0001279620

false

0001279620

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 14, 2023

| Zoned Properties, Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 000-51640 |

|

46-5198242 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

8360 E. Raintree Drive, #230

Scottsdale, AZ |

|

85260 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(Registrant’s telephone number, including

area code): (877) 360-8839

N/A

(Former name, former address and former fiscal

year, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2.)

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Regulation

FD Disclosure.

On August 14, 2023, Zoned

Properties, Inc. (the “Company”) issued a press release announcing its financial results for the three and six months ended

June 30, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information contained

in the website is not a part of this current report on Form 8-K.

Item 7.01. Regulation

FD Disclosure.

Beginning August 14,

2023, the Company’s management will deliver the investor presentation attached hereto as Exhibit 99.2 and incorporated herein by

reference.

The information included

in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K.

Item 9.01 Financial

Statement and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ZONED PROPERTIES, INC. |

| |

|

| Dated: August 14, 2023 |

/s/ Bryan McLaren |

| |

Bryan McLaren |

| |

Chief Executive Officer & Chief Financial Officer |

2

Exhibit 99.1

Zoned Properties Reports Strong Second Quarter

2023 Financial Results

Posting Positive Net Income and Revenue Growth of 55%

Strong Balance Sheet Allows for Continued Scaling

of Investment Portfolio

SCOTTSDALE, AZ., August 14, 2023 /AccessWire/

-- Zoned Properties®, Inc. (“Zoned Properties” or the “Company”) (OTCQB: ZDPY), a leading real estate development

firm for emerging and highly regulated industries, including legalized cannabis, today announced its second quarter financial results

and operational highlights. The following results pertain to the three months ended June 30, 2023.

Second Quarter Financial Highlights:

| ● | Revenues were $772,617 for the quarter ended June 30, 2023, compared to revenues of $498,652 for the quarter

ended June 30, 2022, representing an increase of 55%. |

| ● | The Company reported net income of $42,159 for the quarter ended June 30, 2023, as compared to a net loss

of $39,063 for the quarter ended June 30, 2022. |

| ● | Cash provided by operating activities was $140,195 for the quarter ended June 30, 2023, |

| ● | Operating expenses were $707,812 for the quarter ended June 30, 2023, compared to $507,856 for the quarter

ended June 30, 2022, representing an increase of 39%. |

| ● | The Company had cash on hand of $3.28 million as of June 30, 2023, compared to cash on hand of $3.25 million

as of March 31, 2023. |

Management Commentary:

“We are laser focused

on the continued growth of our property investment portfolio targeting direct-to-consumer real estate leased to best-in-class cannabis

retailers. Our team has been leveraging our property technology and national services network, which gives us a competitive edge to identify

great acquisition and investment opportunities. With a full pipeline of acquisition prospects, a robust balance sheet, and a strategic

capital allocation approach, we are incredibly enthusiastic about the growth opportunity for Zoned Properties. Given our line of sight

on the properties we are pursuing, we anticipate capital deployment to be active for the remainder of the year,” said Bryan McLaren,

Chief Executive Officer of Zoned Properties.

“Moreover, as we

look at our tangible book value, future growth prospects, and our current business in relation to our public valuation, we recognize the

significant disconnect. Our leadership team is exploring all possible strategies to drive shareholder value, and we look forward to keeping

shareholders apprised of our progress on a go-forward basis.”

Operational Highlights:

| ● | Zoned Properties has secured contractual rights for new real estate acquisition targets that have been

positioned for lease opportunities to best-in-class cannabis dispensary retailers in new and exciting state markets. The Company has properties

secured in escrow under either option or purchase agreements in Arizona, Alabama, Mississippi, and Missouri. |

| ● | The Company’s Property Investment Portfolio remains strong with 100% occupied assets net-leased to consumer-focused

and brand-centric cannabis tenants with a weighted average lease term of 15 years. |

| ● | Zoned Properties continues to build out its proprietary cannabis technology platform, REZONE, in preparation

for commercial launch. REZONE is a zoning and mapping software solution focusing on democratizing real estate information for the regulated

cannabis industry in partnership with Zoneomics. The platform is built on the foundations of Artificial Intelligence (“AI”)

and Machine Learning algorithms that can intelligently collect, rationalize and categorize vast streams of real estate data layers, with

a focus on cannabis-related data. This data is then provided to users in a business-ready format. The platform allows users to search

for parcels or survey entire markets and visualize the available green zone parcels, identify potential setback issues and gain other

valuable insights according to local zoning codes. The primary objective is to help users capture cannabis real estate insights with ease. |

