0001119190

false

0001119190

2023-08-01

2023-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 1, 2023

HUMBL,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-31267 |

|

27-1296318 |

| (State

of other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 101

W. Broadway |

|

|

| Suite

1450 |

|

|

| San

Diego, CA |

|

92101 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (786) 738-9012

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HMBL |

|

OTC

Pink |

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

August 1, 2023, HUMBL, Inc. (“HUMBL”) entered into a Master Consulting Agreement (the “Agreement”) and Promissory

Note (“Note”) with BRU, LLC (“BRU”). Under the terms of the Agreement, BRU will provide information technology

support to HUMBL for a three-year term. HUMBL has agreed to pay compensation in shares of HUMBL common stock and cash. The initial stock

consideration is 389,000,000 shares of HUMBL’s common stock (the “Shares”) as compensation for past due invoices owed

to BRU’s predecessor in interest with a 24-month price floor of $0.0030 so that additional shares of common stock will be issued

to BRU if the aggregate value of the Shares is less than $0.0030 per share on the applicable measurement dates.

Additional

shares of HUMBL common stock will be issued to BRU based on milestones to be mutually agreed to by HUMBL and BRU by August 11, 2023.

HUMBL will issue 120,000,000 shares of its common stock (the “Additional Shares”) upon completion of the milestones that

shall not be more than two years after execution of the Agreement. The value of the Additional Shares shall be equal to the number of

Additional Shares multiplied by $0.0030 (the “Additional Share Value”). On each anniversary of the execution date (the “Anniversary

Date”) until the milestones are met, but in no event more than two years from the execution date, the Additional Share Value shall

equal the value of the Shares on the Anniversary Date, based on the closing price of HUMBL’s common stock on the Anniversary Date

(the “Anniversary Value”) (as may be adjusted for any reverse split). To the extent the Anniversary Value is lower than the

public market value of HUMBL’s common stock, HUMBL will issue additional Shares to BRU equal to the amount necessary for the total

number of Shares and Additional Shares issued under the Agreement to equal the Anniversary Share Value that in no event will be less

than $0.0030 per share, or, at HUMBL’s election, pay in cash the difference between the public market value of HUMBL’s common

stock and the Anniversary Share Value.

HUMBL

has agreed to make two cash payments to BRU: $100,000 within 10 days following the execution of the Agreement and $400,000 through a

Note with an 18-month term that bears no interest unless there is an event of default. The $400,000 cash payments under the Note are

due and payable as follows: $100,000 within 45 days after the execution date; (b) $200,000 on the date that is one year from the execution

date; and (c) $100,000 on or before the maturity date. HUMBL will also pay BRU $41,666.67 a month for the term of the Agreement

(subject to annual inflation adjustments) for ongoing technology development services provided by BRU.

The

foregoing description of the Agreement and the Note does not purport to be complete and is qualified in its entirety by reference to

the Agreement which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, HUMBL has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| Date:

August 4, 2023 |

HUMBL,

Inc. |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

|

Brian

Foote |

| |

|

President

and CEO |

Exhibit

10.1

MASTER

CONSULTING SERVICES AGREEMENT

This

Master Consulting Services Agreement (this “Agreement”) dated as of August 1, 2023 (the “Execution Date”)

is entered into by and between BRU, LLC, a Wyoming limited liability company (“Contractor”), and HUMBL,

Inc., a Delaware corporation (“Company”). Contractor and Company are each referred to as a “Party”

and, collectively, as the “Parties”.

Whereas,

Company desires to retain Contractor to perform

certain consulting services for Company; and

Whereas,

Contractor desires to perform such consulting services

for Company.

Now,

Therefore, in consideration of the foregoing premises,

and the mutual covenants and agreements set forth herein, the parties hereto agree as follows:

1.

