UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 26, 2023

GYRODYNE, LLC

(Exact name of Registrant as Specified in its Charter)

|

New York

|

|

001-37547

|

|

46-3838291

|

|

(State or other jurisdiction

|

|

(Commission File

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

Number)

|

|

Identification No.)

|

ONE FLOWERFIELD

SUITE 24

ST. JAMES, NEW YORK 11780

(Address of principal executive

offices) (Zip Code)

(631) 584-5400

Registrant’s telephone number,

including area code

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares of Limited

Liability Company Interests

|

GYRO

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☒ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 26, 2023, Gyrodyne, LLC, a New York limited liability company (“Gyrodyne” or the “Company”), entered into a letter agreement (the “Cooperation Agreement”) with Leap Tide Capital Management LLC, a Delaware limited liability company (“Leap Tide”), and Jan H. Loeb, the Managing Member of Leap Tide (together with Leap Tide and its affiliates, the “Leap Tide Parties”) relating to, among other things, the composition of the Board of Directors.

Pursuant to the Cooperation Agreement, the Company agreed to appoint Mr. Loeb to the Board to serve in the class of directors up for election at the Company’s 2023 annual meeting, and to nominate Mr. Loeb to stand for election at the 2023 annual meeting.

Until the later of the conclusion of the Company’s 2024 annual meeting or when Mr. Loeb is no longer serving on the Board (the “Termination Date”), the Cooperation Agreement obligates the Leap Tide Parties to vote all Gyrodyne shares beneficially owned by them in favor of the Board’s slate of directors and otherwise in accordance with the Board’s recommendations with respect to other properly vetted proposals and, if requested by the Company, to support the Company (including the Board) and director nominations, proposals and/or announcements made by the Company, and solicit proxies in accordance with the Board’s recommendations.

The Cooperation Agreement also prevents the Leap Tide Parties until the Termination Date from encouraging shareholders to vote against, or to withhold their vote from, the Board’s nominees, or vote in favor of nominees other than those recommended by the Board; publicly propose any strategic transaction involving the Company or any tender or exchange offer for Gyrodyne shares (but not including privately proposing such to the Company’s management or directors); make any public statement with respect to the Company or any action contemplated by the Cooperation Agreement that might require the Leap Tide Parties to make a filing with the Securities and Exchange Commission or other regulatory authority; or enter into any discussions or agreements with respect to any of the foregoing actions, or assist or encourage anyone to take any such action.

The foregoing description of the Cooperation Agreement is qualified in its entirety by reference to the full text of the Cooperation Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Resignation of Philip F. Palmedo as a Director

Philip F. Palmedo, a director of the Company since 1996, resigned as a director of the Company due to health concerns, effective July 28, 2023.

Appointment of Jan H. Loeb as a Director

Following the resignation of Mr. Palmedo, the Company’s Board of Directors on July 28, 2023 appointed Jan H. Loeb to the Board to fill the vacancy on the Board created by Mr. Palmedo’s resignation, and to serve in the class of directors up for election at the Company’s 2023 annual meeting. Mr. Loeb was appointed to the Board pursuant to the terms of the Cooperation Agreement dated July 26, 2023 and described in Item 1.01 of this Report. The Cooperation Agreement is attached to this Report as Exhibit 10.1 and is incorporated herein by reference.

Mr. Loeb is the Managing Member of Leap Tide Capital Management LLC. Mr. Loeb has beneficial ownership of 66,000 Gyrodyne shares. Mr. Loeb is expected to serve on the Board’s Compensation Committee.

As a non-employee director, Mr. Loeb will receive compensation in accordance with the Company’s non-employee director compensation policy. Pursuant to this policy, Mr. Loeb will be entitled to receive an annual director fee of $42,000 per year (which includes attendance at board meetings and committee meetings). Mr. Loeb will not participate in the Company’s retention bonus plan.

Item. 8.01. Other Events.

Press Release Announcing Appointment of Jan H. Loeb, Resignation of Philip F. Palmedo

On August 1, 2023, the Company issued a press release announcing the appointment of Jan Loeb to the Board and the resignation of Philip F. Palmedo from the Board. A copy of such press release is filed as Exhibit 99.1 to this Report and is incorporated herein by reference.

