0001892480false--12-31Q220230.0010.00150000000100000000.00120000000002343650502834372800000.049900018924802023-01-012023-06-300001892480hpco:PurchaseAgreementMemberhpco:GreenStarLabsMemberus-gaap:SubsequentEventMembersrt:MaximumMember2023-07-012023-07-100001892480hpco:PurchaseAgreementMemberhpco:GreenStarLabsMemberus-gaap:SubsequentEventMembersrt:MinimumMember2023-07-012023-07-100001892480hpco:PurchaseAgreementMemberhpco:GreenStarLabsMemberus-gaap:SubsequentEventMember2023-07-012023-07-100001892480hpco:PurchaseAgreementMemberhpco:GreenStarLabsMemberus-gaap:SubsequentEventMember2023-07-100001892480hpco:FMWMediaWorksLLCMember2022-10-012022-10-120001892480hpco:NorthEquitiesCorpMember2022-09-012022-09-170001892480hpco:BousteadSecuritiesLLCMember2022-09-012022-09-0600018924802022-01-012022-12-3100018924802022-07-1500018924802022-07-012022-07-150001892480hpco:HempaccoSharesMember2022-04-012022-04-070001892480hpco:SeptemberOneTwoZeroTwentyTwoMemberhpco:BousteadSecuritiesLLCMember2023-01-012023-06-300001892480hpco:BousteadSecuritiesLLCMember2022-09-060001892480hpco:SeptemberOneTwoZeroTwentyTwoMemberhpco:BousteadSecuritiesLLCMember2023-06-300001892480hpco:HempaccoSharesMember2022-04-070001892480hpco:USTMexicoIncMember2022-01-012022-06-300001892480hpco:USTMexicoIncMember2022-04-012022-06-300001892480hpco:USTMexicoIncMember2023-04-012023-06-300001892480hpco:USTMexicoIncMember2023-01-012023-06-300001892480hpco:GreenStarLabsMember2022-12-310001892480hpco:GreenStarLabsMember2023-04-012023-06-300001892480hpco:GreenGlobeInternationalIncMember2023-04-012023-06-300001892480hpco:GreenStarLabsMember2023-06-010001892480hpco:GreenStarLabsMember2023-01-012023-06-300001892480hpco:AlfalfaHoldingsLLCMember2023-06-300001892480hpco:HempaccoPaperCompanyMember2023-06-300001892480hpco:GreenStarLabsMember2023-06-300001892480hpco:GreenGlobeInternationalIncMember2023-06-300001892480hpco:GreenGlobeInternationalIncMember2023-01-012023-06-300001892480hpco:USTMexicoIncMember2022-12-310001892480hpco:USTMexicoIncMember2023-06-300001892480hpco:PrimusLogisticsMember2022-12-310001892480hpco:PrimusLogisticsMember2022-01-012022-06-300001892480hpco:PrimusLogisticsMember2023-01-012023-06-300001892480hpco:PrimusLogisticsMember2023-06-300001892480hpco:CMOMember2023-01-012023-06-300001892480hpco:CEOMember2022-01-012022-06-300001892480hpco:CEOMember2023-01-012023-06-3000018924802021-07-012021-07-310001892480hpco:ThirdPartyLoanAgreementMember2022-12-310001892480hpco:ThirdPartyLoanAgreementMember2023-06-300001892480hpco:ThirdPartyLoanAgreementMember2021-01-012021-01-150001892480hpco:ThirdPartyLoanAgreementMember2020-06-012020-06-150001892480hpco:GGIIWarrantsMember2021-08-012021-08-110001892480hpco:CompensationWarrantsMember2023-01-012023-06-300001892480hpco:CompensationWarrantsMember2023-01-012023-01-250001892480hpco:CompensationWarrantsMember2023-01-250001892480srt:MaximumMemberhpco:WarrantsMember2023-01-012023-06-300001892480srt:MinimumMemberhpco:WarrantsMember2023-01-012023-06-300001892480srt:MaximumMemberhpco:WarrantsMember2022-01-012022-12-310001892480srt:MinimumMemberhpco:WarrantsMember2022-01-012022-12-310001892480srt:MaximumMemberhpco:WarrantsMember2022-12-310001892480srt:MinimumMemberhpco:WarrantsMember2022-12-310001892480srt:MaximumMemberhpco:WarrantsMember2023-06-300001892480srt:MinimumMemberhpco:WarrantsMember2023-06-300001892480hpco:WarrantsMember2022-01-012022-12-310001892480hpco:WarrantsMember2023-01-012023-06-300001892480hpco:TalentDesigneeWarrantsMember2023-06-300001892480hpco:TalentWarrantsMember2023-06-300001892480hpco:CompensationWarrantsMember2023-06-300001892480hpco:RepresentativesWarrantsMember2023-06-300001892480hpco:ConvertiblePromissoryNotesMember2022-06-012022-06-070001892480hpco:ConvertiblePromissoryNotesMember2023-06-300001892480hpco:ConvertiblePromissoryNotesMember2022-03-1800018924802023-08-010001892480hpco:ConvertiblePromissoryNotesMember2023-01-012023-06-3000018924802021-05-012021-06-210001892480hpco:ConvertiblePromissoryNotesMember2022-03-012022-03-180001892480srt:MaximumMember2023-01-012023-06-300001892480srt:MinimumMember2023-01-012023-06-300001892480hpco:ErnieSparksMember2023-06-300001892480hpco:MiguelCamberoMember2023-06-300001892480hpco:ConvertiblePromissoryNotesMember2021-05-012021-06-210001892480us-gaap:ShortTermDebtMember2022-09-012022-09-060001892480us-gaap:ShortTermDebtMember2022-09-060001892480us-gaap:ShortTermDebtMember2023-06-300001892480us-gaap:ShortTermDebtMember2022-12-310001892480us-gaap:ShortTermDebtMember2022-01-012022-01-060001892480us-gaap:ShortTermDebtMember2019-12-012019-12-110001892480us-gaap:ShortTermDebtMember2019-12-110001892480hpco:OperatingLeaseMember2022-01-012022-06-300001892480hpco:OperatingLeaseMember2022-04-012022-06-300001892480hpco:OperatingLeaseMember2023-04-012023-06-300001892480hpco:OperatingLeaseMember2022-12-310001892480hpco:OperatingLeaseMember2023-06-300001892480hpco:OperatingLeaseMember2023-01-012023-06-300001892480hpco:KiosksPlusImprovementsMember2022-12-310001892480hpco:KiosksPlusImprovementsMember2023-06-300001892480us-gaap:LeaseholdImprovementsMember2022-12-310001892480us-gaap:LeaseholdImprovementsMember2023-06-300001892480hpco:ProductionEquipmentMember2022-12-310001892480hpco:ProductionEquipmentMember2023-06-300001892480hpco:CustomerMember2023-04-012023-06-300001892480hpco:CustomerTwoMember2023-04-012023-06-300001892480hpco:CustomersOneMember2023-04-012023-06-300001892480hpco:CustomerMember2022-04-012022-06-300001892480hpco:CustomerTwoMember2023-01-012023-06-300001892480hpco:CustomerMember2023-01-012023-06-300001892480hpco:CustomerMember2022-06-300001892480hpco:CustomerMember2023-06-300001892480hpco:CustomerMember2022-01-012022-06-300001892480us-gaap:ConvertibleNotesPayableMember2022-01-012022-06-300001892480us-gaap:ConvertibleNotesPayableMember2023-01-012023-06-300001892480hpco:GoingConcernMattersMember2023-04-012023-06-300001892480hpco:GoingConcernMattersMember2023-01-012023-06-300001892480hpco:GoingConcernMattersMember2023-06-300001892480hpco:AlfalfaMember2023-01-012023-06-300001892480hpco:HVIAndWeedsiesMember2023-01-012023-06-300001892480hpco:CuratedNutraLLCMember2023-05-012023-05-030001892480hpco:UnderwritersMember2023-02-012023-02-140001892480hpco:UnderwritersMember2023-02-140001892480hpco:UnderwritersMember2023-01-012023-06-300001892480hpco:UnderwritersMember2023-02-090001892480us-gaap:CorporateJointVentureMember2023-05-012023-05-0700018924802023-03-012023-03-3100018924802023-02-012023-02-080001892480us-gaap:NoncontrollingInterestMember2023-04-012023-06-300001892480us-gaap:RetainedEarningsMember2023-04-012023-06-300001892480us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001892480us-gaap:CommonStockMember2023-04-012023-06-3000018924802023-03-310001892480us-gaap:NoncontrollingInterestMember2023-03-310001892480us-gaap:RetainedEarningsMember2023-03-310001892480us-gaap:AdditionalPaidInCapitalMember2023-03-310001892480us-gaap:CommonStockMember2023-03-310001892480us-gaap:NoncontrollingInterestMember2023-06-300001892480us-gaap:RetainedEarningsMember2023-06-300001892480us-gaap:AdditionalPaidInCapitalMember2023-06-300001892480us-gaap:CommonStockMember2023-06-300001892480us-gaap:NoncontrollingInterestMember2023-01-012023-06-300001892480us-gaap:RetainedEarningsMember2023-01-012023-06-300001892480us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001892480us-gaap:CommonStockMember2023-01-012023-06-300001892480us-gaap:NoncontrollingInterestMember2022-12-310001892480us-gaap:RetainedEarningsMember2022-12-310001892480us-gaap:AdditionalPaidInCapitalMember2022-12-310001892480us-gaap:CommonStockMember2022-12-310001892480us-gaap:NoncontrollingInterestMember2022-04-012022-06-300001892480us-gaap:RetainedEarningsMember2022-04-012022-06-300001892480us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001892480us-gaap:CommonStockMember2022-04-012022-06-3000018924802022-03-310001892480us-gaap:NoncontrollingInterestMember2022-03-310001892480us-gaap:RetainedEarningsMember2022-03-310001892480us-gaap:AdditionalPaidInCapitalMember2022-03-310001892480us-gaap:CommonStockMember2022-03-3100018924802022-06-300001892480us-gaap:NoncontrollingInterestMember2022-06-300001892480us-gaap:RetainedEarningsMember2022-06-300001892480us-gaap:AdditionalPaidInCapitalMember2022-06-300001892480us-gaap:CommonStockMember2022-06-300001892480us-gaap:NoncontrollingInterestMember2022-01-012022-06-300001892480us-gaap:RetainedEarningsMember2022-01-012022-06-300001892480us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001892480us-gaap:CommonStockMember2022-01-012022-06-3000018924802021-12-310001892480us-gaap:NoncontrollingInterestMember2021-12-310001892480us-gaap:RetainedEarningsMember2021-12-310001892480us-gaap:AdditionalPaidInCapitalMember2021-12-310001892480us-gaap:CommonStockMember2021-12-3100018924802022-01-012022-06-3000018924802022-04-012022-06-3000018924802023-04-012023-06-300001892480us-gaap:SeriesAPreferredStockMember2022-12-310001892480us-gaap:SeriesAPreferredStockMember2023-06-3000018924802022-12-3100018924802023-06-3000018924802023-08-11iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesutr:sqftxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal quarter ended June 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission File Number: 001-41487

