0001045942

Track Group, Inc.

false

--09-30

Q3

2023

121,221

102,570

3,772

0

1,916,715

1,829,588

6,214,911

5,950,639

16,852,154

14,804,269

0.0001

0.0001

30,000,000

30,000,000

11,863,758

11,863,758

0.0001

0.0001

20,000,000

20,000,000

0

0

0.0001

0.0001

1,200,000

1,200,000

0

0

3

5

42,864,000

4

4

150,451

42,864,000

0

1,739,745

6.56

6.56

7,514

7,514

5.04

5.04

3,906

3,906

3.50

3.50

6.61

6.61

97

97

2.54

2.54

14,364

14,364

3.12

3.12

101,186

347,198,500

482,965

2,801,500

3,897

19,607,843

27,275

247,999,300

338,954

2,000,700

2,734

14,124,294

19,304

149,794,432

205,330

99,808,328

136,564

210,485

286

500,000,000

678,214

28,248,588

38,317

0

10

540

0

0

0

0

0

2

00010459422022-10-012023-06-30

xbrli:shares

00010459422023-08-01

iso4217:USD

00010459422023-06-30

00010459422022-09-30

0001045942trck:PropertyPlantAndEquipmentExcludingMonitoringEquipmentMember2023-06-30

0001045942trck:PropertyPlantAndEquipmentExcludingMonitoringEquipmentMember2022-09-30

0001045942trck:MonitoringEquipmentMember2023-06-30

0001045942trck:MonitoringEquipmentMember2022-09-30

iso4217:USDxbrli:shares

0001045942trck:SeriesAConvertiblePreferredStockMember2023-06-30

0001045942trck:SeriesAConvertiblePreferredStockMember2022-09-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2023-04-012023-06-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2022-04-012022-06-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2022-10-012023-06-30

0001045942trck:MonitoringAndOtherRelatedServicesMember2021-10-012022-06-30

0001045942trck:ProductSalesAndOtherMember2023-04-012023-06-30

0001045942trck:ProductSalesAndOtherMember2022-04-012022-06-30

0001045942trck:ProductSalesAndOtherMember2022-10-012023-06-30

0001045942trck:ProductSalesAndOtherMember2021-10-012022-06-30

00010459422023-04-012023-06-30

00010459422022-04-012022-06-30

00010459422021-10-012022-06-30

0001045942us-gaap:CommonStockMember2022-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2022-09-30

0001045942us-gaap:RetainedEarningsMember2022-09-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-30

0001045942us-gaap:CommonStockMember2022-10-012022-12-31

0001045942us-gaap:AdditionalPaidInCapitalMember2022-10-012022-12-31

0001045942us-gaap:RetainedEarningsMember2022-10-012022-12-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012022-12-31

00010459422022-10-012022-12-31

0001045942us-gaap:CommonStockMember2022-12-31

0001045942us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001045942us-gaap:RetainedEarningsMember2022-12-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

00010459422022-12-31

0001045942us-gaap:CommonStockMember2023-01-012023-03-31

0001045942us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001045942us-gaap:RetainedEarningsMember2023-01-012023-03-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

00010459422023-01-012023-03-31

0001045942us-gaap:CommonStockMember2023-03-31

0001045942us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001045942us-gaap:RetainedEarningsMember2023-03-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

00010459422023-03-31

0001045942us-gaap:CommonStockMember2023-04-012023-06-30

0001045942us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

0001045942us-gaap:RetainedEarningsMember2023-04-012023-06-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0001045942us-gaap:CommonStockMember2023-06-30

0001045942us-gaap:AdditionalPaidInCapitalMember2023-06-30

0001045942us-gaap:RetainedEarningsMember2023-06-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0001045942us-gaap:CommonStockMember2021-09-30

0001045942us-gaap:AdditionalPaidInCapitalMember2021-09-30

0001045942us-gaap:RetainedEarningsMember2021-09-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-30

00010459422021-09-30

0001045942us-gaap:CommonStockMember2021-10-012021-12-31

0001045942us-gaap:AdditionalPaidInCapitalMember2021-10-012021-12-31

0001045942us-gaap:RetainedEarningsMember2021-10-012021-12-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-10-012021-12-31

00010459422021-10-012021-12-31

0001045942us-gaap:CommonStockMember2021-12-31

0001045942us-gaap:AdditionalPaidInCapitalMember2021-12-31

0001045942us-gaap:RetainedEarningsMember2021-12-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

00010459422021-12-31

0001045942us-gaap:CommonStockMember2022-01-012022-03-31

0001045942us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0001045942us-gaap:RetainedEarningsMember2022-01-012022-03-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

00010459422022-01-012022-03-31

0001045942us-gaap:CommonStockMember2022-03-31

0001045942us-gaap:AdditionalPaidInCapitalMember2022-03-31

0001045942us-gaap:RetainedEarningsMember2022-03-31

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-31

00010459422022-03-31

0001045942us-gaap:CommonStockMember2022-04-012022-06-30

0001045942us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

0001045942us-gaap:RetainedEarningsMember2022-04-012022-06-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-30

0001045942us-gaap:CommonStockMember2022-06-30

0001045942us-gaap:AdditionalPaidInCapitalMember2022-06-30

0001045942us-gaap:RetainedEarningsMember2022-06-30

0001045942us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

00010459422022-06-30

0001045942trck:DebtMaturingInJuly2027Member2023-04-27

0001045942trck:NotesPayableRelatedToConstructionOfMonitoringCentersMember2023-06-30

00010459422021-10-012022-09-30

0001045942trck:StockOptionsAndWarrantsMember2023-06-30

0001045942trck:StockOptionsAndWarrantsMember2022-06-30

0001045942country:US2023-04-012023-06-30

xbrli:pure

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2023-04-012023-06-30

0001045942country:US2022-04-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2022-04-012022-06-30

0001045942srt:LatinAmericaMember2023-04-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembersrt:LatinAmericaMember2023-04-012023-06-30

0001045942srt:LatinAmericaMember2022-04-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembersrt:LatinAmericaMember2022-04-012022-06-30

0001045942trck:OtherThanUnitedStatesAndLatinAmericaMember2023-04-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembertrck:OtherThanUnitedStatesAndLatinAmericaMember2023-04-012023-06-30

0001045942trck:OtherThanUnitedStatesAndLatinAmericaMember2022-04-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembertrck:OtherThanUnitedStatesAndLatinAmericaMember2022-04-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2023-04-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-04-012022-06-30

0001045942country:US2022-10-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2022-10-012023-06-30

0001045942country:US2021-10-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembercountry:US2021-10-012022-06-30

0001045942srt:LatinAmericaMember2022-10-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembersrt:LatinAmericaMember2022-10-012023-06-30

0001045942srt:LatinAmericaMember2021-10-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembersrt:LatinAmericaMember2021-10-012022-06-30

0001045942trck:OtherThanUnitedStatesAndLatinAmericaMember2022-10-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembertrck:OtherThanUnitedStatesAndLatinAmericaMember2022-10-012023-06-30

