Form 8-K - Current report

August 24 2023 - 4:05PM

Edgar (US Regulatory)

0001673481

false

0001673481

2023-08-18

2023-08-18

0001673481

LTRY:CommonStockParValue0.001PerShareMember

2023-08-18

2023-08-18

0001673481

LTRY:WarrantsToPurchaseOneShareOfCommonStockMember

2023-08-18

2023-08-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 18, 2023

LOTTERY.COM

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-38508 |

|

81-1996183 |

(State of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS Employer

ID No.) |

20808

State Hwy 71W, Unit B

Spicewood,

Texas 78669

(Address

of Principal Executive Offices)

(512)

592-2451

(Registrant’s

Telephone Number including Area Code)

Not

Applicable

(Former

name or address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

LTRY |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase one share of common stock |

|

LTRYW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On

August 18, 2023, Lottery.com Inc. (the “Company”) entered into an amendment (the “Amendment”) to its amended

and restated loan agreement, dated as of August 8, 2023 (as amended, the “UCIL Loan Agreement”), with United Capital Investments

London Limited (“UCIL”), to make certain technical amendments to the conversion mechanics therein to comply with Nasdaq’s

listing rules relating to stockholder voting rights.

The

foregoing description of the Amendment is not complete and is qualified in its entirety by the full text of the Amendment, which is filed

herewith as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item

9.01. Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Lottery.Com

Inc. |

| |

|

|

| Date:

August 24, 2023 |

|

|

| |

By: |

/s/ Matthew McGahan |

| |

Name: |

Matthew McGahan |

| |

Title: |

Interim

Chief Executive Officer and Chair of the Board |

Exhibit

10.1

Dated

August 18, 2023

Amendment

Agreement

in

respect of a

Loan

Agreement (Deed)

dated

26 July 2023 and amended and restated on 8 August 2023

between

United

Capital Investments London Limited

as

Lender

and

Lottery.com

Inc

as

Borrower

White

& Case llp

5

Old Broad Street

London

EC2N 1DW

Table

of Contents

| |

|

Page |

| 1. |

Definitions

and Interpretation |

1 |

| 2. |

Definitions

and Interpretation |

1 |

| 3. |

Amendments

to the Loan Agreement |

1 |

| 4. |

Confirmations |

3 |

| 5. |

Representations

and Warranties |

3 |

| 6. |

Costs

and Expenses |

3 |

| 7. |

Incorporation

of Terms |

3 |

| 8. |

Counterparts |

3 |

| 9. |

Governing

Law |

3 |

| 10. |

Enforcement |

3 |

This

Agreement is dated August 18, 2023 and made between:

| (1) | United

Capital Investments London Limited,

a company

existing under the laws of England and Wales, company registration number 10490012, having

its registered office at: 18 (2nd Floor) Savile Row, London, England, W1S 3PW,

the United Kingdom (the “Lender”); and |

| | |

| (2) | Lottery.com,

INC, a company existing under the laws of the State of Delaware, having its registered

office at: 20808 State Hwy. 71W, Unit B, Spicewood, Texas 78669, the United States (the “Borrower”). |

Whereas:

| (A) | Reference

is made to the loan agreement dated 26 July 2023 (as amended and restated on 8 August 2023)

and made between the Lender and the Borrower (as may be further amended, restated, supplemented,

varied or extended from time to time, the “Loan Agreement”). |

| | |

| (B) | The

Parties wish to amend the Loan Agreement on the terms and subject to the conditions set out

in this Agreement. |

| | |

| (C) | It

is intended that this Agreement takes effect as a deed notwithstanding the fact that a party

may only execute this Agreement under hand. |

It

is agreed as follows:

| 1. | Definitions

and Interpretation |

| (a) | Save

as defined in this Agreement, words and expressions defined in the Loan Agreement shall have

the same meanings in this Agreement. |

| | | |

| (b) | Clauses

1.2 through 1.7 and 19 (Third Party rights) of the Loan Agreement shall be deemed

to be incorporated into this Agreement, save that references in the Loan Agreement to “this

Agreement” shall be construed as references to this Agreement. |

In

this Agreement the following expressions shall have the following meanings:

“Effective

Date” means the date of this Agreement.

