Q103-31false00014441920001444192us-gaap:EmployeeSeveranceMember2023-04-012023-06-3000014441922023-08-090001444192us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001444192acst:StockOptionPlanMemberacst:ConsultantMember2023-04-012023-06-300001444192acst:AtTheMarketOfferingMember2022-04-012022-06-300001444192acst:TaxYear2035Member2023-06-300001444192us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-300001444192us-gaap:RetainedEarningsMember2023-04-012023-06-300001444192acst:ReverseStockSplitMember2023-06-292023-06-2900014441922023-06-300001444192acst:TaxYear2041Member2023-06-300001444192us-gaap:SellingAndMarketingExpenseMember2023-04-012023-06-300001444192us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-06-300001444192acst:WarrantsIssuedDecember272017Member2023-06-300001444192acst:CommonClassDAndCommonClassEMembersrt:MinimumMember2023-04-012023-06-300001444192us-gaap:OtherRestructuringMember2023-04-012023-06-3000014441922023-05-080001444192acst:StockOptionPlanMemberus-gaap:RelatedPartyMember2023-04-012023-06-300001444192acst:TaxYearTwoThousandFortyThreeMember2023-06-300001444192us-gaap:RetainedEarningsMember2023-06-3000014441922020-06-2900014441922022-03-142022-03-140001444192us-gaap:CommonClassCMember2023-06-300001444192us-gaap:EmployeeSeveranceMember2023-03-310001444192acst:WarrantsIssuedDecember272017Member2022-06-300001444192us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001444192acst:RKOSupplyAgreementMember2019-10-250001444192us-gaap:RetainedEarningsMember2022-06-300001444192acst:WarrantsIssuedInMay2018Member2022-06-300001444192acst:CanadianDepositsMember2023-06-300001444192acst:TaxYear2033Member2023-06-3000014441922022-03-140001444192acst:AtTheMarketOfferingMember2020-06-292020-06-290001444192acst:TaxYear2032Member2023-06-300001444192acst:AtTheMarketOfferingMember2023-04-012023-06-300001444192us-gaap:AdditionalPaidInCapitalMember2022-03-310001444192acst:WarrantsIssuedInMay2018Member2023-06-300001444192acst:EquityIncentivePlanMember2023-06-3000014441922020-06-292020-06-2900014441922023-03-310001444192us-gaap:RetainedEarningsMember2023-03-310001444192acst:StockOptionPlanMember2023-04-012023-06-300001444192us-gaap:CommonClassAMember2023-06-300001444192acst:RKOSupplyAgreementMember2023-06-300001444192us-gaap:AdditionalPaidInCapitalMember2023-06-300001444192us-gaap:OtherRestructuringMember2023-03-310001444192acst:TaxYear2037Member2023-06-300001444192us-gaap:CommonClassBMember2023-04-012023-06-300001444192acst:EquityIncentivePlanMember2022-04-012022-06-300001444192acst:TaxYear2040Member2023-06-300001444192us-gaap:OtherRestructuringMember2023-06-300001444192us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001444192acst:CanadianDepositsMember2023-03-310001444192us-gaap:SubsequentEventMemberacst:AssetPurchaseAgreementMember2023-07-030001444192acst:TaxYear2030Member2023-06-300001444192acst:EquityIncentivePlanMember2022-06-300001444192us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001444192us-gaap:CommonStockMember2022-03-3100014441922022-06-300001444192acst:StockOptionPlanMember2023-06-300001444192us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-3000014441922023-04-012023-06-300001444192acst:WarrantsIssuedInMay2018Member2023-06-300001444192us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001444192acst:TaxYear2036Member2023-06-300001444192us-gaap:SubsequentEventMemberacst:AssetPurchaseAgreementMember2023-07-032023-07-030001444192acst:TaxYear2029Member2023-06-300001444192us-gaap:CommonStockMember2023-06-300001444192acst:TaxYear2042Member2023-06-300001444192acst:TaxYear2031Member2023-06-300001444192us-gaap:SubsequentEventMember2023-07-142023-07-140001444192us-gaap:RetainedEarningsMember2022-03-310001444192acst:StockOptionPlanMember2023-03-310001444192acst:TaxYear2034Member2023-06-300001444192us-gaap:CommonClassCMember2023-04-012023-06-300001444192us-gaap:CommonStockMember2023-03-310001444192us-gaap:AdditionalPaidInCapitalMember2022-06-300001444192us-gaap:EmployeeSeveranceMember2023-06-300001444192us-gaap:CommonStockMember2022-06-3000014441922022-04-012022-06-300001444192us-gaap:SellingAndMarketingExpenseMember2022-04-012022-06-300001444192acst:TaxYear2038Member2023-06-300001444192acst:CommonClassDAndCommonClassEMembersrt:MaximumMember2023-04-012023-06-300001444192us-gaap:CommonClassBMember2023-06-300001444192acst:CommonClassDAndCommonClassEMember2023-06-300001444192acst:TaxYear2039Member2023-06-300001444192us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001444192acst:EquityIncentivePlanMember2023-04-012023-06-300001444192us-gaap:CommonStockMember2022-04-012022-06-300001444192us-gaap:AdditionalPaidInCapitalMember2023-03-310001444192us-gaap:RetainedEarningsMember2022-04-012022-06-3000014441922022-03-3100014441922021-11-100001444192us-gaap:ResearchAndDevelopmentExpenseMember2023-04-012023-06-300001444192us-gaap:GeneralAndAdministrativeExpenseMember2023-04-012023-06-30iso4217:CADxbrli:sharesxbrli:purexbrli:sharesacst:Voteiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 10-Q

______________________________________

(Mark One)

|

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

or

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35776

______________________________________

Acasti Pharma Inc.

(Exact name of registrant as specified in its charter)

______________________________________

|

|

Québec, Canada |

98-1359336 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

2572 boul. Daniel-Johnson, 2nd Floor

Laval, Québec, Canada H7T 2R3

(Address of principal executive offices, including zip code)

450-686-4555

(Registrant’s telephone number, including area code)

______________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Shares, no par value per share |

ACST |

NASDAQ Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

|

Emerging growth company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of outstanding common shares of the registrant, no par value per share, as of August 9, 2023, was 7,448,033.

ACASTI PHARMA INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended June 30, 2023

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains information that may be forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of U.S. federal securities laws, both of which we refer to in this quarterly report as forward-looking information. Forward- looking information can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not statements about the present or historical facts.

Although the forward-looking statements in this quarterly report are based upon what we believe are reasonable assumptions, you should not place undue reliance on those forward-looking statements since actual results may vary materially from them.

In addition, the forward-looking statements in this quarterly report are subject to a number of known and unknown risks, uncertainties and other factors many of which are beyond our control, that could cause our actual results and developments to differ materially from those that are disclosed in or implied by the forward-looking statements, including, among others:

•We are heavily dependent on the success of our lead drug candidate, GTX-104.

•Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results. Failure can occur at any stage of clinical development.

•We are subject to uncertainty relating to healthcare reform measures and reimbursement policies which, if not favorable to our drug candidates, could hinder or prevent our drug candidates’ commercial success.

•If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our drug products, if approved, we may be unable to generate any revenue.

•If we are unable to differentiate our drug products from branded reference drugs or existing generic therapies for similar treatments, or if the U.S. Food and Drug Administration (“FDA”) or other applicable regulatory authorities approve products that compete with any of our drug products, our ability to successfully commercialize our drug products would be adversely affected.

2

•Our success depends in part upon our ability to protect our intellectual property for our drug candidates.

•Intellectual property rights do not necessarily address all potential threats to our competitive advantage.

•We do not have internal manufacturing capabilities, and if we fail to develop and maintain supply relationships with various third-party manufacturers, we may be unable to develop or commercialize our drug candidates.

•The design, development, manufacture, supply, and distribution of our drug candidates are highly regulated and technically complex.

•If we fail to meet applicable listing requirements, the Nasdaq Stock Market may delist our common shares from trading, in which case the liquidity and market price of our common shares could decline.

•The other risks and uncertainties identified in Item 1A. Risk Factors included in our Annual Report on Form 10-K for the year ended March 31, 2023.

All of the forward-looking statements in this quarterly report are qualified by this cautionary statement. There can be no guarantee that the results or developments that we anticipate will be realized or, even if substantially realized, that they will have the consequences or effects on our business, financial condition, or results of operations that we anticipate. As a result, you should not place undue reliance on the forward-looking statements. Except as required by applicable law, we do not undertake to update or amend any forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are made as of the date of this quarterly report.

We express all amounts in this quarterly report in U.S. dollars, except where otherwise indicated. References to “$” and “U.S.$” are to U.S. dollars and references to “C$” or “CAD$” are to Canadian dollars.

Except as otherwise indicated, references in this quarterly report to “Acasti,” “the Corporation,” “we,” “us” and “our” refer to Acasti Pharma Inc. and its consolidated subsidiaries.

3

PART I. FINANCIAL INFORMATION

Item 1: Financial Information

Unaudited Condensed Consolidated Interim Financial Statements

4

ACASTI PHARMA INC.

Condensed Consolidated Interim Balance Sheet

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

March 31,

2023 |

(Expressed in thousands of U.S. dollars except share data) |

|

Notes |

|

$ |

|

$ |

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

21,633 |

|

27,875 |

Short-term investments |

|

5 |

|

15 |

|

15 |

Receivables |

|

4 |

|

837 |

|

802 |

Prepaid expenses |

|

|

|

1,127 |

|

598 |

Total current assets |

|

|

|

23,612 |

|

29,290 |

|

|

|

|

|

|

|

Operating lease right of use asset |

|

|

|

71 |

|

463 |

Equipment |

|

|

|

84 |

|

104 |

Intangible assets |

|

|

|

41,128 |

|

41,128 |

Goodwill |

|

|

|

8,138 |

|

8,138 |

Total assets |

|

|

|

73,033 |

|

79,123 |

|

|

|

|

|

|

|

Liabilities and Shareholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Trade and other payables |

|

7 |

|

1,886 |

|

3,336 |

Operating lease liability |

|

8 |

|

80 |

|

75 |

Total current liabilities |

|

|

|

1,966 |

|

3,411 |

|

|

|

|

|

|

|

Operating lease liability |

|

|

|

— |

|

410 |

Deferred tax liability |

|

|

|

7,057 |

|

7,347 |

Total liabilities |

|

|

|

9,023 |

|

11,168 |

|

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Common shares, no par value per share; unlimited shares authorized as of June 30, 2023 and March 31, 2023; 7,435,533 shares issued and outstanding as of June 30, 2023 and March 31, 2023 |

|

9(a) |

|

258,294 |

|

258,294 |

Additional paid-in capital |

|

|

|

14,043 |

|

13,965 |

Accumulated other comprehensive loss |

|

|

|

(6,038) |

|

(6,038) |

Accumulated deficit |

|

|

|

(202,289) |

|

(198,266) |

Total shareholders' equity |

|

|

|

64,010 |

|

67,955 |

|

|

|

|

|

|

|

Commitments and contingencies |

|

14 |

|

|

|

|

Total liabilities and shareholders’ equity |

|

|

|

73,033 |

|

79,123 |

See accompanying notes to unaudited interim financial statements.

5

ACASTI PHARMA INC.

Condensed Consolidated Interim Statements of Loss and Comprehensive Loss

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

June 30, 2023 |

|

|

June 30,

2022 |

|

(Expressed in thousands of U.S dollars, except share and per share data) |

|

Notes |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

Research and development expenses, net of government assistance |

|

6 |

|

|

(1,095 |

) |

|

|

(2,590 |

) |

General and administrative expenses |

|

|

|

|

(1,763 |

) |

|

|

(1,919 |

) |

Sales and marketing |

|

|

|

|

(111 |

) |

|

|

(221 |

) |

Restructuring cost |

|

15 |

|

|

(1,485 |

) |

|

|

— |

|

Loss from operating activities |

|

|

|

|

(4,454 |

) |

|

|

(4,730 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign exchange gain (loss) |

|

|

|

|

8 |

|

|

|

(78 |

) |

Change in fair value of warrant liabilities |

|

|

|

|

— |

|

|

|

10 |

|

Interest income and other expense |

|

|

|

|

134 |

|

|

|

32 |

|

Total other income (loss), net |

|

|

|

|

142 |

|

|

|

(36 |

) |

Loss before income tax recovery |

|

|

|

|

(4,312 |

) |

|

|

(4,766 |

) |

|

|

|

|

|

|

|

|

|

Income tax recovery |

|

|

|

|

289 |

|

|

|

242 |

|

|

|

|

|

|

|

|

|

|

Net loss and total comprehensive loss |

|

|

|

|

(4,023 |

) |

|

|

(4,524 |

) |

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

11 |

|

|

(0.54 |

) |

|

|

(0.61 |

) |

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding |

|

|

|

|

7,435,533 |

|

|

|

7,388,065 |

|

See accompanying notes to unaudited interim financial statements

6

ACASTI PARMA INC.