About Zoned Properties, Inc. (OTCQB: ZDPY):

Zoned Properties is a leading real estate development

firm for emerging and highly regulated industries, including legalized cannabis. The Company is redefining the approach to commercial

real estate investment through its integrated growth services.

Headquartered in Scottsdale, Arizona, Zoned Properties

has developed a full spectrum of integrated growth services to support its real estate development model; the Company’s Property

Technology, Advisory Services, Commercial Brokerage, and Investment Portfolio divisions collectively cross-pollinate within the model

to drive project value associated with complex real estate projects. With national experience and a team of experts devoted to the emerging

cannabis industry, Zoned Properties is addressing the specific needs of a modern market in highly regulated industries.

Zoned Properties is an accredited member of the

Better Business Bureau, the U.S. Green Building Council, and the Forbes Business Council. Zoned Properties does not grow, harvest, sell

or distribute cannabis or any substances regulated under United States law such as the Controlled Substance Act of 1970, as amended (the

“CSA”). Zoned Properties corporate headquarters are located at 8360 E. Raintree Dr., Suite 230, Scottsdale, Arizona. For more

information, call 877-360-8839 or visit www.ZonedProperties.com.

Twitter: @ZonedProperties

LinkedIn: @ZonedProperties

Safe Harbor Statement

This press release contains forward-looking

statements. All statements other than statements of historical facts included in this press release are forward-looking statements. In

some cases, forward-looking statements can be identified by words such as “believe,” “expect,” “anticipate,”

“plan,” “potential,” “continue” or similar expressions. Such forward-looking statements include risks and

uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by

such forward-looking statements. These factors, risks and uncertainties are discussed in the Company’s filings with the Securities and

Exchange Commission. Investors should not place any undue reliance on forward-looking statements since they involve known and unknown,

uncertainties and other factors which are, in some cases, beyond the Company’s control which could, and likely will, materially affect

actual results, levels of activity, performance or achievements. Any forward-looking statement reflects the Company’s current views with

respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations,

growth strategy and liquidity. The Company assumes no obligation to publicly update or revise these forward-looking statements for any

reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even

if new information becomes available in the future.

Investor Relations

Zoned Properties, Inc.

Bryan McLaren

Tel (877) 360-8839

Investors@zonedproperties.com

www.zonedproperties.com

Exhibit 99.2

Corporate Presentation August 2023 OTCQB: ZDPY www. ZonedProperties .com

Safe Harbor Statement This presentation contains forward - looking statements . All statements other than statements of historical facts included in this press release are forward - looking statements . In some cases, forward - looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions . Such forward - looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements . These factors, risks and uncertainties are discussed in the Company's filings with the Securities and Exchange Commission . Investors should not place any undue reliance on forward - looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements . Any forward - looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity . The Company assumes no obligation to publicly update or revise these forward - looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward - looking statements, even if new information becomes available in the future . COVID - 19 Statement In March 2020 , the World Health Organization declared COVID - 19 a global pandemic and recommended containment and mitigation measures worldwide . The Company is monitoring this closely, and although operations have not been materially affected by the COVID - 19 outbreak to date, the ultimate duration and severity of the outbreak and its impact on the economic environment and our business is uncertain . Currently, all of the properties in the Company’s portfolio are open to its Significant Tenants and will remain open pursuant to state and local government requirements . The Company did not experience in 2020 or 2021 and does not foresee in 2022 , any material changes to its operations from COVID - 19 . The Company’s tenants are continuing to generate revenue at these properties, and they have continued to make rental payments in full and on time and we believe the tenants’ liquidity position is sufficient to cover its expected rental obligations . Accordingly, while the Company does not anticipate an impact on its operations, it cannot estimate the duration of the pandemic and potential impact on its business if the properties must close or if the tenants are otherwise unable or unwilling to make rental payments . In addition, a severe or prolonged economic downturn could result in a variety of risks to the Company’s business, including weakened demand for its properties and a decreased ability to raise additional capital when needed on acceptable terms, if at all . Forward Looking Statements 2

