| | | | | | | | |

Prospectus Supplement No. 5 To Prospectus dated April 7, 2023 | | Filed Pursuant to Rule 424(b)(3) Registration No. 333-252241 |

Clever Leaves Holdings Inc.

Primary Offering of

17,777,361 Common Shares Issuable Upon Exercise of Warrants

125,370 Common Shares Issuable Upon Exercise of Options

Secondary Offering of

3,654,707 Common Shares

4,900,000 Warrants to Purchase Common Shares

4,900,000 Common Shares Issuable upon Exercise of Warrants

This Prospectus Supplement No. 5 supplements the Prospectus dated April 7, 2023 (the “Prospectus”) of Clever Leaves Holdings Inc., a corporation organized under the laws of British Columbia, Canada (“we” or the “Company”), that forms a part of the Company’s Registration Statement on Form S-1 (File No. 333-252241). This Prospectus Supplement No. 5 is being filed to update and supplement certain information contained in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on August 24, 2023, other than the information included in Item 7.01 and Exhibit 99.1, which were furnished and not filed. This Prospectus Supplement No. 5 should be read in conjunction with the Prospectus. If there is any inconsistency between the information in the Prospectus and this Prospectus Supplement, you should rely on the information in this Prospectus Supplement.

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of material risks of investing in our securities in “Risk Factors” beginning on page 9 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of the Prospectus or this Prospectus Supplement. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is August 24, 2023

| | |

US-LEGAL-12161837/32 174008-0016

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 24, 2023

Clever Leaves Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| British Columbia, Canada | | 001-39820 | | Not Applicable |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Bodega 19-B Parque Industrial Tibitoc P.H, Tocancipá - Cundinamarca, Colombia | | N/A |

| (Address of principal executive offices) | | (Zip Code) |

(561) 634-7430

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol (s) | | Name of each exchange on which registered |

| Common shares without par value | | CLVR | | The Nasdaq Stock Market LLC |

| Warrants, each warrant exercisable for one common share at an exercise price of $11.50 | | CLVRW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders

Reverse Share Split

The board of directors of Clever Leaves Holdings Inc., a company organized under the laws of British Columbia, Canada (the “Company”) has approved a reverse share split of the Company’s common shares, without par value (the “Shares”), at a ratio of one Share for every 30 Shares presently owned (the “Reverse Share Split”). The Reverse Share Split will take effect at approximately 5:00 p.m. Eastern Time on August 24, 2023 (the “Effective Time”). At the market open on August 25, 2023, the Shares are expected to begin trading on a split-adjusted basis under a new CUSIP number.

No fractional shares will be issued in connection with the Reverse Share Split. Instead, pursuant to the Business Corporations Act (British Columbia), each fractional share remaining after completion of the Reverse Share Split that is less than half of a whole Share will be rounded down and canceled without consideration to the holders thereof and each fractional share that is at least half of a whole Share will be rounded up to one whole Share.

The Reverse Share Split will apply to all of the Company’s outstanding Shares as of the Effective Time and therefore will not affect any shareholder’s ownership percentage of the Shares, except for changes as a result of the elimination of fractional shares. The Reverse Share Split will not alter the voting rights or other rights attached to the Shares.

Shareholders of record will receive information from Computershare Investor Services Inc., the Company’s transfer agent, regarding their Share ownership following the Reverse Share Split. Shareholders who hold their Shares in brokerage accounts or in “street name” are not required to take any action in connection with the Reverse Share Split.

As a result of the Reverse Share Split, at the Effective Time, the number of outstanding Shares will be reduced from approximately 45.7 million to approximately 1.5 million, based on the number of Shares outstanding as of August 10, 2023.

