0001213037FALSE12/3100012130372023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023

Cardiff Oncology, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-35558 | 27-2004382 |

| (State or other jurisdiction | (Commission File Number) | IRS Employer |

| of incorporation or organization) | | Identification No.) |

11055 Flintkote Avenue

San Diego, CA 92121

(Address of principal executive offices)

Registrant’s telephone number, including area code: (858) 952-7570

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class: | | Trading Symbol(s) | | Name of each exchange on which registered: |

Common Stock | | CRDF | | Nasdaq Capital Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Conditions.

On August 9, 2023, Cardiff Oncology, Inc. issued a press release announcing company highlights and financial results for the second quarter ended June 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

The information disclosed under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as expressly set forth in such filing.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On August 8, 2023, Cardiff Oncology, Inc. (the “Company”) filed, with the Secretary of State of the State of Delaware, a Certificate of Elimination (the “Certificate of Elimination”) of Series B, Series C, Series D and Series E Convertible Preferred Stock removing the designation and other references to its Series B, Series C, Series D and Series E Convertible Stock from the Company’s Amended and Restated Certificate of Incorporation, as amended. The Certificate of Elimination eliminates and returns the 8,860, 200,000, 154,670 and 865,825 shares of preferred stock previously designated as Series B, Series C, Series D and Series E Preferred Stock, respectively, and no longer issued and outstanding, to the status of authorized but unissued shares of preferred stock, without designation.

The foregoing description of the Certificate of Elimination does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Elimination, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: August 9, 2023

| | | | | | | | |

| CARDIFF ONCOLOGY, INC. |

| |

| |

| By: | /s/ Mark Erlander |

| | Mark Erlander |

| | Chief Executive Officer |

CARDIFF ONCOLOGY, INC.

CERTIFICATE OF ELIMINATION

OF

SERIES B, SERIES C, SERIES D AND SERIES E CONVERTIBLE PREFERRED STOCK

Pursuant to Section 151(g) of the General Corporation Law of the State of

Cardiff Oncology, Inc. (the “Company”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), DOES HEREBY CERTIFY:

FIRST. Pursuant to the authority expressly vested in the Board of Directors of the Company (the “Board”) by the Amended and Restated Certificate of Incorporation of the Company, as amended, the Board previously adopted resolutions creating and authorizing the issuance of (i) 8,860 shares of Series B Convertible Preferred Stock (the "Series B Preferred Stock") in accordance with the provisions of the Certificate of Designation of Series B Preferred Stock as filed with the Delaware Secretary of State on June 8, 2018, (ii) 200,000 shares of Series C Convertible Preferred Stock (the "Series C Preferred Stock") in accordance with the provisions of the Certificate of Designation of Series C Preferred Stock as filed with the Delaware Secretary of State on January 25, 2019, as amended by that certain Amendment to Certificate of Designation of Series C Preferred Stock filed on January 28, 2019, (iii) 154,670 shares of Series D Convertible Preferred Stock (the "Series D Preferred Stock") in accordance with the provisions of the Certificate of Designation of Series D Preferred Stock as filed with the Delaware Secretary of State on May 8, 2020 and (iv) 865,824 shares of Series E Convertible Preferred Stock (the "Series E Preferred Stock") in accordance with the provisions of the Certificate of Designation of Series E Preferred Stock as filed with the Delaware Secretary of State on June 16, 2020.

SECOND. Pursuant to Section 151(g) of the DGCL, the Board adopted the following resolutions respecting the Company’s Series B, Series C, Series D and Series E Preferred Stock, which resolutions have not been amended or rescinded:

NOW, THEREFORE, BE IT HEREBY RESOLVED, that the Chief Executive Officer and Chief Financial Officer (each an “Authorized Officer,” and collectively, the “Authorized Officers”) be, and each of them individually hereby is, authorized and empowered, in the name and on behalf of the Company, to prepare and file with the Delaware Secretary of State a Certificate of Elimination or other certificate to remove the designation and other references to the Series B, Series C, Series D and Series E Preferred Stock from the Company’s Amended and Restated Certificate of Incorporation, as amended, that are contained in each of the Certificate of Designation of Series B , Series C, Series D and Series E Preferred Stock, and will eliminate and return the 8,860, 200,000, 154,670 and 865,825 shares of preferred stock previously designated as Series B, Series C, Series D and Series E Preferred Stock, respectively, to the status of authorized but unissued shares of preferred stock, without designation, in a form approved by the Authorized Officer executing the same, such approval to be conclusively evidenced by the Authorized Officer's execution thereof, and one or more amendments thereto, as such Authorized Officer may deem necessary, advisable, or appropriate or as may be required by the Delaware Secretary of State; and be it further