Table of Contents Revenue Divisions 3 Market Landscape Financial Performance Executive Management I. Company Overview II. III. IV. V. VI. Capital Structure VII. Investment Thesis

Company Overview

Company Philosophy Our Mission To provide a full - spectrum of Real Estate Services for the Regulated Cannabis Industry, positioning the Company for Real Estate Investments & Revenue Growth. Our Vision To Integrate Legacy Cannabis into Modern Communities through Real Estate Development Projects. Our Values Sophistication | Safety | Sustainability | Stewardship 5

Commercial Brokerage The Company’s fully licensed, in - house brokerage team is expanding nationally to service sale and lease transactions for the cannabis real estate market Site Identification Advisory The Company’s consulting division works nationally at identifying, developing, and delivering qualified cannabis commercial real estate opportunities A legacy company focused on regulated cannabis real estate, Zoned Properties, Inc . ( OTCQB : ZDPY ) offers a full - spectrum of commercial real estate services and a property investment portfolio focused on the legalized cannabis industry . Founded in 2014 , Zoned Properties has spent the last decade developing an intricate knowledge of the local, state, and regional zoning and permitting requirements that impact localities across the country, making Zoned Properties a hub for members of the cannabis and/or commercial real estate industries looking to buy, sell, or invest in the commercial cannabis real estate market . Property Technology (PropTech) The Company’s innovative, home - grown tech tool (REZONE) is the Company’s flagship PropTech project, visualizing complex zoning conditions in localities across the country Investment Portfolio Commercial real estate leased to licensed cannabis operators, currently consists of properties in Arizona & Michigan focused on growth towards direct - to - consumer real estate Company Overview 6

Zoned Properties has created an ecosystem of complimentary real estate services designed to facilitate new business, generate new acquisition opportunities, and strengthen the Company’s position as a hub within the cannabis industry. Property Technology Platform • Rezone software provides an unprecedented value to commercial real estate developers and contractors • Rezone’s software will cover all 50 states, enabling the team at Zoned to access a national client base without the expense of opening offices in every market • Rezone positioned to be monetized in 2023 Site Identification Advisory • Since launching in Q2 of 2019, the Company has identified hundreds of qualified cannabis sites across dozens of states, assisting 50+ clients • Zoned Properties' advisory services rely on a best - in - class management, further strengthened by the power of the Company’s PropTech - Stack • Since the launch in Q2 of 2021, the Company opened brokerage offices in 5 states and formed brokerage partnerships providing access to over a dozen states • Zoned Properties Brokerage has closed over $80MM worth of deals and has been engaged for sale and lease projects across 8 state markets Commercial Brokerage • Zoned’s portfolio of commercial cannabis real estate • Zoned Properties uses its full - service business model and national scale to attract and convert clients and partners to tenancy with some of the industry’s top, most reputable brand operators Investment Portfolio Scalable Business Model 7

Revenue Divisions

9 Total Pleasant Ridge, MI Kingman, AZ Green Valley, AZ Chino Valley, AZ Tempe, AZ Dispensary Dispensary Dispensary Cultivation Cultivation Current Use March 2037 April 2040 April 2040 April 2040 April 2040 Lease End Date 2,326,935 24,306 13,939 57,769 2,072,149 158,772 Land Area (SQF) 177,441 17,192 1,497 1,440 97,312 60,000 Rentable Building Area (SQF) $2,330,590 $579,567 $48,000 $42,000 $1,050,970 $610,053** Annual Base Rent Revenue* $13.13 $33.06 $32.06 $29.17 $10.80 $10.17** Annualized Base Rent (P/SQF)* $37,347,893 $8,145,849 $808,000 $707,000 $17,691,322 $9,995,400** Total Lifetime Rent Remaining The Company’s real estate services have been intentionally positioned and designed to feed a strong pipeline of acquisition targets to its Property Investment Portfolio, currently consisting of five properties in Arizona and Michigan expected to produce over $2.3mm of annual rental revenue in FY2023. Investment Portfolio Properties MI AZ Investment Portfolio *Figures are calculated as Straight - Line Accounting per GAAP, as of Q2 2023 **Includes Rent from an on - site Commercial Antenna Lease

