0001349706

false

0001349706

2023-08-21

2023-08-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934

___________________________________________________________________

Date of Report (Date of earliest event reported): August 21, 2023

IMPERALIS HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-52140 |

|

20-5648820 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

1421 McCarthy Blvd., Milpitas, CA 95035

(Address of principal executive offices) (Zip Code)

(510) 657-2635

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

None

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement |

On August 15, 2023, Imperalis

Holding Corp., a Nevada corporation (the “Company”), entered into a Loan and Security Agreement (the “Credit

Agreement”) with Ault Alliance, Inc., a Delaware corporation, as lender (“AAI”). The Credit Agreement provides

for a secured, non-revolving credit facility in an aggregate principal amount of up to $2,000,000. All loans under the Credit Agreement

(collectively, the “Advances”) are due within five business days after request by AAI and AAI is not obligated to make

any further Advances under the Credit Agreement after December 31, 2023. Advances under the Credit Agreement bear interest at the rate

of 10.0% per annum, are secured by a first priority security interest in substantially all of the assets of the Company and its subsidiaries

and may be repaid at any time without penalty or premium. An Advance of approximately $1,080,458 was immediately issued to settle prior

loans made by AAI to the Company.

AAI

is an affiliate of the Company.

The foregoing description of the Credit Agreement

does not purport to be complete and is qualified in its entirety by reference to the form of Credit Agreement which is annexed hereto

as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing

does not purport to be a complete description of the rights and obligations of the parties thereunder and such descriptions are qualified

in their entirety by reference to such exhibit.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant |

The information contained in Item 1.01 of this Current Report on Form

8-K is incorporated herein by reference to this Item 2.03.

| Item 9.01 | Financial Statements and Exhibits |

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

Form of Loan and Security Agreement. |

| |

|

|

| 101 |

|

Pursuant to Rule 406 of Regulation S-T, the cover page is formatted in Inline XBRL (Inline eXtensible Business Reporting Language). |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

IMPERALIS HOLDING CORP. |

| |

|

| |

|

| Dated: August 21, 2023 |

/s/ Amos Kohn

Amos Kohn

Chief Executive Officer |

-3-

Exhibit 10.1

Imperalis Holding Corp., a Nevada Corporation

LOAN AND SECURITY AGREEMENT

This LOAN AND SECURITY AGREEMENT

is entered into with an effective date as of August 15, 2023, by and between Ault Alliance, Inc., a Delaware corporation (“AAI”)

and Imperalis Holding Corp., d/b/a TurnOnGreen, Inc., Nevada corporation (“Borrower”).

RECITALS

WHEREAS, AAI, through its

subsidiary, has previously loaned Borrower, inclusive of $233,000 related to the allocation of corporate overhead, One Million Eighty

Thousand Four Hundred Fifty-Eight Dollars and Twenty-Eight Cents ($1,080,458.28) in the aggregate schedule on Exhibit D attached

hereto (the “Prior Loans”);

WHEREAS, Borrower wishes to

seek, and AAI wishes to grant, an increase in additional credit of Nine Hundred Nineteen Thousand Five Hundred Forty-One Dollars and Seventy-Two

Cents ($919,541.72), which would represent an aggregate loan amount of Two Million Dollars ($2,000,000);

WHEREAS, in consideration

of the increase in additional maximum credit, inclusive of the Prior Loans, of up to $2,000,000, AAI and the Borrower wishes to terminate

the Prior Loans and enter into this Agreement and to make other changes to the terms of the issuance of credit; and

WHEREAS, AAI and Borrower

have agreed to enter into this Agreement to memorialize their understanding regarding their respective rights and obligations with respect

to this Agreement and the Loan as such term is defined herein.

AGREEMENT

NOW; THEREFORE, in consideration

of the making of the Loan and the covenants, agreements, representations and warranties set forth in this Agreement and the other Loan

Documents as defined herein, the receipt and legal sufficiency of which hereby are acknowledged, the parties hereby covenant, agree, represent

and warrant as follows:

1. DEFINITIONS

AND CONSTRUCTION.

1.1 Definitions.

As used in this Agreement, the following terms shall have the following definitions:

“AAI Expenses”

means all reasonable costs or expenses (including reasonable attorneys’ fees and expenses, whether generated in-house or by outside

counsel) incurred in connection with the preparation, negotiation, administration, and enforcement of the Loan Documents; reasonable annual

Collateral audit fees; and AAI’s reasonable attorneys’ fees and expenses (whether generated in-house or by outside counsel)

incurred in amending, enforcing or defending the Loan Documents (including fees and expenses of appeal), incurred before, during and after

an Insolvency Proceeding, whether or not suit is brought.

“Advance”

or “Advances” means a cash advance or cash advances under the Non-Revolving Line.

“Affiliate”

means, with respect to any Person, any Person that owns or controls directly or indirectly such Person, any Person that controls or is

controlled by or is under common control with such Person, and each of such Person’s senior executive officers, directors, and partners.

“Borrower’s

Books” means all of Borrower’s books and records including: ledgers; records concerning Borrower’s assets or liabilities,

the Collateral, business operations or financial condition; and all computer programs, or tape files, and the equipment, containing such

information.

“Business Day”

means any day that is not a Saturday, Sunday, or other day on which national and state banks located in the State of New York are authorized

or required to close.

“Cash”

means cash and cash equivalents.

“Change in Control”

shall mean a transaction in which any “person” or “group” (within the meaning of Section 13(d) and 14(d)(2) of

the Securities Exchange Act of 1934) becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange

Act of 1934), directly or indirectly, of a sufficient number of shares of all classes of stock then outstanding of Borrower ordinarily

entitled to vote in the election of directors, empowering such “person” or “group” to elect a majority of the

Board of Directors of Borrower, who did not have such power before such transaction.

“Closing Date”

means the date of this Agreement.

“Code”

means the Uniform Commercial Code, as amended or supplemented from time to time.

“Collateral”

means the property described on Exhibit A attached hereto.

“Contingent Obligation”

means, as applied to any Person, any direct or indirect liability, contingent or otherwise, of that Person with respect to (i) any indebtedness,

lease, dividend, letter of credit or other obligation of another, including, without limitation, any such obligation directly or indirectly

guaranteed, endorsed, co-made or discounted or sold with recourse by that Person, or in respect of which that Person is otherwise directly

or indirectly liable; (ii) any obligations with respect to undrawn letters of credit; and (iii) all obligations arising under any interest

rate, currency or commodity swap agreement, interest rate cap agreement, interest rate collar agreement, or other agreement or arrangement

designated to protect a Person against fluctuation in interest rates, currency exchange rates or commodity prices; provided, however,

that the term “Contingent Obligation” shall not include endorsements for collection or deposit in the ordinary course of business.

