0001196298

false

0001196298

2023-08-09

2023-08-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 9, 2023

NEPHROS,

INC.

(Exact

name of Registrant as Specified in its Charter)

| Delaware

|

|

001-32288 |

|

13-3971809 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

380

Lackawanna Place, South Orange, New Jersey 07079

(Address

of principal executive offices, including ZIP code)

(201)

343-5202

(Registrant’s

telephone number, including area code)

n/a

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, $0.001 par value |

|

NEPH |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.02 | Results

of Operations and Financial Condition. |

On

August 9, 2023, Nephros, Inc. (the “Company”) issued a press release in which it disclosed its second quarter 2023 financial

results. A copy of this press release is furnished herewith as Exhibit 99.1.

Pursuant

to the rules and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein and in this

Item 2.02 have been furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section nor shall they be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth

by specific reference in such filing regardless of any general incorporation language.

| Item

9.01. | Financial

Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Nephros,

Inc. |

| |

|

|

| Dated:

August 9, 2023 |

By: |

/s/

Andrew Astor |

| |

|

Andrew

Astor |

| |

|

Chief

Financial Officer |

Exhibit

99.1

|

Nephros,

Inc.

380

Lackawanna Place

South

Orange NJ 07079

Call:

201 343 5202

nephros.com |

Nephros

Announces Results for Quarter Ended June 30, 2023

Second-Quarter

Net Revenue of $3.5 Million, a 24% Increase Over 2022;

Year-to-Date Revenue Increases 45%; Maintains Positive Cash Flow Results

SOUTH

ORANGE, NJ, August 9, 2023 – Nephros, Inc. (Nasdaq: NEPH), a leading water technology company providing filtration solutions

to the medical and commercial markets, today announced financial results for the second quarter ended June 30, 2023.

Financial

Highlights*

| ● | Net

revenue from continuing operations of $3.5 million, an increase of 24% |

| ● | Net

loss from continuing operations of $0.4 million, compared to $0.7 million |

| ● | Adjusted

EBITDA from continuing operations of ($0.2 million), compared to ($0.4 million) |

*Stated

performance is relative to same period prior year (second quarter of 2022)

“Last

quarter, Nephros achieved two significant milestones: positive cash flow and record quarterly revenue, representing a 71% year-over-year

increase,” said Robert Banks, President and Chief Executive Officer. “I am pleased to report that in our second quarter,

we maintained positive cash flow and delivered 24% revenue growth year-over-year. I credit much of our success to the implementation

of focused sales strategies and solid execution by our dedicated team. Moving into the second half of the year, I look forward to continuing

high growth rates.”

Andy

Astor, interim Chief Financial Officer commented, “I am also pleased with our second-quarter financial results. Our core business

is stronger than ever, and – coupled with our recent expense reductions – has kept us at cash flow positive status for another

quarter. Additionally, gross margins continued to improve in Q2, increasing from 57% in the first quarter to 59% in the second quarter;

and Active Customer Sites (ACS) increased to 1,427, a 6% year-over-year increase. We expect that net cash flow will remain strong, although

it may fluctuate somewhat, due to working capital usage associated with high revenue growth. Overall, we are confident that the fundamentals

of our business continue to improve, and that our increasing cash balances will be sufficient to fund the company for the foreseeable

future.”

Financial

Performance for the Quarter Ended June 30, 2023

Net

revenue from continuing operations for the quarter ended June 30, 2023, was $3.5 million, compared to $2.9 million in the corresponding

period in 2022, an increase of 24%.

Net

loss from continuing operations for the quarter ended June 30, 2023, was $0.4 million, compared to $0.7 million during the same period

in 2022. The decrease in net loss from continuing operations was driven by increased revenue and gross margins and decreased research

and development costs due to the sale and cessation of our pathogen detection and HDF business areas, respectively.

Adjusted

EBITDA from continuing operations for the quarter ended June 30, 2023, was ($0.2 million), compared to ($0.4 million) during the same

period in 2022.