Condensed Consolidated Interim Statements of Shareholders' Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Expressed in thousands of U.S. dollars except share data) |

|

Notes |

|

|

Number |

|

|

Dollar |

|

|

Additional

paid-in

capital |

|

|

Accumulated

other

comprehensive

loss |

|

|

Deficit |

|

|

Total |

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Balance, March 31, 2023 |

|

|

|

|

|

7,435,533 |

|

|

|

258,294 |

|

|

|

13,965 |

|

|

|

(6,038 |

) |

|

|

(198,266 |

) |

|

|

67,955 |

|

Net loss and total comprehensive loss for the period |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,023 |

) |

|

|

(4,023 |

) |

Stock-based compensation |

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

78 |

|

|

|

— |

|

|

|

— |

|

|

|

78 |

|

Balance at June 30, 2023 |

|

|

|

|

|

7,435,533 |

|

|

|

258,294 |

|

|

|

14,043 |

|

|

|

(6,038 |

) |

|

|

(202,289 |

) |

|

|

64,010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Expressed in thousands of US dollars except for share data) |

|

Notes |

|

Number |

|

|

Dollar |

|

|

Additional

paid-in

capital |

|

|

Accumulated

other

comprehensive

loss |

|

|

Deficit |

|

|

Total |

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

Balance, March 31, 2022 |

|

|

|

|

7,381,425 |

|

|

|

257,990 |

|

|

|

12,154 |

|

|

|

(6,037 |

) |

|

|

(155,837 |

) |

|

|

108,270 |

|

Net loss and total comprehensive loss for the period |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,524 |

) |

|

|

(4,524 |

) |

Cumulative translation adjustment |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(2 |

) |

Stock-based compensation |

|

10 |

|

|

— |

|

|

|

— |

|

|

|

464 |

|

|

|

— |

|

|

|

— |

|

|

|

464 |

|

Net proceeds from shares issued under the at-the-market (ATM) program |

|

|

|

|

34,335 |

|

|

|

195 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

195 |

|

Balance at June 30, 2022 |

|

|

|

|

7,415,760 |

|

|

|

258,185 |

|

|

|

12,618 |

|

|

|

(6,039 |

) |

|

|

(160,361 |

) |

|

|

104,403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

ACASTI PHARMA INC.

Condensed Consolidated Interim Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

June 30, 2023 |

|

|

June 30,

2022 |

|

(Expressed in thousands of U.S. dollars) |

|

Notes |

|

$ |

|

|

$ |

|

Cash flows used in operating activities: |

|

|

|

|

|

|

|

|

Net loss for the period |

|

|

|

|

(4,023 |

) |

|

|

(4,524 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation of equipment |

|

|

|

|

7 |

|

|

|

167 |

|

Stock-based compensation |

|

10 |

|

|

78 |

|

|

|

464 |

|

Change in fair value of warrant liabilities |

|

|

|

|

— |

|

|

|

(10 |

) |

Income tax recovery |

|

|

|

|

(289 |

) |

|

|

(242 |

) |

Unrealized foreign exchange (gain) loss |

|

|

|

|

— |

|

|

|

(10 |

) |

Write-off of equipment |

|

|

|

|

13 |

|

|

|

— |

|

Changes in operating assets and liabilities |

|

12 |

|

|

(2,026 |

) |

|

|

(1,271 |

) |

Net cash used in operating activities |

|

|

|

|

(6,240 |

) |

|

|

(5,426 |

) |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Acquisition of equipment |

|

|

|

|

— |

|

|

|

(7 |

) |

Acquisition of short-term investments |

|

|

|

|

— |

|

|

|

(16 |

) |

Maturity of short-term investment |

|

|

|

|

— |

|

|

|

13,281 |

|

Net cash from investing activities |

|

|

|

|

— |

|

|

|

13,258 |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Net proceeds from issuance under the at-the-market (ATM) program |

|

(9a) |

|

|

— |

|

|

|

195 |

|

Net cash from financing activities |

|

|

|

|

— |

|

|

|

195 |

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate fluctuations on cash and cash equivalents |

|

|

|

|

(2 |

) |

|

|

11 |

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents |

|

|

|

|

(6,242 |

) |

|

|

8,038 |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period |

|

|

|

|

27,875 |

|

|

|

30,339 |

|

Cash and cash equivalents, end of period |

|

|

|

|

21,633 |

|

|

|

38,377 |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents are comprised of: |

|

|

|

|

|

|

|

|

Cash |

|

|

|

|

5,413 |

|

|

|

38,377 |

|

Cash equivalents |

|

|

|

|

16,220 |

|

|

|

— |

|

See accompanying notes to unaudited interim financial statements.

8

ACASTI PHARMA INC.

Notes to Condensed Consolidated Interim Financial Statements

(Unaudited)

(Expressed in thousands of U.S. dollars except share data)

1. Nature of operation

Acasti Pharma Inc. (“Acasti” or the “Corporation”) is incorporated under the Business Corporations Act (Québec) (formerly Part 1A of the Companies Act (Québec)). The Corporation is domiciled in Canada and its registered office is located at 2572 boul. Daniel-Johnson, 2nd Floor Laval, Québec, Canada H7T 2R3.

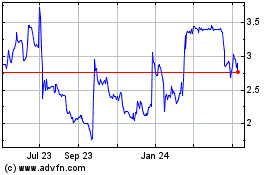

The Corporation’s shares are listed on the Nasdaq Capital Market (the "Nasdaq"), and through March 27, 2023 the Corporation's shares were also listed on the TSX Venture Exchange ("TSXV"), in each case, under the symbol "ACST". On March 13, 2023 the Corporation received approval to voluntarily delist from the TSXV. Effective as at the close of trading on March 27, 2023, the Corporation's common shares are no longer listed and posted for trading on the TSXV.

In August 2021, the Corporation completed the acquisition via a share-for-share merger of Grace Therapeutics, Inc. (“Grace”), a privately held emerging biopharmaceutical company focused on developing innovative drug delivery technologies for the treatment of rare and orphan diseases. The post-merger Corporation is focused on building a late-stage specialty pharmaceutical company specializing in rare and orphan diseases and developing and commercializing products that improve clinical outcomes using its novel drug delivery technologies. The Corporation seeks to apply new proprietary formulations to existing pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, more convenient delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients chosen by the Corporation for further development may be already approved in the target indication or could be repurposed for use in new indications.

The Corporation has incurred operating losses and negative cash flows from operations in each year since its inception. The Corporation expects to incur significant expenses and continued operating losses for the foreseeable future.

In May 2023, the Corporation implemented a strategic realignment plan to enhance shareholder value that resulted in the Corporation engaging a new management team, streamlining its research and development activities to concentrate on its lead product, GTX 104, and greatly reducing its workforce. Moving forward, the Corporation plans to build a smaller, more focused organization in the United States. Further development of GTX-102 and GTX-101 will occur at such time as additional funding is obtained or strategic partnerships are entered into. This strategic realignment is expected to significantly reduce administrative and research and development expenses and enable the Corporation to extend its available cash resources to the second calendar quarter of 2025.