| 2. | Definitions

and Interpretation |

| (a) | Save

as defined in this Agreement, words and expressions defined in the Loan Agreement shall have

the same meanings in this Agreement. |

| | | |

| (b) | Clauses

1.2 (Construction) and 1.3 (Third Party rights) of the Loan Agreement shall

be deemed to be incorporated into this Agreement save that references in the Loan |

| 3. | Amendments

to the Loan Agreement |

| 3.1 | Pursuant

to the terms of the Loan Agreement, each Party consents to the amendments to the Loan Agreement

contemplated by this Agreement. |

| 3.2 | With

effect from the Effective Date paragraphs (c) and (d) of clause 9.1 (Conversion) of

the Loan Agreement shall be deleted in their entirety and the following paragraphs (e) through

(f) (inclusive) shall be inserted to clause 9.1 (Conversion) of the Loan Agreement

instead: |

| “(c) | Unless

paragraph (f) applies, at any time while common stock shares of the Borrower are registered

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

the Lender may not hold more than 4.99% of the issued and outstanding common stock shares

of the Borrower (the “Disclosure Threshold”), without acknowledging and

agreeing that holding beneficial ownership above the Disclosure Threshold shall require disclosure

requirements pursuant to Nasdaq and SEC rules by Borrower. |

| | | |

| (d) | The

Borrower shall not issue or sell any Shares (including shares of common stock underlying

the Warrant) pursuant to this Agreement and the Lender shall not purchase or acquire any

Shares pursuant to this Agreement, to the extent that after giving effect thereto, the aggregate

number of Shares that could be issued pursuant to this Agreement and the transactions contemplated

hereby would exceed such number of shares equal to 19.99% of the Shares issued and outstanding

immediately prior to the execution of this Agreement, which number of shares shall be reduced,

on a share-for-share basis, by the number of shares issued or issuable pursuant to any transaction

or series of transactions (including any warrants or other securities convertible into Shares)

that may be aggregated with the transactions contemplated by this Agreement under applicable

rules of Nasdaq (such maximum number of shares, the “Exchange Cap”), unless

the Borrower’s stockholders have approved the issuance of Shares pursuant to this Agreement

in excess of the Exchange Cap in accordance with the applicable rules of Nasdaq. The Exchange

Cap shall apply during the life of the Agreement notwithstanding whether the Shares remain

listed on Nasdaq. |

| | | |

| (e) | The

Parties further acknowledge that: |

| (i) | the

Borrower may not issue or sell any Shares if such sale would result in violation of any Nasdaq

rules applicable to the Borrower or its Shares; and |

| | | |

| (ii) | any

Shares issued in accordance with this Agreement or issued or issuable pursuant to any transaction

or series of transactions (including any warrants or other securities convertible into Shares)

that may be aggregated with the transactions contemplated by this Agreement under applicable

rules of Nasdaq cannot be voted on (and any such vote will be ignored) to remove the Exchange

Cap. |

| (f) | If

there is a shareholders or similar agreement executed directly or indirectly in relation

to common stock shares of the Borrower or otherwise affecting governance in relation to the

Borrower (the “Relevant SHA”) that has the effect of disapplying, varying

or otherwise affecting the Disclosure Threshold (as applicable)( such threshold calculated

taking into account the terms of a Relevant SHA, the “SHA Threshold”), then,

at any time while common stock shares of the Borrower are listed on the Nasdaq, no Lender

may hold more than the SHA Threshold without acknowledging and agreeing that holding beneficial

ownership above the SHA Threshold shall require disclosure pursuant to Nasdaq and SEC rules

by Borrower.” |

| 3.3 | With

effect from the Effective Date: |

| (a) | all

references in the Loan Agreement to “this Agreement” shall include the Loan Agreement

as amended by this Agreement; and |

| (b) | the

Loan Agreement and this Agreement shall be read and construed as one document and references

in the Loan Agreement and in each Transaction Document shall be read and construed as references

to the Loan Agreement as amended by this Agreement. |

| 3.4 | Save

as amended by this Agreement, the Loan Agreement and each Transaction Document to which it

is a party shall continue in full force and effect. |

| 4.1 | The

Borrower shall, at the request of the Lender, and at its own expense, do all such acts and

things necessary or desirable to give effect to the amendments effected or intended to be

effected pursuant to this Agreement. |

| 5. | Representations

and Warranties |

The

Borrower on the Effective Date makes the representations and warranties set out in Clause 5 (Borrower’s Representations and

Warranties) of the Loan Agreement as if references to “this Agreement” in those representations were references to this

Agreement.

