors convenes a shareholders’ meeting,

(ii) our board of directors convenes a shareholders’ meeting or (iii) our board of directors has taken the necessary steps

so that the shareholders’ meeting could be held within six weeks after such request.

The general meeting is convened by a notice, which includes an agenda

stating the items to be discussed and the location and time of our general meeting. For the annual general meeting, the agenda will include,

among other things, the adoption of our annual accounts, the appropriation of its profits or losses and proposals relating to the composition

of and filling of any vacancies on our board of directors. In addition, the agenda for a general meeting includes such additional items

as determined by our board of directors. Pursuant to Dutch law, one or more shareholders and/or others entitled to attend general meetings

of shareholders, alone or jointly representing at least 3% of the issued share capital, have the right to request the inclusion of additional

items on the agenda of shareholders’ meetings. Such requests must be made in writing, and may include a proposal for a shareholder

resolution, and must be received by us no later than on the sixtieth (60th) day before the day the relevant shareholders’ meeting

is held. No resolutions will be adopted on items other than those which have been included in the agenda. Under our articles of association,

certain items can only be put on the agenda as a voting item by our board of directors. Shareholders meeting the relevant requirements

may still request the inclusion of such items on the agenda as a discussion item.

In accordance with the Dutch Corporate Governance Code, or DCGC, shareholders

who have the right to put an item on the agenda for our general meeting or to request the convening of a general meeting shall not exercise

such rights until after they have consulted our board of directors. If exercising such rights may result in a change in our strategy (for

example, through the dismissal of one or more of our directors), our board of directors must be given the opportunity to invoke a reasonable

period of up to 180 days to respond to the shareholders’ intentions. If invoked, our board of directors must use such response

period for further deliberation and constructive consultation, in any event with the shareholder(s) concerned and exploring alternatives.

At the end of the response time, our board of directors shall report on this consultation and the exploration of alternatives to our general

meeting. The response period may be invoked only once for any given general meeting and shall not apply (i) in respect of a matter

for which a response period has been previously invoked or (ii) if a shareholder holds at least 75% of our issued share capital as

a consequence of a successful public bid.

Moreover, our board of directors can invoke a cooling-off period of

up to 250 days when shareholders, using their right to have items added to the agenda for a general meeting or their right to request

a general meeting, propose an agenda item for our general meeting to dismiss, suspend or appoint one or more directors (or to amend any

provision in our articles of association dealing with those matters) or when a public offer for our company is made or announced without

our support, provided, in each case, that our board of directors believes that such proposal or offer materially conflicts with the interests

of our company and its business. During a cooling-off period, our general meeting cannot dismiss, suspend or appoint directors (or amend

the provisions in our articles of association dealing with those matters) except at the proposal of our board of directors. During a cooling-off

period, our board of directors must gather all

relevant information necessary for a careful decision-making process and at least consult

with shareholders representing 3% or more of our issued share capital at the time the cooling-off period was invoked, as well as with

our Dutch works council (if we or, under certain circumstances, any of our subsidiaries would have one). Formal statements expressed by

these stakeholders during such consultations must be published on our website to the extent these stakeholders have approved that publication.

Ultimately one week following the last day of the cooling-off period, our board of directors must publish a report in respect of its policy

and conduct of affairs during the cooling-off period on our website. This report must remain available for inspection by shareholders

and others with meeting rights under Dutch law at our office and must be tabled for discussion at the next general meeting. Shareholders

representing at least 3% of our issued share capital may request the Enterprise Chamber for early termination of the cooling-off period.

The Enterprise Chamber must rule in favor of the request if the shareholders can demonstrate that:

| · | our board of directors, in light of the circumstances at hand when the cooling-off

period was invoked, could not reasonably have concluded that the relevant proposal or hostile offer constituted a material conflict with

the interests of our company and its business; |

| · | our board of directors cannot reasonably believe that a continuation of the

cooling-off period would contribute to careful policy-making; or |

| · | other defensive measures, having the same purpose, nature and scope as the

cooling-off period, have been activated during the cooling-off period and have not since been terminated or suspended within a reasonable

period at the relevant shareholders’ request (i.e., no ‘stacking’ of defensive measures). |

We will give notice of each general meeting by publication on our website

and, to the extent required by applicable law, in a Dutch daily newspaper with national distribution, and in any other manner that we

may be required to follow in order to comply with Dutch law and applicable stock exchange and SEC requirements. We will observe the statutory

minimum convening notice period for a general meeting. Holders of registered shares may further be provided notice of the meeting in writing

at their addresses as stated in its shareholders’ register.