The Corporation will require additional capital to fund our daily operating needs beyond that time. The Corporation does not expect to generate revenue from product sales unless and until it successfully completes drug development and obtains regulatory approval, which the Corporation expects will take several years and is subject to significant uncertainty. To date, the Corporation has financed its operations primarily through public offerings and private placements of its common shares, warrants and convertible debt and the proceeds from research tax credits. Until such time that the Corporation can generate significant revenue from drug product sales, if ever, it will require additional financing, which is expected to be sourced from a combination of public or private equity or debt financing or other non-dilutive sources, which may include fees, milestone payments and royalties from collaborations with third parties. Arrangements with collaborators or others may require the Corporation to relinquish certain rights related to its technologies or drug product candidates. Adequate additional financing may not be available to the Corporation on acceptable terms, or at all. The Corporation’s inability to raise capital as and when needed could have a negative impact on its financial condition and its ability to pursue its business strategy. The Corporation plans to raise additional capital prior to that time in order to maintain adequate liquidity. Negative results from studies, if any, and depressed prices of the Corporation’s stock could impact the Corporation’s ability to raise additional financing. Raising additional equity capital is subject to market conditions not within the Corporation’s control. If the Corporation does not raise additional funds in this time period, the Corporation may not be able to realize our assets and discharge our liabilities in the normal course of business.

The Corporation remains subject to risks similar to other development stage companies in the biopharmaceutical industry, including compliance with government regulations, protection of proprietary technology, dependence on third-party contractors and consultants and potential product liability, among others. Please refer to the risk factors included in Part 1, Item 1A of the Corporation’s annual report on Form 10-K for the year ended March 31, 2023, filed with the SEC on June 23, 2023 (the “Annual Report”).

Reverse stock split

On June 29, 2023, the Board of Directors of the Corporation approved an amendment to the Corporation's Articles of Incorporation to implement a reverse stock split of the Corporation's Class A common shares, no par value per share, at a ratio of 1-for-6 (the “Reverse Stock Split”). On July 4, 2023, the Corporation filed Articles of Amendment to its Articles of Incorporation with the Registraire des entreprises du Québec, to implement the Reverse Stock Split. All references in these financial statements to number of common shares, warrants and

9

options, price per share and weighted average number of shares outstanding have been adjusted to reflect the Reverse Stock Split, which became effective on July 10, 2023.

2. Summary of significant accounting policies:

Basis of presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X under the Securities Exchange Act of 1934. Any reference in these notes to applicable guidance is meant to refer to the authoritative U.S. GAAP as found in the Accounting Standards Codification (“ASC”) and as amended by Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

The unaudited condensed consolidated financial statements have been prepared on the same basis as the audited annual consolidated financial statements as of and for the year ended March 31, 2023, and, in the opinion of management, reflect all adjustments, consisting of normal recurring adjustments, necessary for the fair presentation of the Corporation’s consolidated financial position as of June 30, 2023, the consolidated results of its operations for the three months ended June 30, 2023 and 2022, its statements of shareholders’ equity for the three months ended June 30, 2023 and 2022 and its consolidated cash flows for the three months ended June 30, 2023 and 2022.

These unaudited condensed consolidated financial statements should be read in conjunction with the Corporation’s audited consolidated financial statements and the accompanying notes for the year ended March 31, 2023 included in the Corporation’s Annual Report. The condensed consolidated balance sheet data as of March 31, 2023 presented for comparative purposes was derived from the Corporation’s audited consolidated financial statements but does not include all disclosures required by U.S. GAAP. The results for the three months ended June 30, 2023 are not necessarily indicative of the operating results to be expected for the full year or for any other subsequent interim period.

The Corporation’s significant accounting policies are disclosed in the audited consolidated financial statements for the year ended March 31, 2023 included in the Annual Report. There have been no changes to the Corporation's significant accounting policies since the date of the audited consolidated financial statements for the year ended March 31, 2023 included in the Annual Report.

Use of estimates

The preparation of these financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, income, and expenses. Actual results may differ from these estimates.

Estimates are based on management’s best knowledge of current events and actions that management may undertake in the future. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected.

Estimates and assumptions include the measurement of stock-based compensation, accruals for research and development contracts and contract organization agreements, and valuation of intangibles and goodwill. Estimates and assumptions are also involved in measuring the accrual of services rendered with respect to research and development expenditures at each reporting date, and determining which research and development expenses qualify for research and development tax credits and in what amounts. The Corporation recognizes the tax credits once it has reasonable assurance that they will be realized.

3. Recent accounting pronouncements

The Corporation has considered recent accounting pronouncements and concluded that they are either not applicable to the business or that the effect is not expected to be material to the consolidated financial statements as a result of future adoption.

4. Receivables

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

March 31,

2023 |

|

|

Notes |

|

$ |

|

$ |

Sales tax receivables |

|

|

|

426 |

|

338 |

Government assistance |

|

6 |

|

361 |

|

412 |

Interest receivable |

|

|

|

50 |

|

52 |

Total receivables |

|

|

|

837 |

|

802 |

10

5. Short-term investments

The Corporation holds various marketable securities, with maturities greater than 3 months at the time of purchase, as follows:

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

March 31,

2023 |

|

|

|

$ |

|

|

$ |

|

Term deposits issued in CAD currency earning interest at 3% and maturing on March 29, 2024 |

|

|

15 |

|

|

|

15 |

|

Total short-term investments |

|

|

15 |

|

|

|

15 |

|

6. Government assistance

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

March 31, 2023 |

|

|

|

$ |

|

|

$ |

|

Investment tax credit |

|

|

361 |

|

|

|

412 |

|

Government assistance is comprised of research and development investment tax credits from the Québec provincial government, which relate to qualifiable research and development expenditures under the applicable tax laws. The amounts recorded as receivables are subject to a government tax audit and the final amounts received may differ from those recorded. For the three months ended June 30, 2023 and 2022, the Corporation recorded $(51) and $41, respectively, as an increase and a reduction of research and development expenses in the Statement of Loss and Comprehensive Loss.