0001045942trck:OtherThanUnitedStatesAndLatinAmericaMember2021-10-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMembertrck:OtherThanUnitedStatesAndLatinAmericaMember2021-10-012022-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2022-10-012023-06-30

0001045942us-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-10-012022-06-30

utr:Y

0001045942trck:MonitoringEquipmentMembersrt:MinimumMember2022-10-012023-03-31

0001045942trck:MonitoringEquipmentMembersrt:MaximumMember2022-10-012023-03-31

0001045942us-gaap:PatentsMember2023-06-30

0001045942us-gaap:PatentsMember2022-09-30

0001045942us-gaap:DevelopedTechnologyRightsMember2023-06-30

0001045942us-gaap:DevelopedTechnologyRightsMember2022-09-30

0001045942us-gaap:TradeNamesMember2023-06-30

0001045942us-gaap:TradeNamesMember2022-09-30

0001045942us-gaap:CostOfSalesMember2023-04-012023-06-30

0001045942us-gaap:CostOfSalesMember2022-04-012022-06-30

0001045942us-gaap:OperatingExpenseMember2023-04-012023-06-30

0001045942us-gaap:OperatingExpenseMember2022-04-012022-06-30

0001045942us-gaap:CostOfSalesMember2022-10-012023-06-30

0001045942us-gaap:CostOfSalesMember2021-10-012022-06-30

0001045942us-gaap:OperatingExpenseMember2022-10-012023-06-30

0001045942us-gaap:OperatingExpenseMember2021-10-012022-06-30

00010459422022-10-012023-03-31

0001045942trck:MonitoringCenterEquipmentMember2023-06-30

0001045942trck:MonitoringCenterEquipmentMember2022-09-30

00010459422023-01-012023-06-30

00010459422022-01-012022-06-30

0001045942us-gaap:OtherAssetsMember2023-06-30

0001045942us-gaap:OtherAssetsMember2022-09-30

0001045942trck:AccruedLiabilitesMember2023-06-30

0001045942trck:AccruedLiabilitesMember2022-09-30

0001045942trck:RightofuseLiabilityMember2023-06-30

0001045942trck:RightofuseLiabilityMember2022-09-30

00010459422017-09-282017-09-28

0001045942trck:AmendedAgreementWithConrentMember2022-09-30

0001045942trck:AmendedAgreementWithConrentMember2023-06-30

0001045942trck:AmendedAgreementWithConrentMember2021-10-012022-09-30

0001045942trck:AmendedAgreementWithConrentMember2022-10-012023-06-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnFeb62024Member2023-06-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnFeb62024Member2022-09-30

0001045942trck:NotePayableWithBancoSantanderMember2023-06-30

0001045942trck:NotePayableWithBancoSantanderMember2022-09-30

0001045942trck:NotePayableWithBancoEstadoMember2023-06-30

0001045942trck:NotePayableWithBancoEstadoMember2022-09-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnMarch42024Member2023-06-30

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnMarch42024Member2022-09-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnMarch42024Member2023-06-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnMarch42024Member2022-09-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnFeb172025Member2023-06-30

0001045942trck:NotePayableWithBancoDeChileMaturingOnFeb172025Member2022-09-30

0001045942trck:AgreementWithConrentMember2020-12-20

0001045942trck:AgreementWithConrentMember2020-12-21

0001045942trck:AmendedAgreementWithConrentMember2023-04-26

0001045942trck:AmendedAgreementWithConrentMembersrt:ScenarioForecastMember2024-07-02

0001045942trck:AmendedAgreementWithConrentMembersrt:ScenarioForecastMember2025-07-02

0001045942trck:AmendedAgreementWithConrentMembersrt:ScenarioForecastMember2026-07-02

0001045942trck:AgreementWithConrentMember2023-06-30

iso4217:CLP

0001045942trck:ChileanPesosMember2021-01-062021-01-06

00010459422021-01-062021-01-06

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnFeb62024Member2021-01-06

00010459422021-01-122021-01-12

0001045942trck:NotePayableWithBancoSantanderMember2021-01-12

00010459422021-01-12

00010459422021-02-022021-02-02

0001045942trck:NotePayableWithBancoEstadoMember2021-02-02

00010459422021-02-02

00010459422021-02-042021-02-04

0001045942trck:NotePayableWithHpFinancialServicesMaturingOnMarch42024Member2021-02-04

00010459422021-02-052021-02-05

0001045942trck:NotePayableWithBancoDeChileMaturingOnMarch42024Member2021-02-05

0001045942trck:ChileanPesosMember2021-02-152021-02-15

0001045942trck:NotePayableWithBancoDeChileMaturingOnFeb172025Member2021-02-15

0001045942trck:ChileanPesosMember2021-02-15

00010459422021-02-15

0001045942trck:SeriesAConvertiblePreferredStockMember2017-10-12

utr:D

0001045942trck:SeriesAConvertiblePreferredStockMember2022-10-012023-06-30

0001045942trck:The2022PlanMember2023-06-30

0001045942us-gaap:RestrictedStockMember2022-04-132022-04-13

0001045942us-gaap:RestrictedStockMembertrck:The2022PlanMember2023-04-012023-06-30

0001045942us-gaap:RestrictedStockMembertrck:The2022PlanMember2022-04-012022-06-30

0001045942us-gaap:RestrictedStockMembertrck:The2022PlanMember2022-10-012023-06-30

0001045942us-gaap:RestrictedStockMembertrck:The2022PlanMember2021-10-012022-06-30

0001045942trck:StockOptionsAndWarrantsMember2023-04-012023-06-30

0001045942trck:StockOptionsAndWarrantsMember2022-07-012023-06-30

0001045942trck:StockOptionsAndWarrantsMember2022-04-012022-06-30

0001045942trck:StockOptionsAndWarrantsMember2021-10-012022-06-30

0001045942trck:The2012PlanMember2022-10-012023-06-30

0001045942trck:The2012PlanMember2021-10-012022-06-30

0001045942trck:SecureAlertIncVFederalGovernmentOfMexicoMember2017-03-242017-03-24

0001045942trck:JesusValleGonzalezEtalVTrackGroupPuertoRicoMemberus-gaap:PendingLitigationMembersrt:MinimumMember2022-05-092022-05-09

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ____________

Commission file number: 0-23153

Track Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 87-0543981 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

200 E. 5th Avenue Suite 100, Naperville, IL 60563

(Address of principal executive offices) (Zip Code)

(877) 260-2010

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large, accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large, accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock as of August 1, 2023, was 11,863,758.

TRACK GROUP, INC.