Annual Meeting Date

The Company has set October 12, 2023 as the date for its 2023 annual meeting of shareholders (the “Annual Meeting”). The Annual Meeting will be held at Flowerfield Celebrations, Mills Pond Road, Saint James, New York 11780, on October 12, 2023, at 11:00 a.m., Eastern Time.

Because the date of the Annual Meeting represents a change of more than 30 days from the anniversary of Gyrodyne’s 2022 annual meeting of shareholders, Gyrodyne has set a new deadline for the receipt of shareholder proposals submitted pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), for inclusion in Gyrodyne’s proxy materials for the Annual Meeting (the “Rule 14a-8 Deadline”). The Rule 14a-8 Deadline is 5:00 p.m. (Eastern Time) on Friday, August 11, 2023, which Gyrodyne has determined to be a reasonable period of time before it expects to begin to print and send its proxy materials. Shareholder proposals should be submitted in writing and must be received by the Corporate Secretary at Gyrodyne’s principal executive offices at One Flowerfield, Suite 24, Saint James, New York 11780, by the Rule 14a-8 Deadline in order to be considered timely.

Shareholder proposals submitted in accordance with Rule 14a-8 of the Exchange Act must also comply with the remaining requirements of Rule 14a-8 of the Exchange Act in order to be considered for inclusion in the proxy materials for the Annual Meeting.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Forward-Looking Statement Safe Harbor

The statements made in this Report and other materials the Company has filed or may file with the Securities and Exchange Commission, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as statements regarding the evaluation of strategic alternatives and liquidation contingencies. These forward-looking statements are based on the current plans and expectations of management and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties relating to our efforts to enhance the values of our remaining properties and seek the orderly, strategic sale of such properties as soon as reasonably practicable, risks associated with the Article 78 proceeding against the Company and any other litigation that may develop in connection with our efforts to enhance the value of and sell our properties, ongoing community activism, risks associated with proxy contests and other actions of activist shareholders, risks related to the recent banking crisis and closure of two major banks (including one with whom we indirectly have a mortgage loan), regulatory enforcement, risks inherent in the real estate markets of Suffolk and Westchester Counties in New York, the ability to obtain additional capital in order to enhance the value of the Flowerfield and Cortlandt Manor properties and negotiate sales contracts and defend the Article 78 proceeding from a position of strength, the potential effects of the COVID-19 pandemic, the risk of inflation, rising interest rates, recession and supply chain constraints or disruptions and other risks detailed from time to time in the Company’s SEC reports. These and other matters the Company discuss in this Report, or in the documents it incorporates by reference into this Report, may cause actual results to differ from those the Company describes.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: August 1, 2023

| |

GYRODYNE, LLC

|

|

| |

|

|

|

| |

By:

|

/s/ Gary Fitlin

|

|

| |

Gary Fitlin

|

|

Exhibit 10.1

Cooperation Agreement

Gyrodyne, LLC

One Flowerfield, Suite 24

Saint James, New York 11780

July 26, 2023

Leap Tide Capital Management LLC

c/o Jan Loeb

2800 Quarry Lake Drive

Baltimore, MD 21209

Dear Mr. Loeb:

This letter agreement is intended to memorialize the understandings and agreements that we have reached with Leap Tide Capital Management LLC (collectively with its affiliates, “Leap Tide”) and you (together with Leap Tide, the “Leap Tide Parties”) relating to, among other things, the composition of the Board of Directors (the “Board”) of Gyrodyne, LLC, a New York limited liability company (the “Company”).

We have successfully reached the following agreements:

1. The Board and any applicable committees of the Board shall take all necessary actions to appoint you to the Board to serve in the class of directors up for election at the 2023 Annual Meeting and with a term ending at the 2026 Annual Meeting. In addition, the Board will nominate you to stand for election at the 2023 Annual Meeting, and the Company will support such nomination and election with the same recommendation and efforts with which it supports the nomination and election of its other nominees. In addition, you irrevocably consent to being named by the Company as a nominee for election to the Board in any applicable proxy statement, proxy card or other solicitation materials of the Company in relation to any Shareholder Meeting prior to the Termination Date.