RESOLVED, that effective on and after the date of effectiveness of the Certificate of Amendment, none of the authorized shares of Series B, Series C, Series D and Series E Preferred

Stock are outstanding, and none will be issued subject to the Certificate of Designation of Series B, Series C, Series D and Series E Preferred Stock, previously filed with the Delaware Secretary of State with respect to the Series B, Series C, Series D and Series E Preferred Stock, respectively.

THIRD. In accordance with Section 151(g) of the DGCL, all matters set forth in the previously filed Certificate of Designation of each of Series B, Series C, Series D and Series E Preferred Stock are hereby eliminated.

IN WITNESS WHEREOF, Cardiff Oncology, Inc. has caused this Certificate of Elimination of Series B, Series C, Series D and Series E Preferred Stock to be duly executed by the undersigned duly authorized officer of the Company as of August 8, 2023

| | | | | |

| /s/ Mark Erlander

Name: Mark Erlander Title: CEO |

Cardiff Oncology Reports Second Quarter 2023 Results and Provides Business Update

- New lead program in first-line RAS-mutated metastatic colorectal cancer (mCRC) and expanded Pfizer relationship; interim topline data expected in mid-2024 -

- Advance to first-line mCRC follows strong signal from new clinical and preclinical findings and guidance from FDA, and represents an increased market opportunity -

- Cash, cash equivalents, and short-term investments of approximately $89.4 million as of June 30, 2023, projected runway into 2025 -

SAN DIEGO, August 9, 2023 - Cardiff Oncology, Inc. (Nasdaq: CRDF), a clinical-stage biotechnology company leveraging PLK1 inhibition, a well-validated oncology drug target, to develop novel therapies across a range of cancers, today announced financial results for the second quarter ended June 30, 2023, and provided a business update.

“2023 has been transformative for Cardiff Oncology, highlighted by the advancement of our lead program to the first-line mCRC setting and an expansion of our relationship with Pfizer,” said Mark Erlander, Ph.D., Chief Executive Officer of Cardiff Oncology. “The shifting of our clinical development program to the first-line was a data-driven decision based on a strong signal from new clinical and preclinical findings, with agreement from the FDA. There are 48,000 new patients in the U.S. annually in the first-line RAS-mutated mCRC setting, with no ongoing clinical trials or new treatments approved in the past 20 years. We believe that there is a tremendous opportunity for onvansertib to provide a meaningful benefit to a substantial number of patients who are fighting cancer in challenging indications. Looking ahead, we anticipate commencing enrollment in our first-line trial this fall with interim topline data expected in mid-2024.”

Upcoming expected milestones

•mPDAC data readout from Phase 2 trial expected in Q3 '23

•SCLC data readout from Phase 2 trial expected in Q3 '23 (investigator-initiated trial with UPMC)

•First patient dosed in first-line mCRC trial expected fall ‘23

•TNBC data readout from Phase 1b/2 trial expected Q4 '23/Q1 '24 (investigator-initiated trial with Dana-Farber Cancer Institute)

•First-line mCRC randomized data readout expected in mid-2024

Company highlights for the quarter ended June 30, 2023 and resent announcements

•Announced new lead program in mCRC and expanded Pfizer relationship.

•Cardiff Oncology will initiate a first-line trial, CRDF-004, a Phase 2 randomized trial generating preliminary safety and efficacy data and evaluating two different doses of onvansertib to confirm an optimal dose. Onvansertib will be added to standard-of-care consisting of FOLFIRI plus bevacizumab, or FOLFOX plus bevacizumab.

•Contingent upon the results of CRDF-004, Cardiff Oncology will initiate CRDF-005, a Phase 3, randomized trial with registrational intent. The FDA has agreed that a seamless trial with objective response rate at an interim point is an acceptable endpoint to pursue accelerated approval, with progression-free survival and trend in overall survival being the endpoints for full approval.