The Reverse Share Split is intended to help the Company regain compliance with Nasdaq Listing Rule 5550(a)(2) (the “Minimum Bid Price Requirement”), as previously disclosed on the Company’s Current Reports on Form 8-K filed on September 29, 2022 and March 30, 2023. If at any time before September 25, 2023, the closing bid price of the Shares is at least $1.00 per share for a minimum of 10 consecutive business days, the staff (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) will provide the Company with written confirmation of compliance. If compliance with the Minimum Bid Price Requirement cannot be demonstrated by September 25, 2023, the Staff will provide written notification that the Company’s securities will be delisted. At that time, the Company may appeal the Staff’s determination to a Nasdaq hearings panel. There can be no assurance that the Company will be able to regain compliance with the Minimum Bid Price Requirement or maintain its listing on Nasdaq.

Adjustment to Warrants and Equity Plan Awards

At the Effective Time, the exercise price of the Company’s outstanding warrants and the number of Shares issuable upon exercise thereof will be adjusted to reflect the Reverse Share Split pursuant to the terms of the Warrant Agreement, dated as December 10, 2018, as amended.

At the Effective Time, the maximum number of Shares issuable under each of the Company’s 2020 Incentive Award Plan, as amended (the “Incentive Award Plan”), and the Company’s 2020 Earnout Award Plan (the “Earnout Plan” and together, the “Plans”) will be equitably adjusted to reflect the Reverse Share Split.

The number of Shares underlying each award of restricted share units (whether vesting based on time or performance) issued under the Plans that are outstanding as of immediately prior to the Reverse Share Split will be ratably adjusted to reflect the Reverse Share Split.

Each award of restricted share units issued under the Earnout Award Plan that vests based on the achievement by the Company of certain threshold Share prices, outstanding as of immediately prior to the Reverse Share Split, will have its Share price targets ratably adjusted to reflect the Reverse Share Split.

The number of Shares underlying stock option awards issued under the Incentive Award Plan that are outstanding and unexercised as of immediately prior to the Reverse Share Split and the exercise price of such stock options will be ratably adjusted to reflect the Reverse Share Split.

Item 7.01. Regulation FD Disclosure.

On August 24, 2023, the Company issued a press release announcing the effectiveness of the Reverse Share Split described in this Current Report of Form 8-K (this “Current Report”). A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated by reference into Item 7.01 of this Current Report.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes certain statements that are not historical facts but are forward-looking statements within the meaning of United States federal securities laws. You should not place undue reliance on such statements because they are subject to numerous risks and uncertainties which are difficult to predict and many of which are beyond the Company’s control and could cause the Company’s actual results to differ from the forward-looking statements. Factors that could cause actual future results to differ materially from current expectations include, but are not limited to, risks and uncertainties relating to the proposed Reverse Share Split, its impact, if any, on the Company and the trading price of the Company’s Shares and warrants, the Company’s ability to regain compliance with Nasdaq listing requirements and the administrative processes related thereto. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,” “forecast,” “will,” “expect,” “budget,” “contemplate,” “believe,” “estimate,” “continue,” “project,” “positioned,” “strategy,” “outlook” and similar expressions. Additional risk factors are described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 30, 2023 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, filed with the SEC on August 14, 2023. The Company disclaims any obligation to publicly update or revise any forward-looking statements to reflect changes and new developments except as required by law or regulation.

| | | | | | | | | | | | | | | | | |

| | | | | |

Exhibit No. | Description |

99.1 | Press Release of Clever Leaves Holdings Inc., dated August 24, 2023 |

104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Clever Leaves Holdings Inc. |

| |

| | By: | /s/ Marta Pinto Leite |

| | Name: | Marta Pinto Leite |

| | Title: | General Counsel and Corporate Secretary |

Date: August 24, 2023

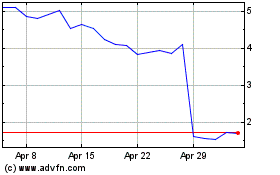

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

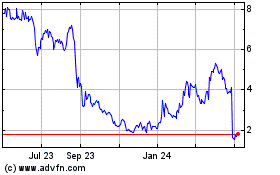

Clever Leaves (NASDAQ:CLVR)

Historical Stock Chart

From Apr 2023 to Apr 2024