Pursuant to our articles of association and Dutch law, our board of

directors may determine a record date (registratiedatum) of 28 calendar days prior to a general meeting to establish which shareholders

and others with meeting rights are entitled to attend and, if applicable, vote at our general meeting. The record date, if any, and the

manner in which shareholders can register and exercise their rights will be set out in the notice of our general meeting. Our articles

of association provide that a shareholder must notify us in writing of his or her identity and his or her intention to attend (or be represented

at) our general meeting, such notice to be received by us on the date set by our board of directors in accordance with our articles of

association and as set forth in the convening notice. If this requirement is not complied with or if upon request no proper identification

is provided by any person wishing to enter our general meeting, the chairman of our general meeting may, in his or her sole discretion,

refuse entry to the shareholder or his or her proxy holder.

Pursuant to our articles of association, our general meeting is chaired

by the chairman of our board of directors, who, nevertheless, may charge another person to preside over the meeting in his place even

if he himself is present at the meeting. If the chairman of our board of directors is absent and he has not charged another person to

preside over the meeting in his place, our directors present at the meeting will appoint one of them to be chairman. In the absence of

all directors, our general meeting will appoint its chairman.

Voting Rights and Quorum

In accordance with Dutch law and our articles of association, each ordinary

share, irrespective of which class it concerns, confers the right on the holder thereof to cast one vote at our general meeting. The voting

rights attached to any ordinary shares held by us or our direct or indirect subsidiaries are suspended, unless the ordinary shares were

encumbered with a right of usufruct or a pledge in favor of a

party other than us or a direct or indirect subsidiary before such ordinary

shares were acquired by us or such a subsidiary, in which case, the other party may be entitled to exercise the voting rights on the ordinary

shares. We may not exercise voting rights for ordinary shares in respect of which we or a direct or indirect subsidiary has a right of

usufruct or a pledge.

Voting rights may be exercised by shareholders or by a duly appointed

proxy holder (the written proxy being acceptable to the chairman of our general meeting) of a shareholder, which proxy holder need not

be a shareholder. The holder of a usufruct or pledge on shares will have the voting rights attached thereto if so provided for when the

usufruct or pledge was created.

Under our articles of association, blank votes (votes where no choice

has been made), abstentions and invalid votes will not be counted as votes cast. However, shares in respect of which a blank vote or invalid

vote has been cast and shares in respect of which the person with meeting rights who is present or represented at the meeting has abstained

from voting are counted when determining the part of the issued share capital that is present or represented at a general meeting. The

chairman of our general meeting will determine the manner of voting and whether voting may take place by acclamation.

Resolutions of the shareholders are adopted at a general meeting by

a majority of votes cast, except where Dutch law or our articles of association provide for a special majority in relation to specified

resolutions. Our articles of association do not provide for a quorum requirement, subject to any provision of mandatory Dutch law.

Subject to certain restrictions in our articles of association, the

determination during our general meeting made by the chairman of that general meeting with regard to the results of a vote will be decisive.

Our board of directors will keep a record of the resolutions passed at each general meeting.

Amendment of Articles of Association

At a general meeting, at the proposal of our board of directors, our

general meeting may resolve to amend the articles of association. A resolution by the shareholders to amend the articles of association

requires a majority of the votes cast.

Merger, Demerger and Dissolution

At the proposal of our board of directors, our general meeting may resolve

with a majority of the votes cast (subject to certain exceptions), or with at least two-thirds of the votes cast if less than half of

the issued capital is present or represented at our general meeting, to legally merge or demerge the company within the meaning of Title

7, Book 2 of the Dutch Civil Code.