Services.

| |

(a) |

Contractor

shall render consulting services to Company as Company may from time to time direct and as may be reasonably acceptable to Contractor

(the “Services”). The Services will include, but not be limited to, assistance with the development and provision

of information technology support. Contractor shall devote sufficient business time, attention, skill and energy to Company as reasonably

necessary to fulfill the responsibilities reasonably assigned to Contractor hereunder, to faithfully and efficiently perform such

responsibilities in a diligent, trustworthy and businesslike manner with the objective of advancing the interests of Company. The

Parties agree that all tangible materials authored or prepared by Contractor for Company as the work product required by the Services

(collectively, the “Works”), are the sole and exclusive property of Company and shall be considered works made

for hire. The performance of the Services will begin upon execution of this Agreement or payment as indicated in Section 5 herein.

|

| |

|

|

| |

(b) |

If,

at any time Contractor performs the Services, Company requests additional Services (“Additional Services”), Contractor

will provide Company with estimated costs for the Additional Services. Prior to Contractor’s performance of any Additional

Services, Company, in its sole discretion, may elect to pay the estimated costs for the proposed Additional Services or rescind its

request that the Contractor perform the Additional Services. |

| |

|

|

| |

(c) |

Contractor

shall notify Company within five business days if, during the performance of any Services (including Additional Services), Contractor,

in its sole discretion, reasonably determines it needs to obtain additional resources or retain additional personnel to complete

the Services and Additional Services. Contractor shall provide an estimate to Company for such resources or personnel and Company

will be invoiced for the actual cost per Section 2(a) herein. |

| MASTER CONSULTING SERVICES AGREEMENT | 1 |

ALL

OF THE SERVICES AND WORKS PROVIDED PURSUANT TO THIS AGREEMENT ARE PROVIDED ON AN AS-IS, WHERE-IS BASIS, WITHOUT ANY REPRESENTATION OR

WARRANTY, WHETHER EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE, ALL OF WHICH ARE

HEREBY DISCLAIMED TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW.

2.

Compensation; Expenses.

(a)

Shares. Within ten days of the Execution Date (the “Effective Date”), Company will issue and deliver, in a

private transaction, 389,000,000 shares of its common stock (the “Shares”) to Contractor as compensation for past

due invoices owed to Contractor’s predecessor in interest. If, either due to market forces or any act or omission of Company or

any of its owners, officers, directors, shareholders, subsidiaries, and affiliates, the public price per share of Company’s common

stock falls below $0.0030 prior to the Effective Date and through the end of the 24th month following the Effective Date,

then in accordance with paragraph (b) of this Section 2, the Company shall issue additional Shares to Contractor such that the aggregate

value of the Shares issued to Contractor shall be not less than $0.0030 per share.

By

way of example only, if the Company hypothetically issues 1,000,000 Shares to Contractor at $0.0030 per Share, the aggregate value would

be $3,000. If, prior to the Effective Date and for two years thereafter, the price per Share has declined to $0.0020, the aggregate value

would be $2,000. The Company would then issue Contractor an additional 500,000 Shares (for a total of 1,500,000 Shares) at $0.0020 per

Share to Contractor for an aggregate value of $3,000.

(b)

Additional Shares. Company and Contractor will meet and confer no later 10 business days from the Execution Date to set three

specific milestones (the “Milestones”) upon completion of which the Company shall issue and deliver to Contractor

in a private transaction an additional 120,000,000 shares of its common stock (the “Additional Shares”). The Milestones

shall be memorialized in a separate writing agreed to by both Parties and shall be incorporated into this Agreement. The value of the

Additional Shares shall be equal to the number of Additional Shares multiplied by the closing public market price of Company’s

common stock on the Execution Date, but shall in no event be less than $0.0030 (the “Additional Share Value”). On

each anniversary of the Execution Date (the “Anniversary Date”) until the Milestones are met, but in no event more

than two years from the Execution Date, the Additional Share Value shall equal the value of the Shares on the Anniversary Date, based

on the closing price of Company’s common stock on the Anniversary Date (the “Anniversary Value”) (as may be

adjusted pursuant to any reverse split). To the extent the Anniversary Value is lower than the public market value of Company’s

common stock, , Company will issue additional Shares to Contractor equal to the amount necessary for the total number of Shares and Additional

Shares issued hereunder to equal the Anniversary Share Value which in no event will be less than $0.0030 per share, or, at its election,

pay the difference between the public market value of Company’s common stock and the Anniversary Share Value in cash.

| MASTER CONSULTING SERVICES AGREEMENT | 2 |

3.

