0001466593false00014665932023-07-312023-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 31, 2023

OTTER TAIL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Minnesota (State or other jurisdiction of incorporation or organization) | 0-53713 (Commission File Number) | 27-0383995 (I.R.S. Employer Identification No.) |

215 South Cascade Street, P.O. Box 496, Fergus Falls, MN 56538-0496

(Address of principal executive offices, including zip code)

(866) 410-8780

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $5.00 per share | OTTR | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 31, 2023 Otter Tail Corporation issued a press release announcing its consolidated financial results for the second quarter of 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Item 2.02 (including Exhibit 99.1 attached hereto) shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

(d) | Exhibits |

| | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| OTTER TAIL CORPORATION |

| |

| |

Date: August 1, 2023 | By: | /s/ Kevin G. Moug |

| | Kevin G. Moug |

| | Chief Financial Officer |

Otter Tail Corporation Announces Second Quarter Earnings, Increases 2023 Earnings Guidance, Board of Directors Declares Quarterly Dividend of $0.4375 per Share

FERGUS FALLS, Minnesota - Otter Tail Corporation (Nasdaq: OTTR) today announced financial results for the quarter ended June 30, 2023.

SUMMARY

Compared to the quarter ended June 30, 2022:

•Consolidated operating revenues decreased 16% to $338 million.

•Consolidated net income decreased 5% to $82 million.

•Diluted earnings per share decreased 5% to $1.95 per share.

CEO OVERVIEW

“We are pleased with our second quarter financial results,” said President and CEO Chuck MacFarlane, “with our employees continuing to adapt to changing market conditions. Our Electric segment produced earnings growth of 4 percent compared to the second quarter of 2022, primarily driven by the recovery of rate base investments. Manufacturing segment earnings decreased 21 percent due to lower sales volumes of horticulture products and unfavorable manufacturing cost absorption. As expected, Plastics segment earnings declined from the second quarter of 2022, driven by general end market softness and reductions in sales volumes as distributors continue to manage inventory levels.

“We look forward to substantial completion of our 49 MW Hoot Lake Solar project, which is currently expected to be placed in service on time and on budget in the third quarter of 2023. Hoot Lake Solar is being constructed on and near the retired Hoot Lake coal plant property in Fergus Falls, Minnesota, allowing us the unique opportunity to utilize our existing transmission rights, substation and land. The project has received renewable rider approval in Minnesota and all costs and benefits of the project are assigned to Minnesota customers.

“We are increasing our 2023 diluted earnings per share guidance to a range of $5.70 to $6.00 from our previous range of $4.55 to $4.85. The increase in earnings guidance is due to stronger than expected Plastics segment performance experienced in the second quarter of 2023, which is expected to continue through the remainder of the year.

“Our long-term focus remains unchanged - executing our strategy to grow our business and achieve operational, commercial and talent excellence to strengthen our position in the markets we serve. We now expect a normalizing of Plastics segment earnings during the last half of 2024. As we return to more normal levels of earnings in this segment, we remain confident in our ability to achieve a compounded annual growth rate in earnings per share of 5 to 7 percent. We then expect to return to an earnings mix of approximately 65 percent from our Electric segment and 35 percent from our Manufacturing and Plastics segments.”

SECOND QUARTER UPDATES

•Otter Tail Power filed its supplemental Integrated Resource Plan (IRP) earlier this year, which requests, among other items, the addition of on-site liquefied natural gas fuel storage at our Astoria Station plant in 2026. In May, the Minnesota Public Utilities Commission decided to align the timing of its decision on the Astoria Station project with the timing of its decision on the overall supplemental IRP. We anticipate a hearing on the IRP in early 2024.

QUARTERLY DIVIDEND

On July 31, 2023, the corporation’s Board of Directors declared a quarterly common stock dividend of $0.4375 per share. This dividend is payable September 8, 2023 to shareholders of record on August 15, 2023.