HEMPACCO CO., INC. |

(Exact name of Registrant as specified in its charter) |

Nevada | | 83-4231457 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

9925 Airway Road, San Diego, CA 92154

(Address of Principal Executive Office and Zip Code)

(619) 779-0715

(Registrant’s Telephone Number, including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share | | HPCO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act. Yes ☐ No ☒

The number of shares of the registrant’s common stock outstanding as of August 11, 2023, was 28,343,728.

HEMPACCO CO., INC.

2023 QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

HEMPACCO CO., INC.

Condensed Consolidated Balance Sheets

(Unaudited)

As of | | June 30, 2023 | | | December 31, 2022 | |

| | | | | | |

ASSETS | | | | | | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 1,386,111 | | | $ | 548,331 | |

Accounts receivable | | | 230,171 | | | | 231,269 | |

Accounts receivable, related parties | | | - | | | | 5,100 | |

Loans receivable, related parties | | | 263,182 | | | | - | |

Inventory | | | 1,181,531 | | | | 645,132 | |

Prepaid expenses and other current assets | | | 405,894 | | | | 442,366 | |

Prepaid expenses, related parties | | | 957,871 | | | | 35,609 | |

Total Current Assets | | | 4,424,760 | | | | 1,907,807 | |

| | | | | | | | |

Property and equipment | | | 7,307,564 | | | | 7,220,565 | |

Right of use asset, related party | | | 297,235 | | | | 351,146 | |

Other intangible assets, net of amortization | | | - | | | | 2,661 | |

Other assets | | | 568,357 | | | | - | |

| | | | | | | | |

TOTAL ASSETS | | $ | 12,597,916 | | | $ | 9,482,179 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Liabilities | | | | | | | | |

Current Liabilities | | | | | | | | |

Accounts payable | | $ | 342,545 | | | $ | 335,605 | |

Accounts payable, related parties | | | 30,169 | | | | 42,831 | |

Accrued liabilities | | | 64,015 | | | | - | |

Customer prepaid invoices and deposits | | | 861,314 | | | | 838,164 | |

Line of credit | | | 100,000 | | | | - | |

Notes payable, related parties | | | 50,000 | | | | 69,282 | |

Convertible promissory notes payable | | | 100,000 | | | | 125,000 | |

Other short term loans | | | 138,252 | | | | - | |

Right of use liability, related party – current | | | 113,091 | | | | 109,552 | |

Total Current Liabilities | | | 1,799,386 | | | | 1,520,434 | |

| | | | | | | | |

Long Term Liabilities | | | | | | | | |

Long-term debt | | | - | | | | 142,770 | |

Right of use liability, related party | | | 200,450 | | | | 258,776 | |

Total Liabilities | | | 1,999,836 | | | | 1,921,980 | |

| | | | | | | | |

Stockholders’ Equity | | | | | | | | |

Preferred stock, $0.001 par value as of June 30, 2023 and December 31, 2022; 50,000,000 shares authorized as of June 30, 2023 and December 31, 2022, respectively. | | | - | | | | - | |

Series A Preferred Stock, $0.001 par value as of June 30, 2023 and December 31, 2022, respectively; 10,000,000 Shares authorized as of June 30, 2023 and December 31, 2022, respectively. 0 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively. | | | - | | | | - | |

Common stock, $0.001 par value as of June 30, 2023 and December 31, 2022, respectively; 200,000,000 shares authorized as of June 30, 2023 and December 31, 2022, respectively. 28,343,728 and 23,436,505 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively. | | | 28,343 | | | | 23,436 | |

Additional paid-in capital | | | 25,118,062 | | | | 18,095,184 | |

Accumulated deficit | | | (14,405,058 | ) | | | (10,463,048 | ) |

Total Stockholders’ Equity | | | 10,741,347 | | | | 7,655,572 | |

Non-controlling interests | | | (143,267 | ) | | | (95,373 | ) |

Total Equity Attributable to Hempacco Co., Inc. | | | 10,598,080 | | | | 7,560,199 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | $ | 12,597,916 | | | $ | 9,482,179 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

HEMPACCO CO., INC.

Condensed Consolidated Statements of Operations

(Unaudited)

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Revenues | | | | | | | | | | | | |

Product sales | | $ | 223,188 | | | $ | 1,853,996 | | | $ | 618,187 | | | $ | 2,811,562 | |

Product sales, related parties | | | 13,760 | | | | 5,000 | | | | 20,319 | | | | 6,000 | |

Manufacturing service revenue | | | 1,386 | | | | 13,995 | | | | 13,438 | | | | 26,595 | |

Kiosk revenue | | | 16,267 | | | | 2,066 | | | | 17,017 | | | | 2,066 | |

Total Revenues | | | 254,601 | | | | 1,875,057 | | | | 678,961 | | | | 2,846,223 | |

| | | | | | | | | | | | | | | | |

Cost of Sales | | | | | | | | | | | | | | | | |

Cost of sales | | | 417,632 | | | | 1,398,028 | | | | 877,891 | | | | 2,197,034 | |

Cost of sales, related parties | | | 14,423 | | | | - | | | | 75,885 | | | | - | |

Total Cost of Sales | | | 432,055 | | | | 1,398,028 | | | | 953,776 | | | | 2,197,034 | |

Gross Profit (Loss) from Operations | | | (177,454 | ) | | | 477,029 | | | | (274,815 | ) | | | 649,189 | |

| | | | | | | | | | | | | | | | |

Operating Expenses | | | | | | | | | | | | | | | | |

General and administrative | | | 947,461 | | | | 235,924 | | | | 1,684,636 | | | | 966,999 | |

General and administrative, related parties | | | 53,414 | | | | 45,000 | | | | 268,697 | | | | 150,000 | |

Sales and marketing | | | 229,759 | | | | 287,866 | | | | 409,588 | | | | 484,110 | |

Sales and marketing, related parties | | | 27,491 | | | | - | | | | 50,087 | | | | - | |

Expensing of related party advances and loans | | | 195,775 | | | | - | | | | 1,320,775 | | | | - | |

Total Operating Expenses | | | 1,453,900 | | | | 568,790 | | | | 3,733,783 | | | | 1,601,109 | |

| | | | | | | | | | | | | | | | |

Net Operating Loss | | | (1,631,354 | ) | | | (91,761 | ) | | | (4,008,598 | ) | | | (951,920 | ) |

| | | | | | | | | | | | | | | | |

Other Income (Expense) | | | | | | | | | | | | | | | | |

Interest expense, net | | | 20,034 | | | | (5,799 | ) | | | 18,746 | | | | (9,396 | ) |