INTENTIONALLY DELETED

4.

INTENTIONALLY DELETED

5

Payment; Note. As additional compensation for past due invoices owed to Contractor’s predecessor in interest, Company shall

pay Contractor as follows:

| |

● |

Upon

execution of this Agreement, Company will pay Contractor $100,000 via wire transfer of immediately available funds; and |

| |

|

|

| |

● |

Issue

a Promissory Note to Contractor in substantially the form attached hereto was Exhibit A; and |

| |

|

|

| |

● |

Upon

execution of this Agreement transfer all of its ownership interests Company agrees to transfer all of its ownership interests in

that certain BLUE Bored Ape Yacht Club NFT #7937 (https://opensea.io/assets/ethereum/0xbc4ca0eda7647a8ab7c2061c2e118a18a936f13d/7937)

the (“NFT”) until of the obligations in the Promissory Note are met including but not limited to all monies owed in the

Promissory Note paid in full. Contractor agrees not to sell, transfer, pledge, assign or hypothecate the NFT while it retains ownership

of the NFT. Moreover, Contractor, upon obtaining possession of the NFT, will immediately grant to Company a worldwide non revocable,

non-transferable exclusive license for the purpose of Company being able to use the NFT for Company business purposes. Upon Company

meeting the requirements of the Promissory Note, Contractor shall immediately transfer ownership of the NFT to Company, however,

if there is an Event of Default as defined in the Promissory Note, then Contractor shall permanently retain ownership of the NFT. |

6.

Release. (i) Upon full payment of the obligations as stated in Section 2 herein, and in consideration thereof, the Contractor,

on its behalf and on the behalf of its parents, subsidiaries, affiliates, related entities, past and present owners, shareholders, directors,

officers, employees, agents, attorneys, accountants, predecessors, successors, and assigns (“Contractor Related Parties”)

shall mutually release and forever discharge Company and its parents, subsidiaries, affiliates, related entities, past and present owners,

shareholders, directors, officers, employees, agents, attorneys, accountants, predecessors, successors, and assigns ( “Company

Related Parties”) from any and all past or present claims or causes of action (including any suit, petition, demand, or other

claim in law or equity), known and unknown, suspected and unsuspected, disclosed and undisclosed, that arise out of or are in any way

related to the Company’s obligation to provide compensation for the services and products provided by Contractor’s predecessor

in interest; and upon execution of this Agreement (ii) the Company shall mutually release and forever discharge the Contractor and its

respective Related Parties from any and all past, present or future claims or causes of action (including any suit, petition, demand,

or other claim in law or equity), known and unknown, suspected and unsuspected, disclosed and undisclosed, that arise out of or are in

any way related to the services and products and products provided by Consultant’s predecessor in interest. Notwithstanding the

above, this release does not apply to the rights and obligations contained in this Agreement, or any other agreement between the Parties

or Related Parties including but not limited to matters relating to indemnification and the enforcement or breach of this Agreement.

| MASTER CONSULTING SERVICES AGREEMENT | 3 |

7.

Rate. Company will pay Contractor an annual fee of $500,000 for the Services plus fees for additional resources, personnel or

Additional Services, if any. Payments to Contractor will be due in equal monthly installments. After the first year of the Initial Term

(as described in Section 14 herein) and for every year thereafter, the rate will increase by the Cost of Living Adjustmenta

for the then current year plus 2 percent. Contractor shall submit a monthly invoice to be received by the Company no later than the tenth

(10th) day of the month following the month during which the Services were performed. Company shall pay the invoice within five business

days of receipt. Interest shall accrue on all overdue amounts at a rate equal to the higher of one and one-half percent (1½%)

per month and the highest rate allowed by applicable law.

