Where Food Comes From, Inc. (WFCF) (Nasdaq: WFCF), the most trusted

resource for independent, third-party verification of food

production practices in North America, today announced financial

results for its second quarter and six-month period ended June 30,

2023.

“We are pleased to announce a solid second quarter highlighted

by 15% revenue growth, a 140% increase in net income and 61% growth

in adjusted EBITDA,” said John Saunders, chairman and CEO. “This

strong performance underscores the resiliency of our company

following a challenging first quarter in which we encountered

several anomalous events that impacted both revenue and

profitability. While we continue to deal with the effects of

inflationary pressures and cyclical cattle trends, we are confident

in our ability to drive long-term growth and profitability based on

the broad scope of our product and service offerings combined and

high customer retention rates. Accordingly, we continued our

aggressive share repurchase program in the second quarter and, over

the past 10 quarters, have returned a total of $7.5 million in

value to stockholders through share buybacks and one special

dividend.

“We also made important additions to our industry-leading

solutions portfolio in the first half of 2023,” Saunders added. “In

the second quarter we were named exclusive third-party verifier for

the Bee Friendly Farming® Certification, a fast-growing program

that supports farmers and ranchers implement regenerative practices

to protect and promote pollinators. That followed our first quarter

announcement that WFCF customer Certified Piedmontese Beef became

the first brand to be certified to PaleoFLEX™, a Paleo Diet

standard that is exclusively administered by Where Food Comes From.

We now certify to 56 different standards – by far the most

comprehensive solutions set in the industry – and have the unique

ability to bundle multiple certifications to drive incremental

revenue while reducing overall costs for our customers.”

Second Quarter Results – 2023 vs. 2022Revenue

in the second quarter ended June 30, 2023, increased 15% year over

year to $6.1 million from $5.3 million.

Revenue mix included:

- Verification and certification services, up 21% to $4.8 million

from $4.0 million.

- Product revenue, up 7% to $0.94 million from $0.88

million.

- Consulting revenue, down 16% to $0.4 million from $0.5

million.

Gross profit in the second quarter increased 18% year over year

to $2.5 million from $2.1 million.

Selling, general and administrative expense was flat year over

year at $1.8 million.

Operating income increased 115% to $0.7 million from $0.3

million in the same quarter last year.

Net income increased 140% year over year to $532,000, or $0.09

per diluted share, from $222,000, or $0.04 per diluted share.

Adjusted EBITDA in the second quarter was up 61% to $917,000

from $570,000.

The Company bought back approximately $836,000 of its common

stock in the second quarter, or 61,000 shares at an average price

of $13.70 per share.

Six Month Results – 2023 vs. 2022Total revenue

in the first half of 2023 decreased 1% to $11.4 million from $11.5

million in the same period last year.

Revenue mix included:

- Verification and certification services, up 11% to $8.6 million

from $7.7 million.

- Product revenue was flat at $1.9 million.

- Consulting revenue, down 52% year over year to $0.9 million

from $1.9 million, due primarily to execution of a large,

non-recurring project with a Japanese government entity in the

first quarter of 2022.

Gross profit in the first half of 2023 was up slightly to $4.6

million from $4.5 million.

Selling, general and administrative expense increased 6% year

over year to $3.8 million from $3.6 million.

Operating income declined 12% year over year to $0.8 million

from $0.9 million.

Net income in the first half was $653,000, or $0.11 per diluted

share, compared to net income of $719,000, or $0.12 per diluted

share, in the same period last year.

Adjusted EBITDA through six months was $1.3 million versus $1.5

million a year ago.

The cash and cash equivalents balance at June 30, 2023, declined

to $3.4 million from $4.4 million at 2022 year-end due primarily to

the Company’s aggressive share repurchase program. Through the

first six months of 2023, the Company bought back more than $2.0

million of its shares.

The Company will conduct a conference call today at 10:00 a.m.

Mountain Time.

Call-in numbers for the conference

call:Domestic Toll Free: 1-877-407-8289International:

1-201-689-8341Conference Code: 13740472

Phone replay:A telephone replay

of the conference call will be available through September 10,

2023, as follows:Domestic Toll Free: 1-877-660-6853International:

1-201-612-7415Conference Code: 13736422

About Where Food Comes From, Inc.Where Food

Comes From, Inc. is America’s trusted resource for third party

verification of food production practices. Through proprietary

technology and patented business processes, the Company

estimates that it supports more than 17,500 farmers, ranchers,

vineyards, wineries, processors, retailers, distributors, trade

associations, consumer brands and restaurants with a wide variety

of value-added services. Through its IMI Global, Validus

Verification Services, SureHarvest, WFCF Organic, and Postelsia

units, Where Food Comes From solutions are used to verify food

claims, optimize production practices and enable food supply chains

with analytics and data driven insights. In addition, the

Company’s Where Food Comes From® retail and restaurant labeling

program uses web-based customer education tools to connect

consumers to the sources of the food they purchase, increasing

meaningful consumer engagement for our clients.