Our shareholders may at a general meeting, based on a proposal by our

board of directors, by means of a resolution passed by a majority of the votes cast, resolve that the company will be dissolved. In the

event of dissolution of the company, the liquidation will be effected by our executive directors, under the supervision of our non-executive

directors, unless our general meeting decides otherwise.

Squeeze-Out

A shareholder who for its own account (or together with its group companies)

holds at least 95% of our issued share capital may institute proceedings against the other shareholders jointly for the transfer of their

shares to the shareholder who holds such 95% majority. The proceedings are held before the Enterprise Chamber of the Amsterdam Court of

Appeal (Ondernemingskamer van het Gerechtshof Amsterdam) (the “Enterprise Chamber”) and can be instituted by means

of a writ of summons served upon each of the minority shareholders in accordance with the provisions of the Dutch Code of Civil Procedure

(Wetboek van Burgerlijke Rechtsvordering). The Enterprise Chamber may grant the claim for squeeze-out in relation to all minority

shareholders and will determine the price to be paid for the shares, if necessary, after appointment of one or three experts who will

offer an opinion to the Enterprise Chamber on the value of the shares of the minority shareholders. Once the order to transfer by the

Enterprise Chamber becomes final and irrevocable, the majority shareholder that instituted the squeeze-

out proceedings will give written

notice of the date and place of payment and the price to the holders of the shares to be acquired whose addresses are known to the majority

shareholder. Unless the addresses of all minority shareholders are known to the majority shareholder acquiring the shares, the majority

shareholder is required to publish the same in a newspaper with a national circulation.

A shareholder that holds a majority of our issued share capital, but

less than the 95% required to institute the squeeze-out proceedings described above, may seek to propose and implement one or more restructuring

transactions with the objective of obtaining at least 95% of our issued share capital so the shareholder may initiate squeeze-out proceedings.

Those restructuring transactions could, among other things, include a merger or demerger involving the company, a contribution of cash

and/or assets against issuance of ordinary shares, the issuance of new ordinary shares to the majority shareholder without preemptive

rights for minority shareholders or an asset sale transaction.

Depending on the circumstances, an asset sale of a Dutch public limited

liability company (naamloze vennootschap) is sometimes used as a way to squeeze out minority shareholders, for example, after a

successful tender offer through which a third party acquires a supermajority, but less than all, of the company’s shares. In such

a scenario, the business of the target company is sold to a third party or a special purpose vehicle, followed by the liquidation of the

target company. The purchase price is distributed to all shareholders in proportion to their respective shareholding as liquidation proceeds,

thus separating the business from the company in which minority shareholders had an interest.

Any sale or transfer of all of our assets and our dissolution or liquidation

is subject to approval by a majority of the votes cast in our general meeting. Our articles of association provide that our general meeting

may only adopt such resolution upon a proposal of our board of directors.

Certain Other Major Transactions

Our articles of association and Dutch law provide that resolutions of

our board of directors concerning a material change in our identity, character or business are subject to the approval of our general

meeting. Such changes include:

| · | a transfer of all or materially all of our business to a third party; |

| · | the entry into or termination of a long-lasting alliance of the company or

of a subsidiary either with another entity or company, or as a fully liable partner of a limited partnership or partnership, if this alliance

or termination is of significant importance to the company; and |

| · | the acquisition or disposition of an interest in the capital of a company

by the company or by its subsidiary with a value of at least one-third of the value of our assets, according to the balance sheet with

explanatory notes or, if the company prepares a consolidated balance sheet, according to the consolidated balance sheet with explanatory

notes in our most recently adopted annual accounts. |

Dividends and Other Distributions

We may only make distributions to our shareholders if our equity exceeds

the aggregate amount of the issued share capital and the reserves that must be maintained pursuant to Dutch law or our articles of association.

We may not make any distribution of profits on shares held by the company as treasury shares and such treasury shares will not be taken

into account when determining the profit entitlement of our shareholders, unless such treasury shares are encumbered with a right of usufruct

or a right of pledge. Under our articles of association, any profits or distributable reserves must first be applied to pay a dividend

on the financing preferred shares, if outstanding.