CASH FLOWS AND LIQUIDITY

Our consolidated cash provided by operating activities for the six months ended June 30, 2023 was $184.5 million compared to $175.6 million for the six months ended June 30, 2022. The increase was driven by no pension plan contribution in 2023, compared with a $20.0 million discretionary contribution in the prior year. This increase was partially offset by lower 2023 earnings and higher working capital. Investing activities for the six months ended June 30, 2023 included capital expenditures of $151.5 million, primarily related to capital investments within our Electric segment, including the purchase of the Ashtabula III wind farm for $50.6 million. Financing activities for the six months ended June 30, 2023 included net proceeds from short-term borrowings of $42.0 million at Otter Tail Power and dividend payments of $36.5 million.

As of June 30, 2023, we had $170.0 million and $110.2 million of available liquidity under our Otter Tail Corporation Credit Agreement and Otter Tail Power Credit Agreement, respectively, along with $150.6 million of available cash and cash equivalents, for total available liquidity of $430.8 million.

SEGMENT PERFORMANCE

Electric Segment | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| ($ in thousands) | 2023 | | 2022 | | Change | | % Change |

| Operating Revenues | $ | 113,763 | | | $ | 130,949 | | | $ | (17,186) | | | (13.1) | % |

| Net Income | 19,634 | | | 18,858 | | | 776 | | | 4.1 | |

| | | | | | | |

| Retail MWh Sales | 1,345,830 | | | 1,286,419 | | | 59,411 | | | 4.6 | % |

| Heating Degree Days | 639 | | | 716 | | | (77) | | | (10.8) | |

| Cooling Degree Days | 254 | | | 154 | | | 100 | | | 64.9 | |

The following table shows heating degree days (HDDs) and cooling degree days (CDDs) as a percent of normal. | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2023 | | 2022 |

| HDDs | 120.6 | % | | 135.1 | % |

| CDDs | 215.3 | % | | 129.4 | % |

The following table summarizes the estimated effect on diluted earnings per share of the difference in retail kilowatt-hour (kwh) sales under actual weather conditions and expected retail kwh sales under normal weather conditions in 2023 and 2022.

| | | | | | | | | | | | | | | | | |

| | 2023 vs Normal | | 2023 vs 2022 | | 2022 vs Normal |

| Effect on Diluted Earnings Per Share | $ | 0.04 | | | $ | 0.01 | | | $ | 0.03 | |

Operating Revenues decreased $17.2 million primarily due to a $19.2 million decrease in fuel recovery revenues and the impact of final interim rate refunds in the second quarter of 2022, partially offset by increased transmission services revenue, increased rider revenue, and higher commercial and industrial sales. The decrease in fuel recovery revenues was primarily the result of lower purchased power costs arising from decreased market energy costs. A planned outage at Coyote Station in the second quarter of 2022 resulted in higher purchased power volumes in 2022. Our Minnesota rate case was finalized in May 2022, which included a determination of the final interim rate refund and resulted in an increase in revenues during the second quarter of 2022 of $4.1 million. Rider revenue increases included recovery of costs related to our Hoot Lake Solar project and our recently purchased Ashtabula III wind farm.

Net Income increased $0.8 million primarily due to increased operating revenues from our rate-base investments and sales volume increases, as well as lower pension costs, partially offset by increased operating and maintenance expenses, such as higher labor costs, increased maintenance costs at our wind farm facilities, and increased interest expense due to higher interest rates on our short-term variable rate debt.