FORM 10-Q

For the Quarterly Period Ended June 30, 2023

INDEX

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

TRACK GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | (Unaudited) | | | | | |

| | | June 30, | | | September 30, | |

| | | 2023 | | | 2022 | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash | | $ | 3,814,518 | | | $ | 5,311,104 | |

| Accounts receivable, net of allowance for doubtful accounts of $121,221 and $102,570, respectively | | | 4,343,221 | | | | 6,236,555 | |

| Prepaid expense and deposits | | | 690,102 | | | | 769,006 | |

| Inventory, net of reserves of $3,772 and $0, respectively | | | 1,276,388 | | | | 1,053,245 | |

| Other current assets | | | - | | | | 284,426 | |

| Total current assets | | | 10,124,229 | | | | 13,654,336 | |

| Property and equipment, net of accumulated depreciation of $1,916,715 and $1,829,588, respectively | | | 130,141 | | | | 170,329 | |

| Monitoring equipment, net of accumulated depreciation of $6,214,911 and $5,950,639, respectively | | | 5,473,207 | | | | 3,624,101 | |

| Intangible assets, net of accumulated amortization of $16,852,154 and $14,804,269, respectively | | | 14,681,500 | | | | 15,661,417 | |

| Goodwill | | | 7,970,956 | | | | 8,061,002 | |

| Other assets | | | 2,849,055 | | | | 3,509,655 | |

| Total assets | | $ | 41,229,088 | | | $ | 44,680,840 | |

| | | | | | | | | |

| Liabilities and Stockholders’ Equity (Deficit) | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 2,724,957 | | | $ | 2,858,915 | |

| Accrued liabilities | | | 2,169,972 | | | | 3,042,443 | |

| Current portion of long-term debt | | | 462,577 | | | | 456,681 | |

| Total current liabilities | | | 5,357,506 | | | | 6,358,039 | |

| Long-term debt, net of current portion | | | 42,798,575 | | | | 42,979,243 | |

| Long-term liabilities | | | 291,477 | | | | 398,285 | |

| Total liabilities | | | 48,447,558 | | | | 49,735,567 | |

| | | | | | | | | |

| Commitments and contingencies (Note 23) | | | | | | | | |

| | | | | | | | | |

| Stockholders’ equity (deficit): | | | | | | | | |

| Common stock, $0.0001 par value: 30,000,000 shares authorized; 11,863,758 and 11,863,758 shares outstanding, respectively | | | 1,186 | | | | 1,186 | |

| Preferred stock, $0.0001 par value: 20,000,000 shares authorized; 0 shares outstanding | | | - | | | | - | |

| Series A Convertible Preferred stock, $0.0001 par value: 1,200,000 shares authorized; 0 shares outstanding | | | - | | | | - | |

| Paid in capital | | | 302,576,531 | | | | 302,437,593 | |

| Accumulated deficit | | | (308,364,947 | ) | | | (306,218,889 | ) |

| Accumulated other comprehensive loss | | | (1,431,240 | ) | | | (1,274,617 | ) |

| Total equity (deficit) | | | (7,218,470 | ) | | | (5,054,727 | ) |

| Total liabilities and stockholders’ equity (deficit) | | $ | 41,229,088 | | | $ | 44,680,840 | |

The accompanying notes are an integral part of these condensed consolidated statements.

TRACK GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

|

June 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Monitoring and other related services |

|

$ |

8,539,023 |

|

|

$ |

8,836,622 |

|

|

$ |

25,007,830 |

|

|

$ |

27,148,837 |

|

| Product sales and other |

|

|

158,555 |

|

|

|

137,460 |

|

|

|

853,485 |

|

|

|

905,020 |

|

| Total revenue |

|

|

8,697,578 |

|

|

|

8,974,082 |

|

|

|

25,861,315 |

|

|

|

28,053,857 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Monitoring, products and other related services |

|

|

4,211,807 |

|

|

|

4,200,635 |

|

|

|

11,835,327 |

|

|

|

12,284,432 |

|

| Depreciation and amortization included in cost of revenue |

|

|

821,915 |

|

|

|

809,234 |

|

|

|

2,438,649 |

|

|

|

2,465,998 |

|

| Total cost of revenue |

|

|

5,033,722 |

|

|

|

5,009,869 |

|

|

|

14,273,976 |

|

|

|

14,750,430 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

3,663,856 |

|

|

|

3,964,213 |

|

|

|

11,587,339 |

|

|

|

13,303,427 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| General & administrative |

|

|

2,228,545 |

|

|

|

2,734,162 |

|

|

|

7,852,864 |

|

|

|

8,003,178 |

|

| Selling & marketing |

|

|

717,246 |

|

|

|

778,656 |

|

|

|

2,215,588 |

|

|

|

2,197,237 |

|

| Research & development |

|

|

750,124 |

|

|

|

583,492 |

|

|

|

2,046,701 |

|

|

|

1,799,821 |

|

| Depreciation & amortization |

|

|

247,083 |

|

|

|

400,062 |

|

|

|

742,366 |

|

|

|

1,231,634 |

|

| Total operating expense |

|

|

3,942,998 |

|

|

|

4,496,372 |

|

|

|

12,857,519 |

|

|

|

13,231,870 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income (loss) |

|

|

(279,142 |

) |

|

|

(532,159 |

) |

|

|

(1,270,180 |

) |

|

|

71,557 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(430,824 |

) |

|

|

(450,582 |

) |

|

|

(1,251,349 |

) |

|

|

(1,390,318 |

) |

| Currency exchange rate gain (loss) |

|

|

418,011 |

|

|

|

(750,124 |

) |

|

|

972,953 |

|

|

|

(460,033 |

) |

| Other income, net |

|

|

- |

|

|

|

(1,593,099 |

) |

|

|

- |

|

|

|

(959,628 |

) |

| Total other income (expense) |

|

|

(12,813 |

) |

|

|

(2,793,805 |

) |

|

|

(278,396 |

) |

|

|

(2,809,979 |

) |

| Income (loss) before income tax |

|

|

(291,955 |

) |

|

|

(3,325,964 |

) |

|

|

(1,548,576 |

) |

|

|

(2,738,422 |

) |

| Income tax expense |

|

|

405,229 |

|

|

|

279,095 |

|

|

|

597,482 |

|

|

|

719,718 |

|

| Net income (loss) attributable to common shareholders |

|

|

(697,184 |

) |

|

|

(3,605,059 |

) |

|

|

(2,146,058 |

) |

|

|

(3,458,140 |

) |

| Foreign currency translation adjustments |

|

|

(402,454 |

) |

|

|

(527,431 |

) |

|

|

(156,622 |

) |

|

|

(530,204 |

) |

| Comprehensive income (loss) |

|

$ |

(1,099,638 |

) |

|

$ |

(4,132,490 |

) |

|

$ |

(2,302,680 |

) |

|

$ |

(3,988,344 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share – basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

$ |

(0.06 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.30 |

) |

| Weighted average shares outstanding |

|

|

11,863,758 |

|

|

|

11,566,869 |

|

|

|

11,863,758 |

|

|

|

11,546,673 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share – diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per share |

|

$ |

(0.06 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.30 |

) |

| Weighted average shares outstanding |

|

|

11,863,758 |

|

|

|

11,566,869 |

|

|

|

11,863,758 |

|

|

|

11,546,673 |

|

The accompanying notes are an integral part of these condensed consolidated statements.

