0001496383

false

0001496383

2023-07-31

2023-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July

31, 2023

Ilustrato Pictures International, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-56487 |

27-2450645 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

26 Broadway, Suite 934

New York, NY |

10004 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area

code: 917-522-3202

|

______________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company []

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

Item 1.01 Entry Into A Material Definitive

Agreement

As previously disclosed, on January 18, 2023,

Quality Industrial Corp. (the “Company”) entered into a definitive stock purchase agreement (the “QI Purchase Agreement”)

with Gerab National Enterprises LLC and Mr. Saseendran Kodapully Ramakrishnan, (together, the “QI Shareholders”) of Quality

International Co Ltd FZC, a United Arab Emirates company (“Quality International”), in order to purchase 52% of the shares

of Quality International (the “QI Shares”) from the QI Shareholders.

Quality International manufactures custom solutions

for businesses operating in the Oil and Gas, Energy, Water Desalination, Wastewater, Offshore and Public Safety sectors.

On July 31, 2023, the parties to the QI Purchase

Agreement entered into an amendment to the QI Purchase Agreement (the “Amended QI Purchase Agreement”) to revise the payment

schedule for the QI Shares, which had previously become effective on March 31, 2023. The purchase price for the QI Shares shall remain

up to $137,000,000 in cash (the “QI Purchase Price”).

Under section 2.1 of the Amended QI Purchase

Agreement, the payment schedule of the QI Purchase Price has been revised (the “Amended Payment Schedule”) to extend the payment

timeline with smaller amounts due at each date. Moreover, break fees were introduced if the payments are not received by their respective

due dates. In the event that the Company fails to meet any of the revised payment dates and/or the revised payment amounts, pursuant to

the Amended Payment Schedule, the parties acknowledge and agree that the QI Shareholders shall have the right, but not the obligation,

to, in their sole discretion, terminate the Amended QI Purchase Agreement and all associated agreements with us. Consequently, if terminated,

the Company would be liable for the applicable break fee pursuant to the table in the Amended Payment Schedule, and the parties agreed

to release each other from the performance of any obligations under the Amended QI Purchase Agreement, together with all related transaction

documents, and the parties shall have no accrued rights under the same save as those which are intended to survive after such termination.

Pursuant to the Amended Payment Schedule, payments

for tranches 4, 5 and 6 are linked and paid in proportion to the percentage of EBITDA target achieved against forecasted EBITDA targets

and capped at 100% of EBITDA target. Any shortfall or surplus (as the case may be) on the EBITDA target of a particular Tranche shall

be carried over to the subsequent Tranche and to be added to or deducted from (as the case may be) the subsequent EBITDA target. Any shortfall

EBITDA existing after the expiration of time allotted for tranche 6, shall be allowed to be delivered within an extended 6-month period

until June 30, 2025, and be paid in proportion to the EBITDA target achieved and capped at 100% of EBITDA target. Any remaining shortfall

existing after the expiration of time allotted for Tranche 6, shall be forfeit, resulting in a reduction to the QI Purchase Price.

Additionally, under section 2.2 of the Amended

QI Purchase Agreement, the Company guarantees and repays Quality International’s future borrowings from any lender, capped at $10

million and a maximum of 22% annual interest. Costs, including a processing fee up to 2% of the principal and expenses during the term,

will be borne by the Company. The financing cost will be covered until the Company pays off the Tranche 3 payment. Any borrowings by Quality

International shall be strictly used for operational purposes.

Item 1.02 Termination of a Material Definitive

Agreement.

As previously disclosed, on January 27, 2023,

we entered into a definitive stock purchase agreement (the “Petro Line Purchase Agreement”) with the shareholders of Petro

Line FZ-LLC (“Petro Line”), a United Arab Emirates company, to purchase 51% of the outstanding shares (the “Petro Line

Shares”) in exchange for $1,530,000 in cash, paid in three tranches, subject to the achievement of financial milestones presented

in a schedule of payments which are set forth in the Petro Line Purchase Agreement.