The amount of any Contingent Obligation shall be deemed to be an amount equal to the stated or determined amount of the primary obligation

in respect of which such Contingent Obligation is made or, if not stated or determinable, the maximum reasonably anticipated liability

in respect thereof as determined by such Person in good faith; provided, however, that such amount shall not in any event exceed the maximum

amount of the obligations under the guarantee or other support arrangement.

“Credit Extension”

means each Advance or any other extension of credit by AAI to or for the benefit of Borrower hereunder.

“Equipment”

means all present and future machinery, equipment, tenant improvements, furniture, fixtures, vehicles, tools, parts and attachments in

which any Borrower has any interest.

“Event of Default”

has the meaning assigned in Article 8.

“GAAP”

means generally accepted accounting principles in the United States, consistently applied, as in effect from time to time.

“Indebtedness”

means (a) all indebtedness for borrowed money or the deferred purchase price of property or services, including without limitation reimbursement

and other obligations with respect to surety bonds and letters of credit, (b) all obligations evidenced by notes, bonds, debentures or

similar instruments, (c) all capital lease obligations, and (d) all Contingent Obligations, if any.

“Insolvency Proceeding”

means any proceeding commenced by or against any Person or entity under any provision of the United States Bankruptcy Code, as amended,

or under any other bankruptcy or insolvency law, including assignments for the benefit of creditors, formal or informal moratoria, compositions,

extension generally with its creditors, or proceedings seeking reorganization, arrangement, or other relief.

“Investment”

means any beneficial ownership of (including stock, partnership or limited liability company interest other securities) any Person, or

any loan, advance or capital contribution to any Person.

“IRC” means

the Internal Revenue Code of 1986, as amended, and the regulations thereunder.

“Lien”

means any mortgage, lien, deed of trust, charge, pledge, security interest or other encumbrance.

“Liquidity”

means the sum of Borrower’s consolidated Cash.

“Loan”

means, collectively, the Credit Extensions available to Borrower under the Loan Documents.

“Loan Documents”

means, collectively, this Agreement, the Note, and any other document, instrument or agreement entered into in connection with this Agreement,

all as amended or extended from time to time.

“Material Adverse

Effect” means a material adverse effect on (i) the business operations, or financial condition of Borrower and its Subsidiaries

taken as a whole, (ii) the ability of Borrower to repay the Obligations or otherwise perform its obligations under the Loan Documents,

(iii) Borrower’s interest in, or the value, perfection or priority of AAI’s security interest in the Collateral.

“Maturity Date”

shall mean that date that the Note becomes due and payable, which shall be five (5) Business Days after written demand for repayment is

made by AAI.

“Negotiable Collateral”

means all of Borrower’s present and future letters of credit of which it is a beneficiary, drafts, instruments (including promissory

notes), securities, documents of title, and chattel paper, and Borrower’s Books relating to any of the foregoing.

“Non-Revolving Line”

means a Credit Extension of up to Two Million Dollars ($2,000,000) granted by AAI to Borrower.

“Note”

has the meaning given to such term in Section 3.1.

“Obligations”

means all debt, principal, interest, AAI Expenses and other amounts owed to AAI by Borrower pursuant to this Agreement or any other agreement,

whether absolute or contingent, due or to become due, now existing or hereafter arising, including any interest that accrues after the

commencement of an Insolvency Proceeding and including any debt, liability, or obligation owing from Borrower to others that AAI may have

obtained by assignment or otherwise.

“Periodic Payments”

means all installments or similar recurring payments that Borrower may now or hereafter become obligated to pay to AAI pursuant to the

terms and provisions of any instrument, or agreement, including this Agreement, now or hereafter in existence between Borrower and AAI.

“Permitted Indebtedness”

means:

(a) Indebtedness

of Borrower in favor of AAI arising under this Agreement or any other Loan Document;

(b) Indebtedness

existing on the Closing Date;

(c) Indebtedness

incurred in connection with capital leases secured by a lien described in clause (c) of the defined term “Permitted Liens;”

provided such Indebtedness does not exceed the lesser of the cost or fair market value of the equipment financed with such Indebtedness;

(d) Subordinated

Debt;

(e) Indebtedness

to trade creditors incurred in the ordinary course of business;

(f) Indebtedness

that constitutes a Permitted Investment;

(g) Guaranties

made in the ordinary course of business; and

(h) Extensions,

refinancings and renewals of any items of Permitted Indebtedness, provided that the principal amount is not increased or the terms modified

to impose more burdensome terms upon Borrower or its Subsidiary, as the case may be.

“Permitted Investment”

means:

(a) Investments

existing on the Closing Date;

(b) (i)

Marketable direct obligations issued or unconditionally guaranteed by the United States of America or any agency or any State thereof

maturing within one (1) year from the date of acquisition thereof, (ii) commercial paper maturing no more than one (1) year from the date

of creation thereof and currently having rating of at least A-2 or P-2 from either Standard & Poor’s Corporation or Moody’s

Investors Service, (iii) certificates of deposit maturing no more than one year from the date of investment therein, and (iv) money market

accounts;

(c) Investments

accepted in connection with Permitted Transfers;

(d) Investments

of Subsidiaries in or to other Subsidiaries or Borrower and Investments by Borrower in Subsidiaries to fund operating expenses in the

ordinary course of business;

(e) Investments

consisting of travel advances and employee relocation loans and other employee loans and advances in the ordinary course of business;

(f) Investments

(including debt obligations) received in connection with the bankruptcy or reorganization of customers or suppliers and in settlement

of delinquent obligations of, and other disputes with, customers or suppliers arising in the ordinary course of Borrower’s business;

(g) Investments

consisting of notes receivable of, or prepaid royalties and other credit extensions, to customers and suppliers who are not Affiliates,

in the ordinary course of business, provided that this subparagraph (g) shall not apply to Investments of Borrower in any Subsidiary;

and

(h) Other

Investments approved in advance and in writing by AAI in its sole discretion.