*Note on non-GAAP Financial Measures This press

release and the accompanying tables include a discussion of EBITDA

and Adjusted EBITDA, which are non-GAAP financial measures provided

as a complement to the results provided in accordance with

generally accepted accounting principles ("GAAP"). The term

"EBITDA" refers to a financial measure that we define as earnings

(net income or loss) plus or minus net interest plus taxes,

depreciation and amortization. Adjusted EBITDA excludes from EBITDA

stock-based compensation and, when appropriate, other items that

management does not utilize in assessing WFCF’s operating

performance (as further described in the attached financial

schedules). None of these non-GAAP financial measures are

recognized terms under GAAP and do not purport to be an alternative

to net income as an indicator of operating performance or any other

GAAP measure. We have reconciled Adjusted EBITDA to GAAP net income

in the Consolidated Statements of Income table at the end of this

release. We intend to continue to provide these non-GAAP financial

measures as part of our future earnings discussions and, therefore,

the inclusion of these non-GAAP financial measures will provide

consistency in our financial reporting.

CAUTIONARY STATEMENTThis news release contains

"forward-looking statements" within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995, based on current

expectations, estimates and projections that are subject to risk.

Forward-looking statements are inherently uncertain, and actual

events could differ materially from the Company’s predictions.

Important factors that could cause actual events to vary from

predictions include those discussed in our SEC filings.

Specifically, statements in this news release about industry

leadership, diversity of services mix, potential for consumer

trends to benefit the Company, ability to continue returning value

and delivering positive results for stockholders, and demand for,

and impact and efficacy of, the Company’s products and services on

the marketplace are forward-looking statements that are subject to

a variety of factors, including availability of capital, personnel

and other resources; competition; governmental regulation of the

agricultural industry; the market for beef and other commodities;

and other factors. Financial results for 2023 and the Company’s

pace of stock buybacks are not necessarily indicative of future

results. Readers should not place undue reliance on these

forward-looking statements. The Company assumes no obligation to

update its forward-looking statements to reflect new information or

developments. For a more extensive discussion of the Company’s

business, please refer to the Company’s SEC filings at

www.sec.gov.

Company Contacts:

John SaundersChief Executive Officer303-895-3002

Jay PfeifferDirector, Investor

Relations303-880-9000jpfeiffer@wherefoodcomesfrom.com

|

|

|

|

|

|

|

|

|

|

Where Food Comes From, Inc. |

|

|

|

|

|

|

|

|

Statements of Income (Unaudited) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

(Amounts in thousands, except per share amounts) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Revenues: |