8.

Expense Reimbursement. Company will reimburse Contractor for all pre-approved, reasonable and documented out-of-pocket expenses

(including but not limited to travel expenses) incurred in performing the Services on a monthly basis, provided that Contractor provides

substantiating documentation for such expenses for any month along with a monthly invoice for expense reimbursement.

9.

Withholding; Indemnification. Company shall timely issue an IRS 1099 Form to Contractor. Contractor shall have sole responsibility

(i) for paying all local, state and federal income, social security, unemployment taxes and foreign taxes (if any) owed on compensation

paid by Company to Contractor under this Agreement, (ii) paying Contractor personnel and (iii) for complying with all applicable labor

and employment requirements with respect to Contractor’s self-employment, sole proprietorship or other form of business organization.

If any governmental agency or other person or entity challenges the independent contractor status of Contractor, Company shall defend,

indemnify and hold Contractor (and any of its affiliates and agents) harmless from and against any claims, liabilities, penalties, or

attorneys’ fees either caused by or relating to the challenge and any adverse determination.

10.

Taxes. All payments required by this Agreement are exclusive of federal, state, municipal or other governmental excises, withholding

taxes and obligations. Contractor will be responsible for all its own tax obligations. The fees do not include any tariffs, customs or

duties that may be applicable to the sale of the Products and Services. When Contractor has the legal obligation to collect such tariffs,

customs or duties, the appropriate amount shall be added to the applicable invoice and paid by Company. The fees do not include any national,

regional, and local excise, sales, use, withholding or similar taxes.

11.

Term. This Agreement shall commence as of the Execution Date and continue for three years (the “Initial Term”),

unless terminated by either Party upon written notice to the other Party as stated in Section 12 herein. After the Initial Term, the

Agreement shall continue for a period of subsequent one year Terms, unless either Party notifies the other in writing no less than 90

days before the end of the then current Term of its decision not to continue the Agreement after the then current Term (written notice

of non-renewal).

aAs determined by the United States Bureau of Labor Statistics.

| MASTER CONSULTING SERVICES AGREEMENT | 4 |

12.

Termination.

| |

a. |

This

Agreement may be terminated at any time for any reason by the Contractor upon 30 days written notice to Company. Company may not

terminate this Agreement at any time except for a material breach of the Agreement by Contractor or, after the Initial Term, upon

written notice of non-renewal as stated in Section 11 herein. Contractor may terminate this Agreement without notice if Company becomes

(i) insolvent; (ii) is subject to a voluntary petition in bankruptcy or a voluntary proceeding relating to insolvency, receivership,

liquidation, or composition for the benefit of creditors; (iii) is subject to an involuntary petition in bankruptcy or any involuntary

proceeding relating to insolvency, receivership, liquidation, or composition for the benefit of creditors, if such petition or proceeding

is not dismissed within sixty (60) days of its filing. |

| |

|

|

| |

b. |

Effect

of Termination. Upon termination of this Agreement: (i) Contractor shall cease providing the Services; (ii) all outstanding payment

obligations of Company under this Agreement for Services rendered will become immediately due and payable following Company’s

receipt of a final invoice from Contractor; and (iii) within thirty (30) days each Party shall return all Confidential Information

(as defined below) of the other Party, and shall not make or retain any copies of the same except as required by law. |

| |

|

|

| |

c. |

No

liability for Termination. Neither Party will be liable to the other for terminating this Agreement in accordance with its Terms. |

13.