“Permitted Liens”

means the following:

(a) Any

Liens existing on the Closing Date or arising under this Agreement or the other Loan Documents;

(b) Liens

for taxes, fees, assessments or other governmental charges or levies, either not delinquent or being contested in good faith by appropriate

proceedings and for which adequate reserves are maintained;

(c) Liens

incurred (i) upon or in any acquired or held by any Borrower or any of its Subsidiaries to secure the purchase price of such Equipment

or indebtedness incurred solely for the purpose of financing the acquisition or lease of such Equipment, or (ii) existing on such Equipment

at the time of its acquisition, provided that the Lien is confined solely to the property so acquired and improvements thereon, and the

proceeds of such Equipment;

(d) Liens

of materialmen, mechanics, warehousemen, carriers, landlord, artisan’s or other similar Liens arising in the ordinary course of

business or by operation of law, which are not past due or which are being contested in good faith by appropriate proceedings;

(e) Liens

which in the aggregate constitute an immaterial and insignificant monetary amount with respect to the net value of Borrower’s assets

taken as a whole;

(f) Lien

securing Subordinated Debt;

(g) Liens

securing judgments or attachments in circumstances that do not constitute an Event of Default;

(h) leases

or subleases, licenses or sublicenses granted in the ordinary course of business which do not interfere in any material respect with the

business of Borrower;

(i) Liens

in favor of custom and revenue authorities arising as a matter of law, in the ordinary course of business, to secure payment of custom

duties in connection with the import and export of goods;

(j) Liens

in favor of financial institutions arising in connection with deposit or investment accounts held at such financial institutions, provided

that such liens only secure fees and service charges associated with such accounts;

(k) deposits

in the ordinary course of business under worker’s compensation, unemployment insurance, social security and other similar laws,

or to secure the performance of bids, tenders or contracts or to secure indemnity, performance or other similar bonds for the performance

of bids, tenders or contracts or to secure statutory obligations or surety or appeal bonds;

(l) Liens

incurred in connection with the extension, renewal or refinancing of the indebtedness secured by Permitted Liens, provided that any extension,

renewal or replacement Lien shall be limited to the property encumbered by the existing Lien and the principal amount of the indebtedness

being extended, renewed or refinanced does not increase in any material respect; and

(m) Liens

arising from judgments, decrees or attachments in circumstances not constituting an Event of Default under Sections 8.5 or 8.9.

“Permitted Transfer”

means the conveyance, sale, lease, transfer or disposition by Borrower or any Subsidiary of:

(a) Inventory

in the ordinary course of business;

(b) licenses

and similar arrangements for the use of the property of Borrower or its Subsidiaries in the ordinary course of business;

(c) worn-out

or obsolete Equipment;

(d) Transfers

otherwise permitted by the terms of Section 7;

(e) sales

and transfers in the ordinary course of business, including normal intercompany business transactions; or

(f) other

assets of Borrower or its Subsidiaries that do not in the aggregate exceed One Hundred Thousand Dollars ($100,000) during any fiscal year.

“Person”

means any individual, sole proprietorship, partnership, limited liability company, joint venture, trust, unincorporated organization,

association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or government agency.

“Interest Rate”

means 10% interest, per annum.

“Responsible Officer”

means each of the Chief Executive Officer and the Chief Financial Officer of Borrower.

“Schedule”

means the schedule of exceptions attached hereto and approved by AAI, if any.

“Subordinated Debt”

means any debt incurred by Borrower that is subordinated in writing to the debt owing by Borrower to AAI on terms reasonably acceptable

to AAI (and identified as being such by Borrower and AAI).

“Subsidiary”

means any corporation, partnership or limited liability company or joint venture in which (i) any general partnership interest or (ii)

more than fifty percent (50%) of the stock, limited liability company interest or joint venture of which by the terms thereof has the

ordinary voting power to elect the Board of Directors, managers or trustees of the entity, at the time as of which any determination is

being made, is owned by a Borrower, either directly or through an Affiliate.

“Trademarks”

means any trademark and servicemark rights, whether registered or not, applications to register and registrations of the same and like

protections, and the entire goodwill of the business of a Borrower connected with and symbolized by such trademarks.

1.2 Accounting

Terms. Any accounting term not specifically defined herein shall be construed in accordance with GAAP and all calculations shall be

made in accordance with GAAP. The term “financial statements” shall include the accompanying notes and schedules.

2. LOAN

AND TERMS OF PAYMENT.

2.1 Credit

Extensions.

(a) Promise

to Pay. Borrower promises to pay to AAI, in lawful money of the United States of America, the aggregate unpaid principal amount of

all Credit Extensions made by AAI to Borrower, together with interest on the unpaid principal amount of such Credit Extensions at rates

in accordance with the terms hereof.

(b) Advances

Under Non Revolving Line.

(i) Amount.

Subject to and upon the terms and conditions of this Agreement and AAI’s availability of capital, as determined by AAI in its sole

and absolute discretion, Borrower may request Advances in an aggregate outstanding amount not to exceed the Non-Revolving Line. Amounts

borrowed pursuant to this Section 2.1(b) which have been repaid may not be reborrowed at any time. All Advances under this Section 2.1(b)

shall be immediately due and payable on the Maturity Date. Borrower may prepay any Advances without penalty or premium upon notice.

(ii) Form

of Request. Whenever a Borrower desires an Advance, such Borrower will notify AAI by email or telephone no later than ten (10) Business

Day prior to the date the Advance is to be made. Each such notification shall be promptly confirmed by a Payment/Advance Form in substantially

the form of Exhibit C hereto. AAI is authorized to make Advances under this Agreement, based upon instructions received from a Responsible

Officer or a designee of a Responsible Officer, or without instructions if in AAI’s discretion such Advances are necessary to meet

Obligations which have become due and remain unpaid. AAI shall be entitled to rely on any telephonic notice given by a person who AAI

reasonably believes to be a Responsible Officer or a designee thereof, and Borrower shall indemnify and hold AAI harmless for any damages

or loss suffered by AAI as a result of such reliance. AAI will evidence the amount of Advances made under this Section 2.1(b) by a Note.

2.2 Overadvances.

If the aggregate amount of the outstanding Advances exceeds the Non-Revolving Line at any time, then within fifteen (15) days (or such

longer period as AAI may grant in its sole discretion) of notice of such excess advanced, Borrower shall pay to AAI, in cash, the amount

of such excess, together with all accrued but unpaid interest on such excess.

2.3 Interest

Rates, Payments, and Calculations.

(a) Interest

Rates. Except as set forth in Section 2.3(b), the Advances shall bear interest at the rate equal to the Interest Rate.

(b) Default

Rate. If any payment is not made within ten (10) days after the date such payment is due, Borrower shall pay AAI a late fee equal

to the lesser of (i) five percent (5%) of the amount of such unpaid amount or (ii) the maximum amount permitted to be charged under applicable

law. All Obligations shall bear interest, from and after the occurrence and during the continuance of an Event of Default, at a rate equal

to five (5) percentage points above the Interest Rate applicable immediately prior to the occurrence of the Event of Default.

(c) Payments.

Interest and principal hereunder shall be due and payable on the Maturity Date. Borrower authorizes AAI, at its option, to charge such

interest, all AAI Expenses, and all Periodic Payments against the Non-Revolving Line, in which case those amounts shall thereafter accrue

interest at the rate then applicable hereunder.

(d) Computation.

All interest chargeable under the Loan Documents shall be computed on the basis of a three hundred sixty-five (365) day year for the actual

number of days elapsed.