|

|

|

|

|

|

|

| |

Verification and certification service revenue |

$ |

4,779 |

|

|

$ |

3,964 |

|

|

$ |

8,585 |

|

|

$ |

7,748 |

|

| |

Product sales |

|

938 |

|

|

|

878 |

|

|

|

1,909 |

|

|

|

1,885 |

|

| |

Consulting revenue |

|

409 |

|

|

|

489 |

|

|

|

899 |

|

|

|

1,854 |

|

| |

|

Total revenues |

|

6,126 |

|

|

|

5,331 |

|

|

|

11,393 |

|

|

|

11,487 |

|

|

Costs of revenues: |

|

|

|

|

|

|

|

| |

Costs of verification and certification services |

|

2,736 |

|

|

|

2,325 |

|

|

|

4,932 |

|

|

|

4,361 |

|

| |

Costs of products |

|

555 |

|

|

|

522 |

|

|

|

1,123 |

|

|

|

1,059 |

|

| |

Costs of consulting |

|

329 |

|

|

|

354 |

|

|

|

689 |

|

|

|

1,540 |

|

| |

|

Total costs of revenues |

|

3,620 |

|

|

|

3,201 |

|

|

|

6,744 |

|

|

|

6,960 |

|

| |

Gross profit |

|

2,506 |

|

|

|

2,130 |

|

|

|

4,649 |

|

|

|

4,527 |

|

|

Selling, general and administrative expenses |

|

1,833 |

|

|

|

1,817 |

|

|

|

3,821 |

|

|

|

3,591 |

|

|

Income from operations |

|

673 |

|

|

|

313 |

|

|

|

828 |

|

|

|

936 |

|

|

Other income/(expense): |

|

|

|

|

|

|

|

| |

Dividend income from Progressive Beef |

|

50 |

|

|

|

50 |

|

|

|

100 |

|

|

|

100 |

|

| |

Gain on disposal of assets |

|

5 |

|

|

|

- |

|

|

|

5 |

|

|

|

- |

|

| |

Loss on foreign currency exchange |

|

(2 |

) |

|

|

(23 |

) |

|

|

(4 |

) |

|

|

(35 |

) |

| |

Other income, net |

|

11 |

|

|

|

1 |

|

|

|

20 |

|

|

|

1 |

|

| |

Interest expense |

|

(1 |

) |

|

|

(1 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

|

Income before income taxes |

|

736 |

|

|

|

340 |

|

|

|

947 |

|

|

|

1,000 |

|

|

Income tax expense |

|

204 |

|

|

|

118 |

|

|

|

294 |

|

|

|

281 |

|

| |

Net income |

$ |

532 |

|

|

$ |

222 |

|

|

$ |

653 |

|

|

$ |

719 |

|

| |

|

|

|

|

|

|

|

|

|

|

Per share - net income: |

|

|

|

|

|

|

|

| |

Basic |

$ |

0.09 |

|

|

$ |

0.04 |

|

|

$ |

0.12 |

|

|

$ |

0.12 |

|

| |

Diluted |

$ |

0.09 |

|

|

$ |

0.04 |

|

|

$ |

0.11 |

|

|

$ |

0.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

| |

Basic |

|

5,670 |

|

|

|

6,013 |

|

|

|

5,693 |

|

|

|

6,053 |

|

| |

Diluted |

|

5,735 |

|

|

|

6,096 |

|

|

|

5,760 |

|

|

|

6,136 |

|

| |

|

|

|

|

|

|

|

|

|

|

Where Food Comes From,

Inc. |

|

Calculation of Adjusted

EBITDA* |

|

(Unaudited) |

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

|

(Amounts in thousands) |

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

Net income |

$ |

532 |

|

|

$ |

222 |

|

|

$ |

653 |

|

|

$ |

719 |

|

|

Adjustments to EBITDA: |

|

|

|

|

|

|

|

| |

Interest expense |

|

1 |

|

|

|

1 |

|

|

|

2 |

|

|

|

2 |

|

| |

Income tax expense |

|

204 |

|

|

|

118 |

|

|

|

294 |

|

|

|

281 |

|

| |

Depreciation and amortization |

|

163 |

|

|

|

197 |

|

|

|

335 |

|

|

|

392 |

|

|

EBITDA* |

|

900 |

|

|

|

538 |

|

|

|

1,284 |

|

|

|

1,394 |

|

|

Adjustments: |

|

|

|

|

|

|

|

| |

Stock-based compensation |

|

17 |

|

|

|

32 |

|

|

|

32 |

|

|

|

83 |

|

| |

Cost of acquisitions |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

ADJUSTED EBITDA* |

$ |

917 |

|

|

$ |

570 |

|

|

$ |

1,316 |

|

|

$ |

1,477 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

*Use of Non-GAAP Financial Measures: Non-GAAP results are presented

only as a supplement to the financial statements and for use within

management's discussion and analysis based on U.S. generally

accepted accounting principles (GAAP). The non-GAAP financial

information is provided to enhance the reader's understanding of

the Company's financial performance, but non-GAAP measures should

not be considered in isolation or as a substitute for financial

measures calculated in accordance with GAAP. Reconciliations of the

most directly comparable GAAP measures to non-GAAP measures are

provided herein. |

|

|

|

All of the items included in the reconciliation from net income to

EBITDA and from EBITDA to Adjusted EBITDA are either (i) non-cash

items (e.g., depreciation, amortization of purchased intangibles,

stock-based compensation, etc.) or (ii) items that management does

not consider to be useful in assessing the Company's ongoing

operating performance (e.g., M&A costs, income taxes, gain on