The

provisions of Clause 23 (Costs) of the Loan Agreement shall apply to this Agreement as if it were expressly set out in this Agreement

with the necessary changes being made and with each reference in the Loan Agreement to “this Agreement” being construed as

references to this Agreement.

The

terms of clauses 12 (Notices), 17 (Invalidity) and 22 (Remedies) of the Loan Agreement shall be deemed to be incorporated

into this Agreement save that references in the Loan Agreement to “this Agreement” shall be construed as references to this

Agreement.

This

Agreement may be executed in any number of counterparts and all of such counterparts taken together shall be deemed to constitute one

and the same instrument.

This

Agreement and any dispute or claim arising out of or in connection with this Agreement or their subject matter, existence, negotiation,

validity, termination, enforceability or breach (including non-contractual disputes or claims) shall be governed by, and construed in

accordance with, English law.

Any

dispute arising out of or in connection with this Agreement, including any question regarding its existence, validity or termination,

shall be referred to and finally resolved by the LCIA under the LCIA Rules (the “Rules”), which Rules are deemed to

be incorporated by reference into this Clause 10. The number of arbitrators shall be one (1). The seat, or legal place, of arbitration

shall be London, the United Kingdom. The language to be used in the arbitral proceedings shall be English. The Parties agree that any

restriction in the Rules upon the nomination or appointment of an arbitrator by reason of nationality shall not apply to any arbitration

commenced pursuant to this Clause 10. Any decision under such arbitration proceedings shall be final and binding on the Parties. The

tribunal shall order an unsuccessful Party in the arbitration to pay the legal and other costs incurred in connection with the arbitration

by a successful Party. Each Party consents to be joined in the arbitration commenced under the arbitration agreement set out in this

Clause 10. For the avoidance of doubt, this Clause 10 constitutes each Party’s consent to joinder in writing for the purposes of

the Rules. Each Party agrees to be bound by any award rendered in the arbitration, to which it was joined pursuant to this Clause 10.

Each Party consents to the consolidation, in accordance with the Rules, of two (2) or more arbitrations commenced under the arbitration

agreement set out in this Clause 10. For the avoidance of doubt, this Clause 10 constitutes each Party’s agreement to consolidation

in writing for the purposes of the Rules.

This

Agreement has been entered into on the date stated at the beginning of this Agreement and executed as a deed by the Borrower and is intended

to be and is delivered by them as a deed on the date specified above.

Signatories

| The

Borrower |

|

|

|

| |

|

|

| Executed as a deed by |

|

|

| Lottery.com Inc |

|

|

| |

|

/s/ Paul

Jordan |

| |

By: |

Paul Jordan |

| The

Lender |

|

|

|

| |

|

|

| Executed as a deed by |

|

|

| United Capital Investments

London Limited |

|

|

| |

|

/s/

Barney Battles |

| |

By: |

Barney Battles |

v3.23.2

Cover

|

Aug. 18, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 18, 2023

|

| Entity File Number |

001-38508

|

| Entity Registrant Name |

LOTTERY.COM

INC.

|

| Entity Central Index Key |

0001673481

|

| Entity Tax Identification Number |

81-1996183

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

20808

State Hwy 71W

|

| Entity Address, Address Line Two |

Unit B

|

| Entity Address, City or Town |

Spicewood

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78669

|

| City Area Code |

(512)

|

| Local Phone Number |

592-2451

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

LTRY

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase one share of common stock |

|

| Title of 12(b) Security |

Warrants

to purchase one share of common stock

|

| Trading Symbol |

LTRYW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LTRY_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LTRY_WarrantsToPurchaseOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

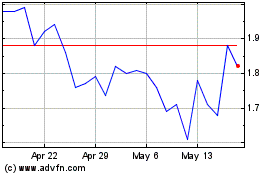

Lottery com (NASDAQ:LTRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

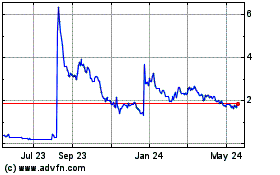

Lottery com (NASDAQ:LTRY)

Historical Stock Chart

From Apr 2023 to Apr 2024