On August 3, 2023, the Company entered into a Termination

Agreement and Release with Petro Line (the “Termination Agreement”), pursuant to which both the Company and Petro Line agreed

to terminate the Petro Line Purchase Agreement, and to release each other from all claims associated with the Petro Line Purchase Agreement,

with each party paying its own costs incurred in connection with the Petro Line Purchase Agreement. The acquisition did not close, and

mutual termination of the agreement will have no impact on QIND’s consolidated financial statements.

The foregoing description of the Amended QI Purchase Agreement and Termination

Agreement is a summary and is qualified in its entirety by reference to the provisions thereof, a copy of which is attached to this Current

Report as Exhibit 10.1 and 10.2 respectively, which are incorporated herein by reference.

SECTION 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Ilustrato Pictures International, Inc.

/s/ Nicolas Link

Nicolas Link, CEO

Date: August 4, 2023

AMENDMENT

AGREEMENT NO. 1

in respect

of

Share Purchase

Agreement dated 18 January 2023 ("Agreement")

between

Quality lndustrial Corp. and Gerab National Enterprises LLC and Mr. Saseendran Kodapully Ramakrishnan

THIS AMENDMENT

AGREEMENT NO. 1 to the Agreement has

been entered into on 31th July

2023

("Amendment

No. 1") between:

| 1. | QUALITY

INDUSTRIAL CORP., a Nevada corporation established under the laws of the State of Nevada, United

States of America, with company IRS employer identification number 35- 2675388, and whose address is at 315 Montgomery Street, San Francisco,

94104 California, United States of America, and having Mr. John-Paul Backwell as the authorized representative and signatory for and on

behalf of the company ("First Party" or

"Purchaser"); |

| 2. | GERAB

NATIONAL ENTERPRISES LLC, a company established under the laws of the Ernirate of Dubai, United

Arab Emirates, and whose address is at Office no. 202, 5-19 Hotel, Office Section, Al Jaddaf Waterfront, Dubai, United Arab Emirates,

and having Mr. Abdullah Sharafi as the authorized representative and signatory for and on behalf of the company ("Second

Party") and |

| 3. | MR.

SASEENDRAN KODAPULLY RAMAKRISHNAN, an lndian national with passport number Z4995587, a

resident in the United Arab Emirates and whose address is at Villa no. 45, La Collection Avenue, Arabian Ranches, And Al Shiba, Dubai,

United Arab Emirates ("Third Party"). |

Hereafter, the Second Party and the

Third Party shall be collectively referred to as the "Sellers".

WHEREAS

| (A) | The Parties entered into the Agreement on 18 January

2023, and subject to the terms and conditions set out under the same, the Purchaser agreed to purchase, and the Sellers agreed to sell,

seventy eight (78) shares in Quality International Co Ltd FZC, a freezone company established under

the rules and regulations of the Hamriyah Free Zone Authority and the laws of the United Arab Emirates, with company registration

number 4378 and whose address is at PO Box 50622, located at 6C-02, Hamriyah Free Zone Phase 2, Sharjah, United Arab Emirates ("Company"). |

| (B) | The Parties have agreed to make various amendments

to the Agreement as set out in this Amendment No. 1. |

AGREED TERMS

Now,

in consideration of the foregoing and in further consideration

of this Amendment No. 1 on

mutual covenants, hereinafter set

forth, it is agreed that:

| 1. | DEFINITIONS AND COMMENCEMENT |

1.1

Terms defined in

the Agreement shall have

the same

meaning when

used in this Amendment

No. 1 unless the

context otherwise required.

1.2

Notwithstanding

the signing date

of this

Addendum No.

1, the effective date of this

Amendment No.