Other income & expense | | | - | | | | 210 | | | | (52 | ) | | | (13,250 | ) |

Total Other Income (Expense) | | | 20,034 | | | | (5,589 | ) | | | 18,694 | | | | (22,646 | ) |

| | | | | | | | | | | | | | | | |

Net Loss | | $ | (1,611,320 | ) | | $ | (97,350 | ) | | $ | (3,989,904 | ) | | $ | (974,566 | ) |

| | | | | | | | | | | | | | | | |

Net Loss Attributable to Non-Controlling Interests | | | 34,911 | | | | 1,350 | | | | 47,894 | | | | 1,583 | |

Net Loss Attributable to Hempacco Co., Inc. | | | (1,576,409 | ) | | | (96,000 | ) | | | (3,942,010 | ) | | | (972,983 | ) |

| | | | | | | | | | | | | | | | |

Basic and Dilutive Earnings per Share | | $ | (0.06 | ) | | $ | (0.00 | ) | | $ | (0.15 | ) | | $ | (0.05 | ) |

| | | | | | | | | | | | | | | | |

Shares Used in Calculating Earnings per Share | | | 28,312,275 | | | | 19,899,969 | | | | 27,093,163 | | | | 19,798,315 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

HEMPACCO CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

| | For the Three Months Ended June 30, 2023 | |

| | | | | Additional | | | | | | Non- | | | | |

| | Common Stock | | | Paid-In | | | Accumulated | | | controlling | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Interests | | | Total | |

Balance as of March 31, 2023 | | | 28,281,505 | | | $ | 28,281 | | | $ | 25,088,092 | | | $ | (12,828,649 | ) | | $ | (108,356 | ) | | $ | 12,179,368 | |

Common stock issued for convertible note | | | 62,223 | | | | 62 | | | | 28,970 | | | | - | | | | - | | | | 29,032 | |

Capital contribution related to joint venture | | | - | | | | - | | | | 1,000 | | | | - | | | | - | | | | 1,000 | |

Net loss attributable to non-controlling interests | | | - | | | | - | | | | - | | | | 34,911 | | | | (34,911 | ) | | | - | |

Net loss for the three months ended June 30, 2023 | | | - | | | | - | | | | - | | | | (1,611,320 | ) | | | - | | | | (1,611,320 | ) |

Balance as of June 30, 2023 | | | 28,343,728 | | | $ | 28,343 | | | $ | 25,118,062 | | | $ | (14,405,058 | ) | | $ | (143,267 | ) | | $ | 10,598,080 | |

| | For the Six Months Ended June 30, 2023 | |

| | | | | Additional | | | | | | Non- | | | | |

| | Common Stock | | | Paid-In | | | Accumulated | | | controlling | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Interests | | | Total | |

Balance as of December 31, 2022 | | | 23,436,505 | | | $ | 23,436 | | | $ | 18,095,184 | | | $ | (10,463,048 | ) | | $ | (95,373 | ) | | $ | 7,560,199 | |

Issuance of common stock | | | 4,830,000 | | | | 4,830 | | | | 7,240,170 | | | | - | | | | - | | | | 7,245,000 | |

Offering costs | | | - | | | | - | | | | (634,600 | ) | | | - | | | | - | | | | (634,600 | ) |

Shares issued for consulting services | | | 15,000 | | | | 15 | | | | 12,885 | | | | - | | | | - | | | | 12,900 | |

Capitalized value of warrants | | | - | | | | - | | | | 374,453 | | | | - | | | | - | | | | 374,453 | |

Common stock issued for convertible note | | | 62,223 | | | | 62 | | | | 28,970 | | | | - | | | | - | | | | 29,032 | |

Capital contribution related to joint venture | | | | | | | | | | | 1,000 | | | | | | | | | | | | 1,000 | |

Net loss attributable to non-controlling interests | | | - | | | | - | | | | - | | | | 47,894 | | | | (47,894 | ) | | | - | |

Net loss for the six months ended June 30, 2023 | | | - | | | | - | | | | - | | | | (3,989,904 | ) | | | - | | | | (3,989,904 | ) |

Balance as of June 30, 2023 | | | 28,343,728 | | | $ | 28,343 | | | $ | 25,118,062 | | | $ | (14,405,058 | ) | | $ | (143,267 | ) | | $ | 10,598,080 | |

| | For the Three Months Ended June 30, 2022 | |

| | | | | Additional | | | | | | Non- | | | | |

| | Common Stock | | | Paid-In | | | Accumulated | | | controlling | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Interests | | | Total | |

Balance as of March 31, 2022 | | | 19,695,532 | | | $ | 19,696 | | | $ | 6,742,803 | | | $ | (4,336,197 | ) | | $ | (14,483 | ) | | $ | 2,411,819 | |

Issuance of common stock | | | 208,000 | | | | 208 | | | | 415,792 | | | | - | | | | - | | | | 416,000 | |

Offering costs | | | - | | | | - | | | | (60,525 | ) | | | - | | | | - | | | | (60,525 | ) |

Common stock issued for convertible note | | | 56,592 | | | | 56 | | | | 56,535 | | | | - | | | | - | | | | 56,591 | |

Net loss attributable to non-controlling interests | | | - | | | | - | | | | - | | | | 1,350 | | | | (1,350 | ) | | | - | |

Net loss for the three months ended June 30, 2022 | | | - | | | | - | | | | - | | | | (97,350 | ) | | | - | | | | (97,350 | ) |

Balance as of June 30, 2022 | | | 19,960,124 | | | $ | 19,960 | | | $ | 7,154,605 | | | $ | (4,432,197 | ) | | $ | (15,833 | ) | | $ | 2,726,535 | |

| | For the Six Months Ended June 30, 2022 | |

| | | | | Additional | | | | | | Non- | | | | |

| | Common Stock | | | Paid-In | | | Accumulated | | | controlling | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Interests | | | Total | |

Balance as of December 31, 2021 | | | 19,695,532 | | | $ | 19,696 | | | $ | 6,321,428 | | | $ | (3,459,214 | ) | | $ | (14,250 | ) | | $ | 2,867,660 | |

Warrant valuation expense | | | - | | | | - | | | | 437,375 | | | | - | | | | - | | | | 437,375 | |

Issuance of common stock | | | 208,000 | | | | 208 | | | | 415,792 | | | | - | | | | - | | | | 416,000 | |

Offering costs paid in connection with sale of common stock | | | - | | | | - | | | | (76,525 | ) | | | - | | | | - | | | | (76,525 | ) |

Common stock issued for convertible note | | | 56,592 | | | | 56 | | | | 56,535 | | | | - | | | | - | | | | 56,591 | |

Net loss attributable to non-controlling interests | | | - | | | | - | | | | - | | | | 1,583 | | | | (1,583 | ) | | | - | |

Net loss for the six months ended June 30, 2022 | | | - | | | | - | | | | - | | | | (974,566 | ) | | | - | | | | (974,566 | ) |

Balance as of June 30, 2022 | | | 19,960,124 | | | $ | 19,960 | | | $ | 7,154,605 | | | $ | (4,432,197 | ) | | $ | (15,833 | ) | | $ | 2,726,535 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

HEMPACCO CO., INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

| | Six Months Ended June 30, | |

| | 2023 | | | 2022 | |

Cash flows from operating activities | | | | | | |

Net loss | | $ | (3,989,904 | ) | | $ | (974,566 | ) |

Adjustments to reconcile net loss to cash used in operating activities | | | | | | | | |

Depreciation and amortization | | | 63,848 | | | | 45,217 | |

Non-cash warrant valuation expense | | | 31,205 | | | | 437,375 | |

Reserving of related party loans | | | 1,320,775 | | | | - | |

Gain on disposal of assets | | | - | | | | 10,690 | |

Stock based compensation for services | | | 12,900 | | | | - | |

Changes in operating assets and liabilities | | | | | | | | |

Trade receivables, net | | | 1,098 | | | | (19,549 | ) |

Accounts receivable, related parties | | | 5,100 | | | | 5,934 | |

Prepaid expenses and other current assets | | | 111,363 | | | | 482,948 | |

Prepaid expenses, related parties | | | (922,262 | ) | | | - | |

Inventories | | | (536,399 | ) | | | (321,390 | ) |

Accounts payable | | | 6,940 | | | | 265,340 | |

Accounts payable, related parties | | | (12,662 | ) | | | (17,972 | ) |

Accrued liabilities | | | 64,015 | | | | 10,423 | |

Customer deposits | | | 23,150 | | | | (1,046,920 | ) |

Right of use assets and liabilities | | | (876 | ) | | | - | |

Net cash used in operating activities | | | (3,821,709 | ) | | | (1,122,470 | ) |

| | | | | | | | |

Cash flows from investing activities | | | | | | | | |

Purchases of property, plant and equipment | | | (148,186 | ) | | | (7,011 | ) |

Proceeds from disposal of equipment | | | - | | | | 40,000 | |

Net cash provided by (used in) investing activities | | | (148,186 | ) | | | 32,989 | |

| | | | | | | | |

Cash flows from financing activities | | | | | | | | |

Equipment loan repayment | | | - | | | | (50,000 | ) |

Long term loan repayment | | | (4,518 | ) | | | - | |

Loans to related parties | | | (1,583,957 | ) | | | (115,777 | ) |

Proceeds from short-term promissory note, related parties | | | - | | | | 50,000 | |