2.4 Crediting

Payments. If no Event of Default exists, AAI shall credit a wire transfer of funds, check or other item of payment to such deposit

account or Obligation as Borrower specifies. During the existence of an Event of Default, AAI shall have the right, in its sole discretion,

to immediately apply any wire transfer of funds, check, or other item of payment AAI may receive to conditionally reduce Obligations,

but such applications of funds shall not be considered a payment on account unless such payment is of immediately available federal funds

or unless and until such check or other item of payment is honored when presented for payment. Notwithstanding anything to the contrary

contained herein, any wire transfer or payment received by AAI or for its benefit at its financial institution after 12:00 noon Pacific

time shall be deemed to have been received by AAI as of the opening of business on the immediately following Business Day. Whenever any

payment to AAI under the Loan Documents would otherwise be due (except by reason of acceleration) on a date that is not a Business Day,

such payment shall instead be due on the next Business Day, and additional fees or interest, as the case may be, shall accrue and be payable

for the period of such extension.

2.5 [Reserved]

2.6 Term.

This Agreement shall become effective on the Closing Date and, subject to Section 12.7, shall continue in full force and effect for so

long as any Obligations remain outstanding or AAI has any obligation to make Credit Extensions under this Agreement. Notwithstanding the

foregoing, AAI shall have the right to terminate its obligation to make Credit Extensions under this Agreement immediately and without

notice upon the occurrence and during the continuance of an Event of Default. After December 31, 2023, AAI will not be obligated to make

any further Advances.

3. CONDITIONS

OF LOANS.

3.1 Conditions

Precedent to Initial Credit Extension. The obligation of AAI to make the initial Credit Extension is subject to the condition precedent

that AAI shall have received, in form and substance satisfactory to AAI, the following:

(a) this

Agreement duly executed by the Borrower;

(b) a

promissory note for the outstanding amount in the form of Exhibit B duly executed by each Borrower (the “Note”);

and

(c) an

officer’s certificate of each Borrower with respect to incumbency and resolutions authorizing the execution and delivery of this

Agreement.

3.2 Conditions

Precedent to all Credit Extensions. The obligation of AAI to make each Credit Extension, including the initial Credit Extension, is

further subject to the following conditions:

(a) timely

receipt by AAI of the Payment/Advance Form as provided in Section 2.1; and

(b) the

representations and warranties contained in Section 5 shall be true and correct in all material respects on and as of the date of such

Payment/Advance Form and on the effective date of each Credit Extension as though made at and as of each such date, and no Event of Default

shall have occurred and be continuing, or would exist after giving effect to such Credit Extension (provided, however, that those representations

and warranties expressly referring to another date shall be true, correct and complete in all material respects as of such date). The

making of each Credit Extension shall be deemed to be a representation and warranty by each Borrower on the date of such Credit Extension

as to the accuracy of the facts referred to in this Section 3.2.

3.3 Cancellation

of Prior Loans and Consolidation of Advances.

(a) Subject

to all of the terms and conditions hereof and in consideration of the increase in the extension of credit to Borrower, AAI and Borrower

agree as follows:

(i) AAI

and Borrower agree to cancel the Prior Loans; and

(ii) AAI

will issue a new Promissory Note in the aggregate face amount of One Million Eighty Thousand Four Hundred Fifty-Eight Dollars and Twenty-Eight

Cents ($1,080,458.28) which aggregates the Prior Loans and prior advances.

4. CREATION

OF SECURITY INTEREST.

4.1 Grant

of Security Interest. Borrower grants and pledges to AAI a continuing security interest in the Collateral to secure prompt repayment

of any and all Obligations and to secure prompt performance by Borrower of its covenants and duties under the Loan Documents. Except for

Permitted Liens, such security interest constitutes a valid, first priority security interest in the presently existing Collateral, and

will constitute a valid, first priority security interest in later-acquired Collateral.

4.2 Perfection

of Security Interest. Borrower authorizes AAI to file at any time financing statements, continuation statements, and amendments thereto

that (i) specifically describing the Collateral or describe the Collateral as all assets of such Borrower of the kind pledged hereunder,

and (ii) contain any other information required by the Code for the sufficiency of filing office acceptance of any financing statement,

continuation statement, or amendment, including whether Borrower is an organization, the type of organization and any organizational identification

number issued to Borrower, if applicable. Borrower shall from time to time endorse and deliver to AAI, at the request of AAI, all Negotiable

Collateral and other documents that AAI may reasonably request, in form satisfactory to AAI, to perfect and continue perfected AAI’s

security interests in the Collateral and in order to fully consummate all of the transactions contemplated under the Loan Documents. Borrower

shall have possession of the Collateral, except where expressly otherwise provided in this Agreement or where AAI chooses to perfect its

security interest by possession in addition to the filing of a financing statement. Borrower shall take such steps as AAI reasonably requests

for AAI to obtain “control” of any Collateral consisting of investment property, deposit accounts, letter-of-credit rights

or electronic chattel paper (as such items and the term “control” are defined in Revised Article 9 of the Code) by causing

the securities intermediary or depositary institution or issuing AAI to execute a control agreement in form and substance satisfactory

to AAI. Borrower will not create any chattel paper in which Borrower is a lessor without placing a legend on the chattel paper acceptable

to AAI indicating that AAI has a security interest in the chattel paper.

4.3 Right

to Inspect. AAI (through any of its officers, employees, or agents) shall have the right, upon reasonable prior notice, from time

to time during Borrower’s usual business hours to inspect a Borrower’s Books and to make copies thereof and to check, test,

and appraise the Collateral in order to verify such Borrower’s financial condition or the amount, condition of, or any other matter

relating to, the Collateral.

5. REPRESENTATIONS

AND WARRANTIES.

Each Borrower represents and

warrants as follows:

5.1 Due

Organization and Qualification. Borrower and each Subsidiary is duly existing under the laws of the state in which it is organized

and qualified and licensed to do business in any state in which the conduct of its business or its ownership of property requires that

it be so qualified, except where the failure to do so could not reasonably be expected to cause a Material Adverse Effect.

5.2 Due

Authorization; No Conflict. The execution, delivery, and performance of the Loan Documents are within Borrower’s powers, have

been duly authorized, and are not in conflict with nor constitute a breach of any provision contained in Borrower’s Certificate/Articles

of Incorporation or Bylaws, nor will they constitute an event of default under any material agreement by which Borrower is bound. Borrower

is not in default under any agreement by which it is bound, except to the extent such default could not reasonably be expected to cause

a Material Adverse Effect.

5.3 Collateral.

Borrower has rights in or the power to transfer the Collateral, and its title to the Collateral is free and clear of Liens, adverse claims,

and restrictions on transfer or pledge except for Permitted Liens.