1 is 1 March 2023 ("Effective

Date").

| 2.1 | Clause 1.02 of the

Agreement shall be

deleted in its entirety and replaced

with the

following: |

"Purchase

Price. The Parties have agreed that

the Purchase Price for the Shares

is up to One Hundred Thirty-Seven

Million United States Dollars ($137,000,000 USD),

which is payable as part

payments as follows:

| Original Payment Arrangement |

Revised Payment Arrangement |

Revised

Payment

Date |

Revised Payment Amount |

Break Fee if a Revised Payment is not received by the Revised Payment Date* |

Paid To |

| Tranche 2 : As |

Tranche |

16 June |

USD |

Tranche 1 value of USD |

Quality International Co Ltd |

| per SPA for |

2.1 |

2023 |

500,000 |

1,000,000 to be |

FZC |

| USD |

|

(paid) |

|

considered as break fee |

|

| 15,000,000, to |

|

|

|

if USD 500,000 not |

|

| be paid |

|

|

|

received by 16-Jun-2023 |

|

| immediately |

Tranche |

On or |

USD |

In addition to USD |

Quality International Co Ltd |

|

upon closing

being 6

March |

2.2 |

before

31 July |

2,000,000 |

1,000,000/-,

50% of USD

500,000 receivable

by |

FZC |

| 2023. |

|

2023 |

|

16-Jun-2023 to be |

|

| |

|

|

|

considered as break fee |

|

| |

|

|

|

(Total USD 1,250,000) |

|

| |

Tranche |

On or |

USD |

In addition to USD |

Quality International Co Ltd |

| |

2.3 |

before |

5,000,000 |

1,000,000/-, 50% each of |

FZC |

| |

|

15 Sept |

|

subsequent payments of |

|

| |

|

2023 |

|

USD 500,000

+ USD

2,000,000 to be |

|

| |

|

|

|

considered a break fee |

|

| |

|

|

|

(Total USD 2,250,000) |

|

| Original |

Revised |

Revised |

Revised |

Break Fee if a Revised |

Paid To |

| Payment Arrangement |

Payment

Arrangement |

Payment

Date |

Payment Amount |

Payment Is not received by the Revised Payment Date* |

|

|

Tranche

3: As per SPA for

USD

66,000,000, to |

Tranche 3.1 |

On or

before

30 Nov

2023 |

USD 73,500,000 |

Break fee Capped at USD 3,500,000 |

$28,500,000

paid to Quality International

Co Ltd FZC,

$39,000,000 to Gerab

National Enterprise

LLC and |

|

be paid on or

before 210

days after

closing

being 6 |

|

|

|

|

$6,000,000 to Saseendran Kodapully Ramakrishnan |

| March 2023. |

|

|

|

|

|

| Tranche 4: As |

Tranche |

31 |

USD |

Break fee not applicable |

$6,000,000 to Gerab |

|

per SPA

for USD 14,000,000, to

be paid

within

30

days of H1, |

4 |

January 2024 |

14,000,000 |

if

Tranche 3.1 is fully received by 30

November

2023. |

National

Enterprise LLC,

$5,000,000 to Saseendran

Kodapully

Ramakrishnan and $3,000,000

to Quality |

| 2023 auditor |

|

|

|

|

International Co Ltd FZC |

| certified |

|

|

|

|

|

| financials |

|

|

|

|

|

|

Tranche

5: As per SPA

for USD 20,000,000

to

be paid within |

Tranche 5 |

15 April

2024

considering

Year End |

USD 20,000,000 |

Break

fee not applicable

if Tranche

3.1 is fully

received by 30

November

2023. |

$15,000,000

to Gerab National

Enterprise LLC,

$2,000,000 to

Saseendran

Kodapully

Ramakrishnan |

|

30 days of

Year End 2023 |

|

audited financials |

|

|

and $3,000,000 to Quality International Co Ltd FZC |

| audited |

|

to be |

|

|

|

| financials |

|

completed |

|

|

|

| |

|

by

15 |

|

|

|

| |

|

March |

|

|

|

| |

|

2024 |

|

|

|

|

Tranche

6: As per SPA for

USD 21,000,000 to

be paid within |

Tranche 6 |

15 April

2025

considering

Year End |

USD

21,000,000 |

Break

fee not applicable if Tranche

3.1 is fully

received by 30

November

2023. |

$15,000,000

to Gerab National Enterprise

LLC,

$3,000,000

to Saseendran

Kodapully

Ramakrishnan |

|

30 days of

Year End 2024 |

|

audited financials |

|

|

and $3,000,000 to Quality International Co Ltd FZC |

| audited |

|

to be |

|

|

|