Proceeds from line of credit | | | 100,000 | | | | - | |

Investment in joint venture | | | (300,000 | ) | | | - | |

Proceeds from the sale of common stock | | | 7,230,750 | | | | 416,000 | |

Offering costs paid in connection with sale of common stock | | | (634,600 | ) | | | (76,525 | ) |

Cash flows provided by financing activities | | | 4,807,675 | | | | 223,698 | |

| | | | | | | | |

Increase (decrease) in cash and cash equivalents | | | 837,780 | | | | (865,783 | ) |

Cash and cash equivalents at beginning of period | | | 548,331 | | | | 933,469 | |

Cash and cash equivalents at end of period | | $ | 1,386,111 | | | $ | 67,686 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: | | | | | | | | |

Cash paid for interest | | $ | 6,762 | | | $ | - | |

Cash paid for taxes | | $ | 132 | | | $ | 2,770 | |

| | | | | | | | |

NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | | | | | |

Warrants recorded as prepaid and other assets | | $ | 374,453 | | | $ | - | |

Conversion of convertible notes payable and accrued interest to common stock | | $ | 29,032 | | | $ | 56,592 | |

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

HEMPACCO CO., INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - ORGANIZATION, BUSINESS AND LIQUIDITY

Organization and Operations

These financial statements are those of Hempacco and its subsidiaries.

Hempacco Co., Inc. (the “Company” or “Hempacco”) was formed on April 1, 2019, as a Nevada corporation.

On April 23, 2021, the Company filed a second amendment to its Articles of Incorporation changing the name of the company from The Hempacco Co., Inc. to Hempacco Co., Inc.

The Company merged with, and became a subsidiary of, Green Globe International, Inc. (“GGII” or “Green Globe International”) on May 21, 2021.

Hempacco manufactures and distributes hemp smokables both under its own name and white label products for clients. The Company also owns high-tech CBD vending kiosks that it plans to place in retail venues throughout the US, in conjunction with a number of joint venture partners.

On October 6, 2021, the California Assembly Bill Number 45 (“AB 45”) was passed into law. Despite the fact that industrial hemp is federally legal and not a controlled substance, this bill prohibits the sale of “inhalable” hemp products in California. However, the manufacture of inhalable hemp products for the sole purpose of sale in other states is not prohibited. This ban on any kind of smokable flower will remain in force until such time as the California Legislature enact a bill to tax the product. It is also legal to manufacture Delta-8 products containing less than 0.3% THC for sale in another State.

Because of the risk and uncertainty regarding the potential market for smokable products in California, the Company has focused on building its distribution network in other States and other Countries. Celebrity joint ventures bring a national demand for our products.

During the six months ended June 30, 2023, the Company entered into the following Joint Ventures and other significant agreements.

Effective January 1, 2023, HempBox Vending, Inc. (“HVI”) a wholly owned subsidiary of the Company entered into a joint venture operating agreement (the “Operating Agreement”) with Weedsies Mobile, LLC (“Weedsies)”, a Florida limited liability company, to operate a joint venture entity (the “Joint Venture”) in Florida by the name of Weedsies Vending, LLC. The Joint Venture was created to market the hemp related products of Weedsies using automated kiosks provided by HVI. Pursuant to the Operating Agreement, the Joint Venture will be owned 50% each by HVI and Weedsies with both entities required to fund $1,000 to the Joint Venture. HVI will be responsible for provision of the self-service vending kiosks and will be responsible for technology and marketing support as well as accounting, financial services, and tax preparation for the Joint Venture. Weedsies will be responsible for installations, repair, customer service, marketing support, billing, and reconciliations to the Joint Venture.

Effective January 24, 2023, the Company entered into a joint venture operating agreement (the “Operating Agreement”) with Alfalfa Holdings, LLC (“Alfalfa”), a California limited liability company, to operate a joint venture entity (the “Joint Venture”) in California by the name of HPDG, LLC. The Joint Venture was created to market and sell hemp smokables products. Pursuant to the Operating Agreement, the Joint Venture will be owned 50% each by the Company and Alfalfa. The Company is required to fund $10,000 to the Joint Venture, manufacture product, and provide accounting, inventory management, staff training, and trade show and marketing services. Alfalfa is required to provide online marketing and promotion, design and branding, and brand management and development services as well as arranging appearances by Snoop Dogg at Joint Venture events. The appearances by Snoop Dog are subject to professional availability and a separate Talent License and Services Agreement between the Joint Venture and Alfalfa as described below (the “Services Agreement”).

In connection with the Operating Agreement, effective January 24, 2023, HPDG, LLC entered into the Services Agreement with Spanky’s Clothing, Inc., and Calvin Broadus, Jr. p/k/a “Snoop Dogg” (collectively “Talent”), pursuant to which Talent will endorse the HDPG, LLC’s smokable hemp products and serve as a spokesperson for the products in the United States. HDPG, LLC shall (i) pay Talent’s legal expenses of $7,500 in connection with entering into the Operating Agreement and Services Agreement; (ii) cause the Company to issue to Talent a fully vested warrant to acquire 450,000 shares of Company common stock at a strike price of $1.00 per share (the “Talent Warrants”); (iii) cause the Company to issue to Talent’s designee a fully vested warrant to acquire 50,000 shares of the Company’s common stock at a strike price of $1.00 per share (the “Talent Designee Warrants”); and (iv) pay Talent royalties of 10% of HDPG, LLC’s gross revenue, with minimum annual royalty payments of $450,000 by the end of the first two years of the initial term of the Services Agreement, an additional $600,000 by the end of the third year of the initial term, and an additional $1,200,000 by the end of the fourth year of the initial term. As of June 30, 2023, the company has accrued $41,956 of the minimum annual royalty payment of $450,000 which will be due and payable on April 10, 2025.On or about January 30, 2023, the Company issued the Talent Warrants and Talent Designee Warrants as required by the Services Agreement (See Note 9).

On February 8, 2023, the Company signed, as guarantor, a lease agreement between US Tobacco de Mexico S.A. de C.V. (“US Tobacco de Mexico,” a related party), which is 100% owned by UST Mexico, Inc. (“UST Mexico,” a related party), and Grupo Fimher, S. de R.I. de C.V. (“Fimher”) for the lease of 43,000 sf of manufacturing space located in Tijuana, Mexico. The term of the lease is three years, commencing on March 1, 2023. The first year’s rent payment is $18,622 per month, with 3.5% inflation increases on the first and second anniversaries of the lease. The estimated total contingent liability at lease inception will be $694,159. Hempacco Co., Inc. and Hempacco Paper Co., Inc. are sub-tenants of US Tobacco de Mexico and will manufacture products at this facility. A liability for the guarantee has not been recorded as of June 30, 2023 as the amount is not probable.

On February 8, 2023, the Company’s subsidiary, Hempacco Paper Co., Inc., leased the above-referenced space for an initial period of one year for a monthly rental of $2,500. Hempacco Paper will use this facility for the manufacture of all its paper products.

Effective February 1, 2023, the Company through its representative in Warsaw, Poland, filed the equivalent of Articles of Incorporation with the court to create Hempacco Europe Sp.z.o.o. (an LLC equivalent), the corporate entity through which the Company will distribute its smokable products throughout the EU. Ownership of the entity rests 99% with the Company, and 1% with Jakub Duda, an individual.

On February 9, 2023, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with Boustead Securities, LLC, and EF Hutton, a division of Benchmark Investments, LLC, as representatives (the “Representatives”) of the underwriters (the “Underwriters”) in connection with the public offering of additional shares of common stock of the Company. The Underwriting Agreement provides for the offer and sale of 4,200,000 shares of the Company’s common stock, par value $0.001 (the “Common Stock”) at a price to the public of $1.50 per share (the “Offering”). In connection therewith, the Company agreed to issue to the Representatives and/or their designees 338,100 warrants to purchase shares of Common Stock, exercisable from February 14, 2023, through February 10, 2028, at $1.50 per share subject to adjustment as provided therein (the “Representatives’ Warrants”, see Note 9). The Company also granted the Underwriters an option (the “Option”) for a period of 45 days to purchase up to an additional 630,000 shares of Common Stock. The Offering is being made pursuant to a Registration Statement on Form S-1 (File No. 333-269566) (the “Registration Statement”), which was declared effective by the Securities and Exchange Commission on February 9, 2023.