2. Until the Termination Date (as defined below), the Leap Tide Parties will appear in person or by proxy at each Shareholder Meeting and will vote or cause to be voted (including, without limitation, in any action by written consent) all Voting Securities beneficially owned, or deemed to be beneficially owned (as determined under Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended), and entitled to vote as of the applicable record date, by the Leap Tide Parties: (a) in favor of the slate of directors recommended by the Board, (b) otherwise in accordance with the Board’s recommendations with respect to any other properly vetted proposals submitted to the shareholders of the Company. Further, the Leap Tide Parties will, if requested by the Company, publicly (and in any engagement with shareholders and proxy advisory firms) and privately support the Company (including the Board), director nominations, proposals and/or announcements made by the Company, and solicit proxies in accordance with the Board’s recommendations with respect to the director nominations and proposals submitted at each Shareholder Meeting until the Termination Date (it being understood that such solicitation would not require the Leap Tide Parties to hire their own proxy solicitor at their own expense to solicit independently of the Company).

3. The term of this letter agreement will commence on the date hereof and will terminate on the date that is the later of (a) the conclusion of the 2024 Annual Meeting and (b) the first date on which you no longer serve on the Board (the “Termination Date”).

4. Until the Termination Date, the Leap Tide Parties shall not:

| |

a.

|

take any action to encourage other shareholders of the Company to vote against the Board’s nominees, withhold their votes with respect to the Board’s nominees, or vote in favor of nominees other than those recommended by the Board, at any Shareholder Meeting and regardless of whether such efforts would constitute a “solicitation” under the proxy rules of the Securities and Exchange Commission (the “SEC”);

|

| |

b.

|

make any public announcement or public proposal with respect to, or offer, seek, or propose, (i) any form of business combination or acquisition or other transaction relating to a material amount of assets or securities of the Company or any of its subsidiaries, (ii) any form of restructuring, recapitalization or similar transaction with respect to the Company or any of its subsidiaries or (iii) any form of tender or exchange offer for shares of stock of the Company, whether or not such transaction involves a change of control of the Company; provided, that the foregoing shall not prohibit the Leap Tide Parties from privately making proposals or requests with respect to such matters to the Company’s management or its directors (but not directly to any of the Company’s other shareholders), to the extent the same are consistent with the other provisions of this letter agreement and to the extent no public announcement of such proposals or requests is made or required;

|

| |

c.

|

make any public statement, disclosure or announcement with respect to the Company, this letter agreement or any of the actions contemplated hereby, reasonably likely to require the Leap Tide Parties to make a filing with the SEC or any other governmental or regulatory authority; or

|

| |

d.

|

enter into any discussions, negotiations, agreements or understandings with any person with respect to any action the Leap Tide Parties are prohibited from taking pursuant to subclauses (a) through (c) above, or advise, assist, encourage or persuade any person to take any such action.

|

5. The Company shall issue a press release (the “Press Release”) in a form prepared by the Company and approved by the Leap Tide Parties (such approval not to be unreasonably withheld), announcing your appointment to the Board. Prior to the issuance of the Press Release, neither the Company nor the Leap Tide Parties shall make any public announcement regarding your appointment without the prior written consent of the other parties contained herein, except to the extent required by applicable law or the applicable securities exchange.

6. Each party to this letter agreement will be entitled to specifically enforce the covenants and other agreements of the other party or parties contained herein and to obtain injunctive relief restraining the other party or parties from breaching or threatening to breach this letter agreement.

7. Certain Defined Terms.

a.“ Annual Meeting” means the annual meeting of shareholders of the Company in the year specified and any adjournments, postponements, reschedulings and continuations thereof and any other meeting of shareholders called or held in lieu thereof.

b.“ Shareholder Meeting” means each annual meeting or special meeting of shareholders of the Company and any meeting or action by written consent of the Company’s shareholders called or held in lieu thereof, and any adjournments, postponements, reschedulings and continuations thereof.

c.“ Voting Securities” means the Company’s common shares of limited liability company interests, par value $1.00 per share and any other securities of the Company entitled to vote in the election of directors.