5.4 Intellectual

Property. To the best of Borrower’s knowledge, each of the copyrights, Trademarks and patents is valid and enforceable, and

no part of such intellectual property has been judged invalid or unenforceable, in whole or in part, and no claim has been made to Borrower

that any part of such intellectual property violates the rights of any third party except to the extent such claim could not reasonably

be expected to cause a Material Adverse Effect.

5.5 Legal

Name. Borrower’s exact legal name is as set forth in the first paragraph of this Agreement.

5.6 Litigation.

There are no actions or proceedings pending by or against Borrower or any Subsidiary before any court or administrative agency in which

a likely adverse decision could reasonably be expected to have a Material Adverse Effect.

5.7 No

Material Adverse Change in Financial Statements. All consolidated and consolidating financial statements related to Borrower and any

Subsidiary that are delivered by Borrower to AAI fairly present in all material respects Borrower’s consolidated and consolidating

financial condition as of the date thereof and Borrower’s consolidated and consolidating results of operations for the period then

ended. There has not been a material adverse change in the consolidated or in the consolidating financial condition of Borrower since

the date of the most recent of such financial statements submitted to AAI.

5.8 Solvency,

Payment of Debts. Borrower is able to pay its debts as they mature; the fair saleable value of Borrower’s assets (including

goodwill minus disposition costs) exceeds the fair value of its liabilities; and Borrower is not left with unreasonably small capital

after the transactions contemplated by this Agreement.

5.9 Compliance

with Laws and Regulations. Borrower and each Subsidiary have met the minimum funding requirements of ERISA with respect to any employee

benefit plans subject to ERISA. No event has occurred resulting from Borrower’s failure to comply with ERISA that is reasonably

likely to result in Borrower’s incurring any liability that could have a Material Adverse Effect. Borrower is not an “investment

company” or a company “controlled” by an “investment company” within the meaning of the Investment Company

Act of 1940. Borrower is not engaged principally, or as one of the important activities, in the business of extending credit for the purpose

of purchasing or carrying margin stock (within the meaning of Regulations T and U of the Board of Governors of the Federal Reserve System).

Borrower has complied in all material respects with all the provisions of the Federal Fair Labor Standards Act. Borrower is in compliance

with all environmental laws, regulations and ordinances except where the failure to comply is not reasonably likely to have a Material

Adverse Effect. Borrower has not violated any statutes, laws, ordinances or rules applicable to it, the violation of which could reasonably

be expected to have a Material Adverse Effect. Borrower and each Subsidiary have filed or caused to be filed all tax returns required

to be filed, and have paid, or have made adequate provision for the payment of, all taxes reflected therein except those being contested

in good faith with adequate reserves under GAAP or where the failure to file such returns or pay such taxes could not reasonably be expected

to have a Material Adverse Effect.

5.10 Subsidiaries.

Borrower does not own any stock, partnership or membership interest or other equity securities of any Person, except for those set forth

on Schedule 5.10 attached hereto.

5.11 Government

Consents. Borrower and each Subsidiary have obtained all consents, approvals and authorizations of, made all declarations or filings

with, and given all notices to, all governmental authorities that are necessary for the continued operation of Borrower’s business

as currently conducted, except where the failure to do so could not reasonably be expected to cause a Material Adverse Effect.

5.12 Full

Disclosure. No representation, warranty or other statement made by Borrower in any certificate or written statement furnished to AAI

taken together with all such certificates and written statements furnished to AAI contains any untrue statement of a material fact or

omits to state a material fact necessary in order to make the statements contained in such certificates or statements not misleading,

it being recognized by AAI that the projections and forecasts provided by Borrower in good faith and based upon reasonable assumptions

are not to be viewed as facts and that actual results during the period or periods covered by any such projections and forecasts may differ

from the projected or forecasted results.

6. AFFIRMATIVE

COVENANTS.

Borrower covenants and agrees

that, until payment in full of all outstanding Obligations (other than inchoate indemnity obligations), and for so long as AAI may have

any commitment to make a Credit Extension hereunder, such Borrower shall do all of the following:

6.1 Good

Standing and Government Compliance. Borrower shall maintain its and each of its Subsidiaries’ corporate existence and good standing

in the jurisdiction of formation, shall maintain qualification and good standing in each other jurisdiction in which the failure to so

qualify could have a Material Adverse Effect, and shall furnish to AAI the organizational identification number issued to Borrower by

the authorities of the state in which Borrower is organized, if applicable. Borrower shall meet, and shall cause each Subsidiary to meet,

the minimum funding requirements of ERISA with respect to any employee benefit plans subject to ERISA. Borrower shall comply in all material

respects with all applicable Environmental Laws, and maintain all material permits, licenses and approvals required thereunder where the

failure to do so could reasonably be expected to have a Material Adverse Effect. Borrower shall comply, and shall cause each Subsidiary

to comply, with all statutes, laws, ordinances and government rules and regulations to which it is subject, and shall maintain, and shall

cause each of its Subsidiaries to maintain, in force all licenses, approvals and agreements, the loss of which or failure to comply with

which could reasonably be expected to have a Material Adverse Effect.

6.2 [Reserved].

6.3 [Reserved].

6.4 Taxes.

Borrower shall make, and cause each Subsidiary to make, due and timely payment or deposit of all material federal, state, and local taxes,

assessments, or contributions required of it by law, including, but not limited to, those laws concerning income taxes, F.I.C.A., F.U.T.A.

and state disability, and will execute and deliver to AAI, on demand, proof satisfactory to AAI indicating that Borrower or a Subsidiary

has made such payments or deposits and any appropriate certificates attesting to the payment or deposit thereof; provided that each Borrower

or a Subsidiary need not make any payment if the amount or validity of such payment is contested in good faith by appropriate proceedings

and is reserved against (to the extent required by GAAP) by Borrower.

6.5 Insurance.

(a) Borrower,

at its expense, shall keep the Collateral insured against loss or damage by fire, theft, explosion, sprinklers, and all other hazards

and risks, and in such amounts, as ordinarily insured against by other owners in similar businesses conducted in the locations where each

Borrower’s business is conducted on the date hereof. Borrower shall also maintain liability and other insurance in an amount not

less than One Million Dollars ($1,000,000) and of a type that are customary to businesses similar to Borrower’s.

(b) All

such policies of insurance shall be in such form, with such companies, and in such amounts as reasonably satisfactory to AAI. All policies

of property insurance shall contain a AAI’s loss payable endorsement, in a form satisfactory to AAI, showing AAI as an additional

loss payee, and all liability insurance policies shall show AAI as an additional insured and specify that the insurer must give at least

30 days’ notice to AAI before canceling its policy for any reason. Upon AAI’s request, each Borrower shall deliver to AAI

certified copies of the policies of insurance and evidence of all premium payments. If no Event of Default has occurred and is continuing,

proceeds payable under any casualty policy will, at each Borrower’s option, be payable to such Borrower to replace the property

subject to the claim, provided that any such replacement property shall be deemed Collateral in which AAI has been granted a first priority

security interest. If an Event of Default has occurred and is continuing, all proceeds payable under any such policy shall, at AAI’s

option, be payable to AAI to be applied on account of the Obligations.