Any remaining profits may be reserved by our board of directors. After

reservation by our board of directors of any distributable profits, our general meeting will be authorized to declare distributions on

the proposal of our board of directors. Our board of directors is permitted, subject to certain requirements, to declare interim dividends

without the approval of the shareholders. Interim dividends may be declared as

provided in our articles of association and may be distributed

to the extent that the shareholders’ equity, based on interim financial statements, exceeds the paid-up and called-up share capital

and the reserves that must be maintained under Dutch law or our articles of association. We may reclaim any distributions, whether interim

or not interim, made in contravention of certain restrictions of Dutch law from shareholders that knew or should have known that such

distribution was not permissible. In addition, on the basis of Dutch case law, if after a distribution we are not able to pay its due

and collectable debts, then our shareholders or directors who at the time of the distribution knew or reasonably should have foreseen

that result may be liable to its creditors.

Upon proposal of our board of directors, the general meeting may determine

that distributions will be made in whole or in part in a currency other than the euro. We shall announce any proposal for a distribution

and the date when and the place where the distribution will be payable to all shareholders by electronic means of communication with due

observance of the applicable law and stock exchange rules. Claims for payment of dividends and other distributions not made within five years

from the date that such dividends or distributions became payable will lapse, and any such amounts will be considered to have been forfeited

to the company (verjaring).

Notices

We will give notice of each general meeting by publication on our website

and, to the extent required by applicable law, in a Dutch daily newspaper with national distribution, and in any other manner that we

may be required to follow in order to comply with Dutch law and applicable stock exchange and SEC requirements. Holders of registered

shares may further be provided notice of the meeting in writing at their addresses as stated in our shareholders’ register.

Registration Rights

Investor Rights and Lock-Up Agreement

We have granted to certain of our securityholders registration rights

pursuant to an Investor Rights and Lock-Up Agreement, dated July 1, 2020, among us and the investors party thereto. Such securityholders

are entitled to the following rights with respect to the registration of their ordinary shares for public resale under the Securities

Act.

Shelf Registration. We

are obligated to file and keep effective a shelf registration statement pursuant to Rule 415 under the Securities Act with respect

to all securities subject to registration rights, subject to certain exceptions.

Demand Registration. Upon

the demand of certain securityholders, we are obligated to effect a resale registration under the Securities Act with respect to all or

any portion of their shares subject to registration rights, subject to certain exceptions. Demand registration rights will not be triggered

if there is an effective resale shelf registration statement.

Piggyback Registration. In

the event that we propose to register any of our securities under the Securities Act, either for our account or for the account of our

other securityholders, holders will be entitled to certain piggyback registration rights allowing each to include its shares in the registration,

subject to certain marketing and other limitations. As a result, whenever we propose to file a registration statement under the Securities

Act, other than with respect to a demand registration, a registration statement on Form S-4, F-4 or S-8 and or a registration of convertible

debt securities, these holders will be entitled to notice of the registration and will have the right to include their registrable securities

in the registration, subject to certain limitations. Piggyback registration rights will not be triggered if there is an effective resale

shelf registration statement, the registration is solely for an offering of securities by us and no other securityholder is entitled to

participate in such registration.

Expenses; Indemnification. We

must pay all registration expenses in connection with effecting any demand registration, piggyback registration or shelf registration.

We are also subject customary indemnification and contribution provisions.

Securities Purchase Agreement

On July

19, 2023, we entered into a securities purchase agreement (the “Securities Purchase Agreement”) with BMS, pursuant to which

we agreed to issue and sell to BMS and BMS agreed to purchase from us 2,419,818 ordinary shares at $14.4639 per share. We agreed to file,

within 60 calendar days of the closing date of the private placement, a registration statement on Form F-3 that registers for resale under

the Securities Act the ordinary shares sold under the securities purchase agreement. We are required to keep such registration statement

effective until the earlier of the date on which all such ordinary shares have been sold pursuant to such registration statement or Rule

144 under the Securities Act, are eligible to be immediately sold to the public without registration or restriction, are no longer outstanding

or July 21, 2024.