Relationship of the Parties. Contractor shall be an independent contractor and not an employee of the Company for all purposes

including, without limitation, as follows:

| |

a. |

No

Employee Benefits. Contractor and its personnel are not eligible for, and shall not participate in or apply for, any Company-provided

employee benefit plan or program, including without limitation, paid vacation, workers’ compensation, group health insurance,

life or disability insurance, paid leave, profit sharing, pension, 401(k), severance, or unemployment insurance. Should Contractor

be deemed to have any rights of participation in any such plans, by signing below, Contractor waives such rights freely, knowingly,

and voluntarily. |

| |

|

|

| |

b. |

Control

of Work. Contractor shall have exclusive control of the method of performance of Contractor’s duties and particular hours of

work, and shall independently manage and control its activities and personnel; provided, however, that Contractor shall keep the

Company regularly apprised of its activities and progress. |

| |

|

|

| |

c. |

No

Agency. Contractor shall have no authority to represent itself as an agent or representative of the Company, nor shall Contractor

have any authority to bind, assume, or create any obligation or responsibility on behalf of the Company without the prior written

authorization of the appropriate Company officer. |

| MASTER CONSULTING SERVICES AGREEMENT | 5 |

14.

Representations and Warranties and Covenants.

| |

a. |

Each

Party represents and warrants that it has the full power and authority to enter into and perform this Agreement without the consent

of any third party. Each Party further represents and warrants that they will comply with all laws and regulations applicable to

their performance under this Agreement. |

| |

|

|

| |

b. |

Contractor

understands that any shares of Company common stock issued pursuant to this Agreement will be characterized as “restricted

securities” under the Securities Act of 1933, as amended (the “Securities Act”), and inasmuch as they are being

acquired from Company in a transaction not involving a public offering and that under the Securities Act and applicable regulations

thereunder such securities may be resold without registration under the Securities Act only in certain limited circumstances and

subject to certain conditions under application securities regulations. Further, Contractor represents that it is familiar with Securities

Act Rule 144, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act. Contractor

understands that Company is under no obligation to register any shares issued hereunder. Contractor understands that it will receive

a Form 1099 for the value of the shares issued hereunder and will responsible for all associated income tax obligations related to

the shares issued hereunder. |

| |

|

|

| |

c. |

Contractor

covenants and agrees to file a Schedule 13D or 13G within the applicable timeframe required under federal securities laws and agrees

to make all other required filings under federal securities laws related to its beneficial ownership of Company stock. |

15.

Confidential Information.

| |

a. |

The

Parties will have access to trade secrets and other non-public information relating to the other Party or their affiliates, including

but not limited to: financial records, customer agreements and supplier agreements (collectively, the “Confidential Information”),

(as defined below), which is vital, sensitive, confidential and proprietary to each Party and their affiliates. During and after

Contractor’s engagement with Company, each Party shall: (i) hold the Confidential Information in the strictest confidence and

take all reasonable precautions to prevent the inadvertent disclosure of Confidential Information to any unauthorized individual

or entity; and (ii) not disclose or otherwise use the Confidential Information in any manner or medium whatsoever, except as required

to perform Contractor’s duties for Company or with Company’s prior written consent. |

| |

|

|

| |

b. |

Each

Party will maintain in confidence all confidential and proprietary information provided by Contractor during the term of this Agreement

and will not directly, indirectly or otherwise, use, disseminate, disclose or publish, or use for the other’s benefit any such

Confidential Information (unless directly related to the Services), without the other Party’s prior written consent. |

| MASTER CONSULTING SERVICES AGREEMENT | 6 |

| |

c. |

For

purposes

of this

Agreement,

“Confidential

Information”

means any data or information

about or relating to the Company or Contractor that

is proprietary

to the Party

disclosing the information (the “Disclosing

Party”) and not generally

known to

the public,

whether in

tangible

or intangible

form,

whenever and however

disclosed,

including,

but not limited

to: (i)

any marketing

strategies,

plans, financial

information,

or projections,

operations,

sales estimates,

business

plans, and performance

results

relating

to the

ongoing and future

business

activities

of the Disclosing Party; (ii)

plans for products

or services,

product lists or offerings, and customer

or supplier

lists;

(iii)

any scientific

or technical

information,

invention,

design,

process,

procedure,

formula,

improvement,

technology,

or method; (iv)

any concepts, reports,

data, know-how,

works-in-progress,

designs, development

tools,

specifications,

inventories, inventions,

information,

and trade

secrets;

(v) as to the Contractor the identity of the owners and

officers of the Contractor; and (vi) any

other information

that should

reasonably

be recognized

as confidential

information

of the Disclosing

Party. Confidential

Information

need

not be

novel, unique,

patentable,

copyrightable

or constitute

a trade secret

in order

to be designated

Confidential

Information.