*Figures are calculated as Straight - Line Accounting per GAAP, as of Q2 2023 10 Direct to Consumer (DTC) Real Estate Strategy Warehouse / Logistics Delivery Hubs Retail Dispensaries Investment Portfolio Metrics Portfolio Strategy & Metrics Lease Occupancy Rate 100% Leased Weighted Average Lease Term 15 Years Portfolio Value at 7.5% Cap Rate Annual Rental Revenue* $2.3 Million YoY Rental Revenue Growth* 45% Growth $31 Million

Project Highlights Development Project for future dispensary property located in Pleasant Ridge, Michigan. The Investment Property was acquired through multiple parcel transactions in December 2022 & February 2023 for $4.3 Million, including $1.85 Million in seller financing, which allowed Zoned Properties to further leverage its capital stack at attractive rates. The Investment Property is leased to NOXX Cannabis under a long - term, absolute - net lease agreement, which will produce an approximate 13.5% Cap Rate when straight - lined over the term of the lease agreement. The lease includes 3% annual increases in base rent over the life of the lease term, yielding approximately $580,000 in annual base rental revenue when straight - lined over the life of the lease term. NOXX Cannabis is a Michigan - based vertical cannabis company providing the best brands at the best prices, through innovation, quality, and inclusivity . Artist’s rendering (front) Artist’s rendering (rear) Recent Transaction Spotlight 11

• Zoned Properties has opened in - house brokerage offices in 5 state markets and is actively recruiting new Boots - on - the - Ground teams in new state markets to capture national opportunities • Additional regional partnerships can provide Zoned Properties Brokerage access to dozens of new state markets • Our competitive positioning is fortified by combining both third - party & in - house CRE property technology to continuously evolve Zoned’s proprietary tech - stack • We use our PropTech solutions to inform clients on unique acquisition & leasing opportunities as a result of changes in local zoning and permitting regulations Since 2021, Zoned Properties Brokerage has closed over $80 million of commercial real estate deals for clients. Property Technology National Footprint Marketing Capabilities • The Company has established relationships and partnerships with some of the leading online marketing and listing services for cannabis commercial real estate • Our Commercial Brokerage also has the capability to directly showcase cannabis properties throughout the Zoned Properties national network Commercial Brokerage 12

The Company’s Advisory team combines decades of commercial real estate experience with proprietary Property Technology that works to identify sites that can be specifically zoned , permitted , and developed for commercial cannabis uses. Site Identification & Advisory Services Site Identification Advisory Zoning & Permitting x Municipal zoning, regulatory, and permitting review x Custom GIS Mapping solutions x Complex project development Codes & Regulations x State and municipal regulatory development requirements x Variable regulatory monitoring x Client liaison with Design/AEC Strategy & Planning Our advisors focus on the unique details of each client project in order to: x Advise on strategy for project delivery success x Assess projects risks and development plans The Zoned Properties team has successfully guided hundreds of commercial cannabis projects across dozens of state markets . 13

Property Technology • Zoned Properties’ innovative home - grown tool, REZONE , visualizes decades of zoning and permit conditions in cities and townships across the country . • The volume, quality, and breadth of the cannabis real estate data included in REZONE is unparalleled, providing Zoned with unique competitive position within the cannabis industry . • The Company expects to begin monetizing the platform in 2023 . • Zoned Properties has invested $50,000 in AnamiTech, alongside the launch of their flagship PropTech platform, GreenSpace Pro , that has focused its property technology platform on project management tools and solutions for the cannabis operators, regulators, and project teams. • GreenSpace Pro platform utilized in over 100 locations across various state markets by major cannabis brands including Cookies, Embarc, and Stiiizy Real estate industry experts believe that Property Technology (PropTech) will become a significant driver of growth and scale in highly regulated real estate marketplaces, especially the legalized cannabis industry. 14