| financials |

|

completed |

|

|

|

| |

|

by 15 |

|

|

|

| |

|

March |

|

|

|

| |

|

2025 |

|

|

|

*Notes

for Tranche 2 and Tranche

3.1: In the

event that the

First Party fails to meet any of the

Revised Payment Dates and/or

the Revised Payment Amounts pursuant

to the table above, the Parties acknowledge

and agree that the Second Party

and the Third Party

shall have the right, but not the obligation,

to, in their sole discretion,

terminate this Agreement, together with all

related transaction documents including

(without limitation) the Disclosure Letter dated 18 January 2023,

the Shareholder Guarantee dated

18 January 2023, the Escrow Agreement dated

1 March 2023 and

the Shareholders' Agreement dated

1 March 2023. Consequently, the

First Party shall be liable for the

applicable break fee pursuant to

the table above, and the Parties

undertake to release each other from

the performance of any obligations under this Agreement,

together with

all related transaction documents

including (without limitation}

the Disclosure Letter

dated 18 January 2023, the

Shareholder Guarantee dated 18 January

2023, the Escrow Agreement

dated 1

March 2023 and the

Shareholders' Agreement dated 1 March

2023, and the Parties

shall have no

accrued rights under

the same save as those

which are intended to survive

after such termination.

*Notes

for Tranches 4, 5

and 6: Pursuant to the

table above, payments

for Tranche 4 to Tranche 6 are linked

and paid in proportion to the percentage

of EBITDA target achieved against forecasted

EBITDA targets and capped at 100% of

EBITDA target.

Any shortfall or surplus (as

the case may be} on

the EBITDA target of a particular Tranche shall

be carried-over

to the subsequent Tranche

and to be added to or deducted from

(as the case may

be} the subsequent

EBITDA target.

Any shortfall EBITDA existing

after the expiration of time allotted for Tranche 6, shall be

allowed to be delivered within an extended 6-month period until

30 June 2025, and be

paid in proportion to the EBITDA target achieved and capped at 100%

of EBITDA target.

Any remaining shortfall

existing after the expiration

of time allotted for Tranche

6, shall be

forfeit, resulting in a reduction

to the Purchase Price."

2.2

A new

Clause

2.03 of the Agreement shall be inserted

with the

following:

112.03

Future Borrowings. The Purchaser undertakes to guarantee

and repay any and all principal

and interest

in respect of any future

borrowings of the Company

from any lender(s}

subject to the following:

(a}

the principal of any such

borrowings shall be

a maximum of USD 10 million (or such

other amount to be agreed

between the Parties};

(b} the

interest rate of any

such

borrowings shall

be a maximum of 22%

per annum (or such other

percentage

to be agreed between the

Parties};

(c}

the costs and

expenses of

any such borrowings

to be provided by the Purchaser

shall be the sum

of: (i} the costs and

expenses payable

by the Company for the tenure

of any such borrowings;

(ii) tenure of any such borrowings

shall

be less than

12 months (or such

other time frame to be agreed

between the Parties), and

all such borrowing shall be

repaid from the applicable

portion related

to Tranche payments due

from the Purchaser to the Company;

and (iii} the one-time processing cost shall

be a maximum of 2%

of the total

principal of any such borrowings;

(d)

the financing

cost shall be borne until

the date the Purchaser remits proceeds

of the Tranche

3 payment to the Company

under the Agreement

to settle the

total amount of any

such borrowings pursuant to

this clause;

and

(e)

any such borrowings by the

Company shall be strictly

be used for the operating purposes

(unless otherwise agreed between

the Parties).