sale of investments, loss on disposal of assets, etc.). In the case

of the non-cash items, management believes that investors can

better assess the Company's operating performance if the measures

are presented without such items because, unlike cash expenses,

these adjustments do not affect the Company's ability to generate

free cash flow or invest in its business. |

|

|

|

We use, and we believe investors benefit from the presentation of,

EBITDA and Adjusted EBITDA in evaluating our operating performance

because it provides us and our investors with an additional tool to

compare our operating performance on a consistent basis by removing

the impact of certain items that management believes do not

directly reflect our core operations. We believe that EBITDA is

useful to investors and other external users of our financial

statements in evaluating our operating performance because EBITDA

is widely used by investors to measure a company's operating

performance without regard to items such as interest expense,

taxes, and depreciation and amortization, which can vary

substantially from company to company depending upon accounting

methods and book value of assets, capital structure and the method

by which assets were acquired. |

|

|

|

Because not all companies use identical calculations, the Company's

presentation of non-GAAP financial measures may not be comparable

to other similarly titled measures of other companies. However,

these measures can still be useful in evaluating the Company's

performance against its peer companies because management believes

the measures provide users with valuable insight into key

components of GAAP financial disclosures. |

|

|

|

Where Food Comes From, Inc. |

|

Balance Sheets |

|

|

|

|

|

|

|

| |

|

|

June 30, |

|

December 31, |

|

(Amounts in thousands, except per share amounts) |

|

2023 |

|

|

|

2022 |

|

|

Assets |

(Unaudited) |

|

(Audited) |

|

Current assets: |

|

|

|

| |

Cash and cash equivalents |

$ |

3,410 |

|

|

$ |

4,368 |

|

| |

Accounts receivable, net of allowance |

|

2,205 |

|

|

|

2,172 |

|

| |

Inventory |

|

1,196 |

|

|

|

888 |

|

| |

Prepaid expenses and other current assets |

|

713 |

|

|

|

463 |

|

|

|

|

Total current assets |

|

7,524 |

|

|

|

7,891 |

|

|

Property and equipment, net |

|

860 |

|

|

|

998 |

|

|

Right-of-use assets, net |

|

2,460 |

|

|

|

2,607 |

|

|

Equity investments |

|

1,191 |

|

|

|

991 |

|

|

Intangible and other assets, net |

|

2,179 |

|

|

|

2,340 |

|

|

Goodwill, net |

|

2,946 |

|

|

|

2,946 |

|

|

Deferred tax assets, net |

|

514 |

|

|

|

523 |

|

|

Total assets |

$ |

17,674 |

|

|

$ |

18,296 |

|

| |

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

Current liabilities: |

|

|

|

| |

Accounts payable |

$ |

713 |

|

|

$ |

640 |

|

| |

Accrued expenses and other current liabilities |

|

1,001 |

|

|

|

769 |

|

| |

Deferred revenue |

|

1,841 |

|

|

|

1,278 |

|

| |

Current portion of finance lease obligations |

|

13 |

|

|

|

9 |

|

| |

Current portion of operating lease obligations |

|

323 |

|

|

|

341 |

|

| |

|

Total current liabilities |

|

3,891 |

|

|

|

3,037 |

|

|

Finance lease obligations, net of current portion |

|

48 |

|

|

|

37 |

|

|

Operating lease obligation, net of current portion |

|

2,593 |

|

|

|

2,745 |

|

|

Total liabilities |

|

6,532 |

|

|

|

5,819 |

|

| |

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

| |

|

|

|

|

|

|

Equity: |

|

|

|

| |

Preferred stock, $0.001 par value; 5,000 shares authorized; |

|

|

|

| |

|

none issued or outstanding |

|

- |

|

|

|

- |

|

| |

Common stock, $0.001 par value; 95,000 shares authorized; |

|

|

|

| |

|

6,508 (2023) and 6,501 (2022) shares issued, and |

|

|

|

| |

|

5,631 (2023) and 5,775 (2022) shares outstanding |

|

6 |

|

|

|

6 |

|

| |

Additional paid-in-capital |

|

12,223 |

|

|

|

12,145 |

|

| |

Treasury stock of 877 (2023) and 727 (2022) shares |

|

(9,329 |

) |

|

|

(7,263 |

) |

| |

Retained earnings |

|

8,242 |

|

|

|

7,589 |

|

|

Total equity |

|

11,142 |

|

|

|

12,477 |

|

|

Total liabilities and stockholders' equity |

$ |

17,674 |

|

|

$ |

18,296 |

|

| |

|

|

|

|

|

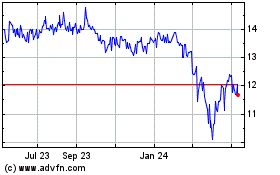

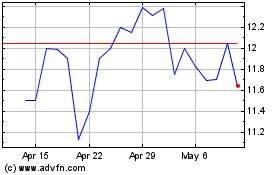

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Where Food Comes From (NASDAQ:WFCF)

Historical Stock Chart

From Apr 2023 to Apr 2024