0001553643

false

0001553643

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): August 8, 2023

RELMADA THERAPEUTICS, INC.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

001-39082 |

|

45-5401931 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

2222 Ponce de Leon Blvd., Floor 3

Coral

Gables, FL |

|

33134 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (786) 629-1376

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common stock, $0.001 par value per share |

|

RLMD |

|

The NASDAQ Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On August 8, 2023, Relmada Therapeutics,

Inc. (the “Company”) issued a press release providing a corporate update and reporting its second quarter 2023 financial results.

(These results are preliminary and unaudited.) The Company also announced that it would conduct a conference call and audio webcast on

August 8, 2023, at 4:30 PM EDT/1:30 PM PDT, to discuss the update and results. The Company’s complete unaudited financial statements

and notes thereto as of, and for the three and six months ended, June 30, 2023 and 2022, will be contained in its Quarterly Report on

Form 10-Q to be filed with the Securities and Exchange Commission. A copy of this press release is attached as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated into this Item 2.02 by reference.

In accordance with General Instruction

B.2 of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K, including the information set forth in Exhibit

99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Dated: August 8, 2023 |

RELMADA THERAPEUTICS, INC. |

| |

|

|

| |

By: |

/s/ Sergio Traversa |

| |

Name: |

Sergio Traversa |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

Relmada

Therapeutics Provides Corporate Update and Reports Second Quarter 2023 Financial Results

CORAL

GABLES, Fla., August 8, 2023 /PRNewswire/ -- Relmada Therapeutics, Inc. (Nasdaq: RLMD), a late-stage biotechnology company addressing

diseases of the central nervous system (CNS), today provided a corporate update and announced preliminary and unaudited financial results

for the second quarter ended June 30, 2023. The Company will host a conference call today, Tuesday,

August 8, at 4:30 PM Eastern Time/1:30 PM Pacific Time.

“We

continue to execute on the Phase 3 clinical development plan for REL-1017 as an adjunctive treatment for major depressive disorder

(MDD)," said Sergio Traversa, Relmada's Chief Executive Officer. “Enrollment in the ongoing Reliance II (study 302) is

progressing as expected, and we remain on track to complete this trial in the first half of 2024. We were also pleased to initiate

Relight, our new Phase 3 Study (study 304), with screening ongoing. We currently anticipate the completion of Relight in the second

half of next year. Moreover, the one year, open-label safety study, Reliance-OLS (study 310), with REL-1017 was recently completed,

and we are preparing for the availability of data from that study during the current quarter.”

“Importantly,

we are sufficiently funded to execute on all of our plans to reach data readouts from both Phase 3 trials, Reliance (study 302) and Relight

(study 304), in 2024,” concluded Mr. Traversa.

Recent

Corporate Highlights

| ● | Enrollment

is ongoing in Reliance II (study 302), a Phase 3 trial of REL-1017 for the adjunctive treatment

of MDD. |

| ● | Screening

has begun in Relight (study 304), a Phase 3 trial of REL-1017 for the adjunctive treatment

of MDD. |

| ● | Data

from the human abuse potential studies of REL-1017 were recently published in the peer-reviewed

journal, Translational Psychiatry. |

| ● | Investigator meetings have been successfully

hosted focusing on our amended and new protocols, quality expectations, increased oversight and engagement, and optimizing clinical execution

for both ongoing Phase 3 studies. |

Upcoming

Anticipated Milestones for REL-1017

| ● | Complete

enrollment in ongoing Reliance II (study 302), which is planned to enroll approximately 300

patients, in the first half of 2024. |

| ● | Complete

enrollment in new Relight study (study 304), which is planned to enroll approximately 300

patients, in the second half of 2024. |

| ● | Announce

results from recently completed Reliance-OLS (study

310), a long-term, open-label study of REL-1017 in MDD, later in the current quarter. |

Second

Quarter 2023 Financial Results

| ● | Research

and development expense for the three months ended June 30, 2023, totaled $13.7 million,

compared to $30.9 million for the three months ended June 30, 2022. The decrease was primarily

associated with the completion of the Reliance I and Reliance III clinical studies in late