TRACK GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

(Unaudited)

| |

|

Common Stock |

|

|

Paid-in |

|

|

Accumulated |

|

|

Comprehensive |

|

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Income (Loss) |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance September 30, 2022 |

|

|

11,863,758 |

|

|

$ |

1,186 |

|

|

$ |

302,437,593 |

|

|

$ |

(306,218,889 |

) |

|

$ |

(1,274,617 |

) |

|

$ |

(5,054,727 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

- |

|

|

|

- |

|

|

|

61,750 |

|

|

|

- |

|

|

|

- |

|

|

|

61,750 |

|

| Foreign currency translation adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

152,246 |

|

|

|

152,246 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

36,384 |

|

|

|

- |

|

|

|

36,384 |

|

| Balance December 31, 2022 |

|

|

11,863,758 |

|

|

$ |

1,186 |

|

|

$ |

302,499,343 |

|

|

$ |

(306,182,505 |

) |

|

$ |

(1,122,371 |

) |

|

$ |

(4,804,347 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

- |

|

|

|

- |

|

|

|

51,459 |

|

|

|

- |

|

|

|

- |

|

|

|

51,459 |

|

| Foreign currency translation adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

93,585 |

|

|

|

93,585 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,485,258 |

) |

|

|

- |

|

|

|

(1,485,258 |

) |

| Balance March 31, 2023 |

|

|

11,863,758 |

|

|

$ |

1,186 |

|

|

$ |

302,550,802 |

|

|

$ |

(307,667,763 |

) |

|

$ |

(1,028,786 |

) |

|

$ |

(6,144,561 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

- |

|

|

|

- |

|

|

|

25,729 |

|

|

|

- |

|

|

|

- |

|

|

|

25,729 |

|

| Foreign currency translation adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(402,454 |

) |

|

|

(402,454 |

) |

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(697,184 |

) |

|

|

- |

|

|

|

(697,184 |

) |

| Balance June 30, 2023 |

|

|

11,863,758 |

|

|

$ |

1,186 |

|

|

$ |

302,576,531 |

|

|

$ |

(308,364,947 |

) |

|

$ |

(1,431,240 |

) |

|

$ |

(7,218,470 |

) |

| |

|

Common Stock |

|

|

Paid-in |

|

|

Accumulated |

|

|

Comprehensive |

|

|

|

|

|

| |

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Income (Loss) |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance September 30, 2021 |

|

|

11,524,978 |

|

|

$ |

1,152 |

|

|

$ |

302,250,954 |

|

|

$ |

(298,828,527 |

) |

|

$ |

(1,054,349 |

) |

|

$ |

2,369,230 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of Common Stock for options/warrants exercised |

|

|

16,474 |

|

|

|

2 |

|

|

|

(2 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Cash received for options/warrants exercised |

|

|

- |

|

|

|

- |

|

|

|

10,570 |

|

|

|

- |

|

|

|

- |

|

|

|

10,570 |

|

| Tax withheld on issuance of Common Stock |

|

|

- |

|

|

|

- |

|

|

|

(3,076 |

) |

|

|

- |

|

|

|

- |

|

|

|

(3,076 |

) |

| Foreign currency translation adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(22,858 |

) |

|

|

(22,858 |

) |

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(305,322 |

) |

|

|

- |

|

|

|

(305,322 |

) |

| Balance December 31, 2021 |

|

|

11,541,452 |

|

|

$ |

1,154 |

|

|

$ |

302,258,446 |

|

|

$ |

(299,133,849 |

) |

|

$ |

(1,077,207 |

) |

|

$ |

2,048,544 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

20,085 |

|

|

|

20,085 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

452,241 |

|

|

|

- |

|

|

|

452,241 |

|

| Balance March 31, 2022 |

|

|

11,541,452 |

|

|

$ |

1,154 |

|

|

$ |

302,258,446 |

|

|

$ |

(298,681,608 |

) |

|

$ |

(1,057,122 |

) |

|

$ |

2,520,870 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of Common Stock for options/warrants exercised |

|

|

37,306 |

|

|

|

4 |

|

|

|

(4 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Tax withheld on issuance of Common Stock |

|

|

- |

|

|

|

- |

|

|

|

(28,368 |

) |

|

|

- |

|

|

|

- |

|

|

|

(28,368 |

) |

| Issuance of Restricted Common Stock to employees for services |

|

|

285,000 |

|

|

|

28 |

|

|

|

(28 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Amortization of equity-based compensation granted to employees |

|

|

- |

|

|

|

- |

|

|

|

94,340 |

|

|

|

- |

|

|

|

- |

|

|

|

94,340 |

|

| Foreign currency translation adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(527,431 |

) |

|

|

(527,431 |

) |

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,605,059 |

) |

|

|

- |

|

|

|

(3,605,059 |

) |

| Balance June 30, 2022 |

|

|

11,863,758 |

|

|

$ |

1,186 |

|

|

$ |

302,324,386 |

|

|

$ |

(302,286,667 |

) |

|

$ |

(1,584,553 |

) |

|

$ |

(1,545,648 |

) |

The accompanying notes are an integral part of these condensed consolidated statements.

TRACK GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| |

|

Nine Months Ended June 30, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows provided by operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,146,058 |

) |

|

$ |

(3,458,140 |

) |

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

3,181,015 |

|

|

|

3,697,632 |

|

| Bad debt expense (recovery) |

|

|

129,714 |

|

|

|

(39,724 |

) |

| Stock based compensation |

|

|

138,938 |

|

|

|

94,340 |

|

| Deferred income tax expense (benefit) |

|

|

(38,259 |

) |

|

|

279,367 |

|

| Loss on monitoring equipment included in cost of revenue |

|

|

381,193 |

|

|

|

218,118 |

|

| Amortization of debt issuance costs |

|

|

120,276 |

|

|

|

105,783 |

|

| Amortization of monitoring center assets included in cost of revenue |

|

|

430,678 |

|

|

|

363,077 |

|

| Income on forgiveness of accrued vendor expense |

|

|

- |

|

|

|

(633,471 |

) |

| Foreign currency exchange (gain)/loss |

|

|

(972,953 |

) |

|

|

460,033 |

|

| Change in assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

1,893,334 |

|

|

|

1,502,015 |

|

| Inventories |

|

|

(223,143 |

) |

|

|

109,934 |

|

| Prepaid expense, deposits and other assets |

|

|

1,062,189 |

|

|

|

(170,821 |

) |

| Accounts payable |

|

|

(133,958 |

) |

|

|

(1,197,458 |

) |

| Accrued liabilities |

|

|

(872,471 |

) |

|

|

(1,142,174 |

) |

| Net cash provided by operating activities |

|

|

2,950,495 |

|

|

|

188,511 |

|

| |

|

|

|

|

|

|

|

|

| Cash flow used in investing activities: |

|

|

|

|

|

|

|

|

| Purchase of property and equipment |

|

|

(27,845 |

) |

|

|

(68,382 |

) |

| Capitalized software |

|

|

(742,276 |

) |

|

|

(560,167 |

) |

| Purchase of monitoring equipment and parts |

|

|

(3,501,359 |

) |

|

|

(2,413,539 |

) |

| Net cash used in investing activities |

|

|

(4,271,480 |

) |

|

|

(3,042,088 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flow used in financing activities: |