8. This letter agreement contains the entire agreement between the parties and supersedes all other prior agreements and understandings, both written and oral, between the parties hereto with respect to the subject matter hereof. No modifications of this letter agreement can be made except in writing signed by an authorized representative of each of the parties.

9. This letter agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement. Signatures to this letter agreement transmitted by electronic mail in “portable document format” (.pdf) or by other electronic means shall have the same effect as physical delivery of the paper document bearing the original signature.

10. If any provision of this letter agreement is held invalid or unenforceable by any court of competent jurisdiction, the other provisions of this letter agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated. Any provision of this letter agreement held invalid or unenforceable only in part or degree shall remain in full force and effect to the extent not held invalid or unenforceable. The parties further agree to use their commercially reasonable best efforts to replace such invalid or unenforceable provision of this letter agreement with a valid and enforceable provision that will achieve, to the extent possible, the purposes of such invalid or unenforceable provision.

11. This letter agreement and all disputes or controversies out of or related to this letter agreement shall be deemed to be made under the laws of the State of New York and for all purposes shall be governed by, and construed in accordance with, the laws of such State applicable to contracts to be made and performed entirely within such State, without reference to conflicts of laws principles.

* * * * * *

If the foregoing accurately sets forth our agreements, please sign this letter agreement as indicated below.

| |

Sincerely,

GYRODYNE, LLC

By: /s/ Paul L. Lamb

Name: Paul L. Lamb Esq.

Title: Chairman of the Board of Directors

Address for Notices for the Company:

Gyrodyne, LLC

Attn: Gary Fitlin

1 Flowerfield, Suite 24,

St. James, New York 11780

|

ACKNOWLEDGED AND AGREED,

as of the date written above:

LEAP TIDE CAPITAL MANAGEMENT LLC

By: /s/ Jan Loeb

Name: Jan Loeb

Title: Managing Member

/s/ Jan Loeb

Jan Loeb, Individually

Address for Notices for the Leap Tide Parties

2800 Quarry Lake Drive

Baltimore, MD 21209

Exhibit 99.1

Press Release

Gyrodyne Appoints Jan Loeb to Board of Directors

ST. JAMES, N.Y.--(BUSINESS WIRE)--Gyrodyne, LLC (Nasdaq: GYRO) (“Gyrodyne” or the “Company”), an owner and manager of a diversified portfolio of real estate properties, today announced that it has appointed Jan Loeb to the Company’s Board of Directors (the “Board”), effective immediately. Mr. Loeb was appointed to the Board pursuant to a cooperation agreement (the “Agreement”) between the Company and Leap Tide Capital Management LLC (collectively with its affiliates, “Leap Tide”).

Paul Lamb, Chairman of the Board, said, “Jan is a proven leader who brings a wealth of strategic knowledge, financial expertise and prior public company board experience, and we are pleased to welcome him as a director. We look forward to benefitting from Jan’s input as we continue to position the Company’s properties for sale to ultimately distribute the maximum value possible to our shareholders.”

The Company also announced that Philip Palmedo, who has served as a director since July 1996, has stepped down from the Board, effective immediately.

Mr. Lamb added: “We want to express our sincere thanks to Phil for his guidance, leadership and dedication as the Company navigated through challenging times over the years.”

Mr. Loeb stated: “We are pleased to have worked constructively with Gyrodyne to reach an agreement that is in the best interests of all stakeholders. I look forward to leveraging my perspectives as a significant shareholder and working alongside my fellow directors to maximize value for all shareholders.”

As part of the Agreement, the Company has agreed to include Mr. Loeb in the Company’s slate of director nominees for election at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) for a three-year term. Additionally, Leap Tide has agreed to customary standstill provisions. The Agreement will be included as an exhibit to the Company’s Current Report on Form 8-K, which will be filed with the U.S. Securities and Exchange Commission (the “SEC”).