Manufacturing Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | $ Change | | % Change |

| Operating Revenues | $ | 102,475 | | | $ | 103,196 | | | $ | (721) | | | (0.7) | % |

| Net Income | 5,969 | | | 7,555 | | | (1,586) | | | (21.0) | |

Operating Revenues decreased $0.7 million primarily due to decreased steel prices, which impacted revenues at BTD Manufacturing, as well as decreased sales volumes at T.O. Plastics. Steel prices declined compared to the second quarter of 2022, resulting in a 15% decrease in material costs, which are passed through to customers. The impact of decreased steel prices was offset by a 14% increase in sales volumes, driven by strong customer and end market demand in the construction, agriculture, and energy markets, as well as sales price increases which were implemented in response to labor and non-steel material cost inflation. Lower scrap metal prices also impacted operating revenues as scrap metal revenues decreased $0.5 million from the previous year. Operating revenues at T.O. Plastics decreased primarily due to decreased sales volumes of horticulture products in response to changing market conditions as order and delivery lead times began to normalize.

Net Income decreased $1.6 million due to unfavorable cost absorption and increased operating expenses compared to the same period last year. Increased labor costs and lower productivity contributed to unfavorable cost absorption and lower profit margins. The increase in labor costs and lower level of productivity during the quarter resulted from increased shift incentives and overtime wages combined with increased staffing levels to meet higher production volumes and the time required for new employees to achieve peak productivity.

Plastics Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | $ Change | | % Change |

| Operating Revenues | $ | 121,478 | | | $ | 165,895 | | | $ | (44,417) | | | (26.8) | % |

| Net Income | 55,392 | | | 63,959 | | | (8,567) | | | (13.4) | |

Operating Revenues decreased $44.4 million primarily due to a 26% decrease in sales volumes compared to the same period last year. Sales volume decreases in the second quarter were driven by general end market softness and distributors continuing to manage inventory levels. Sales prices declined 1% from the second quarter of 2022 but remained elevated compared to pre-2021 levels.

Net Income decreased $8.6 million primarily due to decreased operating revenues resulting from lower sales volumes, as described above. The impact of decreased sales volumes was partially offset by increased operating margins as our sales price to resin spread remains elevated. PVC resin and other input material costs decreased 37% compared to the same period in the previous year as the unique supply and demand conditions, which caused significant increases in resin costs, have subsided and resin costs have stabilized.

Corporate Costs

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | |

| (in thousands) | 2023 | | 2022 | | $ Change | | % Change |

| | | | | | | |

| | | | | | | |

| Net Income (Loss) | $ | 974 | | | $ | (4,435) | | | $ | 5,409 | | | n/m |

Net Income (Loss) at our corporate cost center increased primarily due to non-taxable death benefit proceeds from corporate owned life insurance and market gains on our corporate-owned life insurance policy investments in the second quarter of 2023 compared to losses in the same period last year, increased investment income earned on our short-term cash equivalent investments and decreased employee health care costs.

2023 BUSINESS OUTLOOK

We are increasing our 2023 diluted earnings per share range to $5.70 to $6.00. We expect our earnings mix in 2023, based on our updated guidance, to be approximately 35% from our Electric segment and 65% from our Manufacturing and Plastics segments, net of corporate costs. This anticipated mix deviates from our long-term expected earnings mix of approximately 65% Electric/35% non-electric as we expect Plastics segment earnings in 2023 to remain elevated.

The segment components of our 2023 diluted earnings per share guidance compared with actual earnings for 2022 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2022 EPS

by Segment | | 2023 EPS Guidance

May 1, 2023 | | 2023 EPS Guidance

July 31, 2023 |

| | | Low | | High | | Low | | High |

| Electric | | | $ | 1.91 | | | $ | 2.00 | | | $ | 2.04 | | | $ | 2.00 | | | $ | 2.04 | |

| Manufacturing | | | 0.50 | | | 0.47 | | | 0.51 | | | 0.47 | | | 0.51 | |

| Plastics | | | 4.66 | | | 2.30 | | | 2.49 | | | 3.40 | | | 3.59 | |

| Corporate | | | (0.29) | | | (0.22) | | | (0.19) | | | (0.17) | | | (0.14) | |

| Total | | | $ | 6.78 | | | $ | 4.55 | | | $ | 4.85 | | | $ | 5.70 | | | $ | 6.00 | |

| Return on Equity | | | 25.6 | % | | 14.9 | % | | 15.7 | % | | 18.4 | % | | 19.2 | % |

The following items contributed to our revised 2023 earnings guidance:

Electric Segment - We are maintaining our May 1, 2023 guidance, expecting earnings to increase 6% over 2022.