We are

filing this registration statement to register the resale of the ordinary shares held by the selling securityholder to satisfy our obligations

under the Securities Purchase Agreement.

Stock Exchange Listing

Our ordinary shares are listed on Nasdaq under the symbol “IMTX.”

Transfer Agent

Continental Stock Transfer & Trust Company serves as our agent in

New York to maintain our shareholders’ register on behalf of our board of directors and acts as transfer agent and registrar for

the ordinary shares.

Exchange Controls

Under Dutch law, there are no exchange controls applicable to the transfer

to persons outside of the Netherlands of dividends or other distributions with respect to, or of the proceeds from the sale of, shares

of a Dutch company, subject to applicable restrictions under sanctions and measures, including those concerning export control, pursuant

to applicable resolutions adopted by the United Nations, regulations of the European Union, the Dutch Sanctions Act 1977 (Sanctiewet

1977), national emergency legislation, or other legislation, applicable anti-boycott regulations and similar rules and provided that,

under certain circumstances, payments of such dividends or other distributions must be reported to the Dutch Central Bank at their request

for statistical purposes. There are no special restrictions in our articles of association or Dutch law that limit the right of shareholders

who are not citizens or residents of the Netherlands to hold or vote shares. The European Directive Mandatory Disclosure Rules (2011/16/EU)

in relation to cross-border tax arrangements can provide for future notification requirements.

Under German law, there are no exchange controls restricting the transfer

of funds between Germany and other countries or individuals, subject to applicable restrictions concerning import or export control or

sanctions and measures against certain persons, entities and countries subject to embargoes in accordance with German law and applicable

resolutions adopted by the United Nations and the European Union.

Under German foreign trade regulation, with certain exceptions, every

corporation or individual residing in Germany must report to the German Central Bank on any payment received from or made to a non-resident

corporation or individual if the payment exceeds €12,500 (or the equivalent in a foreign currency). Additionally, corporations and

individuals residing in Germany must report to the German Central Bank on any claims of a resident against, or liabilities payable to,

a non-resident corporation or individual exceeding an aggregate of €5 million (or the equivalent in a foreign currency) at the

end of any calendar month. Resident corporations and individuals are also required to report annually to the German Central Bank on any

stakes of 10% or more they hold in the equity of non-resident corporations with total assets of more than €3 million. Corporations

residing in Germany with assets in excess of €3 million must report annually to the German Central Bank on any stake of 10%

or more in the company held by an individual or a corporation located outside Germany.

TAXATION

Material U.S. Federal Income Tax Considerations for U.S. Holders

In the opinion of Davis Polk & Wardwell LLP, the following is a

description of the material U.S. federal income tax consequences to the U.S. Holders, as defined below, of owning and disposing of our

ordinary shares. It does not describe all tax considerations that may be relevant to a particular person’s decision to acquire ordinary

shares.

This discussion applies only to a U.S. Holder that acquires ordinary

shares registered for offer and sale pursuant to this prospectus and holds ordinary shares as capital assets for U.S. federal income tax

purposes (generally, property held for investment). In addition, it does not describe any tax consequences other than U.S. federal income

tax consequences, including state and local tax consequences and estate tax consequences, and does not describe all of the U.S. federal

income tax consequences that may be relevant in light of the U.S. Holder’s particular circumstances, including alternative minimum

tax consequences, the potential application of the provisions of the Internal Revenue Code of 1986, as amended (the “Code”)

known as the Medicare contribution tax and tax consequences applicable to U.S. Holders subject to special rules, such as:

| · | certain banks, insurance companies and other financial institutions; |

| · | brokers, dealers or traders in securities who use a mark-to-market method

of tax accounting; |

| · | persons holding ordinary shares as part of a straddle, wash sale, conversion

transaction or other integrated transaction or persons entering into a constructive sale with respect to the ordinary shares; |

| · | persons whose functional currency for U.S. federal income tax purposes is

not the U.S. dollar; |

| · | entities or arrangements classified as partnerships or S corporations for

U.S. federal income tax purposes; |

| · | tax-exempt entities, including an “individual retirement account”

or “Roth IRAs” and governmental entities; |

| · | real estate investment trusts or regulated investment companies; |

| · | corporations that accumulate earnings to avoid U.S. federal income tax; |

| · | persons that own or are deemed to own 10% or more of the voting power or value

of our shares; or |

| · | persons holding ordinary shares in connection with a trade or business conducted

outside of the United States or in connection with a permanent establishment or other fixed place of business outside of the United States.

