0001316517

false

CN

0001316517

2023-08-08

2023-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2023

KANDI TECHNOLOGIES GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-33997 |

|

90-0363723 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification) |

Jinhua New Energy Vehicle Town

Jinhua, Zhejiang Province

People’s Republic of China

Post Code 321016

(Address of principal executive offices) (Zip Code)

(86-579) 8223-9700

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

KNDI |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On August 8, 2023, Kandi Technologies

Group, Inc. (the “Company”) issued an earnings release announcing certain financial results for the quarter ended June 30,

2023. A copy of the earnings release is attached hereto as Exhibit 99.1.

The information contained in

this Item 2.02 is not “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and is not deemed incorporated by reference by any general statements incorporating by reference this report or future filings into any

filings under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates

the information by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

KANDI TECHNOLOGIES GROUP, INC. |

| |

|

|

| Date: August 8, 2023 |

By: |

/s/ Dong Xueqin |

| |

Name: |

Dong Xueqin |

| |

Title: |

Chief Executive Officer |

2

Exhibit

99.1

Kandi

Technologies Reports Second Quarter 2023 Financial Results

Strategic product transformation has borne

fruitful outcomes, leading to a remarkable turnaround to profitability

JINHUA, China, Aug. 08, 2023 (GLOBE NEWSWIRE)

-- Kandi Technologies Group, Inc. (the “Company”, “we” or “Kandi”) (NASDAQ GS: KNDI), today announced

its financial results for the second quarter of 2023.

Second Quarter Highlights

| ● | Total

revenues of $36.0 million increased by 72.5% year-over-year. |

| ● | Gross

profit of $13.7 million and gross margin of 38.2%, compared to gross profit of $2.7 million

and gross margin of 13.0% in the same period of 2022. |

| ● | Net

income was $4.4 million, or $0.06 income per fully diluted share, compared to a net loss

of $1.9 million, or $0.02 loss per fully diluted share for the same period of 2022. |

| ● | Cash

and equivalents, restricted cash, and certificate of deposit totaled $232.5 million as of

June 30, 2023. |

Dr.

Xueqin Dong, CEO of Kandi commented, “The Company's efforts invested in product transformation over the past few years have finally

borne fruit this year, leading to a successful turnaround from losses to profits. Net income reached $4.4 million, demonstrating

a significant recovery from the challenges we faced in the prior years. The continued growth of gross profit reflects our commitment

to drive our product mix toward higher-profit and more rapidly growing categories. The success of our all-electric off-road vehicles

is the driving force behind our sales recovery and return to profitability. We see immense potential in the US off-road vehicle market,

and we are dedicated to expanding our product offerings to meet the evolving demands of our customers.”

Q2 2023 Financial Results

Net Revenues and Gross Profit (in USD millions)

| | |

Q2 2023 | | |

Q2 2022 | | |

Y-o-Y% | |

| Net Revenues | |

$ | 36.0 | | |

$ | 20.8 | | |

| +72.5 | % |

| Gross Profit | |

$ | 13.7 | | |

$ | 2.7 | | |

| +405.2 | % |

| Gross Margin% | |

| 38.2 | % | |

| 13.0 | % | |

| - | |

Net revenues of $36.0 million increased by

72.5% from the same period of 2022. Kandi’s focus on innovation, production, and commercialization of electric off-road vehicles

-- particularly crossover golf carts, go karts, and all-terrain vehicles or ATVs -- boosted sales of off-road vehicles and associated

parts to achieve its largest proportion ever of quarterly sales. Gross margin grew versus the year-earlier period because of the greater

profitability of off-road vehicles, with crossover golf carts being a significant contributor to this increase.

Operating Income/Loss (in USD millions)

| | |

Q2 2023 | | |

Q2 2022 | | |

Y-o-Y% | |

| Operating Expenses | |

$ | (14.0 | ) | |

$ | (9.0 | ) | |

| +55.1 | % |

| Loss from Operations | |

$ | (0.2 | ) | |

$ | (6.3 | ) | |

| -96.4 | % |

| Operating Margin% | |

| -0.6 | % | |

| -30.1 | % | |

| - | |

Operating expenses rose to $14.0 million from

$9.0 million in the same period of 2022. While operating expenses were up, significantly higher gross profits resulted in improvement

in operating income. The rise in operating expenses can be attributed mainly to increased sales and marketing expenses associated with

increasing number of electric off-road vehicles exported to the U.S. market, and higher general and administration expenses due to increased

stock-based compensation.