•Pfizer Ignite will be responsible for the clinical execution of the CRDF-004 trail, leveraging Pfizer’s significant R&D capabilities, scale and expertise.

•Our new partnership with Pfizer Ignite expands the relationship established in November 2021 when Pfizer made an equity investment in Cardiff Oncology and nominated Adam Schayowitz, Ph.D., Vice President & Medicine Team Group Lead for Breast Cancer, Colorectal Cancer and Melanoma, Pfizer Global Product Development as a Scientific Advisory Board member.

Second Quarter 2023 Financial Results

Liquidity, cash burn, and cash runway

As of June 30, 2023, Cardiff Oncology had approximately $89.4 million in cash, cash equivalents, and short-term investments.

Net cash used in operating activities for the second quarter of 2023 was approximately $7.1 million, an increase of approximately $0.4 million from $6.7 million for the same period in 2022.

Based on its current expectations and projections, the Company believes its current cash resources are sufficient to fund its operations into 2025.

Operating results

Total operating expenses were approximately $12.3 million for the three months ended June 30, 2023, an increase of $1.8 million from $10.5 million for the same period in 2022. The increase in operating expenses was primarily due to higher salaries and staff costs primarily due to increased headcount and stock-based compensation for additional grants to employees.

About Cardiff Oncology, Inc.

Cardiff Oncology is a clinical-stage biotechnology company leveraging PLK1 inhibition, a well-validated oncology drug target, to develop novel therapies across a range of cancers. The Company's lead asset is onvansertib, a PLK1 inhibitor being evaluated in combination with standard-of-care (SoC) therapeutics in clinical programs targeting indications such as RAS-mutated metastatic colorectal cancer (mCRC) and metastatic pancreatic ductal adenocarcinoma (mPDAC), as well as in investigator-initiated trials in triple negative breast cancer (TNBC) and small cell lung cancer (SCLC). These programs and the Company's broader development strategy are designed to target tumor vulnerabilities in order to overcome treatment resistance and deliver superior clinical benefit compared to the SoC alone. For more information, please visit https://www.cardiffoncology.com.

Forward-Looking Statements

Certain statements in this press release are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified using words such as "anticipate," "believe," "forecast," "estimated" and "intend" or other similar terms or expressions that concern Cardiff Oncology's expectations, strategy, plans or intentions. These forward-looking statements are based on Cardiff Oncology's current expectations and actual results could differ materially. There are several factors that could cause actual events to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results; our clinical trials may be suspended or discontinued due to unexpected side effects or other safety risks that could preclude approval of our product candidate; risks related to business interruptions, including the outbreak of COVID-19 coronavirus, which could seriously harm our financial condition and increase our costs and expenses; uncertainties of government or third party payer reimbursement; dependence on key personnel; limited experience in marketing and sales; substantial competition; uncertainties of patent protection and litigation; dependence upon third parties; and risks related to failure to obtain FDA clearances or approvals and noncompliance with FDA regulations. There are no guarantees that our product candidate will be utilized or prove to be commercially successful. Additionally, there are no guarantees that future clinical trials will be completed or successful or that any precision medicine therapeutics will receive regulatory approval for any indication or prove to be commercially successful. Investors should read the risk factors set forth in Cardiff Oncology's Form 10-K for the year ended December 31, 2022, and other periodic reports filed with the Securities and Exchange Commission. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made as of the date hereof, and Cardiff Oncology does not undertake any obligation to update publicly such statements to reflect subsequent events or circumstances.

Cardiff Oncology Contact:

James Levine

Chief Financial Officer

858-952-7670

jlevine@cardiffoncology.com

Investor Contact:

Kiki Patel, PharmD

Gilmartin Group

332-895-3225

Kiki@gilmartinir.com

Media Contact:

Richa Kumari

Taft Communications

551 344-5592

richa@taftcommunications.com

Cardiff Oncology, Inc.