|

If an entity or arrangement that is classified as a partnership for

U.S. federal income tax purposes holds ordinary shares, the U.S. federal income tax treatment of a partner will generally depend on the

status of the partner and the activities of the partnership. Partnerships holding ordinary shares and partners in such partnerships should

consult their tax advisers as to the particular U.S. federal income tax consequences of owning and disposing of the ordinary shares.

This discussion is based on the Code, administrative pronouncements,

judicial decisions, final, temporary and proposed Treasury regulations, and the income tax treaty between Germany and the United States

(the “Treaty”), all as of the date hereof, any of which is subject to change or differing interpretations, possibly with retroactive

effect.

A “U.S. Holder” is a beneficial owner of our ordinary shares

who, for U.S. federal income tax purposes, is eligible for the benefits of the Treaty and who is:

| · | a U.S. citizen (other than a resident of the Netherlands or Germany) or individual

resident of the United States; |

| · | a corporation, or other entity taxable as a corporation, created or organized

in or under the laws of the United States, any state therein or the District of Columbia; or |

| · | an estate or trust the income of which is subject to U.S. federal income taxation

regardless of its source. |

Certain Treasury regulations (the “Foreign Tax Credit Regulations”)

may in some circumstances prohibit a U.S. person from claiming a foreign tax credit with respect to certain non-U.S. taxes that are not

creditable under applicable income tax treaties. The U.S. Internal Revenue Service (the "IRS") recently released a notice which

indicates that the Treasury Department and the IRS are considering amendments to the Foreign Tax Credit

Regulations and provides temporary relief from certain of their provisions until December 31, 2023. The rules governing the calculation

and timing of foreign tax credits and the deduction of foreign taxes are complex and depend upon a U.S. Holder’s particular circumstances.

Accordingly, U.S. investors that are not eligible for Treaty benefits should consult their tax advisors regarding the creditability or

deductibility of any non-U.S. taxes imposed on dividends on, or dispositions of, ordinary shares. This discussion does not apply to investors

in this special situation.

U.S. Holders should consult their tax advisers concerning the U.S. federal,

state, local and non-U.S. tax consequences of owning and disposing of the ordinary shares in their particular circumstances.

Taxation of Distributions

Subject to the discussion under “—Passive Foreign Investment

Company Rules” below, distributions (if any) paid on ordinary shares, other than certain pro rata distributions of ordinary

shares, will generally be treated as dividends to the extent paid out of our current or accumulated earnings and profits (as determined

under U.S. federal income tax principles). Because we do not maintain calculations of our earnings and profits under U.S. federal income

tax principles, we expect that distributions generally will be reported to U.S. Holders as dividends. Dividends paid to certain non-corporate

U.S. Holders may be eligible for taxation as “qualified dividend income” and therefore, subject to applicable limitations,

may be taxable at long-term capital gain rates. Dividends may constitute qualified dividend income if (a) the ordinary shares with

respect to which the dividends are paid are listed on Nasdaq or are otherwise considered “readily tradable” on an established

securities market for U.S. federal income tax purposes or we are eligible for benefits under the Treaty and (b) we are not a PFIC

in the year in which the dividend is paid or the prior taxable year. However, there can be no assurance that our ordinary shares will

remain listed or otherwise be considered readily tradable on an established securities market in the future, nor (as discussed under “Passive

Foreign Investment Company Rules” below) that we will not be a PFIC for any future taxable year. U.S. Holders should consult their

tax advisers regarding the availability of the reduced tax rate on dividends in their particular circumstances.

As described below under “—Material Dutch Tax Considerations”

and “—Material German Tax Considerations,” it is expected that any dividends we pay to a U.S. Holder will be subject

to German withholding tax (and will not be subject to Dutch withholding tax). The amount of a dividend will include any amounts withheld