6.6 Additional

Filings. Borrower shall use its best efforts, to the extent requested by the AAI, to execute any documents necessary in order to consummate

the transactions contemplated in this Agreement including without limitation, UCC-1 Financial Statement(s) filed in the State of Nevada.

7. NEGATIVE

COVENANTS.

Borrower covenants and agrees

that, until the outstanding Obligations (other than inchoate indemnity obligations) are paid in full, Borrower will not do any of the

following without AAI’s prior written consent, which shall not be unreasonably withheld:

7.1 Dispositions.

Convey, sell, lease, license, transfer or otherwise dispose of (collectively, to “Transfer”), or permit any of its

Subsidiaries to Transfer, all or any part of its business or property, other than Permitted Transfers. Borrower will not engage in any

bulk sale of all or substantially all of its assets.

7.2 Change

in Name, Location, Executive Office, or Executive Management; Change in Business; Change in Fiscal Year. Change its name or its jurisdiction

of formation or relocate its chief executive office without prior written notification to AAI; hire or fire any executive officer; engage

in any business, or permit any of its Subsidiaries to engage in any business, other than or reasonably related or incidental to the businesses

currently engaged in by each Borrower; change its fiscal year end.

7.3 Mergers

or Acquisitions. Merge or consolidate, or permit any of its Subsidiaries to merge or consolidate, with or into any other business

organization (other than mergers or consolidations of a Subsidiary into another Subsidiary or into a Borrower), or acquire, or permit

any of its Subsidiaries to acquire, all or substantially all of the capital stock or property of another Person except where (i) such

transactions do not in the aggregate exceed One Million Dollars ($1,000,000) during any fiscal year, (ii) no Event of Default has occurred,

is continuing or would exist after giving effect to such transactions, (iii) such transactions do not result in a Change in Control, and

(iv) Borrower is the surviving entity.

7.4 Indebtedness.

Create, incur, assume, guarantee or be or remain liable with respect to any Indebtedness, or permit any Subsidiary so to do, other than

Permitted Indebtedness, or prepay any Indebtedness prior to its scheduled maturity or take any actions which impose on each Borrower an

obligation to prepay any Indebtedness prior to its scheduled maturity, except Indebtedness to AAI.

7.5 Encumbrances.

Create, incur, assume or allow any Lien with respect to any of its property, or assign or otherwise convey any right to receive income,

including the sale of any Accounts, or permit any of its Subsidiaries so to do, except for Permitted Liens.

7.6 Distributions.

Pay any dividends or make any other distribution or payment on account of or in redemption, retirement or purchase of any capital stock,

except that (i) Borrower may pay dividends in capital stock, and (ii) Borrower may make dividends or distributions to AAI or its Affiliates.

7.7 Investments.

Acquire or own, or make any Investment in or to any Person, or permit any of its Subsidiaries so to do, other than Permitted Investments.

7.8 Transactions

with Affiliates. Directly or indirectly enter into or permit to exist any material transaction with any Affiliate of Borrower except

for (i) transactions that are in the ordinary course of a Borrower’s business, upon fair and reasonable terms that are no less favorable

to a Borrower than would be obtained in an arm’s length transaction with a non-affiliated Person and (ii) transactions that are

otherwise permitted pursuant to Section 7.

7.9 No

Investment Company; Margin Regulation. Become or be controlled by an “investment company,” within the meaning of the Investment

Company Act of 1940, or become principally engaged in, or undertake as one of its important activities, the business of extending credit

for the purpose of purchasing or carrying margin stock, or use the proceeds of any Credit Extension for such purpose.

8. EVENTS

OF DEFAULT.

Any one or more of the following

events shall constitute an Event of Default by Borrower under this Agreement:

8.1 Payment

Default. If Borrower fails to pay any of the Obligations when due.

8.2 Covenant

Default.

(a) If

Borrower fails to perform any obligation under Sections 6.5 or 6.7 violates any of the covenants contained in Article 7 of this Agreement;

or

(b) If

Borrower fails or neglects to perform or observe any other material term, provision, condition, covenant contained in this Agreement,

in any of the Loan Documents, or in any other present or future agreement between Borrower and AAI and as to any default under such other

term, provision, condition or covenant that can be cured, has failed to cure such default within ten (10) Business Days after Borrower

receives notice thereof; provided, however, that if the default cannot by its nature be cured within such ten (10) Business Day period

or cannot after diligent attempts by Borrower be cured within such ten (10) Business Day period, and such default is likely to be cured

within a reasonable time, then Borrower shall have an additional reasonable period (which shall not in any case exceed thirty (30) days)

to attempt to cure such default, and within such reasonable time period the failure to have cured such default shall not be deemed an

Event of Default but no Credit Extensions will be made.

8.3 Material

Adverse Effect. If there occurs any Material Adverse Effect.

8.4 Attachment.

If any material portion of Borrower’s assets is attached, seized, subjected to a writ or distress warrant, or is levied upon, or

comes into the possession of any trustee, receiver or person acting in a similar capacity and such attachment, seizure, writ or distress

warrant or levy has not been removed, discharged or rescinded within ten (10) days, or if a Borrower is enjoined, restrained, or in any

way prevented by court order from continuing to conduct all or any material part of its business affairs, or if a judgment or other claim

becomes a lien or encumbrance upon any material portion of a Borrower’s assets, or if a notice of lien, levy, or assessment is filed

of record with respect to any of Borrower’s assets by the United States Government, or any department, agency, or instrumentality

thereof, or by any state, county, municipal, or governmental agency, and the same is not paid within ten (10) days after a Borrower receives

notice thereof, provided that none of the foregoing shall constitute an Event of Default where such action or event is stayed or an adequate

bond has been posted pending a good faith contest by a Borrower (provided that no Credit Extensions will be made during such cure period).

8.5 Insolvency.

If Borrower becomes insolvent, or if an Insolvency Proceeding is commenced by Borrower, or if an Insolvency Proceeding is commenced against

a Borrower and is not dismissed or stayed within thirty (30) days (provided that no Credit Extensions will be made prior to the dismissal

of such Insolvency Proceeding).

8.6 Judgments.

If a judgment or judgments (not covered by insurance) for the payment of money in an amount, individually or in the aggregate, of at least

One Hundred Thousand Dollars ($100,000) shall be rendered against Borrower and shall remain unsatisfied and unstayed for a period of thirty

(30) days (provided that no Credit Extensions will be made prior to the satisfaction or stay of such judgment).

8.7 Change

in Control. If a Change in Control occurs.