2022. |

| ● | General

and administrative expense for the three months ended June 30, 2023, totaled $12.3 million,

compared to $14.6 million for the three months ended June 30, 2022. The decrease was primarily

driven by a decrease in stock-based compensation. |

| ● | Net

loss for the three months ended June 30, 2023, was $25.3 million, or $0.84 per basic and

diluted share, compared with a net loss of $39.9 million, or $1.33 per basic and diluted

share, for the three months ended June 30, 2022. |

Six

Months Ended June 30, 2023 Financial Results

| ● | Research

and development expense for the six months ended June 30, 2023, totaled $29.6 million, compared

to $55.9 million for the six months ended June 30, 2022. The

decrease was primarily driven by a decrease in study costs associated with the completion

of Reliance I and III in late 2022. |

| ● | General

and administrative expense for the six months ended June 30, 2023, totaled $24.6 million,

compared to $27.9 million for the six months ended June 30, 2022. The

decrease was primarily driven by a decrease in stock-based compensation. |

| ● | Net

loss for the six months ended June 30, 2023 and 2022 was $51.6 million and $79.7 million,

respectively. The Company had a net loss of $1.72 and $2.73 per share for the six months

ended June 30, 2023 and 2022, respectively. |

| ● | As

of June 30, 2023, the Company had cash, cash equivalents, and short-term investments of approximately

$118.5 million, compared to cash, cash equivalents, and short-term investments of approximately

$148.3 million at December 31, 2022. |

Conference

Call and Webcast Details

Tuesday,

August 8 at 4:30 PM ET

| Toll

Free: |

877-407-0792 |

| International: |

201-689-8263 |

| Conference

ID: |

13740070 |

| Webcast: |

|

https://viavid.webcasts.com/starthere.jsp?ei=1624681&tp_key=1f9f03a8ac

About

REL-1017

REL-1017,

a new chemical entity (NCE) and novel NMDA receptor (NMDAR) channel blocker that preferentially targets hyperactive channels while maintaining

physiological glutamatergic neurotransmission, is currently in late-stage development for the adjunctive treatment of major depressive

disorder (MDD). The ongoing Clinical Research Program is designed to evaluate the potential for REL-1017 as a rapid-acting, oral, once-daily

antidepressant treatment.

About

Relmada Therapeutics, Inc.

Relmada

Therapeutics is a late-stage biotechnology company addressing diseases of the central nervous system (CNS), with a focus on major depressive

disorder (MDD). Relmada's experienced and dedicated team is committed to making a difference in the lives of patients and their families.

Relmada's lead program, REL-1017, is a new chemical entity (NCE) and novel NMDA receptor (NMDAR) channel blocker that preferentially

targets hyperactive channels while maintaining physiological glutamatergic neurotransmission. REL-1017 is in late-stage development as

an adjunctive treatment for MDD in adults. Learn more at www.relmada.com.

Forward-Looking

Statements

The

Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. This

press release contains statements which constitute "forward-looking statements" within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statement that is not historical in nature is a forward-looking

statement and may be identified by the use of words and phrases such as "expects," "anticipates," "believes,"

"will," "will likely result," "will continue," "plans to," "potential," "promising,"

and similar expressions. These statements are based on management's current expectations and beliefs and are subject to a number of risks,

uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements,

including potential failure of clinical trial results to demonstrate statistically and/or clinically significant evidence of efficacy and/or

safety, failure of top-line results to accurately reflect the complete results of the trial, failure to obtain regulatory approval of

REL-1017 for the treatment of major depressive disorder, and the other risk factors described under the heading "Risk Factors"

set forth in the Company's reports filed with the SEC from time to time. No forward-looking statement can be guaranteed, and actual results

may differ materially from those projected. Relmada undertakes no obligation to publicly update any forward-looking statement, whether

as a result of new information, future events, or otherwise. Readers are cautioned that it is not possible to predict or identify all

the risks, uncertainties and other factors that may affect future results and that the risks described herein should not be a complete

list.

Investor

Contact:

Tim

McCarthy

LifeSci

Advisors

tim@lifesciadvisors.com

Media

Inquiries:

Corporate

Communications

media@relmada.com

Relmada

Therapeutics, Inc.

Condensed

Consolidated Balance Sheets

| | |

As of

June 30,

2023

(unaudited) | | |

As of

December 31,

2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 14,469,354 | | |

$ | 5,395,905 | |

| Short-term investments | |

| 104,059,737 | | |

| 142,926,781 | |

| Other receivables | |

| - | | |

| 512,432 | |

| Prepaid expenses | |

| 3,474,540 | | |

| 4,035,186 | |

| Total current assets | |

| 122,003,631 | | |

| 152,870,304 | |

| Other assets | |

| 34,590 | | |

| 34,875 | |

| Total assets | |

$ | 122,038,221 | | |

$ | 152,905,179 | |

| | |

| | | |

| | |

| Commitments and Contingencies (See Note 6) | |

| | | |

| | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,853,616 | | |

$ | 5,261,936 | |

| Accrued expenses | |

| 5,848,850 | | |

| 7,206,941 | |

| Total current liabilities | |

| 10,702,466 | | |

| 12,468,877 | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Class A convertible preferred stock, $0.001 par value, 3,500,000 shares authorized, none issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value, 150,000,000 shares authorized, 30,099,203 shares issued and outstanding | |