|

|

|

|

|

|

|

|

| Principal payments on long-term debt |

|

|

(393,840 |

) |

|

|

(378,775 |

) |

| Payment of deferred financing fees |

|

|

(44,151 |

) |

|

|

- |

|

| Tax withholdings related to net share settlement of equity-based awards |

|

|

- |

|

|

|

(31,444 |

) |

| Proceeds from exercise of stock options |

|

|

- |

|

|

|

10,570 |

|

| Net cash used in financing activities |

|

|

(437,991 |

) |

|

|

(399,649 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

|

262,390 |

|

|

|

(253,803 |

) |

| |

|

|

|

|

|

|

|

|

| Net decrease in cash |

|

|

(1,496,586 |

) |

|

|

(3,507,029 |

) |

| Cash, beginning of period |

|

|

5,311,104 |

|

|

|

8,421,162 |

|

| Cash, end of period |

|

$ |

3,814,518 |

|

|

$ |

4,914,133 |

|

| |

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

1,839,569 |

|

|

$ |

1,855,187 |

|

| Cash paid for taxes |

|

$ |

621,730 |

|

|

$ |

201,956 |

|

The accompanying notes are an integral part of these condensed consolidated statements.

TRACK GROUP, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(1) BASIS OF PRESENTATION

The unaudited interim condensed consolidated financial information of Track Group, Inc. and subsidiaries (collectively, the “Company” or “Track Group”) has been prepared in accordance with the Instructions to Form 10-Q and Article 8 of Regulation S-X promulgated by the Securities and Exchange Commission (“SEC”). Certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted pursuant to such rules and regulations. In the opinion of management, the accompanying interim consolidated financial information contains all adjustments, consisting only of normal recurring adjustments necessary to present fairly the Company’s financial position as of June 30, 2023 and results of its operations for the three and nine months ended June 30, 2023. These financial statements should be read in conjunction with the audited annual consolidated financial statements and notes thereto that are included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2022, filed with the SEC on December 16, 2022. The results of operations for the nine months ending June 30, 2023, may not be indicative of the results for the fiscal year ending September 30, 2023.

As of June 30, 2023 and September 30, 2022, the Company had an accumulated deficit of $308,364,947 and $306,218,889, respectively. The Company had net loss of $2,146,058 and $3,458,140 for the nine months ended June 30, 2023 and 2022, respectively. On April 27, 2023, the Company announced a three-year extension of its $42.9 million debt to July 1, 2027 (See Note 19). The Company also has six notes payable maturing between January 2, 2024, and February 17, 2025, related to the construction of two monitoring centers for a new contract, with outstanding balances due for the six notes totaling $547,603, net of deferred financing fees at June 30, 2023 (See Note 19). The Company’s ability to return to profitable operations is dependent upon generating a level of revenue adequate to support its cost structure, which it achieved on an operating basis in the fiscal year ended September 30, 2021, and was close to achieving in the fiscal year ended September 30, 2022, excluding the approximate $1.7 million asset impairment. Management has evaluated the significance of these conditions, as well as the recent change in the maturity date, and has determined that the Company can meet its operating obligations for a reasonable period. The Company expects to fund operations using cash on hand and through operational cash flows through the upcoming twelve months.

(2) PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of Track Group, Inc. and its active subsidiaries, Track Group Analytics Limited, Track Group Americas, Inc., Track Group International LTD., and Track Group - Chile SpA. All inter-company transactions have been eliminated in consolidation.

(3) RECENT ACCOUNTING STANDARDS

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies, which are adopted by the Company as of the specified effective date. The Company considers the applicability and impact of all Accounting Standards Updates (ASUs) issued by the Financial Accounting Standards Board. ASUs not listed below were assessed and determined to be either not applicable or are expected to have minimal impact on the Company's Consolidated Financial Statements.

Recently Issued Accounting Standards

In January 2017, the FASB issued Accounting Standards Update (“ASU”) 2017-04, “Intangibles – Goodwill and Other: Simplifying the Test for Goodwill Impairment” (“ASU 2017-04”). ASU 2017-04 simplifies the subsequent measurement of goodwill by removing the second step of the two-step impairment test. The amendment requires an entity to perform its annual or interim goodwill impairment test by comparing the fair value of a reporting unit with the carrying amount. An entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. ASU 2017-04 became effective for accelerated filing companies for annual periods or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019 and all other entities should adopt the amendments in ASU 2017-04 for its annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2022. The amendment should be applied on a prospective basis. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The Company will adopt ASU 2017-04 in the fiscal year 2024. The Company has determined this adoption will not have a significant impact on its consolidated financial position, results of operations, or cash flows.

In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-03”). ASU 2016-13 adds a current expected credit loss (“CECL”) impairment model to GAAP that is based on expected losses rather than incurred losses. Modified retrospective adoption is required with any cumulative-effect adjustment recorded to retained earnings as of the beginning of the period of adoption. ASU 2016-13 became effective for fiscal years beginning after December 15, 2019, excluding smaller reporting entities, which will be effective for fiscal years beginning after December 15, 2022. The Company will adopt ASU 2016-13 in fiscal year 2024. The Company does not expect the application of the CECL impairment model to have a significant impact on our allowance for uncollectible amounts for accounts receivable.

(4) IMPAIRMENT OF LONG-LIVED ASSETS

The Company reviews its long-lived assets for impairment when events or changes in circumstances indicate that the book value of an asset may not be recoverable and in the case of goodwill, at least annually. The Company evaluates whether events and circumstances have occurred which indicate possible impairment as of each balance sheet date. If the carrying amount of an asset exceeds its fair value, an impairment charge is recognized for the amount by which the carrying amount exceeds the estimated fair value of the asset. Impairment of long-lived assets is assessed at the lowest levels for which there is an identifiable fair value that is independent of other groups of assets.

(5) BUSINESS COMBINATIONS

The Company accounts for its business acquisitions under the acquisition method of accounting as indicated in Accounting Standards Codification (“ASC”) Topic 805, “Business Combinations” (“ASC 805”), which requires the acquiring entity in a business combination to recognize the fair value of all assets acquired, liabilities assumed and any non-controlling interest in the acquiree and establishes the acquisition date as the fair value measurement point. Accordingly, the Company recognizes assets acquired and liabilities assumed in business combinations, including contingent assets and liabilities and non-controlling interest in the acquiree, based on fair value estimates as of the date of acquisition. In accordance with ASC 805, the Company recognizes and measures goodwill as of the acquisition date, as the excess of the fair value of the consideration paid over the fair value of the identified net assets acquired.

Acquired Assets and Assumed Liabilities

Pursuant to ASC 805-10-25, if the initial accounting for a business combination is incomplete by the end of the reporting period in which the combination occurs, but during the allowed measurement period not to exceed one year from the acquisition date, the Company retrospectively adjusts the provisional amounts recognized at the acquisition date, by means of adjusting the amount recognized for goodwill.