Manufacturing Segment - We are maintaining our May 1, 2023 guidance.

•Backlog for the manufacturing companies as of June 30, 2023 was approximately $200 million, compared with $245 million one year ago.

Plastics Segment - We are increasing our Plastics segment guidance based on:

•Continued strength in our product sales prices and related margins. While sales prices and margins have begun to recede from historic highs, the rate of decline is slower than our previous expectations. The impact of higher sales prices and margins is partially offset by a decrease in expected sales volumes over the remainder of 2023.

•Our guidance reflects lower second half earnings as compared to the first half of 2023 as we expect sales prices and margins to decline modestly over the remainder of 2023. Should pricing and margins remain elevated relative to our expectations, there could be further upside to our current year earnings.

Corporate Costs - We are decreasing our Corporate cost guidance based on the following:

•The results in the second quarter of 2023 were better than expected due to gains on our corporate-owned life insurance policies, including death benefit proceeds, earnings on our cash balance investments and lower employee healthcare costs.

•Increased earnings on our cash balance investments over the remainder of the year due to a higher balance of invested funds and a higher yield.

•These items are partially offset by an increase in our operating and maintenance expenses.

CONFERENCE CALL AND WEBCAST

The corporation will host a live webcast on Tuesday, August 1, 2023, at 10:00 a.m. CDT to discuss its financial and operating performance.

The presentation will be posted on our website before the webcast. To access the live webcast, go to www.ottertail.com/presentations and select “Webcast.” Please allow time prior to the call to visit the site and download any software needed to listen in. An archived copy of the webcast will be available on our website shortly after the call.

If you are interested in asking a question during the live webcast, visit and follow the link provided in the press release announcing the upcoming conference call.

FORWARD-LOOKING STATEMENTS

Except for historical information contained here, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “could,” “estimate,” “expect,” “future,” “goal,” “intend,” “likely,” “may,” “outlook,” “plan,” “possible,” “potential,” “predict,” “probable,” “projected,” “should,” “target,” “will,” “would” and similar words and expressions are intended to identify forward-looking statements. Such statements are based upon the current beliefs and expectations of management. Forward-looking statements made herein, which may include statements regarding 2023 earnings and earnings per share, long-term earnings, earnings per share growth and earnings mix, anticipated levels of energy generation from renewable resources, anticipated reductions in carbon dioxide emissions, future investments and capital expenditures, rate base levels and rate base growth, future raw materials costs, future raw materials availability and supply constraints, future operating revenues and operating results, and expectations regarding regulatory proceedings, as well as other assumptions and statements, involve known and unknown risks and uncertainties that may cause our actual results in current or future periods to differ materially from the forecasted assumptions and expected results. The Company’s risks and uncertainties include, among other things, uncertainty of future investments and capital expenditures, rate base levels and rate base growth, risks associated with energy markets, the availability and pricing of resource materials, inflationary cost pressures, attracting and maintaining a qualified and stable workforce, changing macroeconomic and industry conditions, long-term investment risk, seasonal weather patterns and extreme weather events, counterparty credit risk, future business volumes with key customers, reductions in our credit ratings, our ability to access capital markets on favorable terms, assumptions and costs relating to funding our employee benefit plans, our subsidiaries’ ability to make dividend payments, cyber security threats or data breaches, the impact of government legislation and regulation including foreign trade policy and environmental, health and safety laws and regulations, the impact of climate change including compliance with legislative and regulatory changes to address climate change, expectations regarding regulatory proceedings, and operational and economic risks associated with our electric generating and manufacturing facilities. These and other risks are more fully described in our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K, as updated in subsequently filed Quarterly Reports on Form 10-Q, as applicable. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any obligation to update any forward-looking information.