Net Income/Loss (in USD millions)

| | |

Q2 2023 | | |

Q2 2022 | | |

Y-o-Y% | |

| Net Income (Loss) | |

$ | 4.4 | | |

$ | (1.9 | ) | |

| -333.9 | % |

| Net Income (Loss) per Share, Basic and Diluted | |

$ | 0.06 | | |

$ | (0.02 | ) | |

| - | |

Net income was $4.4 million, a noteworthy

improvement compared to a net loss of $1.9 million during the same period in 2022. The primary factor for the swing to profit was the

better gross margins.

Second Quarter 2023 Conference Call

Details

The Company has scheduled a conference call

and live webcast to discuss its financial results at 8:00 A.M. Eastern Time (8:00 P.M. Beijing Time) on Tuesday, Aug 8, 2023. Management

will deliver prepared remarks to be followed by a question-and-answer session.

The dial-in details for the conference call

are as follows:

| ● | Toll-free

dial-in number: +1-877-407-3982 |

| ● | International

dial-in number: + 1-201-493-6780 |

| ● | Webcast

and replay: https://viavid.webcasts.com/starthere.jsp?ei=1627967&tp_key=83400af773 |

The live audio webcast of the call can also

be accessed by visiting Kandi's Investor Relations page on the Company's website at http://www.kandivehicle.com. An archive of the

webcast will be available on the Company's website following the live call.

About Kandi Technologies Group, Inc.

Kandi Technologies Group, Inc. (KNDI), headquartered

in Jinhua Economic Development Zone, Zhejiang Province, is engaged in the research, development, manufacturing, and sales of various vehicular

products. Kandi conducts its primary business operations through its wholly-owned subsidiary, Zhejiang Kandi Technologies Group Co., Ltd.

(“Zhejiang Kandi Technologies”), formerly, Zhejiang Kandi Vehicles Co., Ltd. and its subsidiaries including Zhejiang Kandi

Smart Battery Swap Technology Co., Ltd, and SC Autosports, LLC (d/b/a Kandi America), the wholly-owned subsidiary of Kandi in the United

States, and its wholly-owned subsidiary, Kandi America Investment, LLC. Zhejiang Kandi Technologies has established itself as one of China's

leading manufacturers of pure electric vehicle parts and off-road vehicles.

Safe Harbor Statement

This press release contains certain statements

that may include "forward-looking statements." All statements other than statements of historical fact included herein are "forward-looking

statements." These forward-looking statements are often identified by the use of forward-looking terminology such as "believes,"

"expects" or similar expressions, involving known and unknown risks and uncertainties. Although the Company believes that the

expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of

the date of this press release. The Company's actual results could differ materially from those anticipated in these forward-looking statements

as a result of a variety of factors, including the risk factors discussed in the Company's periodic reports that are filed with the Securities

and Exchange Commission and available on the SEC's website (http://www.sec.gov). All forward-looking statements attributable to the Company

or persons acting on its behalf are expressly qualified in their entirety by these risk factors. Other than as required under the applicable

securities laws, the Company does not assume a duty to update these forward-looking statements.

Follow us on Twitter: @ Kandi_Group

Contacts:

Kandi Technologies Group, Inc.

Ms. Kewa Luo

+1 (212) 551-3610

IR@kandigroup.com

The Blueshirt Group

Mr. Gary Dvorchak, CFA

gary@blueshirtgroup.com

- Tables Below -

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

June 30,

2023 | | |

December 31,

2022 | |

| | |

(Unaudited) | | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash and cash equivalents | |

$ | 69,406,103 | | |

$ | 84,063,717 | |

| Restricted cash | |

| 54,238,569 | | |

| 66,976,554 | |

| Certificate of deposit | |

| 108,902,429 | | |

| 81,191,191 | |

| Accounts receivable (net of allowance for doubtful accounts of $2,679,598 and $2,285,386 as of June 30, 2023 and December 31, 2022, respectively) | |