Unrecognized Canadian federal tax credits may be used to reduce future Canadian federal income tax and expire as follows:

|

|

|

|

|

|

|

$ |

|

2029 |

|

9 |

|

2030 |

|

|

23 |

|

2031 |

|

|

36 |

|

2032 |

|

|

345 |

|

2033 |

|

|

353 |

|

2034 |

|

|

348 |

|

2035 |

|

|

415 |

|

2036 |

|

|

229 |

|

2037 |

|

|

252 |

|

2038 |

|

|

259 |

|

2039 |

|

|

355 |

|

2040 |

|

|

226 |

|

2041 |

|

|

146 |

|

2042 |

|

|

312 |

|

2043 |

|

|

642 |

|

|

|

|

3,950 |

|

7. Trade and other payables

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

March 31, 2023 |

|

|

|

$ |

|

|

$ |

|

Trade payables |

|

|

607 |

|

|

|

1,242 |

|

Accrued liabilities and other payables |

|

|

994 |

|

|

|

946 |

|

Employee salaries and benefits payable |

|

|

285 |

|

|

|

1,148 |

|

Total trade and other payables |

|

|

1,886 |

|

|

|

3,336 |

|

8. Leases

The Corporation has historically entered into lease arrangements for its research and development and quality control laboratory facility located in Sherbrooke, Québec. As of June 30, 2023, the Corporation had one operating lease with required future minimum payments. On

11

March 14, 2022, the Corporation renewed the lease agreement effective April 1, 2022, resulting in a commitment of $556 over a 24 months base lease term and 48 months additional lease renewal term. In April 2023, the Corporation elected not to renew the additional 48 months lease renewal term with the lease expected to terminate March 31, 2024. The Corporation accounted for the change in lease term as a lease modification under ASC 842. Due to the modification in lease term, the Corporation remeasured the lease liability and right-of-use asset associated with the lease. As of the effective date of modification, the Corporation recorded an adjustment to the right-of-use asset and lease liability in the amount of $369 based on the net present value of lease payments discounted using an estimate incremental borrowing rate of 4.3%.

The following table contains a summary of the lease costs recognized under ASC 842 and other information pertaining to the Corporation’s operating lease for the three month period ended June 30, 2023:

|

|

|

|

|

Operating cash flows for operating lease |

|

$ |

24 |

|

Weighted-average remaining lease term (in years) |

|

|

0.75 |

|

Weighted-average discount rate |

|

|

4.3 |

% |

As the Corporation's lease do not provide an implicit rate, the Corporation utilized its incremental borrowing rate to discount lease payments, which reflects the fixed rate at which the Corporation could borrow on a collateralized basis the amount of the lease payments in the same currency, for a similar term, in a similar economic environment.

Future minimum lease payments under the Corporation’s operating lease as of June 30, 2023 were as follows:

|

|

|

|

|

|

|

June 30, 2023 |

|

|

|

$ |

|

2024 |

|

|

81 |

|

2025 and thereafter |

|

|

- |

|

Total lease payments |

|

|

81 |

|

Less: interest |

|

|

(1 |

) |

Total lease liability |

|

|

80 |

|

9. Capital and other components of equity

a. Common Shares

Authorized capital stock

Unlimited number of shares

•Class A shares (Common Shares), voting (one vote per share), participating and without par value. As of June 30, 2023, there were 7,435,533 Class A shares issued and outstanding.

•Class B shares, voting (ten votes per share), non-participating, without par value and maximum annual non-cumulative dividend of 5% on the amount paid per share. Class B shares are convertible, at the holder’s discretion, into Class A shares (Common Shares), on a one-for-one basis, and Class B shares are redeemable at the holder’s discretion for CAD $4.80 per share, subject to certain conditions. As of June 30, 2023, there were no Class B shares issued and outstanding.

•Class C shares, non-voting, non-participating, without par value and maximum annual non-cumulative dividend of 5% on the amount paid per share. Class C shares are convertible, at the holder’s discretion, into Class A shares (Common Shares), on a one-for-one basis, and Class C shares are redeemable at the holder’s discretion for CAD $1.20 per share, subject to certain conditions. As of June 30, 2023, there were no Class C shares issued and outstanding.

•Class D and E shares, they are non-voting, non-participating, without par value and maximum monthly non-cumulative dividend between 0.5% and 2% on the amount paid per share. Class D and E shares are convertible, at the holder’s discretion, into Class A shares (Common Shares), on a one-for-one basis, and Class D and E shares are redeemable at the holder’s discretion, subject to certain conditions. As of June 30, 2023, there were no Class D or E shares issued and outstanding.

At-the-Market (“ATM”) Program

On June 29, 2020, the Corporation entered into an amended and restated sales agreement (the “Sales Agreement”) with B. Riley FBR, Inc. ("B.Riley"), Oppenheimer & Co. Inc. and H.C. Wainwright & Co., LLC (collectively, the “Agents”) to amend the Corporation’s existing ATM program. Under the terms of the Sales Agreement, which had a three-year term, the Corporation could issue and sell from time-to-time common shares having aggregate gross proceeds of up to $75,000,000 through the Agents. Subject to the terms and conditions of the

12

Sales Agreement, the Agents would use their commercially reasonable efforts to sell the common shares from time to time, based upon the Corporation’s instructions. The Corporation had no obligation to sell any of the common shares and could, at any time, suspend sales under the Sales Agreement. The Corporation and the Agents could terminate the Sales Agreement in accordance with its terms. Under the terms of the Sales Agreement, the Corporation provided the Agents with customary indemnification rights and the Agents were entitled to compensation at a commission rate equal to 3.0% of the gross proceeds from each sale of the common shares. The Sales Agreement expired pursuant to its terms on June 29, 2023 and the Corporation plans to revisit the renewal of a facility in the coming months.

On November 10, 2021, the Corporation filed a prospectus supplement relating to its at-the-market program, expiring July 7, 2023, with B. Riley, Oppenheimer& Co. Inc. and H.C. Wainwright & Co., LLC acting as agents. Under the terms of the ATM Sales Agreement and the prospectus supplement, the Corporation may issue and sell from time-to-time common shares having an aggregate offering price of up to $75,000,000 through the agents; however, our use of the shelf registration statement on Form S-3 will be limited for so long as we are subject to General Instruction I.B.6 of Form S-3, which limits the amounts that we may sell under the registration statement and in accordance with the ATM agreement. The common shares will be distributed at market prices prevailing at the time of the sale and, as a result, prices may vary between purchasers and during the period of distribution. The volume and timing of sales under the ATM program, if any, will be determined at the sole discretion of the Corporation’s board of directors and management.

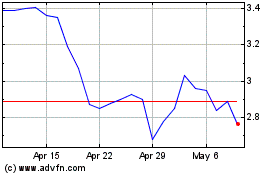

During the three months ended June 30, 2023, no common shares were sold under the ATM program. During the three months ended June 30, 2022, 34,335 common shares were sold for total net proceeds of approximately $195 with commissions, legal expenses and costs related to the share sale amounting to $6. The common shares were sold at the prevailing market prices, which resulted in an average price of approximately $5.82 per share.

b. Warrants

During the three month period ended June 30, 2023, the remaining 137,370 warrants to acquire one common share at an exercise price of CAD $62.88 expired on May 9, 2023.

10. Stock-based compensation

At June 30, 2023, the Corporation had in place a stock option plan for directors, officers, employees, and consultants of the Corporation (“Stock Option Plan”).