On February 11, 2023, the Underwriters exercised the Option in full, and on February 14, 2023, the Offering was completed. At the closing of the Offering, the Company (i) sold an aggregate of 4,830,000 shares of Common Stock for total gross proceeds of $7,245,000, and (ii) issued the Representatives’ Warrants as directed by the Representatives. After deducting underwriter commissions and Offering expenses, the Company received net proceeds of $6,610,400.

The Underwriting Agreement includes customary representations, warranties, and covenants by the Company. It also provides that the Company will indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended (the “Securities Act”), or contribute to payments the Underwriter may be required to make because of these liabilities.

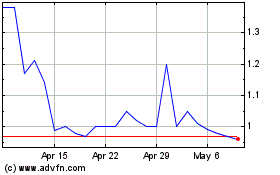

On April 6, 2023, Hempacco Co. received a letter notification from the Nasdaq Capital Market (“Nasdaq”) advising of its non-compliance with Nasdaq listing rules because Hempacco had failed to maintain its stock price at above $1.00 for a period of 30-days. The Nasdaq rules provide for a period of 180 days in which Hempacco must restore compliance. This period expires on October 3, 2023.

On April 20, 2023, Hempacco received a further letter notification from Nasdaq advising of its non-compliance with Nasdaq listing rules because Hempacco had failed to file its Annual Report on Form 10-K (for the 2022 fiscal year) with the Securities and Exchange Commission by the required due date. The deficiency was cured by Hempacco by the filing of the Annual Report on Form 10-K on May 15, 2023.

On May 3, 2023, Hempacco paid $300,000 to Curated Nutra, LLC, the 50% partner in Green Star Labs, Inc., (“GSL”) for the purchase of additional manufacturing equipment. This equipment is required to fulfill product orders from Hempacco’s Snoop Dogg JV entity. This equipment will remain the property of Hempacco Inc., until such time that an agreement is reached with Curated Nutra for the transfer of its ownership interest in GSL. On July 10, 2023, Hempacco signed a Purchase Agreement and an accompanying Assignment Agreement with Viva Veritas LLC (“Veritas”) (the successor to Curated Nutra, LLC) whereby Veritas agreed to assign its 50% interest in GSL to Hempacco together with additional equipment lines related to bottling and gummy production (see Note 14).

On May 7, 2023, Hempacco entered into a joint venture agreement with Nasir Ghesani, a New York distribution company doing business as “Reliable Distributor,” with each party to own 50% of the joint venture and working capital needs to be paid by Hempacco. The joint venture is intended to enter new master distributor agreements for Hempacco smokable products to be placed in New York area convenience stores, gas stations and specialty smoke shops. On May 16, 2023. the Company formed a new Nevada Corporation, RD-HPCO, Inc. as the joint venture entity between the Company and Nasir Ghesani.

On May 23, 2023, Hempacco received a letter notification from Nasdaq advising of its non-compliance with Nasdaq listing rules because Hempacco had failed to file its Quarterly Report on Form 10-Q (for the quarter ended March 31, 2023) with the Securities and Exchange Commission by the required due date. The deficiency was cured by the filing of the Quarterly Report on Form 10-Q on July 5, 2023.

Going Concern Matters

The accompanying financial statements have been prepared in conformity with generally accepted accounting principles in the United States (“GAAP”), which contemplates the Company’s continuation as a going concern. The Company incurred a net loss of $3,989,904 during the six months ended June 30, 2023, and has an accumulated deficit of $14,405,058 as of June 30, 2023. During the three months ended June 30, 2023, the Company’s net cash used in operations was $3,821,709.

Management intends to raise additional operating funds through equity and/or debt offerings. However, there can be no assurance management will be successful in its endeavors. Due to uncertainties related to these matters, there exists a substantial doubt about the ability of the Company to continue as a going concern. The accompanying financial statements do not include any adjustments related to the recoverability or classification of asset-carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern. If we are not able to successfully execute our future operating plans, our financial condition and results of operation may be materially adversely affected, and we may not be able to continue as a going concern.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

Our unaudited consolidated financial statements have been prepared in accordance with US GAAP and the applicable rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial information. As permitted under those rules, we omitted certain footnotes or other financial information that are normally required by US GAAP for annual financial statements. We have included all adjustments necessary for a fair presentation of the results of the interim period. These adjustments consist of normal and recurring items. Our consolidated financial statements are not necessarily indicative of results that may be expected for any other interim period or for the full year. These consolidated financial statements should be read in conjunction with the audited annual consolidated financial statements and related notes filed with the SEC on May 12, 2023. In the opinion of management, the unaudited consolidated financial statements reflect all adjustments, which are of a normal recurring nature, necessary for a fair statement of the Company’s financial condition and results of operations and cash flows for the interim periods presented.

Principles of Consolidation

The financial statements include the accounts of the Company and all of its wholly owned subsidiaries. All significant inter-company balances and transactions have been eliminated in consolidation.

Joint Venture entities where the company owns at least 51% and controls the accounting and administration of the entities will be accounted for under ASC 810-10 which will allow full consolidation of the assets and liabilities into the Company’s balance sheet, with non-controlling interests being calculated and disclosed in the balance sheet and operating statement of the Company. Joint Venture entities where the company owns less than 51% are evaluated for treatment as variable interest entities. The Company may provide accounting and administration for these entities, may have board of director control, and may provide the majority of funding for these entities. Any entities not falling within this criterion will be accounted for under ASC 323-30. These consolidated financial statements include the operating results and the assets of the nine currently operating, joint venture entities, all of which have been deemed variable interest entities for the period ended June 30, 2023. The non-controlling interests of these ventures have been disclosed on the consolidated balance sheet and income statement.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Some of these judgments can be subjective and complex, and, consequently, actual results may differ from these estimates.

Revenue Concentration

Sales to three of the Company’s customers made up approximately 28%, 18% and 11%, respectively, of our revenues for the three months ended June 30, 2023 and sales to one of the Company’s customers made up approximately 91% of our revenues for the three months ended June 30, 2022. Sales to two of the Company’s customers made up approximately 40% and 12%, respectively, of our revenues for the six months ended June 30, 2023 and sales to one of the Company’s customers made up approximately 91% of our revenues for the six months ended June 30, 2022. The balance receivable from these customers on June 30, 2023 and 2022 represents approximately 23% and 30%, respectively, of the total accounts receivable balance of $230,171 and $326,349 as of that date. As a result of a legal dispute between a major customer and a third party during 2022, we experienced a significant reduction in our projected revenues and cash flow for the three and six months ended June 30, 2023.

Basic and Diluted Net Loss per Common Share

Pursuant to ASC 260, Earnings Per Share, basic net income and net loss per share are computed by dividing the net income and net loss by the weighted average number of common shares outstanding. Diluted net income and net loss per share is the same as basic net income and net loss per share when their inclusion would have an anti-dilutive effect due to our continuing net losses.

For the six months ended June 30, 2023, and 2022, the following outstanding dilutive securities were excluded from the computation of diluted net loss per share as the result of the computation was anti-dilutive.

| | June 30, | | | June 30, | |

| | 2023 | | | 2022 | |

| | (Shares) | | | (Shares) | |

Warrants | | | 838,100 | | | | - | |

Promissory Notes convertible to shares | | | 100,000 | | | | 50,000 | |

TOTAL | | | 938,100 | | | | 50,000 | |

Fair Value of Financial Instruments

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”) establishes a framework for all fair value measurements and expands disclosures related to fair value measurement and developments. ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

ASC 820 requires that assets and liabilities measured at fair value are classified and disclosed in one of the following three categories:

| · | Level 1—Quoted market prices for identical assets or liabilities in active markets or observable inputs. |

| · | Level 2—Significant other observable inputs that can be corroborated by observable market data; and |

| · | Level 3—Significant unobservable inputs that cannot be corroborated by observable market data. |

The carrying amounts of cash, accounts receivable, accounts receivable – related parties, inventory, deposits and prepayments, accounts payable and accrued liabilities, accounts payable – related parties, customer pre-paid invoices & deposits, other short-term liabilities – equipment loan, operating lease – right of use liability – short term portion approximate fair value because of the short-term nature of these items.

Non-Controlling Interests

The Company accounts for the non-controlling interests in its subsidiaries and joint ventures in accordance with U.S. GAAP. and ASC 805-20.

The Company has chosen to record the minority interests (NCI’s) in the equity section of the balance sheet, and on the income statement, the profit or loss attributable to the minority interests will be reported as a separate non-operating line item.

The Company measures its non-controlling interests using the percentage of ownership interest held by the respective NCI’s during the accounting period.