About Jan Loeb

Mr. Loeb has more than 40 years of money management and investment banking experience. He has been the Managing Member of Leap Tide since 2007. From 2005 to 2007, he served as the President of Leap Tide’s predecessor, Leap Tide Capital Management Inc., which was formerly known as AmTrust Capital Management Inc. He served as a Portfolio Manager of Chesapeake Partners from February 2004 to January 2005. From January 2002 to December 2004, he served as Managing Director at Jefferies & Company, Inc. From 1994 to 2001, he served as Managing Director at Dresdner Kleinwort Wasserstein, Inc. (formerly Wasserstein Perella & Co., Inc.). He served as a Lead Director of American Pacific Corporation from July 8, 2013 to February 27, 2014, and also served as its Director from January 1997 to February 27, 2014. He served as an Independent Director of Pernix Therapeutics Holdings Inc. (formerly, Golf Trust of America, Inc.) from 2006 to August 31, 2011. He served as a Director of TAT Technologies, Ltd. from August 2009 to December 21, 2016. He served as a Director of Keweenaw Land Association, Ltd. from December 2016 until May 2019. He has served as President, Executive Chairman and board member of Novelstem International Corp since July 2018.

About Gyrodyne, LLC

Gyrodyne, LLC owns and manages a diversified portfolio of real estate properties comprising office, industrial and service-oriented properties in the New York metropolitan area. The Company owns a 63 acre site approximately 50 miles east of New York City on the north shore of Long Island, which includes industrial and office buildings and undeveloped property, and a medical office park in Cortlandt Manor, New York, both of which are the subject of plans to seek value-enhancing entitlements. The Company’s common shares are traded on the NASDAQ Stock Market under the symbol GYRO. Additional information about the Company may be found on its web site at www.gyrodyne.com.

Forward-Looking Statements

The statements made in this press release and other materials the Company has filed or may file with the SEC, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as statements regarding the evaluation of strategic alternatives and liquidation contingencies. These forward-looking statements are based on the current plans and expectations of management and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties relating to our efforts to enhance the values of our remaining properties and seek the orderly, strategic sale of such properties as soon as reasonably practicable, risks associated with the Article 78 proceeding against the Company and any other litigation that may develop in connection with our efforts to enhance the value of and sell our properties, ongoing community activism, risks associated with proxy contests and other actions of activist shareholders, risks related to the recent banking crisis and closure of two major banks (including one with whom we indirectly have a mortgage loan), regulatory enforcement, risks inherent in the real estate markets of Suffolk and Westchester Counties in New York, the ability to obtain additional capital in order to enhance the value of the Flowerfield and Cortlandt Manor properties and negotiate sales contracts and defend the Article 78 proceeding from a position of strength, the potential effects of the COVID-19 pandemic, the risk of inflation, rising interest rates, recession and supply chain constraints or disruptions and other risks detailed from time to time in the Company’s SEC reports. These and other matters the Company discuss in this press release may cause actual results to differ from those the Company describes.

Important Additional Information

The Company intends to file a proxy statement and BLUE proxy card with the SEC in connection with its upcoming Annual Meeting and, in connection therewith, the Company, its directors and certain of its executive officers will be participants in the solicitation of proxies from the Company’s shareholders in connection with such meeting. SHAREHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING BLUE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING. The Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed on March 30, 2023, contains information regarding the direct and indirect interests, by security holdings or otherwise, of the Company’s directors and executive officers in the Company’s securities. Information regarding subsequent changes to their holdings of the Company’s securities can be found in the SEC filings on Forms 3, 4, and 5, and on the Company’s website at http://www.gyrodyne.com/insidertransactions.php or through the SEC’s website at www.sec.gov. Updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the definitive proxy statement and other materials to be filed with the SEC in connection with the Annual Meeting. Shareholders will be able to obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at http://www.gyrodyne.com/proxy.php.

Contacts

Longacre Square Partners

Joe Germani / Aaron Rabinovich

jgermani@longacresquare.com / arabinovich@longacresquare.com

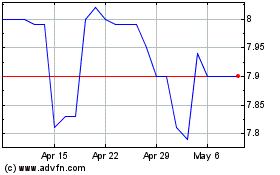

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Apr 2023 to Apr 2024