Market Landscape

$38.8B Current Industry Size (1) 35% Industry Growth (2020 - 2021) (1) 91% of Adults Support Legalization (2) 38 States with Cannabis Legalization 11,022 Dispensary Licenses as of January 2023 (3) 16% of All US Adults Smoke Marijuana (4) 11.8% Projected Industry CAGR (5) 40,000 US Localities that Govern Cannabis Regulations Bullish Industry Environment (1) MJBizDaily 16 (2) Pew Research Center (3) Cannabiz Media (4) Gallup (5) IBIS

The Cannabis industry has seen unprecedented geographic growth within the last 15 years . As of May 2023 , 38 states and the District of Columbia have approved the legalization and regulation of cannabis programs at the state level ; either medicinally, recreationally, or in a limited capacity (i . e . , CBD with THC) . Geographic Industry Expansion Proj. 2030 2023 2015 2010 40 37 23 11 State Adoption (1) >15,000 11,022 (5) 954 (4) <500 Dispensaries $57.0 Billion (6) $38.8 Billion (3) $3.1 Billion (3) n/a Annual Industry Sales 93% 91% 53% 32% Public Approval (2) (1) DISA 17 (2) Pew Research Center (3) MJ Biz Daily (4) CNBC (5) Cannabis Media (6) Forbes

Financial P e r f or m a n c e

$299,824 $550,064 $498,652 $772,617 - $25,893 $119,373 $151,226 $140,195 ($100,000) $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 $900,000 Q2 2020 Q2 2021 Q2 2022 Q2 2023 Total Revenue Cash Flow from Operations Quarterly Performance (Q2 2023) Total Revenue & Cash Flow from Operations Financial Highlights 35% increase in Property Investment Portfolio revenue (YoY) 163% increase in Real Estate Services revenue (YoY) 55% increase in Total Revenue (YoY) Net Profit of approximately $42k versus a net loss of ($39k) in the previous corresponding period Approximately $140k in Cash Flow from Operations (YoY) Operational Highlights Zoned Properties has secured contractual rights for new real estate acquisition targets that have been positioned for lease opportunities to best - in - class cannabis dispensary retailers. The Company currently has properties secured in escrow under either option or purchase agreements in Arizona, Alabama, Mississippi, and Missouri. 19

$603,693 $895,909 $1,437,353 $1,460,461 $72,732 $284,408 $270,968 $143,784 $0 $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 Q2 2020 Q2 2021 Total Revenue Q2 2022 Cash Flow from Operations Q2 2023 YTD Performance (Q2 2023) Total Revenue & Cash Flow from Operations Financial Highlights 45% increase in Property Investment Portfolio revenue (YoY) 60% reduction in Real Estate Services revenue (YoY) 2% increase in Total Revenue (YoY) Net Loss of approximately ($267k) versus ($65k) in the prior corresponding period $3.28MM net Cash on Hand Continued Positive Cash Flow from Operations Operational Highlights The Company has made significant progress expanding the capabilities of REZONE, its AI - backed Property Technology platform in 2023. The platform is designed to intelligently collect, rationalize and categorize vast streams of real estate data layers, with a focus on cannabis - related data 20

$1,260,421 $1,215,262 $1,820,485 $2,660,090 $284,914 $170,040 $489,257 $871,901 $0 $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 2019 2020 2021 Cash Flow from Operations 2022 Total Revenue Annual Performance (FY2022) Total Revenue & Cash Flow from Operations Financial Highlights 42.4% increase in Property Investment Portfolio revenue segment (YoY) 46.1% increase in Total Revenue (YoY) 54.5% increase in Real Estate Services revenue segment (YoY) 78.2% increase in Cash Flow from Operations (YoY) Operational Highlights Opened access to Capital Sources for prospective Property Acquisitions & Revenue Growth Diversified Property Investment Portfolio, increasing Annual Rental Revenue to >$2.3 Million Focused on Talent Acquisition to support growing team and national operations expansion 21