| 23,137,337 | | |

| 38,150,876 | |

| Inventories | |

| 57,107,433 | | |

| 40,475,366 | |

| Notes receivable | |

| 256,276 | | |

| 434,461 | |

| Other receivables | |

| 9,813,439 | | |

| 11,912,615 | |

| Prepayments and prepaid expense | |

| 3,159,764 | | |

| 2,970,261 | |

| Advances to suppliers | |

| 2,073,612 | | |

| 3,147,932 | |

| TOTAL CURRENT ASSETS | |

| 328,094,962 | | |

| 329,322,973 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS | |

| | | |

| | |

| Property, plant and equipment, net | |

| 89,909,721 | | |

| 97,168,753 | |

| Intangible assets, net | |

| 5,927,783 | | |

| 7,994,112 | |

| Land use rights, net | |

| 2,725,604 | | |

| 2,909,950 | |

| Construction in progress | |

| 36,854 | | |

| 199,837 | |

| Deferred tax assets | |

| 1,427,290 | | |

| 1,432,527 | |

| Long-term investment | |

| 137,851 | | |

| 144,984 | |

| Goodwill | |

| 31,335,036 | | |

| 33,178,229 | |

| Other long-term assets | |

| 9,911,534 | | |

| 10,630,911 | |

| TOTAL NON-CURRENT ASSETS | |

| 141,411,673 | | |

| 153,659,303 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 469,506,635 | | |

$ | 482,982,276 | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 36,693,759 | | |

$ | 35,321,262 | |

| Other payables and accrued expenses | |

| 11,736,250 | | |

| 14,131,414 | |

| Short-term loans | |

| 6,967,612 | | |

| 5,569,154 | |

| Notes payable | |

| 16,310,719 | | |

| 19,123,476 | |

| Income tax payable | |

| 1,011,755 | | |

| 1,270,617 | |

| Other current liabilities | |

| 5,476,994 | | |

| 6,089,925 | |

| TOTAL CURRENT LIABILITIES | |

| 78,197,089 | | |

| 81,505,848 | |

| | |

| | | |

| | |

| NON-CURRENT LIABILITIES | |

| | | |

| | |

| Deferred taxes liability | |

| 1,172,820 | | |

| 1,378,372 | |

| Contingent consideration liability | |

| – | | |

| 1,803,000 | |

| Other long-term liabilities | |

| 465,784 | | |

| 602,085 | |

| TOTAL NON-CURRENT LIABILITIES | |

| 1,638,604 | | |

| 3,783,457 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 79,835,693 | | |

| 85,289,305 | |

| | |

| | | |

| | |

| STOCKHOLDER’S EQUITY | |

| | | |

| | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 75,010,171 and 77,668,730 shares issued and 75,010,171 and 74,180,171 outstanding at June 30,2023 and December 31,2022, respectively | |

| 75,010 | | |

| 77,669 | |

| Less: Treasury stock (null shares and 3,488,559 shares with average price of $2.81 at June 30, 2023 and December 31, 2022 ) | |

| – | | |

| (9,807,820 | ) |

| Additional paid-in capital | |

| 446,260,170 | | |

| 451,373,645 | |

| Accumulated deficit (the restricted portion is $4,422,033 and $4,422,033 at June 30, 2023 and December 31, 2022, respectively) | |

| (12,640,763 | ) | |

| (16,339,765 | ) |

| Accumulated other comprehensive loss | |

| (46,029,611 | ) | |

| (28,333,239 | ) |

| TOTAL KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS’ EQUITY | |

| 387,664,806 | | |

| 396,970,490 | |

| | |

| | | |

| | |

| Non-controlling interests | |

| 2,006,136 | | |

| 722,481 | |

| TOTAL STOCKHOLDERS’ EQUITY | |

| 389,670,942 | | |

| 397,692,971 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 469,506,635 | | |

$ | 482,982,276 | |

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30,

2023 | | |

June 30,

2022 | | |

June 30,

2023 | | |

June 30,

2022 | |

| | |

| | |

| | |

| | |

| |

| REVENUES FROM UNRELATED PARTIES, NET | |

$ | 35,953,339 | | |

$ | 20,841,183 | | |

$ | 58,815,447 | | |

$ | 45,732,587 | |

| REVENUES FROM THE FORMER AFFILIATE COMPANY AND RELATED PARTIES, NET | |

| – | | |

| – | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | |

| REVENUES, NET | |

| 35,953,339 | | |

| 20,841,183 | | |

| 58,815,447 | | |

| 45,732,587 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF GOODS SOLD | |

| (22,218,767 | ) | |

| (18,122,316 | ) | |

| (37,051,645 | ) | |

| (40,626,557 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| GROSS PROFIT | |

| 13,734,572 | | |

| 2,718,867 | | |

| 21,763,802 | | |

| 5,106,030 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSE: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| (874,562 | ) | |