Cost

of goods sold for the quarters ended June 30, 2023, and June 30, 2022 was $1.5 million. Gross margins for the quarter ended June 30,

2023 were 59%, compared with 49% during the same period in 2022.

|

Nephros,

Inc.

380

Lackawanna Place

South

Orange NJ 07079

Call:

201 343 5202

nephros.com |

Research

and development expenses for the quarter ended June 30, 2023, were $0.2 million, compared with $0.3 million during the quarter ended

June 30, 2022. The decrease in net loss from continuing operations was driven by increased revenue and gross margins and decreased research

and development costs due to the sale and cessation of our pathogen detection and HDF business areas, respectively.

Depreciation

and amortization expenses for the quarter ended June 30, 2023 were approximately $54,000, compared with approximately $51,000 for the

corresponding period in 2022.

Selling,

general and administrative expenses for the quarter ended June 30, 2023, were approximately $2.2 million compared with approximately

$1.9 million for the corresponding period in 2022.

As

of June 30, 2023, Nephros had cash and cash equivalents of $4.1 million.

Adjusted

EBITDA Definition and Reconciliation to GAAP Financial Measures

Adjusted

EBITDA from continuing operations is calculated by taking net loss from continuing operations calculated in accordance with generally

accepted accounting principles (“GAAP”) and excluding all interest-related expenses and income, tax-related expenses and

income, non-recurring expenses and income, and non-cash items, including depreciation, amortization, and non-cash compensation. The following

table presents a reconciliation of Adjusted EBITDA from continuing operations to net loss from continuing operations, the most directly

comparable GAAP financial measure, for the second quarter of the 2023 and 2022 fiscal years:

| | |

Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

(in $ thousands) | | |

| |

| Reconciliation of net loss from continuing operations: | |

| | |

| |

| Net loss from continuing operations | |

| (433 | ) | |

| (747 | ) |

| | |

| | | |

| | |

| Adjustments: | |

| | | |

| | |

| Depreciation of property and equipment | |

| 10 | | |

| 20 | |

| Amortization of other assets | |

| 44 | | |

| 41 | |

| Interest expense | |

| - | | |

| 6 | |

| Interest income | |

| (13 | ) | |

| (1 | ) |

| Non-cash stock-based compensation | |

| 194 | | |

| 258 | |

| | |

| | | |

| | |

| Adjusted EBITDA loss from continuing operations | |

| (198 | ) | |

| (423 | ) |

Nephros

believes that Adjusted EBITDA from continuing operations provides useful information to management and investors regarding certain financial

and business trends relating to Nephros’ financial condition and results of operations. Management does not consider Adjusted EBITDA

from continuing operations in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal

limitation of Adjusted EBITDA from continuing operations is that it excludes significant expenses and income that are required by GAAP

to be recognized in Nephros’ financial statements. In addition, Adjusted EBITDA from continuing operations is subject to inherent

limitations as it reflects the exercise of judgments by management about which expenses and income are excluded or included in determining

Adjusted EBITDA from continuing operations. To compensate for these limitations, management presents Adjusted EBITDA from continuing

operations in connection with net income loss from continuing operations, the most directly comparable GAAP financial measure. Nephros

urges investors to review the reconciliation of Adjusted EBITDA from continuing operations to net income loss from continuing operations

and not to rely on any single financial measure to evaluate the business.

|

Nephros,

Inc. 380

Lackawanna

Place

South

Orange NJ 07079

Call:

201 343 5202

nephros.com |

Conference

Call Today at 4:30pm ET

Nephros

will host a conference call today at 4:30pm ET, during which management will discuss Nephros’ financial results and provide a general

business overview.

Participants

may dial into the call as follows:

Domestic

access: 1 (844) 808-7106

International

access: 1 (412) 317-5285

Upon

joining, please ask to be joined into the Nephros conference call.

An

audio archive of the call will be available shortly after the call on the Nephros Investor Relations page.

Alternatively,

a replay of the call may be accessed until August 16, 2023 at 1 (877) 344-7529 or 1 (412) 317-0088 for international callers and

entering replay access code: 1827043.