The Receiving

Party acknowledges

that the

Confidential

Information

is proprietary

to the Disclosing

Party, has been

developed and obtained

through

great efforts

by the Disclosing

Party, and that

the Disclosing

Party regards

all of its

Confidential

Information

as protected trade

secrets. |

| |

d. |

Notwithstanding

anything

in the foregoing

to the contrary,

Confidential

Information

shall not include

information

which: (i)

was known

by the Receiving

Party prior to

receiving

the Confidential

Information

from the

Disclosing

Party;

(b) becomes

rightfully

known to

the Receiving

Party from

a third-party

source not

known (after

diligent

inquiry)

by the Receiving

Party to be under

an obligation

to Disclosing

Party to

maintain

confidentiality;

(c) is

or becomes publicly

available

through

no fault of or

failure

to act by the

Receiving

Party in breach

of this

Agreement;

(d) is required

to be disclosed

in a judicial

or administrative

proceeding,

or is otherwise

requested

or required

to be disclosed

by law or regulation,

however each party shall, promptly upon receipt of the subpoena or other process, make available to the other party and its counsel

the documents and other information sought and shall assist such counsel in resisting or otherwise responding to such process; and

(e) is or has been independently

developed by employees,

consultants,

or agents of

the Receiving

Party without

violation

of the terms

of this

Agreement

or reference

or access to

any Confidential

Information. |

| |

|

|

| |

e. |

The

right and obligations of Contractor and Company arising under this Section 15 shall survive, and not be impaired by, the expiration

or termination of this Agreement. |

| MASTER CONSULTING SERVICES AGREEMENT | 7 |

16.

Insurance.

| |

a. |

Coverage

Requirements. At all times during the Term the Company shall each procure and maintain, at its sole cost and expense, at least

the following types and amounts of insurance coverage in an amount that is customary to adequately protect a business in its category

from liability naming Contractor as additional insured: |

| |

|

|

| |

● |

Commercial

general liability including (i) bodily injury, (ii) property damage, (iii) contractual liability coverage covering its obligations

of indemnity and defense, (iv) products liability, and (v) personal and advertising injury. Such insurance shall provide for occurrence-based

coverage and shall have such other terms, conditions, and endorsements of coverage as are deemed prudent by Contractor from time

to time. |

17.

Return of Property. Upon termination of Contractor’s engagement or upon written request from Company, Contractor shall immediately

deliver to Company all property (including without limitation all electronic files, data, memory devices, documents, and any copies thereof)

belonging to Company or containing or reflecting the Works.

18.

Company Indemnification and Hold Harmless.

| |

a. |

Company

agrees to indemnify Contractor, hold Contractor and its respective heirs, administrators, officers, employees, directors, executors,

trustees, beneficiaries, agents and representatives (“Contractor Indemnitees”) harmless, and defend Contractor Indemnitees

from against any and all losses, claims, damages, liabilities, fines, taxes, penalties and expenses (including reasonable costs of

investigation and legal counsel fees) (“Claims), in addition to any liability the Company may otherwise have, arising out of,

or related to (a) Contractor’s Services and/or Works asserted against Contractor or Company, (b) any breach of any representation

or warranty made by Company contained in or made pursuant to this Agreement, (b) any breach of or failure by Company to perform any

covenant or obligation of Company contained in this Agreement, or (d) the enforcement of this indemnification obligation. |

| |

|

|

| |

b. |

As

soon as is reasonable after Contractor either (i) receives notice of any Claim or the commencement of any action by any third party

which Company reasonably believes may give rise to a claim for indemnification from Company (a “Third Party Claim”)

or (ii) sustains any loss not involving a Third Party Claim (“Loss”) or action which Contractor reasonably believes may

give rise to a claim for indemnification from Company hereunder, Contractor shall, if a claim in respect thereof is to be made against