NOTE 3 - ACCOUNTS RECEIVABLE

As of June 30, 2023, and December 31, 2022, accounts receivable consisted of the following:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Accounts receivable | | $ | 263,891 | | | $ | 478,680 | |

Accounts receivable, related parties | | | - | | | | 5,100 | |

Allowance for doubtful accounts | | | (33,720 | ) | | | (247,411 | ) |

Total accounts receivable | | $ | 230,171 | ) | | $ | 236,369 | |

The Company recorded a reserve against the entire balance of accounts receivable from related parties as of June 30, 2023. See Note 11 for additional information on related party transactions related to receivables.

NOTE 4 - INVENTORY

As of June 30, 2023, and December 31, 2022, inventory, which consists primarily of the Company’s raw materials, finished products and packaging is stated at the following amounts:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

| | | | | | |

Finished goods | | $ | 462,818 | | | $ | 109,879 | |

Raw materials (Net of obsolescence allowance) | | | 718,713 | | | | 535,253 | |

Total inventory at cost less obsolescence allowance | | $ | 1,181,531 | | | $ | 645,132 | |

The Company identified a potential for obsolescence in particular raw materials and provided an allowance for this risk in full in the year ended December 31, 2020. As of June 30, 2023 and December 31, 2022 and 2021, respectively, this allowance remains unchanged. This obsolescence allowance is continually re-evaluated and adjusted as necessary.

NOTE 5 - PROPERTY AND EQUIPMENT

As of June 30, 2023, and December 31, 2022, property and equipment consisted of the following:

| | June 30, | | | December 31, | |

| | 2023 | | | 2022 | |

Production equipment | | $ | 4,033,172 | | | $ | 3,837,236 | |

Leasehold improvements | | | 12,431 | | | | 12,431 | |

Kiosks | | | 3,583,529 | | | | 3,631,279 | |

| | | 7,629,132 | | | | 7,480,946 | |

Accumulated depreciation | | | (321,568 | ) | | | (260,381 | ) |

Total property and equipment | | $ | 7,307,564 | | | $ | 7,220,565 | |

Depreciation expense was $33,196 and $61,187 for the three and six months ended June 30, 2023, respectively, and $22,813 and $45,217 for the three and six months ended June 30, 2022, respectively.

NOTE 6 - OPERATING LEASES – RIGHT OF USE ASSETS

The Company entered into a 72-month agreement to lease approximately 6,300 square feet of manufacturing, storage, and office space on January 1, 2020, for a period of 6 years with Primus Logistics, Inc. (“Primus”), a related party that is controlled by the Company’s CEO. Approximately 1,800 square feet (28.5%) is used as a manufacturing facility with the balance used as corporate offices and storage. There was no security deposit paid, and the lease carries no optional extension periods. The term of the lease is for six years. At inception of the lease, the Company recorded a right of use asset and liability. The Company used an effective borrowing rate of 6.23% within the calculation.

In addition to the rental of manufacturing space, the Company transacts routine storage business with Primus. The primary business of Primus is the provision of cold storage facilities used for perishable raw materials and finished products from pharmaceutical manufacturing companies. The company stores its raw hemp smokable material with Primus.

Base monthly rent commenced at $10,000 per month, with subsequent defined annual increases. All operating expenses are borne by the lessee. Amounts payable to the related party for rent as of June 30, 2023, and December 31, 2022, were $0 and $5,163 respectively. On June 30, 2023, and December 31, 2022, the amounts of $155,465 and $25,000 respectively, of prepaid rent were included in the deposits and prepayments account.

Operating lease right of use (“ROU”) assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. ROU assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Generally, the implicit rate of interest in arrangements is not readily determinable and the Company utilizes its incremental borrowing rate in determining the present value of lease payments. The Company’s incremental borrowing rate is a hypothetical rate based on its understanding of what its credit rating would be. The operating lease ROU asset includes any lease payments made and excludes lease incentives. Our variable lease payments primarily consist of maintenance and other operating expenses from our real estate leases. Variable lease payments are excluded from the ROU assets and lease liabilities and are recognized in the period in which the obligation for those payments is incurred. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term.

The following are the expected lease payments as of June 30, 2023, including the total amount of imputed interest/present value discount.

Year Ending December 31 | | Operating Leases | |

2023 | | $ | 65,558 | |

2024 | | | 135,049 | |

2025 | | | 139,100 | |

Total lease payments | | | 339,707 | |

Less: Imputed interest/present value discount | | | (26,166 | ) |

Total | | $ | 313,541 | |

Rent expenses were $32,779 and $65,558 during the three and six months ended June 30, 2023, respectively, and $31,827 and $63,654 during the three and six months ended June 30, 2022, respectively.

See Note 1 for information on a new lease between Hempacco Paper Co., Inc., and UST Mexico.

NOTE 7 - OTHER SHORT-TERM LIABILITIES – EQUIPMENT LOAN

On December 11, 2019, the Company entered into a loan for $1,500,000 within an initial maturity of 18 months to fund the purchase of equipment to use in its production. The loan did not have a stated interest rate, and, therefore, the Company calculated an imputed discount of $109,627, which was amortized over 18 months. As of December 31, 2022, the discount had been completely amortized. The loan is secured by the production equipment.

On January 6, 2022, the first payment of $50,000 was made to the lender. The Company was granted forbearance with respect to further loan payments until the Company’s planned initial public offering (“IPO”) was funded. On September 6, 2022, the Company executed a settlement agreement and mutual release with the lender providing for the full repayment of the outstanding loan balance of $1,450,000 with a cash payment of $250,000 and the issuance of 266,667 restricted shares of Hempacco common stock. As of June 30, 2023, and December 31, 2022, the principal balance of the loan was $0.

NOTE 8 - CONVERTIBLE NOTES

During May and June 2021, the Company entered into financing arrangements to provide working capital. The Company received proceeds of $175,000 from three private investors. The promissory notes carried interest at the rate of between 8% and 12% and matured between May 4, 2022, and October 23, 2022. The notes automatically converted at 75% of the 30-day average bid price of the obligor common stock (or the public company common stock as the case may be), with the exception of the $50,000 Taverna 12% Note, which converted at the lower of $1.00 per share or the current market price of Hempacco stock. The notes could not be converted prior to maturity. The Taverna note matured on May 4, 2022, and were converted, along with accrued interest, into 56,592 shares of Hempacco common stock on June 7, 2022.

The notes payable to Miguel Cambero for $100,000 and Ernie Sparks for $25,000 originally matured on October 23, 2022. Both notes were extended through April 30, 2023. On or about May 16, 2023, Ernest Sparks’ note and accrued interest of $4,032 were converted into 62,223 shares of the Company’s common stock.

The Company’s note payable to Miguel Cambero is convertible under its terms into shares of common stock. Subsequent to June 30, 2023, the note and accrued interest will be converted into common stock.

On or about March 18, 2022, the Company issued a promissory note to a related party, Jerry Halamuda for $50,000. The note carries an interest rate of 8% and the initial maturity date was June 18, 2022. The note is secured by 50,000 common shares of the Company. On June 18, 2022, the Company and the investor signed Amendment No. 1 to the promissory note extending the maturity date to September 18, 2022. Subsequently, additional amendments were executed which extended the maturity date to June 18, 2023, and then to September 18, 2023. The $50,000 principal balance of the note was repaid on August 1, 2023. Accrued interest will be repaid in stock at a later date.

NOTE 9 - WARRANTS

As of June 30, 2023, the following warrants are outstanding:

Talent Warrants (see Note 1) | | | 450,000 | |

Talent Designee Warrants (see Note 1) | | | 50,000 | |

Compensation Warrants | | | 500,000 | |

Representatives’ Warrants (see Note 1) | | | 338,100 | |

| | | 938,100 | |

On August 11, 2021, the Company signed an agreement with Boustead Securities, LLC (the “Representative”), which was amended on or about March 18, 2022, with respect to a number of proposed financing transactions. Included in the agreement was the initial public offering of the Company’s common stock, for which a listing on NASDAQ was successfully applied, the private placement of Hempacco securities prior to the IPO (“pre-IPO Financings”), and other financings separate from the IPO or the pre-IPO Financings (each such other financing an “Other Financing”). See Note 12 below for further details.

In addition to the other compensation delineated in the agreement, the Company agreed to issue and sell to the Representative (and/or its designees) on the closing date of an IPO or Other Financing as applicable, five-year warrants to purchase shares of the Company’s common stock. The warrants are equal to 7% of the gross offering amount at an initial exercise price of 150% of the offering price per share in the IPO, or 100% of the offering price in Other Financing.