Category: Earnings

About the Corporation: Otter Tail Corporation, a member of the S&P SmallCap 600 Index, has interests in diversified operations that include an electric utility and manufacturing businesses. Otter Tail Corporation stock trades on the Nasdaq Global Select Market under the symbol OTTR. The latest investor and corporate information is available at www.ottertail.com. Corporate offices are in Fergus Falls, Minnesota, and Fargo, North Dakota.

Media Contact: Stephanie Hoff, Director of Corporate Communications, (218) 739-8535

Investor Contact: Beth Osman, Manager of Investor Relations, (701) 451-3571

# # #

OTTER TAIL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands, except per-share amounts) | 2023 | | 2022 | | 2023 | | 2022 |

| Operating Revenues | | | | | | | |

| Electric | $ | 113,763 | | | $ | 130,949 | | | $ | 265,671 | | | $ | 261,365 | |

| Product Sales | 223,953 | | | 269,091 | | | 411,126 | | | 513,579 | |

| Total Operating Revenues | 337,716 | | | 400,040 | | | 676,797 | | | 774,944 | |

| Operating Expenses | | | | | | | |

| Electric Production Fuel | 14,833 | | | 14,714 | | | 26,326 | | | 29,567 | |

| Electric Purchased Power | 5,212 | | | 24,162 | | | 47,037 | | | 44,691 | |

| Electric Operating and Maintenance Expense | 45,522 | | | 42,379 | | | 91,070 | | | 86,659 | |

| Cost of Products Sold (excluding depreciation) | 120,658 | | | 152,466 | | | 233,027 | | | 304,225 | |

| Other Nonelectric Expenses | 16,870 | | | 17,252 | | | 35,568 | | | 34,457 | |

| Depreciation and Amortization | 24,232 | | | 23,566 | | | 48,089 | | | 47,113 | |

| Electric Property Taxes | 4,336 | | | 4,435 | | | 8,957 | | | 8,866 | |

| Total Operating Expenses | 231,663 | | | 278,974 | | | 490,074 | | | 555,578 | |

| Operating Income | 106,053 | | | 121,066 | | | 186,723 | | | 219,366 | |

| Other Income and (Expense) | | | | | | | |

| Interest Expense | (9,696) | | | (8,991) | | | (19,111) | | | (17,939) | |

| Nonservice Components of Postretirement Benefits | 2,421 | | | 751 | | | 4,833 | | | 772 | |

| Other Income (Expense), net | 3,253 | | | (889) | | | 5,370 | | | (629) | |

| Income Before Income Taxes | 102,031 | | | 111,937 | | | 177,815 | | | 201,570 | |

| Income Tax Expense | 20,062 | | | 26,000 | | | 33,365 | | | 43,630 | |

| Net Income | $ | 81,969 | | | $ | 85,937 | | | $ | 144,450 | | | $ | 157,940 | |

| | | | | | | |

| Weighted-Average Common Shares Outstanding: | | | | | | | |

| Basic | 41,678 | | | 41,597 | | | 41,655 | | | 41,573 | |

| Diluted | 42,053 | | | 41,944 | | | 42,035 | | | 41,907 | |

| Earnings Per Share: | | | | | | | |

| Basic | $ | 1.97 | | | $ | 2.07 | | | $ | 3.47 | | | $ | 3.80 | |

| Diluted | $ | 1.95 | | | $ | 2.05 | | | $ | 3.44 | | | $ | 3.77 | |

OTTER TAIL CORPORATION

CONSOLIDATED BALANCE SHEETS (unaudited)