| (1,253,843 | ) | |

| (1,753,542 | ) | |

| (2,394,429 | ) |

| Selling and marketing | |

| (2,780,515 | ) | |

| (1,172,528 | ) | |

| (4,608,244 | ) | |

| (2,366,227 | ) |

| General and administrative | |

| (8,838,319 | ) | |

| (6,574,079 | ) | |

| (16,397,771 | ) | |

| (12,330,610 | ) |

| Impairment of goodwill | |

| (507,603 | ) | |

| – | | |

| (507,603 | ) | |

| – | |

| Impairment of long-lived assets | |

| (962,737 | ) | |

| – | | |

| (962,737 | ) | |

| – | |

| TOTAL OPERATING EXPENSE | |

| (13,963,736 | ) | |

| (9,000,450 | ) | |

| (24,229,897 | ) | |

| (17,091,266 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS FROM OPERATIONS | |

| (229,164 | ) | |

| (6,281,583 | ) | |

| (2,466,095 | ) | |

| (11,985,236 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 1,954,563 | | |

| 1,378,774 | | |

| 4,054,906 | | |

| 2,601,078 | |

| Interest expense | |

| (194,239 | ) | |

| (138,433 | ) | |

| (367,609 | ) | |

| (286,577 | ) |

| Change in fair value of contingent consideration | |

| 2,164,000 | | |

| (391,000 | ) | |

| 1,803,000 | | |

| 2,299,000 | |

| Government grants | |

| 189,948 | | |

| 463,219 | | |

| 810,352 | | |

| 707,317 | |

| Other income, net | |

| 807,315 | | |

| 2,373,528 | | |

| 1,073,780 | | |

| 2,417,310 | |

| TOTAL OTHER INCOME, NET | |

| 4,921,587 | | |

| 3,686,088 | | |

| 7,374,429 | | |

| 7,738,128 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) BEFORE INCOME TAXES | |

| 4,692,423 | | |

| (2,595,495 | ) | |

| 4,908,334 | | |

| (4,247,108 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME TAX (EXPENSE) BENEFIT | |

| (305,223 | ) | |

| 719,843 | | |

| 74,323 | | |

| 752,443 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) | |

| 4,387,200 | | |

| (1,875,652 | ) | |

| 4,982,657 | | |

| (3,494,665 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| LESS: NET INCOME ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | |

| 659,088 | | |

| 61,619 | | |

| 1,283,655 | | |

| 58,662 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) ATTRIBUTABLE TO KANDI TECHNOLOGIES GROUP, INC. STOCKHOLDERS | |

| 3,728,112 | | |

| (1,937,271 | ) | |

| 3,699,002 | | |

| (3,553,327 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE LOSS | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (19,279,059 | ) | |

| (19,966,230 | ) | |

| (17,696,372 | ) | |

| (18,956,419 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

$ | (14,891,859 | ) | |

$ | (21,841,882 | ) | |

$ | (12,713,715 | ) | |

$ | (22,451,084 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE SHARES OUTSTANDING BASIC | |

| 74,378,083 | | |

| 75,863,479 | | |

| 74,282,823 | | |

| 76,075,484 | |

| WEIGHTED AVERAGE SHARES OUTSTANDING DILUTED | |

| 76,315,953 | | |

| 75,863,479 | | |

| 75,786,201 | | |

| 76,075,484 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) PER SHARE, BASIC | |

$ | 0.06 | | |

$ | (0.02 | ) | |

$ | 0.07 | | |

$ | (0.05 | ) |

| NET INCOME (LOSS) PER SHARE, DILUTED | |

$ | 0.06 | | |

$ | (0.02 | ) | |

$ | 0.07 | | |

$ | (0.05 | ) |

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’

EQUITY

(UNAUDITED)

| | |

Number of

Outstanding

Shares | | |

Common

Stock | | |

Treasury

Stock | | |

Additional Paid-in

Capital | | |

Accumulated

Earning

(Deficit) | | |

Accumulated

Other

Comprehensive

Income | | |

Non-controlling

interests | | |

Total | |

| Balance, December 31, 2021 | |

| 77,385,130 | | |

$ | 77,385 | | |

$ | (2,392,203 | ) | |

$ | 449,479,461 | | |

$ | (4,216,102 | ) | |

$ | 251,786 | | |

$ | – | | |

$ | 443,200,327 | |

| Stock issuance and award | |

| 25,000 | | |

| 25 | | |

| – | | |

| 92,925 | | |

| – | | |

| – | | |

| – | | |

| 92,950 | |

| Stock buyback | |

| – | | |

| – | | |

| (1,570,324 | ) | |

| (13,236 | ) | |

| – | | |

| – | | |

| – | | |

| (1,583,560 | ) |

| Capital contribution from shareholder | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,198,398 | | |