Contingent Consideration

In certain acquisitions, the Company has agreed to pay additional amounts to the seller contingent upon the achievement by the acquired businesses of certain future goals, which may include revenue milestones, new customer accounts and earnings targets. The Company records contingent consideration based on its estimated fair value as of the date of the acquisition. The Company evaluates and adjusts the value of contingent consideration, if necessary, at each reporting period based on the progress toward and likely achievement of certain targets on which issuance of the contingent consideration is based. Any differences between the acquisition-date fair value and the changes in fair value of the contingent consideration subsequent to the acquisition date are recognized in the current period earnings until the arrangement is settled. If there is uncertainty surrounding the value of contingent consideration, then the Company’s policy is to wait until the end of the measurement period before making an adjustment.

(6) ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

Comprehensive income (loss) includes net income (loss) as currently reported under GAAP and other comprehensive income (loss). Other comprehensive income (loss) considers the effects of additional economic events, such as foreign currency translation adjustments, which are not required to be recorded in determining net income (loss), but rather are reported as a separate component of stockholders’ equity. The Chilean Peso, New Israeli Shekel and the Canadian Dollar are used as functional currencies of the following operating subsidiaries: (i) Track Group Chile SpA; (ii) Track Group International Ltd.; and (iii) Track Group Analytics Limited, respectively. The balance sheets of all subsidiaries have been converted into United States Dollars at the prevailing exchange rate at June 30, 2023.

(7) NET INCOME (LOSS) PER COMMON SHARE

Basic net income (loss) per common share (“Basic EPS”) is computed by dividing net income (loss) available to common stockholders by the weighted average number of common shares outstanding during the period.

Diluted net income (loss) per common share (“Diluted EPS”) is computed by dividing net income (loss) attributable to common stockholders by the sum of the weighted-average number of common shares outstanding and the weighted-average dilutive common share equivalents outstanding. The computation of Diluted EPS does not assume exercise or conversion of securities that would have an anti-dilutive effect.

Common share equivalents consist of shares issuable upon the exercise of options to purchase shares of the Company’s common stock, $0.0001 par value per share (“Common Stock”) (“options”) and warrants to purchase Common Stock (“warrants”). As of June 30, 2023 and 2022, there were 4,688 and 327,674 of outstanding common share equivalents that were not included in the computation of Diluted EPS for the nine months ended June 30, 2023, and 2022, respectively, as their effect would be anti-dilutive.

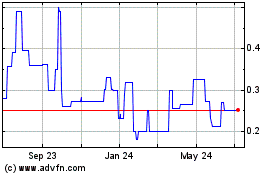

At June 30, 2023 all stock options and warrants had exercise prices that were above the market price of $0.28 and have been excluded from the diluted earnings per share calculations. At June 30, 2022 no options and warrants had exercise prices that were below the market price of $0.70 and have been excluded in the basic and diluted earnings per share calculations.

The common stock equivalents outstanding as of June 30, 2023 and 2022 consisted of the following:

| | | June 30, | | | June 30, | |

| | | 2023 | | | 2022 | |

| Issuable common stock options and warrants | | | 4,688 | | | | 327,674 | |

| Total common stock equivalents | | | 4,688 | | | | 327,674 | |

(8) REVENUE RECOGNITION

Monitoring and Other Related Services. Monitoring services include two components: (i) lease contracts pursuant to which the Company provides monitoring services and lease devices to distributors or end users and the Company retains ownership of the leased device; and (ii) monitoring services purchased by distributors or end users who have previously purchased monitoring devices and opt to use the Company’s monitoring services. Sales of devices and leased GPS devices are required to use the Company’s monitoring service and both the GPS leased devices and monitoring services are accounted for as a single performance obligation. Monitoring revenue is recognized ratably over time, as the customer simultaneously receives and consumes the benefit of these services as they are performed. Payment due or received from the customers prior to rendering the associated services are recorded as deferred revenue.

The balance of accounts receivables at June 30, 2023 of $4,343,221 includes an unbilled balance of $559,205 and the balance of accounts receivable at September 30, 2022 of $6,236,555 included an unbilled balance of $777,514. The balance of accounts receivable at September 30, 2021 of $7,163,615 included an unbilled balance of $420,697. The balances of the deferred revenue at June 30, 2023, September 30, 2022, and September 30, 2021 are $5,702, $3,299, and $22,500, respectively, and were included in accrued liabilities on the Condensed Consolidated Balance Sheets. The Company recognized $3,927 and $7,656, respectively, of deferred revenue in the three and nine months ended June 30, 2023 and recognized $10,512 and $110,027, respectively, of deferred revenue in the three and nine months ended June 30, 2022.

Product Sales and Other. The Company sells devices and replacement parts to customers under certain contracts, as well as law enforcement software licenses and maintenance, and analytical software. Revenue from the sale of devices and parts is recognized upon their transfer of control to the customer, which is generally upon delivery. Delivery is considered complete at either the time of shipment or arrival at destination, based on the agreed upon terms within the contract. Payment terms are generally 30 days from the invoice date.

Multiple Element Arrangements. The majority of our revenue transactions do not have multiple elements. However, on occasion, the Company may enter revenue transactions that have multiple elements. These may include different combinations of products or services that are included in a single billable rate. These products or services are delivered over time as the customer utilizes our services. In cases where obligations in a contract are distinct and thus require separation into multiple performance obligations, revenue recognition guidance requires that contract consideration be allocated to each distinct performance obligation based on its relative standalone selling price. The value allocated to each performance obligation is then recognized as revenue when the revenue recognition criteria for each distinct promise or bundle of promises has been met.

The standalone selling price for each performance obligation is an amount that depicts the amount of consideration to which the entity expects to be entitled in exchange for transferring the good or service. When there is only one performance obligation associated with a contract, the entire sale value is attributed to that obligation. When a contract contains multiple performance obligations the transaction value is first allocated using the observable price, which is generally a list price, net of applicable discount, or the price used to sell in similar circumstances. In circumstances when a selling price is not directly observable, the Company will estimate the standalone selling price using information available to us.

The following table presents the Company’s revenue by geography, based on management’s assessment of available data:

| | | Three Months Ended June 30, 2023 | | | Three Months Ended June 30, 2022 | |

| | | Total Revenue | | | % of Total Revenue | | | Total Revenue | | | % of Total Revenue | |

| | | | | | | | | | | | | | | | | |

| United States | | $ | 6,134,587 | | | | 71 | % | | $ | 6,466,124 | | | | 72 | % |

| Latin America | | | 2,437,040 | | | | 28 | % | | | 2,362,203 | | | | 26 | % |

| Other | | | 125,951 | | | | 1 | % | | | 145,755 | | | | 2 | % |

| Total | | $ | 8,697,578 | | | | 100 | % | | $ | 8,974,082 | | | | 100 | % |

| | | Nine Months Ended June 30, 2023 | | | Nine Months Ended June 30, 2022 | |

| | | Total Revenue | | | % of Total Revenue | | | Total Revenue | | | % of Total Revenue | |

| | | | | | | | | | | | | | | | | |

| United States | | $ | 18,166,817 | | | | 70 | % | | $ | 19,918,449 | | | | 71 | % |

| Latin America | | | 7,023,604 | | | | 27 | % | | | 7,189,118 | | | | 26 | % |

| Other | | | 670,894 | | | | 3 | % | | | 946,290 | | | | 3 | % |

| Total | | $ | 25,861,315 | | | | 100 | % | | $ | 28,053,857 | | | | 100 | % |

The above table includes total revenue for the Company, of which monitoring and other related services is the majority (approximately 97% for the nine months ended June 30, 2023, and approximately 97% for the nine months ended June 30, 2022) of the Company’s revenue. Latin America includes the Bahamas, Chile, Puerto Rico, Panama and the U.S. Virgin Islands, and other includes Canada and Saudi Arabia.