The Stock Option Plan continues to provide for the granting of options to purchase common shares. Under the terms of the Stock Option Plan, the exercise price of the stock options granted under the Stock Option Plan may not be lower than the closing price of the Corporation’s common shares on the Nasdaq Capital Market at the close of such market the day preceding the grant. The maximum number of common shares that may be issued upon exercise of options granted under the amended Stock Option Plan shall not exceed 20% of the aggregate number of issued and outstanding shares of the Corporation as of July 28, 2022. The terms and conditions for acquiring and exercising options are set by the Corporation’s Board of Directors, subject to, among others, the following limitations: the term of the options cannot exceed ten years and (i) all options granted to a director will be vested evenly on a monthly basis over a period of at least twelve (12) months, and (ii) all options granted to an employee will be vested evenly on a quarterly basis over a period of at least thirty-six (36) months.

The total number of options issued to any one consultant within any twelve-month period cannot exceed 2% of the Corporation’s total issued and outstanding common shares (on a non-diluted basis). The Corporation is not authorized to grant within any twelve-month period such number of options under the Stock Option Plan that could result in a number of common shares issuable pursuant to options granted to (a) related persons exceeding 2% of the Corporation’s issued and outstanding common shares (on a non-diluted basis) on the date an option is granted, or (b) any one eligible person in a twelve-month period exceeding 2% of the Corporation’s issued and outstanding common shares (on a non-diluted basis) on the date an option is granted.

The following table summarizes information about activities within the Stock Option Plan for the three month period ended June 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

options |

|

|

Weighted average

exercise price |

|

|

Weighted average

grant date

fair value |

|

Outstanding, March 31, 2023 |

|

|

740,957 |

|

|

|

13.60 |

|

|

|

11.23 |

|

Forfeited/Cancelled |

|

|

(267,797 |

) |

|

|

7.72 |

|

|

|

6.21 |

|

Outstanding, June 30, 2023 |

|

|

473,178 |

|

|

|

16.93 |

|

|

|

14.07 |

|

Exercisable, June 30, 2023 |

|

|

402,247 |

|

|

|

18.62 |

|

|

|

15.51 |

|

Forfeited and cancelled options were as a result of the Corporations restructuring that occurred during the three months ended June 30, 2023. No options were granted or exercised during the three month period ended June 30, 2023.

13

Compensation expense recognized under the stock option plan is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

|

|

$ |

|

|

$ |

|

Research and development expenses |

|

|

2 |

|

|

|

158 |

|

General and administrative expenses |

|

|

60 |

|

|

|

282 |

|

Sales and marketing expenses |

|

|

16 |

|

|

|

24 |

|

|

|

|

78 |

|

|

|

464 |

|

As of June 30, 2023, there was $130 of total unrecognized compensation cost, related to non-vested stock options, which is expected to be recognized over a remaining weighted average vesting period of 0.97 years.

Corporation equity incentive plan

The Corporation established an equity incentive plan (the “Equity Incentive Plan”) for employees, directors, and consultants. The Equity Incentive Plan provides for the issuance of restricted share units (RSUs), performance share units, restricted shares, deferred share units and other stock-based awards, subject to restricted conditions as may be determined by the Board of Directors. There were no such awards outstanding as of June 30, 2023, and June 30, 2022, and no stock-based compensation was recognized for the period ended June 30, 2023 and June 30, 2022 under the Equity Incentive Plan.

11. Loss per share

Diluted loss per share was the same amount as basic loss per share, as the effect of options, and warrants would have been anti-dilutive, as the Corporation has incurred losses in each of the periods presented. All currently outstanding options could potentially be dilutive in the future.

The Corporation excluded the following potential common shares, presented based on amounts outstanding at each period end, from the computation of diluted net loss per share attributable to common shareholders for the periods indicated because including them would have had an anti-dilutive effect:

|

|

|

|

|

|

|

June 30, 2023 |

|

June 30, 2022 |

Options outstanding |

|

473,178 |

|

704,585 |

May 2018 public offering warrants |

|

— |

|

137,370 |

December 2017 public offering warrants |

|

— |

|

147,354 |

12. Supplemental cash flow disclosure

Changes in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

June 30, 2023 |

|

|

June 30,

2022 |

|

|

|

$ |

|

|

$ |

|

Receivables |

|

|

(35 |

) |

|

|

(434 |

) |

Prepaid expenses |

|

|

(529 |

) |

|

|

(839 |

) |

Trade and other payables |

|

|

(1,449 |

) |

|

|

2 |

|

Write-off of operating lease right of use asset |

|

|

(13 |

) |

|

|

— |

|

Total changes in operating assets and liabilities |

|

|

(2,026 |

) |

|

|

(1,271 |

) |

14

13. Financial instruments

a. Concentration of credit risk

Financial instruments that potentially subject the Corporation to a concentration of credit risk consist primarily of cash and cash equivalents and investments. Cash and cash equivalents and investments are all invested in accordance with the Corporation’s Investment Policy with the primary objective being the preservation of capital and the maintenance of liquidity, which risk is managed by dealing only with highly rated Canadian institutions. The carrying amount of financial assets, as disclosed in the consolidated balance sheets, represents the Corporation’s credit exposure at the reporting date.

b. Foreign currency risk

The Corporation is exposed to financial risk related to the fluctuation of foreign exchange rates and the degrees of volatility of those rates. Foreign currency risk is limited to the portion of the Corporation's business transactions denominated in currencies other than the Corporation's functional currency of the U.S. dollar. Fluctuations related to foreign exchange rates could cause unforeseen fluctuations in the Corporation's operating results. The Corporation does not use derivative instruments to hedge exposure to foreign exchange risk. The fluctuation of the Canadian dollar in relation to the U.S. dollar and other foreign currencies will consequently have an impact upon the Corporation’s net loss.

c. Liquidity risk

Liquidity risk is the risk that the Corporation will encounter difficulty in meeting the obligations associated with its financial liabilities that are settled by delivering cash or another financial asset. The Corporation manages liquidity risk through the management of its capital structure and financial leverage. It also manages liquidity risk by continuously monitoring actual and projected cash flows. The Board of Directors reviews and approves the Corporation's operating budgets, and reviews material transactions outside the normal course of business. The Corporation currently does not have long-term debt nor arranged committed sources of financing and is operating via use of existing cash and short-term investment balances. Refer to Note 1 – Nature of Operations.

The Corporation’s financial liabilities obligations include trade and other payables, which fall due within the next 12 months.

14. Commitments and contingencies

Research and development contracts and contract research organizations agreements

The Corporation utilize contract manufacturing organizations ("CMOs") for the development and production of clinical materials and contract research organizations (“CROs”) to perform services related to its clinical trials. Pursuant to the agreements with these CMOs and CROs, the Corporation has either the right to terminate the agreements without penalties or under certain penalty conditions.