About

Nephros

Nephros

is committed to improving the human relationship with water through leading, accessible technology. We provide innovative water filtration

products and services, along with water-quality education, as part of an integrated approach to water safety. Nephros goods serve the

needs of customers within the healthcare and commercial markets, offering both proactive and emergency solutions for water management.

For

more information about Nephros, please visit nephros.com.

Forward-Looking

Statements

This

release contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements regarding

Nephros’ expected future revenue, gross margins, cash flows and expectations on achieving and maintaining positive cash flow and

profitability, including the timing thereof, and other future financial performance, and other statements that are not historical facts,

including statements that may be accompanied by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,”

“believes,” “hopes,” “potential” or similar words. Actual results could differ materially from those

described in these forward-looking statements due to certain factors, including inflationary factors and general economic conditions,

changes in business and competitive conditions, the availability of capital when needed, dependence on third-party manufacturers, distributors

and researchers, and regulatory reforms. These and other risks and uncertainties are detailed in Nephros’ reports filed with the

U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2022, which it may

update in Part II, Item 1A – Risk Factors in its Quarterly Reports on Form 10-Q that it has filed or will file hereafter. Nephros

does not undertake any responsibility to update the forward-looking statements in this release.

Investor

Relations Contacts:

Kirin

Smith, President

PCG Advisory, Inc.

(646) 823-8656

ksmith@pcgadvisory.com

Robert

Banks, CEO

Nephros, Inc.

(201) 343-5202 x110

robert.banks@nephros.com

Andy

Astor, Interim CFO

Nephros, Inc.

(201) 343-5202 x120

andy.astor@nephros.com

|

Nephros,

Inc.

380

Lackawanna Place

South

Orange NJ 07079

Call:

201 343 5202

nephros.com |

NEPHROS,

INC. AND SUBSIDIARIES

CONSOLIDATED

BALANCE SHEETS

(In

thousands, except share and per share amounts)

(Unaudited)

| ASSETS | |

June 30, 2023 | | |

December 31, 2022 | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,060 | | |

$ | 3,634 | |

| Accounts receivable, net | |

| 1,576 | | |

| 1,286 | |

| Inventory | |

| 2,126 | | |

| 3,153 | |

| Prepaid expenses and other current assets | |

| 152 | | |

| 188 | |

| Total current assets | |

| 7,914 | | |

| 8,261 | |

| Property and equipment, net | |

| 98 | | |

| 116 | |

| Lease right-use-of assets | |

| 824 | | |

| 984 | |

| Intangible assets, net | |

| 402 | | |

| 423 | |

| Goodwill | |

| 759 | | |

| 759 | |

| License and supply agreement, net | |

| 335 | | |

| 402 | |

| Other assets | |

| 54 | | |

| 54 | |

| TOTAL ASSETS | |

$ | 10,386 | | |

$ | 10,999 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Current portion of secured note payable | |

$ | - | | |

$ | 71 | |

| Accounts payable | |

| 302 | | |

| 740 | |

| Accrued expenses | |

| 572 | | |

| 285 | |

| Current portion of lease liabilities | |

| 323 | | |

| 316 | |

| Total current liabilities | |

| 1,197 | | |

| 1,412 | |

| Equipment financing, net of current portion | |

| - | | |

| 1 | |

| Lease liabilities, net of current portion | |

| 534 | | |

| 705 | |

| TOTAL LIABILITIES | |

| 1,731 | | |

| 2,118 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| Preferred stock, $.001 par value; 5,000,000 shares authorized at June 30, 2023 and December 31, 2022; no shares issued and outstanding at June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Common stock, $.001 par value; 40,000,000 shares authorized at June 30, 2023 and December 31, 2022; 10,484,932 and 10,297,429 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively | |

| 10 | | |

| 10 | |

| Additional paid-in capital | |

| 152,215 | | |

| 148,413 | |

| Accumulated deficit | |

| (143,570 | ) | |

| (142,831 | ) |

| Subtotal | |

| 8,655 | | |

| 5,592 | |

| Noncontrolling interest | |

| - | | |

| 3,289 | |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 8,655 | | |

| 8,881 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 10,386 | | |

$ | 10,999 | |

|

Nephros,

Inc.