(9) PREPAID EXPENSE AND DEPOSITS

As of June 30, 2023 and September 30, 2022, the outstanding balance of prepaid expense and deposits was $690,102 and $769,006, respectively. These balances are comprised largely of tax deposits, vendor deposits and other prepaid supplier expense.

(10) INVENTORY

Inventory is valued at the lower of the cost or net realizable value. Cost is determined using the first-in/first-out method. Net realizable value is determined based on the item's selling price. Inventory is periodically reviewed in order to identify obsolete or damaged items or impaired values.

Inventory primarily consists of completed circuit boards and other parts used to manufacture new devices. Completed and shipped ReliAlert™ devices are reflected in Monitoring Equipment. As of June 30, 2023 and September 30, 2022, inventory consisted of the following:

| |

|

June 30, 2023 |

|

|

September 30, 2022 |

|

| Monitoring equipment component boards inventory |

|

$ |

1,280,160 |

|

|

$ |

1,053,245 |

|

| Reserve for damaged or obsolete inventory |

|

|

(3,772 |

) |

|

|

- |

|

| Total inventory, net of reserves |

|

$ |

1,276,388 |

|

|

$ |

1,053,245 |

|

The Company uses a third-party fulfillment service provider. As a result of this service, the Company’s employees do not actively assemble new products or repair a significant amount of monitoring equipment shipped directly from suppliers. Purchases of monitoring equipment are recognized directly. Management believes this process reduces maintenance and fulfillment costs associated with inventory and monitoring equipment.

(11) PROPERTY AND EQUIPMENT

Property and equipment consisted of the following as of June 30, 2023 and September 30, 2022:

| | | June 30, 2023 | | | September 30, 2022 | |

| Equipment, software and tooling | | $ | 1,435,992 | | | $ | 1,399,288 | |

| Automobiles | | | 5,039 | | | | 4,187 | |

| Leasehold improvements | | | 385,376 | | | | 380,586 | |

| Furniture and fixtures | | | 220,449 | | | | 215,856 | |

| Total property and equipment before accumulated depreciation | | | 2,046,856 | | | | 1,999,917 | |

| Accumulated depreciation | | | (1,916,715 | ) | | | (1,829,588 | ) |

| Property and equipment, net of accumulated depreciation | | $ | 130,141 | | | $ | 170,329 | |

Property and equipment depreciation expense for the three months ended June 30, 2023 and 2022 was $24,012 and $36,002, respectively. Property and equipment depreciation expense for the nine months ended June 30, 2023 and 2022 was $71,062 and $111,232, respectively. Depreciation expense for property and equipment is recognized in operating expense on the Condensed Consolidated Statements of Operations.

(12) MONITORING EQUIPMENT

The Company leases monitoring equipment to agencies for offender tracking under contractual service agreements. The monitoring equipment is amortized using the straight-line method over an estimated useful life of between three and five years. Monitoring equipment as of June 30, 2023 and September 30, 2022, was as follows:

| | | June 30, 2023 | | | September 30, 2022 | |

| Monitoring equipment | | $ | 11,688,118 | | | $ | 9,574,740 | |

| Less: accumulated depreciation | | | (6,214,911 | ) | | | (5,950,639 | ) |

| Monitoring equipment, net of accumulated depreciation | | $ | 5,473,207 | | | $ | 3,624,101 | |

Depreciation of monitoring equipment for the three months ended June 30, 2023 and 2022 was $387,668 and $343,507, respectively. Depreciation of monitoring equipment for the nine months ended June 30, 2023 and 2022 was $1,141,246 and $1,061,916, respectively. Depreciation expense for monitoring devices is recognized in cost of revenue on the Condensed Consolidated Statements of Operations. During the three months ended June 30, 2023 and 2022, the Company recorded charges of $171,499 and $32,634, respectively, for devices that were lost, stolen or damaged. During the nine months ended June 30, 2023 and 2022, the Company recorded charges of $381,193 and $218,118, respectively, for devices that were lost, stolen or damaged. Lost, stolen and damaged items are included in Monitoring, products & other related service costs in the Condensed Consolidated Statements of Operations.

(13) INTANGIBLE ASSETS

The following table summarizes intangible assets at June 30, 2023 and September 30, 2022, respectively:

| | | June 30, 2023 | | | September 30, 2022 | |

| | | Gross | | | Accumulated Amortization | | | Net | | | Gross | | | Accumulated Amortization | | | Net | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Patent & royalty agreements | | $ | 21,120,565 | | | $ | (14,025,690 | ) | | $ | 7,094,875 | | | $ | 21,120,565 | | | $ | (13,027,465 | ) | | $ | 8,093,100 | |

| Developed technology | | | 10,272,902 | | | | (2,687,662 | ) | | | 7,585,240 | | | | 9,206,006 | | | | (1,649,563 | ) | | | 7,556,443 | |

| Trade name | | | 140,187 | | | | (138,802 | ) | | | 1,385 | | | | 139,115 | | | | (127,241 | ) | | | 11,874 | |

| Total intangible assets | | $ | 31,533,654 | | | $ | (16,852,154 | ) | | $ | 14,681,500 | | | $ | 30,465,686 | | | $ | (14,804,269 | ) | | $ | 15,661,417 | |

The intangible assets summarized above were purchased or developed on various dates from July 2011 through June 30, 2023. Amortization expense for the three months ended June 30, 2023 and 2022 was $657,318 and $829,787, respectively. Amortization expense included in cost of revenue on the Condensed Consolidated Statements of Operations for three months ended June 30, 2023 and 2022 was $434,247 and $465,727, respectively. Amortization expense included in operating expense on the Condensed Consolidated Statements of Operations for three months ended June 30, 2023 and 2022 was $223,071 and $364,060, respectively.

Amortization expense for the nine months ended June 30, 2023 and 2022 was $1,968,707 and $2,524,484, respectively. Amortization expense included in cost of revenue on the Condensed Consolidated Statements of Operations for the nine months ended June 30, 2023 and 2022 was $1,297,403 and $1,404,082, respectively. Amortization expense included in operating expense on the Condensed Consolidated Statements of Operations for nine months ended June 30, 2023 and 2022 was $671,304 and $1,120,402, respectively.