| 30,099 | | |

| 30,099 | |

| Additional paid-in capital | |

| 625,041,121 | | |

| 602,517,138 | |

| Accumulated deficit | |

| (513,735,465 | ) | |

| (462,110,935 | ) |

| Total stockholders’ equity | |

| 111,335,755 | | |

| 140,436,302 | |

| Total liabilities and stockholders’ equity | |

$ | 122,038,221 | | |

$ | 152,905,179 | |

Relmada

Therapeutics, Inc.

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

Three months ended | | |

Six months ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expenses: | |

| | |

| | |

| | |

| |

| Research and development | |

$ | 13,740,205 | | |

$ | 30,912,671 | | |

$ | 29,601,215 | | |

$ | 55,925,524 | |

| General and administrative | |

| 12,286,521 | | |

| 14,599,401 | | |

| 24,579,120 | | |

| 27,883,971 | |

| Total operating expenses | |

| 26,026,726 | | |

| 45,512,072 | | |

| 54,180,335 | | |

| 83,809,495 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (26,026,726 | ) | |

| (45,512,072 | ) | |

| (54,180,335 | ) | |

| (83,809,495 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (expenses) income: | |

| | | |

| | | |

| | | |

| | |

| Gain on Settlement | |

| - | | |

| 6,351,606 | | |

| | | |

| 6,351,606 | |

| Interest/investment income, net | |

| 1,363,406 | | |

| 387,333 | | |

| 2,571,037 | | |

| 717,282 | |

| Realized (loss) gain on short-term investments | |

| - | | |

| 24,502 | | |

| (666,708 | ) | |

| 9,480 | |

| Unrealized (loss) gain on short-term investments | |

| (639,634 | ) | |

| (1,186,337 | ) | |

| 651,476 | | |

| (2,949,624 | ) |

| Total other (expenses) income | |

| 723,772 | | |

| 5,577,104 | | |

| (2,555,805 | ) | |

| 4,128,744 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (25,302,954 | ) | |

$ | (39,934,968 | ) | |

$ | (51,624,530 | ) | |

$ | (79,680,751 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per common share – basic and diluted | |

$ | (.84 | ) | |

$ | (1.33 | ) | |

$ | (1.72 | ) | |

$ | (2.73 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding – basic and diluted | |

| 30,099,203 | | |

| 29,935,895 | | |

| 30,099,203 | | |

| 29,168,511 | |

Relmada

Therapeutics, Inc.

Condensed

Consolidated Statements of Stockholders’ Equity

(Unaudited)

| | |

Three and Six months ended June 30, 2023 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Total | |

| Balance – December 31, 2022 | |

| 30,099,203 | | |

$ | 30,099 | | |

$ | 602,517,138 | | |

$ | (462,110,935 | ) | |

$ | 140,436,302 | |

| Stock based compensation | |

| - | | |

| - | | |

$ | 11,354,466 | | |

| - | | |

| 11,354,466 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (26,321,576 | ) | |

| (26,321,576 | ) |

| Balance – March 31, 2023 | |

| 30,099,203 | | |

| 30,099 | | |

| 613,871,604 | | |

| (488,432,511 | ) | |

| 125,469,192 | |

| Stock based compensation | |

| - | | |

| - | | |

| 11,169,517 | | |

| - | | |

| 11,169,517 | |

| Net loss | |

| - | | |

| | | |

| - | | |

| (25,302,954 | ) | |

| (25,302,954 | ) |

| Balance – June 30, 2023 | |

| 30,099,203 | | |

$ | 30,099 | | |

$ | 625,041,121 | | |

$ | (513,735,465 | ) | |

$ | 111,335,755 | |

| | |

Three and Six months ended June 30, 2022 | |

| | |

Common Stock | | |

Additional

Paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Par Value | | |

Capital | | |

Deficit | | |

Total | |

| Balance - December 31, 2021 | |

| 27,740,147 | | |

$ | 27,740 | | |

$ | 513,304,258 | | |

$ | (305,067,112 | ) | |

$ | 208,264,886 | |

| Stock based compensation | |

| - | | |

| - | | |

| 11,930,681 | | |

| - | | |

| 11,930,681 | |

| ATM offering, net | |

| 1,609,343 | | |

| 1,610 | | |

| 29,581,932 | | |

| - | | |

| 29,583,542 | |

| Warrant exercised for cash | |

| 33,334 | | |

| 33 | | |

| 299,973 | | |

| - | | |

| 300,006 | |

| Options exercised for cash | |

| 20,000 | | |

| 20 | | |

| 64,780 | | |

| - | | |

| 64,800 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (39,745,783 | ) | |