Contractor under this Section 18, notify the Company in writing of such claim, action or Loss, as the case may be; provided, however,

that failure to notify Company shall not relieve Company of its indemnity obligation. Any such notification must be in writing and

must state in reasonable detail the nature and basis of the Claim, action or Loss, to the extent known. Except as provided in this

Section 18 Company shall have the right to contest, defend, litigate or settle any such Third Party Claim which involves solely monetary

damages; provided that the Company shall have notified the Contractor in writing of its intention to do so within 15 days of the

Contractor having given notice of the Third Party Claim to the Company; provided, that the Company shall diligently contest the Third

Party Claim. The Contractor shall have the right to participate in, and to be represented by counsel (at Company’s expense)

in any such contest, defense, litigation or settlement conducted by the Company. |

| MASTER CONSULTING SERVICES AGREEMENT | 8 |

| |

c. |

The

Company, if it shall have assumed the defense of any Third Party Claim as provided in this Agreement, shall not consent to a settlement

of, or the entry of any judgment arising from, any such Third Party Claim without the prior written consent of the Contractor (which

consent shall not be unreasonably withheld, conditioned or delayed). The Company shall not, without the prior written consent of

the Contractor, enter into any compromise or settlement which commits the Contractor to take, or to forbear to take, any action or

which does not provide for a complete release by such third party of the Contractor. All expenses (including attorneys’ fees)

incurred by the Company in connection with the foregoing shall be paid by the Company. |

| |

|

|

| |

d. |

If

Contractor Indemnitees are entitled to indemnification against a Third Party Claim, and the Company fails to accept a tender of,

or assume the defense of, a Third Party Claim pursuant to this Section 18 the Company shall not be entitled, and shall lose its right,

to contest, defend, litigate and settle such a Third Party Claim, and the Contractor shall have the right, without prejudice to its

right of indemnification hereunder, in its discretion exercised in good faith, to contest, defend and litigate such Third Party Claim,

and may settle such Third Party Claim either before or after the initiation of litigation, at such time and upon such terms as the

Contractor deems fair and reasonable, provided that at least ten (10) days prior to any such settlement, written notice of its intention

to settle is given to the Company. |

| |

|

|

| |

e. |

Contractor

and Company agree that Contractor is under no obligation to and will not indemnify Company nor hold Company harmless in any manner,

including but not limited to the Services and Works, nor shall Contractor be in any way held liable for the Services or Works, however

Contractor agrees to cooperate in any litigation involving the Services and/or Works provided Company meets its obligations as stated

in this Section 18, has paid Contractor in full for its Services and the Works and pays Contractor a reasonable hourly rate or per

diem as agreed to by the parties if such assistance requires more than one hour of Contractor’s time. |

| |

|

|

| |

f. |

The

terms of this Section 18 shall survive the expiration or termination of this Agreement. |

| MASTER CONSULTING SERVICES AGREEMENT | 9 |

CONTRACTOR’S

MAXIMUM LIABILITY TO COMPANY ARISING FOR ANY REASON RELATING TO CONTRACTOR’S PERFORMANCE OF SERVICES OR THE WORKS UNDER THIS AGREEMENT

SHALL BE LIMITED TO THE AMOUNT OF FEES PAID TO CONTRACTOR FOR THE PERFORMANCE OF SUCH SERVICES OR WORKS FOR THE FIRST SIX MONTHS OF THIS

AGREEMENT.

19.

Assignment. Neither Party shall assign or transfer any obligations under this Agreement without the prior written consent of the

other Party, and any attempt to do so shall be void except that Company may assign this Agreement to an Affiliate, with affiliate being

defined as any entity which directly or indirectly controls, is controlled by or is under common control with the subject entity. “Control”,

for purposes of this definition, means direct or indirect ownership or control of more than 50% of the voting interests of the subject

entity, the authority to appoint directors to the Board of the subject entity, or the power to direct or cause the direction of the management

and policies of the subject entity. This Agreement will be binding upon and inure to the benefit of Company’s successors and assigns.