380

Lackawanna Place

South

Orange NJ 07079

Call:

201 343 5202

nephros.com |

NEPHROS,

INC. AND SUBSIDIARIES

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In

thousands, except share and per share amounts)

(Unaudited)

| | |

Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Net revenue: | |

| | | |

| | |

| Product revenues | |

$ | 3,537 | | |

$ | 2,837 | |

| Royalty and other revenues | |

| 8 | | |

| 13 | |

| Total net revenues | |

| 3,545 | | |

| 2,850 | |

| Cost of goods sold | |

| 1,466 | | |

| 1,455 | |

| Gross margin | |

| 2,079 | | |

| 1,395 | |

| Operating expenses: | |

| | | |

| | |

| Selling, general and administrative | |

| 2,239 | | |

| 1,885 | |

| Research and development | |

| 221 | | |

| 273 | |

| Depreciation and amortization | |

| 54 | | |

| 51 | |

| Total operating expenses | |

| 2,514 | | |

| 2,209 | |

| Operating loss from continuing operations | |

| (435 | ) | |

| (814 | ) |

| Other (expense) income: | |

| | | |

| | |

| Interest expense | |

| - | | |

| (6 | ) |

| Interest income | |

| 13 | | |

| 1 | |

| Other (expense) net | |

| (11 | ) | |

| 72 | |

| Total other expense: | |

| 2 | | |

| 67 | |

| Loss from continuing operations | |

| (433 | ) | |

| (747 | ) |

| Net loss from discontinued operations | |

| - | | |

| (390 | ) |

| Net loss | |

| (433 | ) | |

| (1,137 | ) |

| Less: Undeclared deemed dividend attributable to noncontrolling interest | |

| - | | |

| (66 | ) |

| Net loss attributable to Nephros Inc. shareholders | |

$ | (433 | ) | |

$ | (1,203 | ) |

| | |

| | | |

| | |

| Net loss per common share, basic and diluted from continuing operations | |

$ | (0.04 | ) | |

$ | (0.07 | ) |

| Net loss per common share, basic and diluted from discontinued operations | |

| - | | |

| (0.04 | ) |

| Net loss per common share, basic and diluted | |

$ | (0.04 | ) | |

$ | (0.11 | ) |

| Net loss per common share, basic and diluted, attributable to continuing noncontrolling interest | |

| - | | |

| (0.01 | ) |

| | |

| | | |

| | |

| Net loss per common share, basic and diluted, attributable to Nephros, Inc, shareholders | |

$ | (0.04 | ) | |

$ | (0.12 | ) |

| Weighted average common shares outstanding, basic and diluted | |

| 10,297,429 | | |

| 10,299,148 | |

| | |

| | | |

| | |

| Comprehensive loss: | |

| | | |

| | |

| Net loss | |

$ | (433 | ) | |

$ | (1,137 | ) |

| Other comprehensive loss, foreign currency translation adjustments, net of tax | |

| - | | |

| - | |

| Comprehensive loss | |

| (433 | ) | |

| (1,137 | ) |

| Comprehensive loss attributable to continuing noncontrolling interest | |

| - | | |

| (66 | ) |

| Comprehensive loss attributable to Nephros, Inc. shareholders | |

$ | (433 | ) | |

$ | (1,203 | ) |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

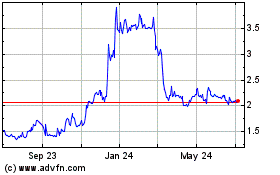

Nephros (NASDAQ:NEPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

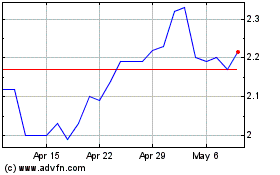

Nephros (NASDAQ:NEPH)

Historical Stock Chart

From Apr 2023 to Apr 2024