8.8 Misrepresentations.

If any material misrepresentation or material misstatement exists now or hereafter in any warranty or representation set forth herein

or in any certificate delivered to AAI by any Responsible Officer pursuant to this Agreement or to induce AAI to enter into this Agreement

or any other Loan Document.

9. AAI’S

RIGHTS AND REMEDIES.

9.1 Rights

and Remedies. Upon the occurrence and during the continuance of an Event of Default, AAI may, at its election, without notice of its

election and without demand, do any one or more of the following, all of which are authorized by Borrower:

(a) Declare

all Obligations, whether evidenced by this Agreement, by any of the other Loan Documents, or otherwise, immediately due and payable (provided

that upon the occurrence of an Event of Default described in Section 8.6, all Obligations shall become immediately due and payable without

any action by AAI);

(b) Cease

advancing money or extending credit to or for the benefit of Borrower under this Agreement or under any other agreement between Borrower

and AAI;

(c) Settle

or adjust disputes and claims directly with account debtors for amounts, upon terms and in whatever order that AAI reasonably considers

advisable;

(d) Make

such payments and do such acts as AAI considers necessary or reasonable to protect its security interest in the Collateral. Borrower agrees

to assemble the Collateral if AAI so requires, and to make the Collateral available to AAI as AAI may designate. Borrower authorizes AAI

to enter the premises where the Collateral is located, to take and maintain possession of the Collateral, or any part of it, and to pay,

purchase, contest, or compromise any encumbrance, charge, or lien which in AAI’s determination appears to be prior or superior to

its security interest and to pay all expenses incurred in connection therewith. With respect to any of Borrower’s owned premises,

Borrower hereby grants AAI a license to enter into possession of such premises and to occupy the same, without charge, in order to exercise

any of AAI’s rights or remedies provided herein, at law, in equity, or otherwise;

(e) Set

off and apply to the Obligations any and all (i) balances and deposits of Borrower held by AAI, and (ii) indebtedness at any time owing

to or for the credit or the account of Borrower held by AAI;

(f) Ship,

reclaim, recover, store, finish, maintain, repair, prepare for sale, advertise for sale, and sell (in the manner provided for herein)

the Collateral. AAI is hereby granted a license or other right, solely pursuant to the provisions of this Section 9.1, to use, without

charge, Borrower’s labels, patents, copyrights, rights of use of any name, trade secrets, trade names, trademarks, service marks,

and advertising matter, or any property of a similar nature, as it pertains to the Collateral, in completing production of, advertising

for sale, and selling any Collateral and, in connection with AAI’s exercise of its rights under this Section 9.1, Borrower’s

rights under all licenses and all franchise agreements shall inure to AAI’s benefit;

(g) Sell

the Collateral at either a public or private sale, or both, by way of one or more contracts or transactions, for cash or on terms, in

such manner and at such places (including Borrower’s premises) as AAI determines is commercially reasonable, and apply any proceeds

to the Obligations in whatever manner or order AAI deems appropriate. AAI may sell the Collateral without giving any warranties as to

the Collateral. AAI may specifically disclaim any warranties of title or the like. This procedure will not be considered adversely to

affect the commercial reasonableness of any sale of the Collateral. If AAI sells any of the Collateral upon credit, Borrower will be credited

only with payments actually made by the purchaser, received by AAI, and applied to the indebtedness of the purchaser. If the purchaser

fails to pay for the Collateral, AAI may resell the Collateral and Borrower shall be credited with the proceeds of the sale;

(h) AAI

may credit bid and purchase at any public sale;

(i) Apply

for the appointment of a receiver, trustee, liquidator or conservator of the Collateral, without notice and without regard to the adequacy

of the security for the Obligations and without regard to the solvency of Borrower, any guarantor or any other Person liable for any of

the Obligations; and

(j) Any

deficiency that exists after disposition of the Collateral as provided above will be paid immediately by Borrower.

AAI may comply with any applicable state or federal

law requirements in connection with a disposition of the Collateral and compliance will not be considered adversely to affect the commercial

reasonableness of any sale of the Collateral.

9.2 Power

of Attorney. Effective only upon the occurrence and during the continuance of an Event of Default, Borrower hereby irrevocably appoints

AAI (and any of AAI’s designated officers, or employees) as Borrower’s true and lawful attorney to: (a) send requests for

verification of Accounts or notify account debtors of AAI’s security interest in the Accounts; (b) endorse Borrower’s name

on any checks or other forms of payment or security that may come into AAI’s possession; (c) sign Borrower’s name on any invoice

or bill of lading relating to any Account, drafts against account debtors, schedules and assignments of Accounts, verifications of Accounts,

and notices to account debtors; (d) dispose of any Collateral; (e) make, settle, and adjust all claims under and decisions with respect

to Borrower’s policies of insurance; and (f) settle and adjust disputes and claims respecting the accounts directly with account

debtors, for amounts and upon terms which AAI determines to be reasonable. The appointment of AAI as Borrower’s attorney in fact,

and each and every one of AAI’s rights and powers, being coupled with an interest, is irrevocable until all of the Obligations (other

than inchoate indemnity obligations) have been fully repaid and performed and AAI’s obligation to provide Credit Extensions hereunder

is terminated.

9.3 Accounts

Collection. At any time after the occurrence and during the continuance of an Event of Default, AAI may notify any Person owing funds

to Borrower of AAI’s security interest in such funds and verify the amount of such Account. Borrower shall collect all amounts owing

to Borrower for AAI, receive in trust all payments as AAI’s trustee, and immediately deliver such payments to AAI in their original

form as received from the account debtor, with proper endorsements for deposit.

9.4 AAI

Expenses. If Borrower fail to pay any amounts or furnish any required proof of payment due to third persons or entities, as required

under the terms of this Agreement, then AAI may do any or all of the following after reasonable notice to Borrower: (a) make payment of

the same or any part thereof; (b) set up such reserves under the Revolving Line as AAI deems necessary to protect AAI from the exposure

created by such failure; or (c) obtain and maintain insurance policies of the type discussed in Section 6.5 of this Agreement, and take

any action with respect to such policies as AAI deems prudent. Any amounts so paid or deposited by AAI shall constitute AAI Expenses,

shall be immediately due and payable, and shall bear interest at the then applicable rate hereinabove provided, and shall be secured by

the Collateral. Any payments made by AAI shall not constitute an agreement by AAI to make similar payments in the future or a waiver by

AAI of any Event of Default under this Agreement.

9.5 AAI’s

Liability for Collateral. AAI has no obligation to clean up or otherwise prepare the Collateral for sale. All risk of loss, damage

or destruction of the Collateral shall be borne by Borrower.