| (39,745,783 | ) |

| Balance – March 31, 2022 | |

| 29,402,824 | | |

| 29,403 | | |

| 555,181,624 | | |

| (344,812,895 | ) | |

| 210,398,132 | |

| Stock based compensation | |

| - | | |

| - | | |

| 12,295,016 | | |

| - | | |

| 12,295,016 | |

| Warrant exercised for cash | |

| 91,058 | | |

| 91 | | |

| 595,259 | | |

| - | | |

| 595,350 | |

| Options exercised for cash | |

| 45,812 | | |

| 46 | | |

| 352,698 | | |

| - | | |

| 352,744 | |

| ATM offering, net of offering costs | |

| 484,900 | | |

| 485 | | |

| 13,144,572 | | |

| - | | |

| 13,145,057 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| (39,934,968 | ) | |

| (39,934,968 | ) |

| Balance – June 30, 2022 | |

| 30,024,594 | | |

$ | 30,025 | | |

$ | 581,569,169 | | |

$ | (384,747,863 | ) | |

$ | 196,851,331 | |

Relmada

Therapeutics, Inc.

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

Six months ended

June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities | |

| | |

| |

| Net loss | |

$ | (51,624,530 | ) | |

$ | (79,680,751 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 22,523,983 | | |

| 24,225,697 | |

| Gain on settlement of fees | |

| - | | |

| (6,351,606 | ) |

| Realized loss (gain) on short-term investments | |

| 666,708 | | |

| (9,480 | ) |

| Unrealized (gain) loss on short-term investments | |

| (651,476 | ) | |

| 2,949,624 | |

| Change in operating assets and liabilities: | |

| | | |

| | |

| Lease payment receivable | |

| - | | |

| 44,143 | |

| Other receivables | |

| 512,432 | | |

| (256,192 | ) |

| Prepaid expenses and other assets | |

| 560,931 | | |

| 7,810,846 | |

| Accounts payable | |

| (408,320 | ) | |

| 2,698,790 | |

| Accrued expenses | |

| (1,358,091 | ) | |

| 7,513,045 | |

| Net cash (used in) operating activities | |

| (29,778,363 | ) | |

| (41,055,884 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of short-term investments | |

| (45,577,832 | ) | |

| (33,412,425 | ) |

| Sale of short-term investments | |

| 84,429,644 | | |

| 23,244,237 | |

| Net cash provided by (used in) investing activities | |

| 38,851,812 | | |

| (10,168,188 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from issuance of common stock, net | |

| - | | |

| 42,728,599 | |

| Proceeds from options exercised for common stock | |

| - | | |

| 417,544 | |

| Proceeds from warrants exercised for common stock | |

| - | | |

| 895,356 | |

| Net cash provided by financing activities | |

| - | | |

| 44,041,499 | |

| Net increase/(decrease) in cash and cash equivalents | |

| 9,073,449 | | |

| (7,182,573 | ) |

| Cash and cash equivalents at beginning of the period | |

| 5,395,905 | | |

| 44,443,439 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of the period | |

$ | 14,469,354 | | |

$ | 37,260,866 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | - | | |

$ | - | |

| Income Tax | |

$ | - | | |

$ | - | |

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity File Number |

001-39082

|

| Entity Registrant Name |

RELMADA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001553643

|

| Entity Tax Identification Number |

45-5401931

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2222 Ponce de Leon Blvd.

|

| Entity Address, Address Line Two |

Floor 3

|

| Entity Address, City or Town |

Coral

Gables

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33134

|

| City Area Code |

(786)

|

| Local Phone Number |

629-1376

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

RLMD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

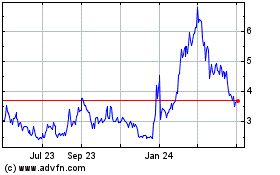

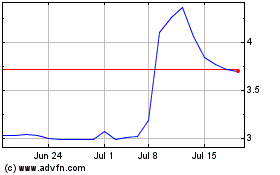

Relmada Therapeutics (NASDAQ:RLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Relmada Therapeutics (NASDAQ:RLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024