| | | | | | | | | | | |

| June 30, | | December 31, |

| (in thousands) | 2023 | | 2022 |

| Assets | | | |

| Current Assets | | | |

| Cash and Cash Equivalents | $ | 150,578 | | | $ | 118,996 | |

| Receivables, net of allowance for credit losses | 194,951 | | | 144,393 | |

| Inventories | 144,441 | | | 145,952 | |

| Regulatory Assets | 19,058 | | | 24,999 | |

| Other Current Assets | 15,084 | | | 18,412 | |

| Total Current Assets | 524,112 | | | 452,752 | |

| Noncurrent Assets | | | |

| Investments | 59,882 | | | 54,845 | |

| Property, Plant and Equipment, net of accumulated depreciation | 2,316,246 | | | 2,212,717 | |

| Regulatory Assets | 96,128 | | | 94,655 | |

| Intangible Assets, net of accumulated amortization | 7,393 | | | 7,943 | |

| Goodwill | 37,572 | | | 37,572 | |

| Other Noncurrent Assets | 52,653 | | | 41,177 | |

| Total Noncurrent Assets | 2,569,874 | | | 2,448,909 | |

| Total Assets | $ | 3,093,986 | | | $ | 2,901,661 | |

| | | |

| Liabilities and Shareholders' Equity | | | |

| Current Liabilities | | | |

| Short-Term Debt | $ | 50,197 | | | $ | 8,204 | |

| | | |

| Accounts Payable | 104,661 | | | 104,400 | |

| Accrued Salaries and Wages | 26,029 | | | 32,327 | |

| Accrued Taxes | 31,900 | | | 19,340 | |

| Regulatory Liabilities | 41,743 | | | 17,300 | |

| Other Current Liabilities | 46,032 | | | 56,065 | |

| Total Current Liabilities | 300,562 | | | 237,636 | |

| Noncurrent Liabilities and Deferred Credits | | | |

| Pensions Benefit Liability | 33,198 | | | 33,210 | |

| Other Postretirement Benefits Liability | 47,364 | | | 46,977 | |

| Regulatory Liabilities | 245,935 | | | 244,497 | |

| Deferred Income Taxes | 231,910 | | | 221,302 | |

| Deferred Tax Credits | 15,544 | | | 15,916 | |

| Other Noncurrent Liabilities | 67,093 | | | 60,985 | |

| Total Noncurrent Liabilities and Deferred Credits | 641,044 | | | 622,887 | |

| Commitments and Contingencies | | | |

| Capitalization | | | |

| Long-Term Debt | 823,941 | | | 823,821 | |

| Shareholders’ Equity | | | |

| Common Shares | 208,553 | | | 208,156 | |

| Additional Paid-In Capital | 425,867 | | | 423,034 | |

| Retained Earnings | 693,138 | | | 585,212 | |

| Accumulated Other Comprehensive Income | 881 | | | 915 | |

| Total Shareholders' Equity | 1,328,439 | | | 1,217,317 | |

| Total Capitalization | 2,152,380 | | | 2,041,138 | |

| Total Liabilities and Shareholders' Equity | $ | 3,093,986 | | | $ | 2,901,661 | |