9.6 No

Obligation to Pursue Others. AAI has no obligation to attempt to satisfy the Obligations by collecting them from any other Person

liable for them and AAI may release, modify or waive any collateral provided by any other Person to secure any of the Obligations, all

without affecting AAI’s rights against Borrower. Borrower waives any rights they may have to require AAI to pursue any other Person

for any of the Obligations.

9.7 Remedies

Cumulative. AAI’s rights and remedies under this Agreement, the Loan Documents, and all other agreements shall be cumulative.

AAI shall have all other rights and remedies not inconsistent herewith as provided under the Code, by law, or in equity. No exercise by

AAI of one right or remedy shall be deemed an election, and no waiver by AAI of any Event of Default on Borrower’s part shall be

deemed a continuing waiver. No delay by AAI shall constitute a waiver, election, or acquiescence by it. No waiver by AAI shall be effective

unless made in a written document signed on behalf of AAI and then shall be effective only in the specific instance and for the specific

purpose for which it was given. Borrower expressly agrees that this Section may not be waived or modified by AAI by course of performance,

conduct, estoppel or otherwise.

9.8 Demand;

Protest. Except as otherwise provided in this Agreement, Borrower waives demand, protest, notice of protest, notice of default or

dishonor, notice of payment and nonpayment and any other notices relating to the Obligations.

10. NOTICES.

Unless otherwise provided

in this Agreement, all notices or demands by any party relating to this Agreement or any other agreement entered into in connection herewith

shall be in writing and (except for financial statements and other informational documents which may be sent by first-class mail, postage

prepaid) shall be personally delivered or sent by a recognized overnight delivery service, certified mail, postage prepaid, return receipt

requested, or by email to Borrower or to AAI, as the case may be, at its addresses set forth below:

| If to Borrower: |

Imperalis Holding Corp. |

| |

1421 McCarthy Blvd. |

| |

Milpitas, CA 95035 |

| |

Attn: Amos Kohn |

| |

Email: |

| |

|

| If to AAI: |

11411 Southern Highlands Parkway, Suite 240 |

| |

Las Vegas, NV 89141 |

| |

Attn: William Horne |

| |

Email: |

The parties hereto may change

the address at which they are to receive notices hereunder, by notice in writing in the foregoing manner given to the other.

11. CHOICE

OF LAW AND VENUE; JURY TRIAL WAIVER.

This Agreement shall be governed

by, and construed in accordance with, the internal laws of the State of New York, without regard to principles of conflicts of law. Borrower

and AAI hereby submits to the exclusive jurisdiction of the state and Federal courts located in the County of New York, State of New York.

THE UNDERSIGNED ACKNOWLEDGE THAT THE RIGHT TO TRIAL BY JURY MAY BE WAIVED UNDER CERTAIN CIRCUMSTANCES. TO THE EXTENT PERMITTED BY LAW,

EACH PARTY, AFTER CONSULTING (OR HAVING HAD THE OPPORTUNITY TO CONSULT) WITH COUNSEL OF ITS, HIS OR HER CHOICE, KNOWINGLY AND VOLUNTARILY,

AND FOR THE MUTUAL BENEFIT OF ALL PARTIES, WAIVES ANY RIGHT TO TRIAL BY JURY IN THE EVENT OF LITIGATION ARISING OUT OF OR RELATED TO THIS

AGREEMENT OR ANY OTHER DOCUMENT, INSTRUMENT OR AGREEMENT BETWEEN THE UNDERSIGNED PARTIES.

12. GENERAL

PROVISIONS.

12.1 Successors

and Assigns. This Agreement shall bind and inure to the benefit of the respective successors and permitted assigns of each of the

parties and shall bind all Persons who become bound as a debtor to this Agreement; provided, however, that neither this Agreement nor

any rights hereunder may be assigned by Borrower without AAI’s prior written consent, which consent may be granted or withheld in

AAI’s sole discretion. AAI shall have the right without the consent of or notice to Borrower to sell, transfer, negotiate, or grant

participation in all or any part of, or any interest in, AAI’s obligations, rights and benefits hereunder.

12.2 Indemnification.

Borrower shall defend, indemnify and hold harmless AAI and its officers, employees, and agents against: (a) all obligations, demands,

claims, and liabilities claimed or asserted by any other party in connection with the transactions contemplated by this Agreement; and

(b) all losses or AAI Expenses in any way suffered, incurred, or paid by AAI, its officers, employees and agents as a result of or in

any way arising out of, following, or consequential to transactions between AAI and Borrower whether under this Agreement, or otherwise

(including without limitation reasonable attorneys’ fees and expenses), except for obligations, demands, claims, liabilities and

losses caused by AAI’s gross negligence or willful misconduct.

12.3 Time

of Essence. Time is of the essence for the performance of all obligations set forth in this Agreement.

12.4 Severability

of Provisions. Each provision of this Agreement shall be severable from every other provision of this Agreement for the purpose of

determining the legal enforceability of any specific provision.

12.5 Amendments

in Writing, Integration. All amendments to or terminations of this Agreement or the other Loan Documents must be in writing. All prior

agreements, understandings, representations, warranties, and negotiations between the parties hereto with respect to the subject matter

of this Agreement and the other Loan Documents, if any, are merged into this Agreement and the Loan Documents.

12.6 Counterparts.

This Agreement may be executed in any number of counterparts and by different parties on separate counterparts, each of which, when executed

and delivered, shall be deemed to be an original, and all of which, when taken together, shall constitute but one and the same Agreement.

12.7 Survival.

All covenants, representations and warranties made in this Agreement shall continue in full force and effect so long as any Obligations

(other than inchoate indemnity obligations) remain outstanding or AAI has any obligation to make any Credit Extension to Borrower. The

obligations of Borrower to indemnify AAI with respect to the expenses, damages, losses, costs and liabilities described in Section 12.2

shall survive until all applicable statute of limitations periods with respect to actions that may be brought against AAI have run.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused

this Agreement to be executed as of the date first written above.

| |

|

|

| |

AULT ALLIANCE, INC. |

| |

|

|

| |

|

|

| |

|

|

| |

By: |

|

| |

Name: |

| |

Title: |

| |

|

|

| |

|

|

| |

IMPERALIS HOLDING CORP. |

| |

|

|

| |

|

|

| |

|

|

| |

By: |

|

| |

Name: |

| |

Title: |

[Signature Page to Loan and Security Agreement]

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

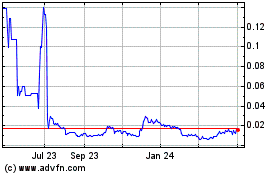

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

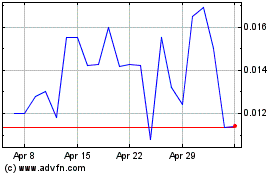

Imperalis (PK) (USOTC:IMHC)

Historical Stock Chart

From Apr 2023 to Apr 2024