20.

Equitable Modification; Severability; Titles. If any court or other adjudicating entity refuses to enforce any part of this Agreement

as written, the court or entity shall modify that part to the minimum extent necessary to make it enforceable under applicable law, and

shall enforce it as so modified. The invalidity or unenforceability of any one provision of this Agreement shall not impair, invalidate,

or render unenforceable any other provision of this Agreement. The paragraph headings herein shall be without substantive meaning.

21.

Notices. Any notice under this Agreement shall be in writing and addressed as set forth on the signature page hereto, and shall

be deemed to have been validly delivered upon: (i) personal delivery to the recipient or the listed address; (ii) three (3) calendar

days after deposit in the United States mails with proper postage; or (iii) one (1) business day after delivery to Federal Express or

other reputable overnight courier service. Notices to Contractor shall be sent c/o Registered Agents of Wyoming, LLC, 400 E 20th Street,

Cheyenne, Wyoming 82001 and if to Company to Brian Foote at Brian@HUMBL.com.

22.

Force Majeure. Except for the obligation to pay money, neither Party will be liable for any failure or delay in its performance

under this Agreement due to any cause beyond its reasonable control, including, acts of war, acts of God, epidemic or pandemic as declared

by the United States Centers for Disease Control, earthquake, flood, embargo, riot, sabotage, labor shortage or dispute, governmental

act or failure of third party utility or telecommunications systems or the internet which may substantially delay, materially interfere

with or render impossible the provision by Contractor of some or all of the Services or Products.

23.

Entire Agreement. This Agreement constitutes the entire agreement between the Parties with respect to the subject matter hereof.

This Agreement supersedes all prior written or oral understandings, discussions and agreements with respect thereto.

| MASTER CONSULTING SERVICES AGREEMENT | 10 |

24.

Amendments; Waiver. This Agreement may be amended or modified only by written mutual agreement of the Parties. The failure of

either Party to enforce its rights under this Agreement shall not be construed as a waiver of such rights, and shall not affect the Party’s

right to later enforce such provision or the Agreement.

25.

Governing Law; Jury Waiver. This Settlement Agreement shall be construed and governed solely by the laws of the State of California,

without regard to California’s conflict of law principles. The Parties agree that the state or federal courts located in San Diego

County, California will be the exclusive venue for any dispute arising under this Agreement. The Parties hereby waive any rights they

may have to trial by jury.

26.

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all

of which together shall constitute one instrument. The Parties acknowledge and agree that this Agreement may be executed by electronic

signature, which shall be considered as an original signature for all purposes and shall have the same force and effect as an original

signature. The Parties hereto confirm that any electronic copy of another Party’s executed counterpart to this Agreement (or such

Party’s signature page thereof) will be deemed to be an executed original thereof.

27.

Headings. The headings of this Agreement are for convenience of reference only and shall not form part of, or affect the interpretation

of, this Agreement.

28.

U.S. Dollars. All monetary amounts in this Agreement are expressed as currency of the United States of America (U.S. Dollars).

| |

COMPANY |

| |

|

|

| |

By: |

|

| |

Its: |

|

| |

|

|

| |

|

|

| |

CONTRACTOR |

| |

|

|

| |

By: |

|

| |

Its: |

|

| |

Address: |

|

| |

|

|

| MASTER CONSULTING SERVICES AGREEMENT | 11 |

EXHIBIT

A

PROMISSORY

NOTE

| MASTER CONSULTING SERVICES AGREEMENT | 12 |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

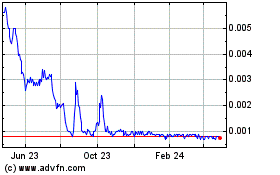

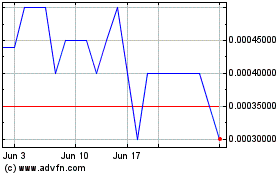

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Apr 2023 to Apr 2024