| 1,198,398 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| (1,616,056 | ) | |

| – | | |

| (2,957 | ) | |

| (1,619,013 | ) |

| Foreign currency translation | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,009,811 | | |

| – | | |

| 1,009,811 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2022 | |

| 77,410,130 | | |

$ | 77,410 | | |

$ | (3,962,527 | ) | |

$ | 449,559,150 | | |

$ | (5,832,158 | ) | |

$ | 1,261,597 | | |

$ | 1,195,441 | | |

$ | 442,298,913 | |

| Stock issuance and award | |

| 238,600 | | |

| 239 | | |

| – | | |

| 584,331 | | |

| – | | |

| – | | |

| – | | |

| 584,570 | |

| Stock buyback | |

| – | | |

| – | | |

| (1,974,490 | ) | |

| (22,578 | ) | |

| – | | |

| – | | |

| – | | |

| (1,997,068 | ) |

| Net income (loss) | |

| – | | |

| – | | |

| – | | |

| – | | |

| (1,937,271 | ) | |

| – | | |

| 61,619 | | |

| (1,875,652 | ) |

| Foreign currency translation | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (19,966,230 | ) | |

| (63,460 | ) | |

| (20,029,690 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2022 | |

| 77,648,730 | | |

$ | 77,649 | | |

$ | (5,937,017 | ) | |

$ | 450,120,903 | | |

$ | (7,769,429 | ) | |

$ | (18,704,633 | ) | |

| 1,193,600 | | |

$ | 418,981,073 | |

| | |

Number of

Outstanding

Shares | | |

Common

Stock | | |

Treasury

Stock | | |

Additional

Paid-in

Capital | | |

Accumulated

Earning

(Deficit) | | |

Accumulated

Other

Comprehensive

Income | | |

Non-controlling

interests | | |

Total | |

| Balance, December 31, 2022 | |

| 77,668,730 | | |

$ | 77,669 | | |

$ | (9,807,820 | ) | |

$ | 451,373,645 | | |

$ | (16,339,765 | ) | |

$ | (28,333,239 | ) | |

$ | 722,481 | | |

$ | 397,692,971 | |

| Stock issuance and award | |

| 10,000 | | |

| 10 | | |

| – | | |

| 22,290 | | |

| – | | |

| – | | |

| – | | |

| 22,300 | |

| Stock based compensation | |

| – | | |

| – | | |

| – | | |

| 980,893 | | |

| – | | |

| – | | |

| – | | |

| 980,893 | |

| Net income (loss) | |

| – | | |

| – | | |

| – | | |

| – | | |

| (29,110 | ) | |

| – | | |

| 624,567 | | |

| 595,457 | |

| Foreign currency translation | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,582,687 | | |

| – | | |

| 1,582,687 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, March 31, 2023 | |

| 77,678,730 | | |

$ | 77,679 | | |

$ | (9,807,820 | ) | |

$ | 452,376,828 | | |

$ | (16,368,875 | ) | |

$ | (26,750,552 | ) | |

$ | 1,347,048 | | |

$ | 400,874,308 | |

| Stock issuance and award | |

| 820,000 | | |

| 820 | | |

| – | | |

| 2,706,780 | | |

| – | | |

| – | | |

| – | | |

| 2,707,600 | |

| Stock based compensation | |

| – | | |

| – | | |

| – | | |

| 980,893 | | |

| – | | |

| – | | |

| – | | |

| 980,893 | |

| Cancellation of the Treasury Stock | |

| (3,488,559 | ) | |

| (3,489 | ) | |

| 9,807,820 | | |

| (9,804,331 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| Net income | |

| – | | |

| – | | |

| – | | |

| – | | |

| 3,728,112 | | |

| – | | |

| 659,088 | | |

| 4,387,200 | |

| Foreign currency translation | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (19,279,059 | ) | |

| – | | |

| (19,279,059 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, June 30, 2023 | |

| 75,010,171 | | |

$ | 75,010 | | |

$ | – | | |

$ | 446,260,170 | | |

$ | (12,640,763 | ) | |

$ | (46,029,611 | ) | |

$ | 2,006,136 | | |

$ | 389,670,942 | |

KANDI TECHNOLOGIES GROUP, INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Six Months Ended | |