(14) GOODWILL

The following table summarizes the activity of goodwill at June 30, 2023 and September 30, 2022, respectively:

| | | June 30, 2023 | | | September 30, 2022 | |

| | | Beginning of the Year Gross | | | Effect of foreign currency translation on Goodwill | | | End of the Year Gross | | | Beginning of the Year Gross | | | Effect of foreign currency translation on Goodwill | | | End of the Year Gross | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Goodwill Balance | | $ | 8,061,002 | | | $ | (90,046 | ) | | $ | 7,970,956 | | | $ | 8,519,998 | | | $ | (458,996 | ) | | $ | 8,061,002 | |

Goodwill is recognized in connection with acquisition transactions in accordance with ASC 805. The Company performs an impairment test for goodwill annually or more frequently if indicators of potential impairment exist. No impairment of goodwill was recognized through June 30, 2023.

(15) OTHER ASSETS

As of June 30, 2023 and September 30, 2022, the balance of other assets was $2,849,055 and $3,509,655, respectively. Other assets at June 30, 2023 are comprised largely of cash used as collateral for Performance Bonds as well as contractually required monitoring center and other equipment, right of use assets, lease deposits and other long-term assets. The Company anticipates these performance bonds will be reimbursed to the Company upon completion of its contracts with the customer. See Note 23.

The Company was contractually obligated to construct and equip two monitoring centers for an international customer, as well as supply equipment for the customer’s satellite locations, which have been owned by the customer since construction was completed. The monitoring center equipment is amortized using the straight-line method over the contract period between 32 and 40 months. Monitoring center equipment as of June 30, 2023 and September 30, 2022, was as follows:

| | | June 30, 2023 | | | September 30, 2022 | |

| Monitoring center equipment | | $ | 1,829,409 | | | $ | 1,520,115 | |

| Less: accumulated amortization | | | (1,080,298 | ) | | | (524,178 | ) |

| Monitoring center equipment, net of accumulated amortization | | $ | 749,111 | | | $ | 995,937 | |

The Santiago and Puerto Montt monitoring centers amortization is recorded in Monitoring, products and other related service costs on the Condensed Consolidated Statements of Operations. Amortization of costs related to the Santiago and Puerto Montt monitoring centers for the three and nine months ended June 30, 2023, were $150,177 and $430,678, respectively. Amortization of costs related to the monitoring centers for the three and nine months ended June 30, 2022, were $138,887 and $363,077, respectively. The Company recorded revenue from the customer based on a contractually agreed upon unit per day amount during the contract period. See Note 19 for details of the borrowings related to the monitoring centers construction and equipment.

(16) LEASES

Leases as Lessor

Monitoring Equipment and Other Related Services

The Company leases monitoring equipment and provides monitoring services to its customers with contract terms varying from month-to-month to several years and each daily contract price varies. Devices supplied to customers are not serial number unique and a single device may be used by multiple customers over its useful life. If a leased device is returned for repair, it will likely be replaced with a different device from a different customer or possibly a new device.

The Company’s tracking devices are considered operating leases under ASC 842 as transfer of control of the asset does not occur at the end of the lease, a single device is not specific to a customer and devices may be used by multiple customers throughout their life cycle. Due to the movement of devices from customer to customer, relatively few long-term contracts, the measurement of the equipment life and the present value of the equipment’s fair values would not be a measurement to qualify the devices as sales-type leases.

Operating lease and monitoring revenue associated with the Company’s monitoring equipment for the three and nine months ended June 30, 2023 and 2022 are shown in the table below:

| | | Three Months Ended June 30, | | | Nine Months Ended June 30, | |

| | | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| Monitoring equipment operating revenue | | $ | 7,123,377 | | | $ | 7,355,582 | | | $ | 20,928,564 | | | $ | 22,807,064 | |

The Company cannot accurately estimate 5-years of future minimum lease receipts for its devices leased to customers because none of its customers make any contractual commitment regarding the number of active devices utilized in any given year and those quantities of active devices vary significantly for every customer each and every day.

Leases as Lessee

The following table shows right of use assets and lease liabilities for real estate and equipment, with the associated financial statement line items as of June 30, 2023 and September 30, 2022.

| | | June 30, 2023 | | | September 30, 2022 | |

| | | Operating lease asset | | | Operating lease liability | | | Operating lease asset | | | Operating lease liability | |

| | | | | | | | | | | | | | | | | |

| Other assets | | $ | 450,669 | | | | - | | | $ | 575,716 | | | $ | - | |

| Accrued liabilities | | | - | | | | 159,192 | | | | - | | | | 177,431 | |

| Long-term liabilities | | | - | | | | 291,477 | | | | - | | | | 398,285 | |

The following table summarizes the supplemental cash flow information for the nine months ended June 30, 2023 and 2022:

| | | Nine Months Ended June 30, 2023 | | | Nine Months Ended June 30, 2022 | |

| | | | | | | | | |

| Cash paid for noncancelable operating leases included in operating cash flows | | $ | 213,917 | | | $ | 203,953 | |

| Right of use assets obtained in exchange for operating lease liabilities | | $ | 5,150 | | | $ | 496,567 | |

The future minimum lease payments under noncancelable operating leases with terms greater than one year as of June 30, 2023 are:

| | | Operating Leases | |

| From July 2023 to June 2024 | | $ | 174,635 | |

| From July 2024 to June 2025 | | | 104,224 | |

| From July 2025 to June 2026 | | | 93,826 | |

| From July 2026 to June 2027 | | | 95,613 | |

| From July 2027 to June 2028 | | | 16,426 | |

| Undiscounted cash flow | | | 484,724 | |

| Less: imputed interest | | | (34,055 | ) |

| Total | | $ | 450,669 | |

| Reconciliation to lease liabilities: | | | | |

| Lease liabilities - current | | $ | 159,192 | |

| Lease liabilities - long-term | | | 291,477 | |

| Total lease liabilities | | $ | 450,669 | |

The weighted-average remaining lease term and discount rate related to the Company’s lease liabilities as of June 30, 2023 were 3.52 years and 4%, respectively. The Company’s lease discount rates are generally based on the estimates of its incremental borrowing rate as the discount rates implicit in the Company’s leases cannot be readily determined.

(17) ACCRUED LIABILITES

Accrued liabilities consisted of the following as of June 30, 2023 and September 30, 2022:

| |

|

June 30, 2023 |

|

|

September 30, 2022 |

|

| Accrued payroll, taxes and employee benefits |

|

$ |

1,110,962 |

|

|

$ |

1,412,055 |

|

| Deferred revenue |

|

|

5,702 |

|

|

|

3,299 |

|

| Accrued taxes - foreign and domestic |

|

|

286,382 |

|

|

|

371,293 |

|

| Accrued other expense |

|

|

80,686 |

|

|

|

123,752 |

|

| Accrued legal and other professional costs |

|

|

61,302 |

|

|

|

57,905 |

|

| Accrued costs of revenue |

|

|

465,518 |

|

|

|

352,060 |

|

| Right of use liability |

|

|

159,192 |

|

|

|

177,431 |

|

| Deferred financing fees |

|

|

- |

|

|

|

88,685 |

|

| Accrued interest |

|

|

228 |

|

|

|

455,963 |

|

| Total accrued liabilities |

|

$ |

2,169,972 |

|

|