OTTER TAIL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

| | | | | | | | | | | |

| June 30, |

| (in thousands) | 2023 | | 2022 |

| Operating Activities | | | |

| Net Income | $ | 144,450 | | | $ | 157,940 | |

| Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: | | | |

| Depreciation and Amortization | 48,089 | | | 47,113 | |

| Deferred Tax Credits | (372) | | | (373) | |

| Deferred Income Taxes | 8,708 | | | 25,160 | |

| Discretionary Contribution to Pension Plan | — | | | (20,000) | |

| Investment (Gains) Losses | (4,295) | | | 4,440 | |

| Stock Compensation Expense | 6,484 | | | 5,511 | |

| Other, net | 161 | | | (164) | |

| Change in Operating Assets and Liabilities: | | | |

| Receivables | (50,558) | | | (50,885) | |

| Inventories | 2,396 | | | 2,889 | |

| Regulatory Assets | 7,320 | | | 5,604 | |

| Other Assets | 3,561 | | | 3,240 | |

| Accounts Payable | 1,037 | | | 1,933 | |

| Accrued and Other Liabilities | (4,271) | | | (3,394) | |

| Regulatory Liabilities | 27,169 | | | (3,859) | |

| Pension and Other Postretirement Benefits | (5,382) | | | 475 | |

| Net Cash Provided by Operating Activities | 184,497 | | | 175,630 | |

| Investing Activities | | | |

| Capital Expenditures | (151,516) | | | (70,791) | |

| Proceeds from Disposal of Noncurrent Assets | 2,970 | | | 2,840 | |

| Purchases of Investments and Other Assets | (5,079) | | | (5,944) | |

| Net Cash Used in Investing Activities | (153,625) | | | (73,895) | |

| Financing Activities | | | |

| Net Borrowings (Repayments) on Short-Term Debt | 41,993 | | | (91,163) | |

| | | |

| Proceeds from Issuance of Long-Term Debt | — | | | 90,000 | |

| | | |

| Dividends Paid | (36,524) | | | (34,372) | |

| Payments for Shares Withheld for Employee Tax Obligations | (3,088) | | | (2,942) | |

| Other, net | (1,671) | | | (2,806) | |

| Net Cash Provided by (Used in) Financing Activities | 710 | | | (41,283) | |

| Net Change in Cash and Cash Equivalents | 31,582 | | | 60,452 | |

| Cash and Cash Equivalents at Beginning of Period | 118,996 | | | 1,537 | |

| Cash and Cash Equivalents at End of Period | $ | 150,578 | | | $ | 61,989 | |

OTTER TAIL CORPORATION

SEGMENT RESULTS (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Operating Revenues | | | | | | | |

| Electric | $ | 113,763 | | | $ | 130,949 | | | $ | 265,671 | | | $ | 261,365 | |

| Manufacturing | 102,475 | | | 103,196 | | | 209,257 | | | 208,154 | |

| Plastics | 121,478 | | | 165,895 | | | 201,869 | | | 305,425 | |

| Total Operating Revenues | $ | 337,716 | | | $ | 400,040 | | | $ | 676,797 | | | $ | 774,944 | |

| | | | | | | |

| Operating Income (Loss) | | | | | | | |

| Electric | $ | 25,188 | | | $ | 26,869 | | | $ | 55,284 | | | $ | 54,810 | |

| Manufacturing | 8,320 | | | 10,700 | | | 17,829 | | | 16,637 | |

| Plastics | 75,035 | | | 86,561 | | | 120,718 | | | 155,422 | |

| Corporate | (2,490) | | | (3,064) | | | (7,108) | | | (7,503) | |

| Total Operating Income | $ | 106,053 | | | $ | 121,066 | | | $ | 186,723 | | | $ | 219,366 | |

| | | | | | | |

| Net Income (Loss) | | | | | | | |

| Electric | $ | 19,634 | | | $ | 18,858 | | | $ | 42,854 | | | $ | 38,091 | |

| Manufacturing | 5,969 | | | 7,555 | | | 12,831 | | | 11,639 | |

| Plastics | 55,392 | | | 63,959 | | | 89,078 | | | 114,806 | |

| Corporate | 974 | | | (4,435) | | | (313) | | | (6,596) | |

| Total Net Income | $ | 81,969 | | | $ | 85,937 | | | $ | 144,450 | | | $ | 157,940 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

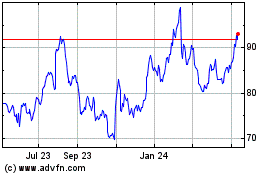

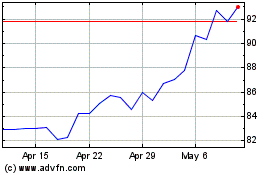

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Otter Tail (NASDAQ:OTTR)

Historical Stock Chart

From Apr 2023 to Apr 2024