Condensed Statements of Operations

(in thousands, except for per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Royalty revenues | $ | 108 | | | $ | 91 | | | $ | 191 | | | $ | 165 | |

| Costs and expenses: | | | | | | | |

| | | | | | | |

| Research and development | 8,020 | | | 7,448 | | | 17,072 | | | 14,656 | |

| Selling, general and administrative | 4,296 | | | 3,086 | | | 7,379 | | | 7,026 | |

| | | | | | | |

| | | | | | | |

| Total operating expenses | 12,316 | | | 10,534 | | | 24,451 | | | 21,682 | |

| | | | | | | |

| Loss from operations | (12,208) | | | (10,443) | | | (24,260) | | | (21,517) | |

| | | | | | | |

| Interest income, net | 1,053 | | | 253 | | | 1,993 | | | 383 | |

| | | | | | | |

| | | | | | | |

| Other income (expense), net | 5 | | | (253) | | | (106) | | | (302) | |

| Net loss | (11,150) | | | (10,443) | | | (22,373) | | | (21,436) | |

| Preferred stock dividend | (6) | | | (6) | | | (12) | | | (12) | |

| | | | | | | |

| Net loss attributable to common stockholders | $ | (11,156) | | | $ | (10,449) | | | $ | (22,385) | | | $ | (21,448) | |

| | | | | | | |

| Net loss per common share — basic and diluted | $ | (0.25) | | | $ | (0.24) | | | $ | (0.50) | | | $ | (0.50) | |

| | | | | | | |

| | | | | | | |

| Weighted-average shares outstanding — basic and diluted | 44,677 | | | 43,306 | | | 44,677 | | | 43,269 | |

| | | | | | | |

Cardiff Oncology, Inc.

Condensed Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 19,369 | | | $ | 16,347 | |

| Short-term investments | 70,059 | | | 88,920 | |

| Accounts receivable and unbilled receivable | 161 | | | 771 | |

| Prepaid expenses and other current assets | 3,142 | | | 5,246 | |

| Total current assets | 92,731 | | | 111,284 | |

| Property and equipment, net | 1,356 | | | 1,269 | |

| Operating lease right-of-use assets | 1,978 | | | 2,251 | |

| Other assets | 1,390 | | | 1,387 | |

| Total Assets | $ | 97,455 | | | $ | 116,191 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,939 | | | $ | 1,956 | |

| Accrued liabilities | 5,501 | | | 5,177 | |

| | | |

| Operating lease liabilities | 683 | | | 675 | |

| | | |

| Total current liabilities | 9,123 | | | 7,808 | |

| | | |

| | | |

| Operating lease liabilities, net of current portion | 1,753 | | | 2,040 | |

| | | |

| | | |

| Total Liabilities | 10,876 | | | 9,848 | |

| | | |

| Stockholders’ equity | 86,579 | | | 106,343 | |

| Total liabilities and stockholders’ equity | $ | 97,455 | | | $ | 116,191 | |

Cardiff Oncology, Inc.

Condensed Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Operating activities | | | |

| Net loss | $ | (22,373) | | | $ | (21,436) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| | | |

| | | |

| Depreciation | 188 | | | 69 | |

| Stock-based compensation expense | 2,645 | | | 2,207 | |

| Amortization of premiums on short-term investments | (405) | | | 557 | |

| | | |

| Release of clinical trial funding commitment | — | | | 139 | |

| | | |

| | | |

| Changes in operating assets and liabilities | 4,154 | | | 1,520 | |

| Net cash used in operating activities | (15,791) | | | (16,944) | |

| | | |

| Investing activities: | | | |

| Capital expenditures | (259) | | | (412) | |

| Net purchases, maturities and sales of short-term investments | 19,072 | | | 26,378 | |

| Net cash provided by investing activities | 18,813 | | | 25,966 | |

| | | |

| Financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by financing activities | — | | | — | |

| Net change in cash and cash equivalents | 3,022 | | | 9,022 | |

| Cash and cash equivalents—Beginning of period | 16,347 | | | 11,943 | |

| Cash and cash equivalents—End of period | $ | 19,369 | | | $ | 20,965 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

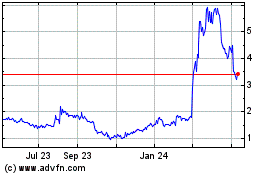

Cardiff Oncology (NASDAQ:CRDF)

Historical Stock Chart

From Mar 2024 to Apr 2024

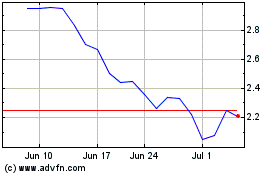

Cardiff Oncology (NASDAQ:CRDF)

Historical Stock Chart

From Apr 2023 to Apr 2024