2.3

Clause 6.01(g)

of the

Agreement shall be

deleted in its entirety and replaced

with the

following:

"(g)

Purchaser confirms that it

has received, or Sellers have made available,

all necessary information for Purchaser

to arrange for its internal purposes relating

to audited financial statements of the Company by

a PCAOB qualified third party independent auditor

for the past two completed fiscal

years ending December 2021

and December 2022."

2.3 A new

Clause 8.03 of the Agreement shall

be inserted with the following:

"8.03

Financial Information Sharing. The

Sellers shall make available

all necessary financial information to the Purchaser, which

the Purchaser may reasonably be required

to arrange for its internal purposes relating to audited

financial statements of the

Company by a PCAOB

qualified third party independent auditor and periodic filings

by the Purchaser, and to

enable the Purchaser to

: (a) undertake the necessary guarantee and repay any

and all principal and interest

in respect of any future borrowings of the Company

from any lender(s) subject

to Clause 2.03 of the Agreement;

and (b) acquire debt financing to support

of the ongoing cash flow

requirements of the Company in respect of Clause 8(e) of the

Agreement."

3.1 The

Parties hereby agree and acknowledge

that' this Amendment No.

1 in its entirety shall constitute

an integral part of

the Agreement.

3.2 Save

and except for the amendments stipulated in

this Amendment No.

1, all other

terms of the Agreement remain

unchanged and

continue to be in

full force and effect.

3.3

This

Amendment No.1

and any dispute

or claim (including non-contractual

disputes or claims)

arising out of or in

connection with it

or its

subject matter

or formation shall be

governed by

and construed in

accordance with English

law. Each

party irrevocably agrees

that the courts of the Dubai

International

Financial Centre shall

have exclusive jurisdiction

to settle any dispute

or claim

(including non-contractual

disputes or claims) arising out of

or in connection with this

Amendment No.

1 or its

subject matter

or formation.

[REMAINDER

OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, this Amendment

No. 1 has been duly executed and delivered on the date first above written.

/s/ John-Paul Backwell

John-Paul Backwell, Chief Executive Officer

For and on behalf of

QUALITY INDUSTRIAL CORP.

/s/ Abdullah Sharafi

Abdullah Sharafi Managing Director

For and on behalf of

GERAB NATIONAL ENTERPRISES LLC

/s/ Saseendran Kodapully Ramakrishnan

SASEENDRAN KODAPULLY RAMAKRISHNAN

TERMINATION AND RELEASE AGREEMENT

This Termination and Release Agreement

(“Agreement”) is entered into as of this 3rd day of August, 2023, by and among Quality Industrial Corp., a Nevada corporation

(“Quality Industrial”) and Petro Line FZ-LLC, a United Arab Emirates company (“Petro Line”).

WHEREAS, on or about January 27, 2023,

Quality Industrial entered into a Share Purchase Agreement (the “Purchase Agreement”) with Petro Line for Quality Industrial

to purchase and Petro Line to sell an amount of shares in Petro Line equal to 51% of the outstanding capital stock of Petro Line in exchange

for cash consideration of $1,530,000 USD (the “Purchase Price”) payable over time;

WHEREAS, as of the date of this Agreement,

the Purchase Agreement has not closed, no portion of the Purchase Price has been paid to Petro Line, and Petro Line has not contributed

any shares of its capital stock to Quality Industrial; and

WHEREAS, the parties to the Purchase Agreement

now desire to terminate and release each other from the Purchase Agreement.

NOW, THEREFORE, in exchange for consideration,

the adequacy of which is hereby acknowledged, the parties agree as follows:

| 1. | Termination. Subject to the terms and conditions of this Agreement, as of

the date hereof, the Parties hereby terminate the Purchase Agreement, and any and all rights, obligations or duties created thereunder. |

| 2. | Coordination. The parties agree to take whatever measures are necessary

return to their respective positions as if the Purchase Agreement was never executed. Each party shall pay its own costs incurred in connection

with the Purchase Agreement. The parties agree to negotiate a new Purchase Agreement. |

| 3. | Mutual Release. Except for the obligations set forth in this Agreement,

each party hereby releases, remises, acquits and forever discharges any other party to this Agreement and their related or controlled