| | |

June 30,

2023 | | |

June 30,

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net income (loss) | |

$ | 4,982,657 | | |

$ | (3,494,665 | ) |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 6,044,494 | | |

| 6,447,548 | |

| Impairments | |

| 1,470,340 | | |

| – | |

| Provision of allowance for doubtful accounts | |

| 530,759 | | |

| 4,301 | |

| Deferred taxes | |

| (200,316 | ) | |

| (116,206 | ) |

| Change in fair value of contingent consideration | |

| (1,803,000 | ) | |

| (2,299,000 | ) |

| Stock award and stock based compensation expense | |

| 4,724,507 | | |

| 639,690 | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| | |

| | | |

| | |

| Accounts receivable | |

| 6,424,500 | | |

| (9,108,858 | ) |

| Notes receivable | |

| 588,417 | | |

| 1,925,896 | |

| Inventories | |

| (17,938,859 | ) | |

| (9,949,597 | ) |

| Other receivables and other assets | |

| 1,302,745 | | |

| (2,806,192 | ) |

| Advances to supplier and prepayments and prepaid expenses | |

| 680,110 | | |

| 13,475,591 | |

| | |

| | | |

| | |

| Increase (Decrease) In: | |

| | | |

| | |

| Accounts payable | |

| 20,729,603 | | |

| 32,751,997 | |

| Other payables and accrued liabilities | |

| (1,071,220 | ) | |

| 4,198,349 | |

| Notes payable | |

| (15,133,991 | ) | |

| (7,788,622 | ) |

| Income tax payable | |

| (70,636 | ) | |

| (777,068 | ) |

| Net cash provided by operating activities | |

$ | 11,260,110 | | |

$ | 23,103,164 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchases of property, plant and equipment, net | |

| (1,360,492 | ) | |

| (1,491,918 | ) |

| Payment for construction in progress | |

| (76,792 | ) | |

| (308,304 | ) |

| Certificate of deposit | |

| (33,214,435 | ) | |

| (21,617,615 | ) |

| Net cash used in investing activities | |

$ | (34,651,719 | ) | |

$ | (23,417,837 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Proceeds from short-term loans | |

| 7,928,212 | | |

| 5,070,582 | |

| Repayments of short-term loans | |

| (6,398,565 | ) | |

| (4,570,582 | ) |

| Contribution from non-controlling shareholder | |

| – | | |

| 787,499 | |

| Purchase of treasury stock | |

| – | | |

| (3,580,628 | ) |

| Net cash provided by (used in) financing activities | |

$ | 1,529,647 | | |

$ | (2,293,129 | ) |

| | |

| | | |

| | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | |

$ | (21,861,962 | ) | |

$ | (2,607,802 | ) |

| Effect of exchange rate changes | |

$ | (5,533,637 | ) | |

$ | (6,734,387 | ) |

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF YEAR | |

$ | 151,040,271 | | |

$ | 168,676,007 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | |

$ | 123,644,672 | | |

$ | 159,333,818 | |

| -CASH AND CASH EQUIVALENTS AT END OF PERIOD | |

| 69,406,103 | | |

| 87,098,779 | |

| -RESTRICTED CASH AT END OF PERIOD | |

| 54,238,569 | | |

| 72,235,039 | |

| | |

| | | |

| | |

| SUPPLEMENTARY CASH FLOW INFORMATION | |

| | | |

| | |

| Income taxes paid | |

$ | 76,016 | | |

$ | 140,831 | |

| Interest paid | |

$ | 198,793 | | |

$ | 102,722 | |

| | |

| | | |

| | |

| SUPPLEMENTAL NON-CASH DISCLOSURES: | |

| | | |

| | |

| Contribution from non-controlling shareholder by inventories, fixed assets and intangible assets | |

$ | – | | |

$ | 393,986 | |

7

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

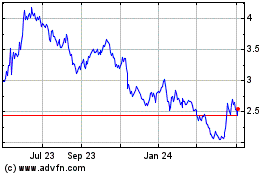

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

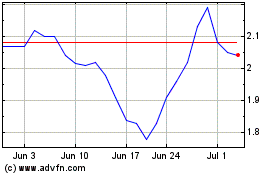

Kandi Technolgies (NASDAQ:KNDI)

Historical Stock Chart

From Apr 2023 to Apr 2024