On January 25, 2023, the Company issued fully vested warrants to purchase 500,000 shares of the Company’s common stock to non-employees as compensation for services (“Compensation Warrants”). The Compensation Warrants have an exercise price of $1.00 and a contractual life of 5 years. Stock-based compensation expense related to the Compensation Warrants was $12,900 for the six months ended June 30, 2023. As of June 30, 2023, total compensation costs related to the common stock warrants not yet recognized amounted to approximately $343,248. The amounts were recorded as prepaid compensation, for which there is a current and noncurrent portion that is amortized over the life of the contract. As of June 30, 2023, the current portion of $74,891 is included in prepaid expenses and other current assets on the balance sheet and the noncurrent portion of $268,357 is included in other assets. During the six months ended June 30, 2023, $31,205 was amortized to sales and marketing expense.

The Black-Scholes model uses the following variables to calculate the value of an option or warrant for the six months ended June 30, 2023, and the twelve months ended December 31, 2022:

| | Input Range | | | Input Range | |

| | June 30, | | | December 31, | |

Description | | 2023 | | | 2022 | |

a) Price of the Issuer’s Security | | $ 0.75-$1.25 | | | $ 1.00 - $7.00 | |

b) Exercise (strike) price of Security | | $1.00 | | | $ 0.75 - $1.50 | |

c) Time to Maturity in years | | 5 years | | | 3 to 5 years | |

d) Annual Risk-Free Rate | | 5-year T-Bill | | | 2-year T-Bill | |

e) Annualized Volatility (Beta) | | 90% - 100% | | | 59% - 100% | |

NOTE 10 - OTHER LOANS PAYABLE

On June 15, 2020, Hempacco entered into a loan agreement with a third party whereby the Company received $85,000. The terms of the loan were for one year, with 0% interest. On January 15, 2021, the lender further advanced $83,328 on the same terms. In December 2021, a letter agreement and loan extension were signed by the lender in which it was confirmed that the new maturity date of the loan would be August 15, 2023. As of June 30, 2023, and December 31, 2022, the balance outstanding was $138,252 and $142,770, respectively.

In July 2021, the Company secured a line of credit facility with First Citizens Bank in the amount of $100,000. The line of credit bears interest at a floating rate equal to 1.0% above the Wall Street Journal Prime Rate at any time and matured in July 2023. On July 1, 2023, the facility was renewed for an additional 12 months and will be reviewed by the bank for potential renewal on June 30, 2024. The line of credit is guaranteed by the CEO of the Company. As of June 30, 2023 and December 31, 2022, $100,000 and $0, respectively, was owed on the line of credit. On June 30, 2023, the interest rate on the facility was 9.25%.

NOTE 11 - RELATED PARTY TRANSACTIONS

As of June 30, 2023, and December 31, 2022, the Company owed Primus $0 and $5,163 respectively, for rent and storage fees. As of June 30, 2023, and December 31, 2022, Primus had been paid $169,780 and $25,000 respectively, in advance, for rent. During the six months ended June 30, 2023 and 2022, the Company expensed $94,266 and $70,094, respectively, for services provided by Primus. The Company’s CEO owns 90% of Primus.

As of September 1, 2022, the salaries of the CEO and the CMO, as defined in their respective employment agreements, were paid through the Company’s payroll service. These payments replace the prior independent contractor payments received by their entities, Strategic Global Partners, Inc. and Cube 17, Inc., respectively. Although employment contracts were dated from January 2022, salaries were paid with effect from September 1, 2022. During the three and six months ended June 30, 2023, the Company incurred expenses of $60,000 and $120,000, respectively, related to salaries for the CEO and CMO. During the three and six months ended June 30, 2022, the Company incurred expenses of $60,000 and $30,000, respectively, related to consulting fees for the CEO and CMO. The Company does not believe there is substantial risk that employer taxes with penalties and interest may be due related to payments made to the CEO and CMO as consultants.

As of June 30, 2023, and December 31, 2022, the Company was owed $0 and $0, respectively, and owed $32,108, and $0, respectively, by and, to UST Mexico, Inc. (“UST Mexico”). Amounts payable have been netted against prepaid expenses. The Company sells hemp products to UST Mexico and provides manufacturing consulting services. The value of goods and services provided to UST Mexico, which are recorded as revenue, was $0 and $6,559, respectively, for the three and six months ended June 30, 2023, and $6,000 and $6,000 for the three and six months ended June 30, 2022. UST Mexico is a manufacturer of tobacco cigarettes in Mexico and provides consulting services and parts for the Company’s equipment. The value of goods and services provided by UST Mexico was $103,009 and $148,009, respectively, for the three and six months ended June 30, 2023, and $43,220 and $90,000, respectively, for the three and six months ended June 30, 2022. As of June 30, 2023, the Company prepaid expenses of $790,099 for products and services related to Hempacco Paper Company that are covered by open purchase orders.

As of June 30, 2023, UST Mexico owned 947,200,000 shares of common stock of Green Globe International, Inc. UST Mexico is a related party by virtue of the CEO’s 25% interest in UST Mexico.

On or about March 1, 2022, the Company entered into a mutual line of credit agreement with its parent company, Green Globe International, Inc. (“GGII”). The purpose of the credit agreement is to facilitate short-term borrowing needs on an interest-free basis, with advances being subject to repayment within 90 days with a maximum of $500,000 allowed to be outstanding within any 90-day period. On December 1, 2022, the maximum amount was increased to $1,500,000. During the twelve months ended December 31, 2022, the Company loaned GGII a net amount of $692,119. As of June 30, 2023, the balance owed to the Company by GGII was $1,614,027. The Company recorded a reserve against the entire balance as of June 30, 2023. The Company concluded that collection of the loan balance is not probable. Thus, during the three and six months ended June 30, 2023, the Company recorded a reserve of $ 195,775 and $1,320,775, respectively, which is included in expensing of related party advances and loans on the statement of operations. Subsequent to June 30, 2023, the Company made additional loans of $50,500 to GGII.

During 2023 and 2022, the Company made short term cash advances directly to Green Star Labs, Inc., a subsidiary joint venture of the Company’s parent, Green Globe International, Inc. As of June 30, 2023 and December 31, 2022, the balance owed by Green Star Labs, Inc. to the Company was $1,200,400 and $605,994, respectively. The Company concluded that collection of a portion of the loan balance is not probable. Thus, the three and six months ended June 30, 2023, the Company recorded a reserve of $0 and $479,000, respectively, which is included in expensing of related party advances and loans on the statement of operations. During the six-month period ended June 30, 2023, the Company made payments of approximately $737,397 (net of repayments) as pre-payment against purchase orders for new products primarily related to the Alfalfa Holdings LLC joint venture (“Snoop Dogg”). During the six months ended June 30, 2023, the Company received approximately $170,000 in inventory from Green Star Labs, Inc. On June 1, 2023, the Company issued a purchase order to Green Star Labs in the amount of $604,000, and in the same period Green Star Labs shipped $0 of product to the Company. Management anticipates that the remaining outstanding loan balance will be eliminated by additional product shipments in the third quarter of 2023. Subsequent to June 30, 2023, the Company made loans of $266,000 to Green Star Labs, Inc.

NOTE 12 - STOCKHOLDERS’ EQUITY

Common Stock

On September 28, 2021, the Company amended its Articles of Incorporation to increase the number of authorized shares of common stock to 200,000,000.

On or about April 7, 2022, the Company issued 208,000 shares of Hempacco common stock at $2.00 per share to nine investors, eight of which were third parties. The Company received gross proceeds of $416,000, and net proceeds of $339,475 after payment of commissions and expenses to the Company’s registered broker and the payment of expenses associated with the private offering and the Public Offering.

On or about July 15, 2022, the Company acquired from Nery’s Logistics, Inc., an entity that is owned by a significant shareholder (greater than 10%) of the Company’s parent, two cigarette production equipment lines together with multiple cigarette and cigar-related trademarks. The total acquisition price was deemed to be $4,000,000 to be paid solely by the issuance of 2,000,000 common shares of the Company. $3,400,000 was initially allocated to the value of the equipment, and the balance of $600,000 was allocated to intangible assets. A subsequent appraisal, performed in Mexico, valued the equipment at $2,278,337. No value was allocated to the trademarks. During the year ended December 31, 2022, the Company recorded a one-time charge of $1,121,663 to its statement of operations account in order to reduce the asset costs to net realizable value.

On July 15, 2022, the Company also settled two vendor accounts payable balances totaling $100,000 by the issuance of 50,000 common shares of the Company.

On September 1, 2022, the Company sold 1,000,000 shares of Hempacco common stock at $6.00 per share to its underwriter in the Company’s IPO, and to Boustead Securities, LLC (“Boustead”) pursuant to the underwriting agreement, in connection with the IPO (the “Underwriting Agreement”). After deducting the underwriting commission and expenses, the Company received net proceeds of $5,390,753.