entities, and all of their directors, officers, members, managers, partners, employees, servants, attorneys, assigns, heirs, successors,

agents and representatives, past and present, and the respective successors, executors, administrators and any legal and personal representatives

of each of the foregoing, and each of them, from any and all claims, demands, actions, causes of action, debts, liabilities, rights, contracts,

obligations, duties, damages, costs, expenses or losses, of every kind and nature whatsoever, and by whomever asserted, whether at this

time known or suspected, or unknown or unsuspected, anticipated or unanticipated, direct or indirect, fixed or contingent, or which may

presently exist or which may hereafter arise or become known, in law or in equity, in the nature of an administrative proceeding or otherwise,

for or by reason of any event, transaction, matter or cause whatsoever, with respect to, in connection with or arising out of the Purchase

Agreement, or otherwise. |

It is understood by the parties that

the facts with respect to which the foregoing release is given may hereafter turn out to be other than or different from the facts now

known to a party or the parties or believed by a party or the parties to be true, and each party therefore expressly assumes the risk

of the facts turning out to be so different and agrees that the foregoing release shall be in all respects effective and not subject to

termination or rescission by any such difference in facts.

| 4. | No Assignment. The parties to this Agreement represent and warrant that

neither they or their affiliated persons or entities have assigned or transferred any claim or interest herein or authorized any other

person or entity to assert any claim or claims on its behalf with respect to the subject matter of this Agreement. |

| 5. | Non-Disparagement. The parties agree not to make any oral or written statements

or otherwise take any action that is intended or may reasonably be expected to disparage the reputation, business, prospects or operations

of any other party to this Agreement. |

| 6. | Cooperation. Each of the parties hereby agree to perform any and all acts

and to execute and deliver any and all documents reasonably necessary or convenient to carry out the intent and the provisions of this

Agreement. |

| 7. | Governing Law. This Agreement shall be governed by and construed in accordance

with the laws of the Dubai International Financial Centre in the United Arab Emirates and subject to the exclusive jurisdiction of the

courts of the Dubai International Financial Centre (DIFC), without reference to the principles of conflict of laws. |

| 8. | Complete Agreement. This Agreement represents the complete agreement among

the parties concerning the subject matter in this Agreement and supersedes all prior agreements or understandings, written or oral, including

the Purchase Agreement, or otherwise. This Agreement may not be amended or modified otherwise than by a written agreement executed by

the parties hereto or their respective successors and legal representatives. |

| 9. | Successors and Assigns. This Agreement shall be binding and inure to the

benefit of the parties hereto, their predecessors, parents, subsidiaries and affiliated corporations, all officers, directors, shareholders,

agents, employees, attorneys, assigns, successors, heirs, executors, administrators, and legal representatives of whatsoever kind or character

in privity therewith. |

| 10. | Counterparts. This Agreement may be executed in counterparts, one or more

of which may be facsimiles, but all of which shall constitute one and the same Agreement. Facsimile signatures of this Agreement shall

be accepted by the parties to this Agreement as valid and binding in lieu of original signatures. |

[SIGNATURE PAGE]

The parties to this Agreement have executed this Agreement

as of the day and year first written above.

QUALITY INDUSTRIAL CORP.

By /s/ John-Paul Backwell

Printed Name: John-Paul Backwell

Title Chief

Executive Officer

PETRO

LINE FZ-LLC

By

/s/ Suliman Naameh

Printed

Name:: Suliman Naameh

Title:

Partner

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

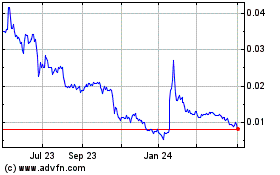

Ilustrato Pictures (PK) (USOTC:ILUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

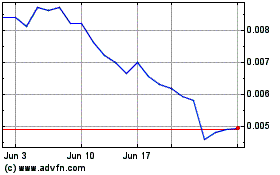

Ilustrato Pictures (PK) (USOTC:ILUS)

Historical Stock Chart

From Apr 2023 to Apr 2024