Executive Management

Executive Management Bryan McLaren, MBA | Chairman of the Board & Chief Executive Officer Mr . McLaren has a strong professional background in the social, economic, and environmental development of complex business organizations . Over his professional career, he has successfully implemented large - scale projects for corporate and community organizations . Mr . McLaren has been certified as a Licensed REALTOR, Green Roof Professional, LEED Green Associate, and is an active Forbes Contributor as part of the Forbes Real Estate Council . Prior to his role at Zoned Properties, McLaren worked as a Sustainability Consultant for Waste Management where he led the strategic development and operational implementation of zero - waste programs for Higher Education clients . Sustainable development has been a life - long passion for McLaren, who strives to create a global impact by forging a strong foundation for principles of sustainability in emerging industries . Berekk Blackwell | President & Chief Operating Officer Mr . Blackwell has served as our Chief Operating Officer since July 1 , 2021 , and as our President since July 1 , 2022 . Prior to his appointment to these positions and since September 2020 , Mr . Blackwell served as our Director of Business Development . From December 2018 until June 2021 , Mr . Blackwell also served as President of Daily Jam Holdings LLC . From January 2016 to December 2018 , he served as Vice President of Due North Holdings LLC . Prior to joining the Company, Mr . Blackwell developed domestic and international markets for Kahala Brands, a global franchise organization with more than 3 , 000 retail locations in over a dozen countries . He also led emerging brand and portfolio operations for several private equity groups investing in the restaurant franchise space . Mr . Blackwell earned his B . A . in Finance from Fort Lewis College . Daniel Gauthier, JD | Chief Legal Officer & Chief Compliance Officer Mr . Gauthier has served as our Chief Legal Officer, Chief Compliance Officer, and Corporate Secretary since July 1 , 2022 . Mr . Gauthier has an extensive background in a range of real estate transactions, including acquisition, development, financing, leasing, and syndication, and business transactions, including mergers and acquisitions, joint ventures, corporate governance, general counsel and regulated cannabis . Prior to joining the Company, Mr . Gauthier’s private practice included representation of a broad range of real estate developers, private and public homebuilders, businesses of all sizes, banks and lending institutions, and more . Gauthier holds a Juris Doctor degree from the Sandra Day O’Connor College of Law, Arizona State University, where he was a Pedrick Scholar and an articles editor of Jurimetrics : The Journal of Law, Science, and Technology . 23

Capital Structure

25 Capital Structure Common Shares Outstanding* Cash on Hand* 12.2MM $3.3MM Market Capitalization*** $7.8MM Total Full Year Cash Flow from Operations** $871.9K Total Inside Beneficial Ownership** 22% Zoned Properties (OTCQB: ZDPY) Capital Markets Profile * Figures as of June 30, 2023 ** Figures as of December 31, 2022 *** Market Capitalization calculated as of August 7, 2023

Investment Thesis

Property Investment Portfolio Generating >$2.3 Million Passive Rental Revenue (Annually) Focused on Direct - to - Consumer commercial real estate investments within the regulated cannabis industry Scalable Growth Model with 8 Years of Publicly Audited Company Financials & Reporting Tight capital structure & operating cash - flow, number of shares outstanding has remained the same since 2018 at 12,201,548 Non - Plant Touching Company in the High Growth Emerging Cannabis Industry The commercial cannabis industry topped $38 billion in 2022, with analysts expecting the industry to reach $57 billion by 2030 Competitive Positioning with Access to Unique Pipeline of New Property Acquisitions Zoned Properties has developed an integrated business model that fuels a strong pipeline for property investments. Increasing Ability to Access Capital with Strong Reputation Newly established Banking Relationships & Capital Broker Partnerships. In 2022, Secured $4.5mm debt facility @ 7.65%. Investment Thesis 27

Company Contact Information Bryan McLaren Chairman, CEO, & CFO Zoned Properties, Inc. | Scottsdale, AZ www.ZonedProperties.com Tel 480.351.8193 | Investors@ZonedProperties.com 28

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

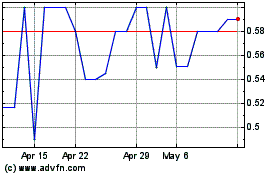

Zoned Properties (QB) (USOTC:ZDPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zoned Properties (QB) (USOTC:ZDPY)

Historical Stock Chart

From Apr 2023 to Apr 2024