On September 6, 2022, Boustead exercised its warrants to purchase the Company’s common stock issued to it in connection with IPO, pursuant to paragraph 1.3.1 of the Underwriting Agreement. Boustead elected to convert its right to purchase 70,000 common shares at $9.00 per share using the cashless basis formula in the warrants. The exercise resulted in the issuance of 54,928 shares of common stock to Boustead. The market price of these shares on the issue date was $4.74 per share, resulting in an increase of $55 in common stock and an increase in additional paid in capital of $260,303 as well as additional underwriting expenses of $260,358, which was a decrease to additional paid in capital.

On September 17, 2022, the Company entered a Marketing Services Agreement with North Equities Corp. of Toronto, Canada, effective as of September 19, 2022, for an initial period of 6-months. Compensation for the initial period will be the issuance of 41,494 restricted shares of the Company’s common stock under SEC Rule 144. This amount represents a market value of approximately $100,000 as of the effective date. The shares were issued to North Equities Corp. of Toronto on October 4, 2022. The Company will also reimburse North Equities for all direct, pre-approved and reasonable expenses incurred in performing the marketing services.

On October 12, 2022, the Company entered a Broadcasting and Billboard Agreement with FMW Media Works LLC (“FMW”) of Hauppauge, New York, for a period of three months. FMW will produce an informative TV show which will discuss the Company and its business. Total compensation will be made through the issuance of 63,292 restricted common shares of Hempacco under SEC Rule 144. The market value of the issued shares was $148,103 and was expensed in full in 2022.

See Note 1 for additional issuance of common stock.

NOTE 13 - COMMITMENTS AND CONTINGENCIES

On or about October 7, 2022, the Company accepted service in a suit filed in the United States District Court for the Southern District of New York by Long Side Ventures LLC, R & T Sports Marketing Inc., Sierra Trading Corp., Taconic Group LLC, KBW Holdings LLC, Robert Huebsch, Ann E. Huebsch, Joseph Camberato, Joseph Crook, Sachin Jamdar, Michael Matilsky, Gerard Scollan, and Daisy Arnold (collectively “Plaintiffs”) against Hempacco Co., Inc., Mexico Franchise Opportunity Fund, LP, Sandro Piancone, Jorge Olson, Neville Pearson, Stuart Titus, Jerry Halamuda, Retail Automated Concepts, Inc. f/k/a Vidbox Mexico Inc., and Vidbox Mexico S.A. De C.V. (collectively “Defendants”) (Case No. 1:22-cv-08152 (ALC)). The suit alleged that (i) Plaintiffs previously received a judgment (the “Judgment”) in a New York state court action (the “State Action”) against Retail Automated Concepts, Inc. (“RAC”) and Vidbox Mexico S.A. De C.V. (“Vidbox Mexico”), for breach of promissory notes issued by RAC to the Defendants in 2018 and guaranteed by Vidbox Mexico, and (ii) prior to the filing of the State Action, the Defendants fraudulently transferred and commingled assets, specifically 600 retail kiosks, in order to avoid enforcement of the Judgment with the Plaintiffs seeking monetary damages from Defendants. On or about November 29, 2022, the court granted the Defendants’ request to file a motion to dismiss the suit, and on December 30, 2022, the Defendants filed a motion to dismiss the suit for failure to state a claim and lack of personal jurisdiction. The court has not yet ruled on the motion to dismiss. Defendants believe the suit is without merit and intend to defend the matter vigorously.

NOTE 14 - SUBSEQUENT EVENTS

The Company has evaluated subsequent events through the date of issuance of these financial statements.

On July 10, 2023, the Company signed a Purchase Agreement and an accompanying Assignment Agreement with Viva Veritas LLC (“Veritas”) whereby Veritas agreed to assign its 50% interest in Green Star labs, Inc. to Hempacco together with additional equipment lines related to bottling and gummy production.

The total purchase price to be paid by the Company is $3,500,000. The preliminary purchase price has been allocated as $2,500,000 for the interest in Green Star Labs, and $1,000,000 for the equipment. $3,200,000 of the $3,500,000 total purchase price was paid by the Company’s issuance of a convertible promissory note in the principal amount of $3,200,000 to the seller, which became effective on July 10, 2023. As noted previously (see Note 1), Hempacco had already paid the sum of $300,000 to Veritas for the purchase of additional equipment, which represented the cash portion of the total $3,500,000 purchase price and was credited against the total purchase price by the seller, such that the total $3,500,000 purchase price was deemed paid after issuance of the $3,200,000 promissory note to the seller.

The promissory note carries a 10% interest rate and matures twelve months from the issue date. The holder has the right, after 6-months after the issue date, to convert all or part of the then outstanding principal balance of the note into common stock of the issuer, provided, however, that the holder may not convert the note into Company common stock to the extent that such conversion would result in the holder’s beneficial ownership of the Company common stock being in excess of 4.99% of the Company’s issued and outstanding common stock. Additionally, the note contains a maximum issuance limitation such that the note will no longer be convertible after the Company has issued an aggregate of 5,572,000 shares upon conversion of the Note. The applicable conversion price shall be 95.238% of the average closing price of the Company’s common stock during the three days immediately preceding the conversion.

See Note 8, 10, and 11 for additional subsequent events.

ITEM 2. MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, adopted pursuant to the Private Securities Litigation Reform Act of 1995. Statements that are not purely historical may be forward-looking. For example, statements in this Annual Report regarding our plans, strategy and focus areas are forward-looking statements. You can identify some forward-looking statements by the use of words such as “believe,” “anticipate,” “expect,” “intend,” “goal,” “plan,” and similar expressions. Forward-looking statements involve inherent risks and uncertainties regarding events, conditions and financial trends that may affect our future plans of operation, business strategy, results of operations and financial position. A number of important factors could cause actual results to differ materially from those included within or contemplated by such forward-looking statements, including, but not limited to risks relating to the continuing impacts of the COVID-19 pandemic (including supply chain disruption), the ongoing war in Ukraine and its impact on the global economy, our history of losses since inception, our dependence on a limited number of customers for a significant portion of our revenue, the demand for hemp smokables products, our dependence on key members of our management and development team, and our ability to generate and/or obtain adequate capital to fund future operations. For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward-looking statements, please see the discussion under “Risk Factors” in our other publicly available filings with the Securities and Exchange Commission. Forward-looking statements reflect our analysis only as of the date of this Quarterly Report on Form 10-Q. Because actual events or results may differ materially from those discussed in or implied by forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statement. We do not undertake responsibility to update or revise any of these factors or to announce publicly any revision to forward-looking statements, whether as a result of new information, future events or otherwise.

The following discussion and analysis should be read in conjunction with the consolidated financial statements and the notes thereto included in Item 8 of this Quarterly Report on Form 10-Q.

Hempacco Co., Inc., collectively with its subsidiaries, is referred to in this Form 10-Q as “Hempacco”, “we”, “us”, “our”, “registrant”, or “Company”.

Overview

We are focused on Disrupting Tobacco™ by manufacturing and selling nicotine-free and tobacco-free alternatives to traditional cigarettes. We utilize a proprietary, patented spraying technology for terpene infusion and patent-pending flavored filter infusion technology to manufacture hemp- and herb-based smokable alternatives.

We have conducted research and development in the smokables space and are engaged in the manufacturing and sale of smokable hemp and herb products, including The Real Stuff™ Hemp Smokables. Our operational segments include private label manufacturing and sales, intellectual property licensing, and the development and sales of inhouse brands using patented counter displays. Our private label customers include well-known and established companies in the cannabis and tobacco-alternatives industries, and we currently own approximately 600 kiosk vending machines which we plan to refurbish and use to distribute our products in a wider fashion under our HempBox Vending brand.

Our hemp cigarette production facility, located in San Diego, California, has the capacity to produce up to 30 million cigarettes monthly. From our facility, we can small-to-large quantities of product—from single displays of product to targeted retail locations to truckloads of product to private label customers—with in-house processing, packing, and shipping capabilities.

Results of Operations

For the Three and Six Months Ended June 30, 2023, compared to the Three and Six Months Ended June 30, 2022

Revenue

For the three and six months ended June 30, 2023 and 2022, revenues were as follows:

| | Three Months Ended June 30, | | | Change | |

| | 2023 | | | 2022 | | | $ | | | % | |

Revenues | | | | | | | | | | | | |

Product sales | | $ | 223,188 | | | $ | 1,853,996 | | | $ | (1,630,808 | ) | | | (88 | )% |

Product sales, related parties | | | 13,760 | | | | 5,000 | | | | 8,760 | | | | 175 | % |

Manufacturing service revenue | | | 1,386 | | | | 13,995 | | | | (12,609 | ) | | | (90 | )% |

Kiosk revenue | | | 16,267 | | | | 2,066 | | | | 14,201 | | | | 687 | % |

Total Revenues | | $ | 254,601 | | | $ | 1,875,057 | | | $ | (1,620,456 | ) | | | (86 | )% |