Raw krill oil supply contract

On October 25, 2019, the Corporation signed a supply agreement with Aker Biomarine Antarctic. (“Aker”) to purchase raw krill oil product for a committed volume of commercial starting material for CaPre, one of the Corporation’s former drug candidates, for a total fixed value of $3.1 million. As at June 30, 2023, the remaining balance of the commitment with Aker amounts to $2.8 million. During the second calendar quarter of 2022, Aker informed the Corporation that Aker believed it had satisfied the terms of the supply agreement as to their obligation to deliver the remaining balance of raw krill oil product, and that the Corporation was therefore required to accept the remaining product commitment and to pay Aker the $2.8 million balance. The Corporation disagrees with Aker’s position and believes that Aker is not entitled to further payment under the supply agreement. Accordingly, no liability has been recorded. The dispute was unresolved as of June 30, 2023, and remains unresolved. There is uncertainty as to whether the Corporation will be required to make further payment to Aker in connection with the dispute. Additionally, in the event the Corporation is required to accept delivery from Aker of the remaining balance of raw krill oil product under the supply agreement, there is uncertainty as to whether the Corporation can recover value from the product, which may result in the Corporation incurring a loss on the supply agreement in the near term.

15

Legal proceedings and disputes

In the ordinary course of business, the Corporation is at times subject to various legal proceedings and disputes. The Corporation assesses its liabilities and contingencies in connection with outstanding legal proceedings utilizing the latest information available. Where it is probable that the Corporation will incur a loss and the amount of the loss can be reasonably estimated, the Corporation records a liability in its consolidated financial statements. These legal contingencies may be adjusted to reflect any relevant developments. Where a loss is not probable or the amount of loss is not estimable, the Corporation does not accrue legal contingencies. While the outcome of legal proceedings is inherently uncertain, based on information currently available, management believes that it has established appropriate legal reserves. Any incremental liabilities arising from pending legal proceedings are not expected to have a material adverse effect on the Corporation’s financial position, results of operations, or cash flows. However, it is possible that the ultimate resolution of these matters, if unfavorable, may be material to the Corporation’s financial position, results of operations, or cash flows. No reserves or liabilities have been accrued as of June 30, 2023.

15. Restructuring Costs

On May 8, 2023, the Corporation communicated its decision to terminate a substantial amount of its workforce as part of a plan that intended to align the Corporation’s organizational and management cost structure to prioritize resources to GTX-104 and reduce losses to improve cash flow and extend available cash resources. The Corporation incurred $1,485 of costs primarily consisting of employee severance costs. Unpaid Liabilities associated with the restructuring costs are recorded in trade and other payables on the consolidated balance sheets.

The Corporation’s restructuring charges and payments are comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee |

|

|

|

|

|

|

|

|

|

severance |

|

|

Legal |

|

|

Total |

|

Expenses incurred |

|

|

1,447 |

|

|

|

38 |

|

|

|

1,485 |

|

Payments made |

|

|

(1,212 |

) |

|

|

- |

|

|

|

(1,212 |

) |

Balance at June 30, 2023 |

|

|

235 |

|

|

|

38 |

|

|

|

274 |

|

16. Subsequent events

On July 3, 2023, the Corporation entered into an asset purchase agreement to sell its lab equipment with a net book value of $54 as of June 30, 2023 for $109 in net proceeds.

On July 14, 2023, the Corporation's Board of Directors approved the grant of 446,502 stock options at an exercise price of $2.64 under the Corporation's Stock Option Plan.

On July 19, 2023, the Corporation entered into a new short term lease for its new headquarters located at 2572 boul. Daniel-Johnson, 2nd Floor Laval, Québec, Canada H7T 2R3. On July 24, 2023, the Corporation terminated it's lease for premises located at 3009 boul. de la Concorde East, Suite 102, Laval, Québec, Canada H7E 2B5.

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

This management’s discussion and analysis (“MD&A”) is presented in order to provide the reader with an overview of the financial results and changes to our consolidated balance sheets as at June 30, 2023, and for the three month period then ended. This MD&A also explains the material variations in our results of operations, consolidated balance sheets and cash flows as of and for the three months ended June 30, 2023 and 2022.

Market data, and certain industry data and forecasts included in this MD&A were obtained from internal Corporation surveys and market research conducted by third parties hired by us, publicly available information, reports of governmental agencies and industry publications, and independent third-party surveys. We have relied upon industry publications as our primary sources for third-party industry data and forecasts. Industry surveys, publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. We have not independently verified any of the data from third-party sources or the underlying economic assumptions they have made. Similarly, internal surveys, industry forecasts and market research, which we believe to be reliable based upon our management’s or contracted third parties’ knowledge of our industry, have not been independently verified. Our estimates involve risks and uncertainties, including assumptions that may prove not to be accurate, and these estimates and certain industry data are subject to change based on various factors, including those discussed in this quarterly report and in our most recently filed Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on June 23, 2023 (the “Annual Report”). This MD&A contains forward-looking information. You should review our important note about forward-looking statements presented at the beginning of this quarterly report.

This MD&A should be read in conjunction with our unaudited condensed consolidated interim financial statements for the three months ended June 30, 2023 and 2022 included elsewhere in this quarterly report. Our interim financial statements were prepared in accordance with U.S. GAAP.

All amounts appearing in this MD&A for the period-by-period discussions are in thousands of U.S. dollars, except share and per share amounts or unless otherwise indicated.

Business Overview

We are focused on developing and commercializing products for rare and orphan diseases that have the potential to improve clinical outcomes by using our novel drug delivery technologies. We seek to apply new proprietary formulations to approved and marketed pharmaceutical compounds to achieve enhanced efficacy, faster onset of action, reduced side effects, more convenient drug delivery and increased patient compliance; all of which could result in improved patient outcomes. The active pharmaceutical ingredients used in the drug candidates under development by Acasti may be already approved in a target indication or could be repurposed for use in new indications.

The existing well understood efficacy and safety profiles of these marketed compounds provides the opportunity for us to utilize the Section 505(b)(2) regulatory pathway under the Federal Food, Drug and Cosmetic Act for the development of our reformulated versions of these drugs, and therefore may provide a potentially shorter path to regulatory approval. Under Section 505(b)(2), if sufficient support of a product’s safety and efficacy either through previous U.S. Food and Drug Administration ("FDA") experience or sufficiently within the existing and accepted scientific literature, can be established, it may eliminate the need to conduct some of the pre-clinical studies and clinical trials that new drug candidates might otherwise require.

Our therapeutic pipeline consists of three unique clinical stage and multiple pre-clinical stage assets supported by an intellectual property portfolio of more than 40 granted and pending patents in various jurisdictions worldwide. These drug candidates aim to improve clinical outcomes in the treatment of rare and orphan diseases by applying proprietary formulation and drug delivery technologies to existing pharmaceutical compounds to achieve improvements over the current standard of care, or to provide treatment for diseases with no currently approved therapies.

We believe that rare disorders represent an attractive area for drug development, and there remains an opportunity for us to utilize already approved drugs that have established safety profiles and clinical experience to potentially address significant unmet medical needs. A key advantage of pursuing therapies for rare disorders is the potential to receive orphan drug designation (“ODD”) from the FDA. Our three drug candidates currently in clinical development have received ODD status, provided certain conditions are met at new drug application ("NDA") approval. ODD provides for seven years of marketing exclusivity in the United States post-launch, provided certain conditions are met, and the potential for faster regulatory review. ODD status can also result in tax credits of up to 50% of clinical development costs conducted in the United States upon marketing approval and a waiver of the NDA fees, which we estimate can translate into savings of approximately $3.2 million for our lead drug candidate, GTX-104. Developing drugs for rare diseases can often allow for clinical trials that are more manageably scaled and may require a smaller, more targeted commercial infrastructure.

The specific diseases targeted for drug development by us are well understood, although the patient populations suffering from such diseases may remain poorly served by available therapies or in some cases, approved therapies do not yet exist. We aim to effectively treat debilitating symptoms that result from these underlying diseases.

17

Our lead drug candidate:

•GTX-104 is a clinical stage, novel, injectable formulation of nimodipine being developed for intravenous infusion (IV) in aneurysmal subarachnoid hemorrhage (aSAH) patients to address significant unmet medical needs. The unique nanoparticle technology of GTX-104 facilitates aqueous formulation of insoluble nimodipine for a standard peripheral IV infusion. GTX-104 provides a convenient IV delivery of nimodipine in the Intensive Care Unit eliminating the need for nasogastric tube administration in unconscious or dysphagic patients. Intravenous delivery of GTX-104 also has the potential to lower food effects, drug-to-drug interactions, and eliminate potential dosing errors. Further, GTX-104 has the potential to better manage hypotension in aSAH patients. GTX-104 has been administered in over 150 healthy volunteers and was well tolerated with significantly lower inter- and intra-subject pharmacokinetic variability compared to oral nimodipine. The pivotal PK bridging study was successfully completed in May 2022.

Other pipeline drug candidates:

•GTX-102, an oral-mucosal betamethasone spray for the treatment of Ataxia Telangiectasia (“A-T”), a complex orphan pediatric genetic neurodegenerative disorder usually diagnosed in young children, for which no FDA approved treatment currently exists.

•GTX-101, a topical bioadhesive film-forming bupivacaine spray for Postherpetic Neuralgia (“PHN”), which can be persistent and often causes debilitating pain following infection by the shingles virus. We believe that GTX-101 could be administered to patients with PHN to treat pain associated with the disease.

In May 2023, we announced the strategic decision to prioritize development of GTX-104 with a goal to advance the product candidate to commercialization, while conserving resources as much as possible to complete development efficiently. We estimate that the deferral of GTX-102 and GTX-101 clinical development could be at least three years given the timeline to complete the development and potential commercial launch of GTX-104. Further development of GTX-102 and GTX-101 will occur at such time as we obtain additional funding or enter into strategic partnerships for license or sale with third parties.

The decision to defer further development of GTX-102 and GTX-101 triggered a comprehensive impairment review of our intangible assets as of March 31, 2023. Given the extended timeline, we increased the discount rates used to value the related assets in order to recognize additional risks related to prioritizing one asset over the others, financing the projects given limited available resources and the need to preserve cash to advance GTX-104 as far as possible, potential competitor advances that could arise over three years, and the general market depression affecting small cap development companies like us and the prohibitively high dilution and expense of available funding in the capital markets. Increasing the discount rates significantly reduced the discounted cash flow values for each of the programs deferred. Accordingly, in the quarter ended March 31, 2023 we booked impairment charges related to GTX-102 and GTX-101 of $22.7 million and $6.0 million respectively, together with further adjustments made to deferred taxes and goodwill directly related to those assets. The impairment charge overall amounted to $33.5 million. We continue to believe that GTX-102 and GTX-101 may eventually provide significant value when development resumes and, if approved, commercialized successfully.

Our management team possesses significant experience in drug formulation and drug delivery research and development, clinical and pharmaceutical development and manufacturing, regulatory affairs, and business development, as well as being well-versed in late-stage drug development and commercialization. Importantly, our team is comprised of industry professionals with deep expertise and knowledge, including a world-renowned practicing neurosurgeon-scientist and respected authority in aSAH, as well as product development, chemistry, manufacturing and controls (“CMC”), planning, implementation, management, and execution of global Phase 2 and Phase 3 trials for a drug candidate for aSAH.

GTX-104 Overview

Nimodipine was granted FDA approval in 1988, and is the only approved drug that has been clinically shown to improve neurological outcomes in aSAH patients. It is only available in the United States as a generic oral capsule and as a branded oral liquid solution called NYMALIZE™, which is manufactured and sold by Arbor Pharmaceuticals (acquired in September 2021 by Azurity Pharmaceuticals). Nimodipine has poor water solubility and high permeability characteristics as a result of its high lipophilicity. Additionally, orally administered nimodipine has dose-limiting side-effects such as hypotension, poor absorption and low bioavailability resulting from high first-pass metabolism, and a narrow administration window as food effects lower bioavailability significantly. Due to these issues, blood levels of orally administered nimodipine can be highly variable, making it difficult to manage blood pressure in aSAH patients. Nimodipine capsules are also difficult to administer, particularly to unconscious patients or those with impaired ability to swallow. Concomitant use with CYP3A inhibitors is contraindicated (NIMODIPINE Capsule PI).

NIMOTOP™ is an injectable form of nimodipine that is manufactured by Bayer Healthcare. It is approved in Europe and in other regulated markets (but not in the United States). It has limited utility for aSAH patients because of its high organic solvent content, namely 23.7% ethanol and 17% polyethylene glycol 400 (NIMOTOP SmPC).

18

•GTX-104 is a clinical stage, novel formulation of nimodipine for IV infusion in aSAH patients. It uses surfactant micelles as the drug carrier to solubilize nimodipine. This unique nimodipine injectable formulation is composed of a nimodipine base, an effective amount of polysorbate 80, a non-ionic hydrophilic surfactant, and a pharmaceutically acceptable carrier for injection. GTX-104 is supplied as an aqueous concentrate that upon dilution with saline, dextrose or lactated ringer, is a ready-to-use infusion solution, which is stable and clear.

Key Potential Benefits:

•Novel nanoparticle technology facilitates aqueous formulation of insoluble nimodipine for a safe, standard peripheral IV infusion:

•Better control of blood pressure and improved management of hypotension

•Eliminates food effects that impact the absorption of the oral form of nimodipine

•Lower inter and intra-subject variability as compared to oral nimodipine